The Way You MOVE

Key Takeaways

- The recent volatility in the bond market, indicated by the MOVE index, has contributed to increased use of the Reverse Repurchase Agreement (RRP) facility. As the bond market stabilizes, it is expected that some capital will move from the RRP back into the private market and serve as a buffer to net liquidity.

- The Fed may pause rate hikes, and historical data shows that while risk assets underperform after the final hike amid persistent inflation, they thrive in disinflationary periods. Thus, a pause in rate hikes should be viewed as constructive for cryptoassets.

- On April 12th, Ethereum's "Shapella" upgrade marks the formal transition to proof-of-stake and unlocks 16 million staked ETH. Concerns about outsized sell pressure are mitigated by existing liquidity access, withdrawal queue restrictions, and market de-risking prior to the upgrade. A ETHBTC rally may follow the upgrade's successful implementation.

- Polygon Labs launched the beta version of Polygon zkEVM, a zero-knowledge rollup network enabling high throughput and low fees on Ethereum. It stands out with EVM-equivalence, allowing seamless Ethereum app deployment. The success of Polygon's PoS chain and new scaling solutions, including zkEVM, support a bullish outlook on MATIC.

- The CFTC filed a lawsuit against Binance for unregistered crypto derivatives trading by US customers, similar to prior BitMEX action. The CFTC declared BTC, ETH, and LTC as commodities, potentially influencing the regulatory jurisdictional battle between the CFTC and SEC.

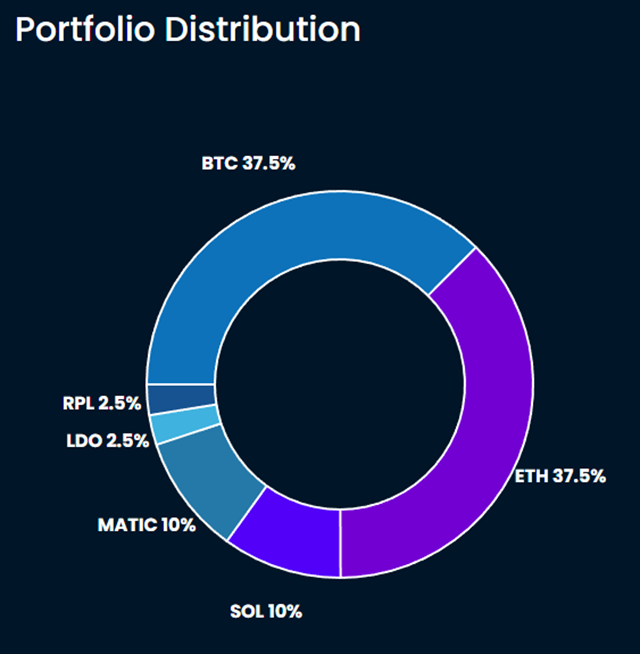

- Core Strategy – After an impressive quarter for bitcoin and the wider crypto industry, it is certainly tempting to look for recent tailwinds to turn to headwinds. However, we think the risk asymmetry in 1H remains to the upside, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Key risks to this perspective would include sustained bond market volatility, a hawkish shift from global central banks, or a debt ceiling resolution, which would result in a glut of new treasuries coming to market.

Bond Volatility Moving Lower is Good for Liquidity

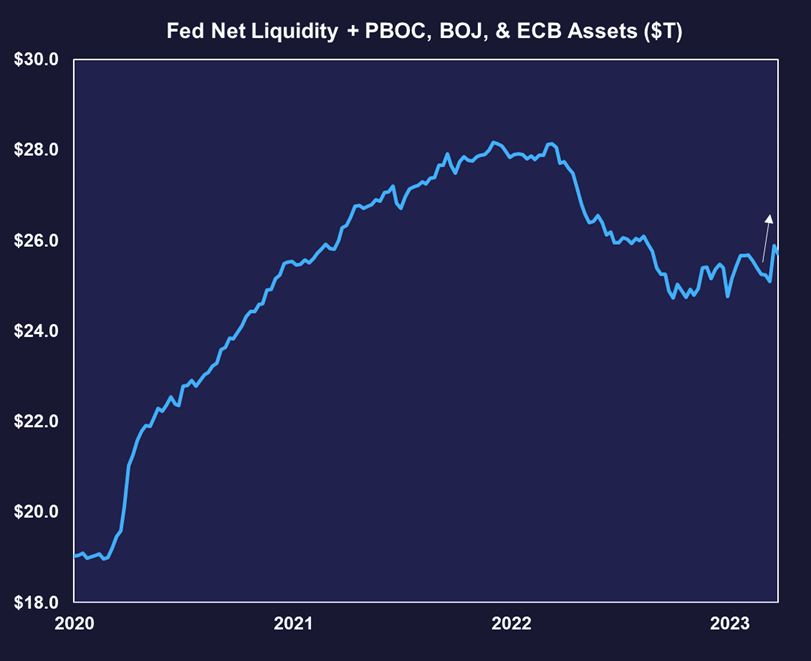

Over the past few weeks, we have discussed how the ongoing banking crisis, the Fed’s language shift and easing monetary policies from major central banks have led to increased net liquidity in the U.S. and higher global USD liquidity.

