Grayscale Victory Aligning with Increase in Global Liquidity

Key Takeaways

- This week brought positive developments in both liquidity conditions and crypto-specific catalysts, most notably a court ruling that vacated the SEC's denial of a spot Bitcoin ETF, sparking a strong market rally and setting the stage for future ETF approvals.

- In a key legal win for the DeFi sector, a court dismissed a class-action lawsuit against Uniswap Labs, ruling that the platform is not liable for third-party scams and highlighting that legislative action, rather than existing securities laws, should address regulatory gaps in DeFi.

- Key financial indicators such as the DXY, global liquidity metrics, the Fed's Net Liquidity component, the MOVE index, and recent gold price movements collectively suggest potential near-term tailwinds for the crypto market.

- While current indicators suggest a sustained crypto rally, we identify three major risks—seasonal downturns in crypto, a pending DOJ case against Binance, and the government's upcoming sale of a significant Bitcoin holding—that could potentially halt the rally.

- Core Strategy – Despite the risks outlined below, we believe that the Grayscale victory—paving the way for spot ETF approval and reducing perceived regulatory risks—along with improving macro conditions, should offer the crypto market an opportunity for a rally in the coming weeks. However, if liquidity conditions tighten again, it may warrant a reassessment of our tactically bullish outlook.

Grayscale Victory

As recently discussed, we’ve been awaiting either short-term relief in liquidity conditions—indicated by falling interest rates, a declining DXY, and increasing central bank liquidity—or the realization of crypto-specific catalysts for better price action. This week, we received encouraging news on both fronts.

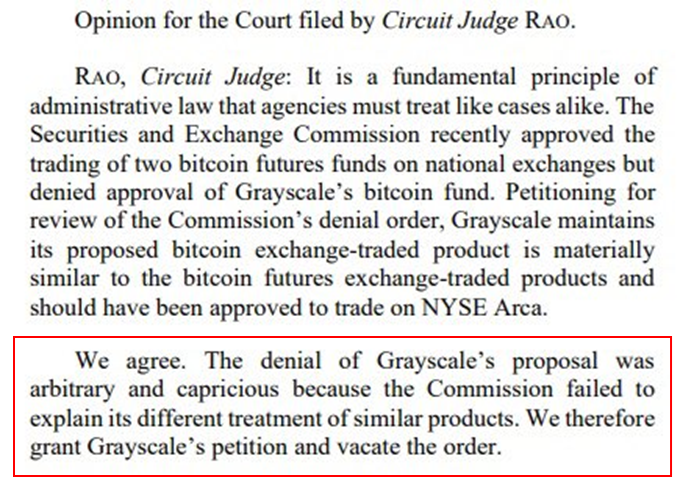

The courts have ruled that the SEC acted in an arbitrary and capricious manner when denying the spot Bitcoin ETF.

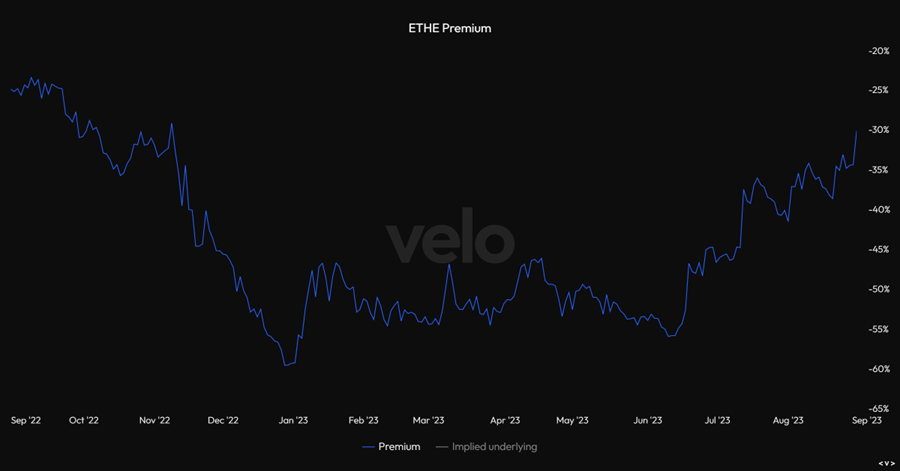

In the wake of this news, cryptoassets, trusts, and crypto equities experienced a strong rally on Tuesday. This development will likely pave the way for a Bitcoin ETF to enter the market and could lead to the conversion of existing trusts into ETF products. The discounts to NAV on GBTC and ETHE both shrank substantially following the announcement.

