Moon Mission

Key Takeaways

- Perpetual futures data shows modest long speculation compared to the last cycle, suggesting the market's rise lacks the excessive speculation many remain wary of.

- In our opinion, Bitcoin's leadership in the improving market breadth indicates a healthier, more sustainable uptrend than one led by altcoins, and is reminiscent of the early stages of prior bull markets.

- Despite incremental retail investor activity, the current rally remains primarily driven by institutional capital.

- Stacks’ retracement after a near 100% rally was driven by a misplaced narrative. We maintain that the tailwinds for STX are strong, making it a worthwhile asset to accumulate during dips as we near Q1.

- Trade Idea: Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

- Core Strategy – Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market. A potential bounce in rates could serve as a short-lived headwind for the broader altcoin and crypto equities market, but a lack of correlations, persistence of flows, and near-term catalysts mean that risk asymmetries still skew to the upside.

Challenging the Accusations of Froth

Amidst the recent sharp rally in the crypto market, investors who weathered the prolonged bear market are understandably cautious, keeping a close watch for any signs of excess. Despite the violence in the most recent rally, we believe it’s too early to declare the market as overbought. Our assessment is based on several factors:

- Perpetual futures data indicates a relatively modest level of long speculation, especially when compared to the last cycle. This lack of aggressive long positioning suggests that the market’s upward movement may not be as overheated as some fear.

- The improvement in market breadth is noteworthy, yet it’s Bitcoin (BTC) that continues to lead the charge. A rally driven by Bitcoin typically signifies a healthier market dynamic, as opposed to one led by less established altcoins. This BTC-led growth signals a more balanced and potentially enduring market uptrend.

- There are some signs of retail coming back into the fold, but for the most part, this rally remains driven by institutional capital.

Perps Data

To gauge the demand for leveraged long exposure in the crypto market, we turn our attention to perpetual futures, commonly known as ‘perps’. These instruments are favored by crypto-native investors for achieving leveraged exposure to crypto.

For the uninitiated, perps are akin to traditional futures contracts but without an expiry date. Instead, they feature a unique mechanism called the ‘funding rate’, which aligns the futures price with the spot price. The funding rate increases when there’s higher demand for long positions and decreases in response to reduced demand or increased interest in short positions.

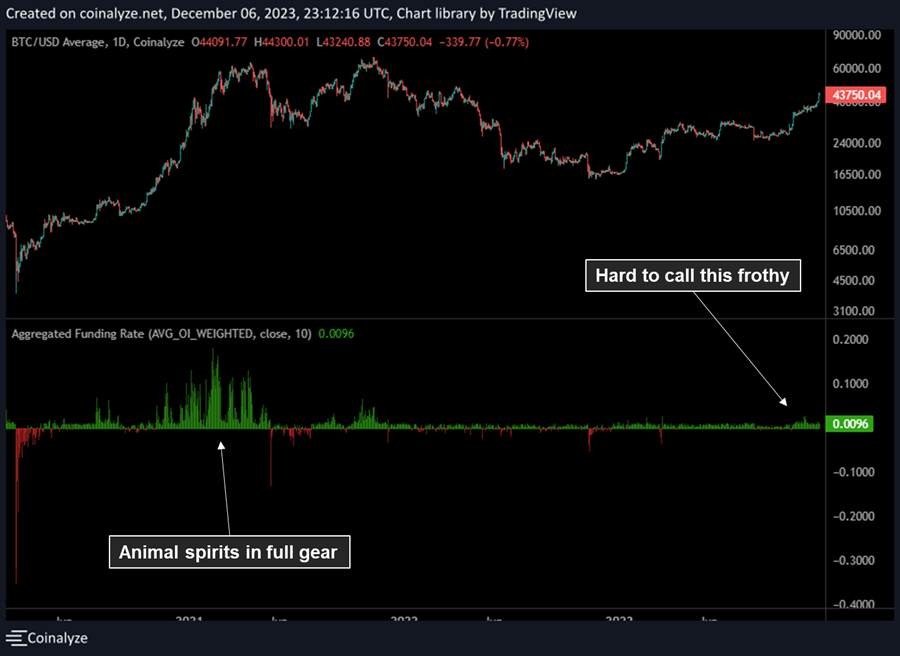

Presented below is the aggregated funding rate across all perps exchanges. This data paints a telling picture: the current market is not exhibiting the same level of leveraged speculation that characterized the peak periods of the last bull market. Instead, the levels we are observing now are more reminiscent of those seen in early to mid-2020, marking the early phase of Bitcoin’s ascent to record highs.

