Adding DePIN Exposure and SOL Beta Through HNT (Core Strategy Rebalance)

Key Takeaways

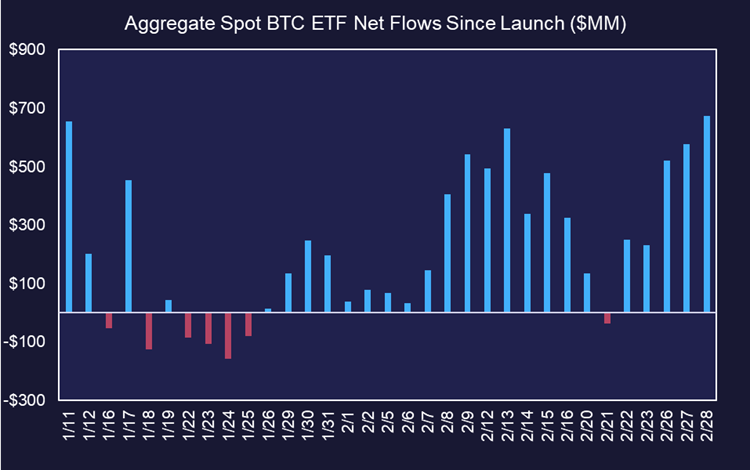

- Flows into ETFs continue to accelerate. As BTC nears a new all-time high, we believe it is unwise to bet against BTC strength until there is a noticeable slowdown in inflows, despite what macro data hits the tape.

- This week’s Coinbase outage as BTC approached $64k suggests a resurgence of retail investor interest in crypto and portends growth in Coinbase's user base and trading volumes next earnings season.

- Given the observable traction Helium Mobile’s 5G mobile product, the network’s recent integration with Solana, and the emerging promise of the DePIN category, we think it is an opportune time to add HNT to the Core Strategy. HNT should benefit from recent Solana strength, given its high beta relationship.

- Active Trade Update – Given the return of animal spirits to the market, we think it is right to think DOGE has some room to move higher in the near term.

- Core Strategy – Our Q1 outlook anticipated some headwinds, and it seems the initial turbulence has subsided for now. Flows into crypto remain strong and breadth against BTC remains subdued. We maintain that ETH, L2s, and STX offer compelling idiosyncratic upside due to their near-term catalysts, and we have no reason to fade recent strength in SOL.

Flows Beget More Flows

We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the continuation of inflows will beget more flows.

BTC ETFs experienced a record-breaking day of net aggregate inflow on Wednesday, amassing nearly $700 million.

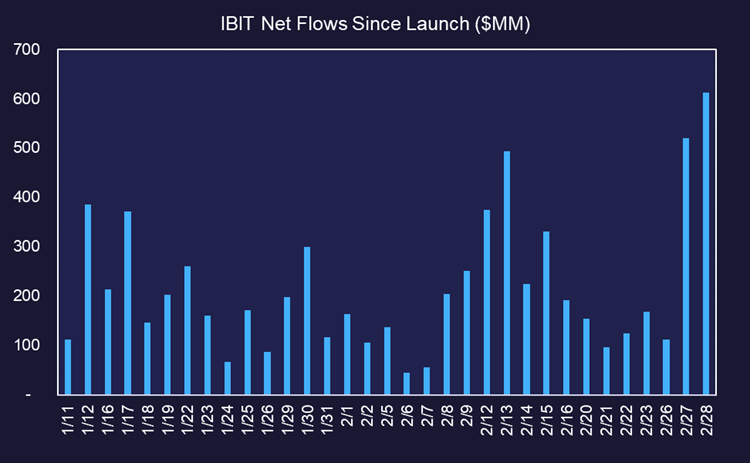

The standout among these ETF products was Blackrock’s IBIT, which alone accounted for over $600 million in net inflows.

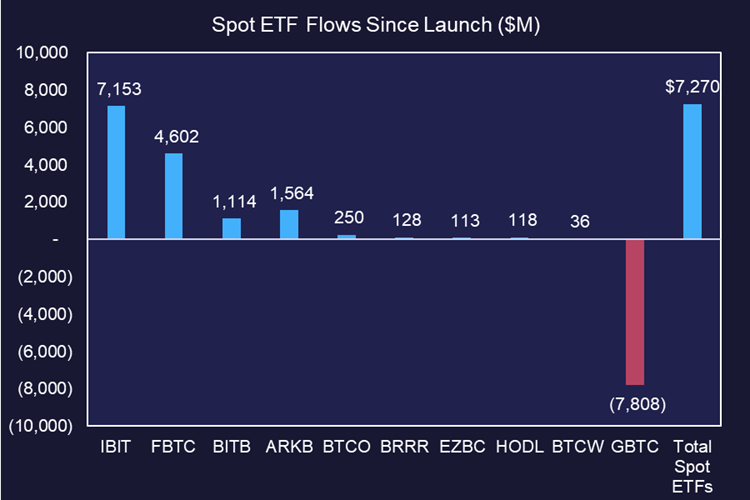

By Thursday morning, the total aggregate inflows had surpassed $7 billion, with IBIT on track to reach the $10 billion mark shortly.

