Compelling Case for Continuation

Weathering the Storm

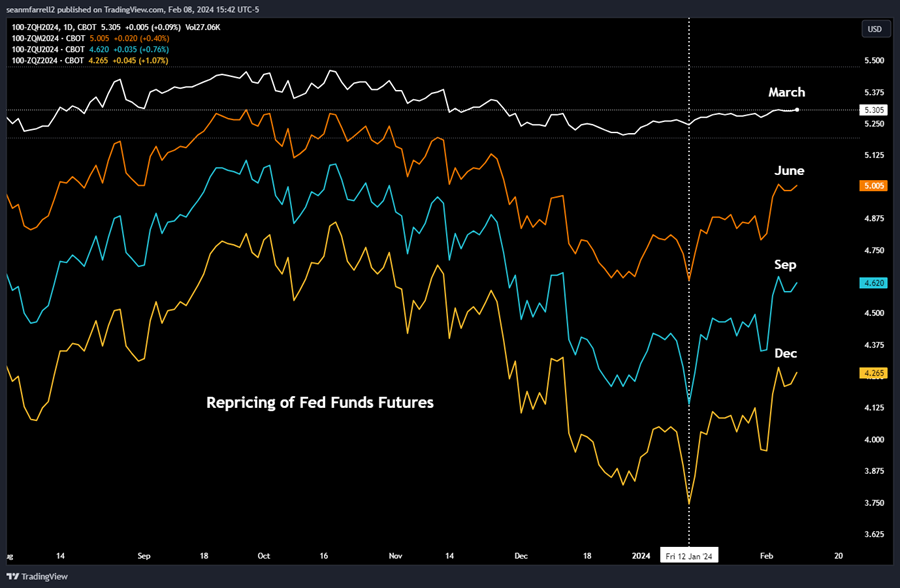

Heading into Q1, the key risks identified were: (1) A potential QRA supply shock, as long-term interest rates could surge due to a possible shift in bond issuance towards longer-duration securities, (2) the repricing of interest rate cuts, as the Federal Reserve downplayed expectations regarding the timing and frequency of such cuts, and (3) concerns regarding the dynamics between the expiration of the Reverse Repurchase Agreement (RRP) and the conclusion of Quantitative Tightening (QT) – specifically, if the RRP, a current liquidity source in the market, were to be depleted while QT persisted, this could result in a reduction of bank reserves below the minimum level deemed necessary for the banking system.

In recent weeks, we have successfully navigated these risks, potentially supported by additional inflows from the newly introduced spot ETFs.

- As noted last week, the market responded positively to a coupon intensive QRA, indicating that demand for coupons at these levels exceeded expectations. This suggests that the market had effectively anticipated the treasury coupon issuance in advance.

- Since mid-January, there has been a significant shift in Fed funds futures. They have now largely discounted the previously anticipated aggressive rate cuts, currently forecasting four rate cuts compared to the three anticipated by the Federal Reserve, with the first expected in May. Thus, barring any surprising inflation data, any further repricing higher should be marginal.

- The RRP risk, which will be more accurately assessed in the coming weeks as we observe the RRP balance behavior, appears to be further mitigated by the reduction in bill issuance from the treasury. A decrease in bills translates to lower demand from funds harvesting the overnight rate through the RRP.

Having navigated through the challenges of rate repricing, the potential supply pressure on longer-term securities, and deferring RRP-related risks, the near-term setup looks quite compelling for a continuation of the current rally.

