The Fed Rug-pulls Bears

Key Takeaways

- The week began with cascading long liquidations, spurred by heightened risk aversion in anticipation of the FOMC Meeting and unusually high selling pressure from miners.

- Miners continue to benefit from Ordinals-driven fee pressure, a tailwind that we expect the market to appreciate further in the coming months.

- The initial risk aversion preceding the FOMC meeting has shifted following the Fed's release of its economic projections, which indicate several rate cuts next year.

- A weakening dollar is supporting risk assets and is likely to act as an additional boost for the broader crypto market as the year draws to a close.

- Core Strategy - Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. As evidenced by the market’s rebound, we do not view this week’s dip as a trend change, but rather a temporary dislocation between the perps and spot markets. In our view, risk asymmetries still skew to the upside.

OI Rinse to Start the Week

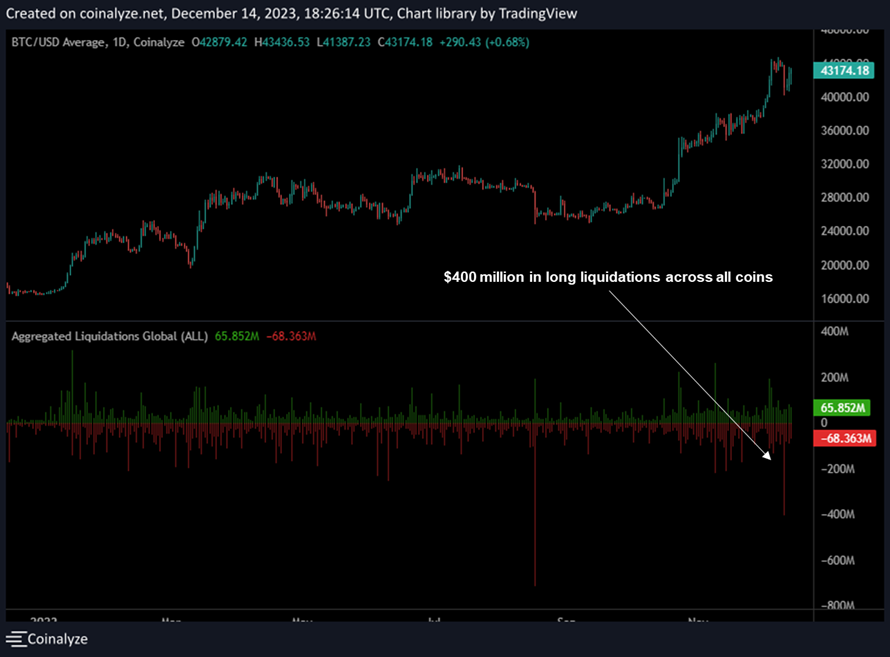

This week the crypto market started off with a bang, marked by a liquidations-driven downturn on Sunday evening. The perpetual futures market witnessed a low liquidity liquidation cascade that wiped out approximately $2.7 billion in open interest across all cryptoassets, according to data from CoinGlass.

At the time, we perceived this event as a normal cleansing of overleveraged weekend positions and viewed any immediate market weakness as a buying opportunity. Following this shake-up, BTC, ETH, and SOL all demonstrated resilience, finding support at the previous week’s low, and have since recovered essentially all losses incurred on Sunday.

Such liquidation cascades, though jarring, serve as a reminder of the inherent volatility in the crypto market. It’s important to remember that achieving outsized returns typically involves navigating through acute periods of volatility.

