Not Wise to Fade the MSTR Bid, Nakamoto Upgrade Goes Live

Key Takeaways

- Despite record inflows into BTC ETFs and bullish sentiment in the CME futures market, we posit that many crypto-native investors remain sidelined.

- Trump’s stalling momentum and potential derisking ahead of the election might be causing BTC's current retest of $70k despite strong ETF inflows and a major breakout.

- MicroStrategy's announcement to deploy nearly $43 billion into BTC over the next three years represents significant bullish buy pressure and could positively impact near-term prices.

- The Stacks Nakamoto upgrade enhances its alignment with Bitcoin through faster block times and improved security. STX remains a compelling way to gain exposure to Bitcoin DeFi and access reliable BTC beta.

- Core Strategy – As we approach year-end, we maintain an optimistic outlook for the crypto market. Favorable seasonality, election-driven tailwinds, and suitable liquidity conditions create a favorable backdrop, skewing risks to the upside. We maintain a bias toward being overweight SOL and remain generally focused on the majors, while selectively adding exposure to altcoins such as HNT, JTO, BONK, RAY, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

BTC ETFs See Massive Inflows: Is Crypto Native Capital Sidelined?

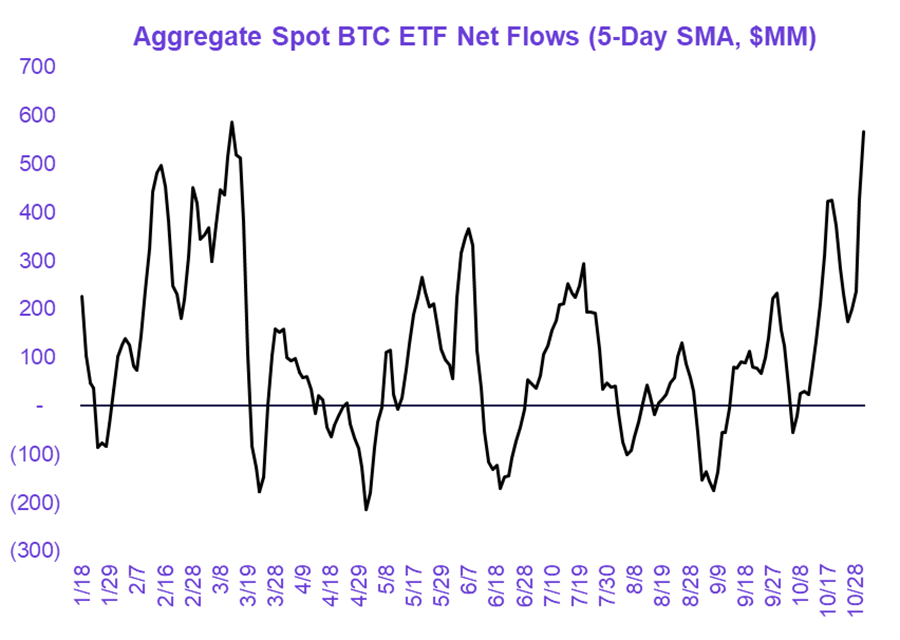

BTC ETFs saw over $2.2 billion in net inflows across all spot ETFs from Monday through Wednesday of this week—the largest three-day sum of inflows since the products launched in January—bringing the five-day moving average to north of $500 million. This is certainly impressive and speaks to the explosive breakout we have seen this week.

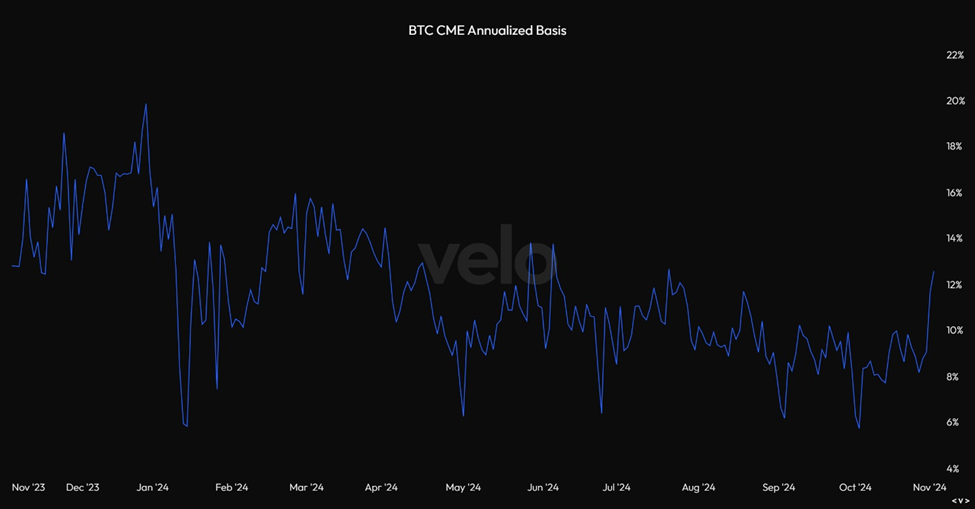

We’ve also seen the annualized CME basis move expeditiously higher to above 12%. This is a good reminder that not all of the inflows into the ETFs are directional flows; a good chunk is likely due to funds putting on the popular basis trade—which at 12% is quite compelling for many. That said, the fact that the basis is moving higher means there’s a bullish impulse in the futures market.

Ultimately, it’s safe to say that buyers have woken up over the past couple of weeks. However, the bullish move has been somewhat exclusive to BTC and some Solana-based alts, which raises some interesting questions about the current market dynamic.

If this rally to nearly all-time highs for BTC has seemed quiet, it’s likely because a lot of investors in the crypto-native world are possibly still sidelined.

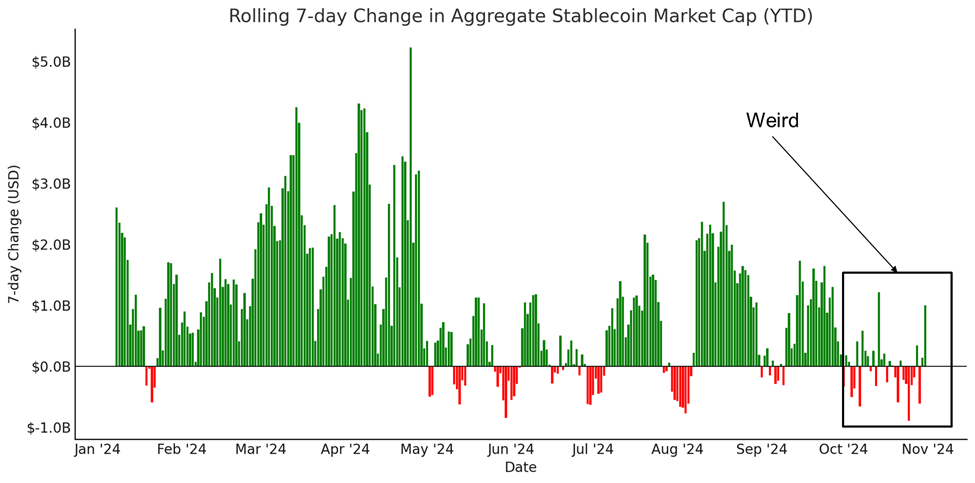

Based on stablecoin flows, it does not appear that we’re seeing the same influx of new dollars moving into the crypto economy that one would expect with BTC above $70k.