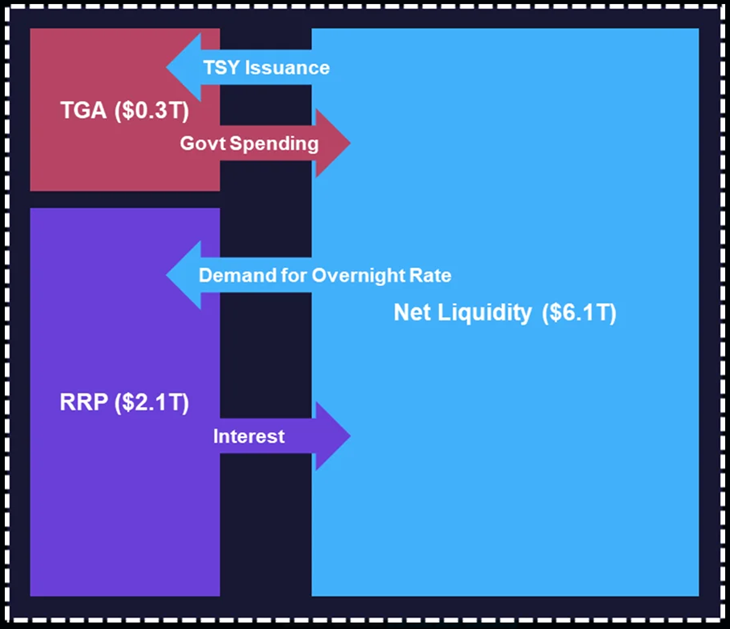

One risk that these absolute liquidity levels face is a negation by the Fed’s reverse repo facility. The Reverse Repo Facility (RRP) is a tool used by the Federal Reserve to control overnight interest rates by decreasing the number of reserve balances in the banking system through reverse repo transactions. In a reverse repo transaction, the Fed sells securities with the agreement to buy them back later, providing an alternative investment option for money market investors when rates fall below the interest on reserve balances rate. When liquidity flows into the RRP, it is theoretically being drained from the private market (numbers below are dated by a few weeks).

The RRP helps support the Federal Reserve’s monetary policy goals and financial system stability. When there is too much capital chasing short-term rates, and they fall below the rate offered by the RRP, inflows into the RRP will increase, and vice versa. Following the exodus from banks, investors plowed their deposits into money market funds which, as mentioned, are known to utilize the RRP for the savory overnight yield.

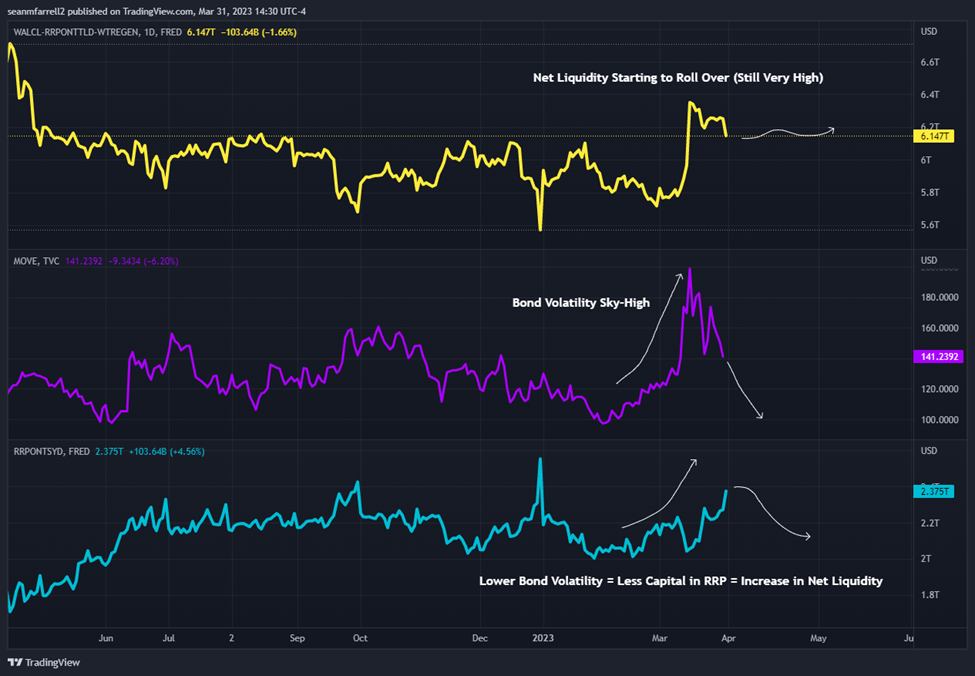

We think that recent bond market volatility, as represented by the MOVE index, has exacerbated the increase in utilization of the RRP, as (1) investors are less likely to park their cash in short term treasuries if they are subject to 12-sigma moves, (2) are certainly not going to venture further on the debt risk curve if “risk-free” treasuries are behaving as such, and (3) many are moving away from banks while the industry waits to see if run risks have been mitigated. With all of this being considered, we think that as the bond market starts to normalize, this will pull some capital out of the RRP and back into the private market.

Of course, the flipside of this framework is that if bond market volatility remains high, and the recent liquidity injection by the Fed begins to be repaid, then the liquidity absorption by the RRP might pose a risk to both liquidity-sensitive assets. This is something we will continue to monitor.

Is the Last Rate Hike Bullish or Bearish?

