Animal Spirits to Persist Through New Year

Key Takeaways

- Data on flows indicate that animal spirits are poised to continue into the New Year. There's been a notable resurgence in CME futures and options volumes, and the aggregate market cap of stablecoins is once again climbing.

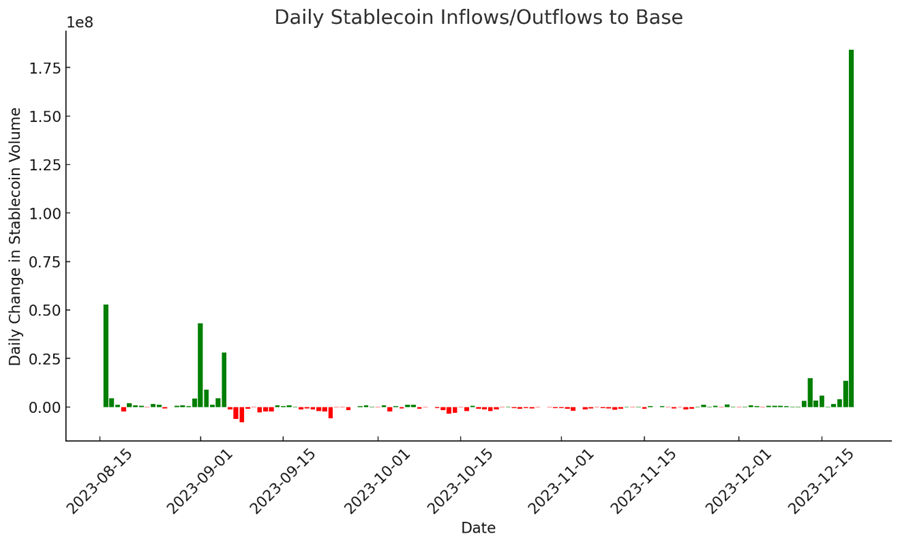

- The influx of stablecoins into Base points to increased traction on the Coinbase-led Layer 2 network, benefiting not only Coinbase shareholders but also OP token holders.

- This week’s rally in Stacks (STX) has been driven by the introduction of liquid stacking, allowing users to earn interest while maintaining liquidity – a clear sign that the STX thesis is beginning to materialize.

- With Solana having recently outpaced Ethereum in weekly DEX volumes, on-chain activity suggests that, despite the rapid surge from $16 to over $90 in just a few months, it may be too early to fade the current rally.

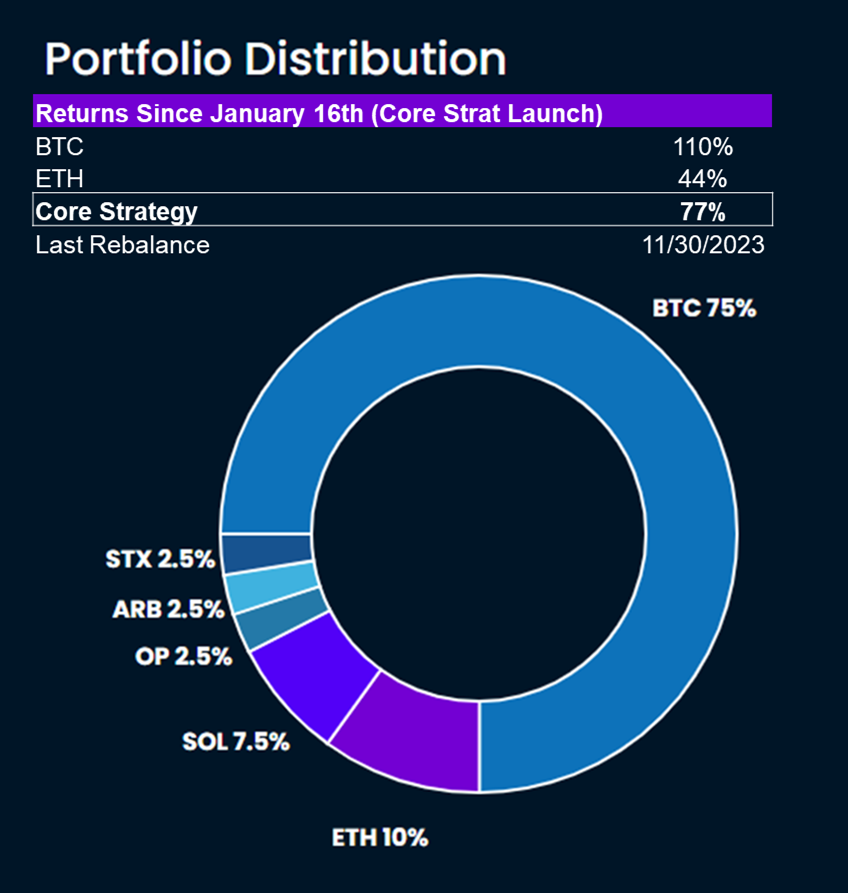

- Core Strategy – Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, anticipated ETF approval January 8-10th, and the impending halving, we believe that now is an opportune time to be fully allocated in the market.