It’s crucial to note that this ruling does not automatically greenlight a Bitcoin ETF. Instead, it invalidates the SEC’s initial reasons for rejecting Grayscale’s application for a spot Bitcoin ETF. Now, the SEC is mandated to reevaluate Grayscale’s application. From what we currently gather, they have four options:

- Identify another rationale for denying the spot Bitcoin ETFs

- Appeal the court’s decision within 45 days

- Potentially revoke approvals for futures-based ETFs to justify the spot ETF denial

- Approve the spot Bitcoin ETFs to comply with the judicial system and avoid further losses in litigation.

We are inclined to view option 4 as the most likely outcome. However, we can’t entirely dismiss other possibilities.

There are several key dates for ETF approvals on the horizon (table below). Notably, the next deadline is for BlackRock’s ETF application, with a decision due this Saturday. This is not a final deadline, which means the SEC is likely to postpone the decision. However, a ruling could technically emerge as early as Friday.

It’s also worth mentioning that the SEC has not yet rejected any applications for an ETH futures ETF. Therefore, we are still on track to potentially see one launched in October.

Another W

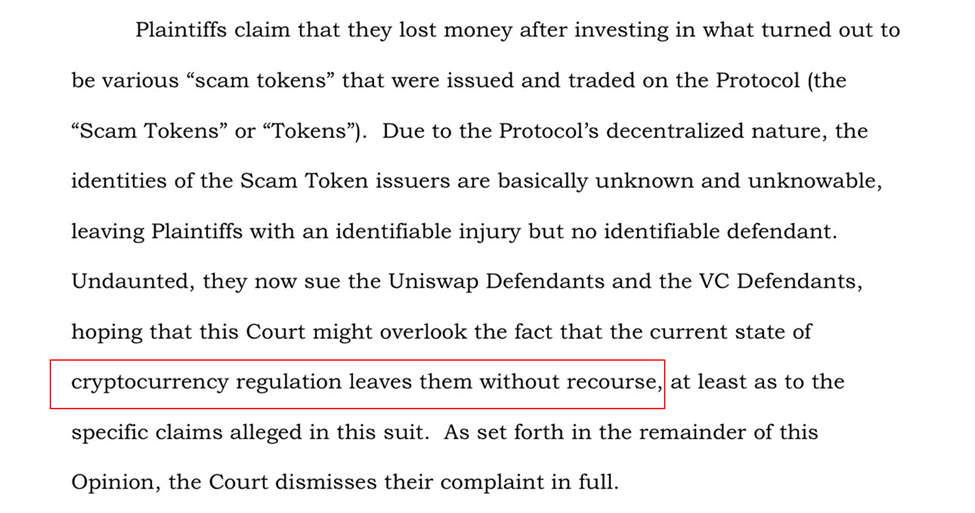

In another less discussed regulatory victory, a court has cleared Uniswap Labs of allegations made in a class-action lawsuit. Six individuals had accused Uniswap Labs of enabling scam tokens on its decentralized exchange (UNI), leading to financial losses for the plaintiffs. They argued that Uniswap Labs had undue control over liquidity pools, including those associated with the scam tokens.

Presiding over the case, Judge Katherine Polk Failla, who is concurrently overseeing a similar SEC case against Coinbase, dismissed the lawsuit. She pointed out that the plaintiffs were unfairly trying to make Uniswap accountable for third-party scams, a claim that does not align with current federal securities laws. Instead, she emphasized that these regulatory gaps should be addressed by Congress rather than the judiciary.

This ruling holds significant weight for the DeFi sector. It sets a legal precedent, implying that DeFi platforms might not be liable for third-party scams occurring on their networks. It also suggests a judicial consensus that regulatory issues in the DeFi space are better suited for legislative action, rather than being enforced through existing securities laws by agencies like the SEC.

This verdict is particularly important because it not only shields DeFi platforms from potential liabilities related to third-party activities but also calls attention to the need for comprehensive legislative action to tackle the regulatory challenges in the rapidly evolving DeFi landscape.

Softening Near-term Macro Picture

The surge in prices on Tuesday was followed by a period of market consolidation on Wednesday, likely disappointing traders who were optimistic about the Grayscale catalyst. While this year has already seen two significant catalysts—the Blackrock ETF application and Ripple’s legal victory—both rallies were short-lived. We’ve previously discussed the factors behind the fading of these rallies, primarily attributing them to shifts in short-term macroeconomic conditions.

Using the U.S. Dollar Index (DXY) as an indicator of liquidity conditions, it’s evident that both previous catalysts coincided with a local low in dollar strength. Given current trends in interest rates and global liquidity, we believe there’s a reasonable chance the current rally could continue over the next few weeks. However, if these conditions change, we may need to reassess our tactical outlook.