There is now considerable evidence that the Fed is considering a pause in rate hikes. Barring any unforeseen developments, there is a high probability that the Fed either hikes one more time or pauses at the next meeting. We tend to skew towards the latter based on the projected tightening in credit conditions, but it likely does not matter all that much.

There are generally two competing mindsets when it comes to the Fed pausing its rate hikes:

- Bullish Mindset: Some investors view the Fed’s pause as a positive sign that inflation is under control and the economy is stable. They believe the pause will support continued economic growth, reduce borrowing costs, and benefit the stock market by promoting favorable business conditions.

- Bearish Mindset: Others interpret the Fed’s pause as an indication of underlying economic concerns, potentially signaling an impending slowdown or recession. They worry that the pause may be a reaction to weakening economic data.

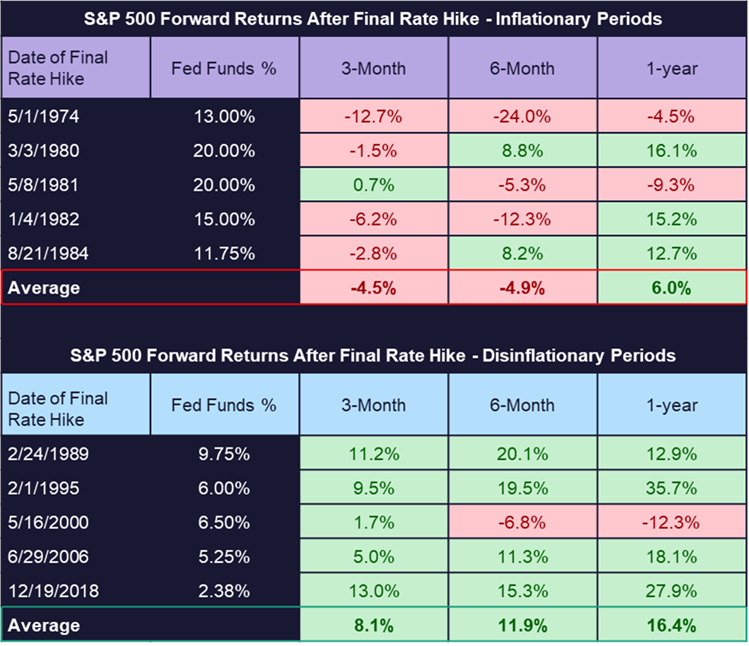

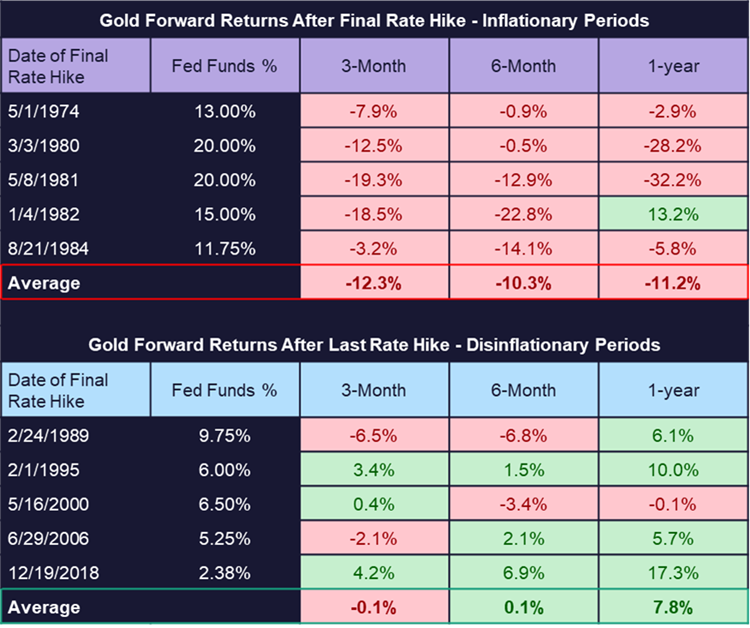

Well, the historical data proves that the inflationary regime in which the final rate hike takes place has a lot to do with market outcomes.

We have witnessed that during periods of persistent inflation, stocks underperform in the short term following the final rate hike. Meanwhile, they have performed quite well following the final rate hike during disinflationary periods. Of note, the 12 months following the final Fed rate hike in both regimes have generally yielded positive results for risk assets.

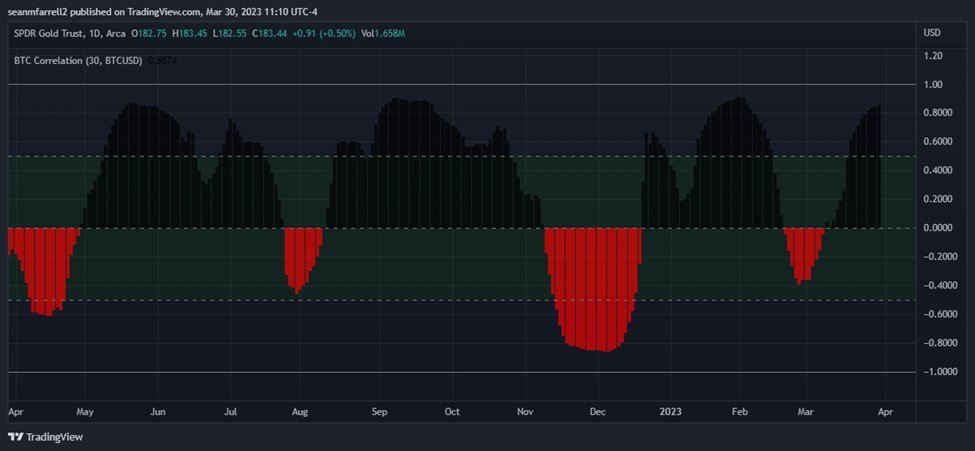

As we have observed in our recent notes, bitcoin’s correlation with gold has been stronger than its correlation with equities. Below is the rolling 30-day correlation between gold and BTC.