Let it Flow

As we approach the holiday weekend and the final week of the year, which is typically marked by lower liquidity due to many stepping away from their desks, one might expect to see a dialing back of risk and a slowdown in trading volumes. However, contrary to these expectations, most data suggest animal spirits seem poised for a rally through the New Year.

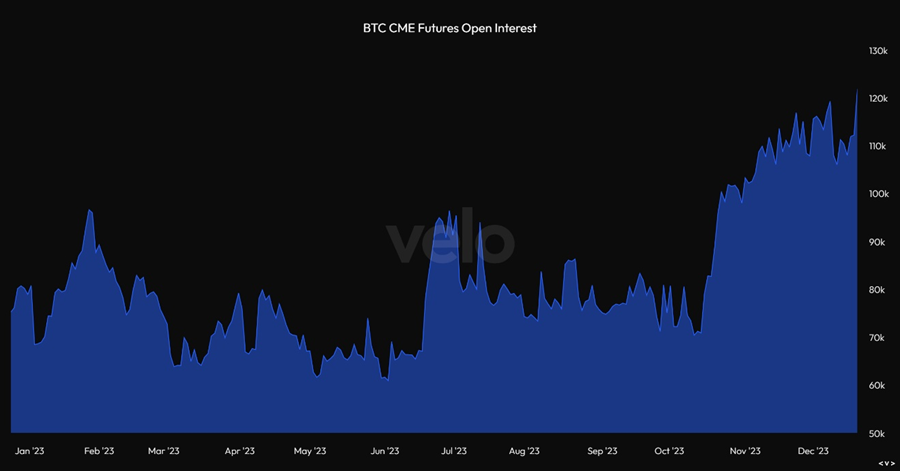

CME futures data, the go-to platform for institutional capital seeking exposure to BTC and ETH, has shown a resurgence. We’re now seeing BTC-denominated open interest returning to an all-time high after a notable decline two weeks ago.

This trend likely mirrors a sentiment shared by many investors, one that resonates with our perspective — there’s no strong incentive to reduce one’s exposure prior to the much-awaited ETF decision, anticipated to arrive January 8-10th.

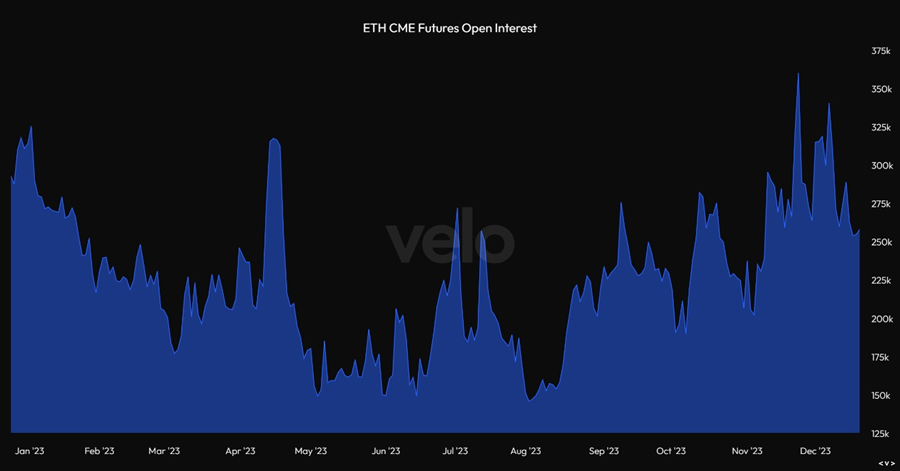

On a separate note, ETH’s underperformance is clearly reflected in the current level of CME open interest. We think this relative underperformance will likely continue, at least until the Bitcoin ETF approval. Post-approval, the market is likely to rapidly adjust its expectations for an ETH ETF in Q2 or Q3, potentially attracting significant flows.

