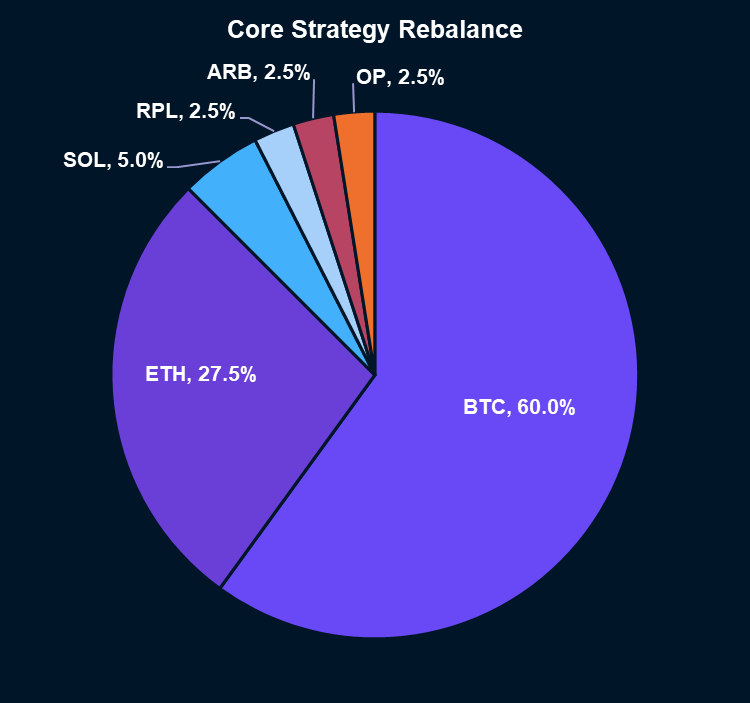

ETHTF (Core Strategy Rebalance)

Key Takeaways

- Last week we attributed crypto’s decline in volatility to competing forces: macro trends and industry-specific tailwinds. This week there were signs of traditional correlations returning.

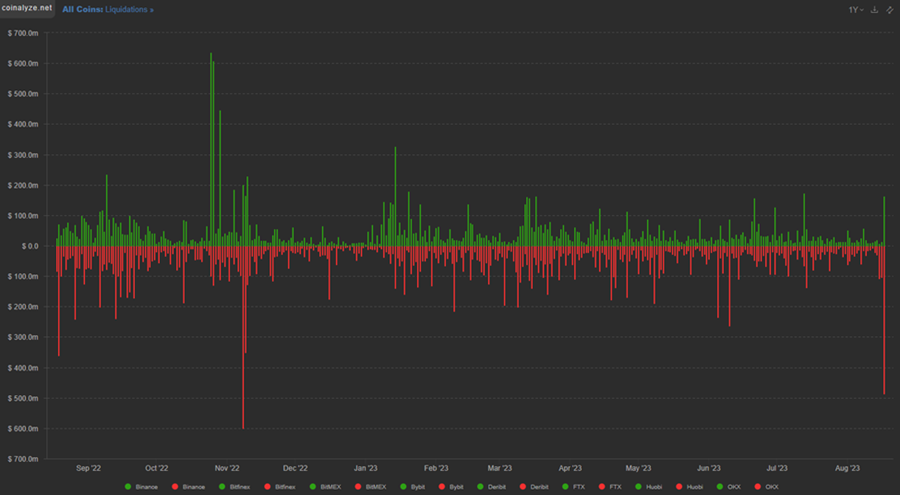

- On Thursday evening, the crypto market experienced $700 million in liquidations, a sign that volatility can't drift lower indefinitely.

- The market's liquidations were partially offset by the SEC's groundbreaking decision to approve an ETH futures ETF, causing a sudden reversal in asset prices.

- This significant industry victory not only reaffirms ETH's status as a commodity but also amplifies the ongoing Grayscale situation, where Grayscale argues against the SEC's logic for denying a spot ETF, potentially leading to the conclusion that an ETH spot ETF should exist.

- The Grayscale case is nearing a decision, with a high chance of a verdict being announced on Friday morning. A victory for Grayscale would be momentous, possibly accelerating the approval of a spot ETF and potentially triggering a substantial rally in trust products like GBTC 2.46% and ETHE 4.57% .

- We posit that the market consensus is a persistent rally in BTC dominance through the halving, but history tells us this is not a foregone conclusion.

- Core Strategy (Rebalance) – As evidenced by the market's reaction following the ETH ETF news, we think it is right to stay allocated and buy dips in anticipation of potential catalysts being realized. We are taking advantage of the major selloff and key ETH-related news to add OP and ARB to our Core Strategy, as we anticipate outperformance through EIP 4844 expected within the next 6 months.

Macro Has Been Winning the Battle

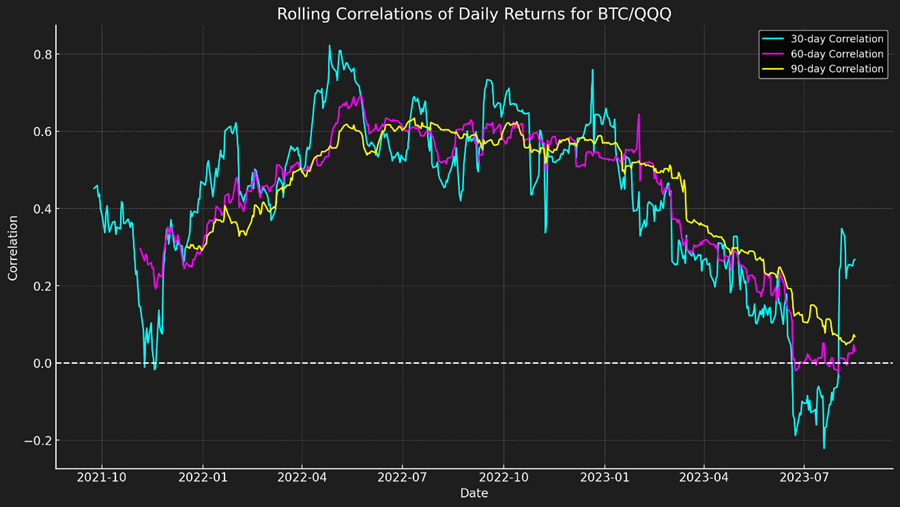

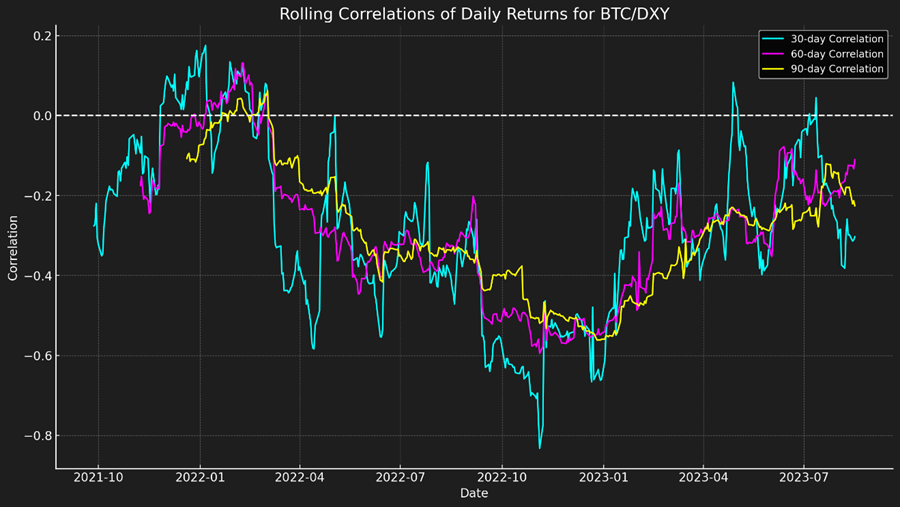

Last week, we advanced the idea that the recent decline in volatility might be traced to two competing forces: (1) positive industry-specific tailwinds and (2) negative macro headwinds. Additionally, the recent dip in macro correlations could be attributed to unique catalysts, notably the BlackRock ETF application.

Our thinking was that without further industry-specific catalysts, traditional macro correlations would likely return. As evidenced by the charts below, this appears to be the case, with a positively correlated relationship to equities and a negatively correlated relationship to the DXY returning, at least for now.

The recent weakness in prices is certainly disconcerting. Rates look like they do not have a ceiling (they will, eventually).

And the dollar, as the cleanest dirty shirt in the fiat laundry is exhibiting continued strength.

Further, global liquidity, as measured by the size of the balance sheets for the top 4 central banks (Fed, PBOC, BOJ, ECB) is down to levels last seen in mid-September of last year.

The Floodgates Open (Momentarily)

The one thing we were sure of was that volatility could not simply drift lower forever. The unknown was the direction that underlying asset prices would break.

That sound you heard this evening was nearly $700 million in liquidations across the crypto market – the most since the implosion of FTX.

We are searching for a proximate cause, but there likely is none. At some point a leveraged market needs spot buy pressure and, frankly, we have not gotten any.

E(TH)TF Approved

The liquidations observed in the market were quickly assuaged by some groundbreaking news. Two weeks ago, we highlighted the intriguing developments surrounding the potential approval of an ETH ETF.

Well, merely minutes after the enormous wipeout in open interest, we received the monumental news that the SEC will be greenlighting an ETH futures ETF. Just like that, asset prices appear to be doing a complete 180.

This is undoubtedly a major win for the industry and further dispels doubts over ETH and its status as a commodity. We also note that this decision heightens the significance of the Grayscale situation. Grayscale is essentially arguing that the SEC’s logic for denying a spot ETF is flawed, based on the idea that spot prices are manipulated. If that’s true, then futures prices must also be manipulated since they’re derived from spot prices. Should the courts rule in Grayscale’s favor, one could conclude that an ETH spot ETF should exist as well.

Potential Grayscale Verdict Inbound

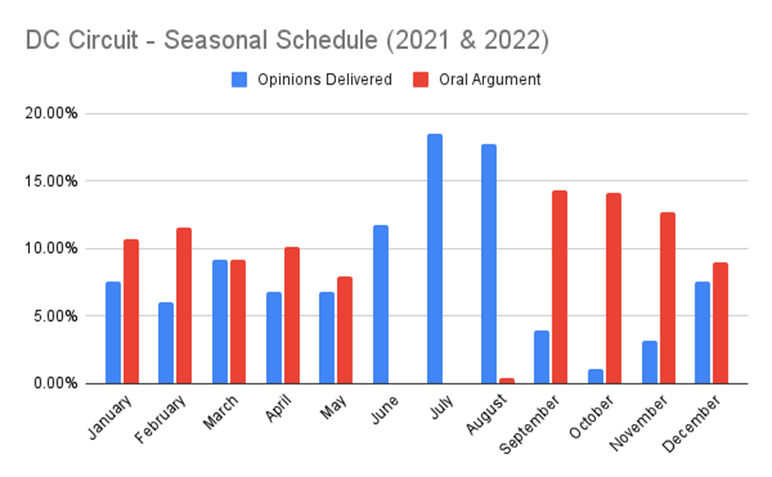

Now onto the second key catalyst on our radar – the Grayscale case. As noted in our market update on Tuesday, prices may receive a jolt sooner rather than later in the form of a Grayscale verdict (the ETH news was an unknown at the time). Scott Johnsson of Van Buren Capital observed that U.S. District Courts often settle cases in August, prior to the arrival of new law clerks. Moreover, 30 of the 32 cases in both March 2021 and 2022 were settled within 160 days post-oral testimony.

Considering that Grayscale presented its case on March 7th, a decision seems imminent. Only a few cases from March, including Grayscale’s, remain unresolved. Johnsson noted that the court typically announces decisions on Tuesdays and Fridays. Since no decision was made on Tuesday, and this week falls within the usual timeline for a court decision, there’s a high chance that Friday will bring news of the verdict. Should we not receive a verdict on Friday, we will be on high alert for each subsequent Tuesday and Friday.

A Grayscale victory would be significant, potentially increasing the likelihood of a spot ETF approval and possibly hastening it. Such a win could lead to a substantial rally for the trust products GBTC 2.46% and ETHE 4.57% , regardless of the underlying assets’ performance.

Qualitative Consensus Seems to Favor Continued BTC Dominance Strength

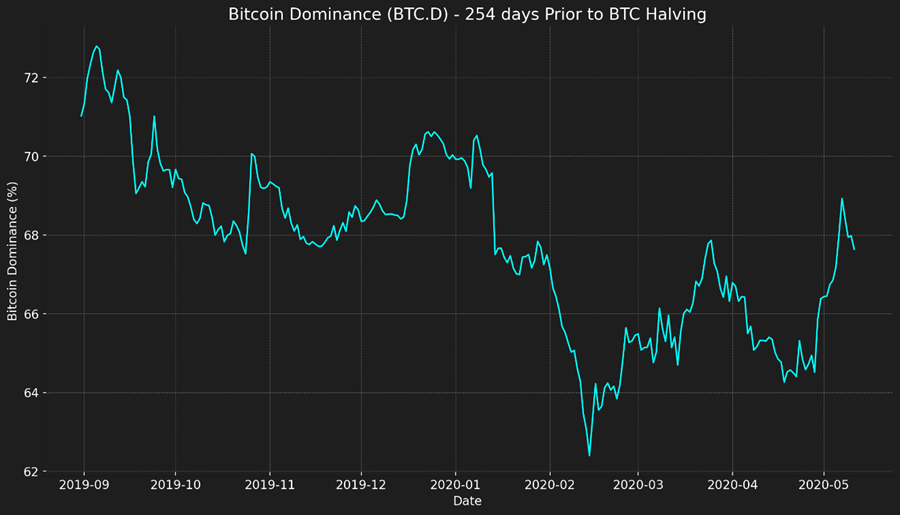

This viewpoint is difficult to quantify, but it seems most investors are confident in BTC dominance (BTC market cap / total crypto market cap) increasing through the next halving. Lower liquidity, an uncertain regulatory environment, and strong fundamental catalysts like a spot ETF and the halving in about 8 months support this belief. Looking at the chart below, we seem poised for another uptick in Bitcoin dominance.

However, we posit that this is not necessarily a foregone conclusion. We do hold the view that at some point new highs in Bitcoin dominance will be achieved, but we shouldn’t be so sure that it will happen before the halving.

While there is limited history of a robust altcoin market heading into a halving (BTC dominance was 95% or higher prior to early 2017), we can at the very least look to the last cycle as precedent. We acknowledge that n=1 and there may have been other factors at play, but we are sure that leading up to the last halving “long BTC dominance” was likely a consensus bet.

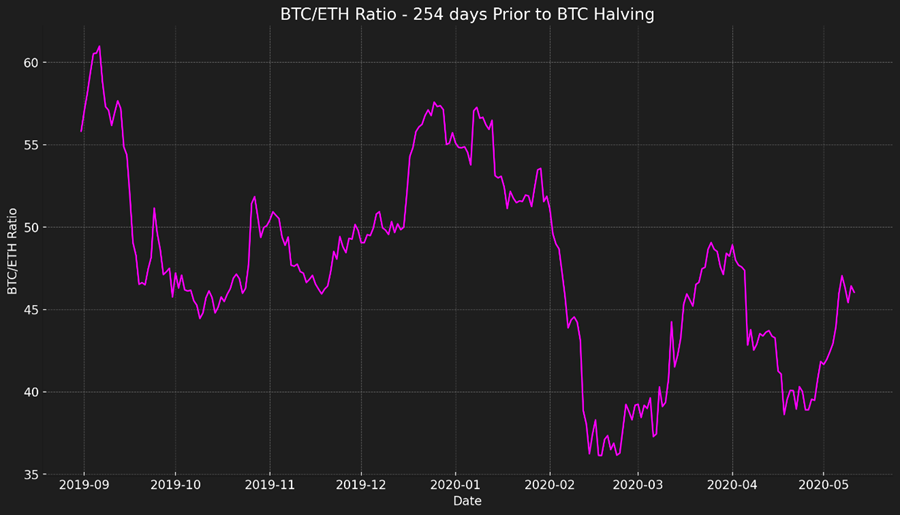

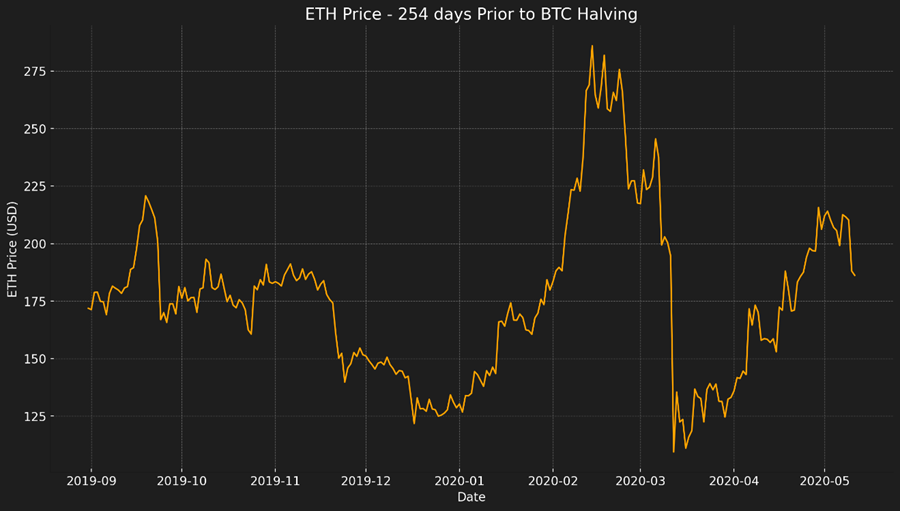

We are currently an estimated 254 days from the next halving. This is certainly subject to change depending on small fluctuations in block times, however, 254 is a reliable estimate.

Below, we map out the performance of BTC/ETH and BTC.D (dominance) from 254 days through the halving. As you can see, both metrics declined over this timeframe. It is also worth mentioning that this timeframe captures the pandemic-fueled crash, a period during which you would expect BTC dominance to thrive as the flight-to-relative-safety trade (stablecoins were a negligible portion of the total crypto market cap at the time).

In absolute terms, BTC had a negative return over these 254 days, while ETH had a positive return.

Does this mean that BTC dominance is surely set to fall into the halving? Not at all. However, this does demonstrate that often consensus is wrong and there is precedent for altcoin strength during pre-halving periods.

Incorporating OP and ARB

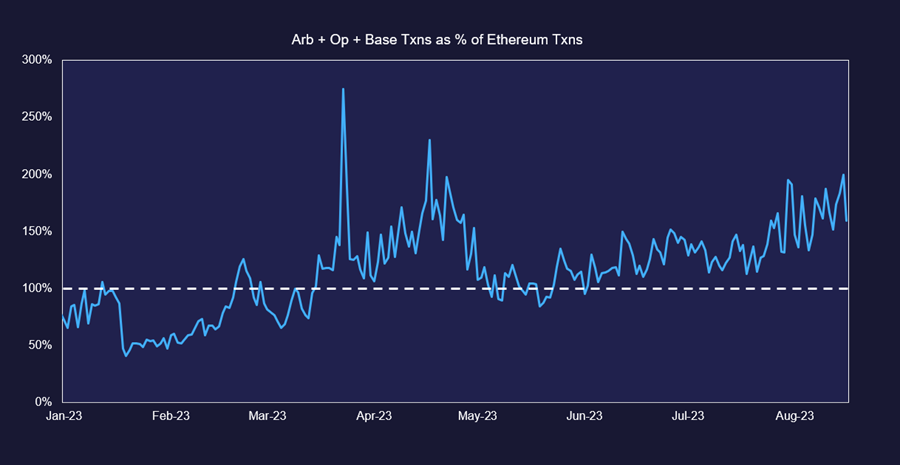

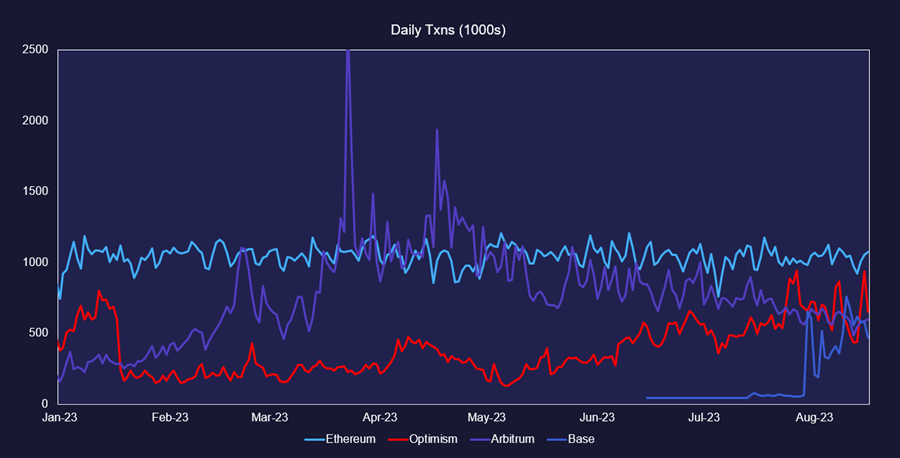

Keeping in mind the huge development pertaining to the ETH futures ETF, the former precedent of ETHBTC rising into the halving, and the recent decline in prices, we view this as a good time to start to establish a position in L2 networks. The thesis is simple: as ETH scales in its layered approach, more attention, activity, and commerce will happen on these layer two networks, and the governance tokens, which we think at some point will implement a burn or dividend mechanism, will accrue value as a result.

Further, we are expecting EIP 4844, Ethereum’s next major upgrade to take place within the next 6 months. In simple terms, this update will make L2 networks cheaper to use as they will save on data costs paid to the L1. This will also result in more profitable sequencers, which could aid in their decentralization.

The two names we are adding to our Core Strategy are OP and ARB.

- OP Mainnet (OP) is an L2 smart contract platform for decentralized applications on Ethereum, founded by Jinglan Wang, Karl Floersch, and Kevin Ho, and launched in 2021. The platform functions by batching users’ transactions and submitting them to Ethereum, with a portion of the transaction fees being paid to Ethereum validators as supply-side fees. Governance of OP Mainnet is in the hands of the Optimism team and investors, who collectively own and oversee the protocol. Among Optimism’s investors are prominent names such as Paradigm, a16z, and IDEO CoLab Ventures.

- Arbitrum (ARB) is an L2 smart contract platform for decentralized applications on Ethereum, founded by Offchain Labs and launched in 2021. It functions by managing fees through a system where total transaction fees are paid by users, and these fees are then divided into supply-side fees, which are shared with Ethereum validators, and revenue that goes to the Sequencer. ARB tokenholders own and govern the protocol, and they currently run the only sequencer, taking a cut of the total transaction fees paid by users (revenue). Some of Arbitrum’s notable investors include Polychain, Alameda Research, and Coinbase Ventures.

Core Strategy

As evidenced by the market’s reaction following the ETH ETF news, we think it is right to stay allocated and buy dips in anticipation of potential catalysts being realized.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin: Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption (Argentina).

- Ethereum: Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana: The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Rocket Pool: An ETH liquid staking provider who we think stands to benefit from: (1) an increase in total % of ETH staked over time, (2) a relative increase in liquid staking relative to the overall amount of ETH staked, and (3) being the only (for now) LSD token with utility beyond governance. We think that over time, the token should outperform if Rocket Pool is able to gain even a semblance of market share on Lido. Key Catalyst: Protocol upgrade slated for Q4.

- Optimism & Arbitrum: As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Active Crypto Equities Trades (Returns Through 8/17)

Tickers in this report: ARB N/A% , OP 10.24% , RPL, SOL N/A% , ETH, BTC, GBTC 2.46% , ETHE 4.57%