Respecting the Seasonality (Core Strategy Rebalance)

Key Takeaways

- While we've been in favor of maintaining risk exposure recently, the ongoing seasonal headwinds and decline in global liquidity make tactically scaling back on altcoins a prudent strategy for better positioning in future market conditions.

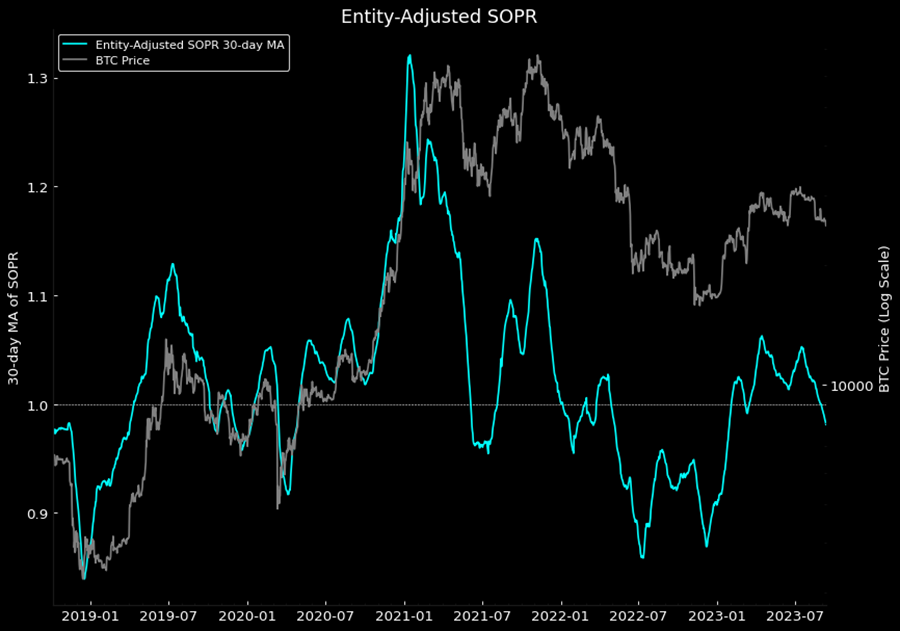

- The declining 30-day moving average of Entity-Adjusted SOPR below 1, coupled with a downward trend in Long-Term Holder SOPR since July, indicates diminishing market confidence, even among long-term Bitcoin investors.