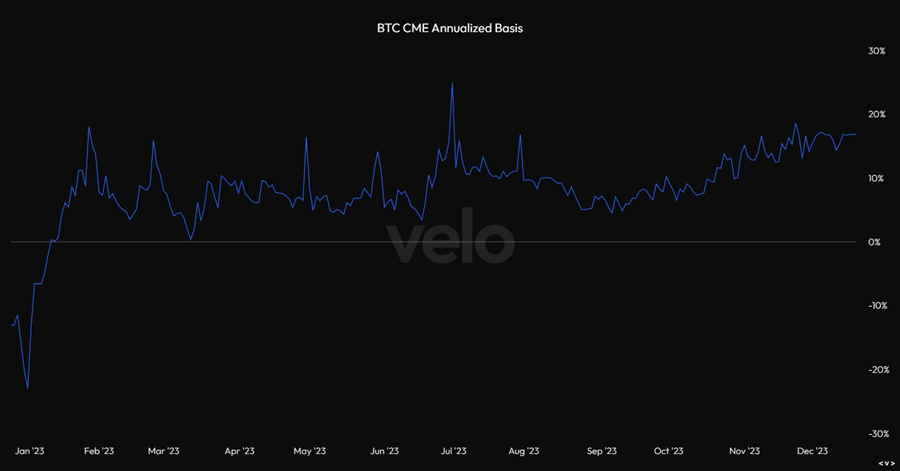

It’s important to note that the CME futures market isn’t just about leveraged long positions. The annualized basis on the CME has climbed to nearly 17%, making the basis trade an attractive option for many traders. While these parties aren’t necessarily making a directional bet on BTC’s price, their actions still significantly impact spot volumes. Of course, those who opt not to roll their trade into the next futures contract might create selling pressure, as we’ve observed to some extent over the past couple of weeks.

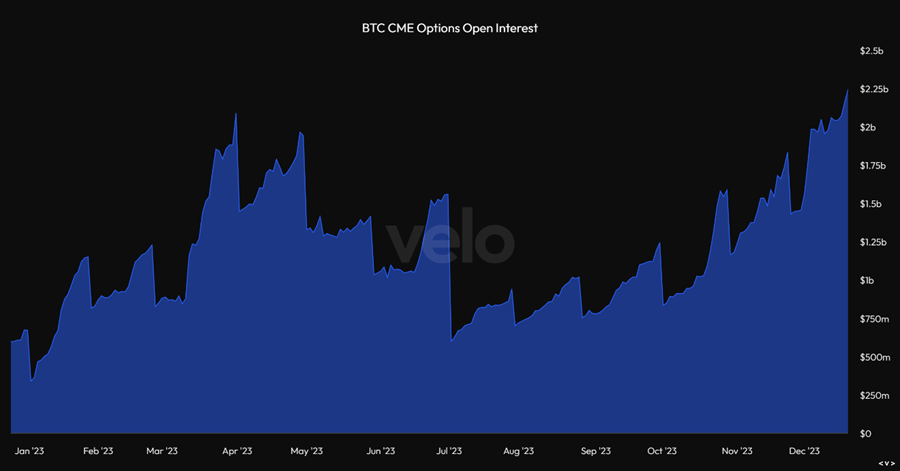

CME options open interest is also pushing higher, now at a new YTD high of over $2.2 billion.

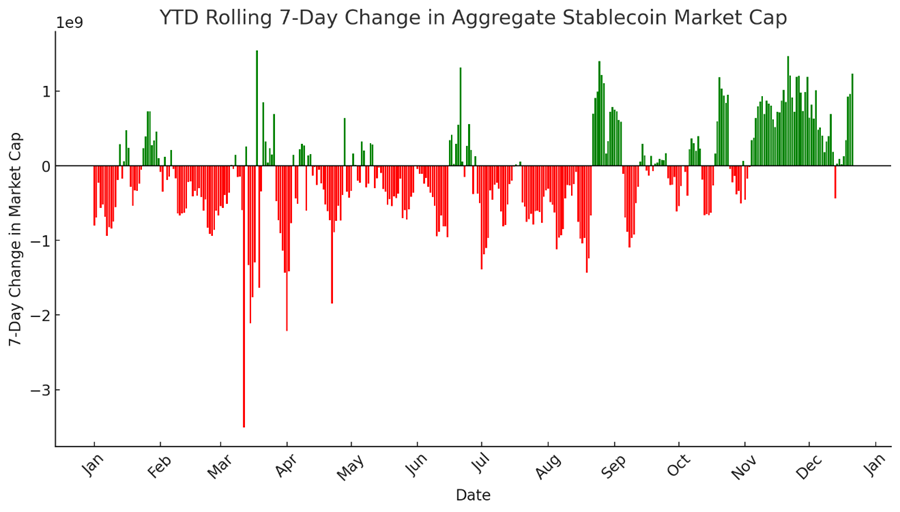

Turning to more forward-looking flows data, we see that after a slight cooldown period, the aggregate stablecoin market cap is once again on the rise. As a reminder this is a reliable indicator of capital moving into the crypto ecosystem.This trend holds particular significance for market breadth, as stablecoins frequently serve as the trading pair for various altcoins.

