FIL Presents Compelling Upside

Key Takeaways

- Market data is beginning to show signs of increased speculation on ETH ahead of significant 1H catalysts. This is evidenced by rising OI on the CME and spiking forward implied volatility.

- Despite the market's focus on the upcoming Bitcoin halving, there is reason to believe—and precedent supports this—that the ETH/BTC ratio has bottomed out and ETH will start to regain its high-beta relationship to Bitcoin in the near term.

- The subsiding net inflows into the bitcoin ETFs is not necessarily a cause for concern, but it does raise the question as to whether BTC is starting to revert to its old highly correlated relationship with tech stocks. It is a trend that we will continue to monitor.

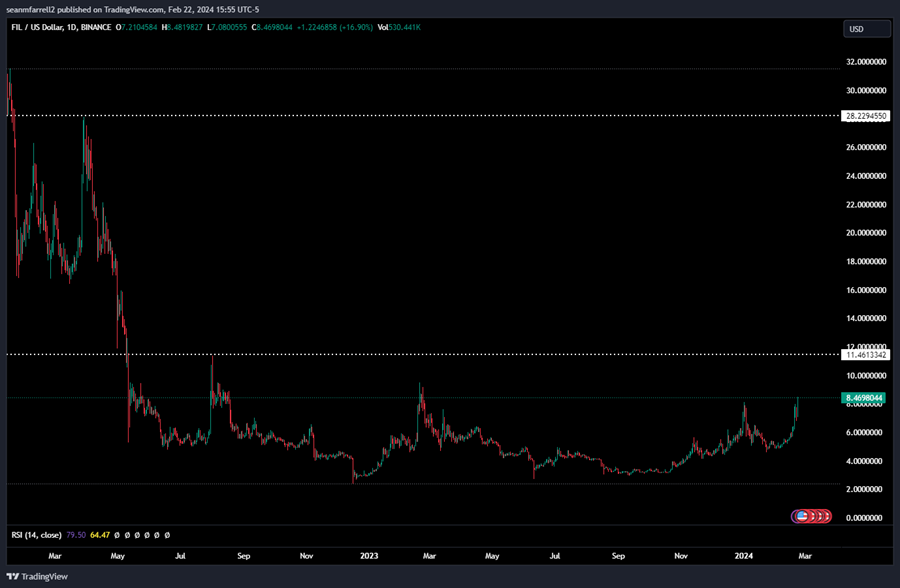

- Trade Idea – Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling short-medium-term trade at these levels. Narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.

- Core Strategy – Our Q1 outlook anticipated some headwinds, and it seems the initial turbulence has subsided for now. Flows into crypto remain strong and breadth against BTC remains subdued. We maintain that ETH, L2s, and STX offer compelling idiosyncratic upside due to their near-term catalysts.

ETH Gaining Relative Momentum

Given the success of Solana and Bitcoin’s persistent dominance in this bull market, many have been quick to write off ETH. There is no doubt that ETH faces its own set of challenges, including a complex modular stack and potential cannibalization by Layer 2 solutions, which, while crucial to ETH’s scaling roadmap, can sometimes fragment liquidity and users. Despite these issues, ETH continues to advance along its extensive scaling roadmap. In our view it appears to be under-owned at this stage in the cycle and should be buoyed by a couple of near-term catalysts poised to boost usage and speculative interest.

One such catalyst is the much-discussed Dencun upgrade, and the other revolves around pending spot ETF applications, a topic we’ve covered thoroughly. While we haven’t adjusted our odds of an ETF approval—still seeing it as a coin flip—we anticipate speculative momentum leading up to the SEC’s decision on ARK’s ETF application due in May, irrespective of the outcome.

Regarding approval, our stance is that a spot ETH ETF should be approved based on criteria similar to those applied to BTC ETFs, yet there’s no guarantee the SEC won’t find a politically motivated reason for denial, possibly citing concerns related to DeFi or staking. We will certainly look to develop more conviction around this decision as we approach the May 23rd deadline.

Since early February, there’s been a noticeable uptick in ETH relative to BTC, with ETH making a quiet ascent back to the $3k mark.

