New Minipools Just in Time for Summer

Key Takeaways

- The Federal Reserve has increased the federal funds rate by 0.25 percentage points to a target range of 5%-5.25%, marking its 10th interest rate increase in just over a year. Barring unforeseen inflationary data, the Fed is likely to pause in June, and asset prices generally respond positively when the cost of money stops increasing at a rapid clip, as long as prices remain stable/disinflationary.

- Based on the information provided, it's reasonable to anticipate a short-term government debt extension in June, which could potentially reduce market liquidity. However, investors should stay vigilant and agile. In the unlikely event of a technical default (which anecdotally seems to have a higher probability than many believe), given Bitcoin's performance during bank insolvencies, we could expect BTC to experience a parabolic surge.

- The ongoing surge in transaction fee revenue, driven by the BRC-20 Ordinals phenomenon, is bolstering the Bitcoin network's health. Increased fees strengthen miners' financials and address concerns about network security. This development is challenging the negative narrative around Bitcoin's sustainability and reigniting interest among former participants. If this trend persists, we may see publicly traded miners outperforming market expectations in the upcoming quarter.

- In our assessment, Rocket Pool presents a compelling long-term risk/reward opportunity, driven by its value proposition for node operators and the value-accruing nature of the RPL token. The performance of the RPL token is closely tied to the growth of rETH supply and the appreciation of ETH's price. The recent atlas upgrade serves as a significant boost to the network's prospects, further enhancing its potential for success.

- Core Strategy – Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling (higher TGA balance = reduced market liquidity), our overall outlook for the year remains positive. Should they follow through, a pause from the Federal Reserve is a positive development for liquidity-sensitive assets. Additionally, there has been an unexpected resurgence in the regional banking crisis, which may provide further support for bitcoin in the near term.

Looks Like a Pause

The Federal Reserve approved its 10th interest rate increase in just over a year, raising the Fed funds rate by 0.25 percentage points to a target range of 5%-5.25%.

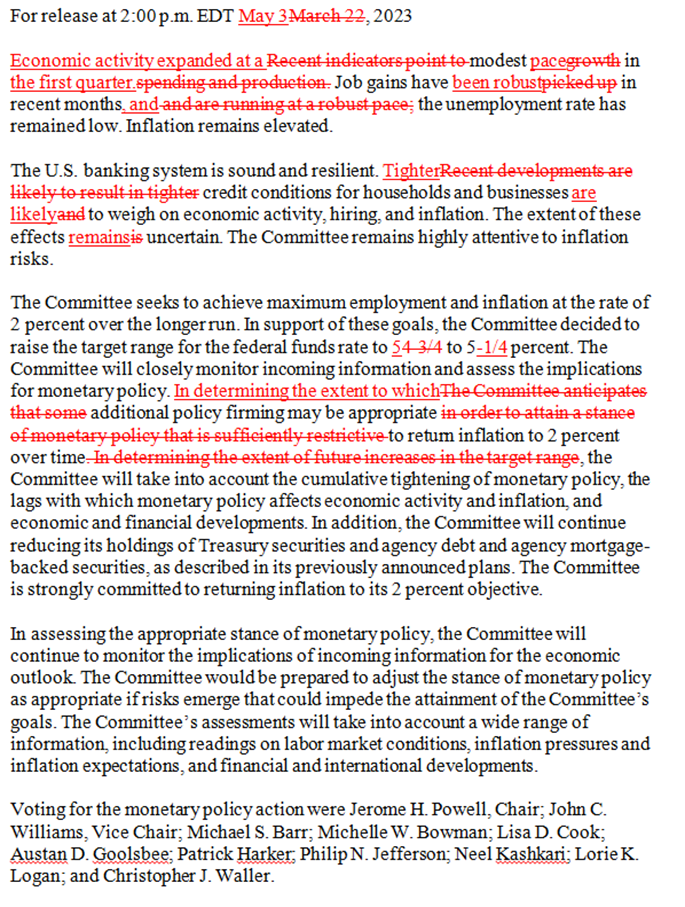

Many interpreted the Fed’s comments as signaling a potential pause in the tightening cycle, mainly due to the removal of a sentence in the post-meeting statement. The statement no longer mentioned that “the Committee anticipates that some additional policy firming may be appropriate” to achieve the Fed’s 2% inflation goal.

This change in language suggested that the central bank might be considering a pause in further rate hikes while assessing the impact of previous hikes on economic growth, inflation, and financial conditions. Furthermore, the statement’s emphasis on data dependency and the acknowledgment of economic and financial developments reinforced the idea that the Fed was adopting a more cautious and flexible approach to its future rate decisions.