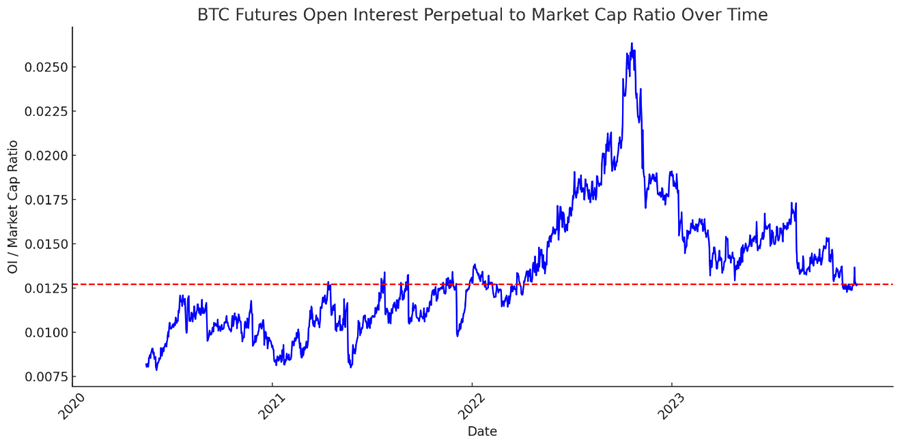

To gain a deeper understanding of market leverage in historical context, we examine the total BTC perpetual futures open interest (OI) as a ratio of the total crypto market capitalization. This ratio offers insights into the extent of leverage in the market compared to past periods.

The data presented below clearly indicates that the current level of leverage is significantly lower than the concerning heights reached during the period leading up to the FTX unraveling. While this ratio might seem elevated compared to 2021, it’s vital to note that leverage has been on a downtrend since the beginning of the year.

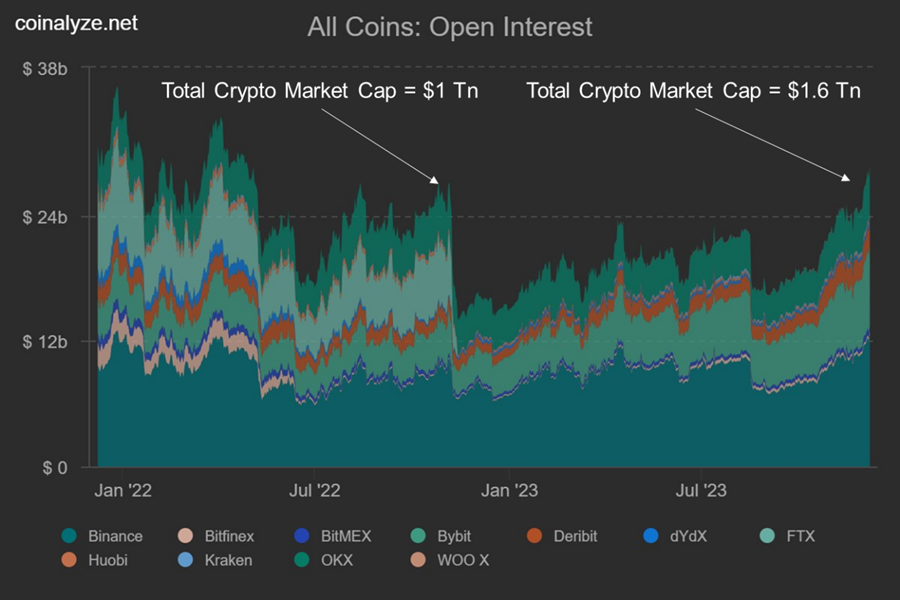

Additionally, we can take a broader view by looking at the aggregate open interest across all assets. The current levels are comparable to those just before the FTX crisis. However, despite OI being at a similar level, the total market cap of the crypto market is now 50% higher.

