Pressing Winners (Core Strategy Rebalance)

Key Takeaways

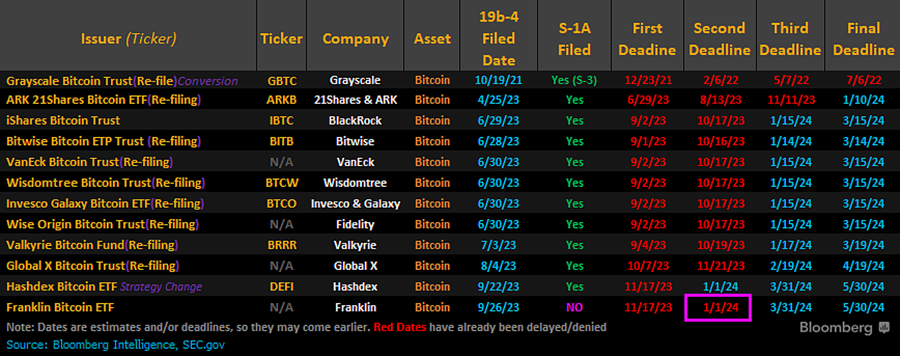

- This week, the SEC unexpectedly postponed its review of Hashdex and Franklin Templeton's spot BTC ETF applications, a move that is likely a strategic way to synchronize comment periods for all ETFs, an additional positive sign for collective ETF approval by January 10th.

- The recent FTX bankruptcy case motion to sell trust assets, which poses a risk of widening the discount to NAV for ETHE and GBTC, is more likely a strategically timed maneuver in anticipation of GBTC's expected ETF conversion and approval.

- Declining staking yields on Ethereum have resulted in a net withdrawal of validators from the network and could possibly cause some minor near-term supply-side headwinds.

- The combination of a compelling narrative, underlying fundamentals, and upcoming catalysts makes STX a strategic inclusion in our Core Strategy, in line with our broader market outlook that anticipates the outperformance of BTC, and the significant beta potentially offered by STX in the coming quarters.

- Core Strategy – Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we have yet to see indications of an overbought market. A potential bounce in rates could serve as a short-lived headwind for the broader altcoin and crypto equities market, but a lack of correlations, persistence of flows, and near-term catalysts mean that risk asymmetries still skew to the upside.

Rates Due For a Bounce (Maybe)

As the crypto market continues to exhibit strength, and despite eradicating one of the market’s biggest unknowns in Binance just last week, it remains essential to be aware of near-term risks.

Recently, the bond market has experienced a significant rally, and there’s been a notable decline in the DXY. Combined with nominal stimulus in Asia, these factors have contributed to a substantial increase in USD global liquidity.

This boost in liquidity has been a driving force behind the expanding breadth in both the crypto market and crypto equities.

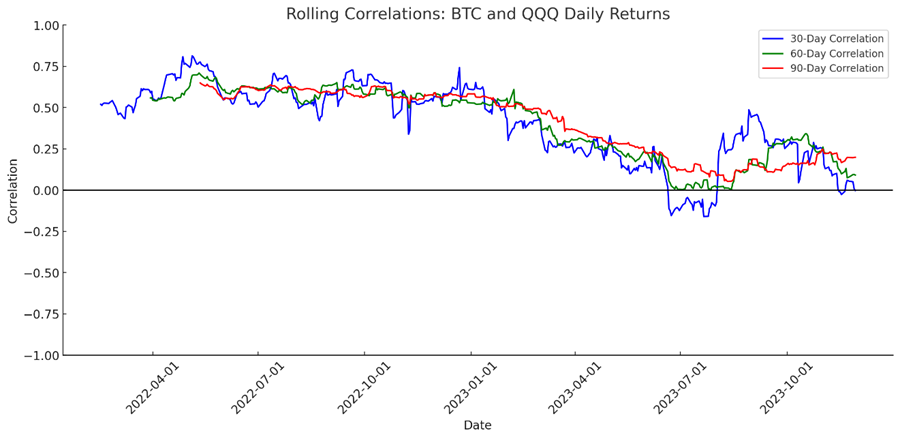

Notably, crypto equities began to align more closely with underlying crypto assets when the 10-year bond yield started to decrease.