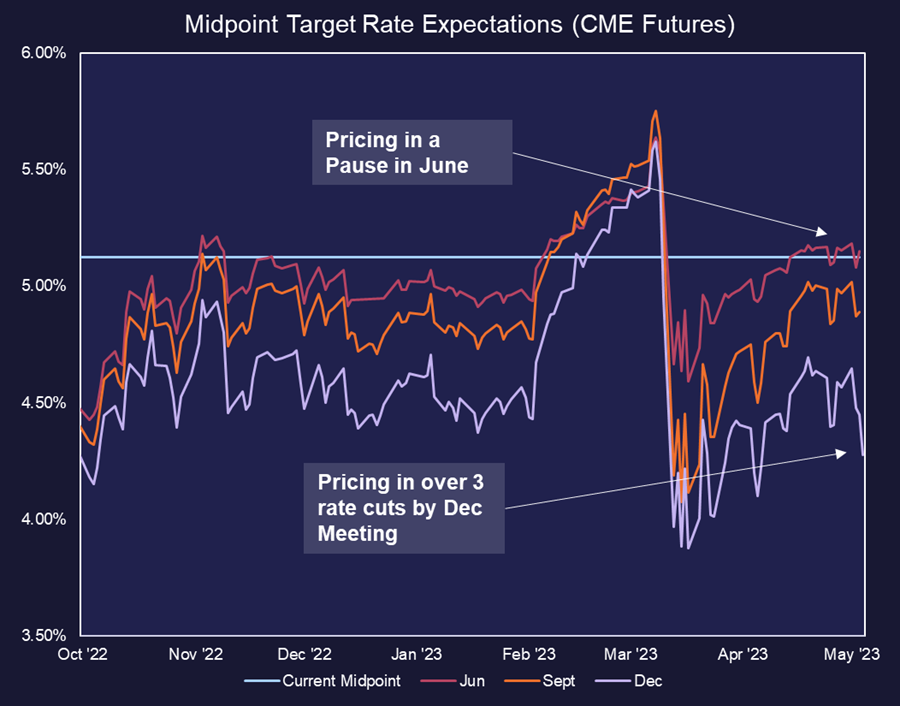

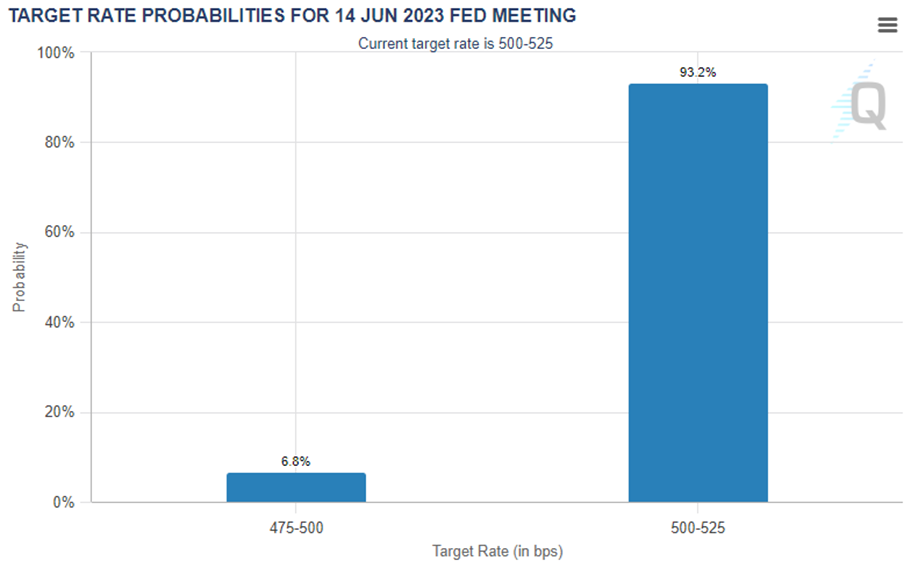

The futures market agreed with the Fed whisperers and is currently pricing in a pause in June. Likely exacerbated by the surprise continuation of the regional bank distress immediately following Jerome Powell’s presser, the market is also anticipating over 3 cuts by December.

Interestingly, the panic over the regional banks, indirectly incited by that day’s additional rate increase, at one point had the market pricing in an immediate cut by June (no longer the case).

Overall, we would agree that the calculus has now shifted, and barring unforeseen inflationary data, the Fed is likely to pause in June.