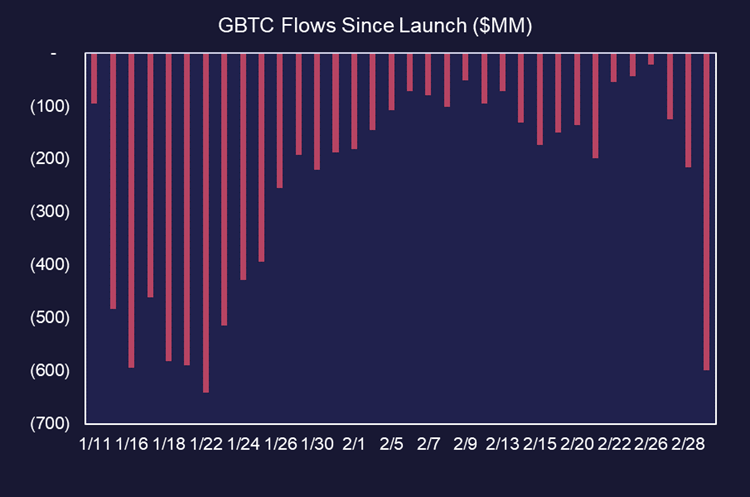

It is worth noting that the GBTC has started to see an uptick in outflows, with a notable $600 million total outflow by the end of Thursday. This movement is speculated to be a consequence of Genesis offloading GBTC assets to pay creditors amidst bankruptcy proceedings. Despite these substantial outflows, the BTC price has remained stable around $62k. This stability, amid significant outflows, suggests that incoming investments are likely to offset these losses. Given the ongoing capital flows into and out of different crypto assets, it’s challenging to anticipate any near-term market weakness. The dynamic between inflows and outflows, particularly with ETFs like IBIT attracting substantial investment while GBTC experiences outflows, underscores the evolving landscape of crypto investment and its resilience against individual asset movements.

Retail Returning

We think that the substantial inflows and this week’s sharp market rally have drawn many investors back into the crypto fold.

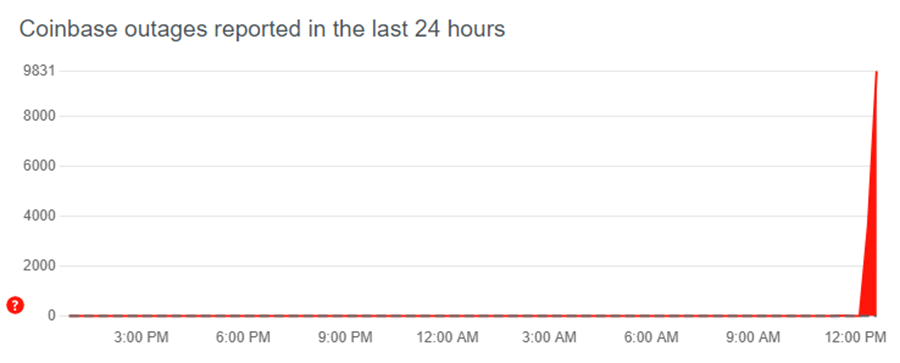

A significant indicator of this trend was the Coinbase outage on Wednesday, coinciding with BTC’s surge towards $64k.

Historically, such outages have happened during periods of extreme price volatility. This resurgence of activity not only highlights increased capital coming into the crypto ecosystem to speculate, but also suggests that Coinbase’s user numbers and trading volumes are poised for notable growth next earnings report.

Adding DePIN Exposure and SOL Beta to Core Strategy

As we entered this year, one of the most promising developments was the rise and potential mainstream adoption of Decentralized Physical Infrastructure Networks (DePIN). DePIN revolutionizes the way we think about infrastructure, leveraging cryptographic incentives to foster the growth, management, and maintenance of physical networks. These networks often aim to construct capex-intensive infrastructure from the ground up or to capitalize on underutilized resources (e.g., unused file storage) in an Airbnb-like model.

