Binance Enforcement Provides Dip-Buying Opportunity as Global Liquidity Continues to Improve

Key Takeaways

- Binance's settlement with the DOJ, involving a $4.3 billion fine and CEO Changpeng Zhao's guilty plea, significantly reduces a major market risk, in our view, potentially encouraging participation from entities previously deterred by Binance-related uncertainty. This outcome lays the groundwork for improved market stability and increased institutional interest in the crypto space. We view any Binance-related dips as buying opportunities.

- The combination of local stimulus from the PBOC and BOJ, along with the recent strength of the JPY, EUR, and CNY relative to the USD, has contributed to enhanced global liquidity, positively aligning with Bitcoin's 24-hour market performance and signaling a possible strong tailwind for crypto into the final month of the year.

- Javier Milei's win in the Argentina presidential election raises the possibility of another Latin American country adopting Bitcoin, potentially triggering a domino effect in the region with nations like El Salvador, and now possibly Argentina, setting a precedent. The opportunity for stablecoins to gain from this political shift is also significant. However, the impact of Milei's victory will depend on the translation of his rhetoric into actions.

- Core Strategy – Given the strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the development of a “Flight to Safety” narrative, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market.

Binance Risk Mitigated

One of the most significant idiosyncratic risks in the crypto market has been the uncertainty surrounding Binance and potential action from the Justice Department against the world’s leading exchange. Earlier this year, we anticipated that any disciplinary actions would likely involve criminal charges against Changpeng Zhao (CZ) and a fine against the exchange.

From our September note:

Today, these views were realized. CZ appeared in court to plead guilty to money laundering charges. He will retain majority ownership of the company but will step down as CEO. Additionally, Binance will plead guilty and pay a $4.3 billion fine, resolving the investigation into allegations of money laundering, bank fraud, and sanctions violations.

As previously noted, this development could cause short-term price weakness. However, it mitigates a longstanding perceived risk in the industry. Many potential market participants have been hesitant to engage in crypto due to uncertainties surrounding Binance and its significant industry influence. Moreover, the Department of Justice has emphasized that the agreement is structured to avoid harming Binance’s customers and the broader crypto market, maintaining operational stability. This is the optimal outcome of this investigation.

This situation likely leads to increased transparency from Binance and greater cooperation with US authorities. This could even be viewed as a tailwind for near-term ETF approval, as fears of market manipulation have declined.

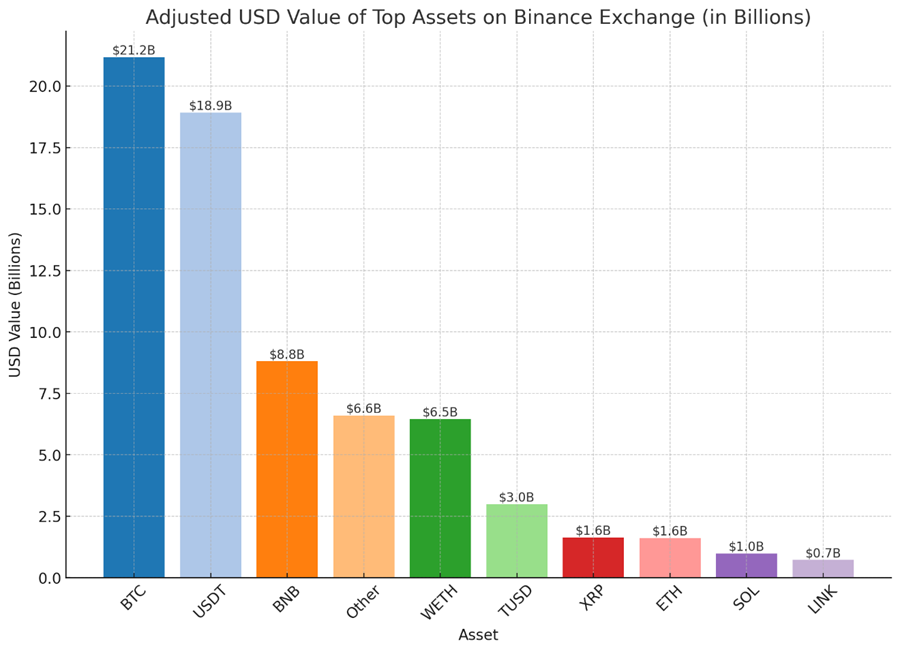

The major risk would be if Binance’s balance sheet is not robust or further investigation were to reveal misuse of customer funds. However, Binance’s longevity, significant market share, and profitable ventures, such as operating nodes for Binance Smart Chain, suggest a minimal risk of asset shortfall. Further, over the past year they have undergone attestations of their asset base. While this lacks the thorough review that would be involved in a full proof-of-reserves audit that matches assets and customer liabilities, this does provide us with some confidence.

Many altcoins, particularly longer tail assets sold off on the news that CZ would be stepping down. Below we see that BTC dropped slightly, but overall, we would say that the market is merely figuring out the implications of this development.