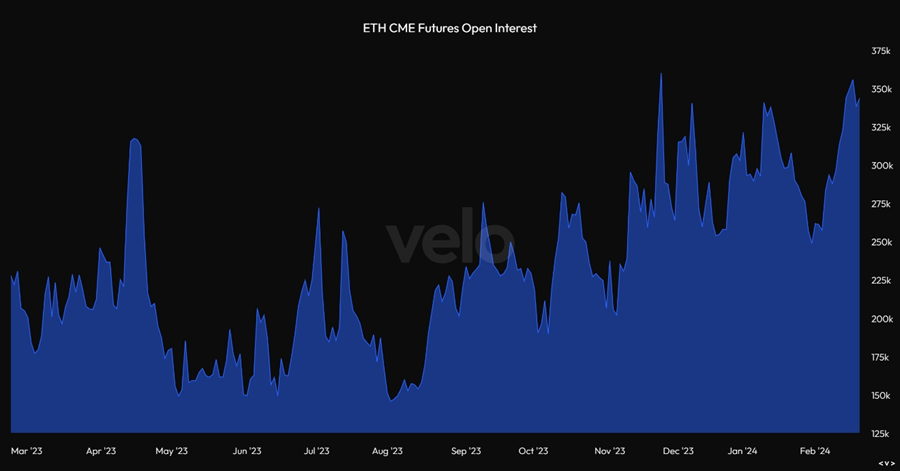

This gradual rise has been accompanied by a significant influx of speculative capital. Futures Open Interest (OI) on the CME has surged, nearing all-time highs in ETH-denominated terms.

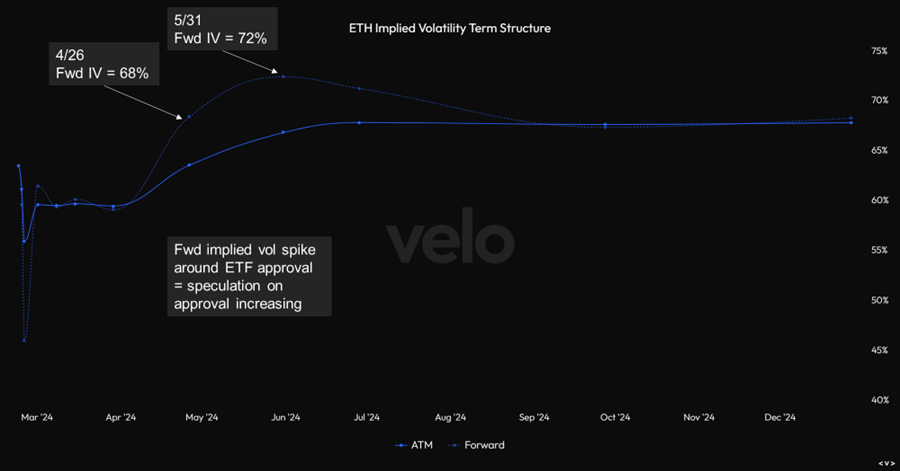

Further, forward implied volatility has spiked around the ETF deadline of May 23rd, indicating traders’ expectations for increased market volatility around this date.

While some argue that BTC will remain the market’s centerpiece due to the upcoming halving, we do not necessarily disagree, however, we believe that ETH is set to reclaim its historically high beta relationship with BTC, a dynamic that has been absent recently.

It’s interesting to note that the ETH/BTC ratio bottomed out before the last halving, a pattern we suspect might repeat, especially considering the low ETH/BTC ratio just before the launch of the Bitcoin ETFs as a potential candidate for a long-term low.

Trade Idea: Filecoin ($FIL)

Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling risk/reward at these levels.

What is Filecoin and How Does It Work?

Filecoin leverages blockchain technology to create a decentralized storage market. It allows anyone to participate as storage providers, who earn FIL by offering their unused storage to clients. Clients pay providers to store or distribute data, with transactions and proofs of storage recorded on the Filecoin blockchain. The network’s unique consensus mechanism, Proof-of-Replication (PoRep) and Proof-of-Spacetime (PoSt), ensures data is stored correctly and securely over time.