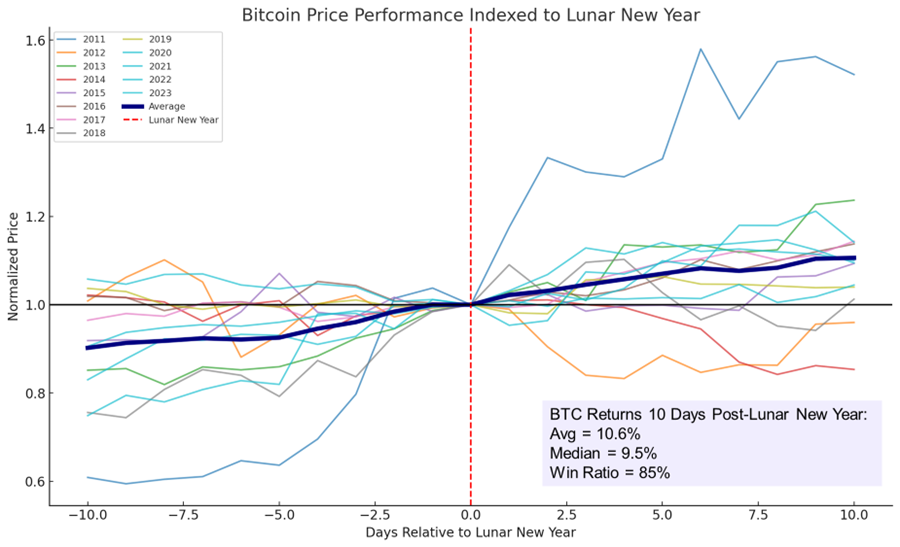

Year of the Dragon

This observation likely falls into the “correlation rather than causation” category, yet Bitcoin’s performance around the Lunar New Year has shown an alarmingly consistent trend. Examining the 10-day returns following the New Year, Bitcoin has recorded negative gains only twice, with no occurrences since 2014. The average return post-Lunar New Year is over 10%.

This Saturday marks the Lunar New Year, heralding the start of the Year of the Dragon. Despite the challenges in pinpointing causation, these patterns are noteworthy. Furthermore, as we will discuss below, there are additional China-related factors that suggest this pattern may persist.

Source: TradingView, Fundstrat

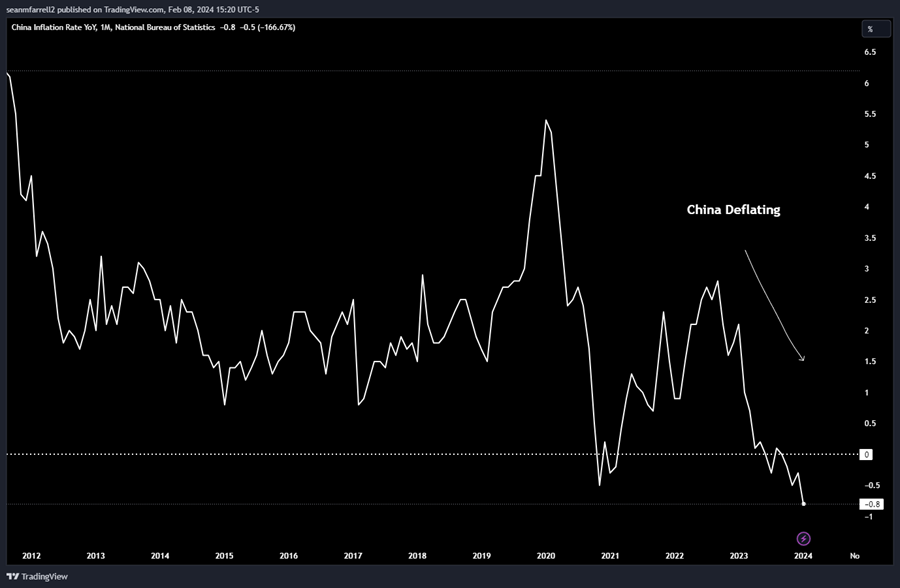

China Deflating Likely Leads to Liquidity Impulse

It is no secret that China’s economy is facing significant challenges, with its real estate and equities markets having been in decline for several years. More importantly, consumer spending is on a downward trend, as evidenced by the country reporting another month of year-over-year deflation, this time at -0.8%.

Although the Chinese government has implemented measures to ease monetary policy in recent months, the persistent economic difficulties suggest that more aggressive actions may be necessary to restore confidence in domestic markets. It is conceivable that China might opt for more substantial fiscal and monetary stimulus measures around the Lunar New Year in an attempt to invigorate the economy.

Recognizing this, and acknowledging the substantial evidence that Chinese investors are turning to crypto as an alternative to domestic equities markets (a trend we speculated on as early as last September), further stimulus measures from the People’s Bank of China (PBOC) could lead to increased capital flows into crypto assets in the near term.

Dencun Upgrade Scheduled

Ethereum developers have confirmed March 13th as the launch date for the Dencun upgrade. Announced during the latest all core developers consensus layer call, the upgrade will introduce EIP-4844 (proto-danksharding), aimed at reducing transaction costs on layer 2 networks by providing dedicated data storage space.

This decision follows the successful deployment of the upgrade on the Holesky testnet, marking the completion of testing across three different networks to ensure smooth implementation on the mainnet. Proto-danksharding represents the initial phase of danksharding, a broader initiative to scale the Ethereum blockchain.