If interest rates begin to regress to the mean – perhaps on a strong PMI print tomorrow, or ahead of the next Treasury quarterly refunding announcement, we may bear witness to a reduction in market breadth.

Recall that the overemphasis on bills issuance in the October refunding announcement fueled a good portion of the duration rally in late October and early November, and in our view, contributed to the broadening of the rally in crypto.

A resurgence in rates on the long end of the curve could create short-lived headwinds for altcoins and crypto equities, on a relative basis, and portend a continuation higher for bitcoin dominance.

However, we do not want to overstate the level of risk that we see in the near term.

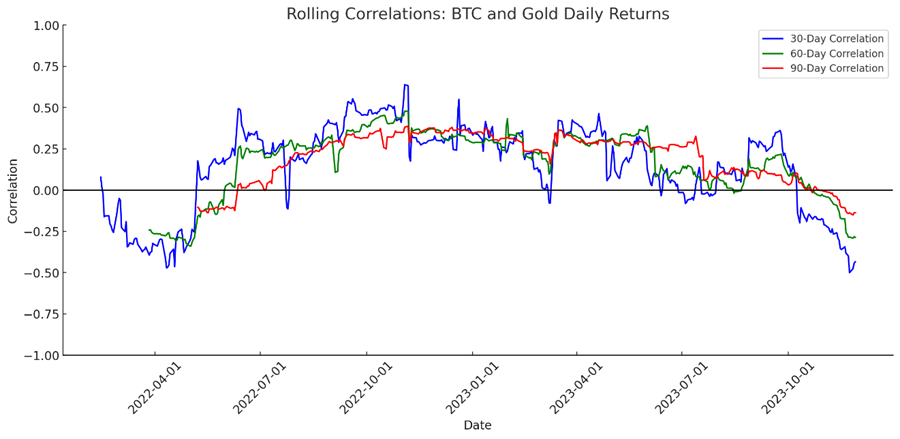

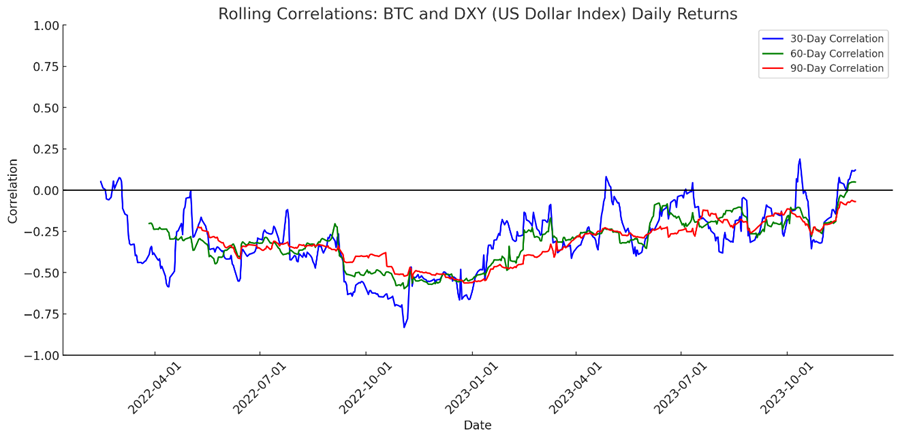

It’s important to recognize that, over most lookback periods, Bitcoin still shows a broad lack of correlation with macro factors.

Therefore, even if there is a temporary recovery in the dollar and rates, Bitcoin’s spot price may not be significantly affected by these macro shifts, and in our view, it is more likely that assets further out on the risk curve, or those that have a cost of capital (equities) would be more adversely affected.