Filecoin Traction

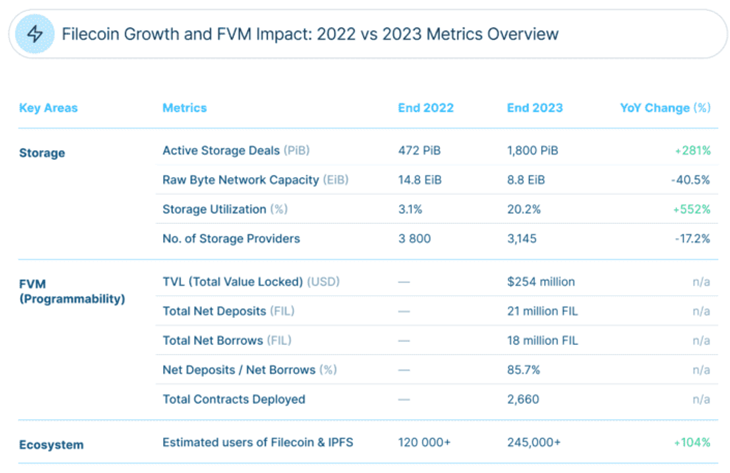

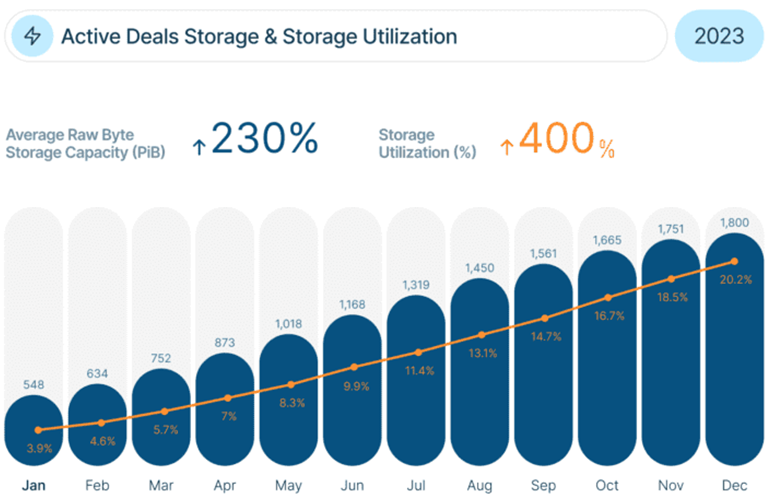

Filecoin witnessed significant growth last year across several key performance metrics. The network saw a substantial increase in total storage capacity, reaching over 1,800 PiB (pebibytes), indicating a robust and growing network of storage providers. There was a marked rise in storage utilization, and the number of active storage deals, reflecting increased adoption and usage of the Filecoin network for decentralized storage needs.

Recent Catalysts / Reasons for Optimism

- Integration with Solana – Filecoin integrated with Solana to enhance Solana’s blockchain infrastructure by providing decentralized storage solutions. This integration allows Solana to store its block history on Filecoin, making it more accessible and usable for infrastructure providers, explorers, and indexers. The rationale behind this integration is to leverage Filecoin’s decentralized storage capabilities for data redundancy, scalability, and enhanced security, supporting Solana’s commitment to decentralization. This strategic partnership highlights the synergies between blockchain compute and storage, aiming to create a more resilient ecosystem.

- Filecoin Virtual Machine (FVM) – Launched last year, the FVM is a runtime environment that enables the deployment of smart contracts (actors) on the Filecoin network. It extends Filecoin’s capabilities beyond storage, allowing for programmable storage primitives and “compute over data” functionalities. The FVM is WASM-based, enabling developers to write smart contracts in various programming languages. It is designed to be Ethereum-compatible, making it easy for developers familiar with Solidity to build on Filecoin. The introduction of FVM opens up a plethora of use cases, including data access control, perpetual storage, and decentralized autonomous organizations (DataDAOs) focused on data management and monetization. Coupled with the advent of FIL liquid staking, and the FVM becomes a massive potential driver for near-term price.

- Glif Recent Fundraise and Future Token Launch – Glif, a protocol within the Filecoin ecosystem, recently raised $4.5 million in a seed funding round led by Multicoin Capital. Glif operates as a liquid leasing protocol for FIL holders and storage providers, enabling them to earn rewards by participating in the protocol. This funding will help Glif expand its services and increase its total value locked. Glif is planning to launch a rewards program offering points to users, with an eventual governance token launch that follows the “vote escrowed” model similar to veCRV. The token and rewards system aims to incentivize participation and governance in the Glif ecosystem, promising a more capital-efficient and engaged community within the broader Filecoin network.