Our view is that any short-term weakness related to Binance should be viewed as a buying opportunity.

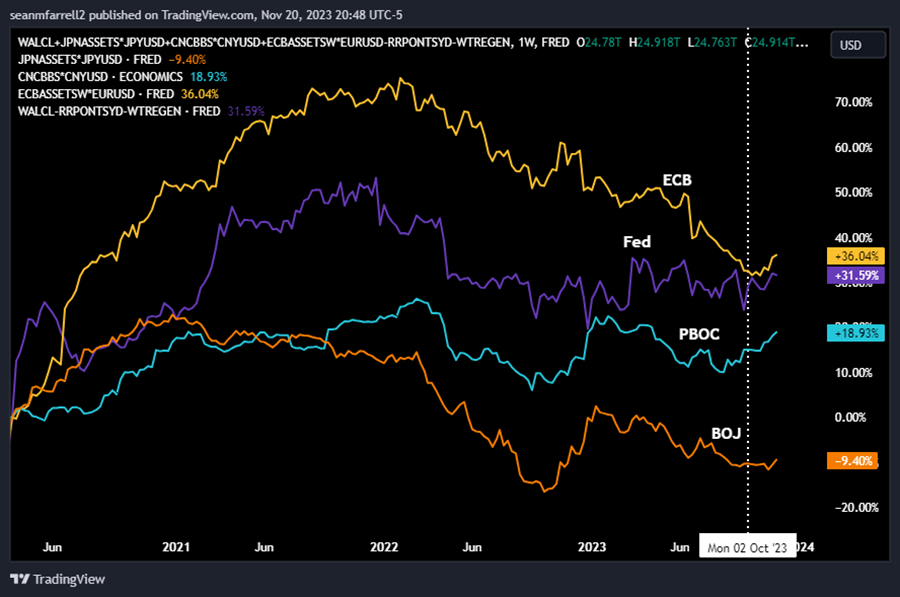

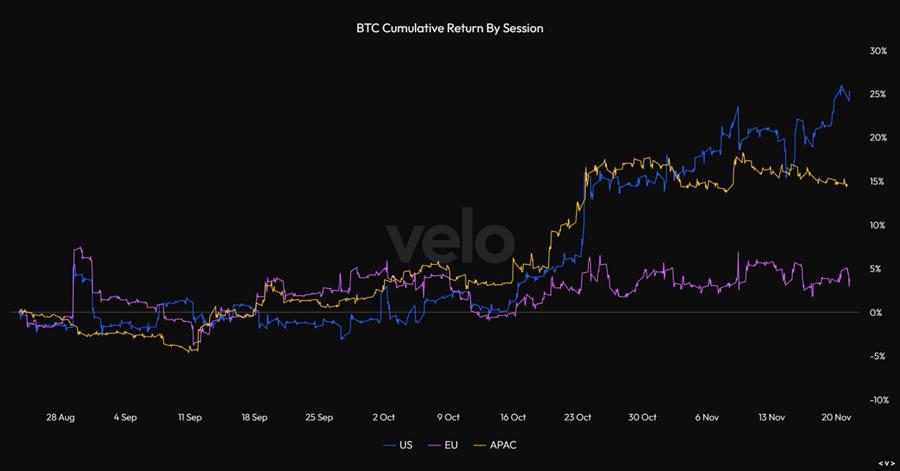

Broader Participation in Global Liquidity Increase

Recently, we noted improvements in domestic and global liquidity metrics, indicating a favorable environment for liquidity-sensitive assets like crypto. An updated chart of the aggregate balance sheet sizes (in USD terms) of the Fed, ECB, PBOC, and BOJ shows a considerable increase over the past month.

We have seen sizeable local stimulus from the PBOC and BOJ and are now finally benefiting from a strengthening EUR, CNY, and JPY relative to the USD.

This broader contribution to global liquidity syncs with the generally positive price performance for bitcoin over all major trading sessions. We think that this should serve as a key tailwind for crypto heading into the final month of the year.