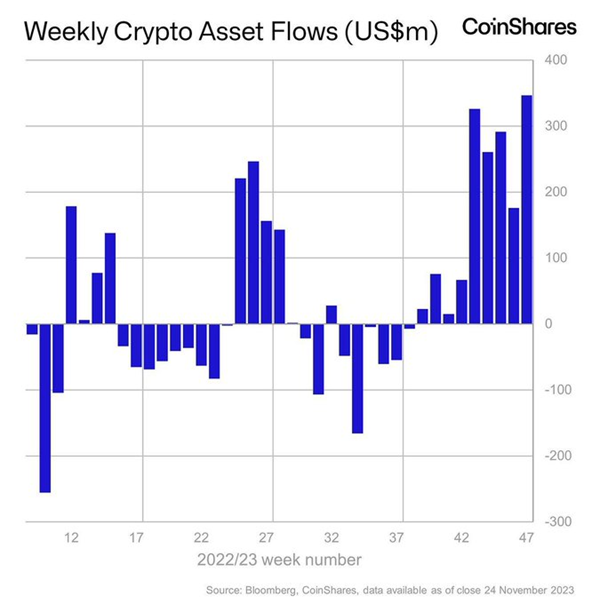

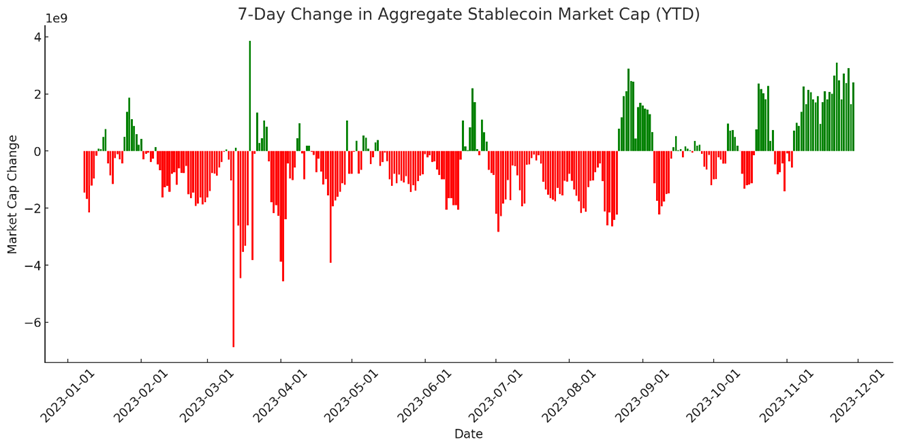

Further, it’s important to note that capital inflows from both stablecoins and ETPs continue to paint a positive near-term picture for the market.

And finally, we should not forget that we are a little over a month away from probable ETF approval for bitcoin and about four months from the next halving, meaning that risk asymmetries still skew to the upside.

ETF Deferrals Are a Positive Sign

This week, the SEC postponed its decisions on the spot BTC ETF applications from Hashdex and Franklin Templeton, scheduling their next reviews for March 31st.

This move by the SEC came as a surprise to many, as these deferrals occurred earlier than expected.

However, ETF experts James Seyffart and Scott Johnsson have speculated that this early deferral might be intentional. The aim, they suggest, is to synchronize the comment periods for all active spot ETF applications, potentially making them all eligible for approval simultaneously in early January.

With the ultimate deadline for ETF approval set for January 10th, we interpret this recent development as a positive sign. It appears to be a strategic move by the SEC, potentially streamlining the process towards a collective decision.

Trust Assets for Sale

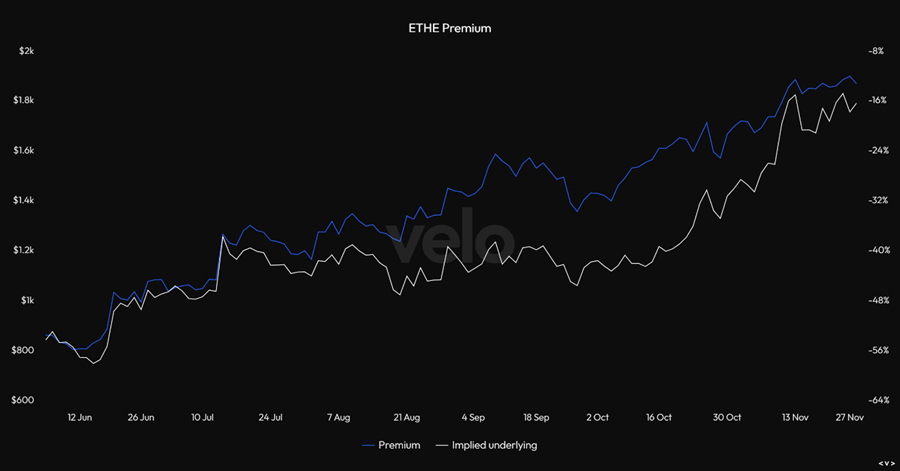

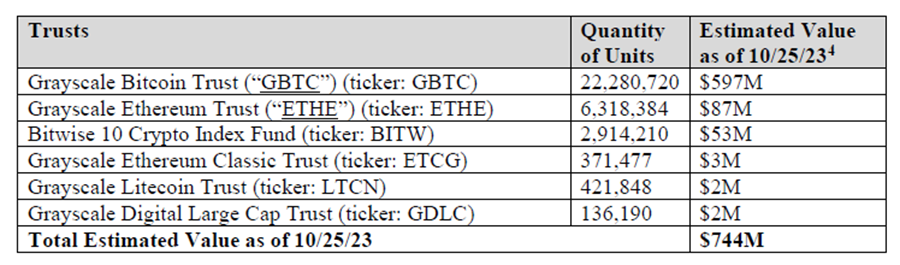

A recent motion in the FTX bankruptcy case brings into focus potential impacts on crypto trust assets, particularly on ETHE and GBTC, which remain key components of our crypto equities basket. Currently, GBTC trades at about an 8% discount to its Net Asset Value (NAV), while ETHE is at a 13% discount.

The FTX estate has received authorization to sell its trust assets, which are primarily shares in various Grayscale Trusts and a Bitwise trust, valued at nearly $900 million using more current pricing.

Galaxy has been assigned by the court to assist in the strategic disposal of these assets — nearly $600 million in GBTC and $90 million in ETHE. Considering the 30-day average trading volumes for these products (GBTC at $4.5 million and ETHE at $2.7 million, based on TradingView data), the introduction of these assets into the market could potentially widen the discount to NAV for both GBTC and ETHE.

However, we think there are a couple of important things to note:

- Galaxy’s role in maximizing value for the estate suggests a measured approach to asset disposal, which would mitigate any immediate market impact.

- More importantly, we think the reason for this sale approval happening now is the likelihood that GBTC converts into an ETF in January, allowing redemptions and bringing the discount to NAV to zero. We think the estate merely wants to be prepared to liquidate its assets should a liquidity window open up for GBTC in January, and then for ETHE later in the year.

Should the market react differently than expected and the discounts widen over the next month, we think there will be sufficient institutional interest to absorb these assets at a steeper discount, which would limit the duration of any widened discount on these assets.

ETH Validators Exiting

Despite skepticism from some quarters, ETH has indeed outperformed BTC since our last core strategy rebalance. However, there are indicators that this relative outperformance may not persist as strongly in the immediate term.