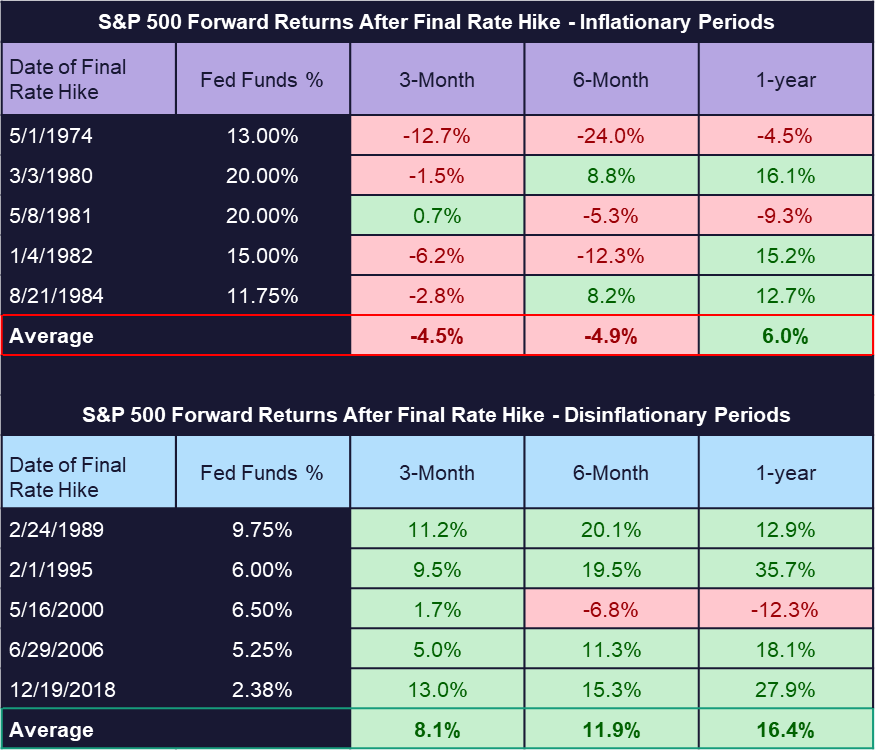

As a reminder, beyond the near-term risks posed by the debt ceiling standoff (more on that below), asset prices generally like it when the cost of money stops increasing at a rapid clip, so long as the prices of goods and services continue to exhibit stable/disinflationary trends.

Bottom line on monetary policy: The Federal Reserve has increased the federal funds rate by 0.25 percentage points to a target range of 5%-5.25%, marking its 10th interest rate increase in just over a year. Barring unforeseen inflationary data, the Fed is likely to pause in June, and asset prices generally respond positively when the cost of money stops increasing at a rapid clip, as long as prices remain stable/disinflationary.

Debt Ceiling Update (Near-term Risk)

A few weeks ago, we advised clients to consider reducing their exposure, taking into account the strong performance of cryptoassets in recent months and the potential impact of a debt ceiling resolution on private market liquidity as the Treasury General Account (TGA) is refilled. While we maintain a generally bullish outlook for the rest of the year and remain largely allocated in our Core Strategy, the increased downside risk in the coming months prompted us to increase our cash reserves in preparation for a significant market downturn.

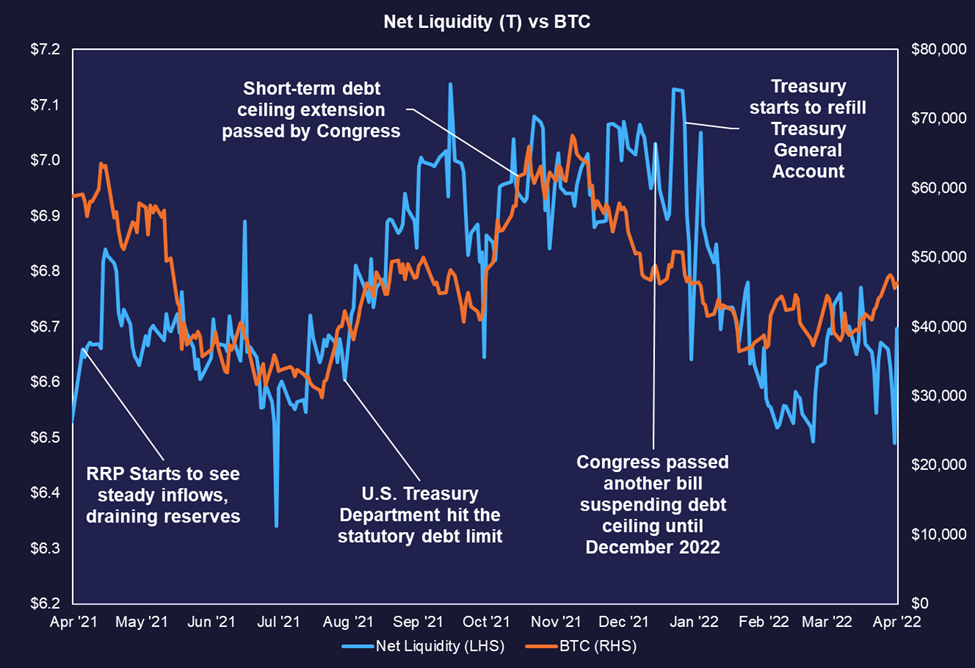

To support our risk-averse stance, we analyzed past debt ceiling agreements and observed a clear relationship between TGA refills, reduced market liquidity, and Bitcoin prices.

Of course, the major unknown for us is timing.

