The Gameplan

Key Takeaways

- Next week, the QRA and the FOMC meeting on January 31st are critical for deciphering the near-term path of liquidity conditions, offering clarity on the direction of long rates, the timing of rate cuts, RRP trajectory, and the Fed's QT plans.

- The Treasury's ongoing preference for bills as a funding source is likely to persist, favoring risk assets and potentially delaying certain liquidity risks to the end of Q1 or beginning of Q2, as the RRP balance presumably declines.

- The Fed is likely to maintain a noncommittal yet open stance on rate cuts leading to a slight uptick in rates. A hard pushback against tapering or ending QT might counter any bullish tailwinds from a positive QRA.

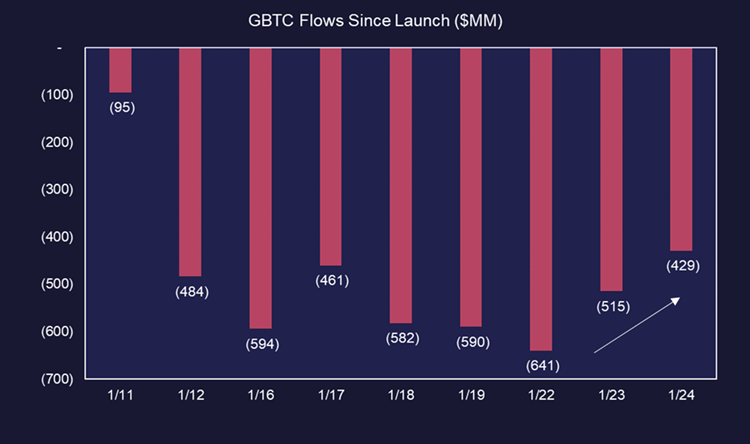

- There are compelling reasons to think that GBTC outflows are subsiding. These include the likely exit of all speculative capital, the confirmed liquidation of the FTX estate's GBTC holdings, and a noticeable trend of decreasing GBTC redemptions, which, if maintained, could positively impact market sentiment.

- The upcoming Jupiter airdrop on Solana, coupled with increased stablecoin inflows, are positive near-term factors to consider.