This disparity indicates a more balanced market, less dominated by leverage than in the previous period.

Breadth Continues to Widen (But in a Healthy Way)

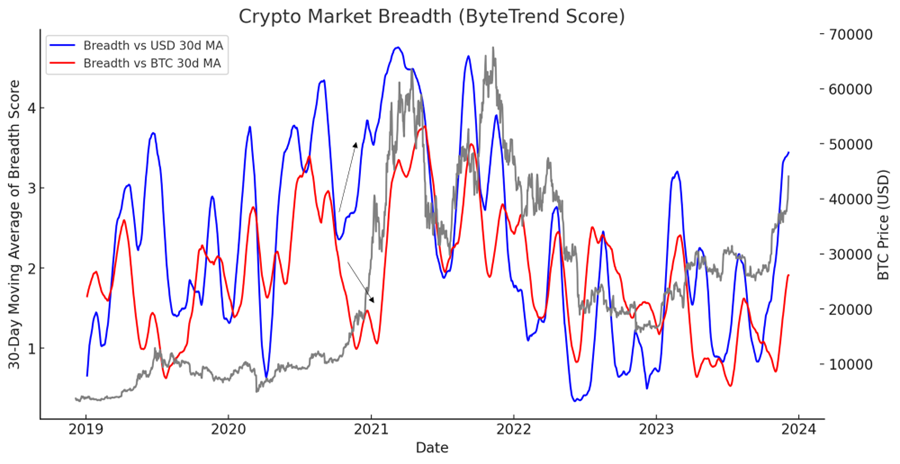

Revisiting a trend we analyzed a few weeks ago, it’s evident that the market breadth is not only expanding but doing so in a manner reminiscent of the early stages of the last bull market. ByteTree, a crypto data provider, offers a comprehensive breadth score ranging from 0 to 5 — with 5 indicating the strongest momentum — for the top 170 coins. This score is derived based on several key criteria:

- The price exceeds the 280-day moving average.

- The price is above the 42-day moving average.

- There’s an upward trajectory in the 280-day moving average slope.

- The 42-day moving average slope is on the rise.

- The most recent interaction with the 20-day maximum/minimum boundary occurred at the maximum.

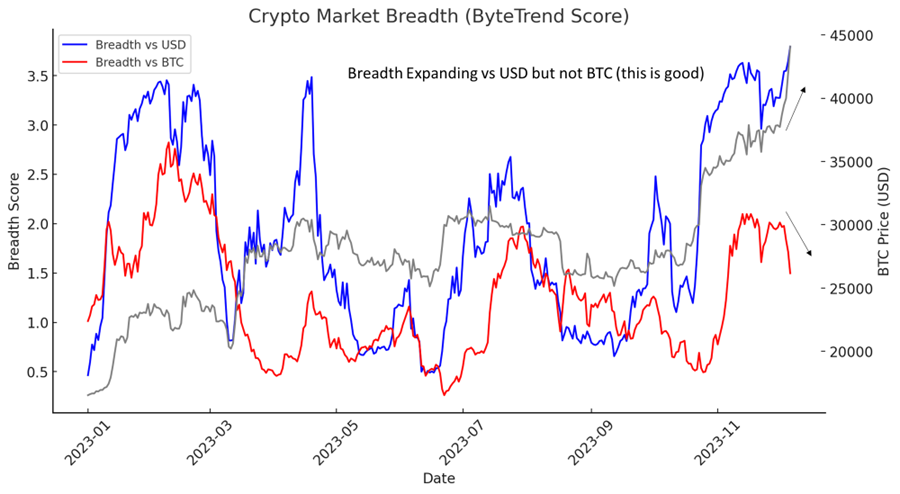

Using this scoring system, we can determine an aggregate breadth score (the market average) for both USD and BTC pairs. Our analysis reveals that the market’s breadth is indeed broadening. However, this expansion is more pronounced against USD than against BTC.

Interestingly, breadth compared to BTC is decreasing, which aligns with the recent surge in Bitcoin’s dominance. This divergence suggests that while the market rally is expanding to more assets, and there remains potential for select altcoins to appreciate further against BTC, BTC is still leading the move higher. Given this dynamic, we think it is way too early to label the market as overheated.

Upon a closer examination of the market data, with a focus on smoothing to capture more pronounced trends, we observe a pattern similar to the one that emerged at the start of the last significant bull market. During 2020, a distinct divergence was noted between breadth scores. The market, in general, performed well against the USD, but comparatively, it lagged in BTC terms until 2021.

This historical perspective suggests that a similar scenario is unfolding currently. The key takeaway from this trend is the continued relevance of Bitcoin (BTC) as a dominant force in the crypto market. Consequently, we advocate for maintaining most of one’s portfolio in BTC. At the same time, it’s prudent to seek out altcoins with the potential to outperform on an idiosyncratic basis.

Market Still Institutionally Driven

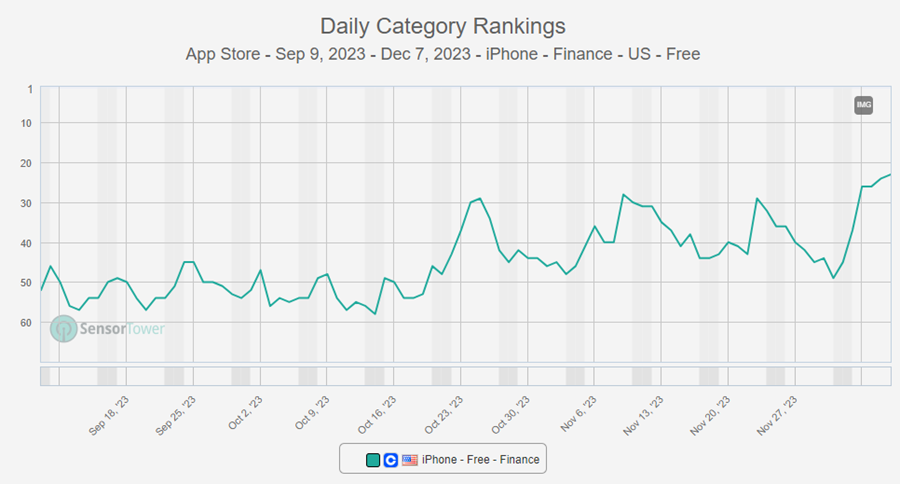

There are encouraging indications that retail investors are gradually re-entering the market. A notable metric supporting this is the improvement in Coinbase’s ranking among finance apps in the Apple App Store. The app has climbed from 57th position to 23rd.

This is certainly an impressive improvement, but it’s important to recall that during the peak of the last cycle, in October 2021, Coinbase reached the number one spot on the overall App Store charts. The current ranking, while improved, is still significantly distanced from those levels.

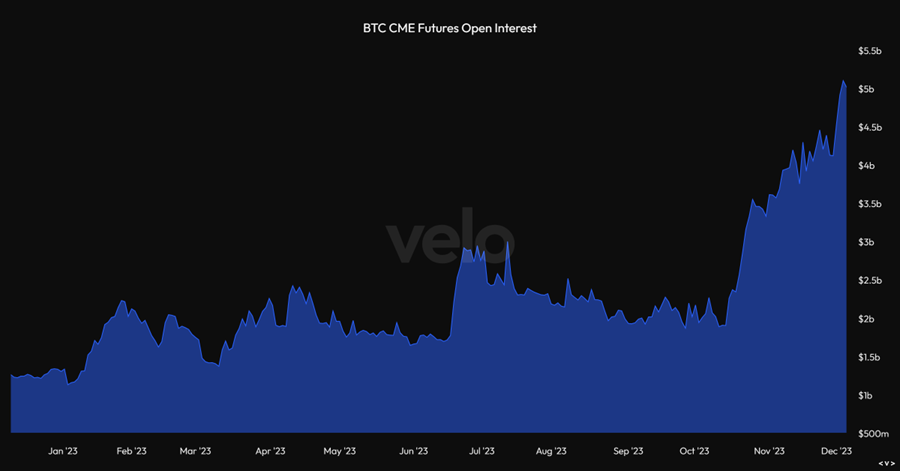

CME data speaks to the level of institutional participation in the market. Futures open interest on the CME has not only reached a new year-to-date high in USD terms but has also set an all-time high when denominated in BTC.

This significant growth in open interest is a clear signal of the increasing involvement and commitment of institutional players in the crypto futures market.

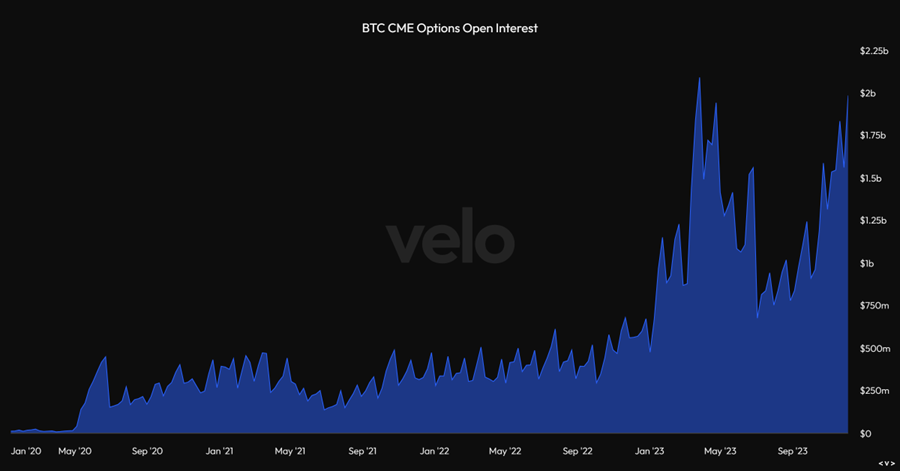

In parallel, the open interest in CME options is nearing another historic peak. This concurrent rise in the options market reinforces the picture of escalated institutional engagement.

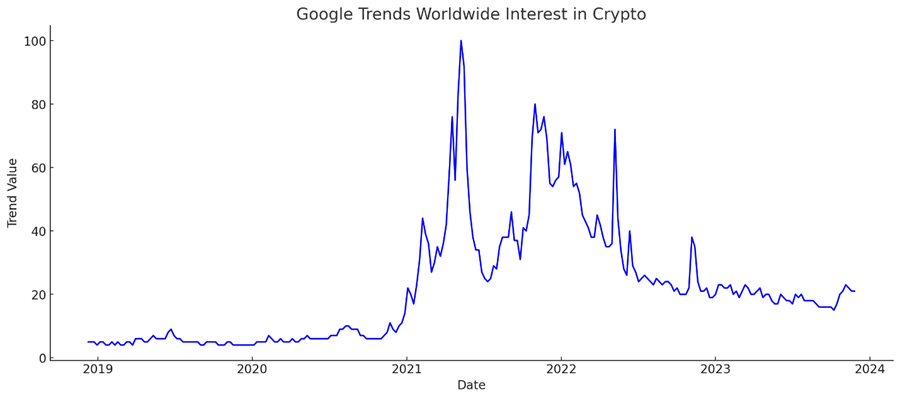

In our view, perhaps the most indicative sign that the market is far from reaching a state of retail euphoria lies in the current lack of search interest in crypto. Typically, search interest serves as a reliable barometer of retail engagement, especially as newcomers start to explore and enter the market. These newer and often less experienced investors frequently turn to online searches for information, driving up search volumes.

The subdued level of search queries related to crypto at this juncture suggests that the market has not yet captured the widespread attention of retail investors. This lack of heightened search activity aligns with the view that the current market dynamics are predominantly shaped by institutional players rather than a surge of retail interest.

Update on STX / Ordinals Drama

Last week, we added the BTC Layer 2, STX (Stacks), to our Core Strategy, and the timing proved impeccable as the token nearly doubled shortly after. Our bullish stance was based on several elements:

- Growing Ecosystem on Bitcoin: The surge in popularity of Ordinals signifies a rising interest in leveraging the Bitcoin network for commerce and innovation.

- Large Addressable Market: Considering the potential of BTC Layer 2 solutions, the total addressable market is substantial. For perspective, Ethereum Layer 2s like Optimism and Arbitrum have fully diluted market caps of $9.0 billion and $11.6 billion, respectively. Stacks, operating on a network over twice the size of Ethereum, has a FD market cap just under $2 billion (more on market sizing below).

- Upcoming Q1 Catalyst: The anticipated Nakamoto upgrade in Q1 is set to boost performance and enhance the flow of value from Bitcoin to L2. This event is likely to attract traders and on-chain enthusiasts, potentially leading to a significant uptick in STX’s value.

- Trading Perspective: Given Bitcoin’s current market leadership, STX offers a more reliable beta relative to Bitcoin than most altcoins.

Ordinals-related Dip

You will note that the first point above cites Ordinals-related hype as evidence of a growing economy on Bitcoin. Concerns arose this week when a core BTC developer suggested future code iterations might block inscriptions, labeling them as “spam” to the network. This announcement impacted BTC-related assets like STX and ORDI.

First off, it’s crucial to understand that such an update requires consensus among network nodes. The network must decide to run the software in order for it to be adopted.

Considering the increased transaction fees benefiting miners from inscriptions and the overall enthusiasm for building on Bitcoin, it seems unlikely the network will adopt this update. Moreover, even if this development materializes, it will not directly affect the future of the Stacks platform.

Regarding STX, much of the recent retracement was narrative-driven, focusing on the overall appetite for a Bitcoin economy rather than STX’s fundamentals. We maintain that the tailwinds for STX are strong, making it a worthwhile asset to accumulate during dips as we near Q1.

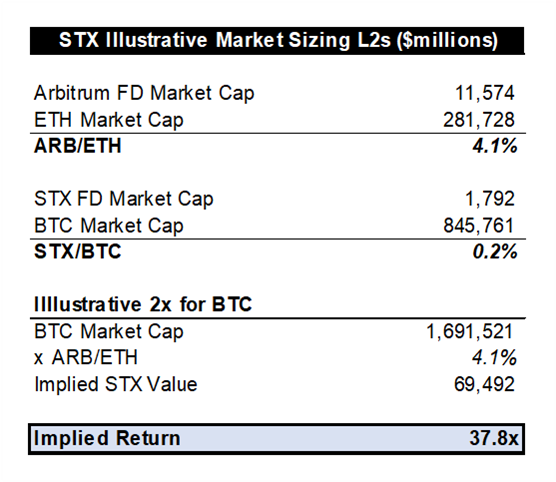

Addressable Market Illustration:

To further articulate the potential of a large addressable market, consider this: The current market cap for the largest Ethereum L2, Arbitrum, is about 4% of Ethereum’s total market cap. If we apply the same ratio to STX, assuming STX is the leading L2 and Bitcoin’s value doubles in a bull market, we would theoretically see a 38x return on STX.

It’s important to recognize that this scenario is illustrative and serves to sharpen our understanding of the potential market scale. It does not take into account factors such as competition, adoption rates, or other market dynamics.

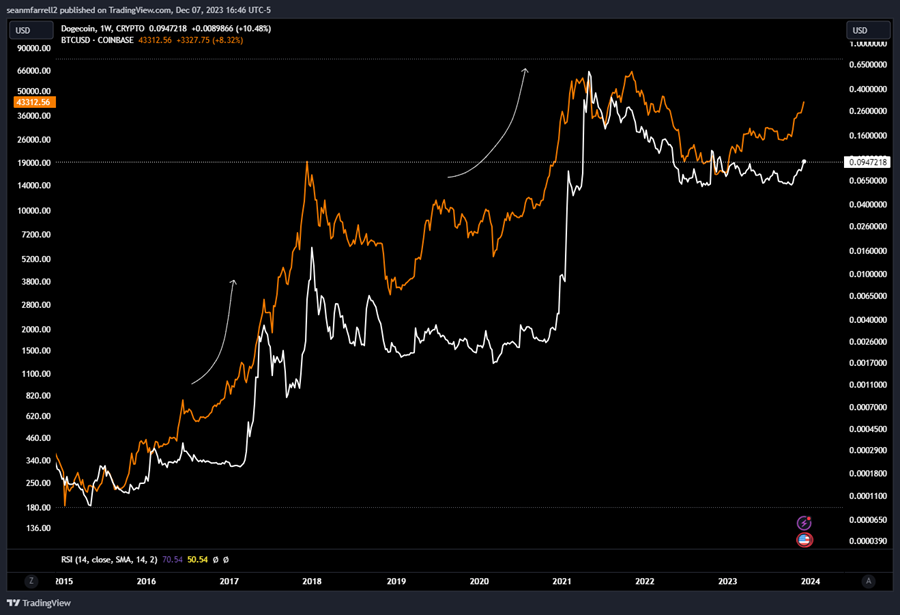

Trade Idea: Sending DOGE to the Moon (Twice)