This week, Treasury Secretary Janet Yellen clarified the debt ceiling timeline more in a letter to Congress. To summarize the status of it all:

- Treasury Secretary Yellen informed Congress that the Treasury could exhaust its resources under the debt limit as early as June 1, but this could potentially occur a few weeks later.

- The Treasury’s financing estimates project a financing need of $112 billion in Q2 and $438 billion in Q3, with a $367 billion deficit for the remainder of Q2.

- The legislative calendar allows limited time to reach a deal, with only two weeks when both the House and Senate are in session before early June.

- If a deal is not reached before June 1, a short-term extension is possible, with a new deadline likely in late July or September 30th.

- Negotiations on spending levels are expected to commence soon, and these could be incorporated into an eventual debt limit bill.

- The upcoming weeks are unpredictable, and if a deal is not reached in time, it could result in missed payments or a short-term extension, necessitating a repeat of the process later.

Bottom Line regarding the debt ceiling: Based on the information provided, it’s reasonable to anticipate a short-term extension in June, which could potentially reduce market liquidity. However, investors should stay vigilant and agile. In the unlikely event of a technical default (which anecdotally seems to have a higher probability than many believe), given Bitcoin’s performance during bank insolvencies, we could expect BTC to experience a parabolic surge. It’s important to note that there is no historical precedent for BTC performance in relation to a US default; thus, this analysis is largely speculative and based on the prevailing narrative surrounding Bitcoin.

Memes Come to Bitcoin (And Could be A Tailwind for Mining Companies)

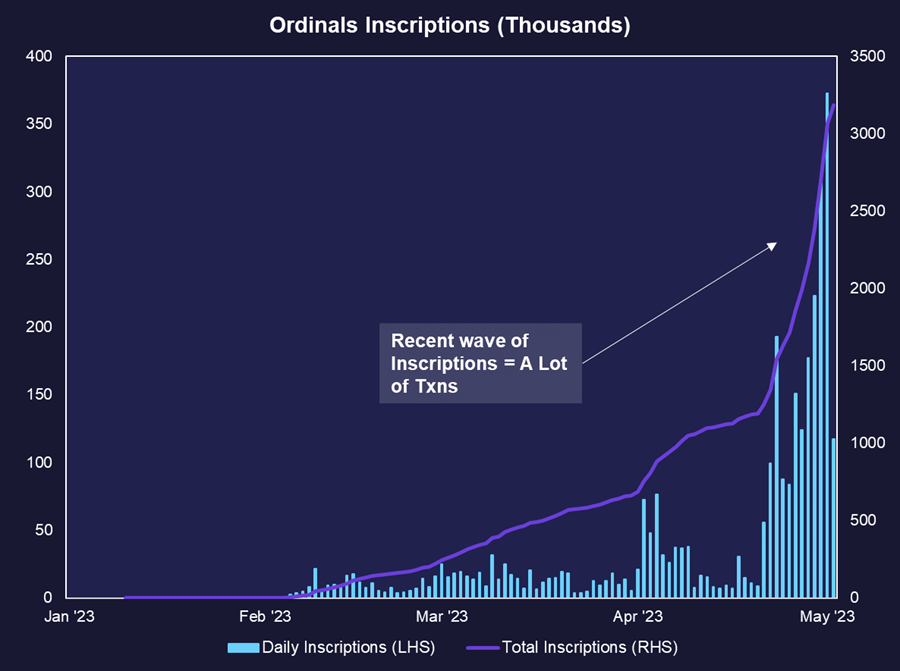

The Ordinals craze on Bitcoin continues to stimulate on-chain activity. The surge in Ordinals inscriptions in recent days is largely due to the introduction and widespread adoption of the BRC-20 token standard. This standard has facilitated the minting of fungible tokens and NFT-like assets on the Bitcoin blockchain, thereby generating substantial interest in the creation of these inscriptions and prompting a notable increase in their quantity.

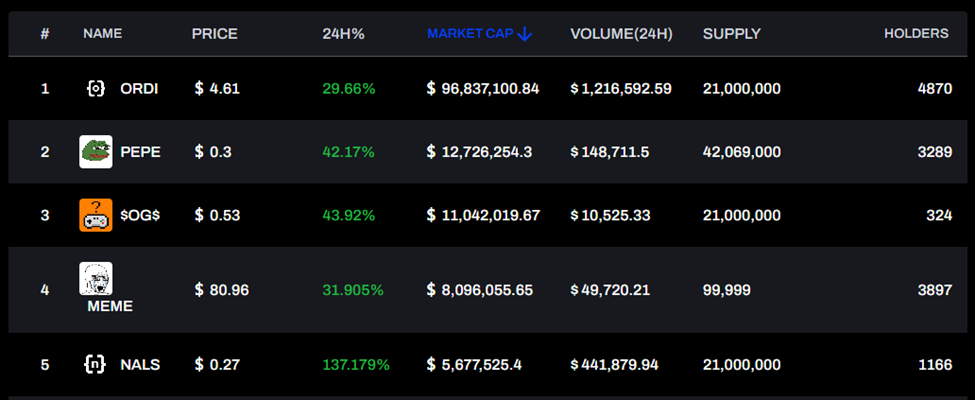

These BRC-20 tokens, largely comprised of memecoins, primarily represent culturally relevant digital artifacts with limited utility beyond that. However, to many, that is largely the point. As of Friday morning, the total market cap of these BRC-20 tokens had ballooned to over $164 million.