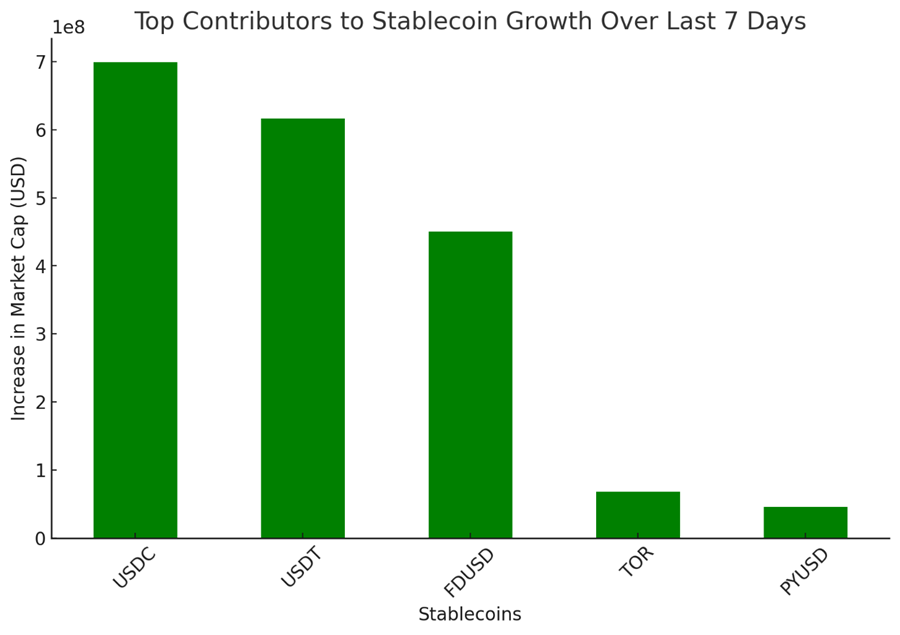

Analyzing the primary contributors to the recent surge in stablecoin mints, we find that USDT continues to be a mainstay on the leaderboard, closely followed by FDUSD, which is particularly favored among Asian market participants. However, the standout over the past week has been USDC, a stablecoin that, despite ceding a significant market share to Tether earlier this year, is now at the forefront of this uptick.

Stablecoin Flows Point to Increased Traction on Base

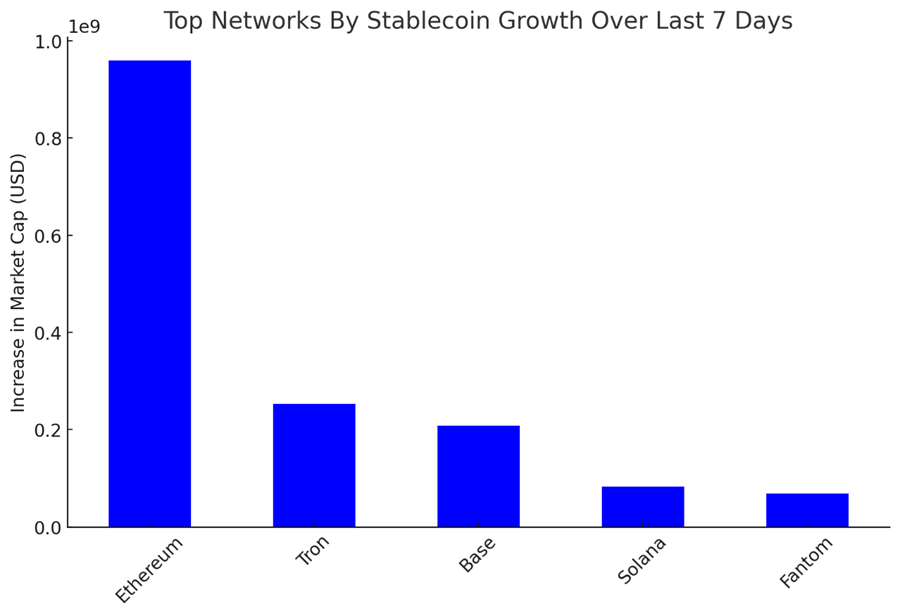

In the past week, a significant portion of stablecoin flows has been channeled into Ethereum and Tron, the two dominant networks in stablecoin usage. However, it’s noteworthy that Base, the Coinbase-led layer 2 network, has also seen considerable capital inflows.

This indicates a rise in on-chain activity and adoption for Base. Although Base does not currently have a native token, there is clear value accrual at the Coinbase shareholder level. Coinbase is the sole sequencer on the network, and thus are the beneficiary of fees paid to transact on Base.

Looking ahead, we anticipate that over the next year, Coinbase will benefit financially from increased transaction fees on Base. This aspect may be underappreciated by traditional equity analysts, who might only recognize its significance once its impact becomes more pronounced.

This is positive news for COIN holders, but it also bodes well for the Core Strategy component, Optimism ($OP). Coinbase and the Optimism Foundation have structured a partnership whereby the Optimism Foundation will grant Base 118 million OP tokens over a six-year period. In return, Base will contribute either 2.5% of its sequencer revenue or 15% of its net profits, whichever is greater, to the Optimism Collective. This partnership was designed to demonstrate a shared commitment to protocols for upgrades.