Thus, in order to cover our bases, we conducted the same exercise as above, but for gold. As the table below demonstrates, a pause in Fed rate hikes amidst a disinflationary trend generally results in positive forward returns for gold.

The takeaway is that if crypto continues to trade in line with equities, gold, or both, then a cessation in Fed rate hikes amid the current disinflationary trend should be considered constructive for the asset class.

Shapella Upgrade Coming April 12th

On April 12th, Ethereum will undergo a milestone event known as “Shapella,” which encompasses both the Shanghai and Capella upgrades. Scheduled for activation at approximately 6:30 pm UTC, Shapella will provide Ethereum participants—including individual contributors and large staking entities—the long-awaited ability to access their staked ETH, an option that has been previously unavailable. Shapella marks the formal conclusion of Ethereum’s transition to a proof-of-stake consensus mechanism and will unlock over 16 million ETH, enabling stakers to reclaim their holdings.

As the date for this substantial unlock approaches, concerns have arisen regarding the potential for outsized sell pressure due to the anticipated increase in supply. Although daily supply and demand dynamics may shift bearishly, we do not perceive this upgrade as entirely bearish. In fact, there is a distinct possibility of a market rally following the successful implementation of the upgrade.

The following points, though previously discussed, merit reiteration to address why concerns regarding staking withdrawals may be overstated:

- Liquidity Access for Most Stakers: More than half of the ETH supply staked in the Ethereum Beacon Chain is facilitated through liquid staking providers or centralized exchanges (CEX). This means that entities staking ETH have options for liquidity if desired, suggesting that a mechanism for accessing staked funds already exists without necessarily waiting for the Shanghai upgrade.

- Withdrawal Queue Post-Shanghai Upgrade: The maximum number of validators permitted to exit the Ethereum Beacon Chain in each epoch is limited to 8, based on the current active validator count of 548,478. Validators have the choice of partial withdrawals (which bypass the exit queue) or full withdrawals (which must go through the exit queue). Both withdrawal types are processed in the withdrawal queue, with 16 partial withdrawals processed per block. Validators are required to wait a predefined withdrawal period (256 epochs for non-slashed validators and 8,192 epochs for slashed validators) before receiving their ETH. These restrictions on exiting and withdrawing staked ETH help minimize the amount of ETH entering the market in a short timeframe, reducing the risk of a sudden supply overhang.

- Market De-Risking Prior to Shanghai Upgrade: The ETH/BTC ratio has demonstrated that many holders have de-risked in anticipation of the Shanghai upgrade. A month ago, we suggested monitoring this ratio closely as the Mainnet launch date approached. Intriguingly, after the successful deployment of Shanghai on the Goerli testnet and increased confidence in the mainnet upgrade timeline, the ETH/BTC ratio dropped to new year-to-date lows. This reflects ETH holders preemptively accounting for potential negative supply-driven impacts on price.

Polygon Update

Polygon Launches its zkEVM

This week, Polygon Labs, the core development team behind the Ethereum scaling solution Polygon (MATIC), officially launched the beta version of Polygon zkEVM, an advanced zero-knowledge-based rollup network. Polygon zkEVM uses zk proofs to bundle multiple transactions into a single proof, which is then posted to the Ethereum mainnet. This approach enables zkEVM to achieve higher throughput and lower gas fees while preserving the security guarantees of the Ethereum blockchain. Zk-rollups offer the advantage of faster finality compared to optimistic rollups. This reduced time to finalization makes zk-rollups well-suited for use cases where quick settlement is essential, such as payments and decentralized exchanges.

Polygon zkEVM is part of a growing zk-rollup network trend that has successfully launched on the mainnet, including ZkSync’s Era. However, Polygon’s solution compares favorably to other existing solutions due to its EVM-equivalence, meaning that Ethereum-based applications can immediately be deployed on the network without any modifications, while other solutions are merely EVM-compatible, meaning the networks are interoperable but may require some code adaptations.

Polygon Adoption Metrics

The native token of the Polygon PoS blockchain, MATIC, has been featured in our Core Strategy since the beginning of this year. There are two key reasons why this is the case:

- Sticky and steadily climbing adoption metrics

- Its ecosystem of scaling solutions

Of course, the rollout of its zkEVM network falls into the second category. But given this significant announcement, we find it might be worth it to dive into some of Polygon’s adoption metrics that elucidate our bullish stance on Polygon a bit more.

