Bitcoin Sniffing Out a Dip in Market Liquidity

Key Takeaways

- Bitcoin's correlation with equities and gold has weakened, highlighting a change in market dynamics. On-chain indicators imply a decline in confidence among holders. These shifts could be influenced by a recent short-term peak in global market liquidity and the anticipation of an upcoming debt ceiling resolution, which may have further implications on liquidity.

- We anticipate that downside risk will be short-lived for several reasons: (1) favorable inflation data this week supports the likelihood of the Fed pausing rate hikes, (2) a supply-driven increase in market rates following the debt ceiling resolution could generate demand outside of the RRP, and (3) global factors, such as China's economic challenges, suggest the potential for monetary expansion.

- The ongoing surge in on-chain activity resulting from the creation of Ordinals on the Bitcoin blockchain has led to increased transaction fees and miner revenue. This development is seen as positive for the stability and security of the network. Arguments against high fees are considered misguided as they fail to acknowledge the market-driven nature of fees and the necessity of full blocks. Bitcoin's scalability will be tackled through layer 2 solutions, and platforms like Stacks may gain popularity.

- Recent on-chain spike in activity has suggested that in a sustained on-chain bull market for ETH, investors should expect a deflationary supply schedule, which socializes the usage of the network to all ETH holders. Further, the unexpected fee increases on L2 networks that occurred upon publishing data to the mainchain strengthens the fundamental need for EIP-4844 and possibly strengthens the trading narrative for L2 networks post implementation.

- Core Strategy – Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling and recent negative price movements, our overall outlook for the year remains positive. If the Federal Reserve follows through with a pause, it would be a positive development for assets sensitive to liquidity conditions.

Bitcoin Reflecting a Local Top in Market Liquidity

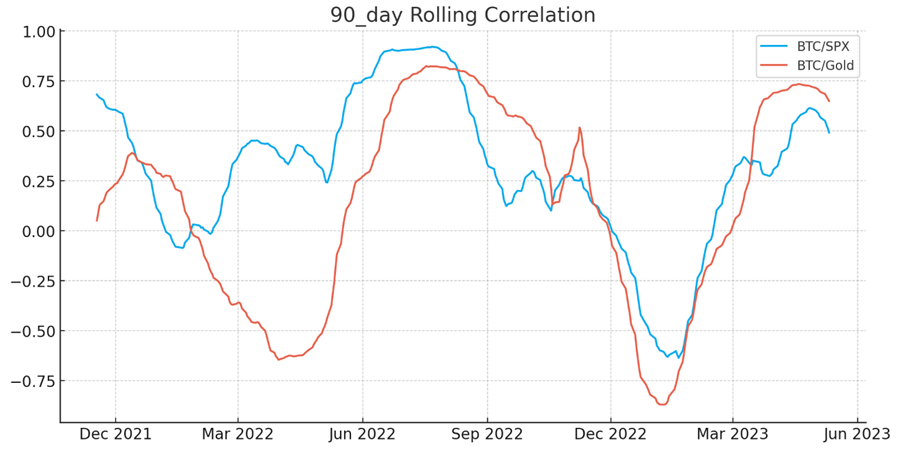

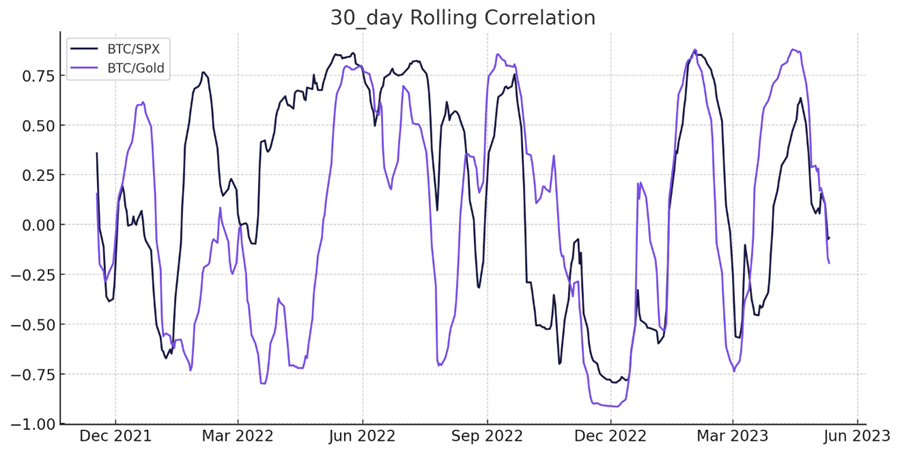

During the majority of Q1 and early Q2, the financial market observed a strong correlation between Bitcoin (BTC), equities, and gold, with an even more pronounced link between BTC and gold. This close relationship was a result of global market liquidity reaching its lowest point in Q4 of 2022, which coincided with a slowdown in inflation and (likely) the final stages of the Federal Reserve’s tightening cycle. This relationship continues to be evident in the 90-day rolling correlations between these assets.