As Base gains more traction, benefits extend beyond Coinbase shareholders. The OP ecosystem stands to gain as well, with funds accrued by the Optimism Collective likely being invested in growth initiatives for Optimism. We believe that the recent surge in Base activity has played a role in the recent OP token price move.

Stacks Thesis Playing Out

We added STX to our Core Strategy several weeks ago. To rehash the bull thesis for Stacks:

- Growing Ecosystem on Bitcoin: The surge in popularity of Ordinals signifies a rising interest in leveraging the Bitcoin network for commerce and innovation.

- Large Addressable Market: Considering the potential of BTC Layer 2 solutions, the total addressable market is substantial. For perspective, Ethereum Layer 2s like Optimism and Arbitrum have fully diluted market caps of $10.8 billion and $11.5 billion, respectively. Stacks, operating on a network over twice the size of Ethereum, has a FD market cap just under $2.6 billion.

- Upcoming Q1 Catalyst: The anticipated Nakamoto upgrade in Q1 is set to boost performance and enhance the flow of value from Bitcoin to L2. This event is likely to attract traders and on-chain enthusiasts, potentially leading to a significant uptick in STX’s value.

- Trading Perspective: Given Bitcoin’s current market leadership, STX offers a more reliable beta relative to Bitcoin than most altcoins.

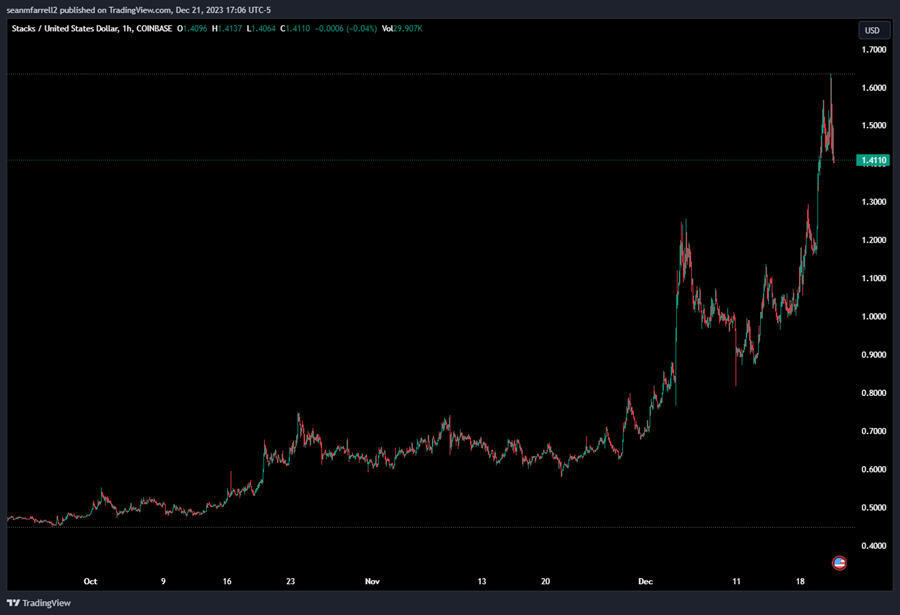

In recent days one might have noticed that STX has rallied considerably, up approximately 50% since last week.

This week, a prominent investor publicly expressed his bullish stance on Stacks, but the recent rally had already started at the time of those comments, and, in our view, appears to be driven by organic demand. On Monday, StackingDAO introduced “liquid stacking,” a Stacks adaptation of liquid staking.

Stacks (STX) offers the unique feature of earning native BTC payouts from consensus, at a rate of approximately 6%. This provides a strong incentive to stack STX. However, prior to this development, stacking STX meant forfeiting the ability to use it as collateral elsewhere. Liquid stacking resolves this issue by allowing users to deposit STX and receive $stSTX in return. This token not only offers the ability to continue receiving interest on your STX, but also provides the user with liquidity, whether for trading or to use stSTX as collateral.

With the advent of stacked STX ($stSTX), users can maintain liquidity while still accruing earnings. At launch, around $500 million in stSTX was minted, suggesting sizeable demand to use stSTX on chain.