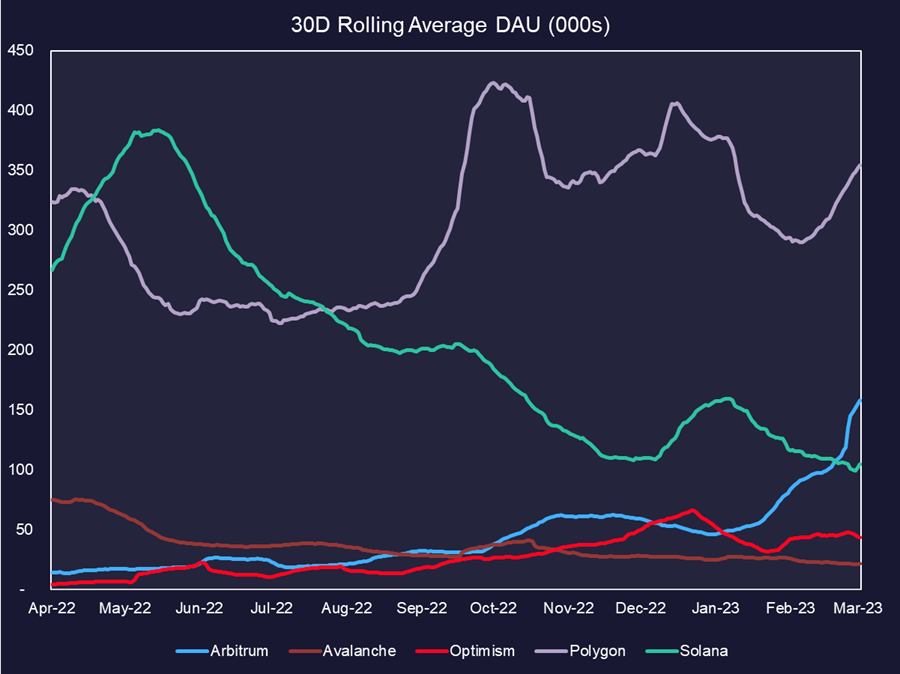

Starting with daily active users, defined as unique addresses interacting with contracts on-chain, we can see that Polygon is in a class of its own compared to its peers. The chart below documents user trends over the past 12 months among the major ETH scaling solutions (OP, ARB, MATIC) and a pair of high throughput networks in Avalanche (AVAX) and Solana (SOL) that target a similar throughput-focused user base.

Polygon’s closest competitor through the first half of 2022 was Solana, but their relationship diverged significantly following the FTX implosion and the subsequent halo effect that possibly plagued the ecosystem. To remove any confusion, as reflected in our Core Strategy, we remain constructive on the Solana ecosystem and expect the network to stage a serious comeback, but the numbers are what they are. The chart below should be construed as bullish for Polygon as opposed to bearish for Solana.

Polygon PoS, which is better understood as its own independent sidechain, was one of the earliest token-enabled scaling solutions for Ethereum. Thus, it has had nearly two years to accumulate a user base that trusts the network. It has the third-most protocols out of any L1 or L2, just behind Ethereum and BSC, and is known to have a rabid business development team in Polygon Labs pushing new integrations with both crypto-native and traditional companies on a daily basis.

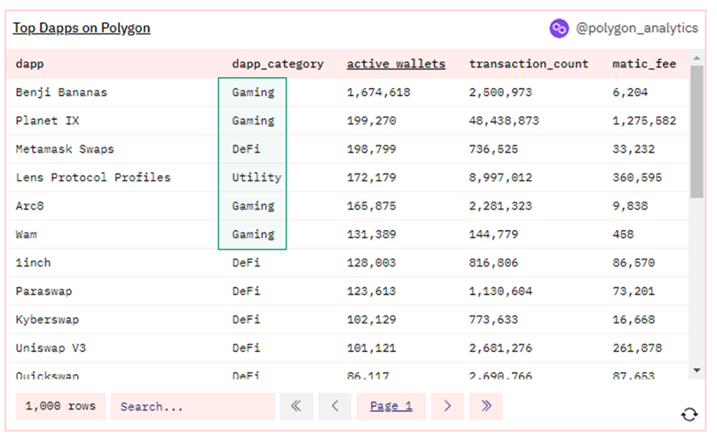

Outside of the blue-chip DeFi applications, Polygon has seen some unique adoption among within the NFT, gaming, and social realms.

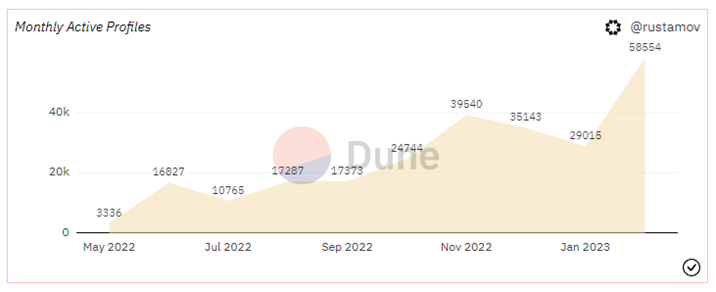

Lens Protocol, the application ranking 4th among all polygon dApps in terms of active wallets, is a composable and user-owned social graph that social media application developers can plug into. A successful Lens protocol would reduce the competitive data moats that benefit existing social media companies and removes the cold start problem for developers working on new applications. We can see below that Lens users have recently accelerated their activity on the network.