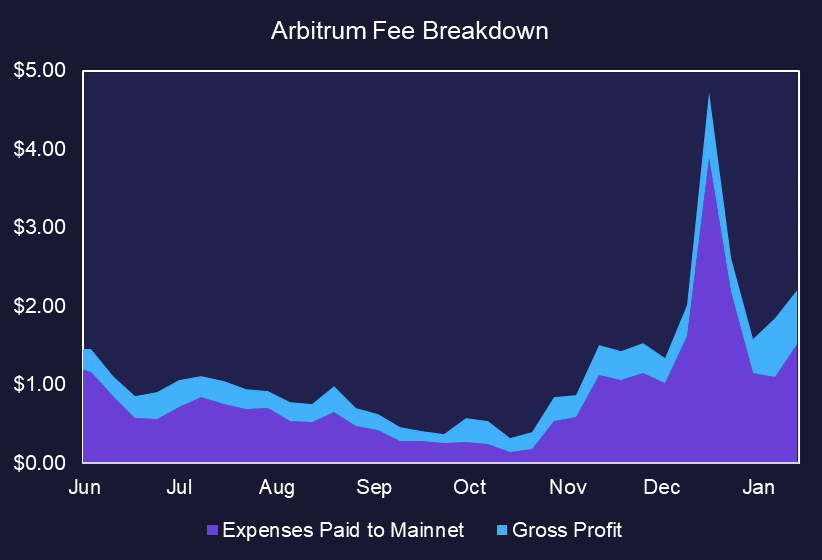

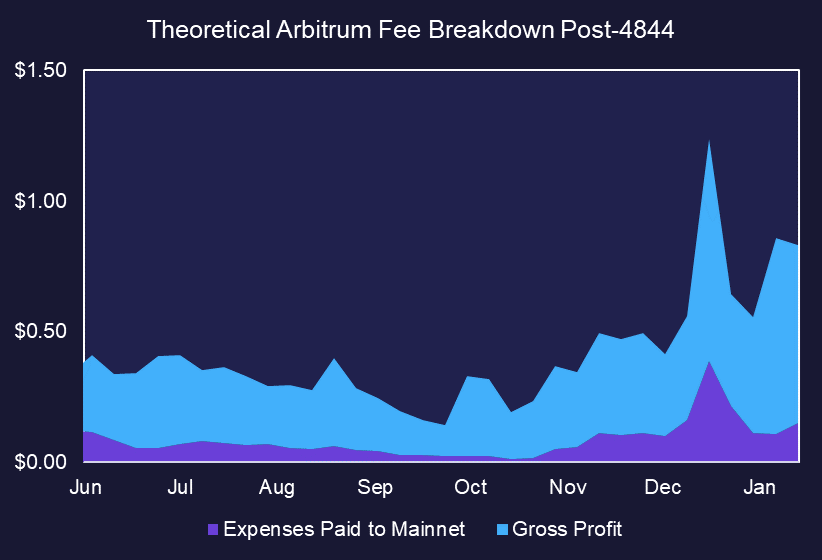

Below are two charts that demonstrate the potential impact of proto-danksharding on L2 costs. The first chart displays the actual fee and margin profile of leading L2, Arbitrum. The second chart displays the theoretical fee and margin profile in a world where the Dencun upgrade results in a 90% reduction in fees. This is not a precise number but is within the range of developer estimates.

Source: TokenTerminal, Fundstrat

There are clear benefits to the end user since fees decrease substantially. All else being equal, the L2 is in the same financial position as it was pre-Dencun, however, given the reduction in fees, it is plausible that transaction activity picks up following the upgrade, ultimately resulting in a higher gross profit.

Of course, the elephant in the room is that the value accruing to the L1 is objectively less since fees are reduced. However, we would argue that similar to the scientific phenomenon in which adding lanes to a highway increases traffic, lowering L2 fees is a theoretical lane addition to the L2 highway, and therefore additional projects and commerce should fill in the space created by this additional lane and make up for lost fees accrued to the L1 due to proto-danksharding.

EIP-4844 has been a catalyst on our radar for some time now. One could make an argument that the update is already priced into OP and ARB, but we would take the other side of that bet. It is likely that over the course of the next few weeks we will see the development organizations for Arbitrum and Optimism engage in marketing activities to bring more projects and users to their respective ecosystems post-upgrade.

Inflows Persist

Some people might be growing tired of our constant tracking of ETF flows. However, we find that the market still cares about them, and therefore they are important to keep tabs on.

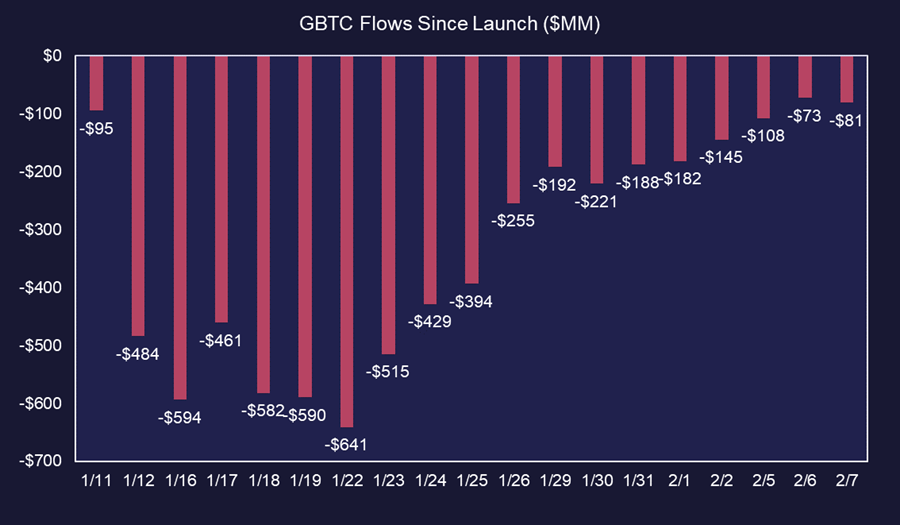

As we noted last week, the GBTC outflows have ground to a slow drizzle. The last two days were below $100 million in outflows.

Source: Farside Investors, Fundstrat

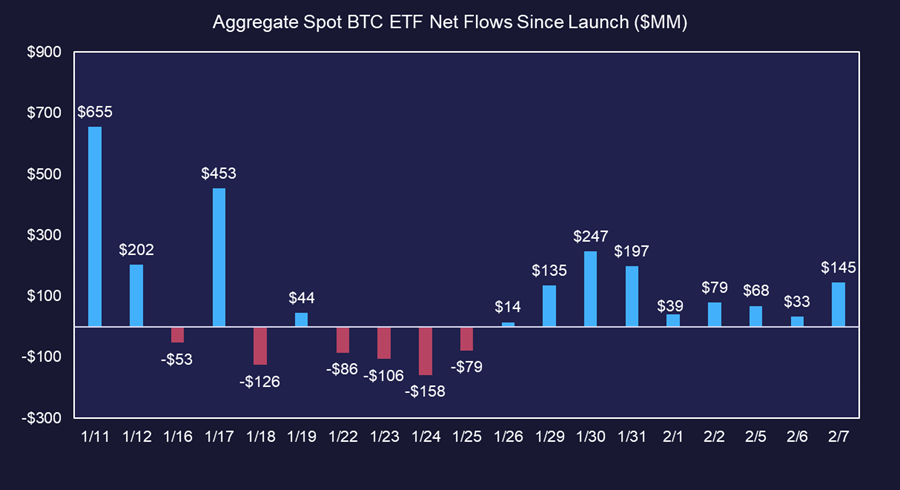

This has resulted in nine consecutive days of positive aggregate inflows, with the latest being an impressive $145 million.

Source: Farside Investors, Fundstrat

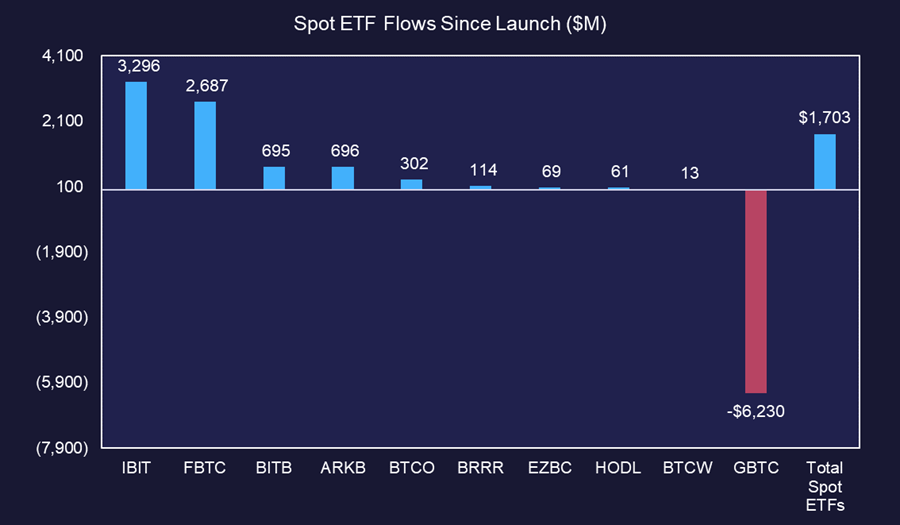

Adding up the total flows since inception, and we get to a total aggregate inflow number of $1.7 billion.

Among the individual issuers, Fidelity and Blackrock are the clear winners now, having brought a staggering $2.6 billion and $3.3 billion, respectively.

Source: Farside Investors, Fundstrat

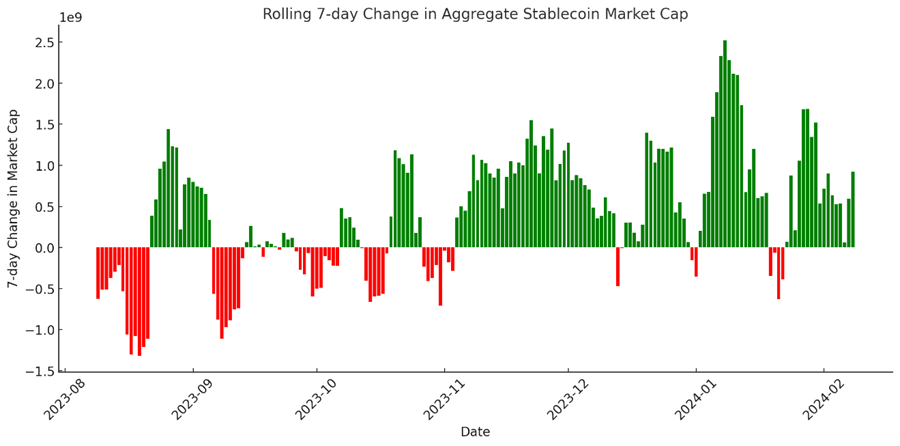

Finally, in stablecoin land, things remain constructive, with capital continuing to move from the fiat banking system into the crypto ecosystem. As we noted last week, these flows are a positive tailwind for altcoins.

Source: DefiLlama, Fundstrat

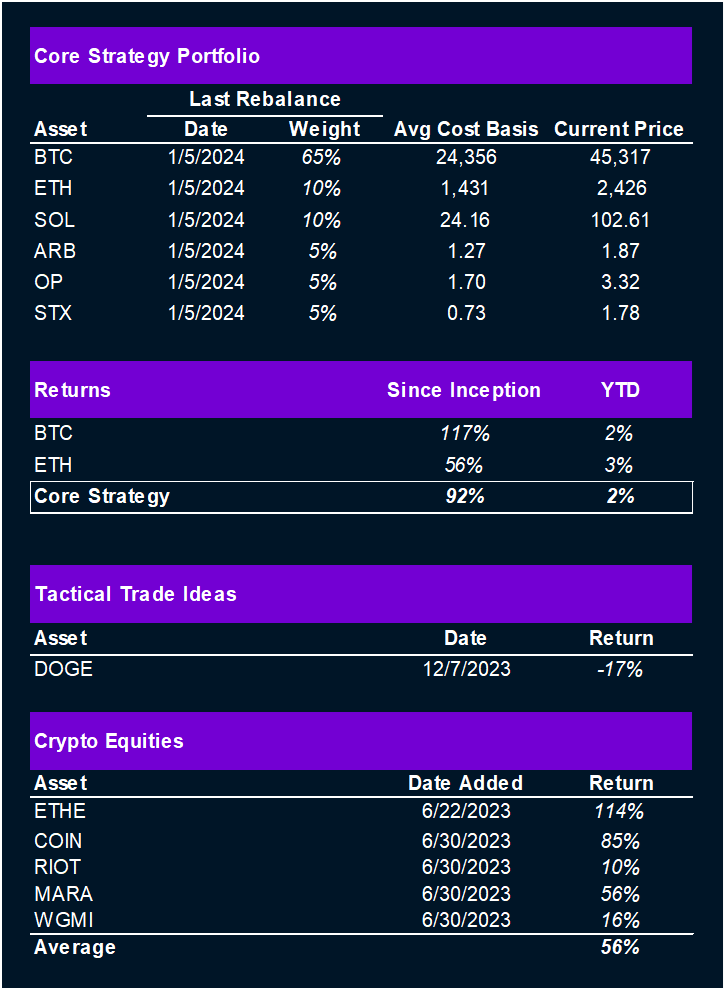

Core Strategy

Our Q1 outlook anticipated some headwinds, and it seems the initial turbulence is subsiding. We maintain that ETH, L2s, and STX offer compelling idiosyncratic upside due to their near-term catalysts. Further, we have no reason to fade the recent strength out of SOL.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -2.72% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH -5.16% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.49% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX -0.45% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.