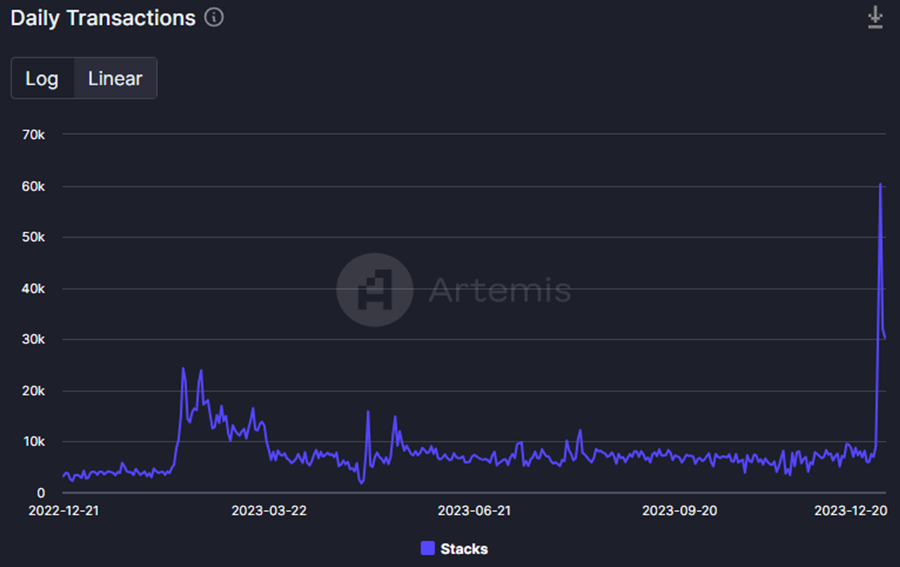

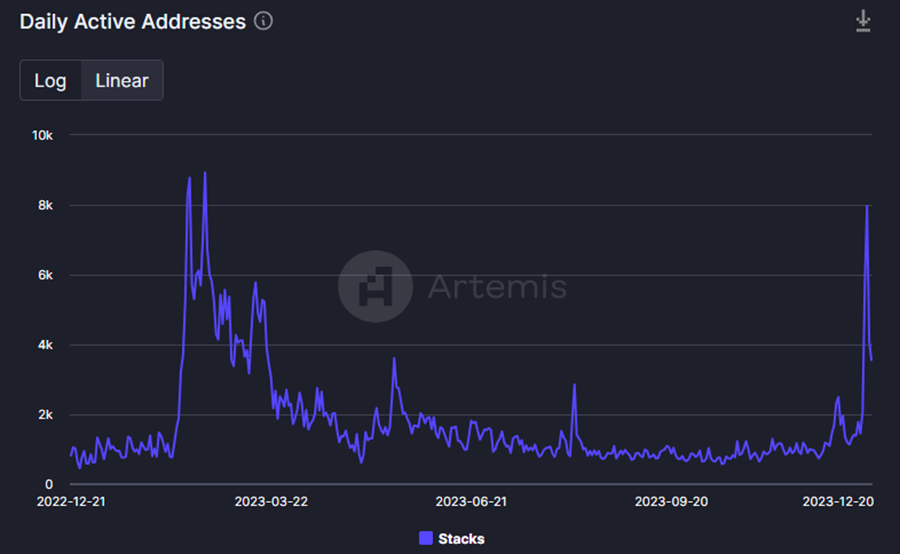

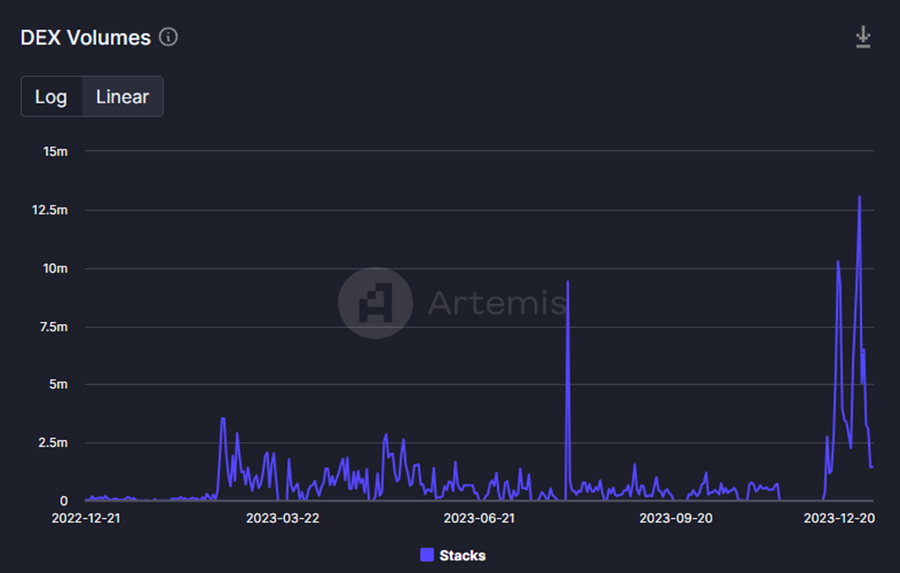

We can see in the charts below that on-chain activity reached unprecedented levels for Stacks, suggesting that more individuals are starting to appreciate the growing momentum around the layered Bitcoin economy and are trying to experiment on chain even before the Nakamoto upgrade, currently expected in Q1 of next year.

SOL Still Shining

In November, we stressed the importance of pressing winners, one of which was Solana. A year ago, this asset was largely written off, and in September, it faced intense selling pressure in anticipation of a possible FTX estate liquidation. Fast forward to today, and the script has completely flipped.