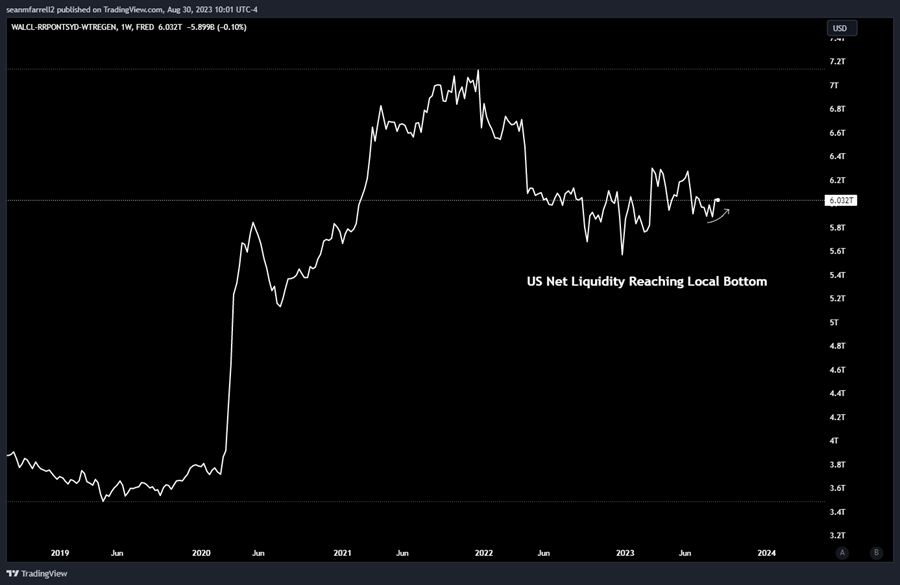

Global liquidity, as indicated by the balance sheet sizes in USD terms for the Fed, ECB, PBOC, and BOJ, appears to have potentially reached a local bottom. Crypto momentum began to wane around late April, coinciding precisely with a reduction in global liquidity. Recently, the PBOC has started to inject liquidity to bolster its struggling economy, and we’ve also observed a decline in the Reverse Repurchase Agreement (RRP) after a few weeks of stagnation. Additionally, interest rates seem to be finding some upward resistance. Should these trends persist, they are likely to serve as near-term tailwinds for the crypto market.

Fed Net Liquidity, a major component of the global liquidity chart above, appears to have reached a local bottom after trending downward since June. This development could signal improving conditions for assets that are sensitive to liquidity changes.

As mentioned in last week’s note, rate volatility has decreased, as evidenced by the MOVE index. This index serves as a reliable indicator of risk within the bond market. Treasuries, which constitute the majority of collateral in the banking system, become more effective as collateral when there is reduced uncertainty regarding interest rate movements. A declining trend in the MOVE index typically suggests that conditions for credit creation are improving.

We believe that the recent uptick in gold prices serves as evidence of easing liquidity conditions. Gold, widely considered a liquidity-sensitive asset, tends to appreciate when banking deposits and lending activity increase.

