Launch Sequence (Core Strategy Rebalance)

Key Takeaways

- Despite earlier rumors suggesting a potential denial and others hinting at early approval, the target remains set for the approval of all spot BTC ETF applications between January 8th and 10th.

- This significant product launch differs from the introduction of CME futures and the futures ETF, both in terms of the macroeconomic context at the time of those launches and the anticipated incremental flows resulting from the marketing efforts of blue-chip asset managers.

- The approval of a spot ETF is likely to enhance the prospects for a spot ETH ETF later this year. This could potentially establish a longer-term bottom in ETHBTC and act as a tailwind for ETH beta names.

- Key risks on the horizon include a reevaluation of the timing for rate cuts and increased duration issuance from the treasury, which could follow the next treasury refunding announcement towards the end of January.

- Core Strategy – With the approval of the spot BTC ETF appearing imminent and the DXY seemingly at a local peak, it seems prudent to lean into this market setup. We anticipate that ETH Layer 2s will continue to perform well, driven by the anticipation of EIP-4844 and increased attention towards ETH following the BTC ETF approval. With that in mind, we are increasing allocation to OP and ARB. We are also increasing STX allocation on the back of continued progress toward the Nakamoto upgrade.

Quick Recap

First and foremost, we would like to extend a Happy New Year to all our clients and subscribers. The past year was indeed eventful, marked by banking crises, significant court victories, and BlackRock’s foray into the sector – truly a remarkable journey.

Our Core Strategy, though it lagged behind the King, performed well. This was particularly supported by the strong performance of our altcoin basket in Q4. We are deeply grateful to those who placed their trust in us to navigate the complexities of the crypto market. We are excited about the prospect of tackling the markets alongside you once again this year.

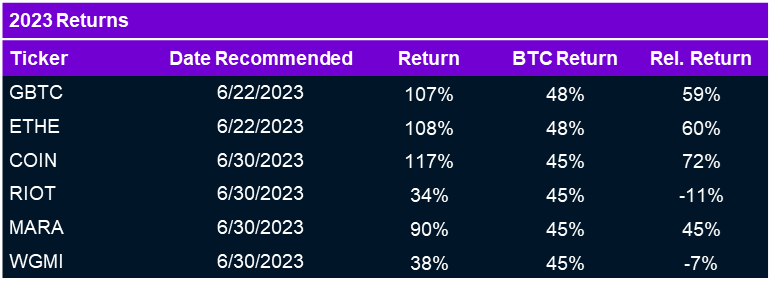

Our crypto equities baskets also performed well. For the record, we have not made any changes to these trade recommendations as of now. Should any changes occur, they will be duly noted and documented in our strategy updates.