On-chain activity has been trending higher for a while now but has recently accelerated to a new level. This is crucial as it suggests that the speculative demand is now bolstered by an organic source, providing additional support at the current price levels. This factor contributes to the sustainability of significant rallies.

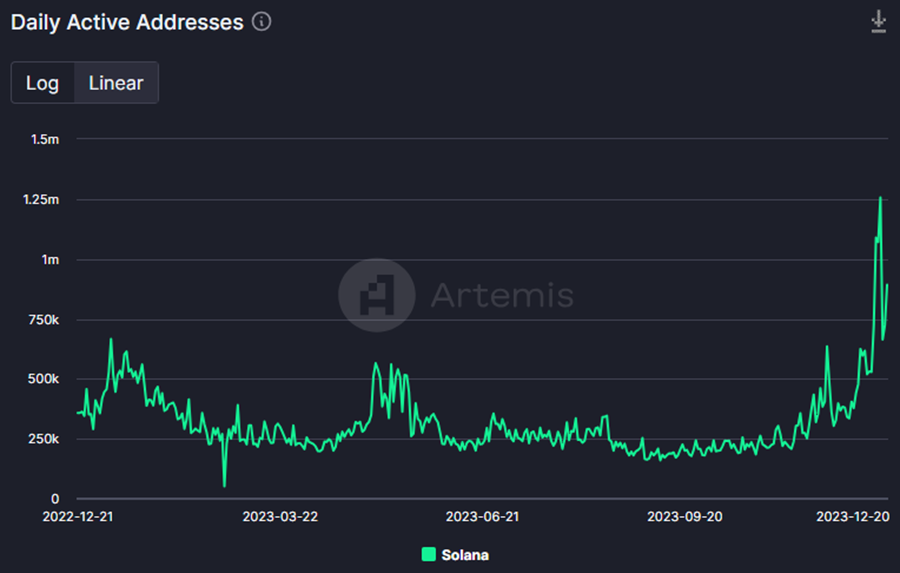

The chart below speaks to the number of users either coming back into the fold, or new users entering the arena for the first time.

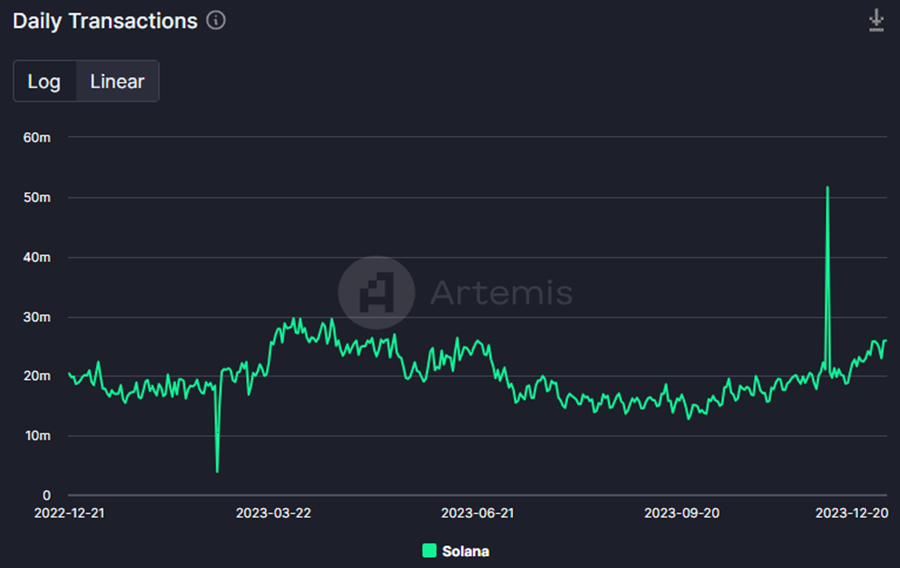

Transaction count, while not as explosive, has been on a steady incline since hitting a low in September.

