Crypto is a Fourth Quarter Team (Core Strategy Rebalance)

Key Takeaways

- On Thursday, equities and crypto markets rebounded, buoyed by anticipated SEC approval of ETH futures ETFs.

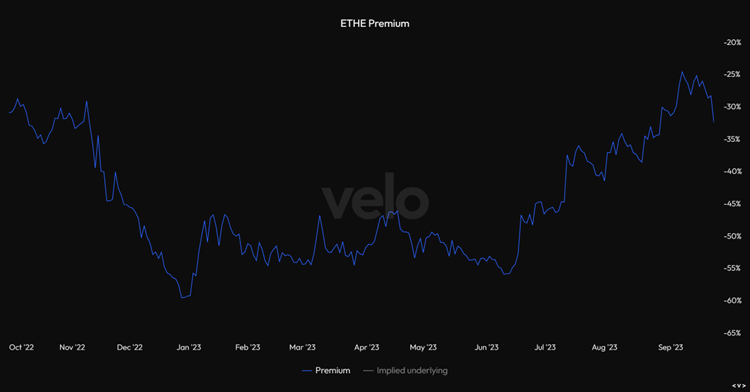

- While an ETH ETF should induce a short-term rally, its intermediate-term impact remains uncertain and will be monitored alongside other indicators (flows). These developments, in the context of a favorable Q4 macro-outlook, enhance the risk/reward profile for Ethereum-based assets like ETHE.

- Amid an upcoming government shutdown that has sped up ETH futures ETF approvals and delayed spot Bitcoin ETF decisions, the odds of a deferral until January for a BTC ETF have risen. However, a Q4 approval for spot Bitcoin ETFs remains our base case.

- Recent shifts in Bitcoin's correlation with macro variables and its outperformance compared to the Nasdaq 100 raise questions about whether crypto is signaling a local or longer-term bottom in asset prices.

- As the typically negative seasonal influences on crypto for August and September wane, we are approaching a period generally considered to be more bullish for crypto markets.

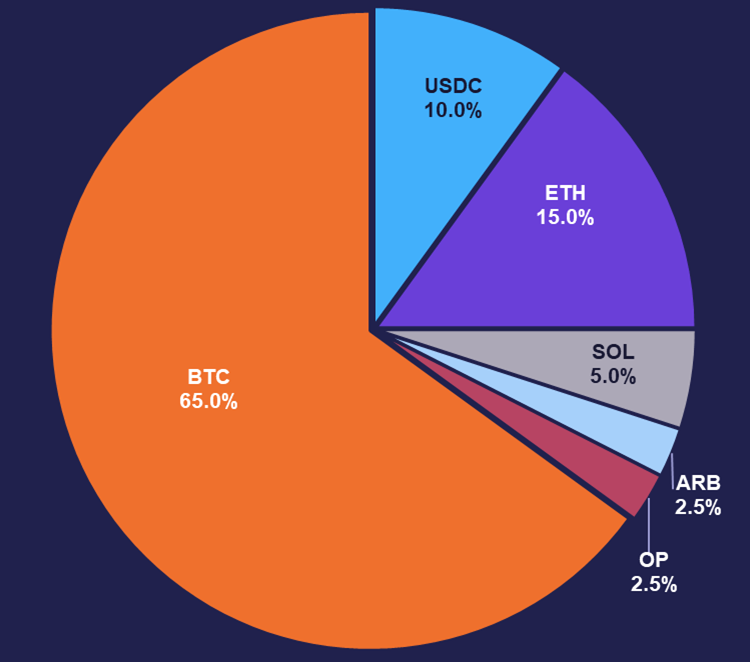

- Core Strategy – Despite soaring rates and volatile asset prices, we believe it's prudent to adopt a more constructive stance on crypto prices as we enter Q4. While we await confirmation from flows data, we think its right to start increasing risk exposure, particularly in the majors and Grayscale trusts, which continue to trade at a discount to NAV. We are reintroducing ETH L2 tokens to the Core Strategy allocation as well as a small allocation to SOL.

