The Fastest Horse

Key Takeaways

- Our outlook for the year anticipates an accelerating crypto cycle with new all-time highs for the majors, potential short-term market challenges, and strong year-end performance for crypto equities in relation to Bitcoin.

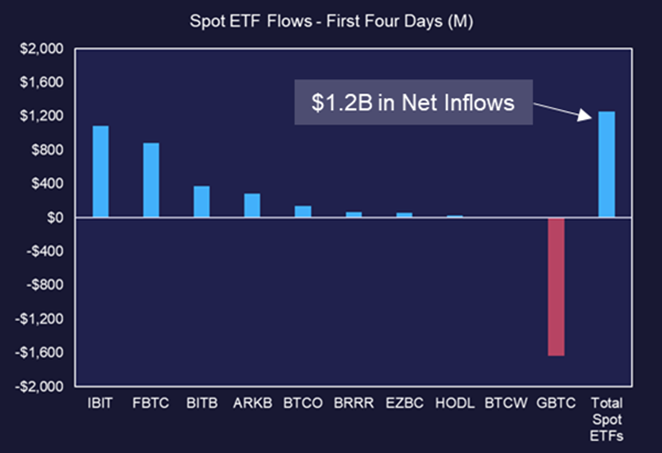

- Q1 is proving challenging for crypto prices due to factors like the dollar’s response to adjusted rate cut expectations, significant de-risking by institutional investors, and sizable selling of GBTC, all countering the massive inflows into spot ETFs.

- The current underperformance of miners is attributed to the same challenges facing crypto assets. We anticipate that BTC will continue to outperform miners in the short term. For those not allocated to the market, miners will likely become attractive once rates reach a short-term peak.

- Core Strategy – Our outlook on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining majority exposure to BTC in our Core Strategy will provide the opportunity to rotate into altcoins once the turbulence surrounding interest rates and GBTC sales subsides. We continue to believe that ETH, L2s, and STX present compelling idiosyncratic upside due to their respective near-term catalysts, and SOL might receive a boost following the Jupiter (JUP) airdrop scheduled for the end of January.

Outlook Overview

Thank you to everyone who joined our annual outlook call this week. We were fortunate to have a lot of success last year in helping our clients and subscribers navigate the crypto market and we look forward to leveling up again this year.

For those who missed the outlook, the replay is now available, along with the deck, but a quick summary of our outlook is below.

- Big Takeaway: Crypto cycle enters acceleration phase, flows increase, majors reach new ATHs, and animal spirits return in full force.

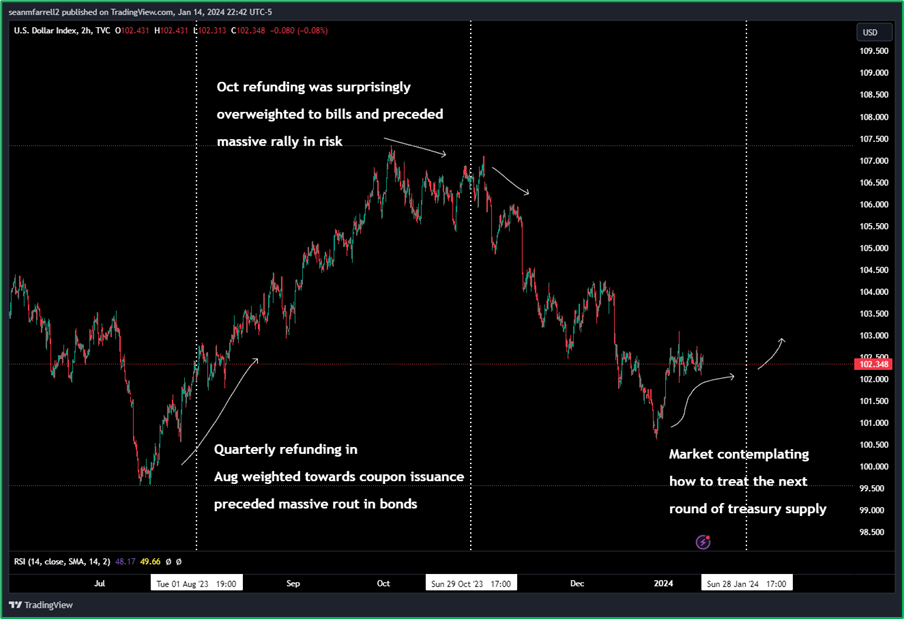

- Possibly a Bumpy Q1: Short-term headwinds include the market repricing the timing of rate cuts and a likely increase in coupon issuance in Q1 (DXY higher), in this environment idiosyncratic performance matters more.

- New ATHs in BTC, ETH, and SOL: Medium-term tailwinds include rate cuts and tapering QT in an election year which are favorable conditions for risk assets. Asian CBs are also expected to continue easing. Among liquidity-sensitive assets crypto is the fastest horse. Alongside these tailwinds are industry specific factors like the halving and increased institutional access post-ETF.