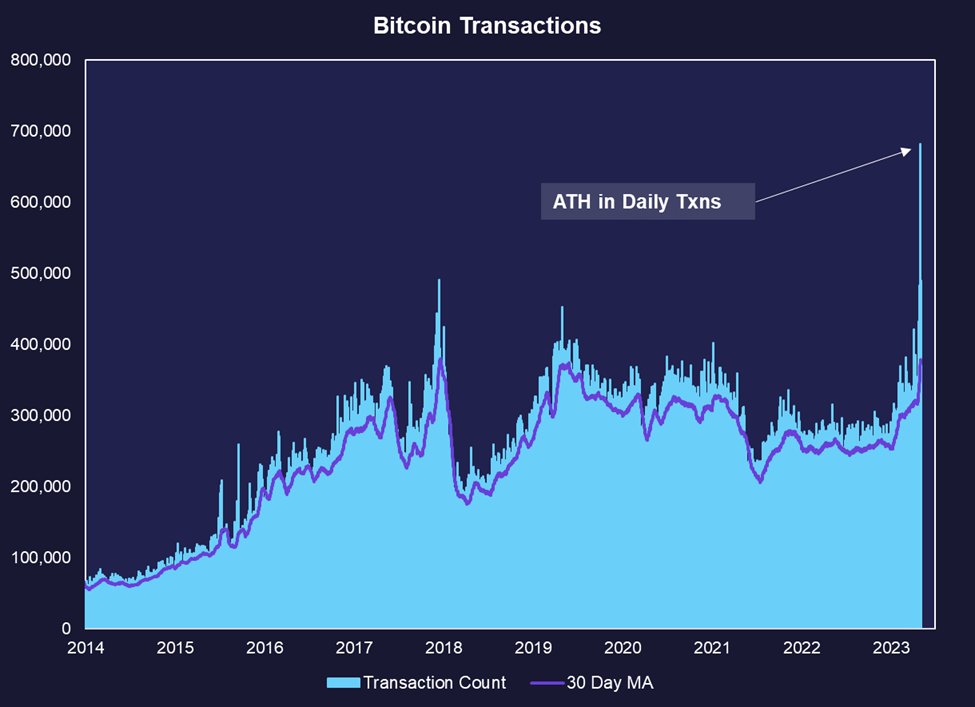

The surge in the creation and trading of these tokens has contributed to the unprecedented increase in block space demand and transaction volume on the Bitcoin network. With more entities minting tokens and creating inscriptions, the volume of transactions reached an all-time high, resulting in larger, full blocks and increased transaction fees.