However, zooming in, it appears that the correlations between Bitcoin and these other liquidity-sensitive assets have been deteriorating recently. The chart below illustrates that BTC has become virtually uncorrelated with both SPX and gold over the trailing 30-day period. We think this shift may indicate an ongoing short-term change in market dynamics.

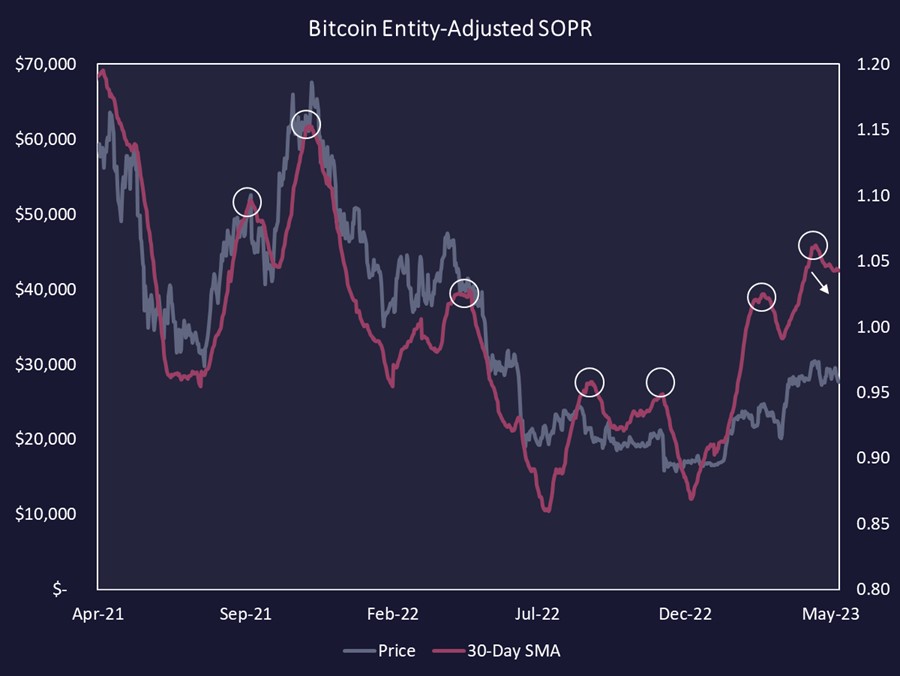

Unsurprisingly, on-chain momentum indicators, particularly our favored Spent Output Profit Ratio (SOPR), reveal diminishing conviction among holders, resulting in more sellers at lower margins. SOPR is an on-chain metric that evaluates the profitability of Bitcoin holders by comparing the purchase price of spent outputs to the price at which they were sold, offering valuable insight into market sentiment and potential trend reversals. A downward-trending SOPR suggests that the market lacks a strong bid from new or existing market participants, indicating a potentially weakening demand.

We believe the market dynamics observed over the past couple of weeks are a result of two factors: (1) Bitcoin and the broader crypto space reacting to a local peak in global market liquidity, and (2) are potentially declining in anticipation of an impending debt ceiling resolution.

