Time to Be Vigilant, But Not Bearish

Key Takeaways

- Breadth and leverage are elevated but not over-extended and are supported by consistent USD inflows.

- Bitcoin continues to trade at a premium on Coinbase, signaling strong demand from U.S. investors, likely driven by an ongoing repricing of regulatory risk in the U.S.

- Economic data reflects a Goldilocks scenario of moderate growth and disinflation, complemented by a dovish Fed, which supports confidence in the near-term outlook for rates and liquidity.

- Recent declines in yields and the DXY provide favorable conditions for liquidity-sensitive assets.

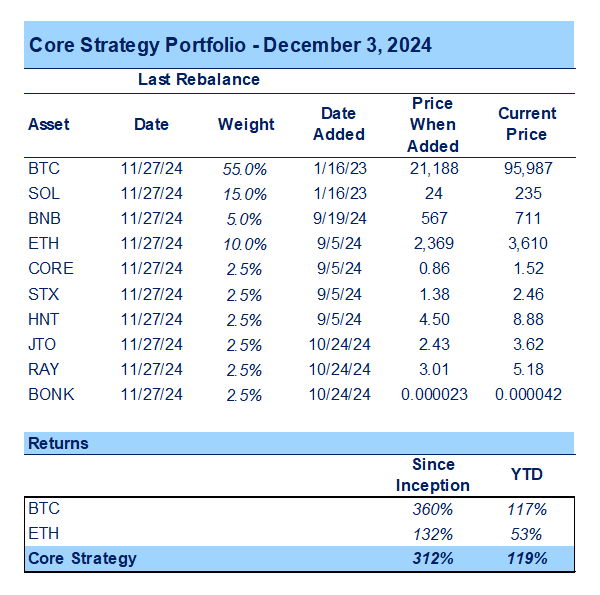

- Core Strategy – Our base case assumes that the macro environment will remain accommodative for crypto through year-end. However, in light of recent market action, we remain alert for signs of a local top (not a cycle top). That said, it is difficult to justify a risk-averse stance at this stage. We remain overweight on SOL and continue to favor altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE, prioritizing assets with high SOL and BTC beta. Additionally, we see an attractive risk/reward opportunity for an ETH catch-up trade. For more details, including our Core Strategy allocation model and crypto equity baskets please refer to the end of this note.

Indications of Froth

Given the violent nature of the past month’s rally, we have been vigilant for signs of a local top. It would be disingenuous to claim that some qualitative “top signals” are not flashing right now. XRP—which we noted as a possible election trade back in October—with only 1–2k daily active addresses (vs ETH’s over 400k, source: Artemis), is ripping toward new highs while influencers take to TikTok to discuss their lofty price targets.

This is not to hate on XRP bulls – we will always respect the pump. We even wrote back in October about how this was probably a great election trade.

However, the point is that “late retail” is back in full force, which confirms that, while we do not believe we are close to the cyclical top, we are no longer super early in this cycle. As cycles progress, there are opportunities to capitalize on local tops in the market for better entries. Thus, it is our view that we should start being more observant for signs of a potential pullback while remaining allocated. Keep in mind that the latter half of any cycle is actually where a lot of outsized returns can be made.

The qualitative data mentioned above can be challenging to rely on for actionable signals, as non-crypto-native retail money is still a source of incremental capital. Further, the ultimate goal for the industry is to attract incremental flows from new cohorts of investors. Therefore, it is more effective to focus on quantifiable indicators, such as leverage, market breadth, and the pace of capital flows into crypto, to assess whether the market is primed for a downturn. Naturally, these signals must be analyzed alongside a well-informed view of the macro backdrop to fully understand the near-term risk/reward dynamic.

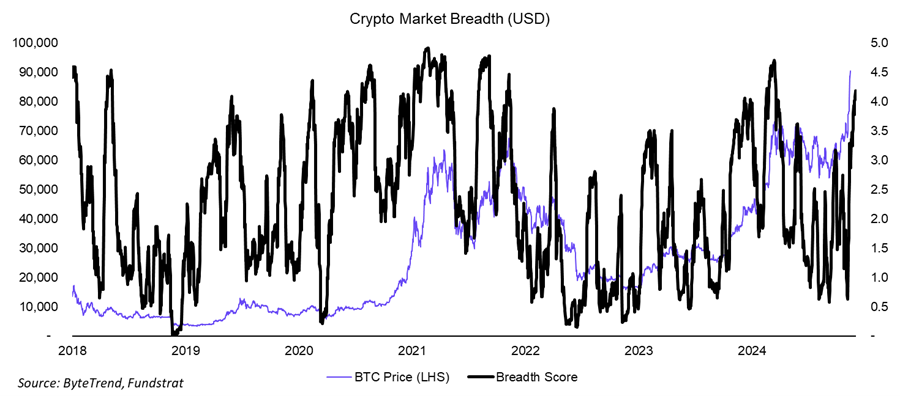

Breadth Expansion

For the first time in a while, we have observed a sustained decrease in BTC dominance within an uptrending market. This indicates a significant rotation of capital into altcoins, with several names in our Core Strategy—such as HNT, CORE, JTO, BONK, and RAY—benefiting significantly. As shown below, market breadth has expanded to levels just shy of where the market peaked in March.

In crypto, as in equities, broad market participation is a sign of strength. However, given crypto’s position on the risk curve, this breadth can be fleeting and must be accompanied by consistent inflows to be sustainable. Consequently, we interpret a breadth score exceeding 4 as an indicator of increased downside risk embedded in the market.

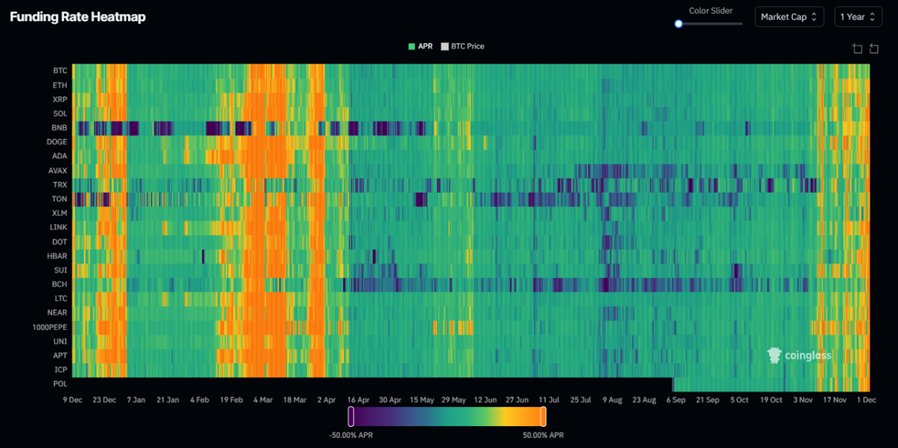

Leverage is Building but Not Abnormal

Above, we determined that more coins are being bought, but how much of that buying is being done with borrowed money?

If we look to funding rates across perpetual futures exchanges, things are certainly getting spicy, but the recent stretch still does not match the fervor that we saw earlier in the year, nor in Q4 2023.

Further, if you look closely, funding rates for the majors have remained relatively tame.

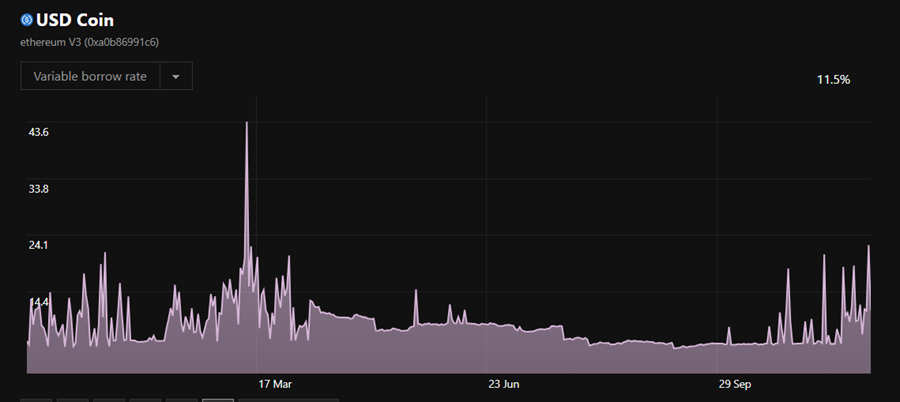

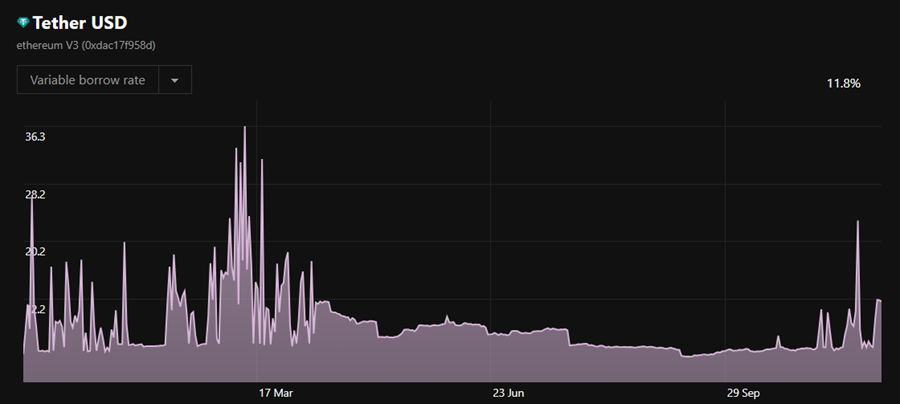

We have also observed elevated borrow rates on Aave for both USDC and USDT, which briefly exceeded 30% before settling back to around 11–12%. While elevated, these levels are not unusual for borrowing rates during a bull market. Considering that the risk-free rate remains at 4.5–4.75%, this crypto-native spread appears reasonable.

This aligns with our observations from perps funding rates – leverage is building, but it is not yet a glaring red flag in the absence of additional data on capital flows.

Flows Still Solid, Led by Stablecoins

Breadth is expanding, and a wider range of coins are being purchased with borrowed money. However, the critical question remains: how much USD-denominated capital is flowing into the ecosystem to sustain this increased speculation? To answer this, we analyze ETF inflows, stablecoin creations, trading volumes, and the Coinbase premium/discount to better understand the direction and pace of capital flows into or out of crypto.

Based on the data presented below:

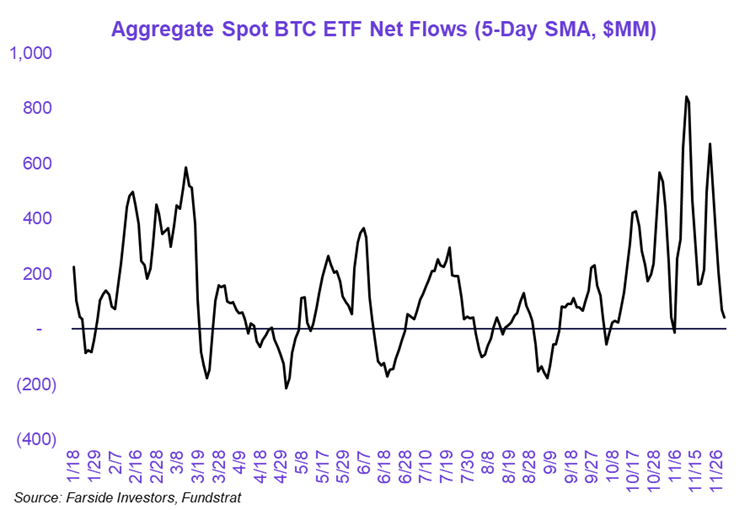

- Spot BTC ETFs: Flows have lagged over the past week but remain in positive territory and have trended higher over the past couple of trading days.

- ETH ETFs: As noted last week, ETH ETFs have posted impressive inflows over the past two weeks. A substantial portion of this activity is possibly tied to rising demand in the ETH basis trade, with annualized basis exceeding 20% late last week.

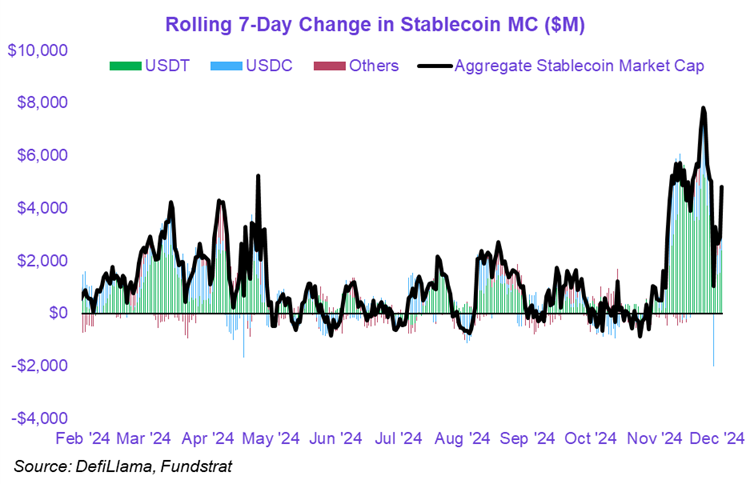

- Stablecoins: Strong inflows into stablecoins continue, signaling a sustained appetite to “buy the dip.” The increase in stablecoin creations aligns with the recent altcoin outperformance observed in the market.

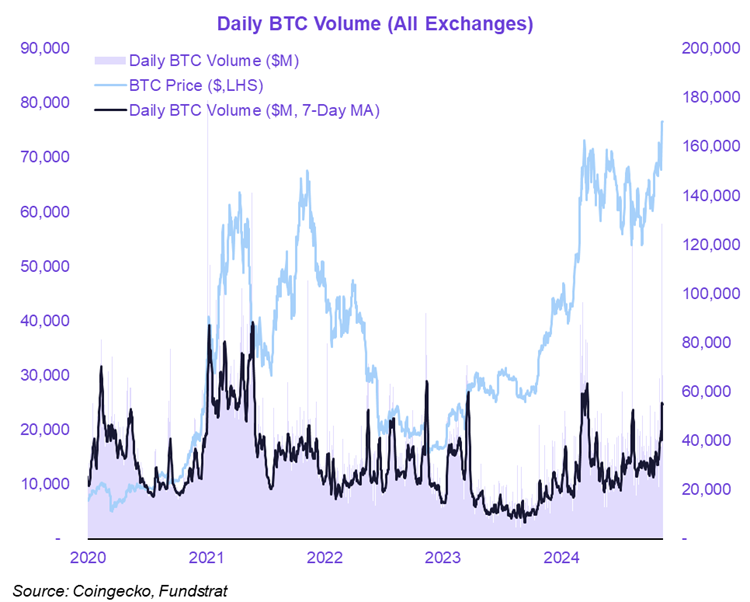

- Spot Volumes: Spot trading volumes remain robust and are trending higher. While BTC has yet to breach the $100k ceiling, there appears to be strong spot demand absorbing supply in the $95k–100k range. Michael Saylor certainly has helped in this regard.

These indicators collectively suggest capital flows into the crypto ecosystem remain robust.

