Remaining Tactically Cautious

Key Takeaways

- Fed Chair Powell's decision to keep interest rates unchanged while unveiling a hawkish-leaning dot plot led to negative market reactions, pushing the U.S. 10-Year Treasury yield to 4.5% and creating headwinds for crypto, even as the Fed's own projections suggest a softer economic landing.

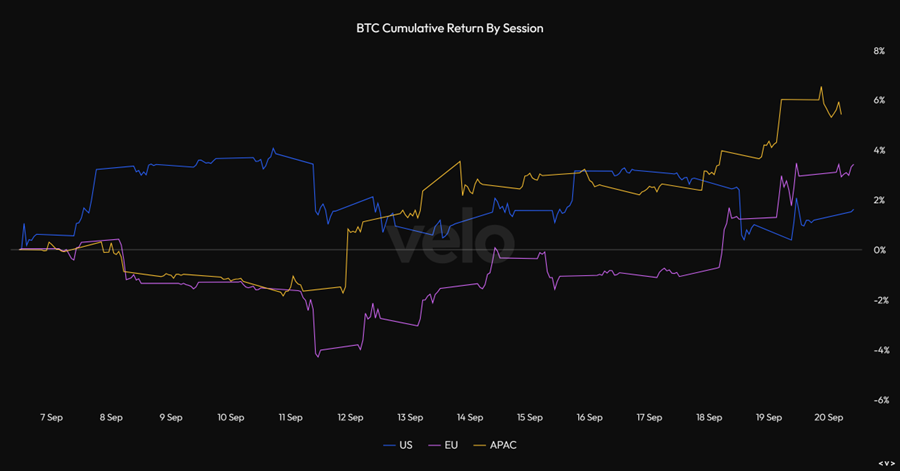

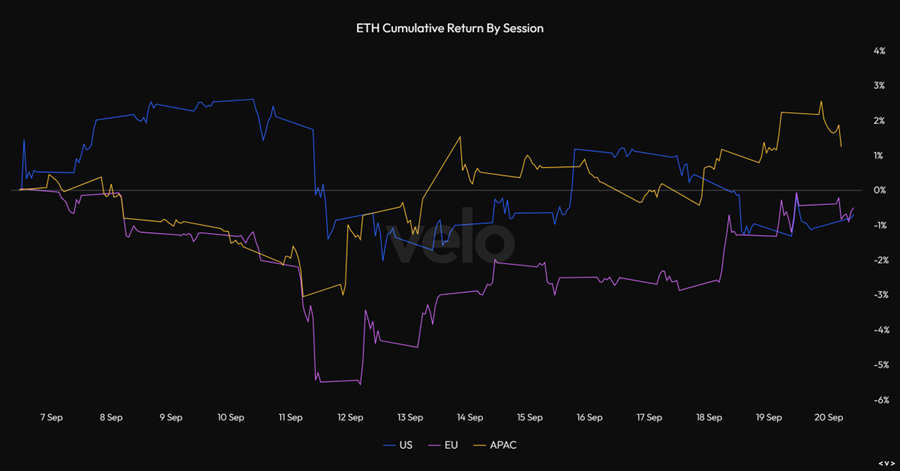

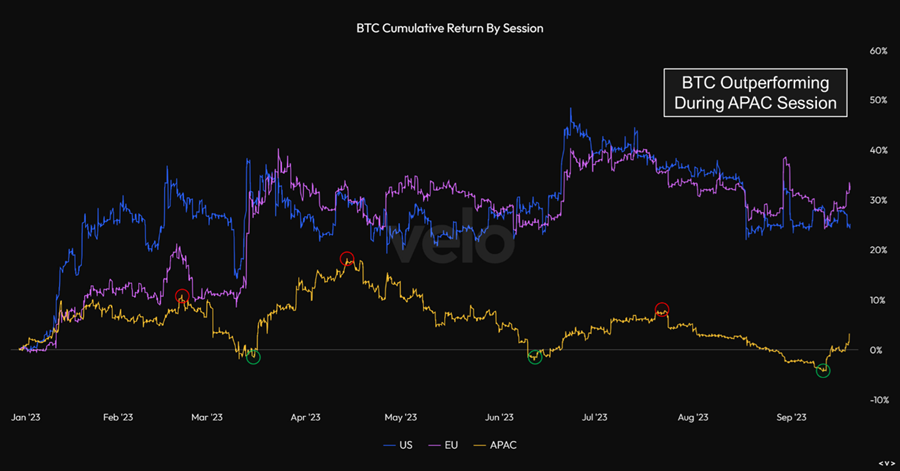

- This week's emerging trend of cryptoassets outperforming during APAC trading hours and weakening during U.S. hours contrasts with earlier underperformance in the APAC session, spurring theories from Chinese economic stimulus to capital flight, and coincides with increased altcoin activity.