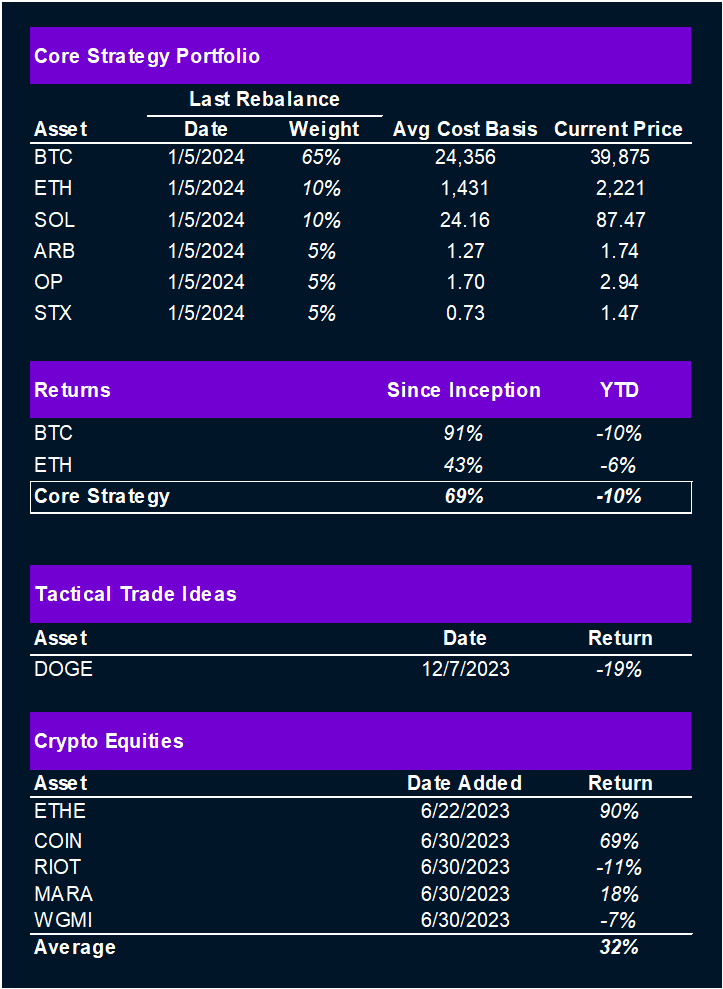

- Core Strategy – Our outlook on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining majority exposure to BTC in our Core Strategy will provide the opportunity to rotate into altcoins once the turbulence subsides. We continue to believe that ETH, L2s, and STX present compelling idiosyncratic upside due to their respective near-term catalysts, and SOL might receive a boost following the Jupiter (JUP) airdrop scheduled for the end of January.

The GBTC Problem

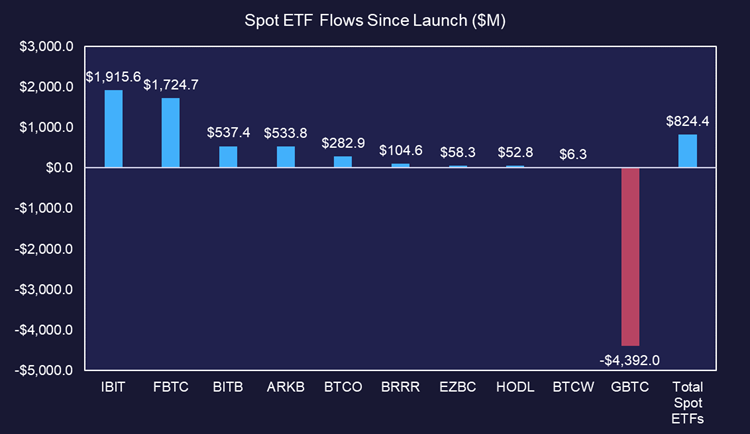

We have been watching spot BTC ETF flows closely since their launch two weeks ago, and while overall net flows remain decidedly positive, the market seems hung up on GBTC outflows. As a reminder, the outflows we care the most about are those from entities that are not rotating into other spot BTC ETFs. This is comprised of some speculative capital that played the run-up into ETF approval as well as sales from bankrupt entities, such as FTX.

While it is difficult to ascertain an exact amount of hidden GBTC available for sale, there are some optimistic data points that we can consider:

- It is likely that all speculative capital has exited. This would have occurred within the first day or two post-launch.

- There is confirmation from reliable sources that the FTX estate has already liquidated all its GBTC holdings as of earlier this week.

- We are starting to see a pattern of decreasing redemptions from GBTC. We will certainly need to see a few more days of follow-through, but a mere slowing down of this AUM exodus would serve as a large boost for the market.

The Real Problem: Rate Cut Repricing and QRA Anticipation

As highlighted in last week’s outlook, there were two predominant risks on our radar that led to our thinking that Q1 would be a bumpy quarter for crypto:

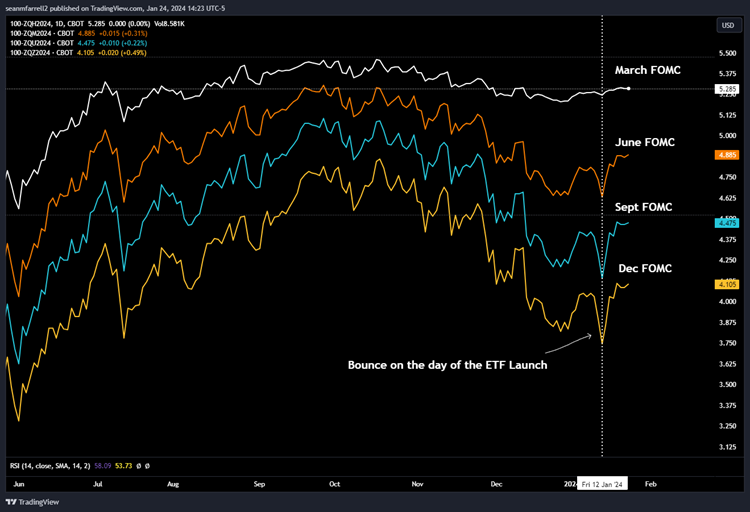

- A repricing of rate cuts as the market was clearly far too ambitious in its view on the timing and magnitude of cuts. This has already started to be reflected.