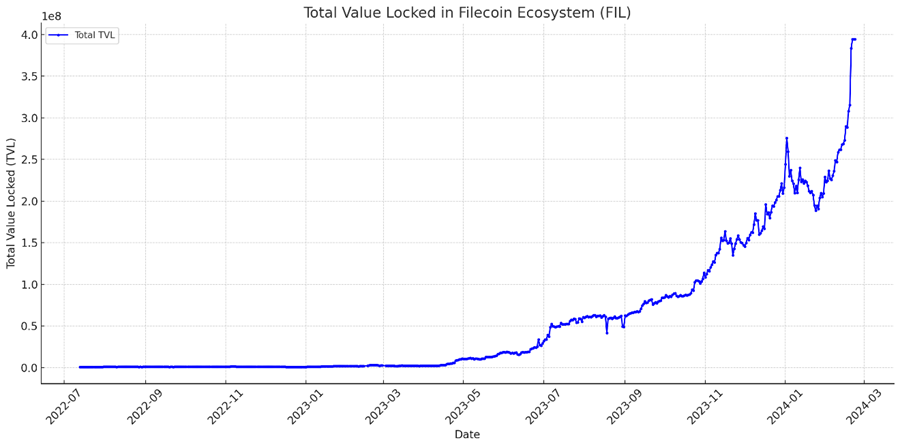

- Demand to Stake FIL Increasing (Chart Below) – This idea dovetails with the point above, but in addition to the increasing demand for storage (increase in FIL fees), there appears to be increasing demand for FIL as collateral in DeFi. As liquid staking apps on Filecoin bring more capital efficiency to the FIL token. Now if someone wants to stake FIL, they can do so, but can use their iFIL as collateral in other DeFi applications. This should create some incremental demand for FIL. We are starting to see the TVL on filecoin increase due to liquid staking options.

- Speculative Demand Increasing in a Healthy Manner (Chart Below) – Price action over the past few days has hinted that this might be a trade that has some legs to it. Spot volumes have spiked considerably, while funding rates remain relatively subdued.

Demand to Stake FIL Increasing

Speculative Demand Increasing in a Healthy Manner

Summarizing Rationale for the Trade

We are designating this as a tactical trade for the interim, primarily because we perceive FIL, at this juncture, as being qualitatively more speculative compared to the assets we incorporate into our Core Strategy. Fundamental concerns warrant attention; notably, despite the stabilization of token inflation post-launch, the annual inflation rate remains high, exceeding 30%. Furthermore, fee levels on Filecoin have stayed relatively low, suggesting that, even with the increased activity mentioned earlier, the project’s revenue generation hasn’t kept pace.

Nevertheless, the narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.