Another Pro-Bitcoin President in Latam

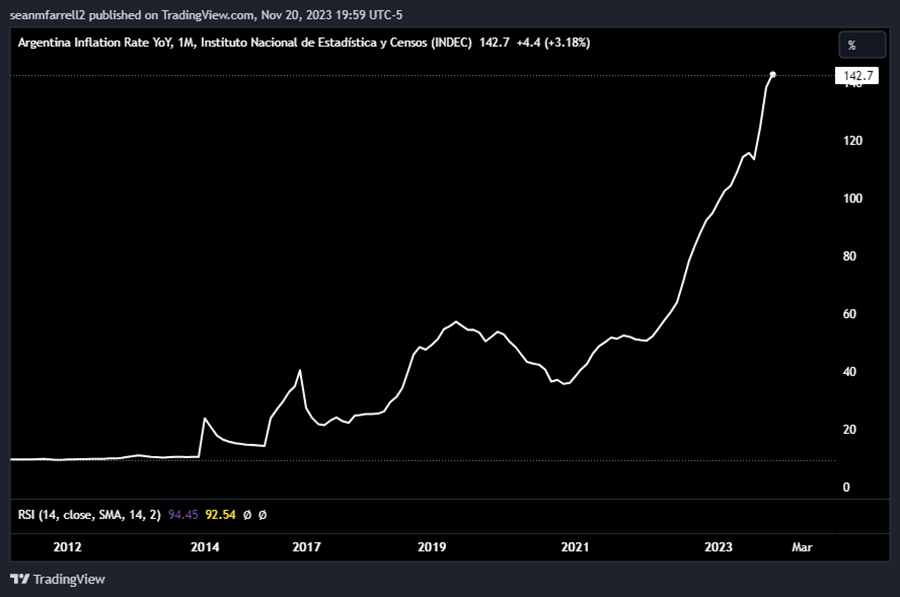

Bitcoin rallied on news of Javier Milei’s presidential election win in Argentina. Milei, a pro-bitcoin libertarian, has expressed strong support for Bitcoin as a concept, but has mostly advocated for the dollarization of Argentina’s economy, which faces triple-digit inflation and multiple debt defaults.

Milei’s victory with 55.7% of the vote against incumbent Sergio Massa’s 44.3% signals potential changes in Argentina’s fiscal and monetary policies. While Milei has not endorsed making bitcoin legal tender, his views toward central banks and monetary debasement suggest possible future adoption of BTC as a reserve asset or even legal tender. This could position Argentina as a leader in Latin America, potentially influencing other countries to follow suit.

Moreover, Milei’s victory could also be bullish for stablecoins and their associated networks. High inflation and limited access to foreign currencies in Latin America have driven natural adoption of USD stablecoins, particularly in Argentina. This trend may benefit networks like Tron and BSC, which are key platforms for stablecoin transactions in the region and could extend to networks like Solana or Layer 2 solutions such as Arbitrum or Optimism if they gain traction. Milei’s goal to dollarize Argentina could leverage existing dollar payment rails, including allowing Argentine banks to issue stablecoins on public networks. However, at this point it is important to note that this is all theoretical and the country’s mounting debts may influence the pace of these developments.

In summary, Milei’s victory increases the likelihood of another Latin American country adopting Bitcoin. This could create a snowball effect in the region, with countries like El Salvador and potentially Argentina setting a precedent. The potential for stablecoins to benefit from this political shift should not be understated. Nonetheless, Milei’s words must be followed by actions to effect real change.

Core Strategy

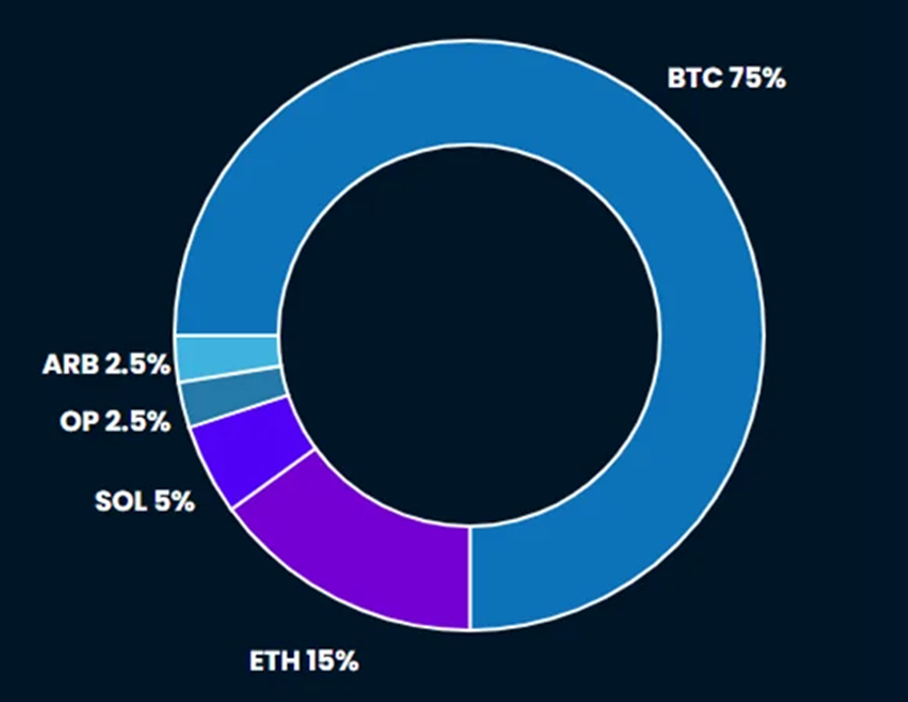

Given the strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the development of a “Flight to Safety” narrative, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL N/A% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP 10.24% ) & Arbitrum (ARB N/A% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities