Quantifying the BlackRock Effect

Key Takeaways

- Based on historical trends, a multiplier effect in the range of 4.0x - 5.0x is reasonable to assume for the Bitcoin network. This means that $1 of demand can result in a $4 - $5 increase in market cap.

- We assign a 75% probability of spot ETF approval in the near term. If a BlackRock spot ETF is approved, we anticipate it would attract new investors and generate increased demand for bitcoin. This could potentially lead to a near-term incremental market cap increase of up to $600 billion (2x current level).

- We remain optimistic about GBTC 0.05% (discount to NAV down to 27%) due to the likelihood of a Grayscale victory over the SEC in the courts.

- We are still constructive on major crypto-related equities like COIN 4.55% , Bitcoin miners (MARA -0.71% , RIOT 3.08% ), and the mining ETF WGMI 4.07% , despite the possibility of short-term overextension. We believe that the worst of the fallout related to miners and regulatory "FUD" is behind us, and the entry of BlackRock into crypto signals a positive shift in regulatory attitudes.

- After a month since the SEC's accusations against Binance, expectations are high for similar charges from the DOJ. The recent departures of key Binance executives suggest imminent legal troubles. Despite potential short-term negative impacts from these developments, we view any resulting sell-off as a buying opportunity.

- Core Strategy – We believe that the market is currently in a "sentiment sweet spot" where both narrative-driven factors (such as the potential spot ETF and the return of US investors) and fundamental factors (such as the upcoming halving event in a few quarters and expanding global liquidity) are bullish. While market sentiment is shifting, the trade remains far from overcrowded, and the risk asymmetry is skewed to the upside.

The Probability of ETF Approval

As emphasized in previous notes, we view BlackRock’s application for a spot ETF as substantial. Regardless of whether an actual spot ETF garners approval in the near term, its “narrative” significance is undeniable.

Yet, our fundamental assumption is that this application indicates new undisclosed insights that Larry Fink and his colleagues are privy to, which the public may not be, and their application will ultimately result in a spot ETF approval.

This hypothesis is reinforced by potential legal developments on the horizon that could further support the approval of a spot-based ETF. Based on our interactions with legal experts in the industry, we are inclined to believe that Grayscale’s lawsuit against the SEC will likely tilt in Grayscale’s favor.

In simple terms, Grayscale’s argument asserts that the SEC approved a futures-based ETF because of the existence of a sizable, regulated futures market in the US, which can be monitored for market manipulation. In contrast, the SEC argues that the spot market lacks a similarly regulated market of substantial size in the US, leaving it susceptible to manipulation and therefore unsuitable for an ETF. However, as per Grayscale’s rationale, since futures market prices are a derivative of spot prices, one cannot have legitimate prices in one market while the other is a product of a manipulated market.

If it becomes apparent that the SEC is set to lose this case, as well as the potential Ripple case — on which we anticipate a ruling in the coming months — the SEC could preempt these decisions. They could then assert that their surveillance-sharing agreement with Coinbase is valid, as argued eloquently by Elliott Stein, a legal analyst at Bloomberg.

It’s worth noting that we have found the insights from Bloomberg ETF specialists Eric Balchunas and James Seyffart particularly illuminating on the bitcoin ETF situation. They accurately forecasted the timing of the futures ETF approval and currently assign a 50% and 51% probability, respectively, to the approval of a spot ETF this year.

Bottom Line on ETF Approval Probability: We remain optimistic about the near-term approval of a spot ETF, assigning it a 75% probability. However, even if this does not occur, the narrative-based momentum remains significant.

Estimating a Bitcoin Multiplier

Crypto, specifically Bitcoin, constitutes a unique asset due to its multifaceted roles. It acts not only as a reliable safeguard against monetary debasement, establishing it as a store of value for certain investors, but also enables transactional services, including trading and payment activities. It’s important to note that, at present, trading accounts for most of Bitcoin’s transactional demand.