Comparative advantages of DePIN Over Traditional Models:

- Cost-effectiveness: DePIN dramatically reduces both the capital and operational costs traditionally associated with infrastructure development. By rewarding both individual and collective contributions of resources like bandwidth, storage, or energy, these networks diminish the need for substantial initial investments from a single entity.

- Rapid Deployment: Echoing the above, decentralized networks boast faster scalability and expansion compared to their centralized counterparts. In a DePIN ecosystem, operators can independently introduce new nodes or components, bypassing the need for centralized oversight. This agility is crucial for extending services to new, particularly underserved or remote, areas, thus accelerating a network’s growth and its scalability.

- Resiliency: The inherent resilience of DePIN to failures and cyberattacks is a standout feature. Thanks to a decentralized architecture, these networks lack single points of failure, ensuring uninterrupted operation even if individual nodes face issues.

Helium

Helium stands out as the frontrunner in DePIN space. It is a decentralized network that supports wireless coverage via a worldwide network of independent operators that install hotspots. The network enables seamless wireless communications through these hotspots, and rewards hotspot managers for building and maintaining the network.

Founded in 2013 and officially launched in 2019, Helium confronted the challenge of motivating individuals to invest in hotspots and foster supply-side network expansion. The adoption of a token model emerged as a key solution, allowing hotspot owners to earn from network usage. This approach assured that the native token’s value would appreciate with growing network demand, presenting a strong incentive for early contributors to engage.

Recently, Helium has undergone substantial changes while remaining true to its original vision of building distributed hardware networks, with its native token, HNT, serving as the foundational currency. By transitioning from its proprietary blockchain to becoming an application running on Solana, Helium taps into Solana’s rapid processing, cost-effectiveness, and interoperability with other DeFi applications. This pivotal change alleviated a major growth impediment by shifting the developers’ focus from blockchain maintenance to enhancing network features, thereby benefiting both users and hotspot owners more directly.

Helium has also broadened its scope beyond the initial LoRaWAN network for IoT devices, venturing into the 5G domain by replicating the successful hotspot model used in its IoT network. This strategic move sees supply-side participants deploying and maintaining hotspots to provide wireless coverage, enabling devices within these hotspots’ vicinity to access the internet through the decentralized network. Users are charged for data transfer and hotspot-related transactions, while hotspots earn inflationary rewards as token incentives.

Helium Mobile

Helium Mobile is managed by Nova Labs, previously known as Helium Inc. Nova Labs leads the development and expansion of Helium Mobile, integrating it into their broader mission to construct decentralized wireless infrastructure, which encompasses both the Internet of Things (IoT) network and the mobile network. Nova Labs functions like any typical development team within the crypto ecosystem, providing support to development efforts. We should note that, despite their heavy influence, any modifications to the Helium network must undergo approval through a decentralized improvement proposal process.

Recently, Helium Mobile unveiled nationwide 5G coverage, a milestone achieved in collaboration with T-Mobile. This partnership aims to enhance the reach and reliability of Helium’s mobile network by marrying it with T-Mobile’s well-established cellular infrastructure. Consequently, Helium Mobile users benefit from seamless connectivity, primarily relying on Helium’s decentralized 5G network, and, when needed, seamlessly transitioning to T-Mobile’s network for augmented coverage.

Operating in a manner akin to a Mobile Virtual Network Operator (MVNO), Helium Mobile delivers mobile services without owning the full spectrum of wireless infrastructure traditionally required. By leveraging its innovative decentralized network technology alongside T-Mobile’s network, Helium Mobile can offer comprehensive coverage even in areas where its own network is still developing. This symbiotic approach allows Helium Mobile to market its services under its brand, embodying a novel fusion of traditional and decentralized telecom models aimed at broadening service access, enhancing network resilience, and promoting the adoption of Helium’s pioneering technology on a grand scale.

It’s crucial to recognize that the dense tower coverage essential for 5G, dictated by higher frequency bands, poses a significant challenge for signal travel over long distances. This requirement could render network expansion prohibitively expensive for potential MVNOs without the support of a tokenized network.

Recent Demand-Side Growth

Due to the token model, supply side buildouts have been less of a hurdle than onboarding users onto these networks. On the supply side, the Helium network boasts:

- 393,578 active IoT hotspots distributed globally. This provides relatively blanket coverage in most highly populated areas.

- 11,908 active 5G mobile hotspots distributed in North America. Coverage is limited to a few highly populated areas but is expected to grow with the launch of Helium Mobile.

The recently launched nationwide mobile plan is offering perhaps the greatest instance in demand side growth since the inception of the Helium network. The mobile plan, priced competitively at $20 per month, is substantially lower than typical charges for similar plans, largely due to current negative margins being subsidized by the company.