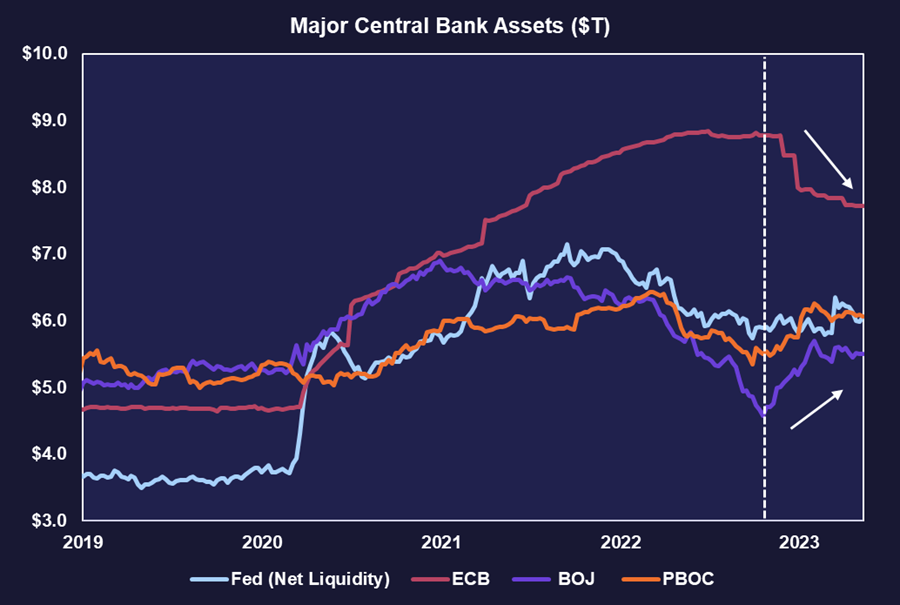

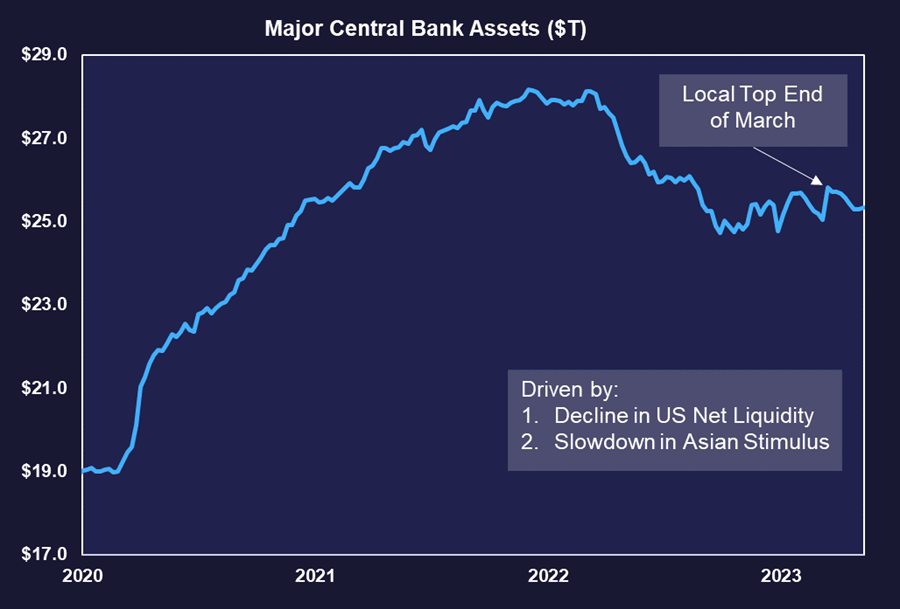

Regarding point (1), the chart below, which our clients have seen multiple times this year, clearly illustrates that liquidity from three of the four major central banks (Federal Reserve, People’s Bank of China (PBOC), and Bank of Japan (BOJ)) bottomed out in October. However, upon closer inspection, one can also observe that US liquidity has decreased in recent weeks, while PBOC and BOJ liquidity have remained relatively flat.

Integrating the information from the chart above into the composite below provides us with a clearer understanding of the local peak in USD market liquidity observed at the end of March.

As it pertains to point (2) above, we return to the debt ceiling ordeal.