ETHTFs Coming to a Brokerage Account Near You

Thursday marked a broad-based rebound in equities and crypto, with a modest bounce in the bond market tagging along. This crypto rally received an extra push from some noteworthy developments. Our flash insight on Thursday morning highlighted Bloomberg’s Eric Balchunas’ commentary, suggesting a high likelihood that the SEC would greenlight ETH futures ETFs this week due to the imminent government shutdown, which could also impact the BTC spot ETF landscape.

Later in the day, VanEck unveiled plans for its upcoming Ethereum Strategy ETF (EFUT). Around the same time, asset manager Valkyrie announced the purchase of ETH futures contracts, following approval to convert its existing Bitcoin futures ETF into a dual-investment vehicle. To us, this sets the stage for ETH futures products to become accessible through major brokerage accounts come Monday.

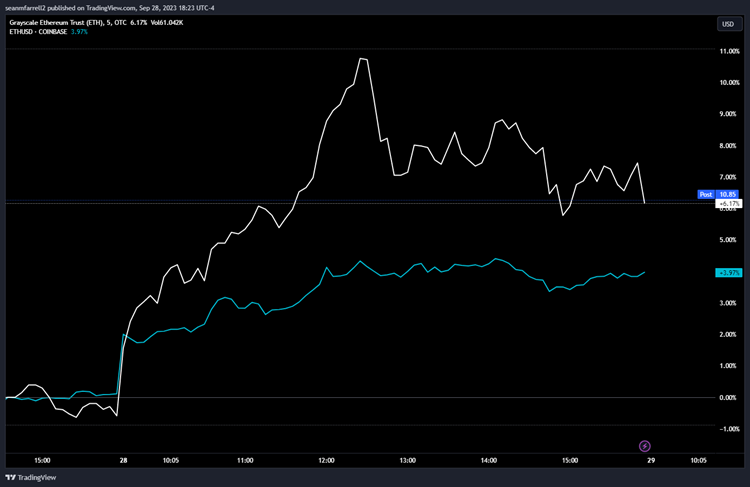

ETH saw solid performance, but ETHE, the Ethereum Grayscale Trust, which opened the day at a 34% discount to NAV compared to GBTC’s 23% discount, doubled spot price performance. With the introduction of ETH futures products, we expect this discount gap to narrow, possibly unlocking a 17% gain for ETHE, in addition to any price appreciation in the underlying.

As for the impact on ETH prices, a short-term rally seems plausible. Companies are likely to embark on a marketing frenzy to secure liquidity and market share right out of the gate. This could result in price discovery in the futures market exerting upward pressure on the spot market. However, let’s temper our excitement; the mere existence of an ETH ETF won’t necessarily catapult ETH prices to astronomical levels. We’ll be closely monitoring other indicators like stablecoin flows, on-chain activity, and macro factors to gauge the sustainability of any rally.

Overall, the macro outlook provides reasons to be optimistic about crypto assets in Q4, as we’ve discussed elsewhere in this note. Regardless of the broader economic climate, the introduction of these new financial products undoubtedly enhances the risk/reward profile for ETHE.

Government Shutdown Clouds the Bitcoin Spot ETF Timeline

The looming government shutdown is casting a shadow over the timeline for spot Bitcoin ETF approvals. With the government likely to close its doors temporarily (duration estimates we have seen range from 1-3 weeks) starting this weekend, regulators are racing to clear their desks before clocking out. One of their recent moves was the expedited approval of ETH futures ETFs.

In a parallel development, it seems they’re also postponing decisions on all pending spot BTC ETF applications until January. Just yesterday, the SEC deferred its decision on the ARK ETF—a call that wasn’t even due until November—and today, they followed suit with the Valkyrie, BlackRock, and Bitwise applications. While this doesn’t guarantee that we’ll be left hanging until the new year, it certainly moves the scales further in that direction.

More importantly, this shift redirects all eyes to the unfolding Grayscale vs. SEC drama. To recap, the SEC has a few cards to play:

- Find a new reason to deny the spot Bitcoin ETFs, risking yet another lawsuit.