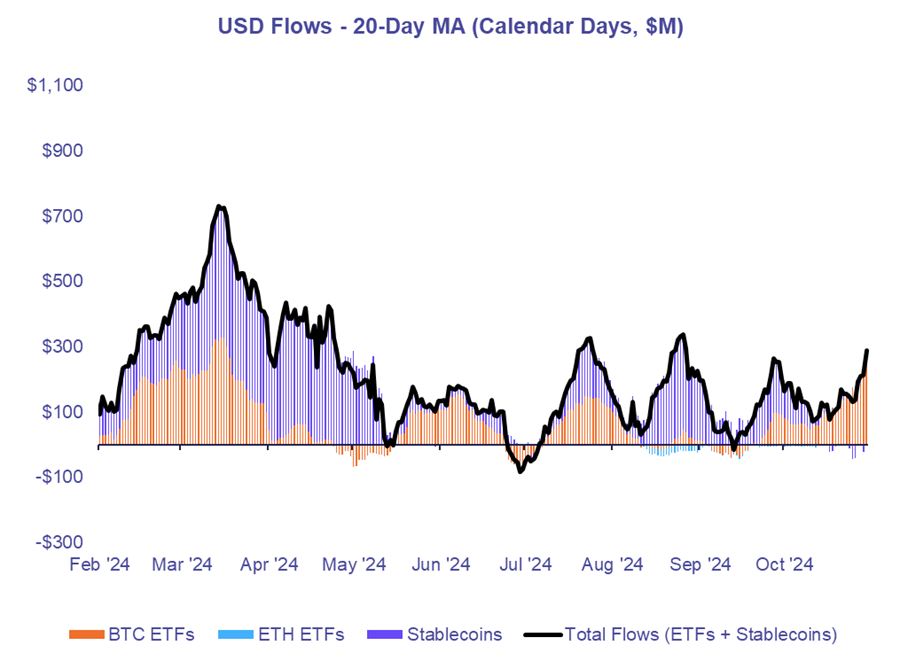

As demonstrated by the chart below, our aggregate measure of USD flows into the crypto economy has been carried by BTC ETFs as of late.

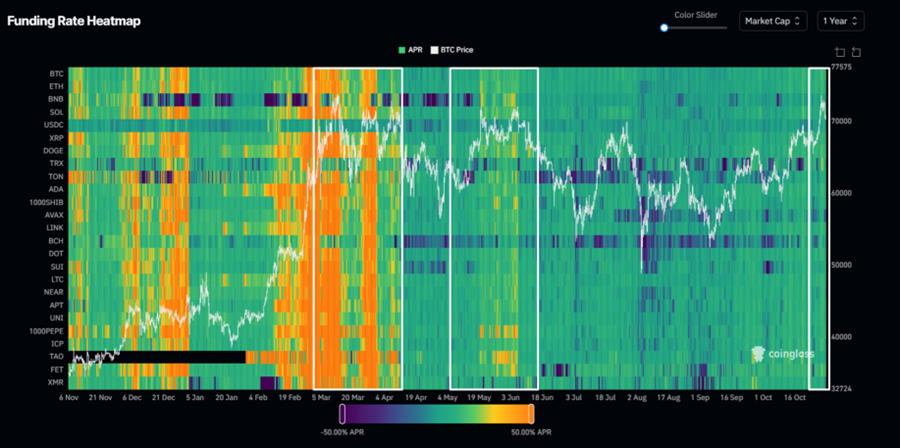

This general view of crypto-native capital sitting on its hands is confirmed by funding rates, which are rather subdued compared to where they were the last couple of times BTC was at these levels.

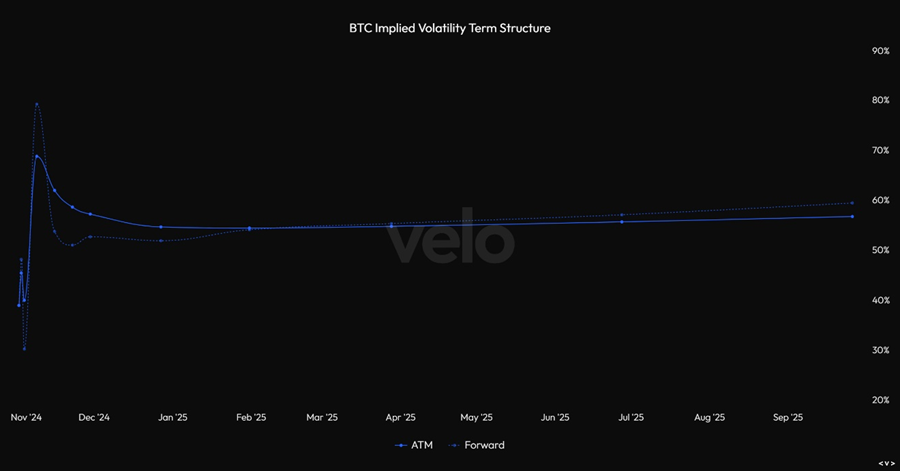

Now, to be clear, it could just be that crypto funds and whales are sitting in spot waiting for November 5th. It could also be the case that many are playing the election via options, as implied vols for next week are through the roof, and therefore we aren’t seeing as much risk being added in futures markets. But my impression—and there’s no way to substantiate this really—is that many are currently still sidelined.