- Potential repricing of rates due to anticipation and/or manifestation of increased coupon issuance following this month’s Quarterly Refunding Announcement (QRA). Due to its ability to influence the long end of the curve and alter the effectiveness of QT, the QRA has become an important variable for assessing liquidity conditions and the overall condition for risk assets.

Big Macro Week Ahead

Next week, two major macro events demand attention: the Treasury QRA and the FOMC meeting, both scheduled for January 31st. These are significant as they will provide insights into (1) the pace of rate cuts, (2) the short-term direction of the DXY, (3) the expected trajectory of the RRP decline, and (4) the timeline for the Fed’s tapering or cessation of QT. Basically, they will help inform the path of liquidity conditions going forward.

Below we do our best to map out a gameplan.

Tackling the QRA

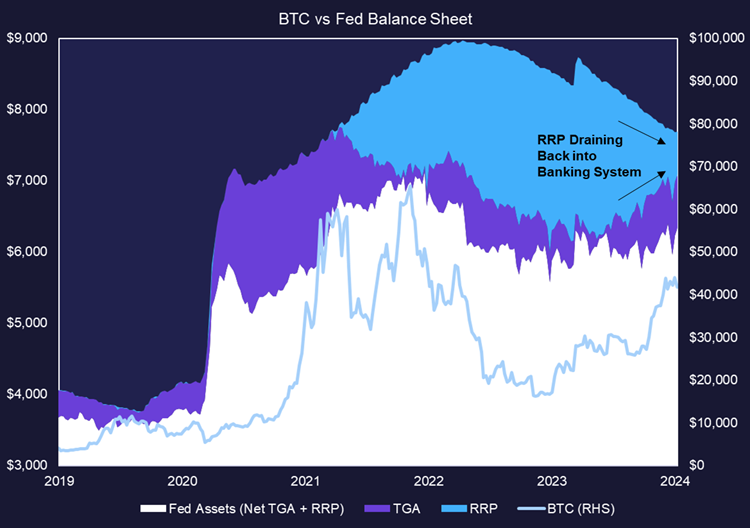

First, let’s revisit the concept of the net liquidity framework. This includes the total assets on the Federal Reserve’s balance sheet, historically a reliable indicator of banking system reserves, which in turn serves as a proxy for liquidity conditions.

More liquidity typically means better conditions for risk assets. However, in recent years, it’s crucial to understand the tools available to the Fed and the Treasury for adjusting reserve levels beyond just quantitative easing (QE) or quantitative tightening (QT). The key tools are the Treasury General Account (TGA) and Reverse Repurchase Agreement (RRP) operations.

When funds are transferred into the TGA and the RRP, they are effectively removed from the banking system, as the participants in those facilities are dealing directly with the Fed. This leads to a reduction in private market reserves.

The process of the Treasury raising capital increases the balance in the TGA, as capital is moved from private banking reserves to the Treasury’s bank account with the Fed. Conversely, government expenditures decrease the TGA balance, funneling funds back into the banking system.

Investors often shift their capital to the RRP to benefit from the overnight rate, especially during times of risk aversion. This inflow boosts the RRP balance, withdrawing deposits from the banking system. In contrast, when capital is redirected back into the banking system, either for investments in short-term bills offering rates higher than the overnight rate or for ‘risk-on’ investments, the RRP balance declines, which in turn increases the collateral within the banking system.

Despite the Fed’s nominal engagement in QT (reducing asset quantity on its balance sheet), actual QT has been minimal since 2022. The first mitigating factor was the TGA’s drawdown in Q1 of 2023, followed by the RRP’s drawdown starting in April of last year, which continues through today.

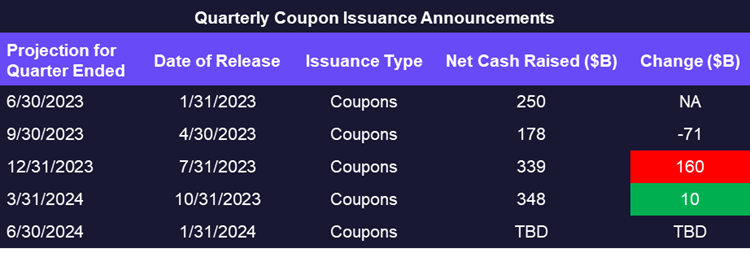

The Quarterly Refunding Announcement (QRA) has become a significant event for investors, as it greatly influences the effectiveness of QT. We can see below that this has served as a key turning point for the DXY over the past two quarters, and risk assets have generally moved opposite the DXY.

