Initial Thoughts Post-ETF

Key Takeaways

- The successful launch of 11 Bitcoin ETFs, with over $4 billion in total trading volumes and BlackRock's fund exceeding $1 billion, represents a remarkable achievement for an asset class born from an open-source community of software developers just 15 years ago.

- The resolution of GBTC's discount to NAV leads to the removal of GBTC as a trade recommendation, as it is now expected to mirror Bitcoin's performance.

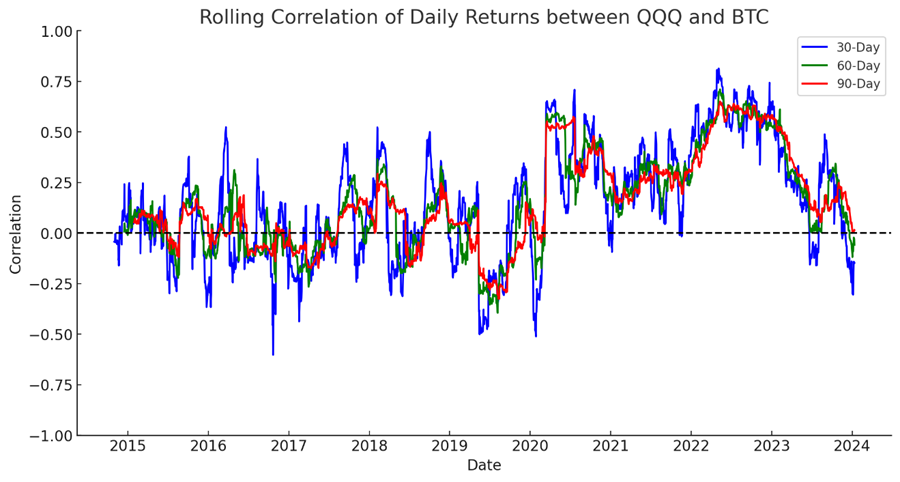

- The day one price action post-ETF launch, marked by Bitcoin's alignment with U.S. risk assets amid fluctuating rates and hawkish Fed comments, suggests a possible return to its correlation with US financial markets.

- In line with our thoughts from last week, the BTC ETF approval has led to an increase in capital allocated to ETH and related assets, in line with expectations around the ETH ETF application and the upcoming EIP 4844 upgrade.

- The aggregate stablecoin market cap's continued increase, coupled with a notable rise in the Ethereum network's share of these assets, points to a healthy influx of capital into crypto.

- Despite recent speculation that the BTC ETF's introduction might end Bitcoin miners' traditional role as Bitcoin's beta, the enduring dynamic seen between gold and its miners—where miners outperform in bull markets despite direct gold investment options—suggests a similar, sustained relationship for BTC and its miners.

- Core Strategy – Encouraging volumes following a spot BTC ETF launch and a muted downside reaction to a hot CPI print point to an encouraging setup in the near term. We remain constructive on ETH Layer 2 tokens ahead of EIP-4844 in February and anticipate increased attention towards ETH ahead of ETH ETF deliberations.

Initial Thoughts on ETF Launches

The past week has marked a pivotal moment in the evolution of the crypto industry, a testament to the remarkable journey of an asset class that emerged from a distrubuted community of open source software developers just 15 years ago. This was evidenced by the successful launch of all 11 eligible Bitcoin ETFs on Thursday morning. Assessing the success of an ETF launch is a multifaceted process, involving a close examination of various key metrics such as trading volumes, the number of trades executed, and most crucially, AUM.

Given the t+1 settlement times, a full view of the first day’s AUM might not be fully available until tomorrow. However, the initial trading volumes have been impressive, with the total volume across all products exceeding $4 billion, a commendable figure by any standard in the ETF realm.

A significant portion of this volume was notably from GBTC trades. This surge in volume is largely perceived as stemming from two main sources: investors in tax-advantaged accounts transitioning their holdings to lower-fee products, and entities unwinding their GBTC arbitrage positions (long GBTC, short spot). When the volumes from GBTC are set aside, the aggregate figure still stands impressively above $2 billion. Notably, the BlackRock fund alone reported over $1 billion in volume, securing its position as one of the highest volume debuts for a single ETF in history.