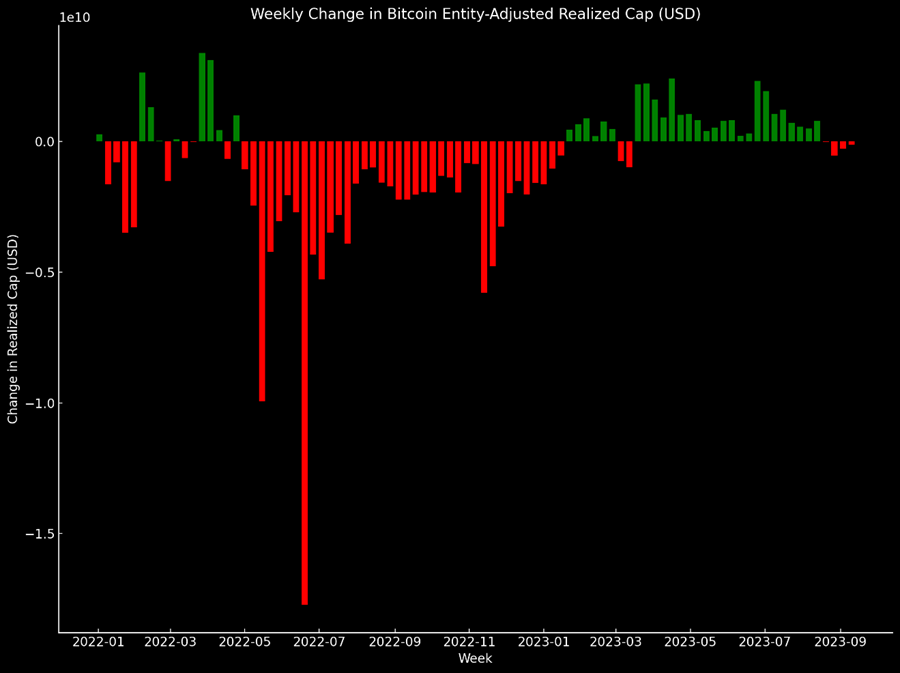

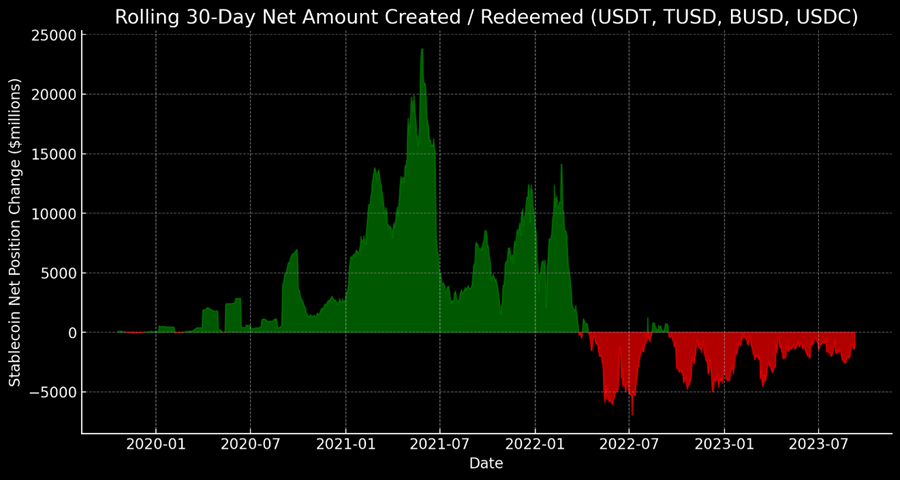

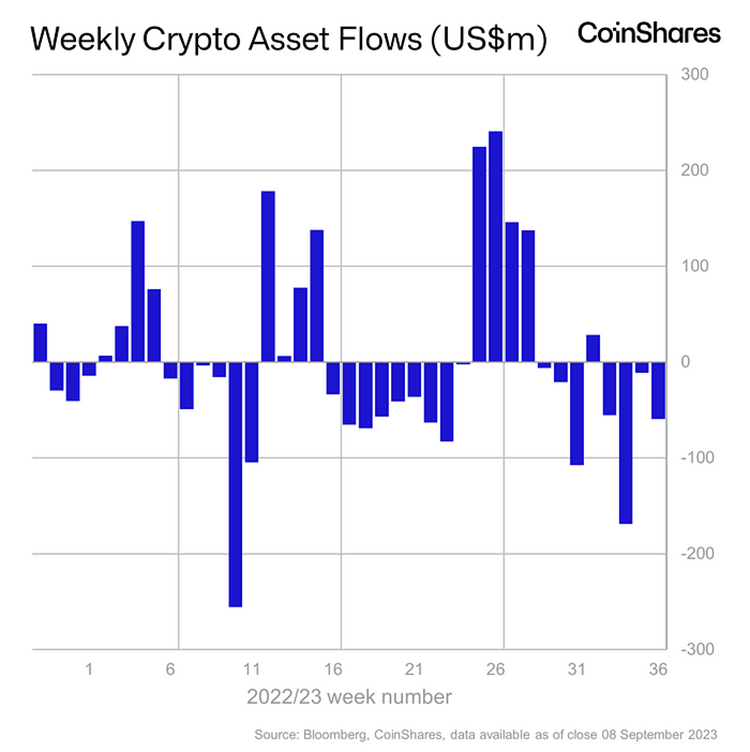

- Four weeks of consistent outflows from the Bitcoin network and a lack of stablecoin growth over the past year, along with recent withdrawals from crypto ETPs, suggest caution is warranted as these factors indicate a current trend of reduced market confidence.