Like any MVNO, Helium Mobile procures data in bulk from T-Mobile and redistributes it to users via Helium hotspots. However, when Helium mobile plan users consume T-Mobile bandwidth, Helium compensates T-Mobile at retail prices rather than wholesale rates (more expensive). While estimates on profitability levels vary, it’s plausible that significant hardware expansion is necessary to ensure that a greater volume of data traffic flows through Helium hotspots, minimizing reliance on T-Mobile’s infrastructure.

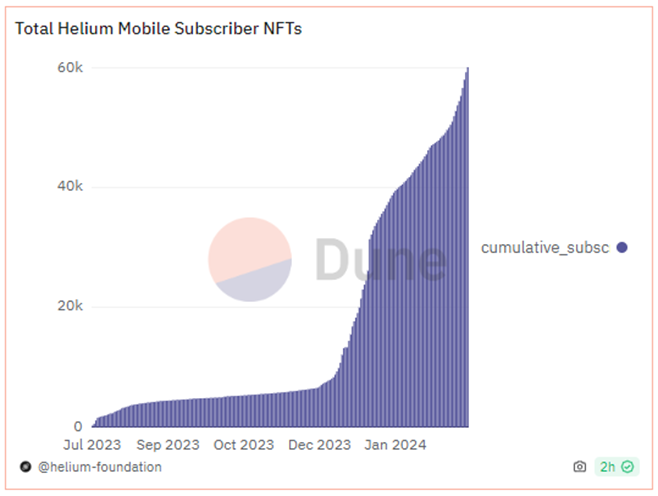

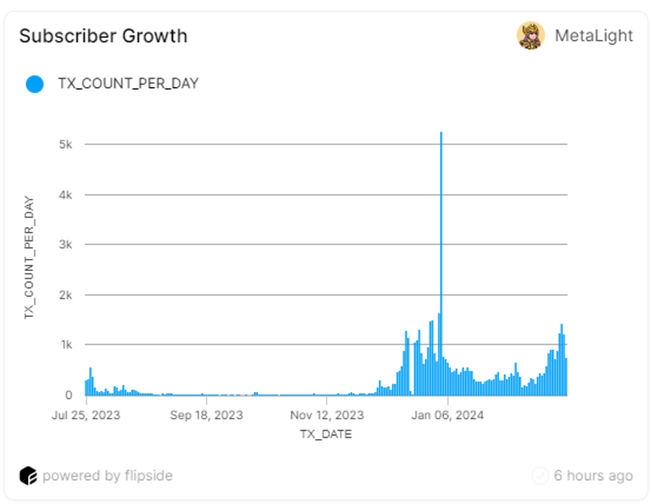

Nonetheless, the early signs of traction are notably impressive. Since its nationwide launch in December, Helium Mobile has consistently attracted new subscribers. Currently boasting around 60,000 in total, this figure translates to an annualized revenue of $14.4 million.

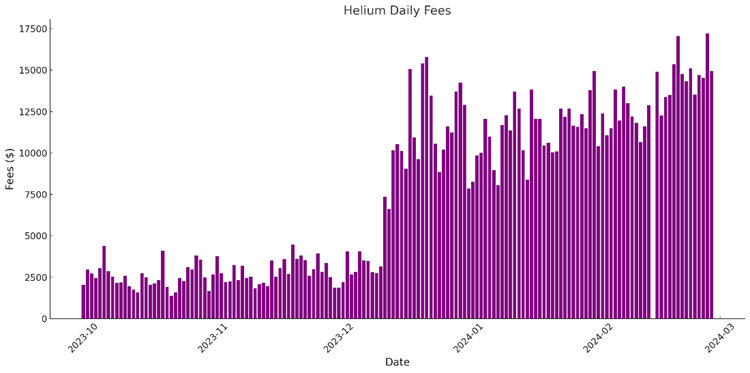

This has translated to a noticeable uptick in fees paid to node operators.

Additionally, a recent partnership with Telefónica aims to deploy mobile hotspots across Mexico. This endeavor seeks to bolster mobile coverage via data sharing, enabling Telefónica’s customers to tap into Helium’s decentralized network of mobile hotspots. This alliance not only extends Helium’s geographic footprint but also underscores the network’s potential in enhancing global connectivity in markets with less robust connectivity infrastructure.

Token Model

The Helium Network operates with a unique token model that facilitates its decentralized wireless network, designed to support both Internet of Things (IoT) devices and mobile data services. This model involves the interplay between four main components: HNT, MOBILE, IOT, and Data Credits (DC).