Scenario 1: If the Treasury plans to issue more long-term bonds (coupons) than short-term debt (bills), it should have the following effects:

- Long-term interest rates may spike, due to added market supply, leading to investors de-risking.

- With a higher proportion of financing through longer term coupons, we will not see the same level of QT offset in the RRP that typically arises from bill issuance.

Scenario 2: Conversely, if the Treasury continues to favor bills over coupons, it will likely:

- Keep the long end of the yield curve stable.

- Speed up the stimulative effects of the RRP, pulling funds from the overnight facility back into the banking system, negating the ongoing $95 billion of QT per month.

The last QRA on October 31st, outlining the funding sources for the rest of Q4 and Q1, surprised investors by favoring bills over longer-term funding sources. This was unexpected, especially since the July 31st QRA had suggested a gradual increase in coupon issuance relative to Q2. As a result, many investors were caught off-guard as bonds rallied.

The comments from the Treasury in October, which we recommend everyone review is below:

Ultimately, the Committee’s second charge highlighted the importance of retaining flexibility in issuance strategy within Treasury’s regular and predictable framework. The charge suggested Treasury consider skewing increases in issuance towards tenors which have less sensitivity to term premium increases, and ones that benefit from greater liquidity. The Committee supported meaningful deviation from the historical recommendation for 15-20% T-Bill share. While most members supported a return to within the recommended band over time, the Committee noted that the work Treasury has done to meaningfully increase WAM over the past 15 years affords them increased flexibility with T-Bill share in the medium term.

To recap our options:

- If the Treasury overweights its refunding toward bills, we view this as bullish for risk assets because it will keep a lid on long rates and will likely lead to an increase in domestic liquidity (in the short-term) as the RRP is drained to zero.

- If the Treasury decides to pivot from last quarter and issue a greater percentage of longer maturity coupons then we would expect to see a major rally in the dollar, and a pullback in risk assets as domestic liquidity conditions tighten.

We are largely subject to the Treasury’s whim here, but we believe there’s a high likelihood that the QRA will lean towards lighter coupon issuance this quarter (overall good for risk).

To be more specific, we are looking for coupons issued in Q2 to approximate the level that we saw for Q1.

This belief is based on (1) last quarter’s indication of a preference for funding government operations with a higher proportion of short-term debt than usual, and (2) the probable intent to issue longer-duration treasuries at lower interest rates, which are expected by Q3, aligning with the Fed’s projection of three rate cuts this year. Additionally, there is a political dimension to consider, where the Treasury would presumably aim to avoid any market disruptions leading up to the election. Favoring bill issuance could be a strategy to maintain stability in the market for another three months, possibly bridging the market to rate cuts and/or an end to QT.

FOMC Breakdown

The second major macro event is the FOMC statement and press conference, scheduled for the same afternoon as the QRA composition release. The interest rate decision itself is unlikely to hold any major surprises. The key elements of the statement and press conference will be (1) any information that alludes to the pace of rate cuts, and (2) any information that elucidates timing on ending QT.

Rate cuts are obviously important to understand, since absent a flailing economy, they should put a hammer on the DXY and be a boost for risk assets. We have seen the market reprice the timing of cuts over the past couple of weeks, which has put upward pressure on rates and the DXY and has been reflected in gold and BTC prices. If the Fed is steadfast in their ways and suggests that we might not get a cut until H2, then perhaps we get another swing higher in rates due to the timing adjustment. Our base case is that we likely do have some minor upside in rates due to this recalibration effect.

The second element of the Fed Press Conference to take note of is their view on the pace of QT. As noted above, despite the Fed’s best efforts, QT has not had the sustained effect on risk assets as it was expected to, largely due to the existence of the RRP, which has served as a source of liquidity for the economy for nearly a year now.