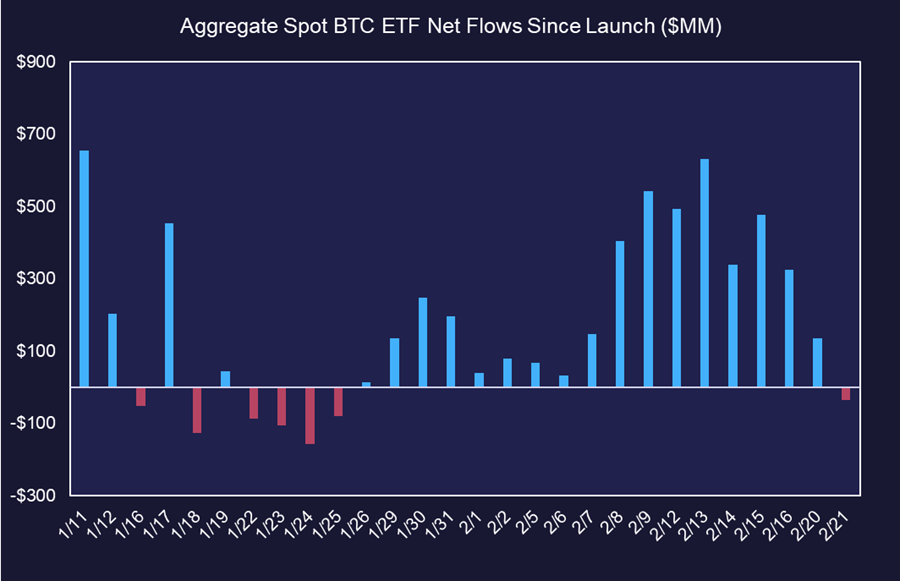

ETF Flows Slow

In tandem with traditional markets, we’ve observed a slowdown in ETF inflows this week, mirroring the broader market’s cautious sentiment. Equities markets showed signs of nervousness ahead of Nvidia’s earnings release, with concerns about potential shortfalls in actuals or estimates and their implications for the broader market and economy. This apprehension was reflected in the crypto market, which began to wobble alongside these fears.

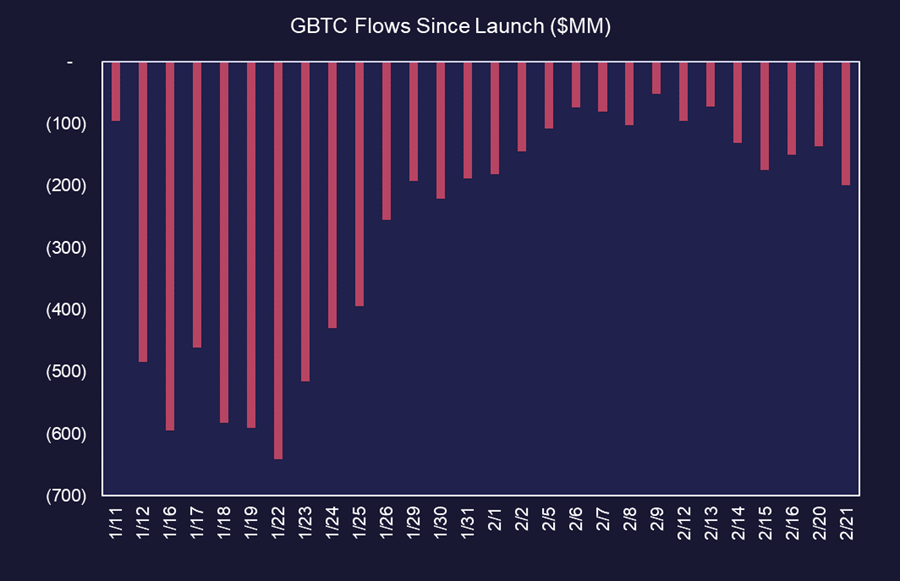

Recent ETF flow data reveals that Wednesday marked the first day of net outflows for BTC ETFs since late January, registering a modest yet negative outflow of $36 million. This decline was predominantly due to a $199 million redemption in GBTC, which significantly overshadowed the inflows into other newly launched ETFs. Notably, GBTC was the lone Bitcoin ETF to experience outflows during this period, suggesting that recent market uncertainties haven’t broadly triggered profit-taking among investors in ETFs launched post-January. Despite these outflows, GBTC’s assets under management (AUM) still stand at nearly $23 billion, even after cumulative outflows exceeding $7 billion. Overall, since January 11th, Bitcoin ETFs have seen over $5 billion in net inflows, with BlackRock’s ETF attracting $5.6 billion, Fidelity’s more than $3.7 billion, ARK’s over $1.3 billion, and Bitwise’s just over $1 billion, underscoring continued investor interest in these financial products.