- Appeal the court’s decision within 45 days.

- Possibly roll back approvals for futures-based ETFs to justify denying spot ETFs (considering they’ve just greenlit ETH futures ETFs).

- Give the nod to spot Bitcoin ETFs, aligning with the judicial system and sidestepping more legal fallout.

In our view, it’s either an appeal or an approval from the SEC. An appeal might just be the SEC kicking an inevitable can down the road but is worth pondering, especially for sizable holders of Grayscale trust products.

Our base case still points to a Bitcoin spot ETF getting the green light in Q4, although these latest developments surely boost the chances of a delay until January.

Bond Rout Continues

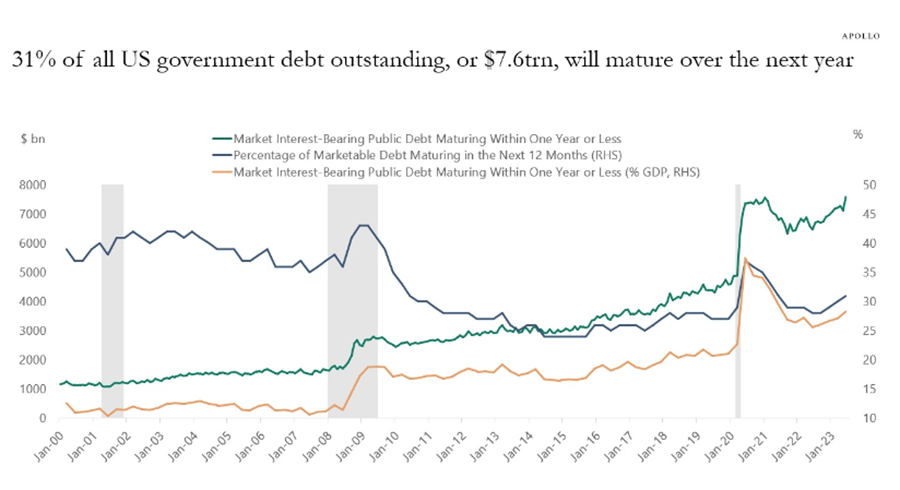

Rates have soared relentlessly, leaving a trail of bond portfolio managers grappling with the wreckage. It has become almost a daily spectacle—new multi-decade records are being set for Treasury rates across various maturities. The long end of the yield curve has been especially volatile, fueled largely by the U.S. Treasury’s massive issuance of duration and the ongoing challenges that foreign central banks face in stabilizing their domestic markets. The troublesome state of fiscal affairs is becoming increasingly apparent. As a reminder, $7.6 trillion in government debt is set to mature over the next year.

For those not deeply familiar with the nuances, long-term interest rates are essentially a blend of a risk-free rate and a term premium, which includes projected inflation. While many analysts attribute the major bond selloff to the market pricing in persistent inflation, we believe that the surge in 10-year and 30-year rates is a combination of inflation expectations and the supply dynamics mentioned earlier. In essence, the pricing of these long-dated Treasuries is influenced by two key variables: skewed supply and demand dynamics, and inflation expectations.

There are a couple of factors that we think could alleviate rising rates and stabilize risk assets in the short term.

Firstly, the release of positive inflation data could serve as a catalyst. While this wouldn’t directly address the issue of oversupply, it could stimulate sufficient demand for Treasury purchases. Our perspective is that inflation has likely peaked. Upcoming PCE data scheduled for release on Friday, along with CPI data for October (assuming the government is still able to produce this data) that is expected to benefit from more favorable base effects, could help recalibrate inflationary concerns.

Secondly, the introduction of more constructive economic data on a global scale could also play a role, although this remains an area of uncertainty for us.

It is important to remember that markets are generally forward-looking, taking into account both future supply and anticipated global demand. We believe these factors should already be theoretically accounted for in current Treasury auction prices. As we transition into Q4, we anticipate that market participants will become increasingly aware of, and responsive to, this dynamic.