Seasonality, Binance, and Government Coins are Risks Worth Keeping in Mind

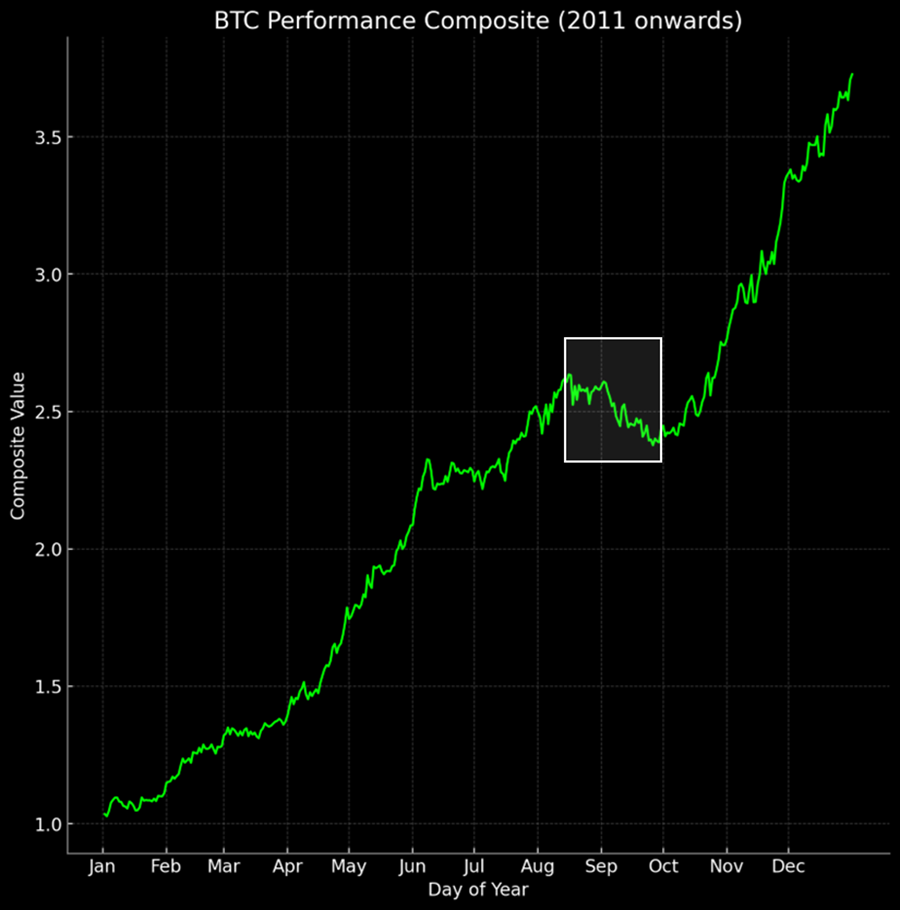

While current indicators suggest that Tuesday’s rally could continue over the next few weeks, it’s crucial to remain aware of near-term risks that could negatively impact prices. As we’ve highlighted in recent notes, we are currently in a seasonally unfavorable period for crypto, a trend that has been fairly consistent since Bitcoin’s inception. In fact, the last time Bitcoin posted a positive return for September was in 2016. Given this historical context, it may be prudent to consider de-risking around the middle of the month if a rally does materialize in the coming weeks (as we think it will).

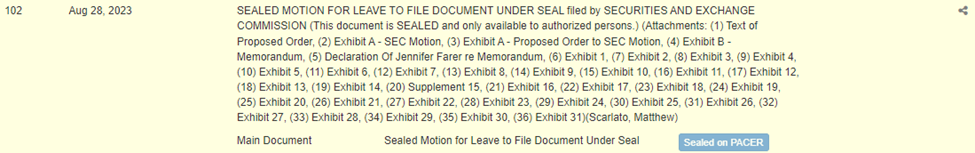

The second risk factor for asset prices is the undisclosed Department of Justice (DOJ) case against Binance, a point we’ve previously flagged as a short-term concern. This week, the SEC submitted a sealed motion in its ongoing case against Binance, which suggests that a DOJ investigation is likely underway. The sealed nature of the motion implies that its contents could interfere with the DOJ’s probe if made public.

Our baseline scenario is that any DOJ action will likely exert downward pressure on asset prices, although we anticipate this impact to be temporary. We speculate that the most probable outcome is a substantial fine levied against the exchange, and it’s possible that Changpeng Zhao (CZ), the CEO of Binance, may face personal charges. We expect that Binance will continue its operations outside the U.S. Regardless, this is a development that warrants close monitoring.

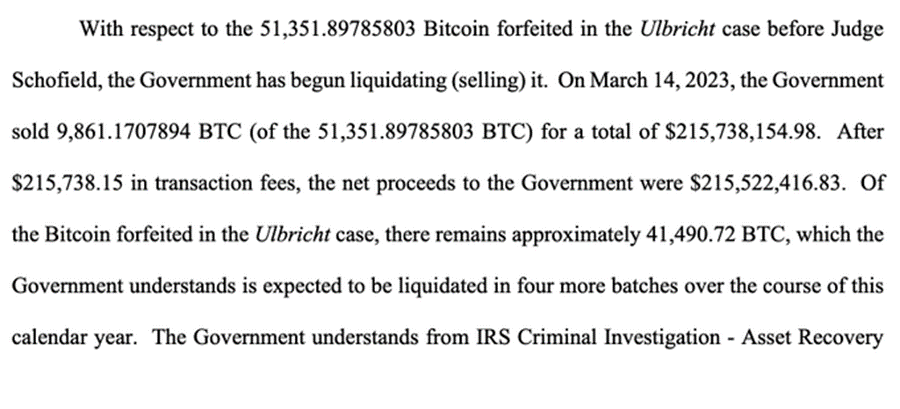

Finally, it’s important to note that the government currently holds approximately 194k BTC, which represents about 1% of all outstanding Bitcoin. They are expected to sell off around 32k+ BTC in three separate tranches before the end of the year. These Bitcoin holdings were seized in a criminal case, and the resulting proceeds are likely to be directed to the DOJ’s asset seizure fund.