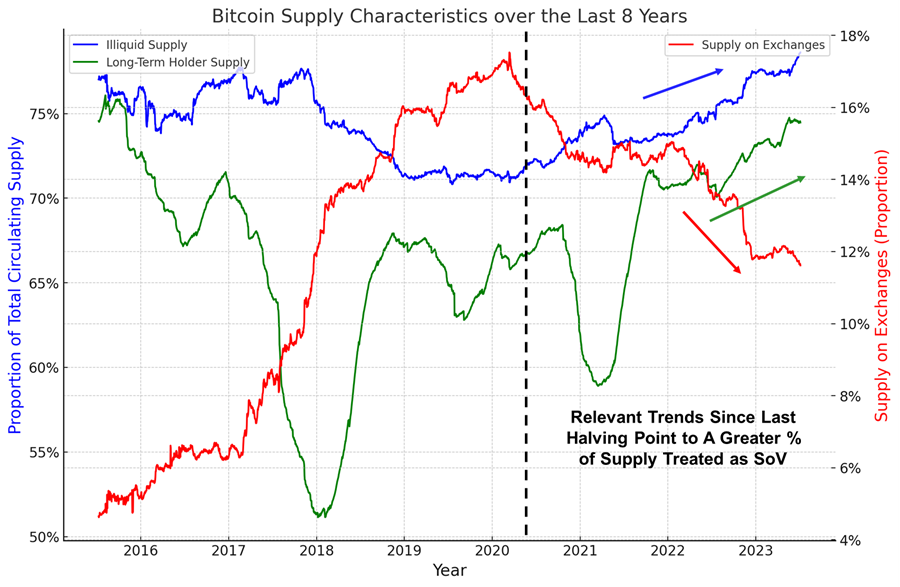

Upon any possible approval of a Blackrock-branded spot ETF, one should reasonably expect an uptick in demand for bitcoin from a new cohort of investors. In evaluating the impact of a sudden surge in dollar-denominated demand for Bitcoin, it’s crucial to differentiate Bitcoin from traditional assets such as company shares or transactional currencies. A considerable part of Bitcoin’s supply is owned by entities that have no intention of selling their ‘sats’, aligning with the narrative of Bitcoin as a long-term store of value. This segment of Bitcoin supply is expanding as more investors support this use case.

Moreover, Bitcoin’s supply is scattered globally across various exchanges, with a substantial portion held in cold storage, away from exchanges. These factors reinforce the multiplier effect observable in each market cycle.

This dynamic leads to a situation where a $1 increase in demand does not correspond to a $1 increase in Bitcoin’s market cap. If such a direct correlation were to exist, over $600 billion in new demand would be necessary to return Bitcoin to its all-time high. Instead, we need to consider a Multiplier Effect that takes into account the circulating supply of BTC relative to the number of coins available for transactional demand.

Multiplier = Total Coins Outstanding / Coins Available

Put simply, the more illiquid a crypto asset’s supply, the larger the expected multiplier effect on the total market cap.

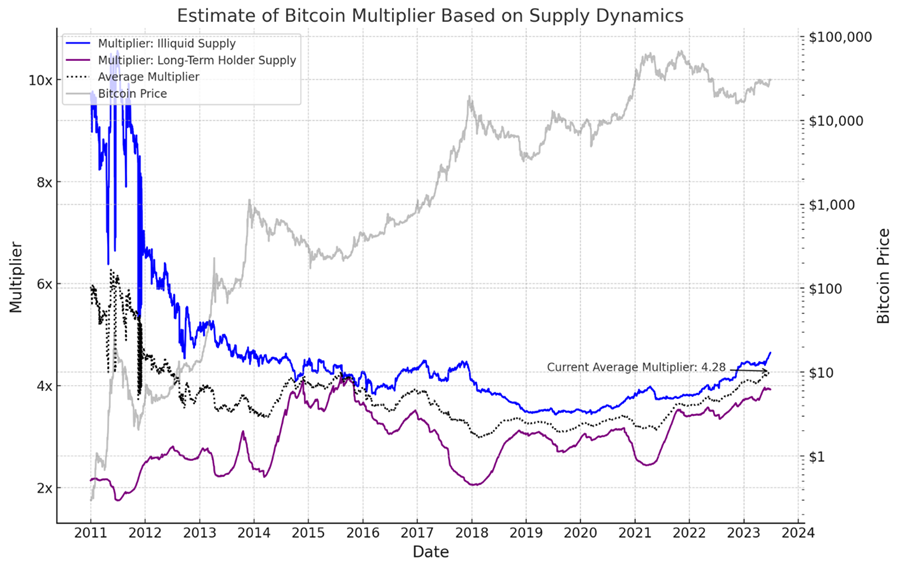

To forecast the potential incremental impact of an ETF approval, we first need to understand the number of coins that are unavailable to satisfy new demand. Several metrics, such as the illiquid supply[1] and supply owned by long-term holders[2], can serve as effective indicators. Applying the equation above, bitcoin’s multiplier using illiquid supply would be computed as follows:

Multiplier = Total Circulating Supply / (Circulating Supply – Illiquid Supply)

Predictably, the volume of illiquid supply is substantially higher at the beginning of any cycle, thereby intensifying the multiplier effect. However, as prices escalate and the Bitcoin network begins to appear overvalued on a fundamental basis, more coins transition into a liquid state, slightly reducing the multiplier effect. Based on these metrics, as noted in the chart below, we can assume a current multiplier range of 3.9x – 4.6x.

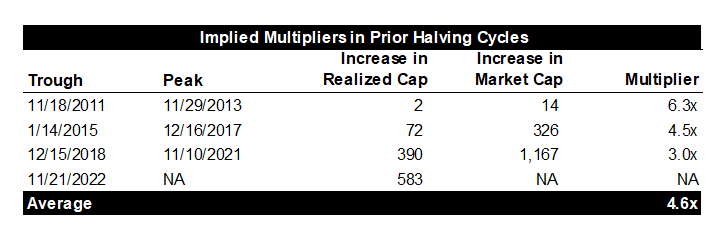

To validate this approach, we can use the change in the realized cap, best thought of as the cost basis of the Bitcoin network, as a proxy for dollar flows into/out of the Bitcoin network and measure the ratio of observed increases in the market cap in previous Bitcoin cycles. This is an aggregate measure throughout an entire bull market, and likely does not capture every dollar of demand, but it should serve as a good approximation for bitcoin’s historical multiplier.

Based on this method, the average multiplier for cycles has been 4.6x, with each successive cycle resulting in a lower multiplier, presumably because the supply became more liquid. This aligns relatively well with our measurement of the multiplier effect in the preceding chart.

Despite the observed multiplier decreasing last cycle, recent trends suggest the Bitcoin network is more illiquid than ever, with more supply being treated as a store of value. This indicates a possibility of an increase in the multiplier in the next cycle.

Given the historical trends outlined above, we believe it is reasonable to assume a multiplier effect for the Bitcoin network in the 4.0x – 5.0x range.

Estimating Dollar Demand

Now that we have a plausible assumption for the effect each additional dollar of demand might have on Bitcoin’s price, we can quantify the incremental effect on Bitcoin’s price from the launch of a BlackRock ETF.

This exercise is intended to establish a framework for understanding potential inflows from the BlackRock ETF, rather than providing an exercise in precision. We believe that the second and third order effects of the world’s largest asset manager endorsing Bitcoin as an asset cannot be easily quantified.

In a recent interview with Fox Business, Larry Fink, the CEO of BlackRock, suggested that Bitcoin has the potential to “revolutionize finance.” Despite previous skepticism about the crypto industry due to concerns about its use for “illicit activities,” Fink now views Bitcoin as a global asset and “represents an asset that people can utilize as an alternative.”

Considering the likelihood of Fink attracting a new cohort of investors who trust the “old guard,” we believe it is reasonable to view the majority of inflows into any BlackRock spot ETF as incremental. This suggests we should regard this rise in spot demand as demand that would not have existed otherwise and should be viewed as additive to any previous projections.

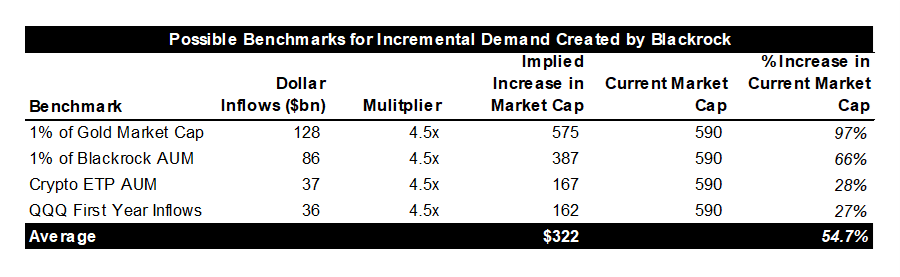

The following chart outlines some ways to quantify potential inflows into any spot Bitcoin ETF, assuming that if the SEC approves it, BlackRock will be one of the managers. Considering that BlackRock will strive to maximize fees from this ETF, we believe they will encourage older generations to consider a 1-5% allocation to Bitcoin, or at the very least start considering Bitcoin as an alternative to gold.

Given the estimates above, it is not unreasonable to think that a new cohort of bitcoin enthusiasts recruited by Larry Fink could contribute an incremental $150-600 billion in market cap to bitcoin.

Remaining Constructive on Crypto Equities

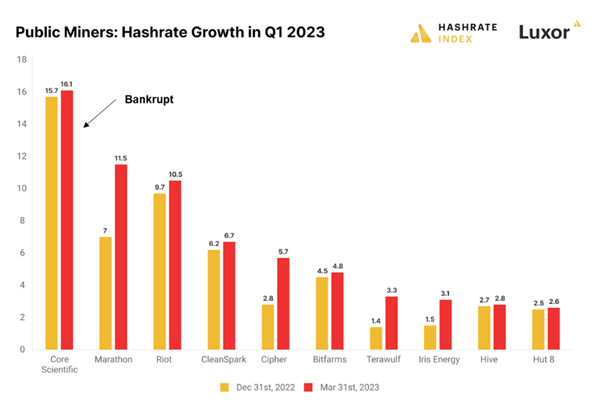

Over the past few weeks, we have maintained a relatively constructive stance on major crypto-related equities, notably COIN 4.55% and Bitcoin miners like MARA -0.71% , RIOT 3.08% (we liked these two because they have the most hash rate of publicly traded miners), and the mining ETF WGMI 4.07% (to capture the meat of the long tail of miners). In a similar light, we continue to view GBTC 0.05% , now trading at a 27% discount to NAV as a risk-adjusted way to achieve quasi-leveraged exposure to either a (1) positive outcome in the Grayscale / SEC lawsuit or (2) the approval of a spot bitcoin ETF.

Coinbase and the bitcoin miners all certainly continued to perform well over the preceding week (chart through 7/7).

While these stocks (Coinbase and miners) may seem somewhat overextended in the short term, we believe they will continue to provide robust avenues for leveraged exposure to Bitcoin. At a high level, our attitude towards crypto equities has improved for a couple of reasons:

- A significant issue with miners in the past was their excessive leverage and large Bitcoin holdings during the latter stages of the last bull market. Last year, we predicted a necessary purge of this unhealthy leverage, followed by some ensuing consolidation. Following several bankruptcies (Core Scientific and Compute North), acquisitions (Galaxy/Argo, Crusoe/Great American Mining, Cleanspark/Assets), and the fire sale of thousands of Bitcoin from miners’ balance sheets, it’s probable that the worst of the miner-related fallout is behind us. Those who have survived are now well-capitalized and have become more cautious about capex management, having witnessed what can occur at the peak of a Bitcoin cycle.

2. Secondly, regulatory risk has been another significant concern for crypto equities. The apparent unbanking of the crypto industry, as orchestrated by prudential banking regulators, along with an SEC seemingly determined to stifle the industry’s growth, had a negative impact on crypto equities, most notably Coinbase. This regulatory risk affected equities more than crypto assets because the underlying assets are globally distributed, while the primary crypto equities we commonly discuss are based in the US. However, as we have noted in recent weeks, we believe that the worst of regulatory “FUD” (Fear, Uncertainty, and Doubt) is behind us. Additionally, the entrance of BlackRock into the crypto space signals a potential shift in regulatory attitudes.

Bottom Line on Crypto Equities: We remain optimistic on GBTC 0.05% (discount to NAV down to 27%), major crypto-related equities like COIN 4.55% , Bitcoin miners (MARA -0.71% , RIOT 3.08% ), and the mining ETF WGMI 4.07% , despite their possible short-term overextension. We believe the worst of miner-related fallout and regulatory “FUD” is behind us, and BlackRock’s entrance into crypto signals a positive shift in regulatory attitudes.

Binance Action Could Lead to Dip-Buying Opportunity

A month has passed since the SEC accused Binance of several violations, including misappropriation of user funds. Many anticipate that the DOJ will also issue charges against Binance and its CEO. We believe this is likely, given recent indications of increased legal enforcement.

Last week, it was reported that several Binance executives, including the Chief Strategy Officer and General Counsel, announced their departures, hinting at potentially imminent and potentially severe legal repercussions for the company.

Given Binance’s prominence in the industry, any DOJ action could create short-term negative price impacts. However, we view any Binance-induced sell-off as a buying opportunity, considering the current macro and narrative-based tailwinds.

Core Strategy

We believe that the market is currently in a “sentiment sweet spot” where both narrative-driven factors (such as the potential spot ETF and the return of US investors) and fundamental factors (such as the upcoming halving event in a few quarters and expanding global liquidity) are bullish. While market sentiment is shifting, the trade remains far from overcrowded, and the risk asymmetry is skewed to the upside.

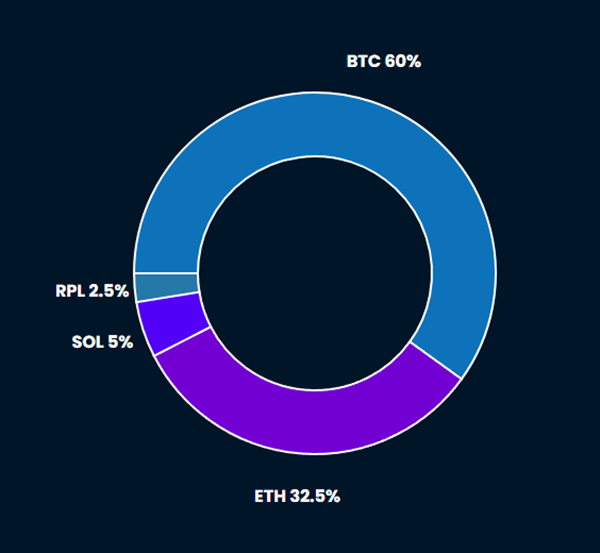

Tickers in this report: BTC, ETH, RPL, SOL 3.97% , GBTC 0.05% , COIN 4.55% , MARA -0.71% , WGMI 4.07%

[1] The total supply held by illiquid entities. The liquidity of an entity is defined as the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.

[2] The total amount of circulating supply held by long term holders. Long- and Short-Term Holder supply is defined with respect to the entity’s averaged purchasing date with weights given by a logistic function centered at an age of 155 days and a transition width of 10 days.