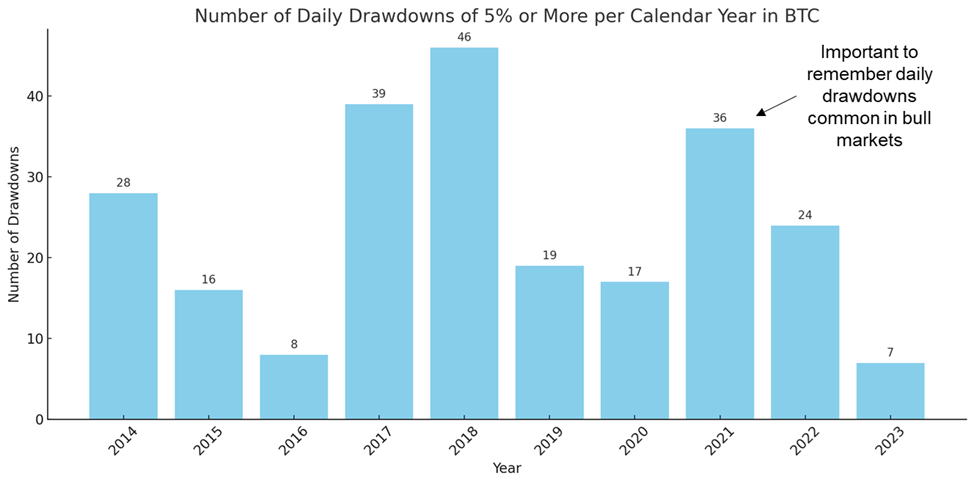

Interestingly, this year has been somewhat atypical regarding price fluctuations, as evidenced by the occurrence of only seven daily drawdowns exceeding 5%.

If these trends persist until the end of December, this year will record the fewest instances of 5% drawdowns in Bitcoin’s history, underscoring a period of relative stability for an otherwise volatile asset.

Why Did We Rinse?

Liquidation cascades happen when momentum in the perps market outpaces the spot market in either direction (long or short).

This past weekend appears to have been sparked by (1) pre-FOMC risk aversion, and in our opinion, (2) spot sell pressure from miners.

Some examples of late-developing risk aversion from institutions:

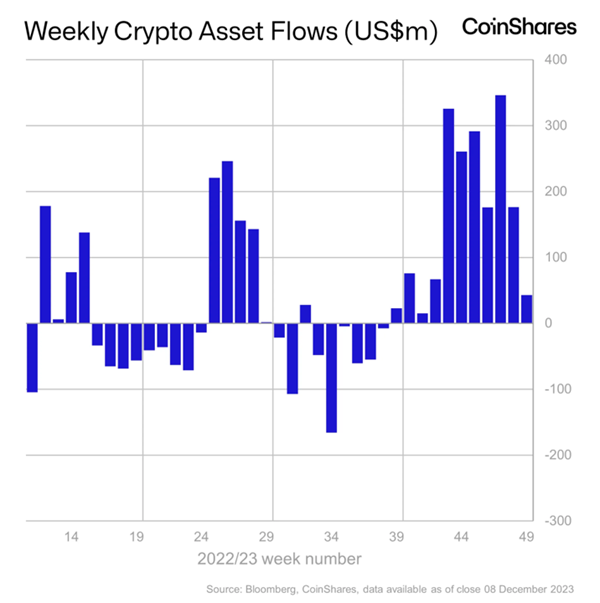

This week, it was revealed that there were continued inflows into crypto Exchange Traded Products (ETPs) for an eleventh consecutive week. However, these inflows were considerably lower than in preceding weeks. This same slowdown in momentum was not seen in the perps market over the weekend.

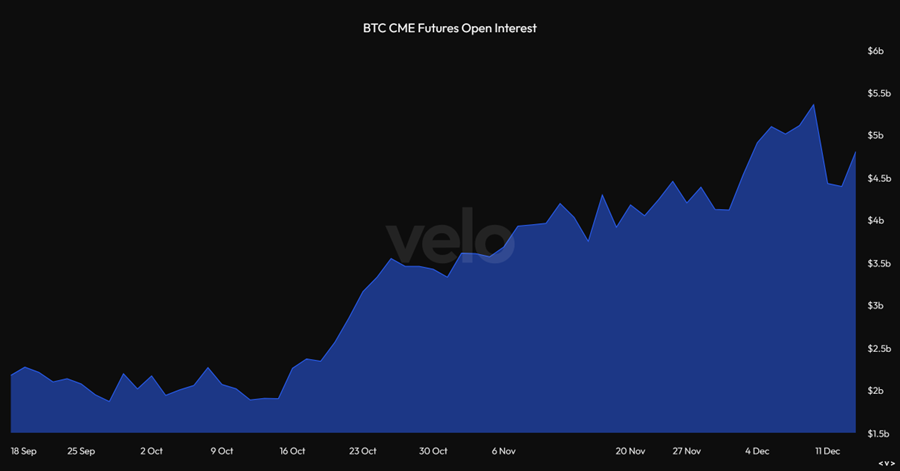

Further, there was a decently sized pullback in open interest on the CME on Monday. This trend suggests that some institutional investors engaged in the BTC trade took profits on Friday. To be fair, this pullback could be attributed to either the costs associated with rolling over futures positions or a general increase in risk aversion ahead of the FOMC meeting.