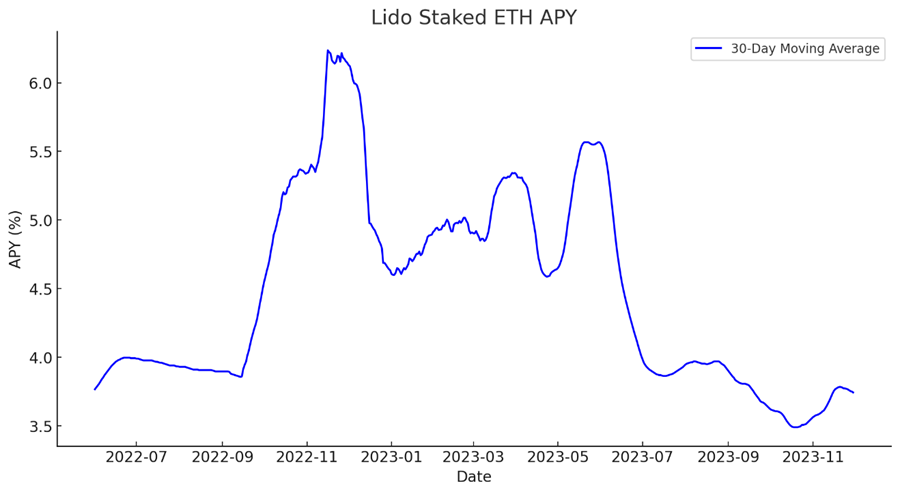

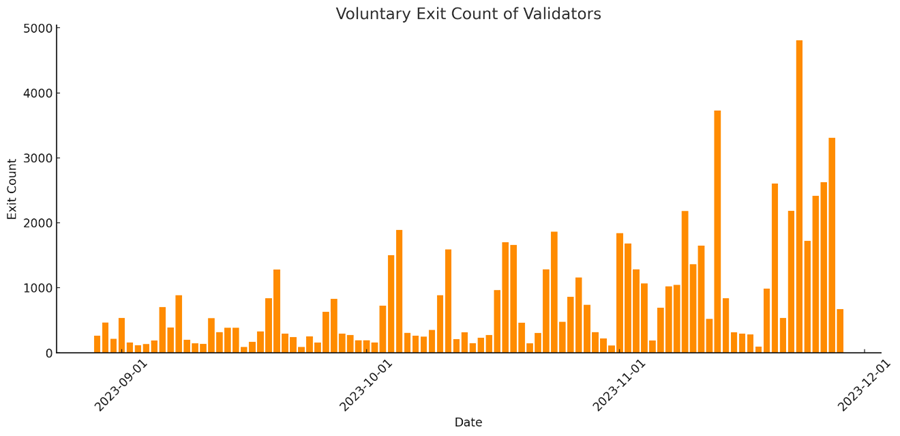

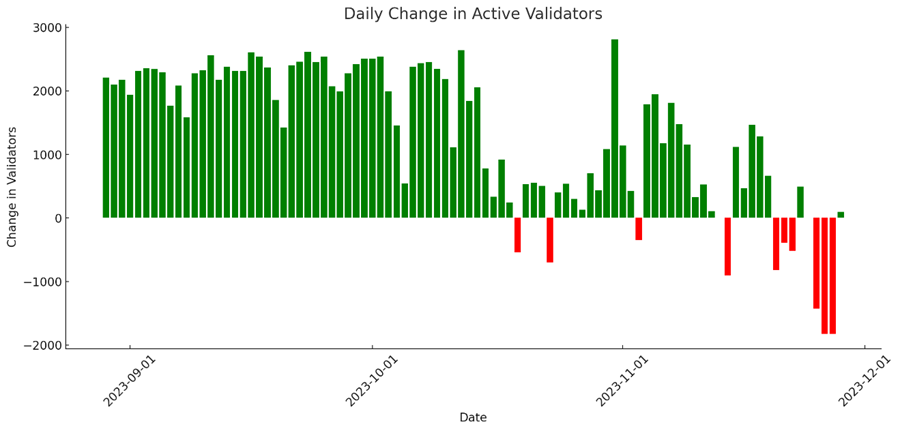

A factor to consider is the change in Ethereum’s staking landscape. With the staking percentage on Ethereum increasing but still relatively muted transaction fees, we have seen a gradual decrease in staking yields on Ethereum.

Consequently, for the first time since the Merge, we are observing more validators exit the Ethereum network than enter.