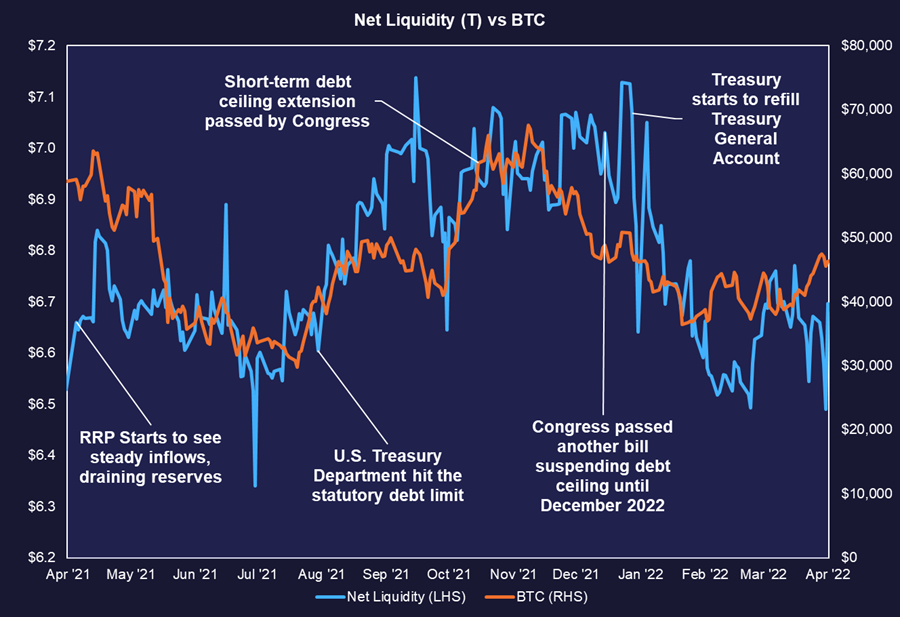

Over the past several weeks, we have emphasized the importance of noting that a debt ceiling resolution is likely to cause a temporary further decline in private market liquidity. This occurs as capital is withdrawn from bank reserves and transferred to the Treasury’s General Account (TGA). For context, let’s review domestic net liquidity during the 2021 debt ceiling negotiations and the subsequent effects on Bitcoin (BTC). This historical perspective can offer valuable insights into potential market reactions to similar events in the present.

Bottom line regarding near-term risks: Bitcoin’s correlation with equities and gold has weakened, indicating a change in market dynamics. On-chain indicators suggest waning confidence among holders. These shifts may be influenced by a recent peak in global market liquidity and anticipation of a forthcoming debt ceiling resolution, which could have additional effects on liquidity.

Ample Reasons to Expect Downside Risk to be Short-Lived

The good news is that the inflation data this week appeared favorable enough to justify a temporary halt in rate hikes by the Federal Reserve. Although rate cuts may still require a series of positive inflation reports or indications of economic decline, the cessation of rate hikes may begin redirecting demand from the overnight rate towards other segments of the financial market.

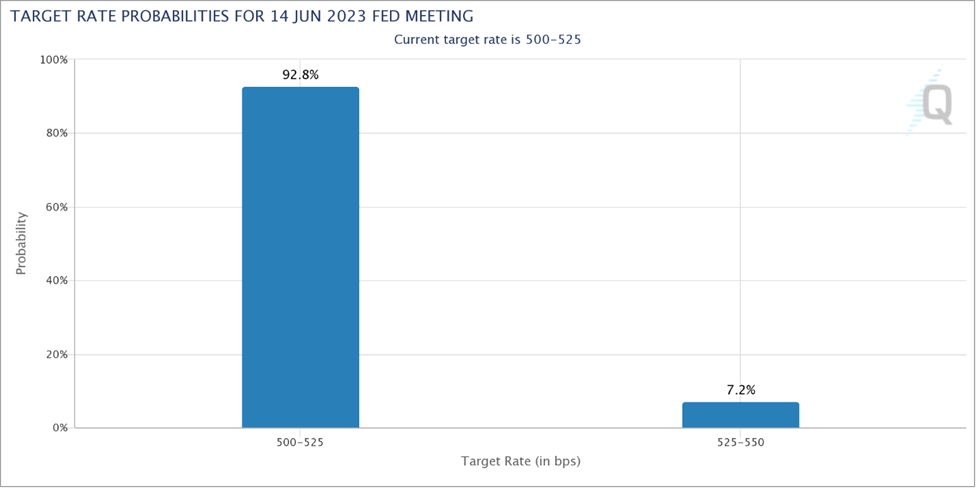

Below, we can observe that the futures market currently reflects a strong likelihood of the Fed adopting a “wait and see” approach at their June meeting.