Clearing the Board

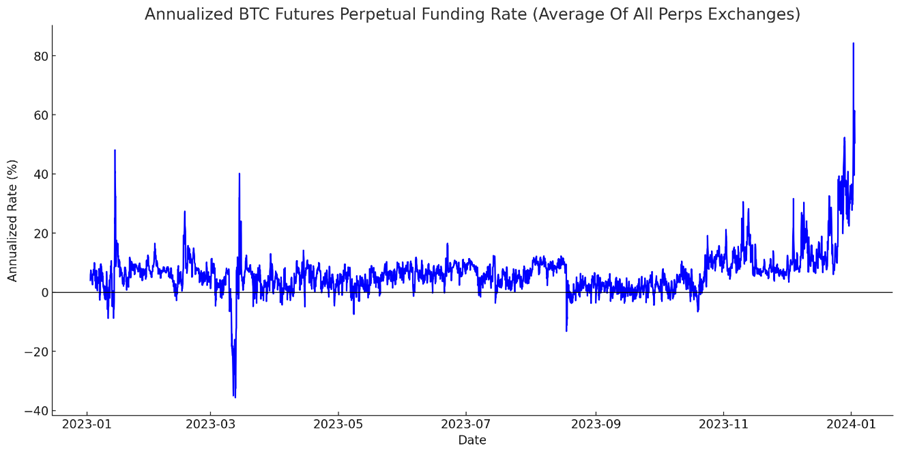

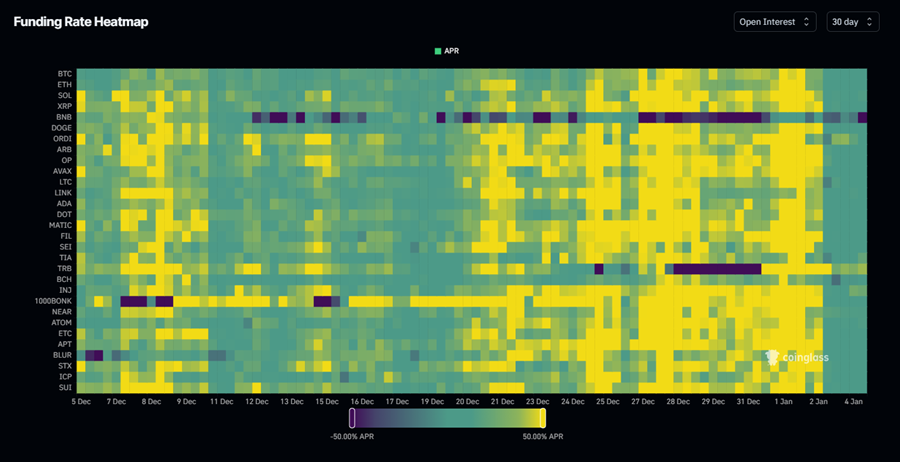

On Tuesday, we noted that funding rates for leverage had become quite elevated. This marked the first indication of speculative excess since the onset of the bull market. At one point, perps funding rates (the fee leveraged long positions pay to others for taking the opposite side of the trade) reached up to 80% annualized. This indicates a substantial demand for leverage in a single direction.

The anticipation of spot ETFs, combined with early-year profit-taking and a strengthening dollar, led to cascading liquidations on Wednesday morning, eliminating about $5 billion in open interest from the perps market. Initially, there were reports from a certain research group suggesting that the ETFs were going to be denied, which many believed triggered the liquidation cascade. However, with hindsight, it’s clear that this was simply a case of the market getting ahead of itself.

We will always strive to inform our clients and subscribers when the market appears overheated. Nonetheless, it’s important to recognize that volatility is an inherent aspect of this market, especially in a bull market.

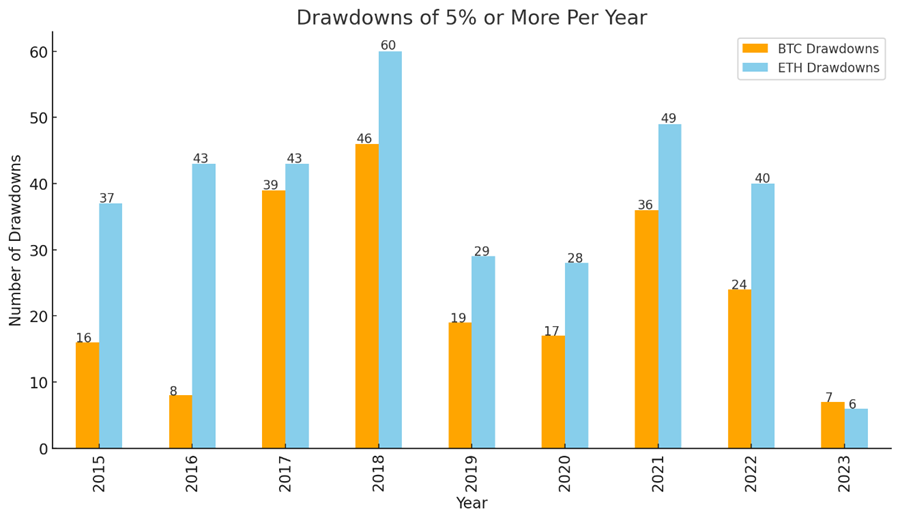

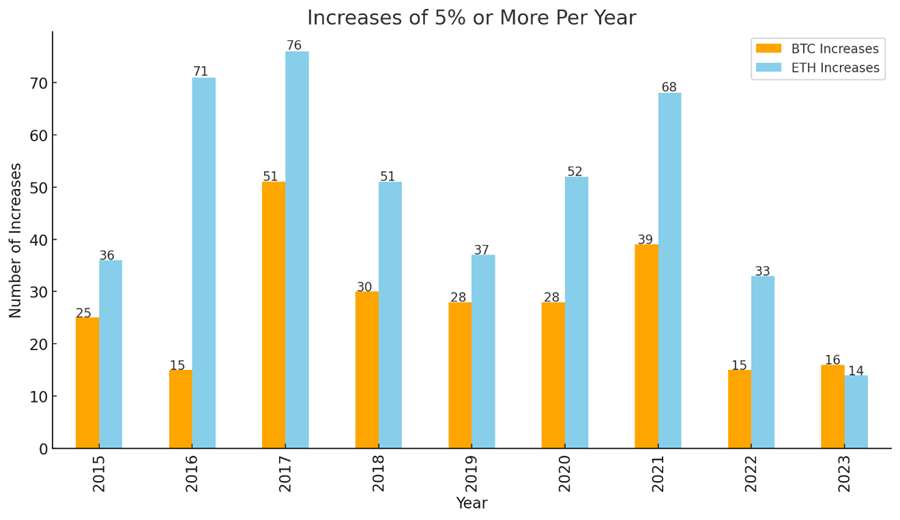

Below is a chart illustrating the number of annual drawdowns of 5% or more per calendar year. Last year was unusual in terms of the amount of downside volatility experienced. Increased demand leads to more leverage, which in turn causes sharp rises and falls. Acknowledging this dynamic is key to traversing this market.

It’s worth noting that volatility cuts both ways. There is a notable correlation between the number of sharp declines and the number of significant increases per calendar year.

As shown in the funding heatmap below, the excessive leverage has now been cleared as funding rates have reset. Importantly, prices have also essentially retraced their entire downward move post-liquidations.

Spot Bitcoin ETF Approval Anticipated Next Week

Since BlackRock filed its application for a spot Bitcoin ETF in June, there has been a significant amount of anticipation and deliberation. We are eagerly awaiting the SEC’s final decision, expected next week. Despite earlier rumors suggesting a potential denial and others hinting at early approval, the target remains set for the approval of all spot BTC ETF applications between January 8th and 10th. This timeframe falls after the public comment period and just before the ARK ETF deadline on January 11th.

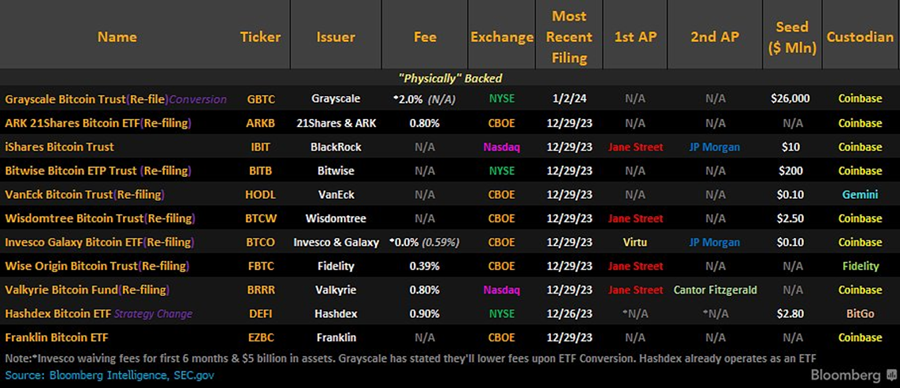

After the ETF

As we approach the anticipated approval of the spot ETF applications, assuming no major surprises in the next few days, our focus naturally shifts to the scheduled launch date. The certainty around this segment of the process is somewhat nebulous but considering the extensive preparation time that issuers have had, coupled with the heightened anticipation, the current macroeconomic setup, and the fierce competition for Assets Under Management (AUM) among the 11 applicants, we project that the time frame between approval and the launch date will be relatively short, likely measured in days rather than weeks. Consequently, there’s a tangible possibility that these products could be accessible in brokerage accounts by the end of next week.

A key question that arises in many discussions is whether this event could be classified as a “sell-the-news” scenario. Historical precedents offer some insight here. Notably, the launch of the CME futures in 2017 coincided with the pinnacle of that cycle, and similarly, the introduction of the BTC futures ETF in 2021 was closely followed by a final surge before reaching the peak of that cycle. This pattern suggests that the upcoming launch might also be followed by a significant drawdown.

However, there are significant distinctions between these previous events and the current one.

First, both previous events coincided with crucial turning points in global liquidity trends. The launch of CME futures took place at the nadir of a prolonged downturn in the DXY, while the introduction of the futures ETF occurred just prior to the initiation of the most intensive tightening campaign ever undertaken by the Federal Reserve. While we are certain to have intermittent rallies in rates and the dollar over the next 12 months, probabilities skew towards global liquidity expansion this year.

Further, there are incremental buyers here. With all respect to both ProShares and the crypto-native fund issuers who have paved the way for increased institutional adoption, BlackRock, WisdomTree, Van Eck, and Fidelity simply carry a different weight in RIA circles.

The reputational risk of RIAs investing in these products is low (“BlackRock said it was ok”), and the amount of marketing and sales efforts that will be made over the first 12 months post-approval to gain a lion’s share of AUM (early winners will likely remain winners) will surely drive some significant level of flows.

