Respecting the Pump

Key Takeaways

- The U.S. Treasury surprised the bond market with its intent to reduce long-term bond issuance, a move that may indirectly benefit BTC due to the resulting increase in market liquidity and the Treasury's public acknowledgment of a challenging fiscal outlook.

- Capital flows across centralized venues continue to exhibit bullish trends, as evidenced by sustained volumes on centralized exchanges, another YTD high in CME open interest, inflows into ETPs, and consistent USDT minting, collectively indicating that the shift in market liquidity observed last week is persisting.

- Although asset prices have risen and inflows have increased, on-chain activity has not experienced a corresponding surge. ETH fees remain below the peak levels earlier this year, Solana's transaction count continues to be subdued, and activity on Ethereum's Layer 2 networks is also relatively muted.

- We have reason to believe that on-chain activity could see a resurgence in the near-term. This potential rebound may be merely spurred by increased market volatility, which often attracts on-chain trading activity, but more likely will be catalyzed by the positive wealth creation effect stemming from Celestia's (TIA) recent airdrop.

- The successful launch of Celestia's mainnet, coupled with a substantial airdrop and similar airdrop initiatives by entities like Pyth and StarkNet this week, underscores the improved liquidity conditions prevailing in the market. The resurgence of airdrops from notable projects further suggests an ongoing shift in market sentiment.

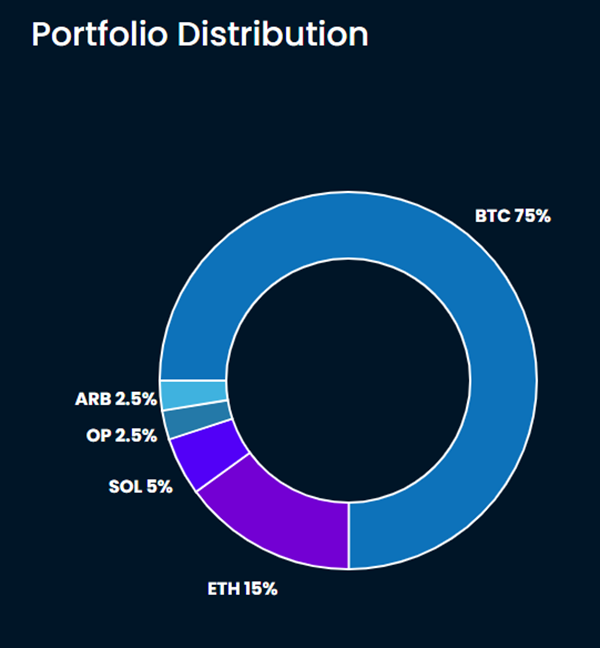

- Core Strategy – Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it's an opportune time to be fully deployed in the market. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC's dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

Treasury Refunding and Its Impact on Asset Prices

The bond market has been experiencing notable volatility, predominantly due to a phenomenon known as a bear steepening. This situation arises when short-term interest rates remain stable, but long-term rates rise precipitously. We attribute this volatility largely to an increase in the supply of long-duration assets, propelled by a growing budget deficit and the expectation of ongoing Treasury issuances.

While this bond market downturn has posed challenges for a variety of risk assets, crypto and gold have distinguished themselves by resisting this bearish trend.

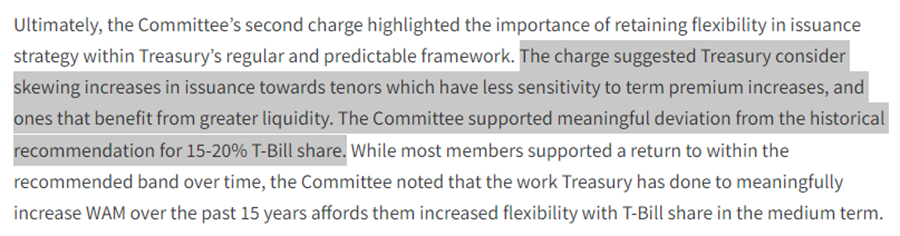

Just yesterday, the Treasury revealed its intention to borrow $776 billion in the forthcoming months. In a surprising admission, officials recognized that the issuance of long-duration assets has been a factor in the uptick of interest rates. Furthermore, they signaled a shift from their traditional practice, which typically sees a 15-20% allocation of Treasury issuances to short-dated bills. In a move aimed at enhancing market liquidity, they intend to scale back the issuance of long-term bonds relative to bills.

This policy change has relieved some of the downward pressure on the long end of the yield curve by supplying less duration than the bond market had priced in. With the Federal Reserve still on hold, this recalibrated issuance approach is also projected to accelerate the drawdown from the Reverse Repurchase Agreement (RRP) facility, redirecting funds into the banking system. Such a move is expected to strengthen the volume and quality of collateral within the financial system, potentially lifting asset prices.

This pivot was immediately reflected in the market, with a notable decrease in the 30-year rate.

We also saw a decent pullback in the DXY over the last day.

Furthermore, the Treasury’s candidness about fiscal challenges underscores conditions in which Bitcoin was designed to excel. Assuming other variables remain constant, these developments should be advantageous for Bitcoin.

Flows Picture Remains (Relatively) Constructive

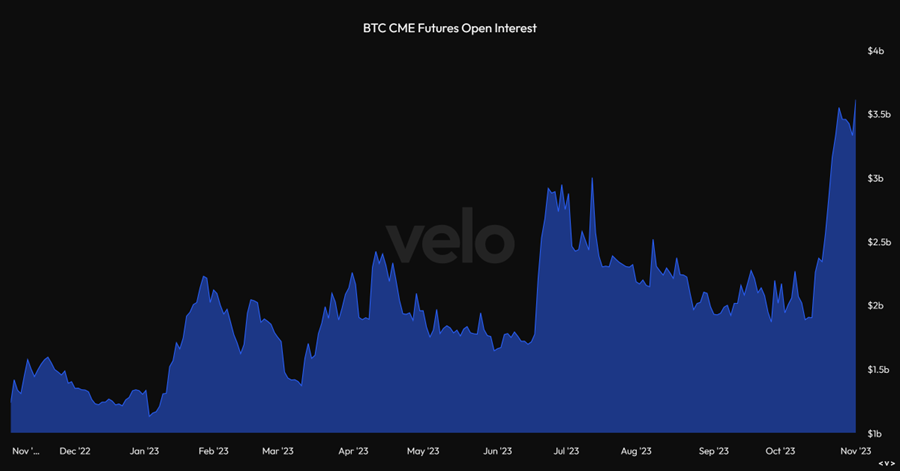

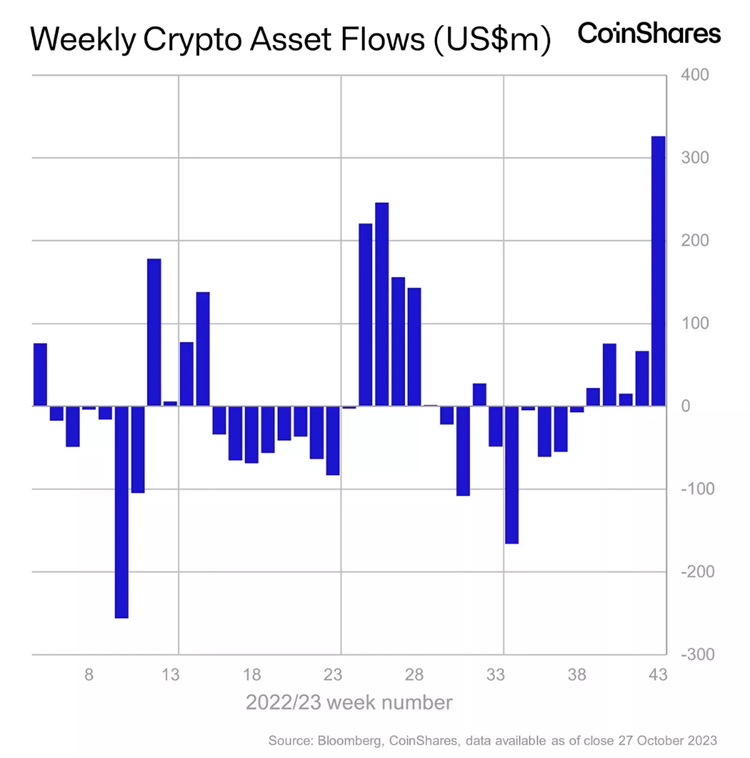

Observing capital flows remains essential in assessing the sustainability of any market rally. Echoing our previous week’s analysis, there’s been a notable shift of capital into centralized venues in crypto. This positive trend has been maintained into the current week. A key highlight is the CME futures open interest, which has reached a new annual peak in USD terms but also an all-time high in BTC terms.

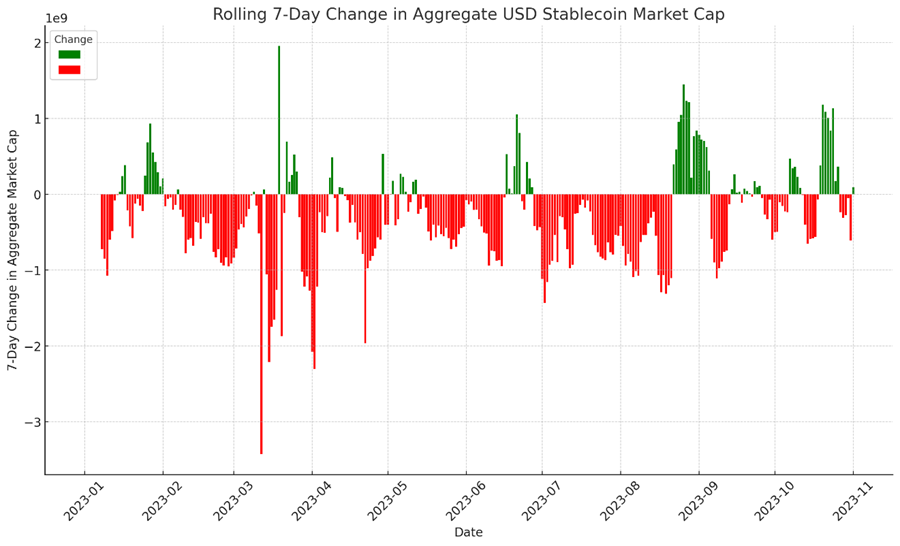

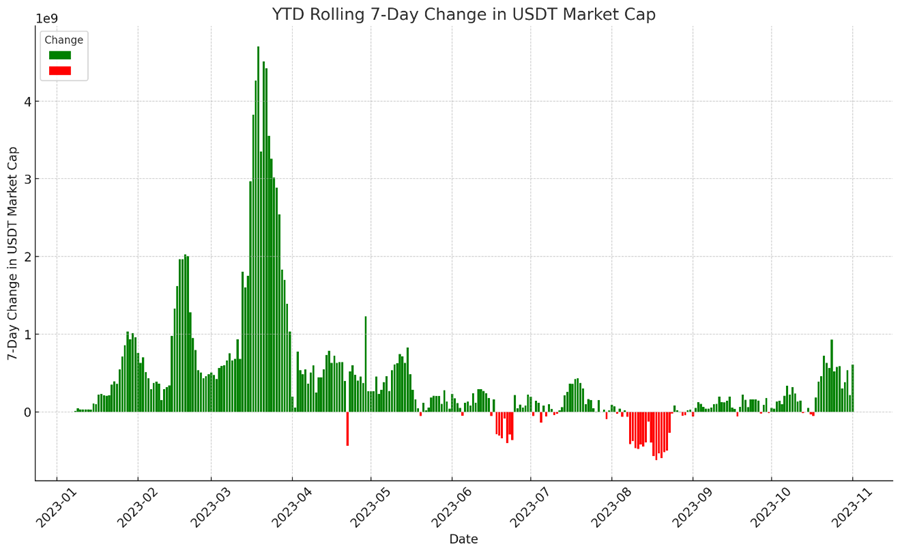

Despite a minor dip in stablecoin inflows, the aggregate market cap for USD stablecoins is still higher than it was a week ago. This is a critical sign that investors are not exiting the crypto market in large numbers, a departure from the trend seen after previous rallies earlier in the year.

The minting of USDT, a staple among institutional traders, remains steady. After a significant increase earlier in the year—spurred by the banking sector’s turmoil and increased regulatory scrutiny over crypto-related banking services—there was a noticeable switch from USDC to USDT. We view the current minting pattern as driven by actual demand, not regulatory shifts.

Furthermore, crypto ETPs are experiencing noteworthy inflows for the fifth consecutive week, indicating that retail interest in crypto continues to rekindle.

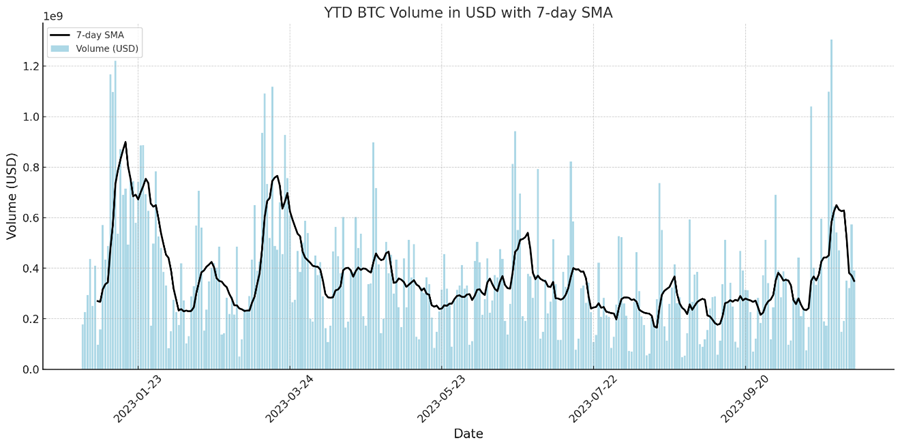

Regarding centralized exchange (CEX) volumes, they remain high compared to previous months. While the first few days of this week saw a decrease from last week’s volumes, it’s premature to conclude that there’s a definitive downtrend in spot trading activity.

Lack of Follow-Through On-Chain (As of Now)

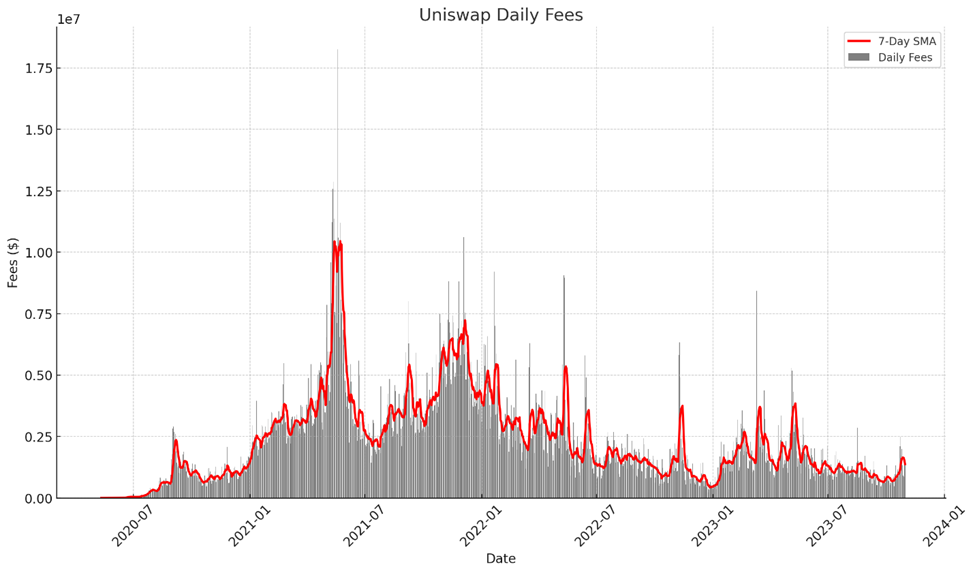

As we scrutinize the breadth of the market’s performance, our attention turns to on-chain activity which, to date, has remained less robust than we would like to see during a broad market rally. Despite the significant increase in asset prices, there hasn’t been a proportional uptick in on-chain activity.

We can see below that fees on Uniswap have started to climb but are still well below YTD highs.