Crypto Calling a Top in Rates?

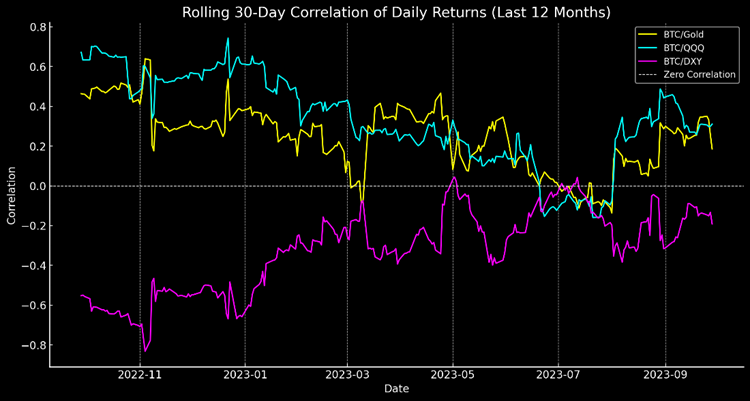

We were more conservative in our Core Strategy in September, largely due to the negative seasonality and a foreseen continued rise in rates and the dollar. The latter came to fruition, however, in recent days, we have seen bitcoin’s correlation with macro variables started to turn back toward 0.

Historically, crypto is the first responder to changes in macro conditions. Thus, one must wonder whether this is a sign of either a local or a longer term bottom in asset prices.

As displayed in the chart below, BTC has outperformed the Nasdaq 100 considerably over the past two weeks. There has been limited constructive price action in crypto prices, but equities have continued to move lower.

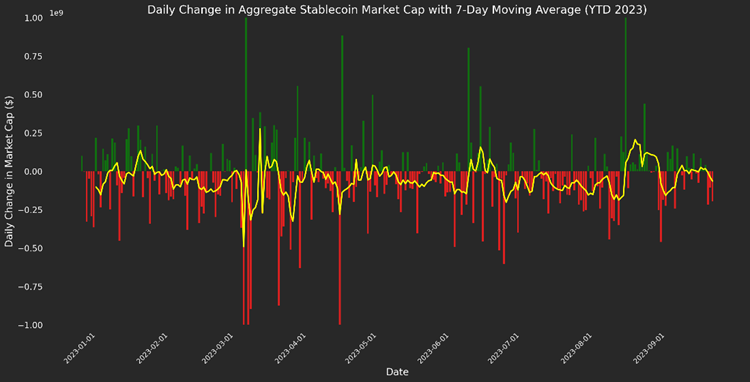

We’re currently observing a shortfall in inflows, as evidenced by lackluster stablecoin minting activity, modest increases in the realized caps for both BTC and ETH, and subdued flows into crypto-specific exchange-traded products. Given these indicators, a degree of skepticism is warranted when discussing potential market rallies. However, it’s worth noting that price surges can sometimes act as the initial spark for a rally, and its sustained inflows in the spot market that serve to maintain such momentum over the longer term.

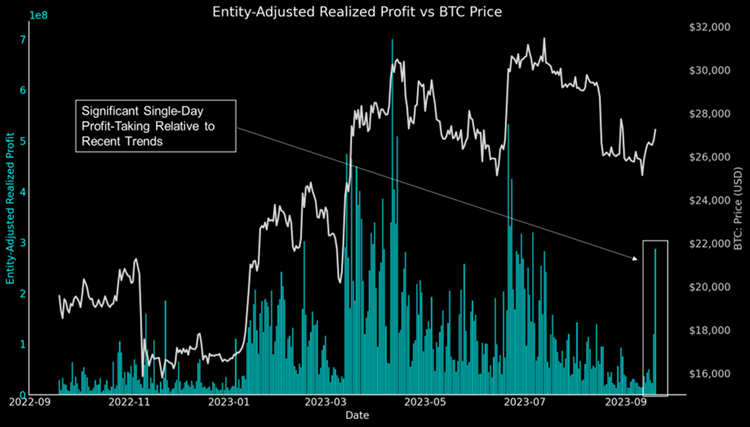

It’s crucial to highlight the significant profit-taking activity we observed last week from some long-term holders. As illustrated by the distinct outlier in the chart below, a substantial amount of Bitcoin was sold for a profit during the early-week rally. While the identity of the seller is not confirmed—it could potentially be a miner—the key takeaway is the market’s capacity to absorb such a large sale. This type of profit-taking, coupled with the market’s resilience in handling it, could indicate that the chart has sufficiently consolidated. Moreover, it suggests that a strong enough base may have formed to support an upward price movement.

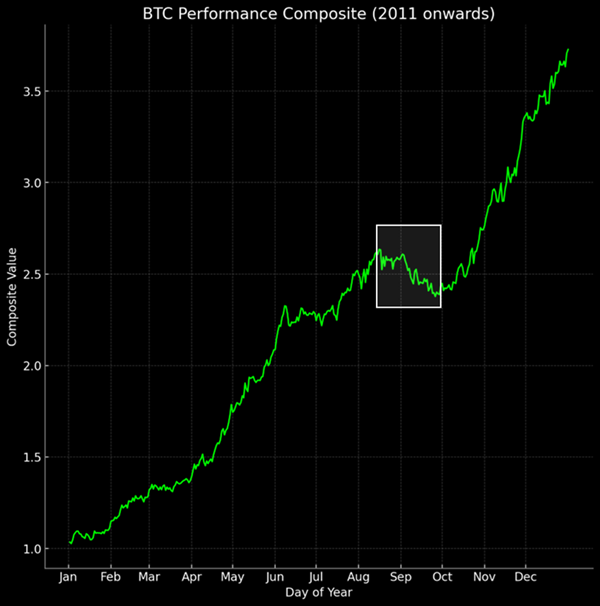

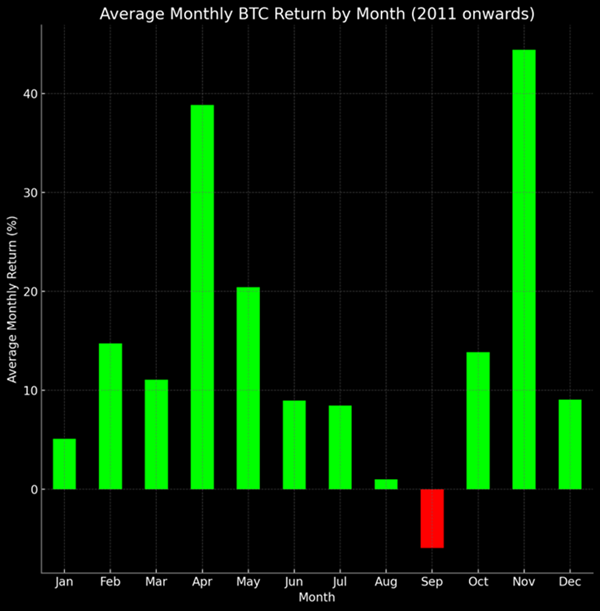

Respecting the Seasonality in the Other Direction

Acknowledging seasonal trends has proven to be a useful strategy in both crypto and traditional markets throughout this year. At the risk of sounding repetitive, it’s important to revisit the chart below. This chart underscores that the typically negative seasonal influences affecting crypto during August and September are nearly behind us.

Coincidentally, we are on the cusp of entering what is generally considered a more bullish seasonal period for crypto.

Core Strategy

Despite soaring rates and volatile asset prices, we believe it’s prudent to adopt a more constructive stance on crypto prices as we enter Q4. While we await confirmation from flows data, we think its right to start increasing risk exposure, particularly in the majors and Grayscale trusts, which continue to trade at a discount to NAV. We are reintroducing ETH L2 tokens to the Core Strategy allocation as well as a small allocation to SOL.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin ($BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum ($ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana ($SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism ($OP) & Arbitrum ($ARB): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities

Returns through 9/29

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...