Source: Bloomberg, Fundstrat

Closing the GBTC Trade

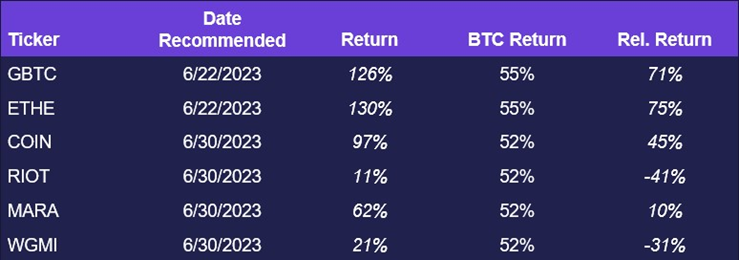

Today the industry also celebrates a significant milestone with the closure of the discount to NAV on GBTC, a longstanding issue finally resolved by regulators allowing daily redemptions/creations. In response, we are removing the recommended equity position in GBTC, which since June, has outperformed Bitcoin by 71%.

Analysis of Day 1 Price Action Following ETF Launch

It’s crucial not to overemphasize the significance of a single day’s price action, especially in the context of the recent ETF launch. The initial premarket spike in price seemed to be driven by anticipatory moves, likely a mix of allocators sourcing Bitcoin before the market opened and speculative buying.

The release of a hotter-than-expected CPI report and hawkish remarks from the Fed’s Mester, hinting at March being too soon for rate cuts, triggered a spike in rates.

Intriguingly, Bitcoin’s price movements mirrored those of other risk assets, initially declining and then recovering as rates stabilized and bonds rallied towards the day’s end.

The key observation from this is not so much about the price itself but about the apparent shift in Bitcoin’s correlations.

Over the past year, Bitcoin had shown a tendency to break away from its correlation with U.S. risk assets. However, the ETF launch and its re-emergence in mainstream consciousness might signal a reversion to a closer correlation with U.S. markets. This change in correlation dynamics could be an early indicator of how Bitcoin might behave in relation to traditional financial markets going forward.

Source: TradingView, Fundstrat

ETH Rotation

As we discussed last week, following the BTC ETF approval, we foresaw bullish trends for ETH and related names, expecting capital rotation in anticipation of the ETH ETF application decision.

After Wednesday’s SEC hack and the fake approval news, there was a notable shift of capital from BTC to ETH and its associated names, likely by traders repositioning post-BTC ETF launch.

However, we think it is too early to declare a cycle bottom for ETHBTC, as BTC dominance typically surges post-halving.

Our Core Strategy thus increased allocation in ETH Layer 2s, which stand to gain from the upcoming EIP 4844 upgrade in February in addition to potential ETF-driven tailwinds, rather than ETH directly.

Regardless of whether this was the cycle bottom or not, we foresee a more positive trend for ETH moving forward, breaking away from its severe downward trajectory relative to BTC.

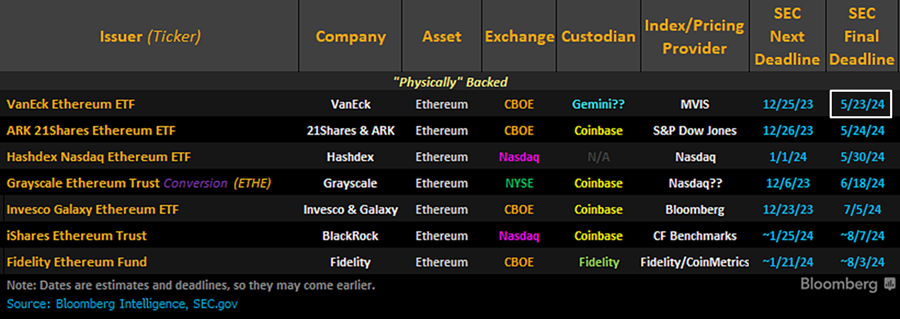

In terms of key dates to be aware of for the ETH ETF, the first final deadline for SEC decision is on May 23rd.