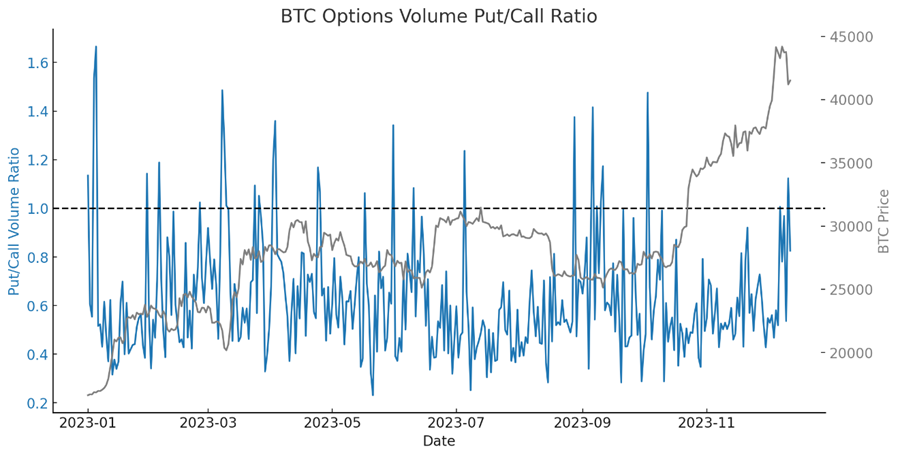

Additionally, the Bitcoin put/call ratio had seen a notable spike in recent days. Such an increase typically indicates a rise in protective or bearish sentiment among traders.

In summary, while these market developments did not signify a structural shift in the crypto market, they were signs of an acute sense of trepidation among investors and traders that grew rapidly ahead of the FOMC meeting.

Miners Shoring up Their Balance Sheets

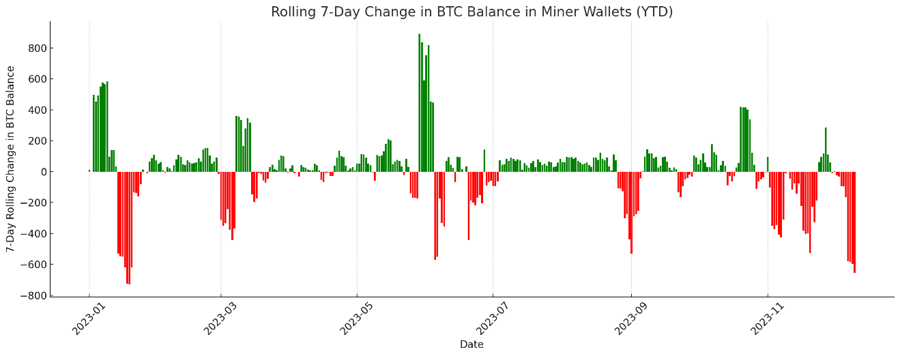

As mentioned above, we think the effect of acute pre-FOMC risk aversion was exacerbated by unusually elevated selling pressure from miners.

Recent data tracking the rolling change in BTC balances in miner wallets clearly shows an increased appetite among miners to capitalize on the recent price surge to liquidate some of their holdings. This move marks a significant shift in strategy compared to past bull markets, where many miners did not effectively leverage such opportunities for cash raising.