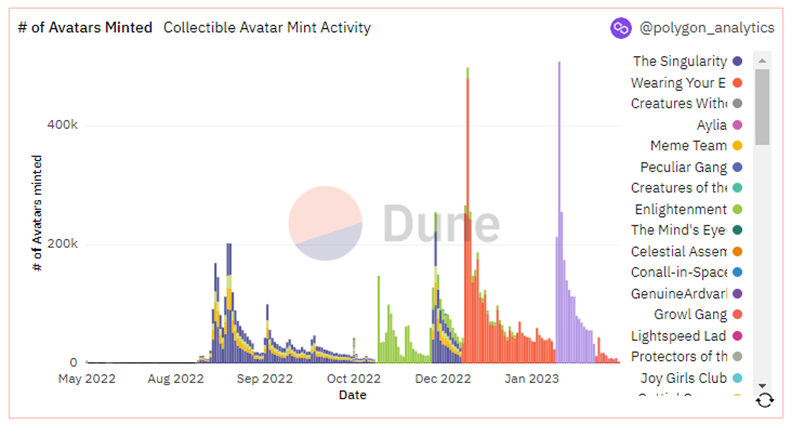

As alluded to above, Polygon Labs has established partnerships with non-crypto companies, including Starbucks, Nike, and Reddit. The team at Reddit, acknowledging the need to translate crypto-enabled solutions to a non-crypto crowd, rebranded the Avatar NFTs to “Digital Collectibles.” As demonstrated below, the Reddit avatar rollout has been received with open arms, leading to a significant increase in users that might otherwise be uninterested in crypto.

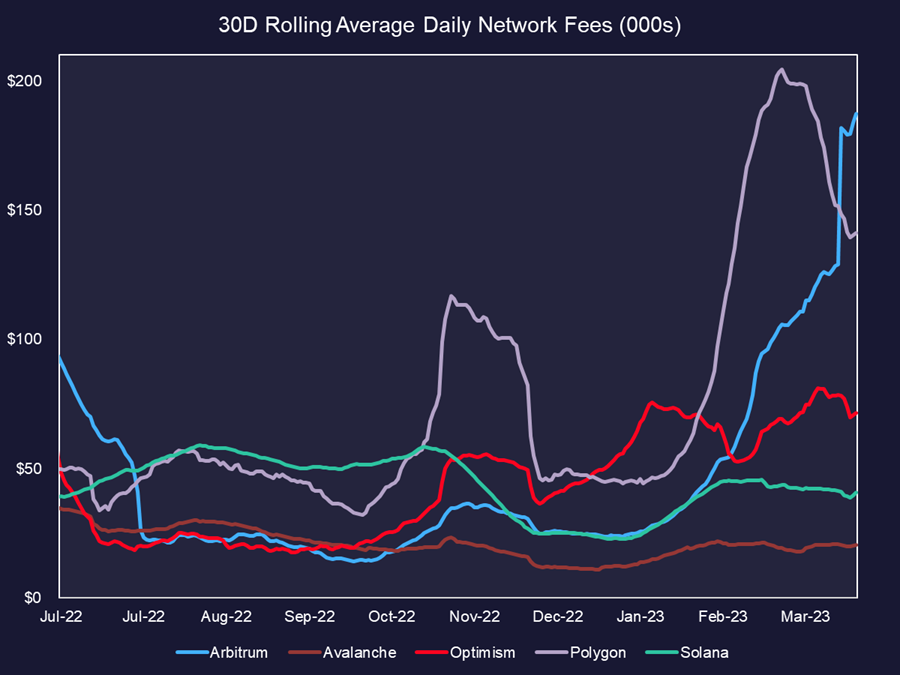

The steady and sticky adoption metrics outlined above have translated to consistent fees collected by validators of the PoS chain. Polygon’s rolling 30-day average is surpassed only by Arbitrum, which has benefitted from an anomalous one-off spike in fees following their airdrop last week.

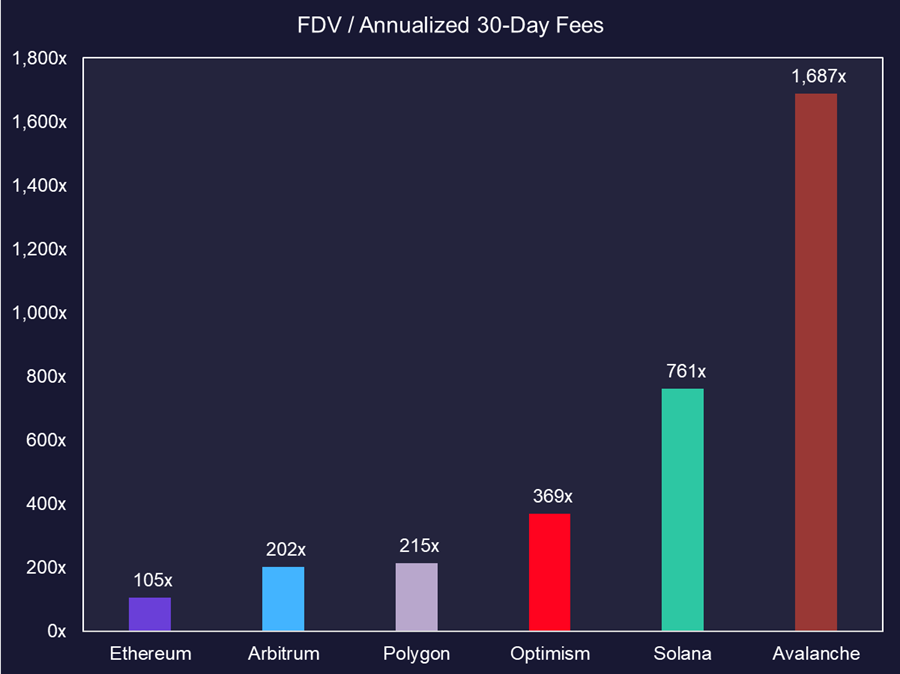

We can put the metrics above into context by observing the comparative valuations of each network relative to fees. Based on this metric, the only competitor that is valued more conservatively on a fully-diluted basis than Polygon is Arbitrum, which as we noted above, is benefitting from a relatively substantial single-day uptick in fees that diverges from historical trends.