- Crypto Equities: Crypto equities underperform BTC on a move higher in rates (Q1), but finish the year much higher, retaining historical high beta relationship to bitcoin.

Bumpy Q1 Underway

As mentioned earlier, there are several current factors challenging crypto prices:

- The Dollar Index (DXY) is reacting to adjustments in rate cut expectations, and in our view, also anticipating the upcoming Treasury quarterly refunding announcement, which may or may not be skewed in weight toward coupon issuance vs bills.

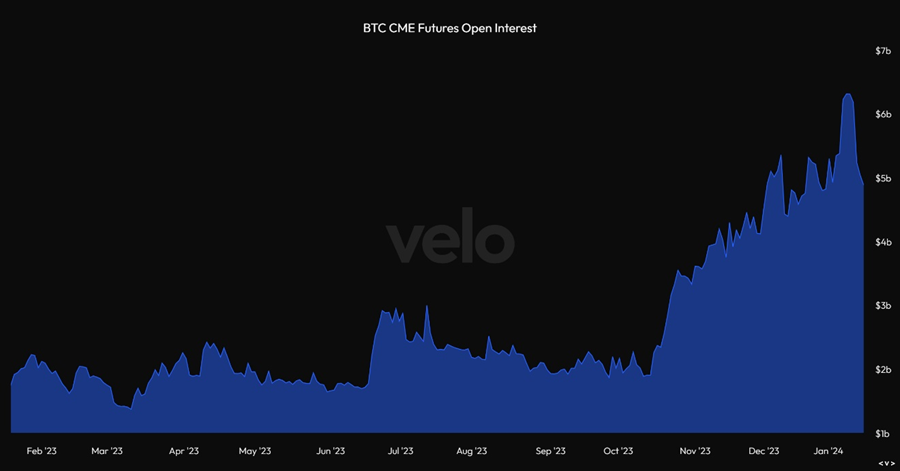

- The recent shift in the rate environment triggered broad de-risking by investors, and this included institutions trading BTC ahead of the ETF launch. This week, we observed over $1 billion in Open Interest (OI) reduction in CME futures.

- Additionally, there appears to be sizable and consistent selling of GBTC shares, likely attributable to both the FTX estate and from traders who are unwinding their arbitrage trades.

Therefore, while net inflows into the spot ETFs have been impressive, there are several countervailing forces working against the positive flows.

These headwinds are likely to persist in the immediate term, but as noted in our outlook – in bull markets dips are for buying.

Clarifying Our Thoughts on Miners

A recurring question from our audience concerns the performance of miners as we approach the halving. Most of the discussion about miners revolves around two primary concerns:

- Miners potentially underperforming due to the halving’s impact on their margins. The logic here is that, assuming constant prices, costs remain the same while revenue is halved.

- Miners potentially underperforming due to diminished demand for direct exposure from investors, given the recent launch of the spot ETF.

Addressing the first point, the halving is a well-known event and has been factored into all recent management guidance and analyst models. This impact should be, therefore, already priced in.