- Amid ongoing liquidity constraints and a robust U.S. dollar, the persistent decline in global central bank liquidity since April casts doubt on a quick market turnaround, even with potential relief from softer CPI figures.

- Core Strategy – Despite initial hopes of overcoming the typically negative September seasonality in the crypto market, this year seems to be following the trend, leading us to recommend reduced exposure to altcoins and more cautious risk management in the coming weeks.

Tactical Caution

Throughout this year, we’ve been navigating a complex interplay between overarching macro influences and crypto-specific events. Milestones such as BlackRock’s ETF application, Ripple’s legal win over the SEC, and Grayscale’s similar success have been promising, yet they’ve occurred amidst a peak in global liquidity.

This timing has effectively curtailed any long-lasting bullish momentum in the crypto markets. While we’ve been vocal proponents of maintaining risk exposure, the convergence of today’s rally, persistent seasonal headwinds, and a strengthening U.S. dollar make this an opportune time to reconsider. Scaling back on crypto assets (particularly alts) at this juncture could serve as a prudent strategy, allowing for better positioning once these transient market conditions subside.

Momentum Failing to Turn Higher

As we have covered in prior analyses, SOPR is an excellent indicator of momentum for bitcoin. The Spent Output Profit Ratio (SOPR) gauges the profitability of coins moved on-chain. It is calculated as the ratio of the coin’s current value at the time it is spent to its original acquisition cost.

A SOPR value of 1 signifies a market at breakeven, indicating that people are neither making nor losing money on their investments. When SOPR is greater than 1, it typically suggests a bullish market sentiment, as it means that investors are selling their coins for a profit. Conversely, a SOPR less than 1 can be a bearish indicator, implying that coins are being sold at a loss. In addition to the basic SOPR, there are variations like Entity-Adjusted SOPR, which refines the metric by ignoring closely related outputs in the same transaction. There are also Long-Term Holder SOPR (LTH-SOPR) and Short-Term Holder SOPR (STH-SOPR) that consider coins held for longer and shorter periods, respectively. These nuanced versions of SOPR offer a more granular view of market behavior and sentiment.

As illustrated in the chart below, the 30-day moving average for Entity-Adjusted SOPR has significantly dropped below the 1 mark and has not yet shown signs of rising.

What’s particularly concerning about this trend is that the Long-Term Holder SOPR (LTH-SOPR), while still above 1, has been on a downward trajectory since July. This suggests a diminishing confidence in the market’s direction, even among long-term investors.

Outflows Persist

Outflows from the Bitcoin network have been persistent for four consecutive weeks, as evidenced by the realized cap, which serves as a proxy for the network’s overall cost basis and inflows/outflows. A rising realized cap is crucial because it indicates that the network’s cost basis is increasing, a positive sign of market confidence.

Additionally, it’s worth noting that there has been no 30-day period of stablecoin growth for over a year. This lack of growth suggests that capital is exiting the cryptocurrency ecosystem, a concerning indicator for the sustained strength of altcoins. In the current environment, altcoins would typically rely on capital inflows through Bitcoin or Ethereum, neither of which is happening at the moment. This paints a particularly bleak picture for the broader cryptocurrency market.

The outflows are also evident in crypto Exchange-Traded Products (ETPs), marking four straight weeks of withdrawals. This aligns with the broader trend of waning market confidence.

Liquidity Continues to Slide

Much of the analysis presented here reiterates themes we’ve consistently discussed over recent weeks, and they continue to hold true. Notably, there is no immediate sign of liquidity easing. The U.S. dollar remains robust, fueled by global economic fragility and a rate environment apprehensive about resurgent inflation.

In terms of U.S. dollars, global central bank liquidity has been on a declining trend since mid-April, coinciding with the apex of momentum in the crypto market. While a softer Consumer Price Index (CPI) figure may provide some relief in the short term, we remain skeptical that it will fully counteract the prevailing outflow and liquidity trends. A turnaround in this regard could take several weeks.