HNT:

- Primary Token: Serves as the foundational currency of the network, used to incentivize the deployment and operation of wireless Hotspots.

- Value Accrual: HNT accrues value as the network usage increases, driven by the demand for DCs, which are required for network transactions and are obtained by burning HNT. This mechanism ensures that as the Helium network grows and more data is transmitted, the demand for HNT increases.

MOBILE and IOT Tokens:

- Specialized Tokens: Introduced for the specific mobile and IoT subnetworks within Helium—MOBILE for the mobile network and IOT for the IoT network. These tokens are mined by respective Hotspot operators through data transfer and Proof of Coverage.

- Backed by HNT: Both MOBILE and IOT tokens can be converted into HNT, with their value and exchange rate algorithmically determined based on the network’s utility and performance.

Data Credits (DC):

- Utility Token: Used to pay for data transmissions and other network operations. DCs are pegged to the USD to ensure stable transaction costs and are created by burning HNT, thus removing HNT from circulation and reducing its supply.

- Non-Transferable: Once minted, DCs are tied to the owner’s wallet and can be delegated but not transferred, ensuring they are used solely for network operations.

Interplay and Value Accrual:

Conversion and Burn Mechanism: The conversion of HNT to DC (for network usage) and MOBILE/IOT to HNT (for redeeming rewards) creates a dynamic ecosystem where network growth and utilization directly impact HNT’s demand and supply.

In summary, the Helium Network’s token model creates a balanced ecosystem where:

- HNT serves as the core economic driver, with its value increasing with network demand.

- MOBILE and IOT tokens align incentives for participants in specialized networks.

- Data Credits facilitate stable and predictable network operations costs.

This innovative model ensures the Helium Network remains decentralized, scalable, and economically viable, fostering the growth of wireless infrastructure for IoT and mobile services globally.

The Investment Thesis Summarized

HNT has certainly rallied off of the bottom this cycle, but zooming out, this is another token that is 84% below ATH, and as noted above, has observable traction to build upon.

From a supply perspective, the amount of HNT in circulation is only 65% of the fully-diluted supply. However, as one can tell from the circulating supply chart below, the rate of inflation has flatlined over the past several months. We think this is due to a couple of factors. First, issuance does decrease by 50% each year, so there is a natural braking mechanism. But also, the new token model requires hotspot owners to convert their IOT and MOBILE tokens into HNT, which likely does not occur instantly. We are speculating, but hotspot owners sitting on MOBILE and HNT might be lessening the pace of issuance. And finally, there is increased activity within the Helium Network recently, which results in the burning of HNT, offsetting some inflation.

The case for incorporating HNT into our Core Strategy is multi-faceted and can be summarized as follows:

- Long-term Vision and Traction: Helium’s ambitious endeavor to establish a nationwide 5G network is not only visionary but is also demonstrating tangible progress, as evidenced by the rapid growth in Helium Mobile subscribers to over 60,000 in mere months. This indicates strong execution capabilities and market demand.

- DePIN Narrative: The unfolding narrative around Decentralized Physical Infrastructure Networks (DePINs) suggests a shift towards more decentralized and efficient infrastructure models. Helium, as a pioneering and sizable player in this space, represents a strategic asset within this thematic investment wave, making it a compelling addition to our portfolio.

- Solana Beta: Our positive outlook on Solana, coupled with our expectation of its appreciating value, positions HNT as a critical asset. Its integration with Solana not only leverages the blockchain’s efficiency and scalability but also aligns HNT with our broader investment thesis on Solana’s ecosystem. This synergy enhances our portfolio’s growth potential and diversification.

Active Trade Updates

DOGE was included as an active trade recommendation a couple of months ago on the basis of the return of animal spirits to the crypto market, as well as the impending launch of a pair of rockets – one of which was to carry a DOGE themed coin, and the other to carry a satellite named DOGE-1. We anticipated that this event might spark a rally in the asset when paired with market conditions.

Fast forward to today and neither mission to space have materialized due to technical issues, but animal spirits have returned after a brief respite. Given the strength in inflows and the current risk appetite in the market, we would keep the DOGE trade active.

Core Strategy

Our Q1 outlook anticipated some headwinds, and it seems the initial turbulence has subsided for now. Flows into crypto remain strong and breadth against BTC remains subdued. We maintain that ETH, L2s, and STX offer compelling idiosyncratic upside due to their near-term catalysts, and we have no reason to fade recent strength in SOL.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -2.72% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH -5.16% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.49% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX -0.45% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- Helium (HNT): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

- Filecoin (FIL): Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling short-medium-term trade at these levels. Narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.