While much of this note has been focused on how the market is not currently in an overly speculative state, it’s important to acknowledge that assets on the farther end of the risk spectrum, like DOGE, can still attract significant interest in the near term. DOGE, the popular memecoin inspired by an 18-year-old Shiba Inu named Kobasu, began as a lighthearted joke but has since evolved into a widely used medium for online tipping and fundraising. It also serves as a fairly reliable indicator of risk appetite in the broader crypto market.

The performance of DOGE during the last bull market, where it soared from less than $0.01 to over $0.75, is well documented, but it’s crucial for newcomers to understand that DOGE has historically rallied during every crypto bull market, making it a capital-efficient way to position for a widespread crypto rally.

In the immediate future, the DOGE trade is fueled by the potential narrative surrounding two upcoming space missions with DOGE themes.

- The first, Astrobotic’s Peregrine Mission One (PM1), is set to occur on December 24th and will carry 21 payloads from various entities, including a physical bitcoin token, a copy of Bitcoin’s Genesis Block, and a physical dogecoin in a DHL Moonbox.

- The second mission, featuring the DOGE-1 satellite developed by Geometric Energy Corporation, is scheduled for launch aboard a SpaceX Falcon 9 rocket on January 12th.

It’s important to bear in mind the inherent risks of space missions, including potential delays or malfunctions, which could lead to a steep sell-off in DOGE. But even if DOGE doesn’t rally in the coming months, historical trends suggest it will eventually become a lucrative trade, as indicated in the chart above.

Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

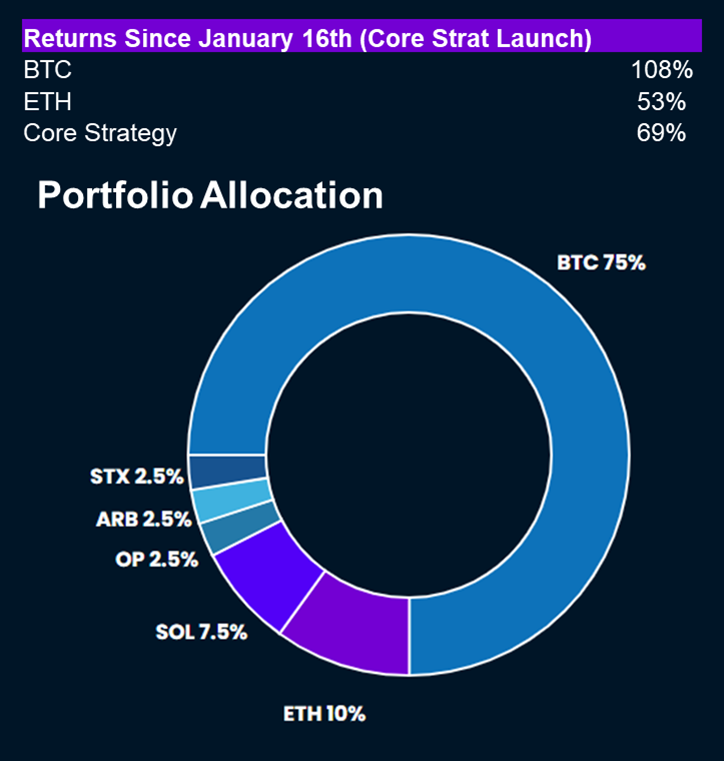

Core Strategy

Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market. A potential bounce in rates could serve as a short-lived headwind for the broader altcoin and crypto equities market, but a lack of correlations, persistence of flows, and near-term catalysts mean that risk asymmetries still skew to the upside.

A brief summary of the theses behind each component of the Core Strategy:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana (SOL -1.69% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.16% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 3.21% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

Crypto Equities