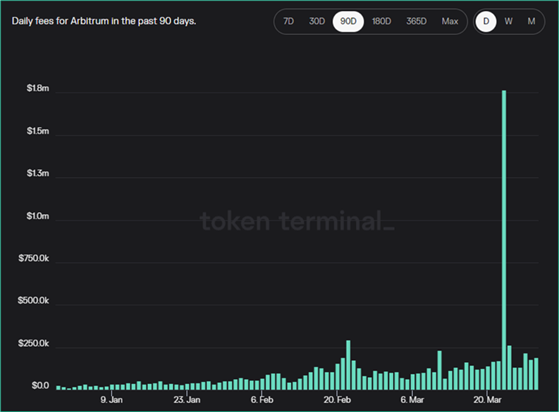

For reference, the chart below speaks to the anomalous performance of Arbitrum last week.

There are certainly still risks with Polygon, and investors should treat the platform accordingly. Network updates are still controlled by a 5 of 9 MultiSig, which seems like a possible attack vector for hackers. Further, the network is noted to have had issues with reorgs, due to bugs in the software. However, the empirical early success of the Polygon PoS chain, coupled with the rollout of their zkEVM, lead us to remain constructive on the network and the underlying token.

How does the zkEVM fit into this?

The extent to which the MATIC token will directly accrue value from the launch of Polygon zkEVM is not yet clear, especially considering that network fees for zkEVM will be paid in ETH, similar to other Layer 2 networks. However, MATIC is anticipated to play a role in staking and governance for Polygon zkEVM in the future, similar to how it operates for Optimism and Arbitrum.

While tokenholders could potentially choose to receive a form of “dividend” from validators on the network in the distant future, the focus here is on the broader implications of zkEVM technology. Several teams, including Scroll and zkSync, are working on zkEVM rollups, but only Polygon has a liquid token (MATIC) that has already been brought to market and has benefited from two years of adoption. As a result, investors who are bullish on zkEVM technology, or zero-knowledge technology in general, may choose to express their positive outlook through the MATIC token.

In summary, the sustained adoption of the Polygon PoS chain, along with the ongoing introduction of new scaling initiatives, such as the recent beta launch of Polygon zkEVM, provide strong empirical evidence to support continued bullishness on the MATIC token. If adoption trends change in the future, a reevaluation of this perspective may be warranted.

CZFTC

The US Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Binance, a prominent crypto derivatives exchange, for allowing US customers to trade crypto derivatives without proper registration. The CFTC’s focus is on Binance’s violation of regulatory requirements rather than any allegations of theft or fraud. Binance is known for creating a separate US platform with limited offerings, but most derivatives are not included in this platform.

This case mirrors the BitMEX case from several years ago. BitMEX, a crypto trading platform, faced legal action from US authorities in October 2020. In early 2021, the US Commodity Futures Trading Commission (CFTC) and the US Department of Justice (DOJ) took legal action against crypto exchange BitMEX and its owners.

The charges included operating an unregistered trading platform and violating anti-money laundering (AML) and know-your-customer (KYC) regulations. BitMEX was specifically accused of allowing US customers to trade crypto derivatives on its platform without proper registration with the CFTC and of failing to implement adequate AML and KYC procedures.

As a result of the legal action, BitMEX reached a settlement with the CFTC, agreeing to pay a $100 million civil monetary penalty. In addition to the civil settlement, the DOJ brought criminal charges against certain individuals associated with BitMEX, including its co-founder Arthur Hayes. Similar to the case with BitMEX, it would be surprising if we did not see criminal charges brought against CZ. At this point, it is likely merely about timing.