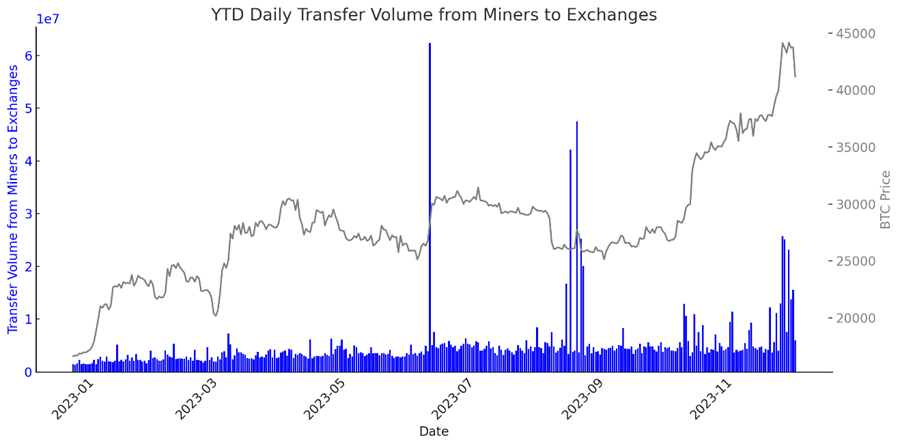

Further evidence of this trend can be seen in the substantial amounts of Bitcoin being transferred from miners to exchanges in the past few weeks. This mass movement of coins reflects a notable selling pressure being exerted by miners on the market over the past few weeks.

The logic behind this strategy becomes more apparent when considering the upcoming halving event. With the cost to mine a single Bitcoin expected to double post-halving, it is a strategic move for miners to offload some of their Bitcoin holdings now. This decision, while financially prudent for the miners, adds a layer of complexity to the market dynamics, potentially impacting market liquidity and prices.

The market was accepting this added supply pressure with ease until Sunday night. Jumping ahead, we think that post-FOMC, the market will resume accepting any added supply with ease.

Ordinals Remains a Windfall for Miners

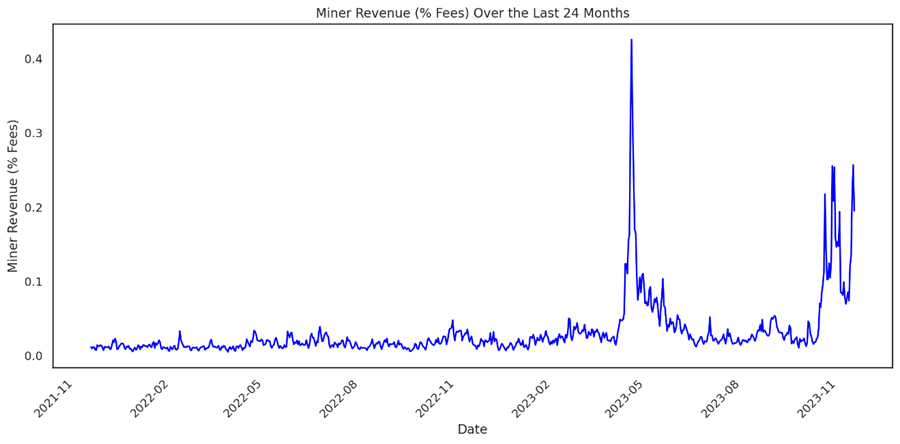

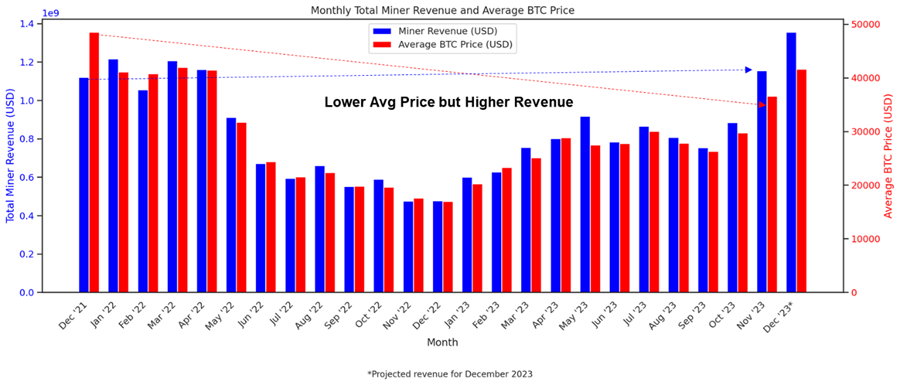

Despite concerns about the rising hash rate, an impending halving, and the implications for Bitcoin miners, the overall industry’s top-line growth has been impressively consistent and robust relative to spot BTC prices.

A key factor in this growth is the increasing popularity of inscriptions, from which miners are notably benefiting. Inscriptions involve embedding additional data, such as images, text, or other digital media, onto a specific sat. Once this data is added, it becomes a permanent fixture of the Bitcoin blockchain.

Growing demand for inscriptions has led to an increase in the average block size, consequently driving up transaction fees, which directly benefits miners. Since the start of November, a significant portion of miner revenue, often above 10%, has been attributable to these fees.