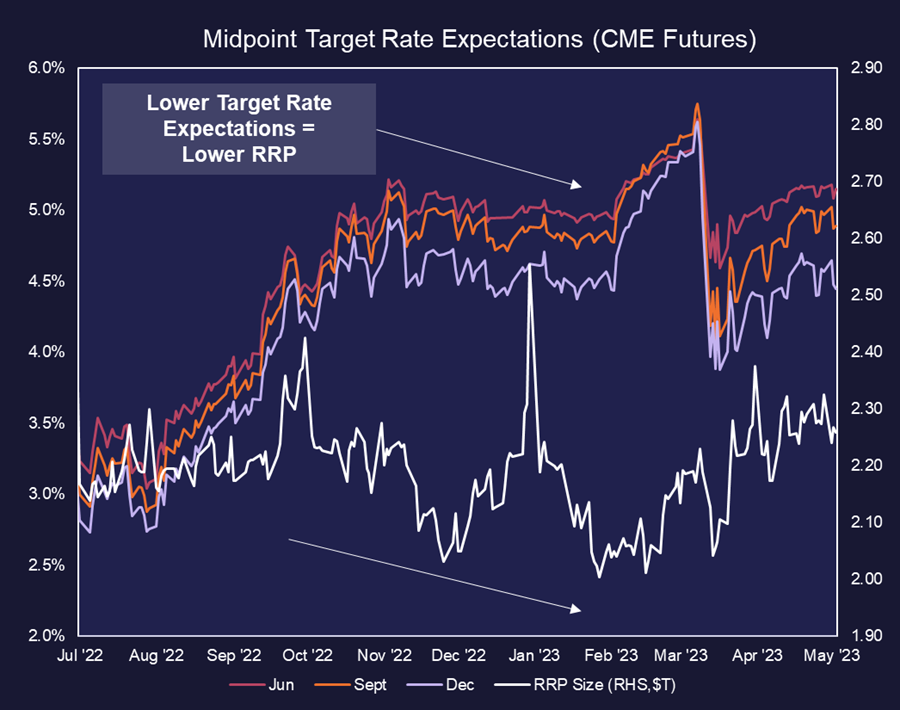

The theory that a rate cut would lead to capital moving out of the Reverse Repurchase Agreement (RRP) facility and back into the banking system can face logical pushback. The question arises: why would capital flow into other areas of the debt or equity market when it can achieve a real yield in the RRP facility?

In response to this pushback, it is important to note that market dynamics can be influenced by various factors beyond just the yield offered in the RRP facility. While the RRP facility may provide an attractive yield, investors and market participants consider a range of factors when making investment decisions.

One key factor is market sentiment and expectations. If there is a perception of a potential slowdown in rate hikes or a change in monetary policy, it can impact investor behavior. Even with the significant yield offered in the RRP facility, capital may still shift out of the RRP and into banking reserves due to factors such as anticipated changes in interest rates, economic outlook, risk appetite, and other investment opportunities.

Our more empirical pushback against this criticism is shown in the chart below. Just last year, we witnessed a partial but substantial exodus from the RRP into the private market when rate hike expectations started to fall. It is possible that we see a similar dynamic play out if the Fed pauses in June.

Secondly, it is likely that rates would rise due to an increased supply of treasuries entering the market following a debt ceiling resolution. Surprisingly, this could lead to a movement of dollars out of money market funds (MMFs) and the overnight rate and into the banking system.

The rationale behind this is relatively straightforward. As inflation approaches the 2% target, investors will face a decision regarding where to seek yield. While the overnight rate offers a yield, it is only guaranteed as long as the Fed Funds rate remains high. On the other hand, investors can opt for a 2-year rate that may exceed 4% by the time the treasury issuance is complete.

In this scenario, investors evaluating their options may consider the potential benefits of locking in a higher yield for a longer duration through longer-term treasury bonds. This could incentivize them to shift their dollars away from MMFs and the overnight rate and towards the banking system.

Finally, on a global scale, there are ample reasons to anticipate monetary expansion from other central banks. China’s recent economic data reveals that inflation remains low, with core inflation holding steady at 0.7% YoY and 0.1% MoM, while consumer prices rose by only 0.1% YoY and declined by 0.1% MoM.

This indicates insufficient demand rather than deflationary pressures. Although the recovery of the service sector is a positive sign, the Chinese economy still faces challenges such as weak consumer sentiment, cautious spending, and a slow property market recovery. Consequently, there is an increasing expectation for the Chinese government to implement additional fiscal stimulus. In parallel, the People’s Bank of China (PBOC) may opt to maintain accommodative monetary policy measures in order to support growth and address the labor market and property sector challenges.

Bottom line regarding impending liquidity tailwinds: Short-lived downside risk is expected due to favorable inflation data potentially pausing rate hikes and redirecting demand to other financial market segments. Factors like market dynamics, sentiment, and investor behavior go beyond yield. A post-debt ceiling resolution increase in rates driven by supply could move dollars to the banking system. Global factors, including China’s economic challenges, indicate the possibility of monetary expansion and fiscal stimulus.

Fee Party Continues

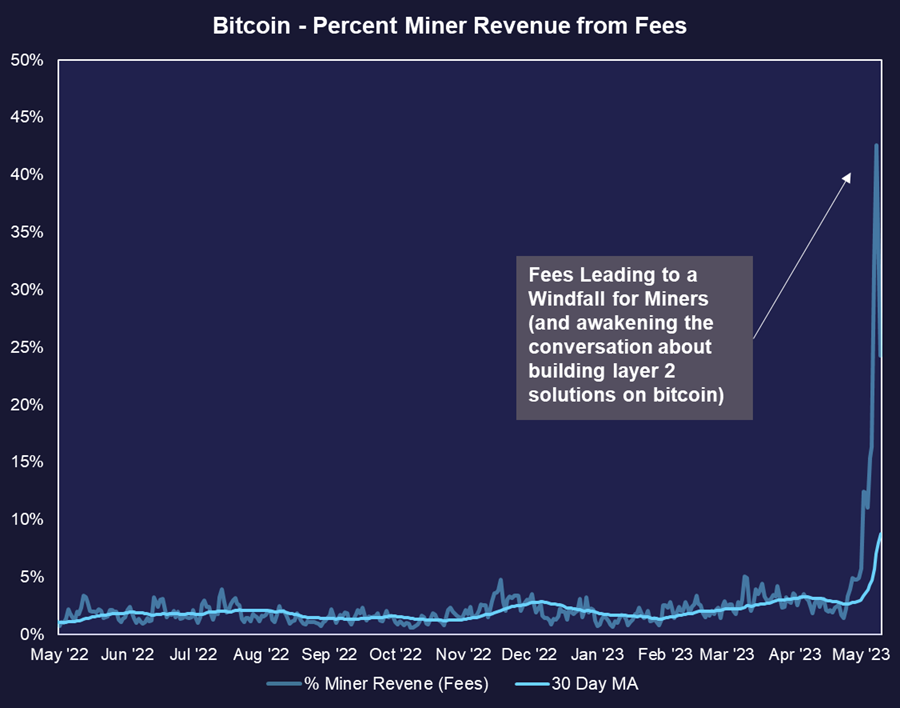

As discussed last week, the surge in the creation of Ordinals on the Bitcoin blockchain, facilitated by the BRC-20 token standard, has led to increased on-chain activity. The increased demand for block space has resulted in larger, full blocks and higher transaction fees. Miners, who traditionally rely on the block subsidy, are now earning a significant portion of their revenue from transaction fees, which may positively impact their financial health. This trend strengthens the Bitcoin network’s stability and security while reigniting interest among individuals who were previously disheartened by cultural challenges. Publicly traded miners could potentially exceed market expectations in the upcoming earnings season as a result.

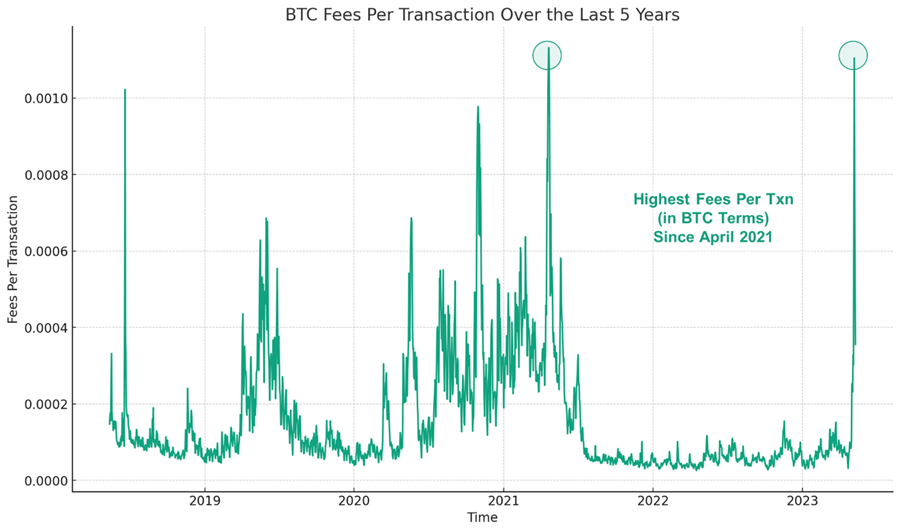

This trend has persisted throughout this week, driving BTC fees per transaction to their highest level since the significant market downturn in 2021. Usually, fees tend to spike during periods of heightened volatility. However, this recent fee increase comes as a surprise, considering that the price of BTC has been relatively stable within a range for the past month. Consequently, this fee surge caught many off guard. For instance, Binance had to temporarily suspend withdrawals last week due to the need to refill their hot wallets, while the network congestion made it challenging to transfer BTC from their cold wallets to the exchange’s hot wallets.

Some have made the odd argument in recent weeks that high fees on the Bitcoin network are negative, as they price out users from the global south and highlight Bitcoin’s shortcomings. We believe these arguments are intellectually lazy and fail to understand the nature of Bitcoin. Fees are determined by market demand, and high fees indicate increased network usage. Having full blocks and competition for block space is crucial for the long-term survival of Bitcoin. Therefore, we should view high fees as a positive development for a network that has experienced limited activity in recent years. Those who view high fees and a congested mempool as a discredit to Bitcoin misunderstand how a truly decentralized and censorship-resistant network scales. Bitcoin operates as a settlement layer, similar to ACH, rather than a credit card payment network like Visa. Bitcoin, along with Ethereum, will scale in layers, and we expect the development community to refocus on creating scalable layer 2 solutions for Bitcoin in light of the recent Ordinals craze. It is possible that networks like Stacks (STX) and similar bitcoin L2 platforms may gain traction leading up to the halvening in under a year from now.