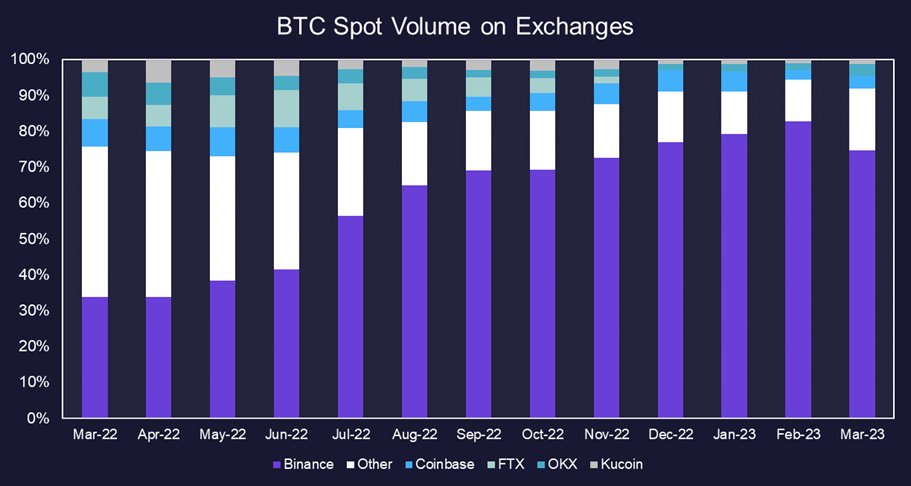

Like BitMEX, barring any disorderly runs from Binance, this regulatory action should not have a negative effect on the broader crypto market. To be clear, Binance is a massive organization. Thus, any quick and unruly exodus is likely negative for crypto assets. However, it is important to consider that at the time of the BitMEX lawsuit, the exchange saw billions of dollars of volume each day – not a small organization. Further, as we can see below, Binance is starting to cede relative market share to other exchanges. This is likely a direct result of their removal of free BTC/USDT trading.

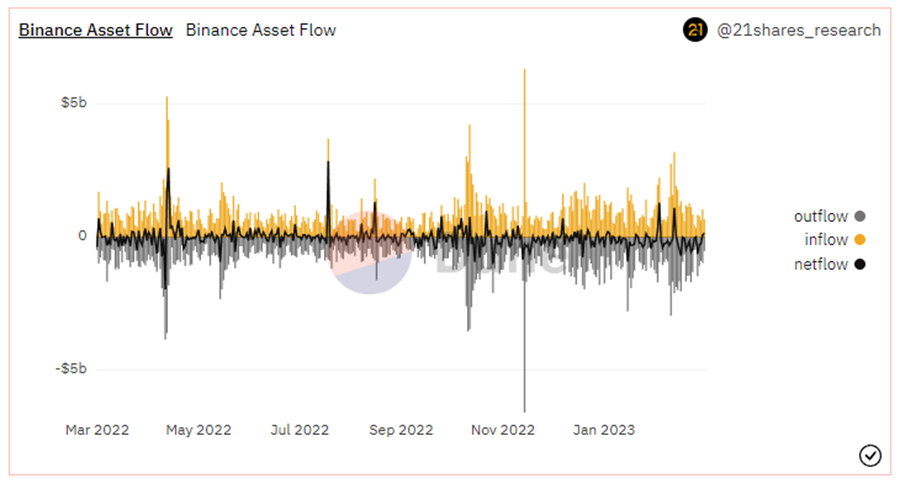

Thus far, it would seem that Binance has not experienced a crisis of confidence amongst its users. The chart below maps out the flows into and out of the exchange. Its 7-day outflow total of just over $5 billion (source: Nansen.io) is relatively normal. Its current total asset base is $72 billion.

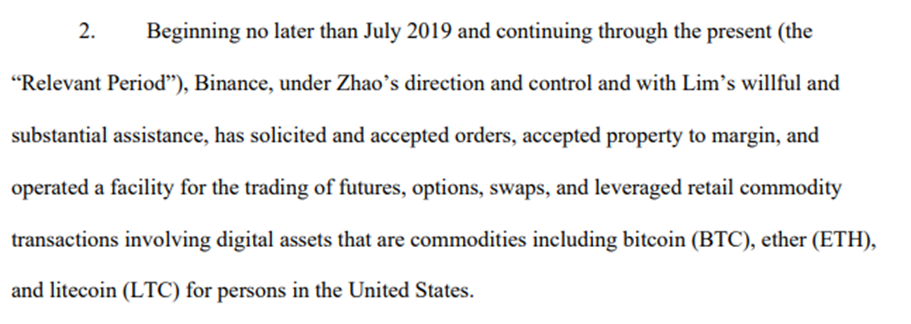

CFTC Declares ETH a Commodity

Embedded in the Binance lawsuit was an interesting nugget of information with potentially significant regulatory implications. In detailing its claim against the crypto exchange, the CFTC listed the transactions of BTC, ETH, and LTC as the commodities in question. See below for the snippet from the lawsuit.

While recent headlines seem to suggest nothing but regulatory headwinds for the industry, we should remember that there remains a jurisdictional battle between the SEC and CFTC as it pertains to who will oversee the crypto markets.

While Gary Gensler has stopped short of labeling ETH a security, he has historically avoided labeling it as a commodity as he has labeled bitcoin. Recently, he even suggested that proof-of-stake tokens could be considered investment contracts.

The CFTC is generally viewed as the regulatory body that is more flexible and open to innovation and therefore is the market’s preferred regulator of the two. Thus, if competition for oversight starts to develop, we could see pressure from the SEC start to abate.

Core Strategy

After an impressive quarter for bitcoin and the wider crypto industry, it is certainly tempting to look for recent tailwinds to turn to headwinds. However, we think the risk asymmetry in 1H remains to the upside, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Key risks to this perspective would include sustained bond market volatility, a hawkish shift from global central banks, or a debt ceiling resolution, which would result in a glut of new treasuries coming to market.

Reports you may have missed

MACRO SETUP STILL LOOKS GOOD FOR CRYPTO As discussed last week, we achieved the favorable setup we were anticipating. A combination of (1) a dovish Federal Reserve, (2) an accelerated tapering of quantitative tightening (QT), and (3) a Quarterly Refunding Announcement (QRA) that met investors' expectations contributed to a decline in rates during the first week of May, alongside a rebound in crypto assets. However, crypto investors remain cautious, and...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....