This has resulted in substantial earnings for miners, surpassing what they would typically earn at similar Bitcoin price levels.

The importance of this revenue stream is underscored by miners increasingly mentioning Ordinals in their press releases.

The combination of this new revenue source and persistently subdued energy prices is poised to provide a sustained tailwind for miners in the coming months.

Fed Pivot as a Shot in the Arm for Crypto

Heading into the new year, the crypto market is buoyed by several bullish indicators. There is strong anticipation for the probable approval of a spot ETF scheduled for January 8-10. Additionally, the forthcoming Bitcoin halving, expected a few months post-ETF approval, is poised to positively influence the market. Concurrently, global liquidity, which appears to have reached its lowest point, is now trending upwards (in our view, this should continue).

This already optimistic outlook received an extra boost with the Federal Reserve’s apparent pivot on Wednesday.

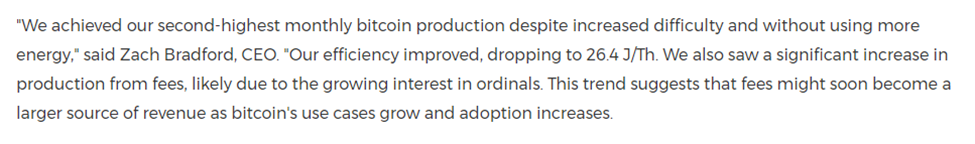

The Fed’s revised economic projections revealed plans for an additional three rate cuts in the next year, bringing the central bank closer to market expectations. This quarter’s SEP coupled with Fed Chair Jay Powell’s dovish press conference, where he effectively declared victory over inflation, served as a boost for risk assets and reversed much of the trepidation discussed above.

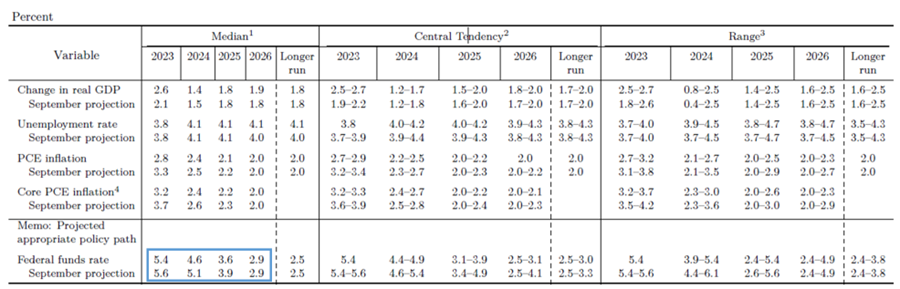

Following the FOMC presser, the Dollar Index (DXY) took a steep dive, with the 10-year Treasury yield falling below 4% for the first time since August.

This decline in the USD, along with continued economic stimulus from China and Japan, has led to a continued increase in global liquidity, as seen in the combination of Fed Net liquidity and the total assets on the balance sheets of the BOJ, ECB, and PBOC.

Despite Bitcoin’s day-to-day correlation with macro factors being minimal, the expansion in global liquidity remains, in our view, a vital tailwind for crypto.

Bitcoin, regarded as a hedge against monetary debasement, is expected to maintain a longer-term positive relationship with global liquidity. Therefore, the Fed’s recent pivot, on top of the already favorable market conditions, further reinforces the bullish sentiment for the crypto market as we approach the new year.

Bullish Sentiment Returning in Derivatives Markets

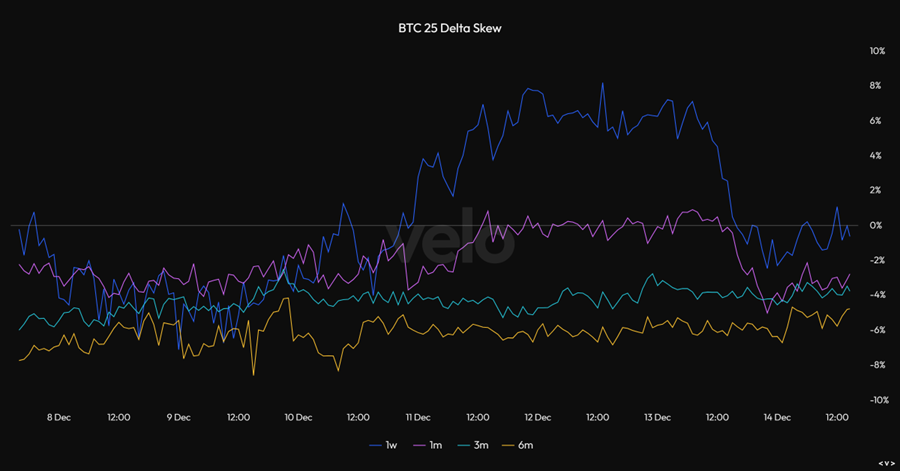

The fleeting risk aversion ahead of the FOMC has already dissipated, as demonstrated by sudden shifts in the derivatives market.

Earlier in the week, the cost of call options for both 1-week and 1-month expiries had dipped below that of puts, signaling a rise in risk aversion as investors braced for the FOMC’s decisions.

However, following the FOMC announcements, this sentiment has swiftly reversed. The 25 delta skew for both 1-week and 1-month timeframes has turned negative again. This change indicates that demand for call options, which are bets on rising prices, now exceeds that for puts. Such a shift points to a resurgence of bullish sentiment in the market.

Additionally, we observed a quick rebound in CME open interest, which recorded a $400 million increase on Wednesday, coinciding with the dovish FOMC press conference.

This increase suggests that institutional investors, who may have previously taken profits due to rising roll costs or general risk aversion, are re-entering the market. This renewed interest from institutional players further underscores the positive shift in market sentiment post-FOMC, hinting at a more optimistic outlook for the crypto market in the short term.

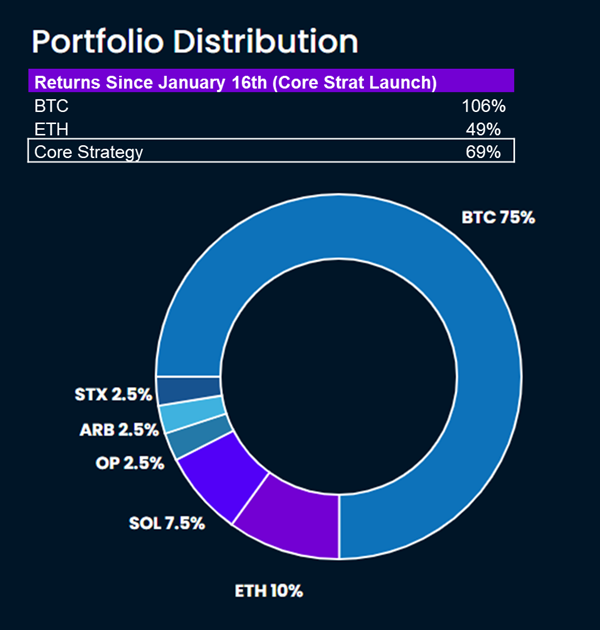

Core Strategy

Given strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the impending halving, we believe that now is an opportune time to be fully allocated in the market. As evidenced by the market’s rebound, we do not view this week’s dip as a trend change, but rather a temporary dislocation between the perps and spot markets. In our view, risk asymmetries still skew to the upside.

A brief summary of the theses behind each component of the Core Strategy:

Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Spot ETF and bitcoin halving (indirect catalyst).

- Solana (SOL 0.54% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.07% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX -3.45% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

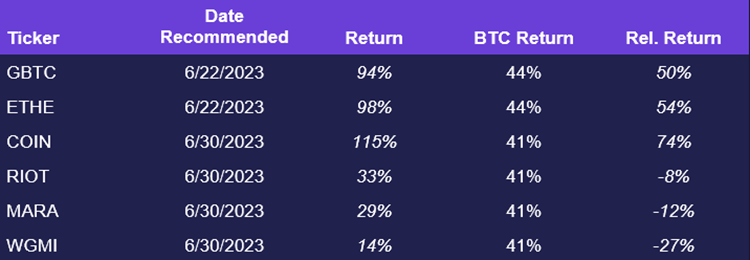

Crypto Equities

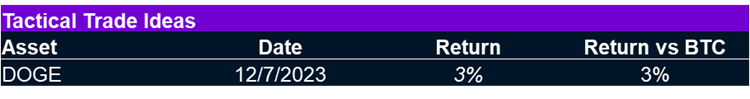

Trade Ideas

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.