Bottom Line regarding bitcoin network congestion: The ongoing surge in on-chain activity resulting from the creation of Ordinals on the Bitcoin blockchain has led to increased transaction fees and miner revenue. This development is seen as positive for the stability and security of the network. Arguments against high fees are considered misguided as they fail to acknowledge the market-driven nature of fees and the necessity of full blocks. Bitcoin’s scalability will be tackled through layer 2 solutions, and platforms like Stacks may gain popularity.

The Utility of Memecoins is Burning ETH

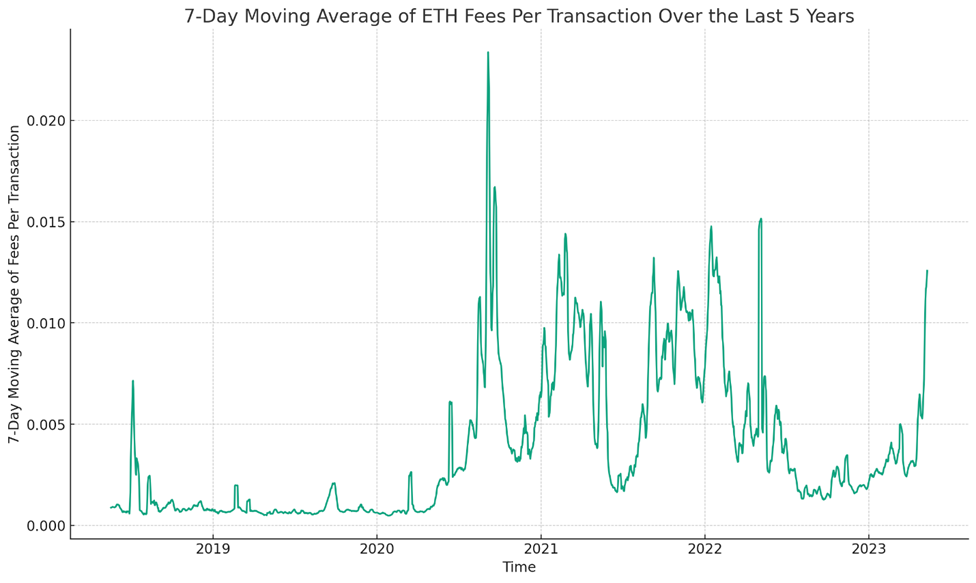

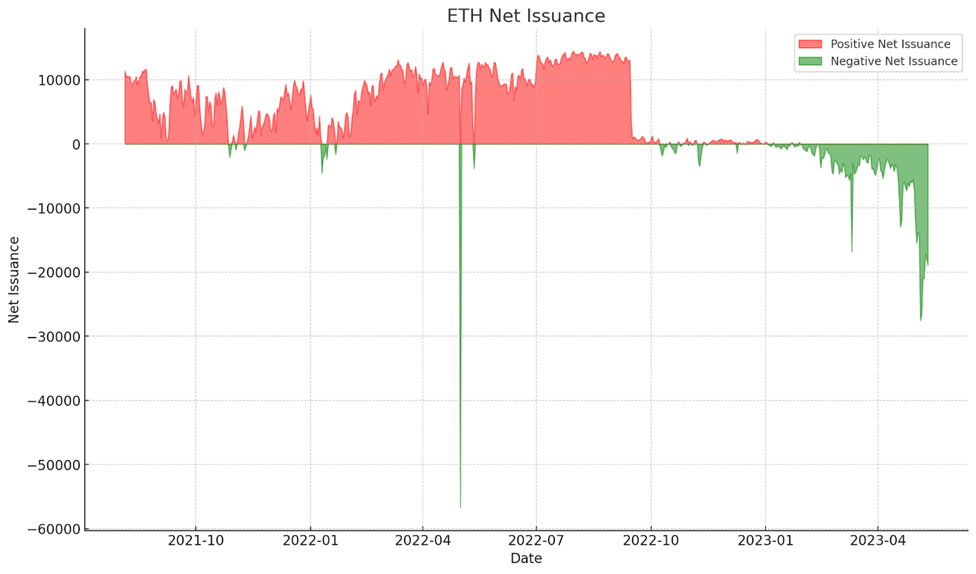

Regarding on-chain activity, the recent craze surrounding memecoins on Ethereum has begun to subside, as those who profited from PEPE have started to take profits. However, this mania has left a lasting impact on the circulating supply of ETH and has further strengthened a crucial narrative within the Ethereum ecosystem. Notably, there has been a significant surge in mainchain transactions, which many have anticipated to remain subdued due to the growing traction of layer 2 networks such as Arbitrum and Optimism.