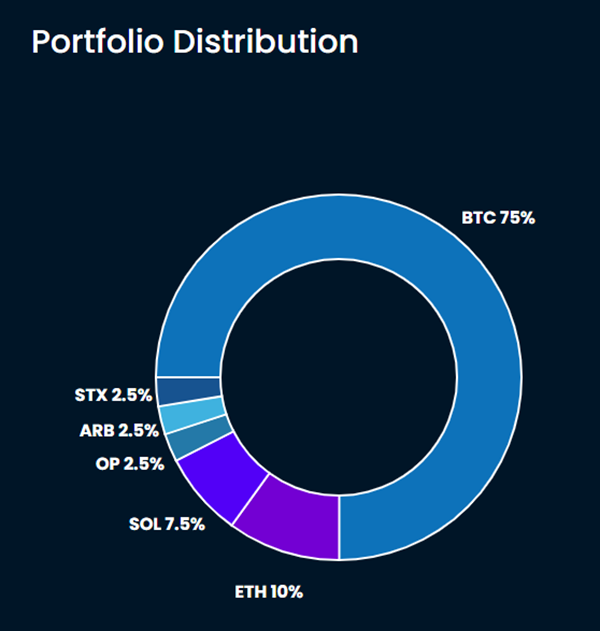

The recent exit of validators and the consequent reduction in staked coins are likely to increase Ethereum’s (ETH) float in the near term. This increase in available coins for trading, as opposed to being locked in staking contracts, could act as a drag on ETH’s price, at least relatively, in our view. While we don’t intend to overemphasize this risk, as ETH and its Layer 2 solutions continue to be part of our Core Strategy, it’s an important factor to monitor. Consequently, we are reallocating a portion of our ETH holdings to a Bitcoin-related altcoin within the Core Strategy (more on that below).

Adding STX

In this stage of the bull market, with Bitcoin leading the charge, it’s strategic to be overweight in BTC. However, there’s significant potential in select altcoins that either demonstrate idiosyncratic outperformance, like SOL, or those that could offer a reliably high beta to Bitcoin. A prime candidate in this context is Stacks (STX).

Intro to Stacks

Stacks is a Layer-2 network solution built on Bitcoin, designed to enable smart contracts and decentralized applications (dApps) while leveraging the security and reliability of Bitcoin. Its primary purpose is to enhance Bitcoin’s utility by enabling complex functionalities, such as smart contracts and DeFi applications, which are not yet natively possible on the Bitcoin blockchain. Stacks operates using a unique consensus mechanism called Proof of Transfer (PoX), linking transactions and smart contracts on Stacks to the Bitcoin blockchain, thereby benefiting from Bitcoin’s robust security. Alongside RSK and Liquid, Stacks is one of the few Layer-2 solutions being developed for Bitcoin and is the only one with a native token.

Initially launched as Blockstack in 2017 by Muneeb Ali and Ryan Shea, the project released its alpha code for the Blockstack browser the same year, marking its first foray into leveraging blockchain technology. In 2018, the project evolved into the Stacks 1.0 blockchain network, further solidifying its blockchain foundation. In 2019, it raised $23 million through an SEC-approved initial coin offering.

The project underwent a significant rebranding in October 2020, becoming Stacks. This change paved the way for the substantial upgrade to Stacks 2.0, which introduced advanced features like smart contracts and deeper integration with the Bitcoin blockchain, representing a critical evolutionary leap in the project’s development.

The native asset of Stacks, STX, is essential to the network’s functionality. STX is used for executing smart contracts, processing transactions, and incentivizing network participation through Stacking. In Stacking, STX holders lock their tokens to support network security and consensus, earning Bitcoin as rewards. The tokenomics of STX are strategically designed to align with the growth and security of the Stacks network, featuring a predefined future capped supply of approximately 1.8 billion tokens and a distribution model that incentivizes miners and network participants. As of the latest data, approximately 80% of STX tokens are already in circulation (source: Coingecko), suggesting that dilution is less of a concern for this asset.