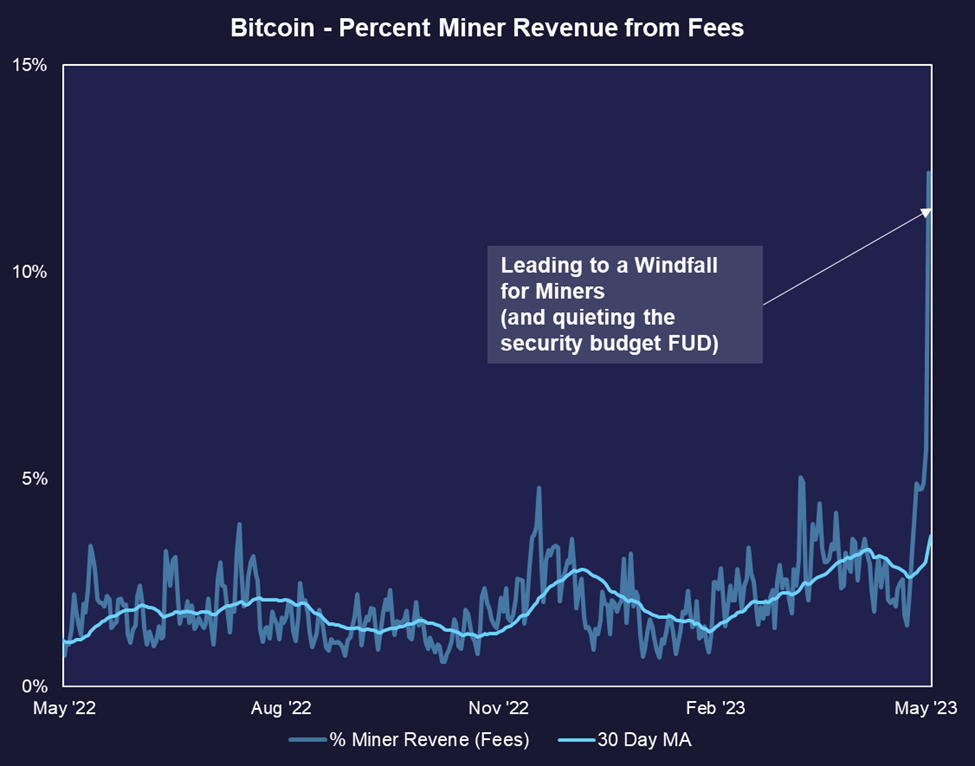

Amid this on-chain bull market, miners, who have predominantly relied on the block subsidy for their revenue, are now experiencing a shift in their earnings structure. The start of the year marked a gradual increase in the proportion of revenue generated from transaction fees, surpassing 10% just a few days ago.

This considerable uptick in transaction fee revenue has likely had a favorable impact on miners’ financial health. Given this windfall, it would not be surprising if some publicly traded miners exceeded analyst expectations during the forthcoming earnings season. Traditional analysts often overlook such subtleties, which could lead to underestimations of their performance. This presents a potential opportunity for those with a deeper understanding of these dynamics to capitalize on this discrepancy.

The Bottom Line with respect to Ordinals: The surge in transaction fee revenue is a beneficial development for the Bitcoin network. The occurrence of full blocks and increased fees not only strengthens miners’ financial stability but also alleviates concerns about the network’s security budget. This trend counters the FUD associated with Bitcoin’s long-term security and sustainability, thereby enhancing its credibility and longevity in the eyes of some doubtful market participants. Moreover, it is reigniting interest in Bitcoin among many individuals who previously left the ecosystem, disheartened by some perceived cultural challenges besetting the ecosystem. Should this trend persist, we could potentially see publicly traded miners surpass market expectations in the coming quarter.

Rocket Pool Gets An Upgrade

At the start of this year, we were quite constructive on liquid staking derivative platforms and their respective governance tokens. A major reason was simply narrative based. Given the Shapella upgrade and the value it would unlock for stakers, we viewed LSD governance tokens (LDO, RPL) as a perfect way to achieve exposure to this event. They performed very well in our Core Strategy through most rebalances. However, notably, we dropped LDO from the mix last week. Our rationale is as follows:

- The narrative-driven portion of the Shappela catalyst is behind us. The update happened, and many who entered their positions in anticipation of this event have/are now taking profits.

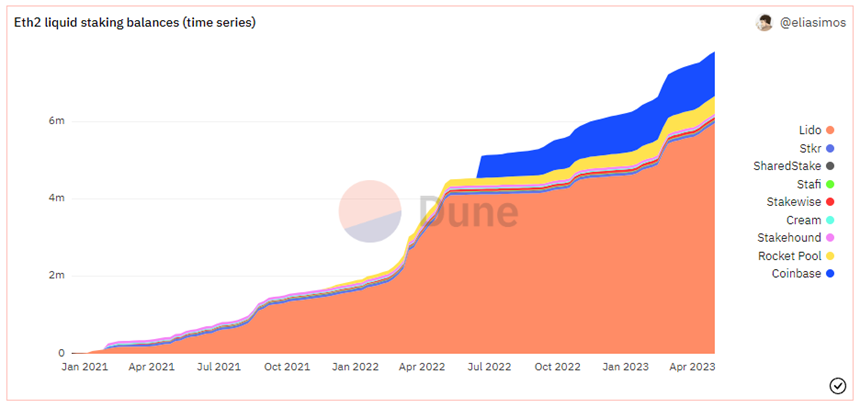

- Despite point 1 above, we remain constructive on LSDs at the application level and anticipate the amount of ETH staked to liquid staking applications to climb.

- RPL possesses fundamental advantages compared to LDO, such that it should continue to command buy pressure solely due to point 2 above, irrespective of what occurs with point 1.

Lido currently holds a substantial lead among liquid staking providers, accounting for 75% of the liquid staking derivative (LSD) market share. However, considering the dynamics and features such as minipools and tokenomics associated with RPL, which we will unpack below, Rocket Pool is positioned advantageously to compete with Lido and potentially gain market share in the LSD market.

Refresher on Rocket Pool

Rocket Pool is a decentralized Ethereum-based protocol that enables users to stake their ETH and earn rewards. It operates by creating “minipools” where users can contribute any amount of ETH, even below the minimum requirement for individual staking. These minipools are supported by node operators who provide additional ETH and RPL tokens as collateral. Users receive a liquid staking derivative token called rETH in exchange for their staked ETH. It provides a more accessible and flexible approach to ETH staking, allowing a wider range of users to participate and earn rewards.

The RPL token is the native token of the Rocket Pool protocol and, in our view, provides greater utility than Lido’s LDO token. It serves multiple functions within the ecosystem. Firstly, RPL is a governance token that enables holders to participate in the decision-making process and shape the future of Rocket Pool through voting on protocol upgrades and proposals.