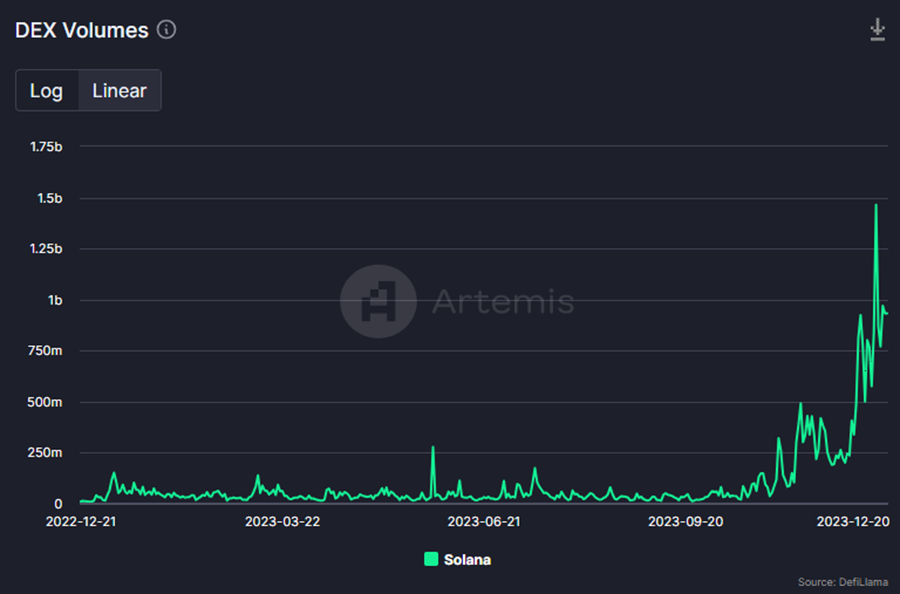

Perhaps the most remarkable aspect is the recent spike in DEX volumes on Solana, which, just a few days ago, surpassed the weekly DEX volumes on Ethereum.

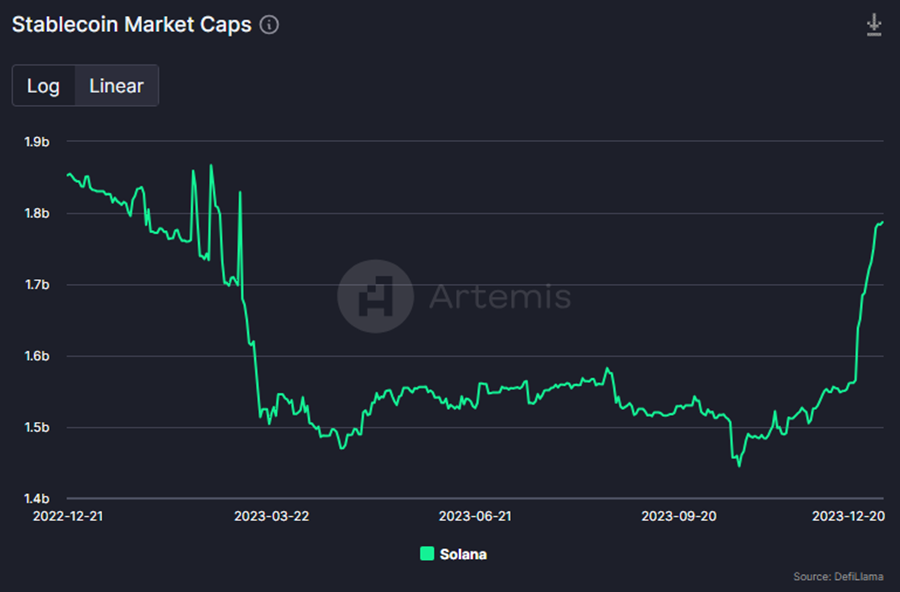

Lastly, we would like to draw attention to the stablecoin market cap on Solana. After a steady increase from September through mid-December, it has recently skyrocketed. As mentioned earlier, this is a bullish sign, indicating that stablecoins, representing sidelined capital, are re-entering the market.

In summary, while it’s understandable for those with a more tactical approach to consider taking profits from their SOL holdings, the dramatic increase in Solana’s value from $17 to $96 over the past few months should not be the sole focus. On-chain indicators hint that this rally may still possess underlying momentum, especially considering Jupiter, a Solana-based aggregator, is expected to airdrop its token at a near-$1 billion valuation in January, potentially creating a “wealth effect” within the ecosystem.

Core Strategy

Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, anticipated ETF approval January 8-10th, and the impending halving, we believe that now is an opportune time to be fully allocated in the market.

A brief summary of the theses behind each component of the Core Strategy:

- Bitcoin ($BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum ($ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana ($SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism ($OP) & Arbitrum ($ARB): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks ($STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

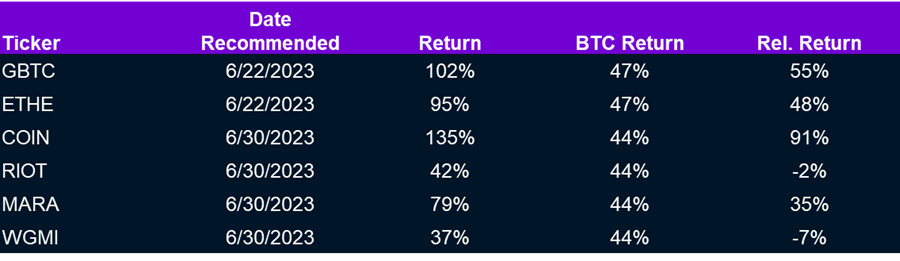

Crypto Equities

Trade Ideas

- DOGE ($DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...