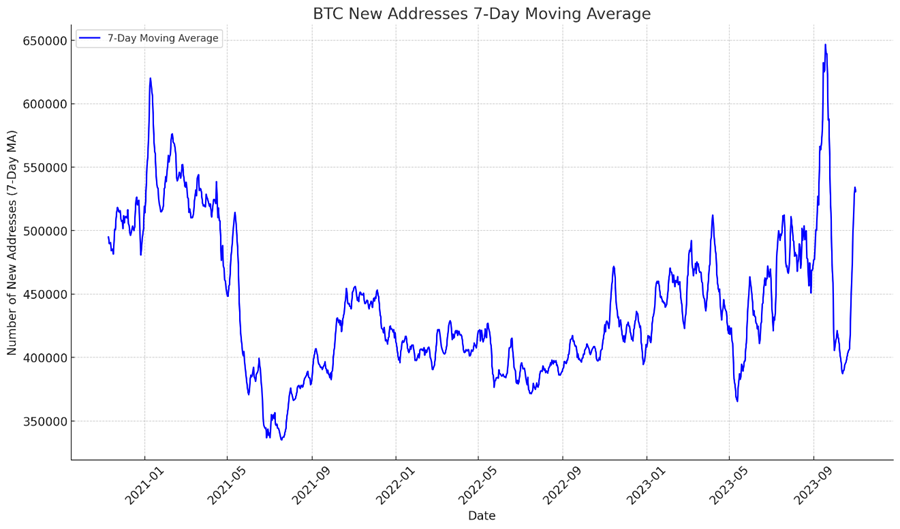

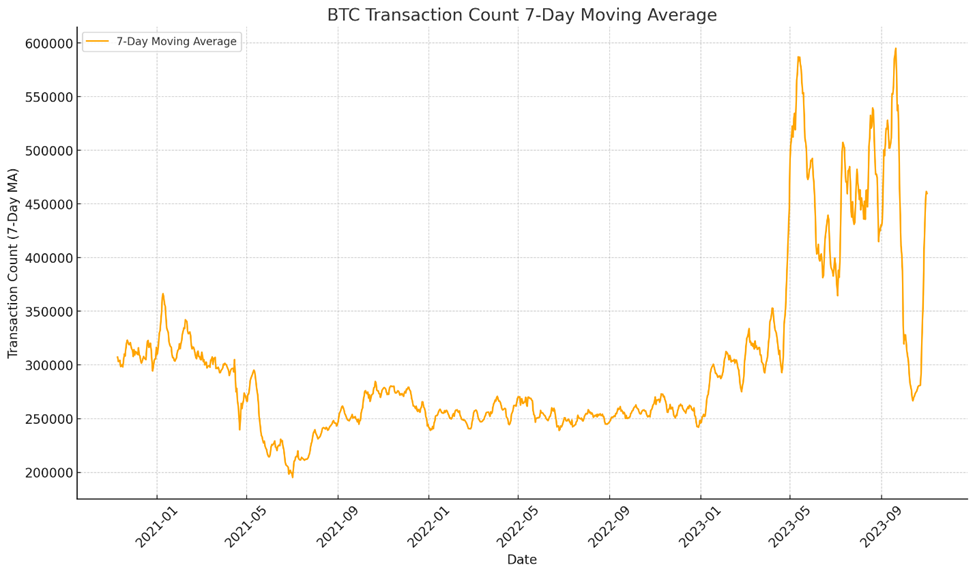

On a positive note, the Bitcoin network has experienced a growth in wallet creation and overall activity. Metrics such as new and active addresses, as well as transaction count, have shown a consistent upward trend from the beginning of the year. However, much of this is largely attributable to the innovative developments surrounding ordinals, which have sparked interest and utility on the network.

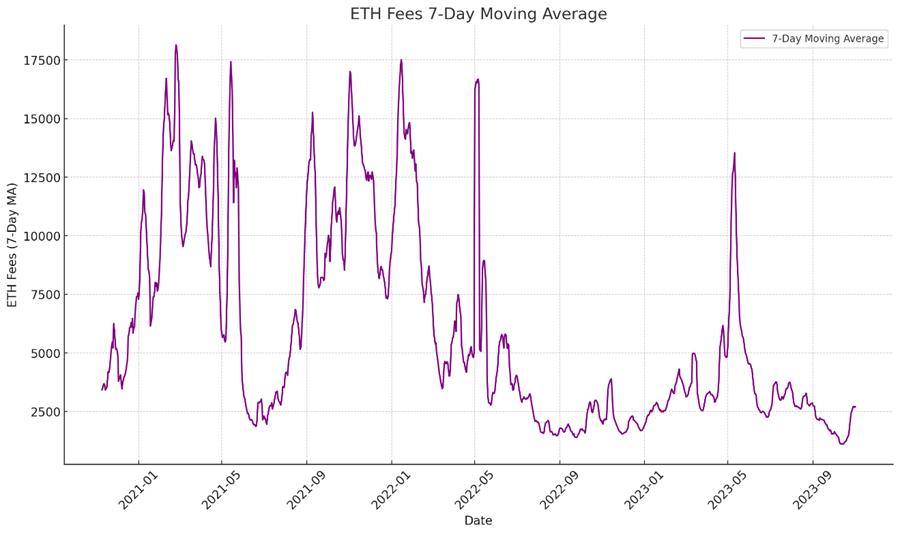

While fees on Ethereum have been climbing, they remain notably below the levels typically expected in a roaring market. On-chain activity is important because it is a critical source of demand for any chain’s native assets. Typically, higher on-chain activity is indicative of a rally gaining breadth and traction. However, the current fee market suggests that this anticipated expansion is not yet materializing.