Mean Regression in Polls Possibly Causing Recent Stall

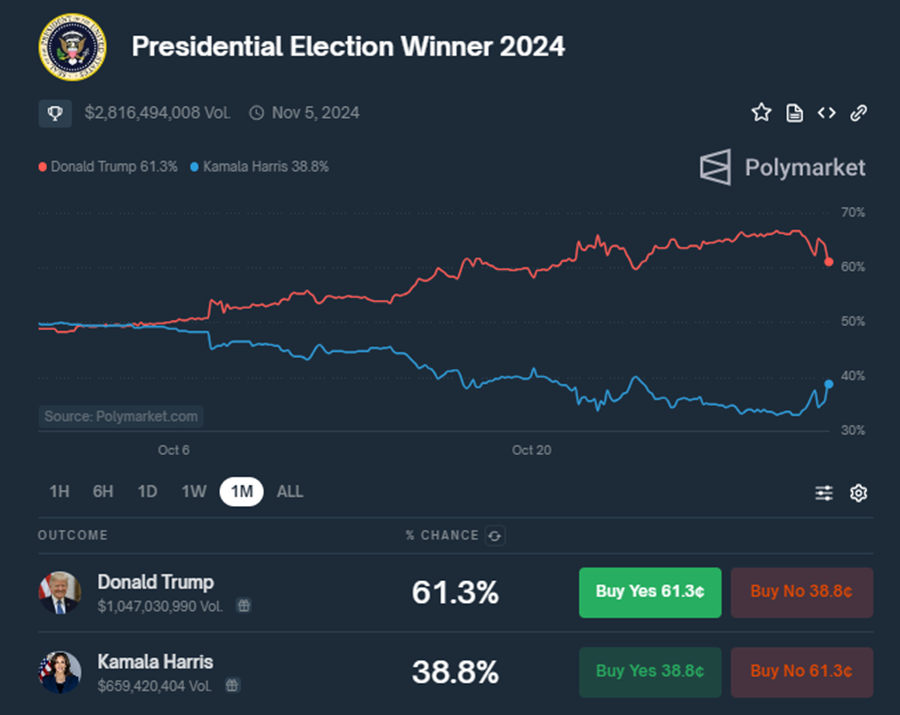

We remain bullish from a macro perspective but also appreciate the relative importance of the election on crypto in the near term. While Trump, the pro-crypto candidate, still has the apparent lead in the polls and prediction markets, his momentum has stalled, and his pricing on prediction markets has rolled over.

Concurrently, we’ve seen Trump-win trades like FNMAS and GEO start to consolidate.

Thus, despite the major breakout and improvement in flows, this mean regression in the polls, coupled with some potential high-level derisking, could be contributing to the current retest of $70k for BTC.