Below is a simplified projection of the RRP. Should the current pace be maintained, we would see this source of liquidity run dry towards the end of Q1 or perhaps into early Q2. This is why timing of any tapering or cessation of QT is important to understand. Should there be a disconnect, it is possible that we run into a drawdown in liquidity around the time that the RRP runs out.

To summarize our expectations:

- We should expect to gain clarity on the timing of rate cuts, our base case is that the Fed is noncommittal but remains consistent that they will entertain them at some point this year. This will result in a slight increase in fed funds futures pricing.

- We should also expect more clarity on the timing of QT. A hard pushback from the Fed on ceasing QT anytime soon might lead to a negative market reaction, countering any tailwinds from a good QRA.

Summary

Next week will be a crucial one for liquidity sensitive assets, including bitcoin. We think that the Treasury remains committed to being overweight bills as a source of funding, which risk assets should like. That would defer some risk to the end of Q1/beginning of Q2, at which point the market will primarily be concerned with market liquidity drying up due to a dwindling RRP balance. Ultimately, as has been the case since the GFC, the Fed is likely to step in and assuage fears by ceasing QT, or pulling some new facility that we have yet to dream of that could appease markets. If the Treasury happens to pivot back to greater coupon issuance, then it is likely that liquidity risks are more concentrated to Q1 as this will result in a further increase in rates and strengthening of the dollar through February.

Quick Thoughts on the BTFP

On Tuesday, the Fed officially announced the end to the Bank Term Funding Program, which was instituted in the wake of the banking crisis in March 2023. Since the lending rate was priced with forward rates, this opened the door for an easy arbitrage trade for institutions – borrowing at the rate pricing in cuts toward the end of this year and lending at a higher risk-free rate.

The implementation of the BTFP served as a quasi-stimulative event towards the beginning of last year as banks could sell their underwater debt to the Fed and have reserves increase by the difference between the market value of their underwater debt and the loans provided by the Fed. Now that this is going away in March, many are concerned about the knock-on effects. Our current take is as follows:

- It is likely a very minor net negative for market liquidity, since reserves will decrease on the margin, but that margin will be the spread between the par value of any underwater debt and the debt borrowed by banks from the Fed plus the arbitrage spread that banks have recently started to accrue.

- We are not so sure there will be another imminent banking crisis since ailing banks can start tapping the discount window.

- There certainly should not be any major effects to banking liquidity in the near term since any ailing banks can renew their loans for another year prior to the facility’s expiration.

- If there is another banking crisis, then that would be good for risk, as the Fed would likely step in to assuage market fears.

- The bullish take is that the Fed has a good view into bank health and would want to avoid another calamity. With that in mind, it is possible that the Fed does not see rate volatility as a serious issue beyond Q1.

Short-Term Solana Tailwinds

Another possibly consequential event to transpire on the 31st is the much-anticipated Jupiter airdrop. Solana’s decentralized exchange aggregator, Jupiter will launch its governance token JUP next week. In its first phase, the project plans to airdrop the token to nearly one million crypto wallets. Ahead of this, Jupiter conducted a test launch using “mockJUP” and hinted at a memecoin launch on its platform next week.

Jupiter’s airdrop strategy, first revealed in November, aims to reward its early users. The airdrop allocation website went live on December 1st. A significant portion of Jupiter’s total token supply, four billion out of 10 billion tokens, will be distributed over four phases. The first phase will dispense one billion Jupiter tokens to 955,000 users who have conducted a minimum of $1,000 in swap volume by November 2nd. These distributions will have varying reward tiers based on each user’s trading volume.

As we have seen in Solana’s recent runup, airdrops can often offer a boost to the price of the underlying chain due to the wealth effect created by the airdrop (users sell their airdrop for SOL). They also often lead to an overall increase in attention and on-chain activity.

From a fundamental perspective, stablecoin flows onto Solana have picked back up in recent days, which suggests that on-chain activity and speculation may increase in the near-term.

Core Strategy

Our outlook on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining majority exposure to BTC in our Core Strategy will provide the opportunity to rotate into altcoins once the turbulence subsides. We continue to believe that ETH, L2s, and STX present compelling idiosyncratic upside due to their respective near-term catalysts, and SOL might receive a boost following the Jupiter (JUP) airdrop scheduled for the end of January.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -4.44% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH -5.36% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.18% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 0.11% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.