Possible Catalyst Drought Ahead

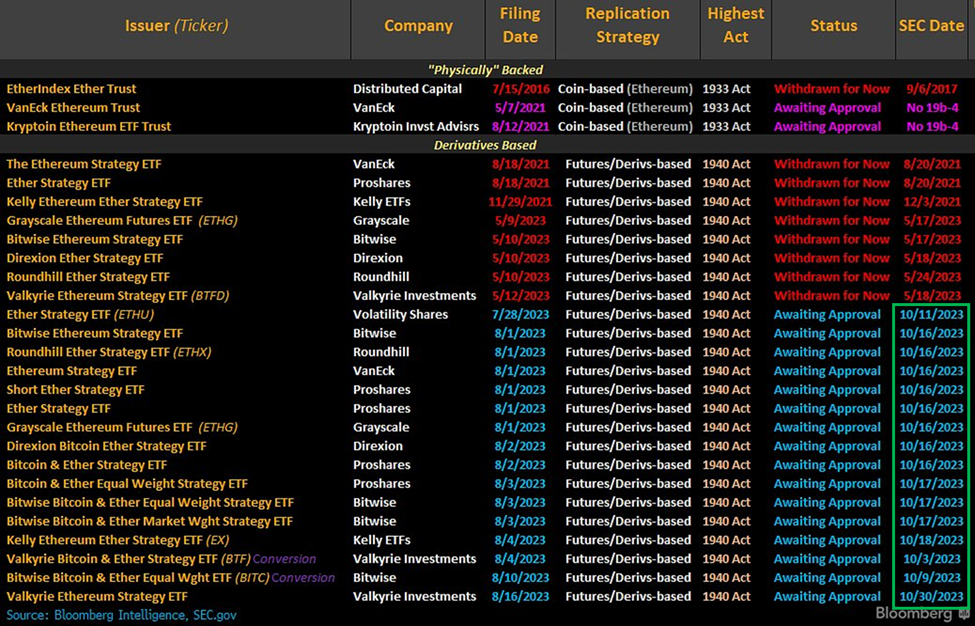

While we remain optimistic about the approval of both BTC and ETH ETFs within this calendar year, immediate updates on this front are unlikely. The next regulatory deadlines for both BTC and ETH ETFs, which could face delays and approvals respectively, are not slated until October.

However, it’s worth noting that we believe that as the market begins to anticipate the launch of ETH futures ETFs, there may be a shift towards pricing in ETH outperformance. For a more detailed analysis on how this could unfold, refer to our note from last week.

Other Crypto-Specific Risks

Binance

A couple of weeks ago, we touched on the undisclosed Department of Justice (DOJ) case against Binance, a development we’ve highlighted as a short-term concern for the market. Our base-case scenario is that any DOJ actions against Binance will likely put temporary downward pressure on asset prices. We anticipate that the most likely outcome is a hefty fine against the exchange, with the possibility of personal charges against Changpeng Zhao (CZ), Binance’s CEO. Despite this, we expect Binance to continue its operations outside of the U.S., making this a situation that merits close attention.

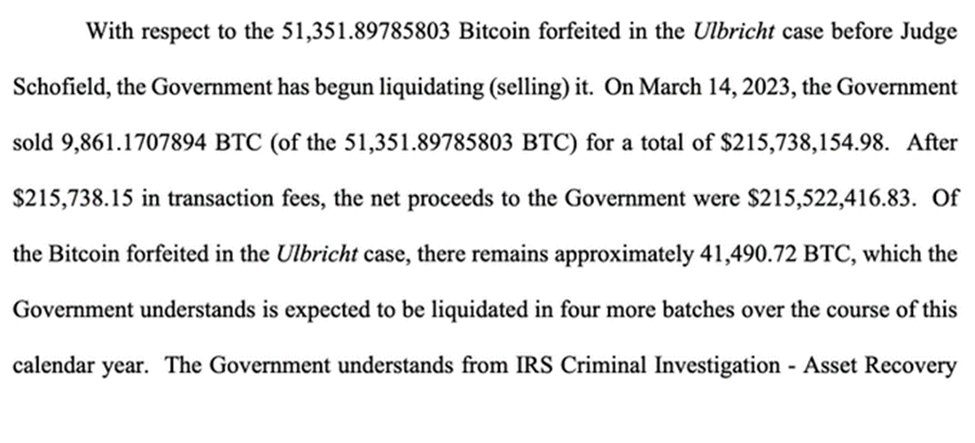

Government Coins

It’s also important to highlight that the U.S. government currently holds around 194,000 BTC, which accounts for about 1% of all outstanding Bitcoin. The government plans to liquidate approximately 32,000+ BTC in three separate tranches before year’s end.