Secondly (where the token differs from LDO), RPL is used as collateral by node operators within the protocol. Node operators stake RPL along with ETH to support the minipools and earn additional rewards. Consequently, RPL is subject to market dynamics as the value of the token is influenced by the adoption and usage of the liquid staking derivative token, rETH, within the Rocket Pool ecosystem.

More Minipools = More Buy Pressure for RPL

In simple terms, node operators can achieve leveraged returns by operating minipools in Rocket Pool. They contribute their own 16 or 8 ETH and borrow the remaining balance of the required 32 ETH from users who mint rETH on the platform. This allows them to operate and collect fees from multiple nodes instead of just one.

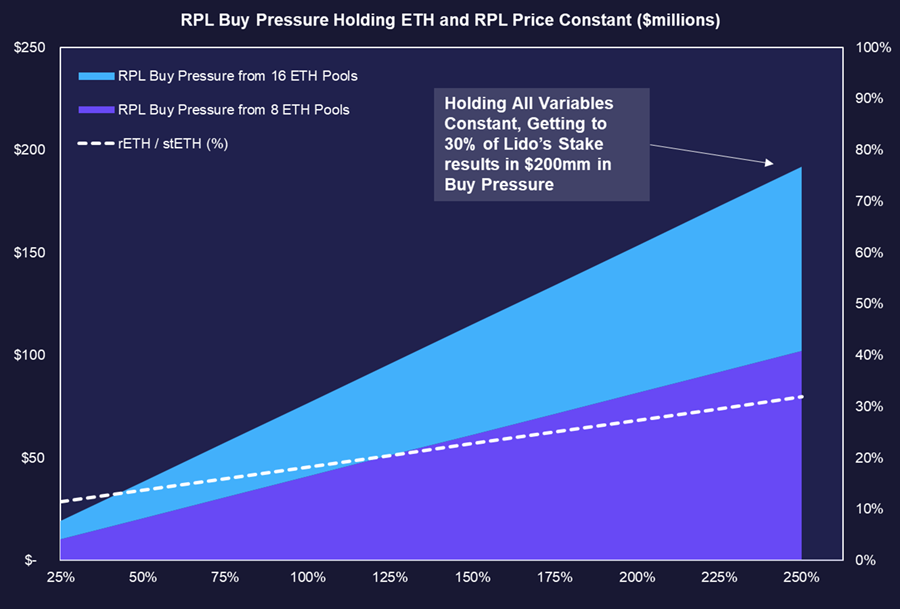

However, to secure the borrowed ETH, node operators must stake RPL tokens as collateral. If a node operator violates the rules or engages in malicious behavior, their staked RPL tokens may be penalized. Each node operator must stake at least 10% of the value of the borrowed ETH in RPL tokens. For example, if a node operator pledges 8 ETH and borrows 24 ETH, they must purchase and stake 2.4 ETH worth of RPL tokens. This creates buying pressure for RPL, as it increases the demand and value of the token. At current prices, this would equate to approximately $5,000 in buying pressure for RPL per 8 ETH minipool.

To extrapolate this further, we calculated the requisite buying pressure assuming:

- ETH and RPL prices are held constant ($2k and $50, respectively).

- The distribution of 8 ETH and 16 ETH minipools remains constant (conservative assumption).

- The amount of ETH staked to Lido is held constant.

- Rocket Pool grows to 30% of Lido’s size (conservative assumption).

- All nodes stake the minimum required RPL (most stake greater than 10%).

Despite the conservative assumptions, we can see that merely increasing the number of ETH staked to Rocket Pool, and consequently, the number of minipools in the network, results in significant buy pressure for a project that has a relatively diminutive (less than $1 billion) market cap. If Rocket Pool merely doubles the number of rETH in circulation, it should result in at least $77 million of buy pressure. Of course, this completely ignores the speculative end of the market, which is not acquiring RPL to stake but merely to prognosticate on price.

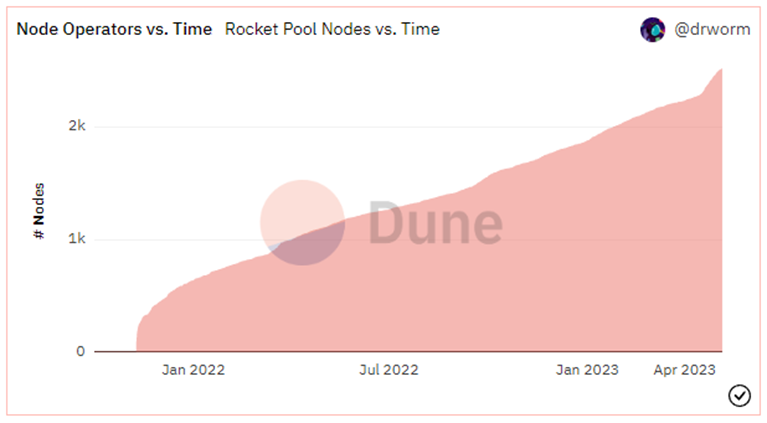

There is also the risk that many node operators already possess sufficient RPL tokens, and thus the increase in minipools will not directly translate to buy pressure. However, this is disproven by both node operator growth and the recent surge in RPL price following the Atlas Upgrade.