Emergence of a Bitcoin Economy

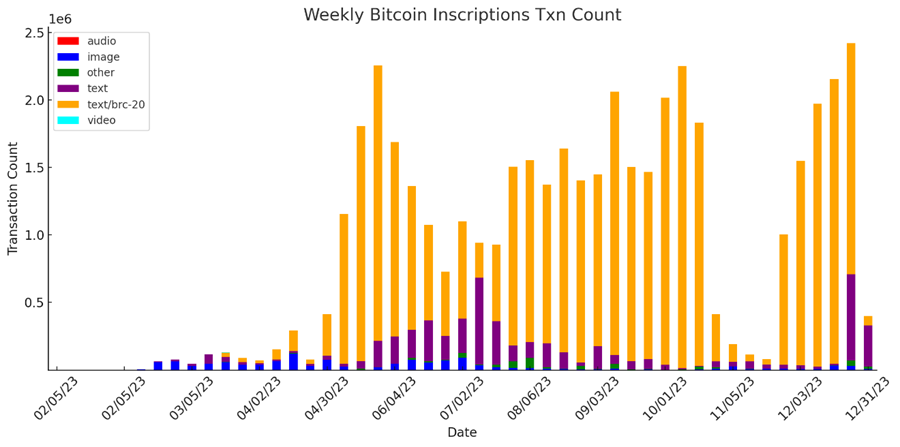

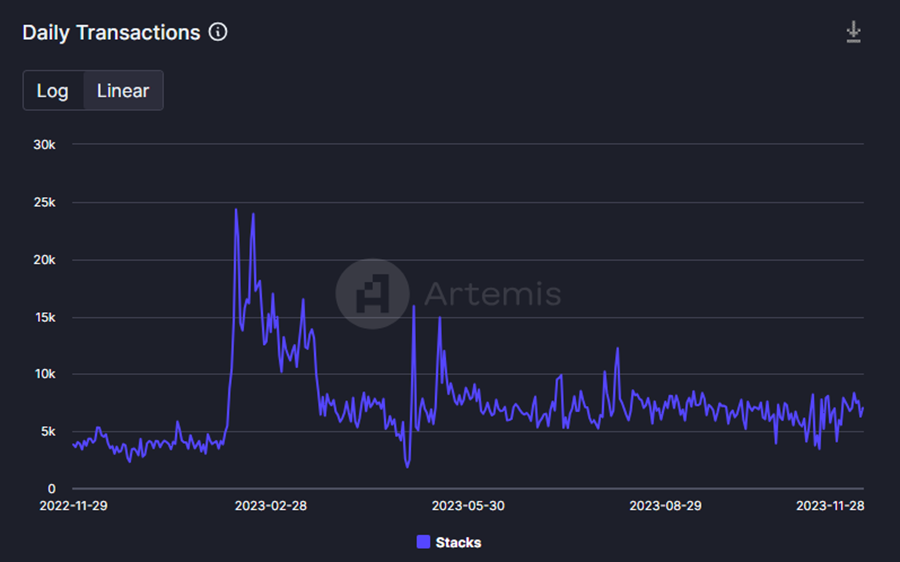

STX experienced a significant upsurge at the beginning of this year, propelled by the advent of Ordinals. The unveiling of Ordinals on the Bitcoin network reignited interest in Stacks, showcasing Bitcoin’s potential for enhanced programmability and more complex applications. Furthermore, Ordinals presented an innovative resolution to the long-standing mining fee conundrum. Many critics, noting that most mining rewards are derived from block subsidies rather than transaction fees, have expressed concerns about this potentially impacting Bitcoin’s security budget in the long term. Developing applications on the Bitcoin network that facilitate commerce could arguably help alleviate these concerns.

This altered perception of Bitcoin’s capabilities has shone a spotlight on Stacks, highlighting its role in potentially facilitating the creation of advanced smart contracts and decentralized applications on the Bitcoin platform. The excitement generated by Ordinals, which has revealed new possibilities for Bitcoin’s blockchain, has affirmed Stacks’ vision and strategy. This, in turn, has attracted both developers and investors, eager to delve into its distinctive features within the burgeoning Bitcoin ecosystem. STX performance relative to BTC has since returned from orbit, but we think its time to consider building a small allocation ahead of Q1.

Upcoming Catalysts

A significant development for Stacks is the upcoming Nakamoto upgrade and the introduction of sBTC, a 1:1 Bitcoin-backed asset within the ecosystem. This upgrade is expected to bring faster transactions, better scalability, and increased security to Stacks. There are often gray areas when it comes to the Layer 2 designation. In our view, a true layer 2 is one that can fully leverage the security budget of its Layer 1. According to Stacks developers, the Nakamoto upgrade should allow for this.

The Stacks community is scheduled to vote on these upgrades, with voting set to open on December 15th through January 31st. If approved, the Nakamoto upgrade and sBTC launch could significantly enhance the utility of Bitcoin in smart contracts and DeFi, marking a major milestone in Stacks’ evolution.

Summary of Thesis

We believe there are compelling fundamental and narrative-driven reasons to hold a long position in Stacks (STX):

- Growing Ecosystem on Bitcoin – The increasing popularity of Ordinals indicates a strong interest in building commerce on the Bitcoin network.

- Large Addressable Market – Assuming L2 solutions on BTC gain traction, the TAM is substantial. Ethereum L2s Optimism and Arbitrum, have fully diluted market caps of $7.2 billion and $10.2 billion, respectively. In contrast, Stacks maintains a market cap of just over $1 billion, despite operating on a network more than twice the size of Ethereum. Given these factors, we believe a market cap ranging from $14 to $20 billion for a leading Bitcoin L2, like Stacks, is a realistic prospect.

- Upcoming Q1 Catalyst – The anticipated Q1 update presents a significant opportunity, in our view. It’s expected that traders will aim to front-run this event, while on-chain enthusiasts may engage in experimental farming for potential airdrops post-upgrade. Importantly, this update will enhance performance and facilitate the flow of value from the Bitcoin network to the L2.

- Trading Perspective – Assuming Bitcoin continues to lead the market in the near term, STX is poised to offer a more reliable beta relative to Bitcoin than most other altcoins.

While STX presents a promising opportunity, it’s not without risks. Ambitious technical milestones on its roadmap still need to be achieved. Historical technical issues, including potential block reorgs and discounted mining, have been addressed but remain noteworthy. Additionally, the current lack of fundamental usage compared to earlier this year poses a risk. However, we anticipate increased activity as the Nakamoto upgrade approaches.

The confluence of narrative, fundamental strengths, and imminent catalysts positions STX as a strategic addition to our Core Strategy. This approach aligns with our broader market perspective, expecting BTC’s leadership to continue and recognizing the high beta potential of select altcoins like STX over the next several quarters.

Core Strategy

Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market. A potential bounce in rates could serve as a short-lived headwind for the broader altcoin and crypto equities market, but a lack of correlations, persistence of flows, and near-term catalysts mean that risk asymmetries still skew to the upside.

A brief summary of the theses behind each component of the Core Strategy:

- Bitcoin (BTC 0.84% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential likely catalysts include spot ETF, the halving (April 2024), and potential nation-state adoption.

- Ethereum (ETH 0.98% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.39% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 0.72% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

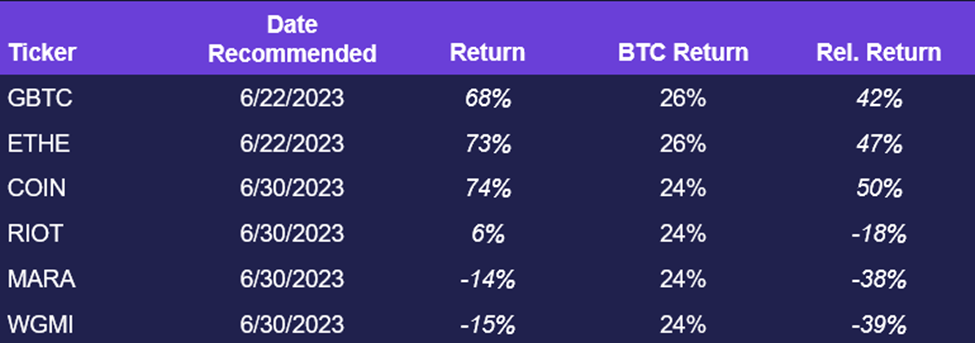

Crypto Equities