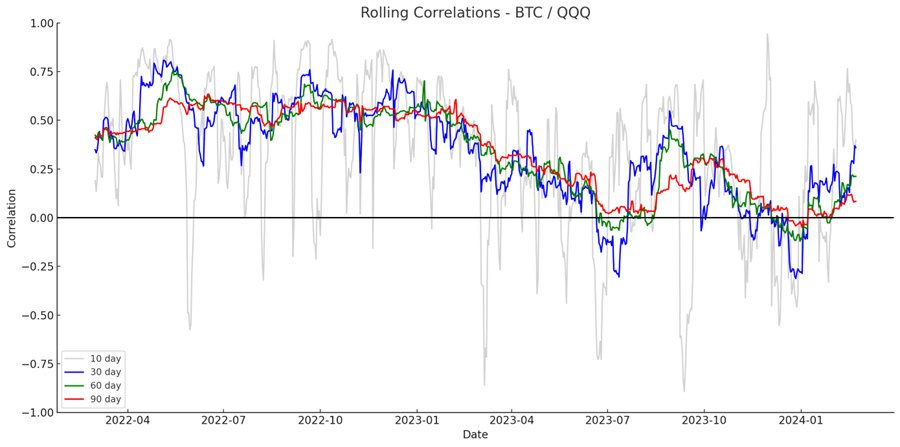

An intriguing market development, as highlighted last week and still under observation, is bitcoin’s rising correlation with US equities. With a new influx of capital, there’s a possibility that Bitcoin and the broader crypto ecosystem may once again be perceived similarly to high-beta tech stocks. The rolling correlations between Bitcoin and QQQ have not reached the levels observed in the previous cycle but have been steadily climbing over the last few weeks, indicating a growing alignment with the performance of tech-heavy equity indices.

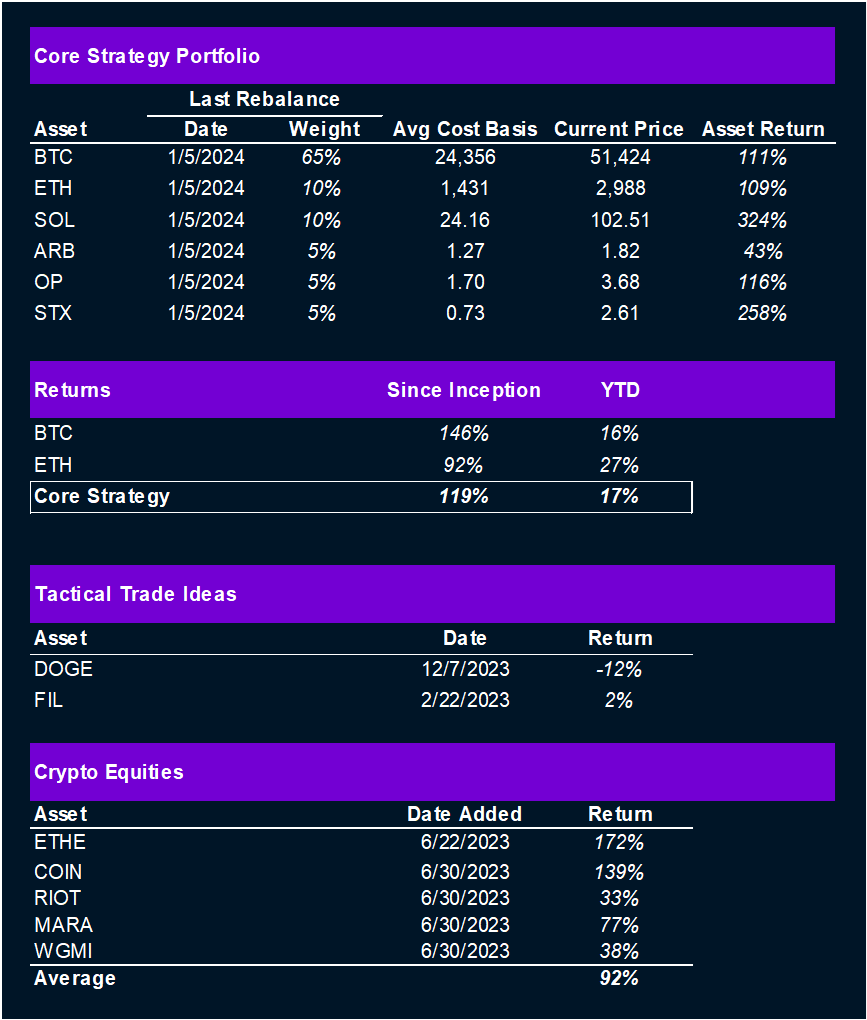

Core Strategy

Our Q1 outlook anticipated some headwinds, and it seems the initial turbulence has subsided for now. Flows into crypto remain strong and breadth against BTC remains subdued. We maintain that ETH, L2s, and STX offer compelling idiosyncratic upside due to their near-term catalysts.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin ($BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum ($ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana ($SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism ($OP) & Arbitrum ($ARB): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks ($STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- DOGE ($DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

- Filecoin ($FIL): Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling short-medium-term trade at these levels. Narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...