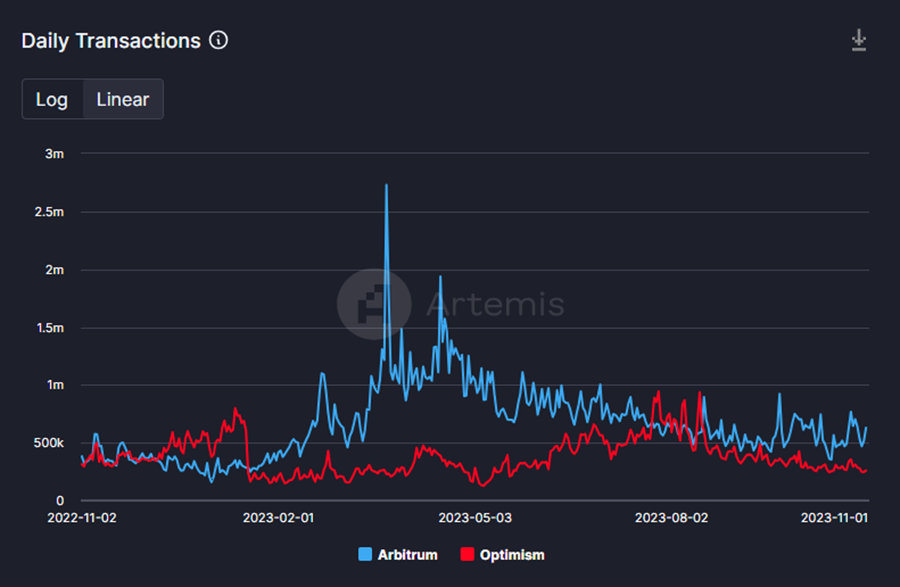

In a similar vein, activity on Ethereum’s Layer 2 networks—which are designed to enhance scalability and reduce costs—has not seen the uptick that one would expect in a speculative market environment.

Solana, the outstanding performer of the past couple of weeks, is also experiencing a lack of activity on-chain.

Reasons for Optimism Despite Slow On-Chain Activity

While the current lag in on-chain activity may raise concerns, particularly for altcoin market participants, there are compelling reasons to maintain a patient outlook and anticipate an uptick soon.

First, market volatility often precedes and catalyzes on-chain engagement, with trading as one of the primary use cases for blockchain applications. As BTC and ETH begin to exhibit increased volatility, we expect speculative capital to be drawn into the on-chain space for trading opportunities, leading to an increase in transactions and fees.

The second, and perhaps more substantial, reason for optimism is the resurgence of airdrops as a popular method for token distribution. This strategy, which places newly issued tokens directly into the hands of users, is not only an incentive for participation but also a strong signal of project confidence.

The fact that prominent projects are once again initiating airdrops suggests a positive sentiment regarding market conditions.

This week, we observed a significant airdrop from Celestia (TIA), which coincided with the launch of its mainnet, marking it as the first public modular data availability network. The airdrop allocated 6% of TIA’s total circulating supply. The Celestia airdrop alone has injected approximately $140 million of on-chain value, particularly targeting users within the Cosmos (ATOM) and Ethereum (ETH) Layer 2 ecosystems.

Such strategic distributions are poised to generate a ‘wealth effect’ that, alongside the previously mentioned capital inflows, is likely to spur on-chain activity and investment in related assets. With the expectation that TIA tokens will soon bridge to EVM-compatible environments, a new wave of on-chain interest is anticipated.

The collective move by Celestia, Pyth, StarkNet, and Jupiter Exchange to launch or announce airdrops underlines a shared constructive outlook on the market. It’s an indicator that these projects are confident enough to engage the public with new tokens, a move usually avoided in bearish and illiquid conditions.

Core Strategy

Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it’s an opportune time to be fully deployed in the market. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC’s dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC 5.22% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH 7.34% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.08% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

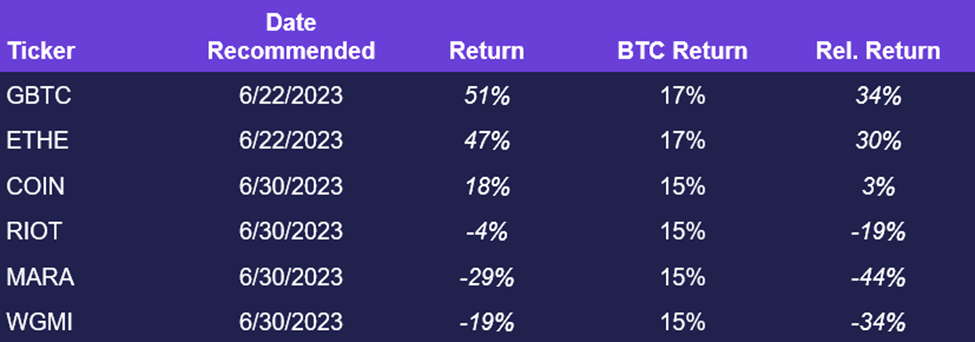

Crypto Equities