MSTR to Buy $42B of BTC Over Three Years

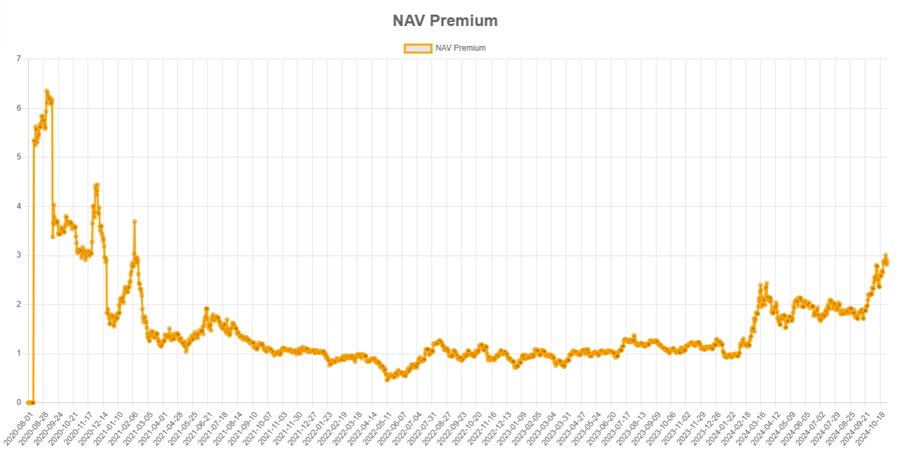

Despite any uncertainty stemming from shifting political tides, we still find it difficult to fade the market in the immediate term, and a lot of this is attributed to the announcement from MSTR yesterday. We talked about this in our Crypto Comments video on Tuesday, but essentially, we anticipated MicroStrategy’s earnings call to be accompanied by a capital-raising initiative. This was due to the fact that their shares were trading at an enormous 2.7x premium to NAV, and it was likely that Saylor would want to stack a few more sats prior to the election next week.

They certainly delivered on those expectations, announcing the world’s largest ATM offering of up to $21B and stating the intent to deploy this amount along with $21B in additional capital from convertible notes into BTC over the next three years.

Adding in the $891 million of capacity in their existing ATM offering results in nearly $43 billion to be deployed into BTC over the next 36 months.

To clarify, our bullish stance on this announcement isn’t based on the expectation that most of the capital will be deployed over the next week. However, it’s hard to envision a scenario where Saylor refrains from deploying a substantial amount (around $1–2 billion) ahead of the election results, especially given the asymmetric upside risk associated with this event. We doubt Saylor would pass on the opportunity to activate some of this dry powder before November 5, with the real possibility of a Red White House or a Red sweep.

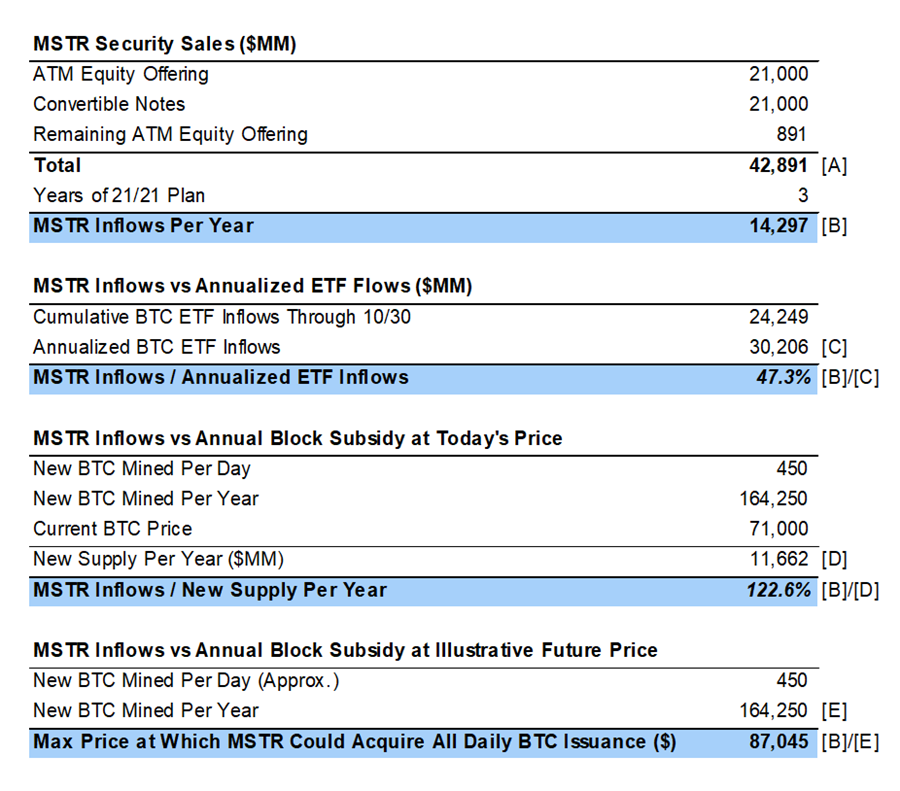

Sometimes large numbers can feel meaningless, especially in financial markets, so we figured it would be good to contextualize just how much $42 billion of USD inflows is. As noted in the table below:

- MicroStrategy’s $14B per year in BTC spend (assuming they break the total cash up evenly throughout the three-year endeavor) equates to nearly half of the annualized ETF inflow levels we’ve seen YTD.

- In a theoretical world where BTC remained at $71k, Saylor would be buying more than the entire sum of new coins issued to miners each year.

- To dovetail with the point above, so long as BTC stays below roughly $87k, Saylor has enough firepower to buy a sum of BTC at least equal to the total number of new BTC issued.

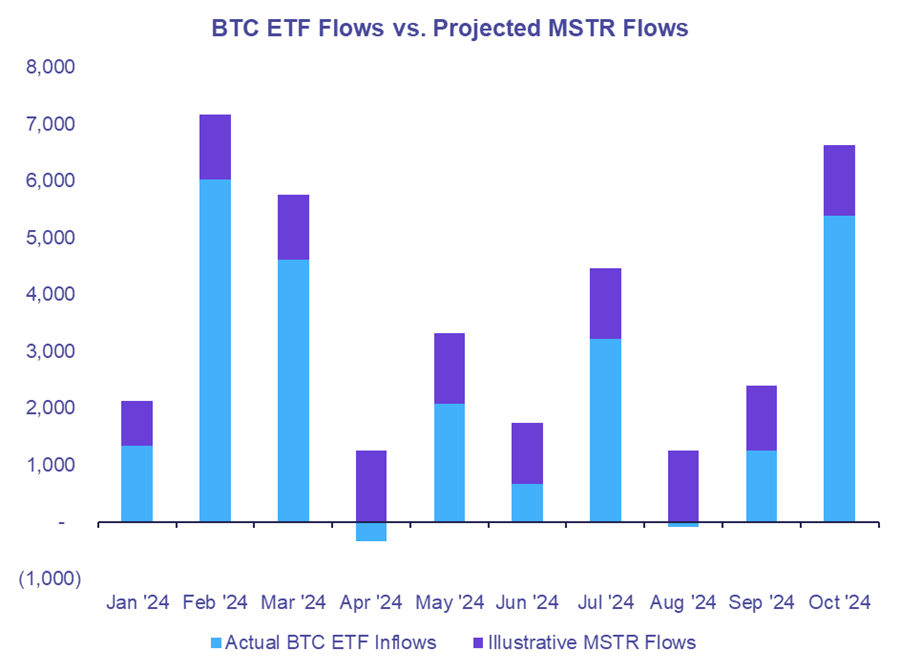

Below is further contextualization of this buy pressure—we took the year-to-date monthly ETF flows and added the theoretical USD flows from MSTR if they were to buy BTC at an even pace over the next three years. Sometimes people in crypto can be hyperbolic about supply and demand dynamics, but to me, this seems to be a rather significant bullish development on the demand side of the equation.

Stacks Upgrade Overview

The long-anticipated Nakamoto upgrade for Stacks has finally gone live, following several months of delay and totaling around 18 months in development. This significant technical upgrade brings major changes to the Stacks ecosystem, particularly in enhancing its alignment with Bitcoin.

The Nakamoto upgrade yields several important benefits:

- Faster Block Times: Stacks miners can now produce multiple Stacks blocks per Bitcoin block, increasing transaction efficiency. Transaction times have dramatically decreased from the previous 10–40 minutes down to seconds, bringing Stacks in line with Bitcoin’s block intervals.

- Enhanced Security Model: With this upgrade, Stacks’ security model now aligns with Bitcoin’s, making transaction reversals on Stacks as difficult as reversing a Bitcoin transaction. This alignment gives Stacks a more legitimate claim to the term “Layer 2.”

- Improved Stacking Yields: Although technically introduced in an April update, recent MEV-related improvements have boosted Stacking yields (Stacks’ version of staking) from approximately 2% to upward of 10% in some cycles.