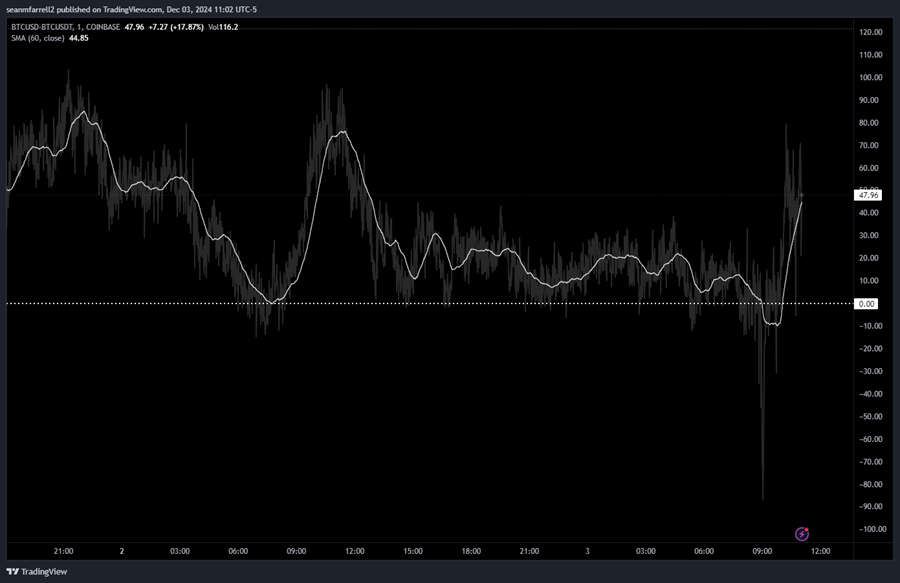

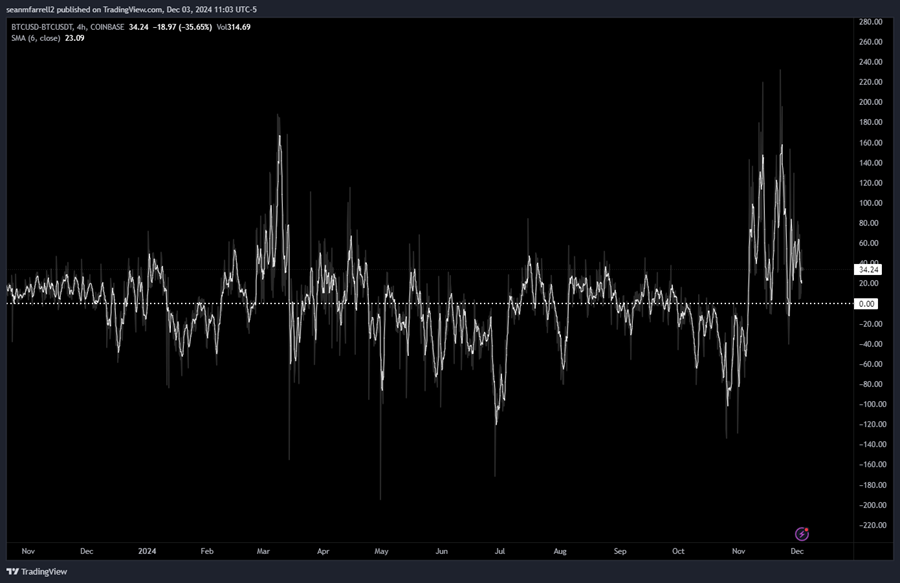

Patriots in Control

Breadth and leverage are rising, but flows remain robust. It’s important to recognize that while the crypto market is global, the U.S. remains the center of capital markets and consequently has an outsized influence on crypto prices. Bull market trends rarely persist without strong U.S. spot demand. To gauge U.S. investor participation, we examine the Coinbase premium or discount, which compares Bitcoin prices on Coinbase and Binance. A Coinbase premium (where BTC is priced higher on Coinbase than on Binance) indicates strong demand from U.S. investors, while a discount suggests the opposite.

Despite recent choppy price action, a strong Coinbase premium persists, particularly during U.S. market hours. This is a very positive sign and makes adopting a bearish stance somewhat difficult.

It is worth noting, however, that the Coinbase premium has begun to trend lower over longer timeframes. If the rolling 24-hour average on the 4-hour chart were to shift to a discount, it would likely signal waning U.S. investor demand and increase our relative level of risk aversion.

Revisiting the Macro Backdrop

Finally, we need to revisit the macro backdrop. Over the past few weeks, we have had the privilege of being somewhat indifferent to the Fed, liquidity, etc, due to the momentum derived from the wholesale repricing of regulatory risk post-election. However, as we approach the year-end it will be important to recalibrate to how liquidity conditions are trending.

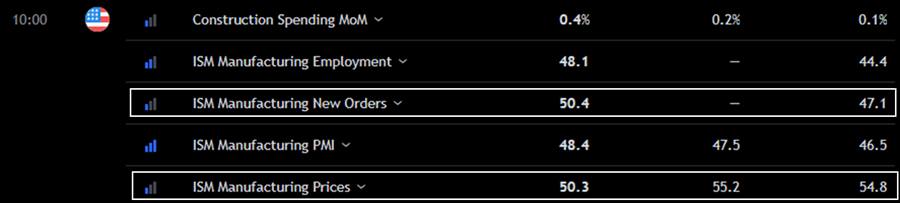

PMIs Consistent with Goldilocks Conditions

Back in September, when people were concerned about the prospect of a recession, and many were clamoring for an emergency 50bps rate cut, we noted that much of the rationale behind the lack of economic investment in parts of the economy were due to the (1) rising uncertainty surrounding the election and (2) elevated interest rates.

We also noted that much of this concern would be resolved by the end of Q4. Fast forward to November’s ISM Manufacturing PMI print, and it seems that manufacturing activity is starting to pick-up post-election and post-rate-cuts.

The headline number remains in contractionary territory but was higher than last month and well above expectations. Importantly, this aggregate number was driven by an increase in New Orders but the price component was well below last month and below market expectations. We would define this print as consistent with goldilocks conditions – slow growth and disinflation.

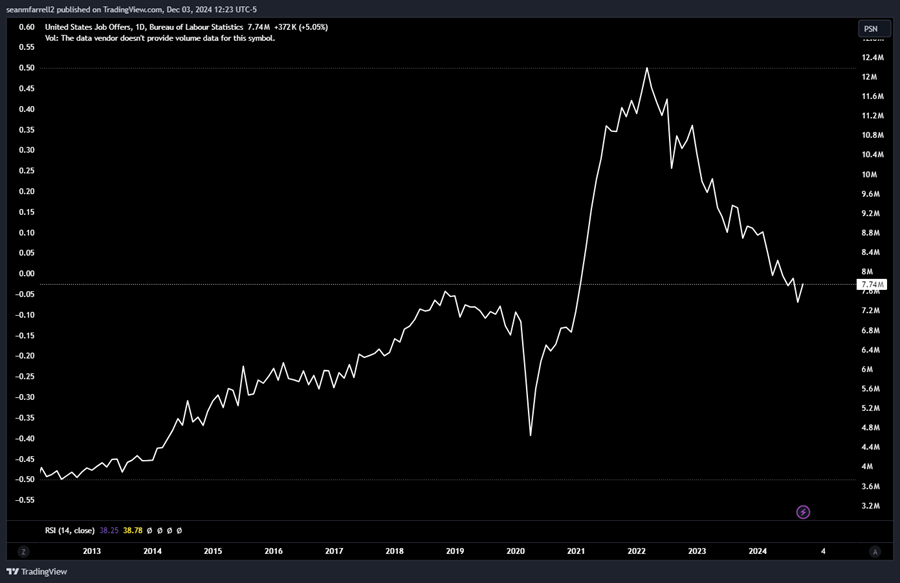

Resilient JOLTs Report

For several months, the Fed has emphasized that risks in the job market are now balanced with inflationary concerns. On Tuesday, the JOLTs report revealed an upside beat, indicating that the job market was tighter in October than in September. This improvement may have been influenced by rate cuts and a dovish Federal Reserve, which likely encouraged hiring in October.

While the JOLTs figure surpassed both market expectations and the prior month’s data, it remains essentially in line with July’s report and below the August numbers. As such, while the report may ease recession fears, it does not warrant a shift toward a more hawkish Fed stance.

Looking ahead, the upcoming Nonfarm Payroll (NFP) data on Friday will likely take precedence in shaping the broader narrative around the labor market.

Fed Still Dovish

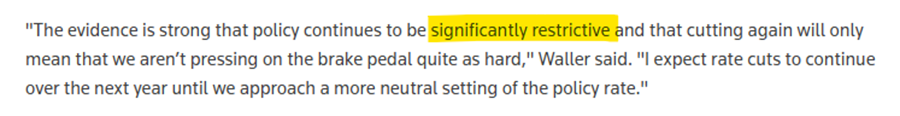

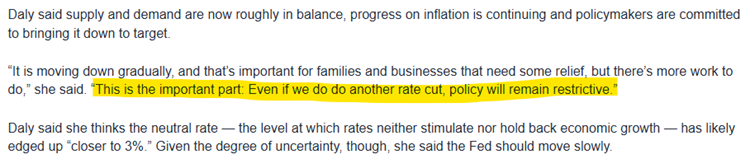

Ultimately, investors can speculate on whether policy will turn more dovish or hawkish based on economic data, but Fed commentary remains the best barometer for the path for rates going forward.

On Monday, Fed Governor Waller gave a speech entitled “Cut or Skip?” at the American Institute for Economic Research Monetary Conference. This was highly anticipated talk from Waller, as he is a somewhat neutral voting member on the committee and there is a lot of discussion over whether the Fed will continue to cut given stickier inflation prints as of late. Well, topic was raised, and while his statement left the door open for the Fed changing its tune should stickier data continue, his responses to the press were unequivocally dovish. He noted that conditions remain significantly restrictive at current levels.

Then on Tuesday morning, we received quotes from an interview with Fed President Mary Daly, who left the door open for delaying a cut, but did not mince words about the fact that rates are still restrictive and that the path for rates is lower.

This dovish commentary, coupled with the growing, but non-inflationary economic data presented above, has coincided with yields and the DXY starting to show signs of rolling over. This is ostensibly a good thing for liquidity-sensitive assets like crypto.

Summary

To bring it all together, the market has gotten relatively hot, with new entrants we’d describe as “late retail.” Breadth and leverage are elevated, but not necessarily over-extended, thanks to consistent inflows into the crypto market. BTC also continues to trade at a premium on Coinbase, adding weight to the idea of outsized demand from U.S. investors, likely supported by an ongoing repricing of regulatory risk in the U.S. On the macro side, economic data is improving but still points to a Goldilocks environment, with a dovish Fed giving us added confidence in the near-term path for rates and liquidity. This dynamic is reflected in the recent dip in yields and the DXY—both positive signals for liquidity-sensitive assets. While we’ll remain alert for (local) top signals as we approach year-end, it’s hard to get too risk-averse here, and we’d look to buy dips.

Core Strategy

Our base case assumes that the macro environment will remain accommodative for crypto through year-end. However, in light of recent market action, we remain alert for signs of a local top. That said, it is difficult to justify a risk-averse stance at this stage. We remain overweight on SOL and continue to favor altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE, prioritizing assets with high SOL and BTC beta. Additionally, we see an attractive risk/reward opportunity for an ETH catch-up trade. For more details, including our Core Strategy allocation model and crypto equity baskets please refer to the end of this note.

Source: Fundstrat

Tickers in this report: BTC -1.39% , XRP -0.95% , SOL -1.22% , ETH 1.54% , HNT -1.60% , STX 2.15% , MKR, BNB, CORE, JTO -5.61% , BONK 1.66% , RAY 0.06% , MSTR -0.95% , SMLR 1.47% , COIN -2.76% , HOOD 0.49% , MARA -2.62% , RIOT 1.42% , WGMI -1.72% , CLSK 1.32% , WULF 1.20% , IREN -1.69% , CORZ -2.01% , BTDR -5.35% , BTBT 0.63% , HUT -2.08% , HIVE -1.37% , AVAX 3.79% , XRP -0.95% , GDLC, BITW -2.72%

Reports you may have missed

CORE STRATEGY With the looming threat of an escalating trade war and economic data robust enough to discourage a more dovish Fed stance, we believe the upside risk for the DXY and yields has increased in Q1. Moreover, the market remains highly volatile and headline-driven, inhibiting the crypto market from gaining meaningful momentum. While regulatory developments are a key medium- to a long-term tailwind for crypto, it is unlikely that...

Developments since the inauguration confirm that the new administration is prioritizing an industry-friendly regulatory environment. Coupled with an easing DXY/yields, a possible TGA spenddown, and favorable seasonality, we think it’s prudent to maintain a long bias. Source: TradingView, Fundstrat Source: TradingView, Fundstrat POWELL MAKES SOME EDITS When the FOMC statement was first released on Wednesday, it carried a distinctly hawkish tilt. The language reflected a more optimistic view on employment...

Recent developments since the inauguration suggest that the new administration is prioritizing an industry-friendly regulatory environment. We believe there is still significant upside headline risk in the early days of Trump's term. Coupled with an easing DXY/yields, as well as substantial inflows into the crypto ecosystem, we think it’s prudent to maintain a long bias. Source: TradingView, Fundstrat Source: TradingView, Fundstrat THE LAUNCH OF TRUMP COIN This past weekend will...

CORE STRATEGY: REMAINING TACTICALLY CAUTIOUS, TGA RUNDOWN + EARLY JAN FLOWS COULD PRODUCE NEEDED SPARK In our view, this cycle is far from over. However, until bonds find a bottom and the USD peaks, it’s prudent for more tactically-minded crypto investors to remain nimble and ready to capitalize on opportunities once a trend reversal is confirmed. While this could happen as early as next week due to early-January inflows, additional...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In f0cf01-978c28-8ea4f8-b3fb96-dba2c5

Already have an account? Sign In f0cf01-978c28-8ea4f8-b3fb96-dba2c5