These holdings were acquired through asset seizures in a criminal case, and the proceeds are expected to funnel into the DOJ’s asset seizure fund. While the government is likely to try and minimize market impact, it doesn’t eliminate the possibility that this added supply could exert downward pressure on BTC prices.

This was exemplified in July, when the DOJ’s sale of around 8,000 BTC seemed to negatively affect the market. This serves as a cautionary tale that large-scale liquidations can influence asset prices, even when the intention is to minimize impact. Consequently, this is another development that warrants increased caution.

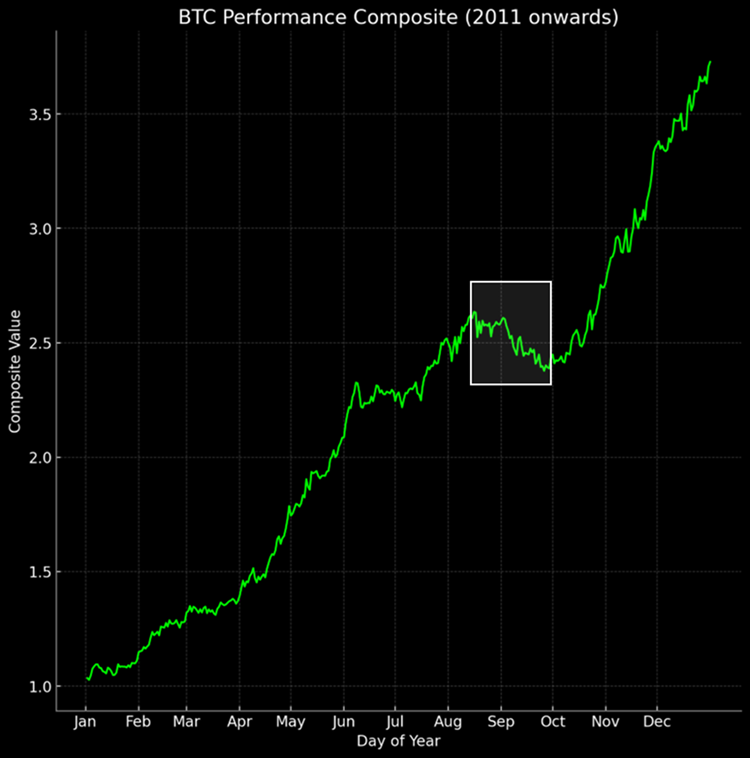

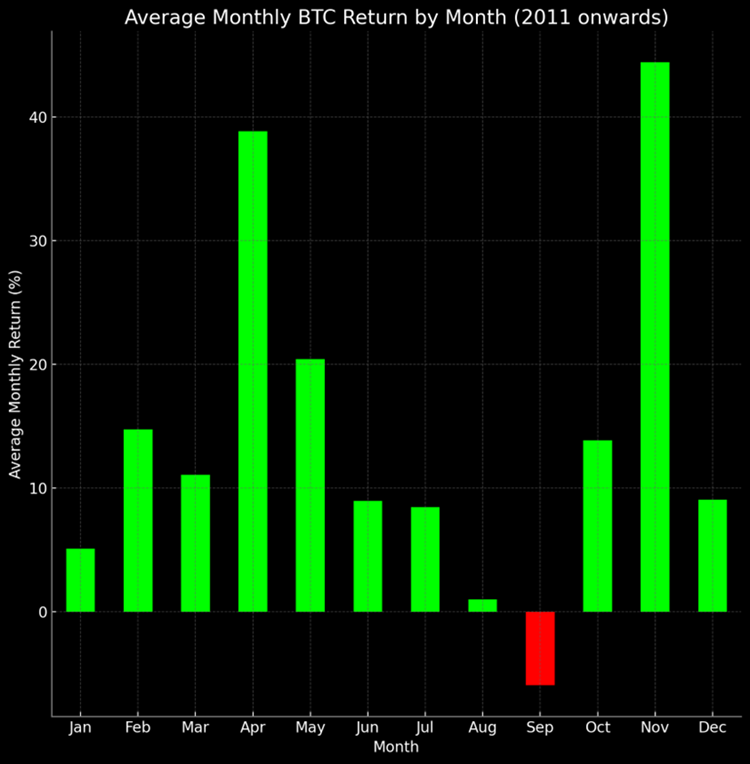

Seasonality

Finally, one significant factor warranting caution in the immediate term is the ongoing seasonal trends. At the beginning of the month, we had hoped to buck the consistently negative September seasonality often observed in the crypto market. Unfortunately, it appears that this year will be no different. Therefore, we recommend reducing exposure to altcoins and managing risk more judiciously over the coming weeks.

Remains A Great Time to Accumulate

It’s worth noting that this advice is more tactical in nature. We remain optimistic about the long-term prospects and believe we have hit cycle lows, entering the initial stages of a new bull market. We’re also optimistic about Q4’s potential to be constructive for crypto.

For those who are not inclined to actively manage their portfolios, this period, and any subsequent price dips, provide excellent opportunities for averaging down. However, our primary responsibility is to assist our clients and subscribers in managing risk and finding opportunities, and in that context, we find it prudent to heed the factors discussed above.

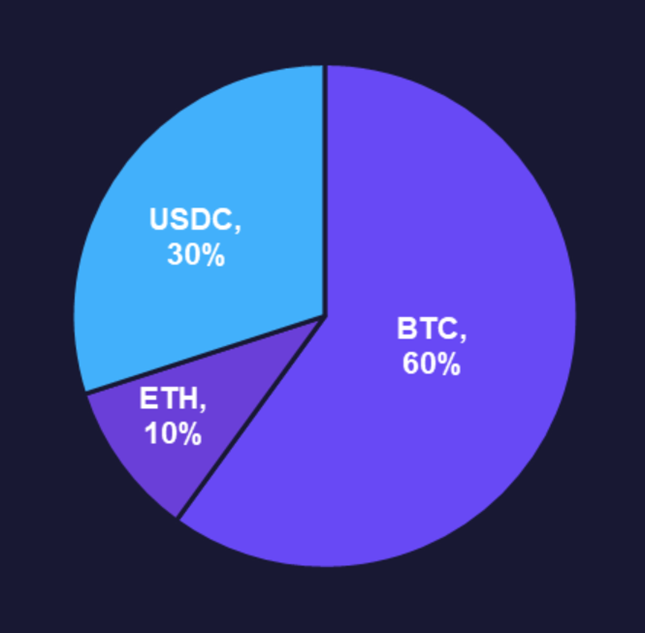

Core Strategy

Despite initial hopes of overcoming the typically negative September seasonality in the crypto market, this year seems to be following the trend, leading us to recommend reduced exposure to altcoins and more cautious risk management in the coming weeks.

Additionally, we recognize that providing a brief summary of our rationale for each component of the Core Strategy could be beneficial. We will include these summaries in our future strategy notes. You may also notice that our allocation has removed some or all of the names listed below. We want to emphasize that we still favor these names in the medium to long term and are likely to revisit them.

- Bitcoin (BTC -2.32% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption (Argentina).

- Ethereum (ETH -2.70% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Rocket Pool (RPL): An ETH liquid staking provider who we think stands to benefit from: (1) an increase in total % of ETH staked over time, (2) a relative increase in liquid staking relative to the overall amount of ETH staked, and (3) being the only (for now) LSD token with utility beyond governance. We think that over time, the token should outperform if Rocket Pool is able to gain even a semblance of market share on Lido. Key Catalyst: Protocol upgrade slated for Q4.

- Optimism (OP) & Arbitrum (ARB -0.03% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.