Given that the government benefits from the sale proceeds, they will likely aim to minimize market impact. However, this doesn’t rule out the possibility that the added supply could create downward pressure on BTC prices.

We observed a similar situation in July, when a sale of approximately 8,000 BTC by the DOJ had a potentially negative impact on the market. This serves as a reminder that large-scale liquidations can indeed influence asset prices, even if the impact is intended to be minimal. Therefore, this is another factor worth keeping an eye on.

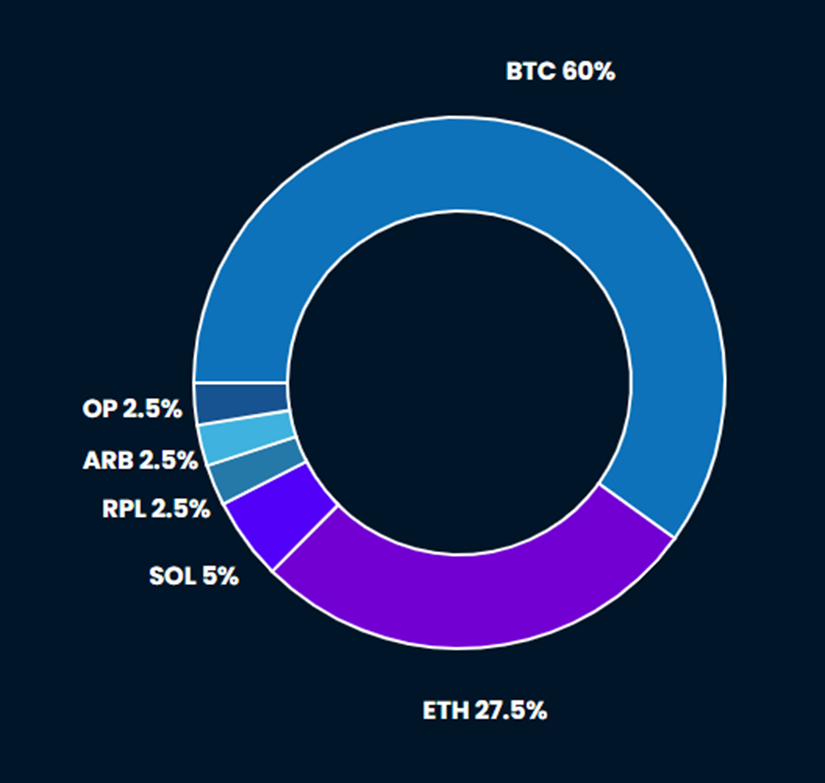

Core Strategy

Despite the risks outlined below, we believe that the Grayscale victory—paving the way for spot ETF approval and reducing perceived regulatory risks—along with improving macro conditions, should offer the crypto market an opportunity for a rally in the coming weeks. However, if liquidity conditions tighten again, it may warrant a reassessment of our tactically bullish outlook.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC -2.68% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption (Argentina).

- Ethereum (ETH -2.49% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Rocket Pool (RPL): An ETH liquid staking provider who we think stands to benefit from: (1) an increase in total % of ETH staked over time, (2) a relative increase in liquid staking relative to the overall amount of ETH staked, and (3) being the only (for now) LSD token with utility beyond governance. We think that over time, the token should outperform if Rocket Pool is able to gain even a semblance of market share on Lido. Key Catalyst: Protocol upgrade slated for Q4.

- Optimism (OP) & Arbitrum (ARB -0.20% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

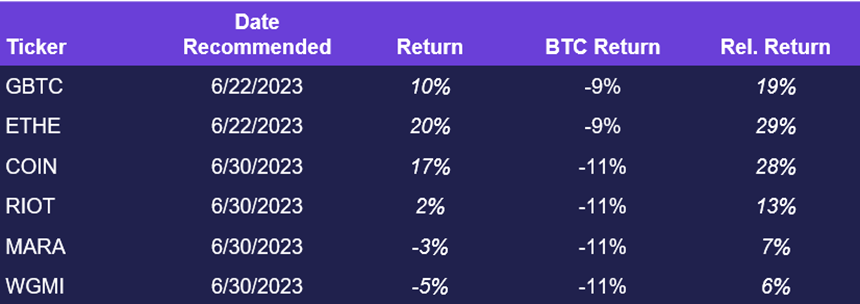

Active Crypto Equities Recommendations (Returns through 8/30)