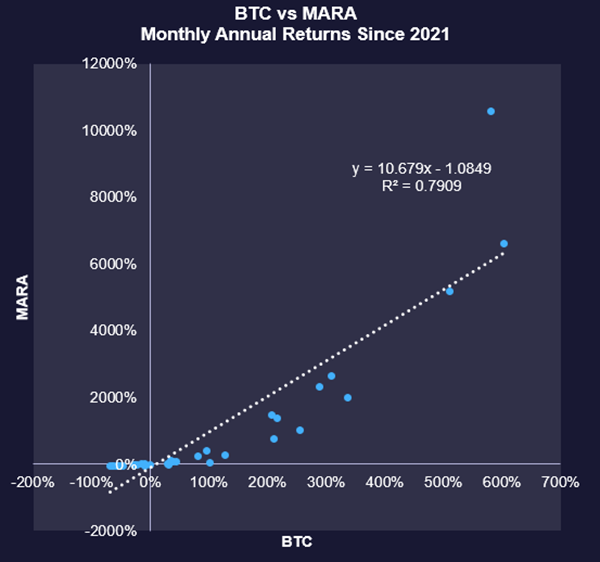

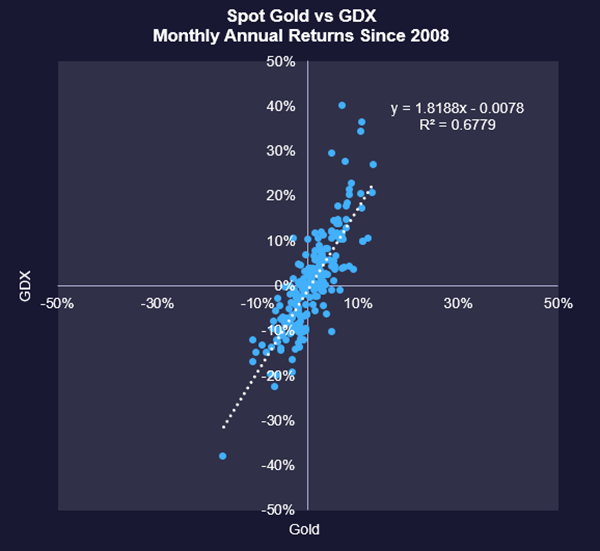

Regarding the second point, we believe this concern is misguided. Historically, investors in miners were not seeking to mirror Bitcoin’s movements directly. Rather, they were aiming for beta exposure to Bitcoin. We expect miners to continue serving this purpose. A compelling piece of evidence supporting this is the enduring high beta relationship between gold and gold miners, despite the existence of publicly traded, liquid ETFs for both for decades.

The current sell-off in miners is attributable to the same headwinds affecting crypto assets. Our perspective is that Bitcoin may continue to outperform miners in the near term. However, once interest rates reach a near-term peak, miners will become an extremely attractive buy.

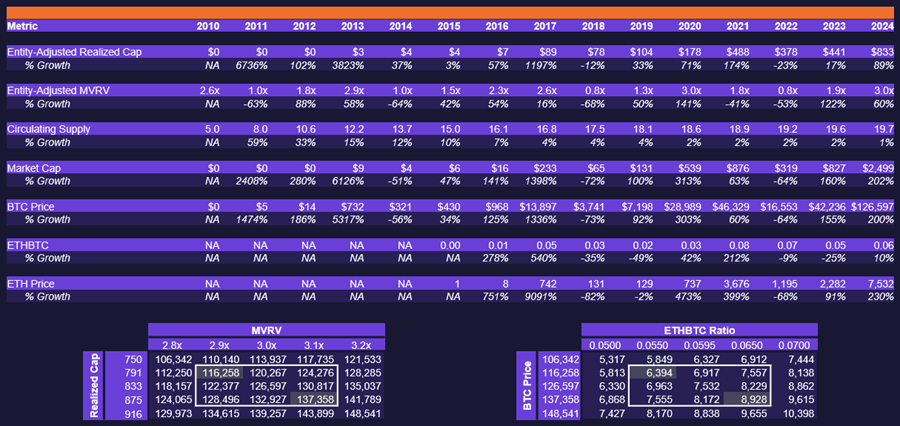

Price Targets

Driven by both the macro and crypto-specific tailwinds discussed above, we see BTC reaching $116-$137k by year end, ETH reaching $6,400 – $9,000, and SOL hitting the $500 – $600 range.

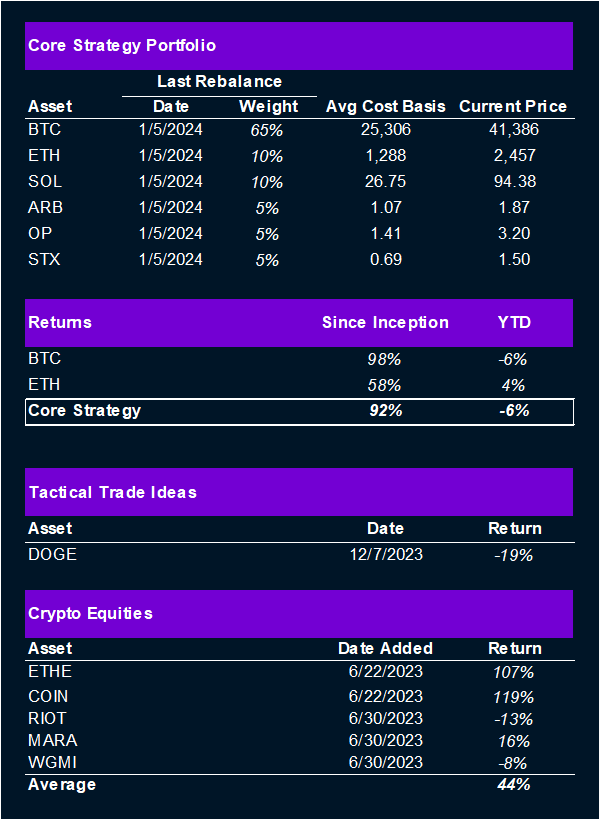

Core Strategy

Our view on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining a portfolio primarily composed of BTC will provide the opportunity to rotate into altcoins once the turbulence surrounding interest rates and GBTC sales subsides. We continue to believe that ETH, ETH Layer 2s, and STX present compelling idiosyncratic upside due to their respective tailwinds, and SOL might receive a boost following the Jupiter (JUP) airdrop scheduled for the end of January.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC 0.84% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH 0.98% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.39% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 0.72% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.