Source: James Seyffart at Bloomberg

Stablecoin Flows Remain Positive

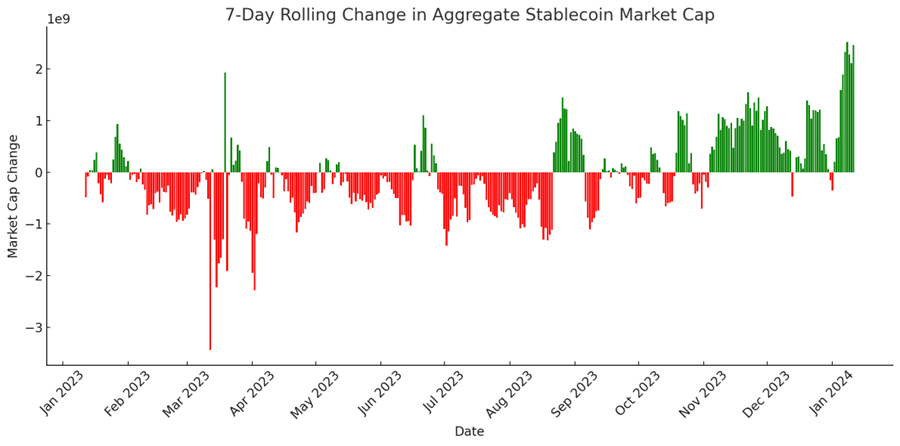

Stablecoin market cap increases continue to signal a positive inflow of capital into the crypto ecosystem, typically setting the stage for altcoins to flourish.

Source: DefiLlama, Fundstrat

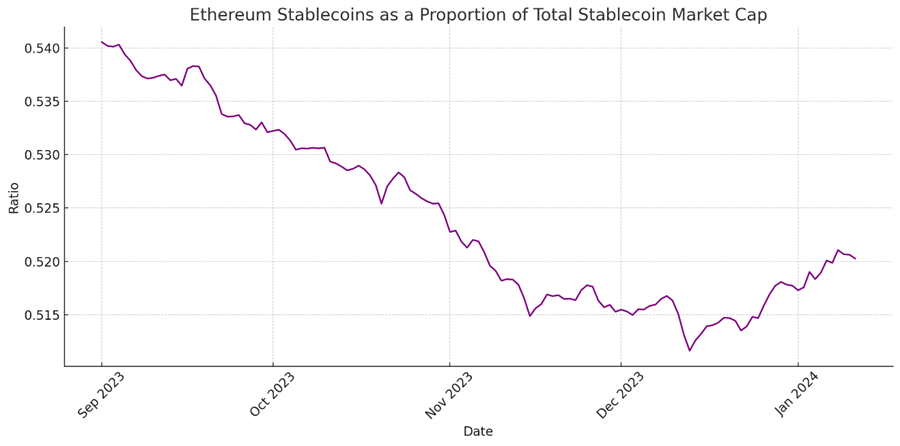

Notably, for the first time in recent memory, the ratio of stablecoins on the Ethereum network to the total stablecoin market cap is on the rise, indicating a more pronounced flow of capital into Ethereum compared to the broader market.

Source: DefiLlama, Fundstrat

Quick Thoughts on Miners

Miners have traditionally acted as a beta to Bitcoin, a trend that persisted until a few weeks ago. Today, however, they experienced a notable sell-off relative to Bitcoin. Many speculate that the historical relationship between miners and Bitcoin may end, arguing that with the advent of a BTC ETF, investors no longer need to gain exposure to Bitcoin through miners.

Yet, this reasoning seems inadequate when considering the enduring relationship between gold and gold miners, despite a readily available gold ETF along with a plethora of derivative products to achieve direct leverage on spot gold prices. In bear markets, gold typically outperforms gold miners, but in bull markets, gold miners often see greater gains than the precious metal itself. This dynamic is likely to continue for BTC and BTC miners. In the long term, BTC might outperform, but during bull markets, the combined effects of operating leverage and rapidly appreciating revenue are expected to have a more pronounced impact on miner share prices.

Core Strategy

Encouraging volumes following a spot BTC ETF launch and a muted downside reaction to a hot CPI figure point to an encouraging setup in the near term. We remain constructive on ETH Layer 2 tokens ahead of EIP-4844 in February and anticipate increased attention towards ETH ahead of ETH ETF deliberations.

- Bitcoin (BTC 0.84% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH 0.98% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.39% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 0.72% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

Crypto Equities

Trade Ideas

DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.