Below we see steady, impressive growth in the number of node operators. Presumably, new node operators are not those who were early investors in the project and, therefore, need to acquire their RPL tokens. These operators entering the fold are likely market-buying RPL to spin up their minipools.

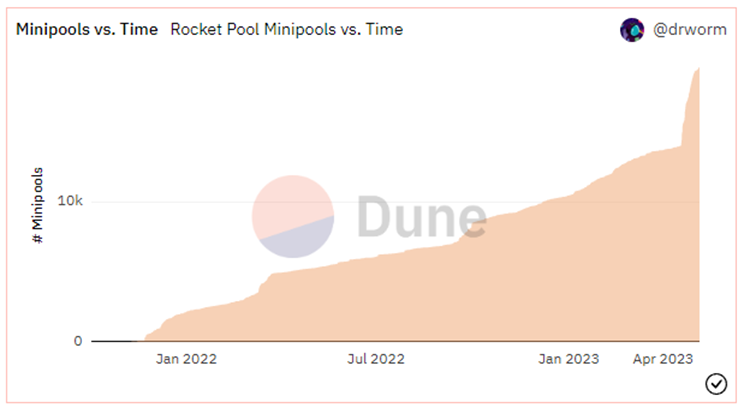

Further, as alluded to above, the network recently underwent a major upgrade, the Atlas Upgrade, which reduced the number of ETH required to spin up a minipools from 16 ETH to 8 ETH, and therefore increased the % of the Rocket Pool stake that is collateralized by RPL. This is demonstrated rather cleanly in the chart below. The upgrade, which transpired a couple of weeks ago, was followed by a surge in minipools, possibly comprised of many 16 ETH minipools converting to 8 ETH minipools (increasing leverage).

As one might expect, there was a clear spike in RPL price around the exact date of the spike in minipools, observed in the chart above. While many might attribute this to speculation around the upgrade, we normally see network upgrades like this priced in ahead of time, leading us to believe that much of the demand for RPL on that day was organic. Further, following the drawdown in mid-April for the wider crypto market, RPL continued to outperform BTC rather substantially (up 11% since 5/1, as compared to BTC up 1%).

Bottom line on Rocket Pool: In our assessment, Rocket Pool presents a compelling long-term risk/reward opportunity, driven by its value proposition for node operators and the value-accruing nature of the RPL token. The performance of the RPL token is closely tied to the growth of rETH supply and the appreciation of ETH’s price. The recent Atlas upgrade serves as a significant boost to the network’s prospects, further enhancing its potential for success.

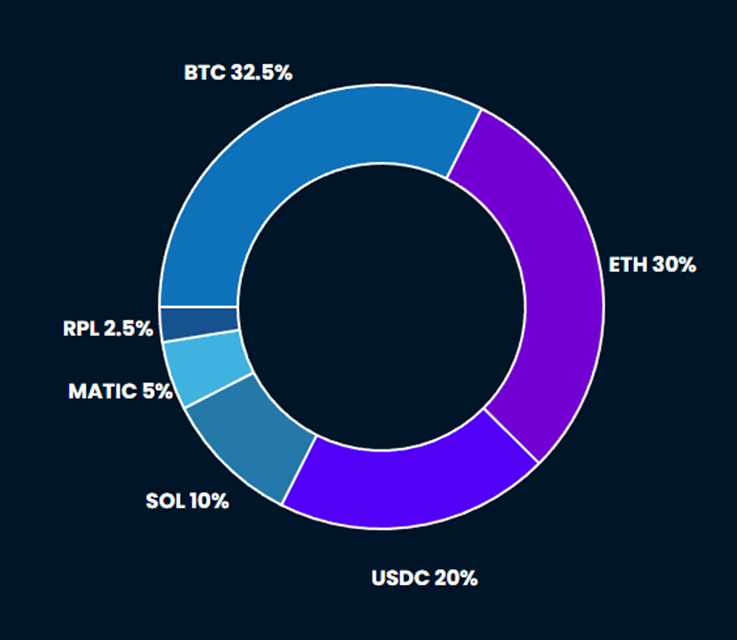

Core Strategy

Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling (higher TGA balance = reduced market liquidity), our overall outlook for the year remains positive. Should they follow through, a pause from the Federal Reserve is a positive development for liquidity-sensitive assets. Additionally, there has been an unexpected resurgence in the regional banking crisis, which may provide further support for bitcoin in the near term.

Tickers in this Report: $BTC, $RPL, $MATIC, $SOL, $ETH, $LDO

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...