- The recent Eclipse mainnet announcement, leveraging both Solana and Ethereum, is likely to expand developer options and enhance both ecosystems, countering skeptics who fear it may undermine Solana.

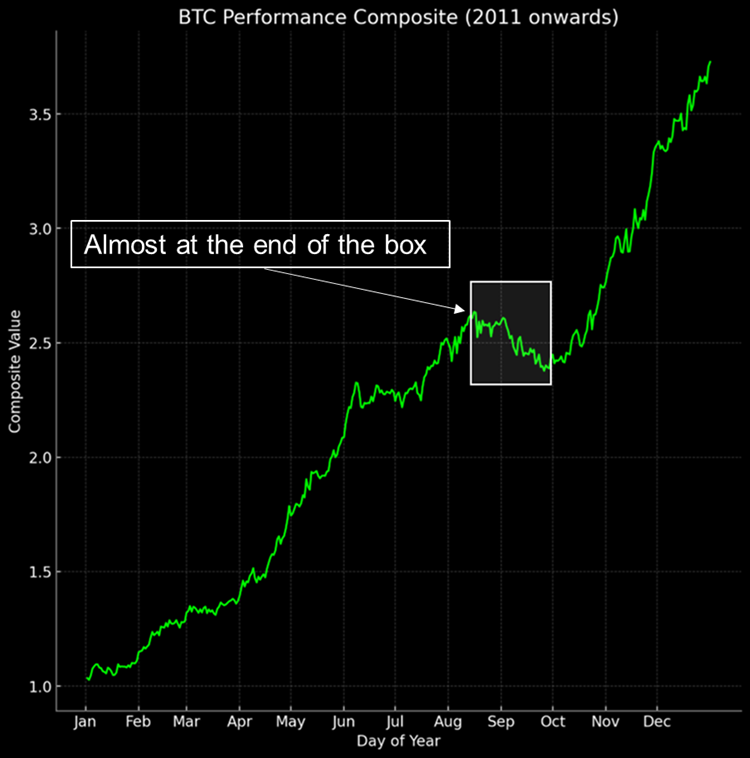

- Core Strategy – Despite initial hopes of overcoming the typically negative September seasonality in the crypto market, this year seems to be following the trend, with a continued rise in rates and DXY strength, leading us to recommend reduced exposure to altcoins and more cautious risk management in the coming weeks.

Rates Surge on Higher for Longer

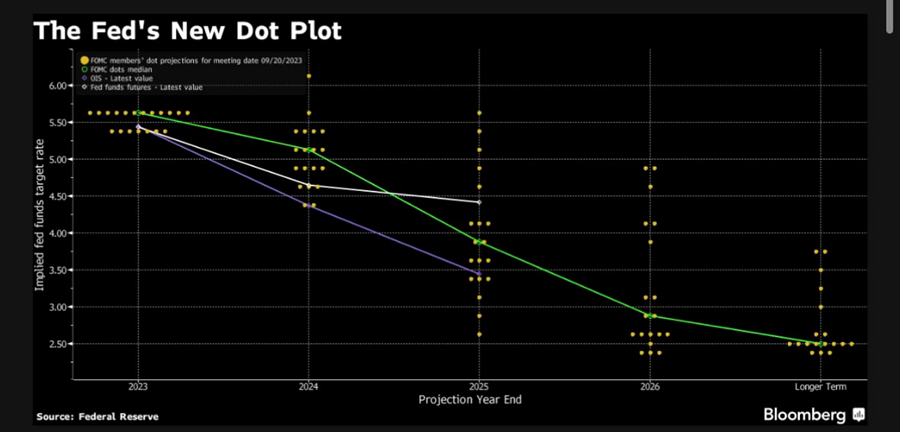

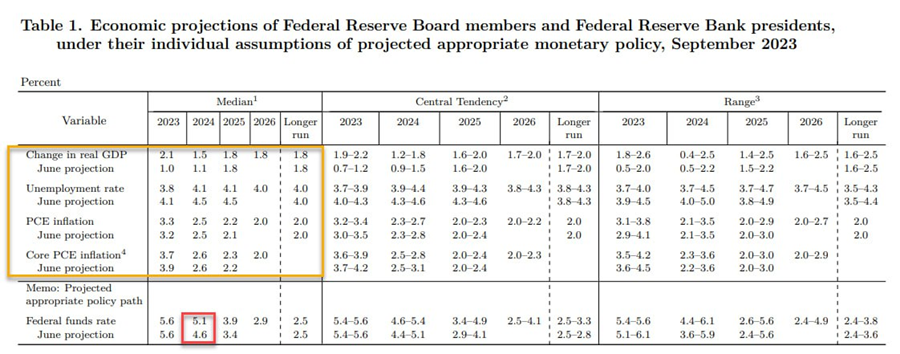

As expected, Fed Chair Powell took to the podium yesterday and kept interest rates unchanged. Concurrently, he unveiled the Fed’s new dot plot, which forecasts one more rate hike for this year but two fewer cuts for the next year. This was perceived as more hawkish than anticipated by both traditional and crypto markets.

The dot plot and Powell’s rhetoric collectively signal a ‘higher for longer’ monetary stance. However, a closer look at the Fed’s economic projections reveals that the Federal Reserve Board anticipates a relatively soft landing. They forecast higher GDP, lower unemployment, and kept PCE inflation at 2.5%.

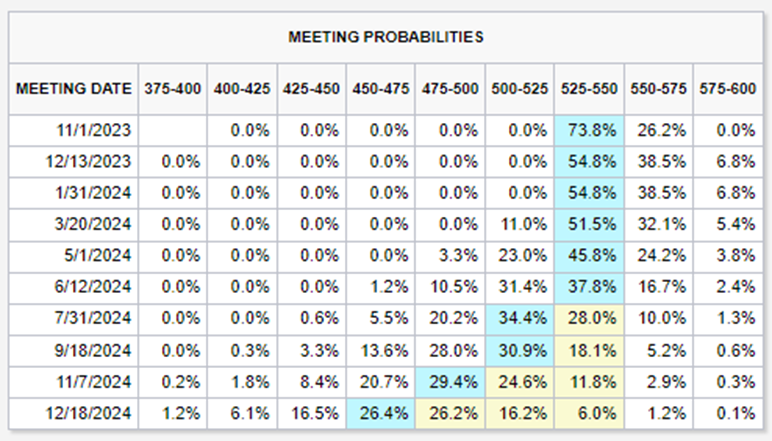

The apparent discrepancy between Powell’s comments and the Federal Reserve’s projections could be the reason why the Fed fund futures market has yet to fully price in an additional rate hike for this year. Additionally, the market is still projecting a year-end rate that is 25 basis points below what the dot plot suggests.

Whether or not the Federal Reserve’s forward-looking statements are to be trusted, the market reaction to the press conference was decidedly negative. Asset prices declined, a trend that persisted into today, as interest rates surged to multi-decade highs. Specifically, the yield on the U.S. 10-Year Treasury bond reached 4.5%, marking its highest level since the Global Financial Crisis (GFC).

This coincides with a period where foreign central banks are selling duration to bolster their domestic currencies, coupled with the U.S. Treasury issuing new coupon bonds. It’s essentially a perfect storm for driving interest rates higher.

The DXY obviously caught a bid in the process as well, a reliable headwind for cryptoassets.

The stakes for upcoming inflation data have undoubtedly risen, particularly given the recent surge in gas prices. This increase has psychologically impacted the public, possibly explaining why Fed Chair Jay Powell adopted a decidedly hawkish tone in his recent communications.

As a side note, for those who are overly concerned about the Federal Reserve’s projections, historical precedent may offer some comfort. Just two years ago, when the Consumer Price Index (CPI) was already exceeding 5%, the Fed was forecasting rate hikes to reach only 1% by the end of 2023. We certainly know how that has played out.

APAC Outperformance

This week, we noticed an interesting trend emerge – cryptoassets have been outperforming during Asia-Pacific (APAC) trading hours and weakening during U.S. market hours. Given its recent emergence, it’s too soon to say whether this pattern will persist or prove to be a fleeting anomaly, but it’s worth noting.

It is particularly noteworthy because on the whole, crypto has significantly underperformed during the APAC session this year.

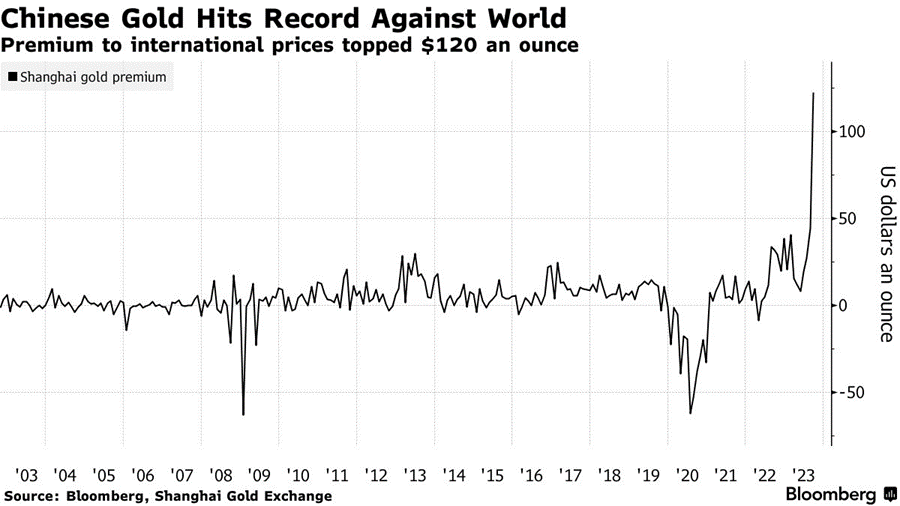

Several theories aim to explain this short-lived phenomenon. One posits that it could be tied to Asian countries responding to Chinese economic stimulus, although this is unlikely since there’s been no corresponding movement in Chinese stocks. Another more plausible theory is capital flight from China, supported by the fact that gold premiums in the country are outpacing those elsewhere. This could indicate that local investors are moving capital into globally transferrable assets like crypto.

While these explanations are speculative, they merit closer examination. This pattern has coincided with a surge in altcoin activity, potentially influenced by APAC investors who are less constrained by U.S. regulations and have a higher proclivity for such assets.

Remaining Cautious

Given the current trajectory of interest rates, the lack of observable catalysts for the CNY or JPY, the expected absence of crypto-specific catalysts in the immediate term, and the historically negative seasonality observed in September, we believe it’s prudent to adopt a cautious approach to risk management and altcoin exposure in the near term. This perspective is reflected in our Core Strategy.

The good news?

We are nearly through the seasonally worst period for crypto, with just a little over a week remaining before the end of the month. Looking ahead, the outlook becomes more optimistic: potential catalysts are likely to reappear as we enter October. Early in the month, we expect an ETH ETF to come to market, possibly followed shortly thereafter by the highly anticipated spot BTC ETF.

SVM as a Legitimizing Force

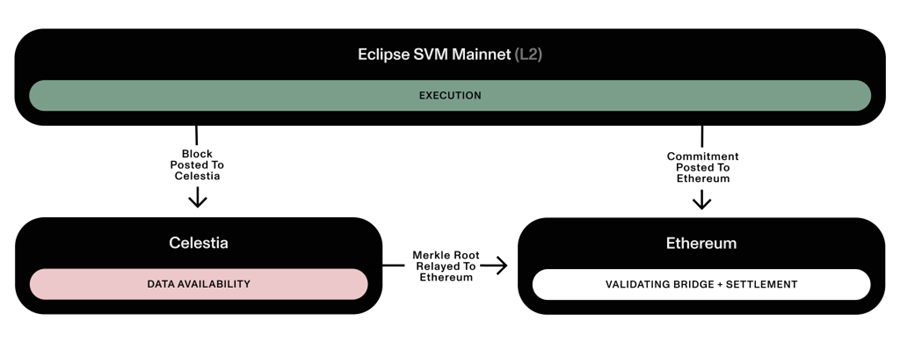

An intriguing development unfolded this week that has captured the crypto community’s attention. Eclipse, an Ethereum Layer 2 network, announced its mainnet architecture. Utilizing the Solana Virtual Machine (SVM) for execution and Ethereum for settlement, Eclipse is an ambitious project with other noteworthy architectural elements like Celestia for data availability and RISC zero for fraud proofs.

However, for the purpose of this note, our focus is on the interplay between Solana and Ethereum and what this means for both ecosystems moving forward. For a more detailed breakdown of the Eclipse architecture, we recommend their recent post.

(Spoiler: Its a win for both Solana and Ethereum)

Eclipse aims to offer a development environment that replicates Solana’s mainnet, promising similar throughput speeds and development languages, along with reportedly low block space costs. Additionally, Eclipse will leverage Ethereum’s stronger security and censorship resistance, as all Layer 2 data will ultimately settle on the Ethereum mainnet. Essentially, Eclipse seeks to marry Ethereum’s robust, modular architecture with Solana’s speed and efficiency, creating a best-of-both-worlds scenario.

Some Ethereum proponents claim this development spells doom for Solana, arguing that Eclipse will divert both developers and users from Solana’s ecosystem. We disagree. If anything, Eclipse could serve as a catalyst for increasing the pool of Solana developers. For those on the fence about which platform to develop on, the SVM offers the flexibility to operate on both Solana and Ethereum.

Moreover, this development doesn’t necessarily negate Solana’s unique selling points, such as its aspiration for a monolithic chain with lightning-fast global state updates. Eclipse’s Layer 2 approach can’t match Solana’s finality speed, as it still relies on Ethereum’s Layer 1 for final settlement. Additionally, Eclipse’s potential higher data fees, courtesy of Celestia, could still make Solana a more economically appealing option. We view this development as a positive for Ethereum, as the integration of more virtual machines like the SVM expands its ecosystem. Meanwhile, the rise of the SVM also enhances interoperability among developers and lends further credibility to Solana. Far from cannibalizing Solana’s user base, we believe this move could mutually benefit both platforms and serve as a legitimizing force for Solana in the crypto space.

Core Strategy

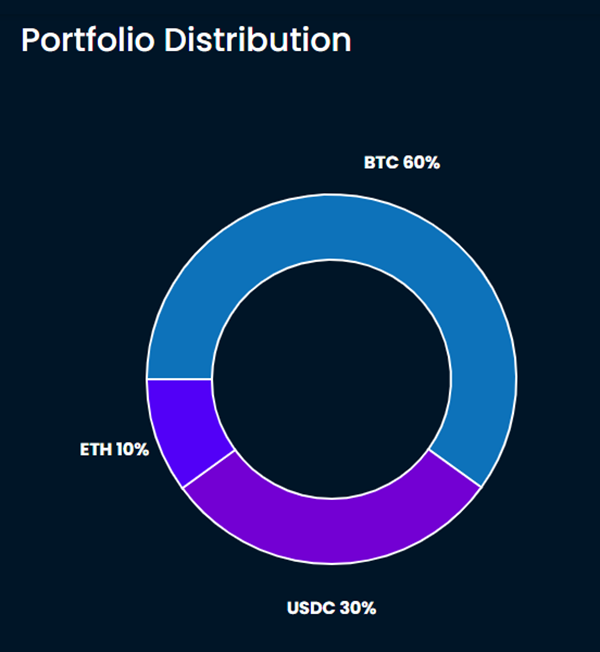

Despite initial hopes of overcoming the typically negative September seasonality in the crypto market, this year seems to be following the trend, with a continued rise in rates and DXY strength, leading us to recommend reduced exposure to altcoins and more cautious risk management in the coming weeks.

Additionally, we recognize that providing a brief summary of our rationale for each component of the Core Strategy could be beneficial. We will include these summaries in our future strategy notes. You may also notice that our allocation has removed some or all of the names listed below. We want to emphasize that we still favor these names in the medium to long term and are likely to revisit them.

- Bitcoin (BTC 5.22% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption (Argentina).

- Ethereum (ETH 7.34% ) Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Rocket Pool (RPL): An ETH liquid staking provider who we think stands to benefit from: (1) an increase in total % of ETH staked over time, (2) a relative increase in liquid staking relative to the overall amount of ETH staked, and (3) being the only (for now) LSD token with utility beyond governance. We think that over time, the token should outperform if Rocket Pool is able to gain even a semblance of market share on Lido. Key Catalyst: Protocol upgrade slated for Q4.

- Optimism (OP) & Arbitrum (ARB 0.08% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

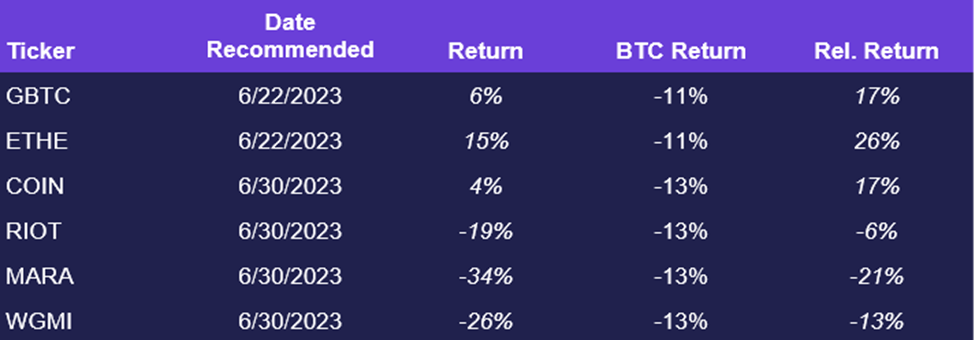

Crypto Equities

In line with our tactical caution in recent weeks, we believe the same mentality should apply to crypto equities. While we still see opportunities for outperformance over the next 12 months, we recommend proceeding with caution for those managing positions in the immediate term.