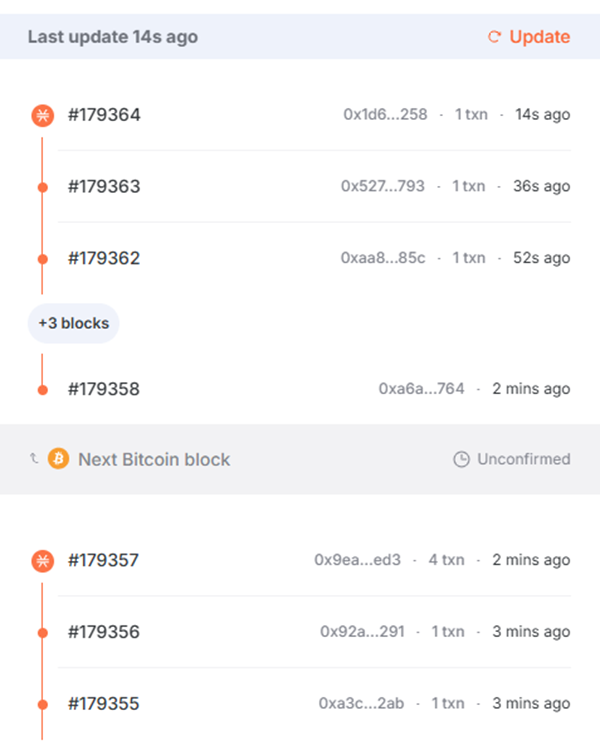

Below is a screenshot from the Hiro Block Explorer Showing the multiple processed blocks on Stacks, seconds apart, segmented by each bitcoin block they will finalize to.

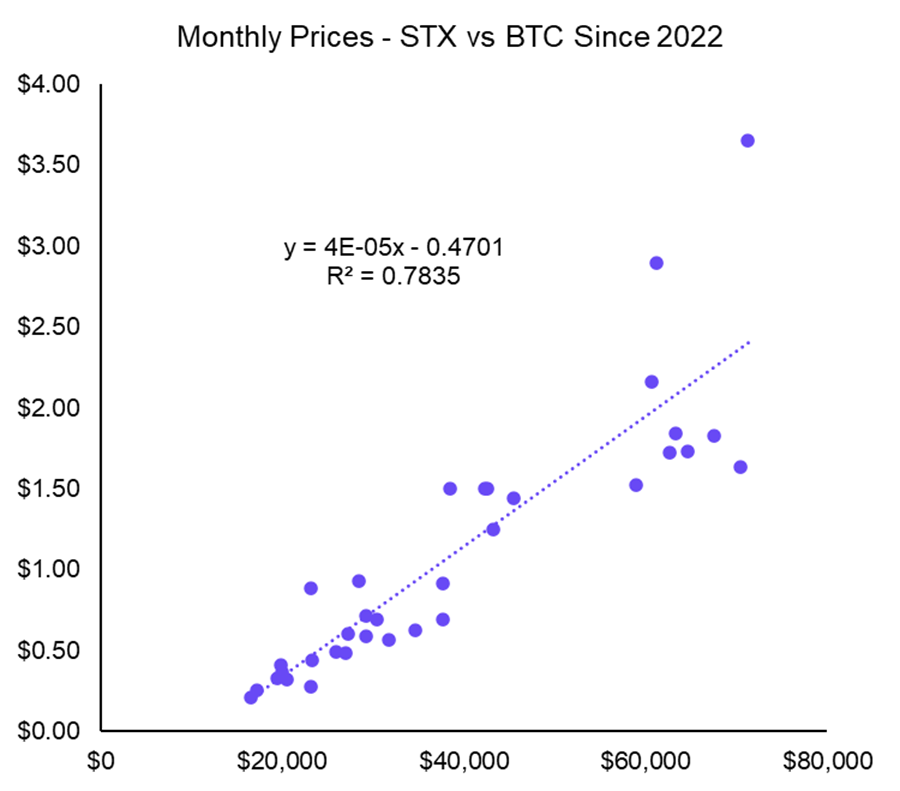

Our thesis that we developed nearly a year ago was centered on Stacks being a compelling way to gain liquid exposure to the emerging Bitcoin DeFi theme. Additionally, STX has historically provided dependable beta to BTC, which remains the center of strength in the crypto market.

Key indicators we’ll be monitoring to gain confidence in the fundamental potential for STX to take the lead in the BTC DeFi race:

- Capital Flows: Observing capital movement into the Stacks ecosystem, particularly as users experiment with new applications.

- Application Diversity: Tracking the launch of new DeFi applications and the extent to which capital flows find their way into these applications.

- Activity Metrics: Monitoring transaction volumes and wallet growth, particularly given the improved user experience. A failure in growth could signal that much of the capital farming various incentive programs might exit following token launches.

- sBTC Development: The Nakamoto upgrade sets the stage for progress on sBTC, a synthetic BTC derivative that allows users to bridge BTC to STX in a non-custodial manner. Utilizing a two-way peg with Bitcoin, sBTC enables BTC to be sent to STX wallets controlled by stackers, removing reliance on centralized entities or federations.

Core Strategy

As we approach year-end, we maintain an optimistic outlook for the crypto market. Favorable seasonality, election-driven tailwinds, and suitable liquidity conditions create a favorable backdrop, skewing risks to the upside. We maintain a bias toward being overweight SOL and remain generally focused on the majors while selectively adding exposure to altcoins such as HNT, JTO, BONK, RAY, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

Tickers in this report: BTC -1.39% , XRP -0.93% , SOL -0.94% , ETH 1.58% , HNT -1.79% , STX 2.15% , MKR, BNB, CORE, JTO -4.61% , BONK 1.85% , RAY -0.23% , MSTR -0.95% , SMLR 1.47% , COIN -2.76% , HOOD 0.49% , MARA -2.62% , RIOT 1.42% , WGMI -1.72% , CLSK 1.32% , WULF 1.20% , IREN -1.69% , CORZ -2.01% , BTDR -5.35% , BTBT 0.63% , HUT -2.08% , HIVE -1.37% , AVAX 3.70% , XRP -0.93% , GDLC, BITW -2.72%

Reports you may have missed

CORE STRATEGY With the looming threat of an escalating trade war and economic data robust enough to discourage a more dovish Fed stance, we believe the upside risk for the DXY and yields has increased in Q1. Moreover, the market remains highly volatile and headline-driven, inhibiting the crypto market from gaining meaningful momentum. While regulatory developments are a key medium- to a long-term tailwind for crypto, it is unlikely that...

Developments since the inauguration confirm that the new administration is prioritizing an industry-friendly regulatory environment. Coupled with an easing DXY/yields, a possible TGA spenddown, and favorable seasonality, we think it’s prudent to maintain a long bias. Source: TradingView, Fundstrat Source: TradingView, Fundstrat POWELL MAKES SOME EDITS When the FOMC statement was first released on Wednesday, it carried a distinctly hawkish tilt. The language reflected a more optimistic view on employment...

Recent developments since the inauguration suggest that the new administration is prioritizing an industry-friendly regulatory environment. We believe there is still significant upside headline risk in the early days of Trump's term. Coupled with an easing DXY/yields, as well as substantial inflows into the crypto ecosystem, we think it’s prudent to maintain a long bias. Source: TradingView, Fundstrat Source: TradingView, Fundstrat THE LAUNCH OF TRUMP COIN This past weekend will...

CORE STRATEGY: REMAINING TACTICALLY CAUTIOUS, TGA RUNDOWN + EARLY JAN FLOWS COULD PRODUCE NEEDED SPARK In our view, this cycle is far from over. However, until bonds find a bottom and the USD peaks, it’s prudent for more tactically-minded crypto investors to remain nimble and ready to capitalize on opportunities once a trend reversal is confirmed. While this could happen as early as next week due to early-January inflows, additional...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 3b9903-314e46-dbf9d0-582fd5-da9108

Already have an account? Sign In 3b9903-314e46-dbf9d0-582fd5-da9108