Ethereum experienced a surge in gas fees, reaching their highest level in over a year, due to the high demand for trading the PEPE meme coin. On May 4, the average cost of a single transaction on Ethereum exceeded $15.82. The popularity of PEPE and other meme coins led to increased trading volumes and market capitalization. As a result, we witnessed ETH move into an incredibly deflationary trajectory as ETH fees spiked, and base fees were burned at an incredible rate.

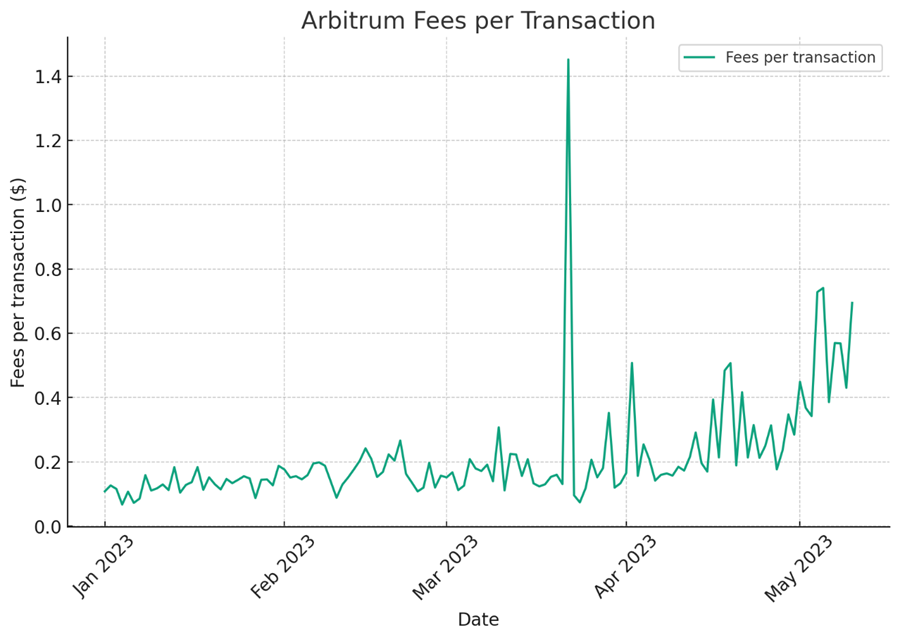

Interestingly, gas fees for Layer-2 transactions were also affected, including fees for zero-knowledge proof (ZK)-based rollups, which experienced significant increases. However, optimistic rollup solutions like Arbitrum One and Optimism had lower gas fees compared to ZK-based solutions.

As demonstrated in the chart below, there was a notable spike in fees per transaction on the high-throughput Arbitrum network, which coincided with a recent surge in activity on the mainchain.

Bottom Line regarding ETH on-chain activity: Recent on-chain spike in activity has suggested that in a sustained on-chain bull market for ETH, investors should expect a deflationary supply schedule, which socializes the usage of the network to all ETH holders. Further, the unexpected fee increases on L2 networks that occurred upon publishing data to the mainchain strengthens the fundamental need for EIP-4844and possibly strengthens the trading narrative for L2 networks post implementation.

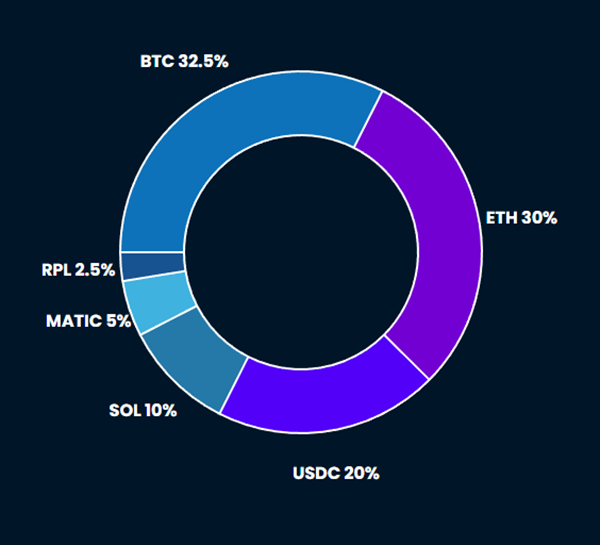

Core Strategy

Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling and recent negative price movements, our overall outlook for the year remains positive. If the Federal Reserve follows through with a pause, it would be a positive development for assets sensitive to liquidity conditions.

Tickers in this report: BTC, ETH, PEPE, ARB 0.13% , OP 0.70% , SOL -0.97% , MATIC RPL, STX -0.67%