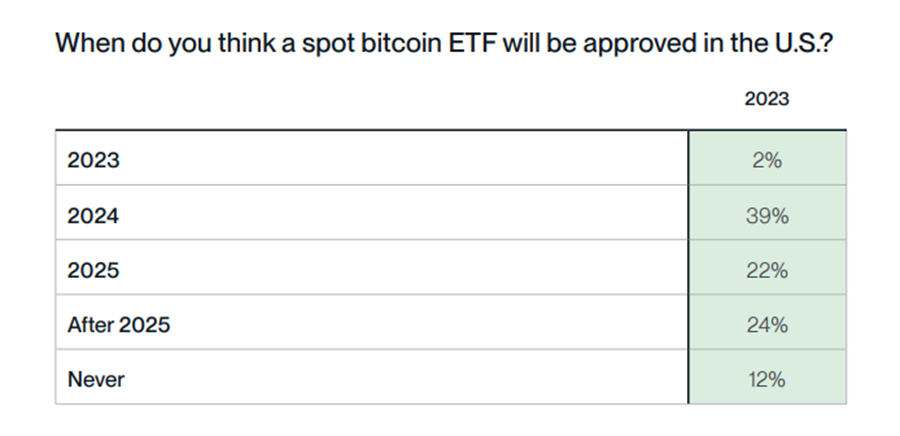

It is also important to note that, unlike our clients and subscribers, the overall market is still skeptical about BTC and the possibility of ETF approval. A survey of 437 RIAs demonstrated a massive departure from our expectations for ETF approval. Surprisingly, only 39% of advisors believe a spot bitcoin ETF will be approved this year (41% if we include the 2% who saw approval last year).

And 88% of respondents who did not have exposure to bitcoin said that a BTC spot ETF approval would entice them to buy bitcoin. These are incremental flows that these new products will acquire.

So no, the ETF is not “priced-in.”

Focus Shifts to ETH and ETH-Adjacent Tokens

Despite our view that next week is categorically different than the CME futures and futures ETF launches, we certainly expect some volatility.

It is likely we will see a rather sizeable rally post-approval. Attention will then shift to fund launches and the subsequent flows post-launch. We will assess these flows in real time but if the market qualitatively deems the initial flows as unimpressive, then we might see some profit-taking from those who invested in anticipation of this launch.

BITO saw over $1 billion in volumes over the first couple of days post-launch. We think that volumes will exceed this level, but if not, this could cause some short-term downside volatility.

From a strategic perspective, we think that post-approval, the crypto market’s attention will shift to ETH. This is for a couple of reasons:

- The approval of the spot BTC ETF certainly increases the likelihood of spot ETH ETF, and we likely see an element of front-running potential approval in the same way that we saw with the BTC ETF.

- There was recently clarity provided around the EIP-4844 (Dencun Upgrade), which should be a tailwind for ETH Layer 2 networks as their costs to submit data to Ethereum will be reduced by 10x. This is a major reason that we have seen OP and ARB rally so violently over the past few weeks.

With that in mind, we think it’s right to lean into the rallies in OP and ARB. They are both nearing or have surpassed new all-time highs and will be entering price discovery.

Both names stand to continue to benefit from a potential bottom in ETHBTC incited by ETH ETF anticipation as well as excitement around the upcoming Dencun upgrade.

Risks

We will delve into the current market risks in more detail next week. However, we believe there’s a possibility of a short-term risk-off environment emerging towards the end of this month.

There’s a chance that the market has become overly optimistic about the timing of the first rate cut, and perhaps too hastily overlooking the impact of increased duration issuance by the Treasury on rates.

The upcoming quarterly refunding announcement in late January, coupled with the next FOMC meeting, could potentially pose a short-term challenge for the crypto markets.

Core Strategy

Major Changes to Core Strategy:

- We are increasing our allocation to OP and ARB, based on the recently clarified timeline of EIP-4844. This move also serves as an ETH beta play in an environment where ETHBTC may start to rally, anticipating the launch of a spot ETH ETF later this year.

- The Nakamoto testnet was successfully launched in December, further substantiating our Stacks thesis. We are increasing our allocation to STX, inspired by the advancements in the Nakamoto upgrade, slated to occur just before the halving in April.

With the approval of the spot BTC ETF appearing imminent and the DXY seemingly at a local peak, it seems prudent to lean into this market setup. We anticipate that ETH Layer 2s will continue to perform well, driven by the anticipation of EIP-4844 and increased attention towards ETH following the BTC ETF approval.

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.15% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

Crypto Equities

Trade Ideas

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

Reports you may have missed

FLOWS RETURNING TO THE MARKET Last week, we discussed how our base case remained that conditions for liquidity-sensitive assets like crypto would improve in the near term, and we continued to lean on our "Buy in May" thesis, given the constructive setup. A combination of (1) a dovish Federal Reserve, (2) an accelerated tapering of quantitative tightening (QT), and (3) a Quarterly Refunding Announcement (QRA) that met investors’ expectations contributed...

MACRO SETUP STILL LOOKS GOOD FOR CRYPTO As discussed last week, we achieved the favorable setup we were anticipating. A combination of (1) a dovish Federal Reserve, (2) an accelerated tapering of quantitative tightening (QT), and (3) a Quarterly Refunding Announcement (QRA) that met investors' expectations contributed to a decline in rates during the first week of May, alongside a rebound in crypto assets. However, crypto investors remain cautious, and...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...