Good Time to Buy Volatility

Key Takeaways

- Despite CPI once again coming in hot, crypto continued to perform relatively well. This was quite similar to the price action following the 9.1% headline inflation print in July.

- Bullish price action on the back of bad news is a good sign of a market bottom and might provide further support for constructive near-term price action.

- Realized and implied volatility in crypto has been declining steadily since the crypto market bottomed in June, leading us to believe this is a great time to buy volatility.

- We peek under the hood of the current futures open interest for bitcoin, which has reached an all-time high. While investors should be aware of the leverage embedded in the market, the current makeup of OI appears much healthier than many would expect.

- Strategy – Given the extraordinary decline in implied volatilities, we think now might be a good opportunity to either capitalize on long options strategies (i.e., call spread) or employ a risk-mitigated non-directional options strategy (i.e., a straddle) to take advantage of any overdue price action for bitcoin over the coming 1-3 months.

- The dramatic bullish reversal on Thursday coupled with recent strength against the dollar and equities is encouraging for near-term price action. We are still constructive on select assets (core: BTC, ETH, SOL -1.07% , merge-adjacent: LDO, RPL, OP -9.70% , MATIC) through the balance of the year.

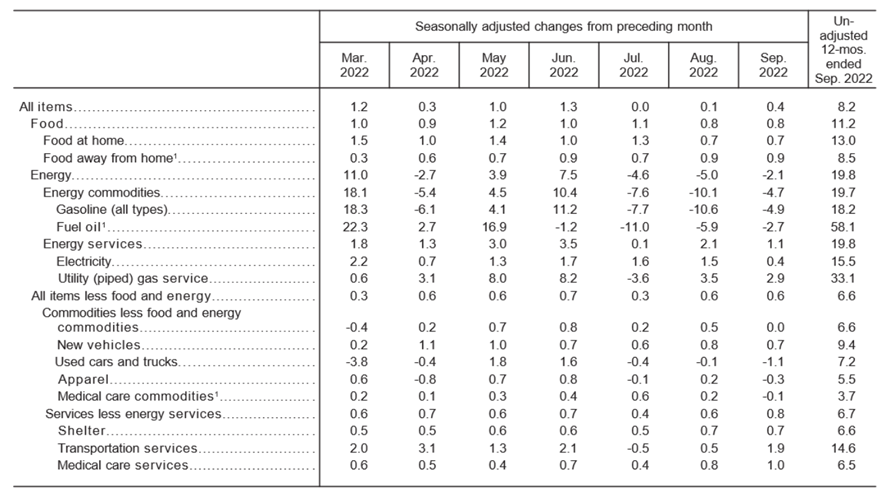

CPI Still Hot

For the second consecutive month, inflation was much hotter than analysts had anticipated. Despite headline CPI easing for the third consecutive month, the headline figure of 8.2% came in above the market consensus of 8.1%, and Core CPI accelerated to 6.6%, the highest in 40 years. Despite some relief in goods inflation, the numbers were not highly constructive for risk markets (or so it would seem).

Bottoming on Bad News Again?

Pre-market rates spiked, and equities and crypto sold off, opening well below the prior day’s close. However, volumes were generally low, and as put option buyers closed their positions, late shorts got washed out, buyers moved in, and the sell-off would go on to be erased rapidly and conclusively.

The bullish reversal saw bitcoin finish the day over 8% off the daily low, with most major altcoins following suit.

This is not the first time we have witnessed this bullish reaction to bad inflationary data this year. In July, the June CPI came in at an eye-popping 9.1%, the highest level in 40 years. Despite this seemingly cataclysmic data point hitting the tape, asset prices found a relatively solid footing and went on to have a rather bullish summer. While the rally was interrupted come September, it was an excellent example of the market pricing in lousy news well before the bad news came to light, leading to a solid and sustained rally.

As it was in July, such bullish price action on the back of bad news is a good sign of a market bottom. This provides further support for constructive near-term price action.

A Good Time to Buy Some Volatility

Recently, we have discussed the impressive way in which crypto has held up in the face of perilous bond and equity markets. The strength in correlations between major cryptoassets and macro variables has waned in recent weeks, leaving us to question whether crypto has already priced in the market’s terminal liquidity conditions and whether further downside relating to earnings revisions should even be contemplated by crypto investors. Despite this pressing question remaining unanswered, we think conditions in the short term are presenting investors with an excellent opportunity to buy some volatility.

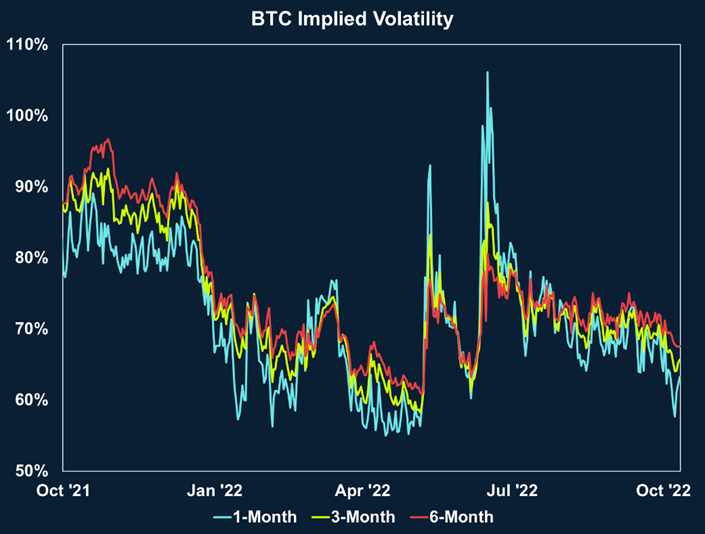

Below we see that the market expectations for bitcoin volatility across most timeframes have been declining steadily since the crypto market bottomed in June.

The picture is more apparent on a realized basis, with 90-day realized volatility sinking to a level not seen since January. Interestingly, this volatility level preceded a rather sizeable bear market rally through early March.

This lack of volatility in crypto is in stark contrast to volatility expectations in traditional markets, as both the MOVE -3.22% index and the VIX have increased steadily since early August.

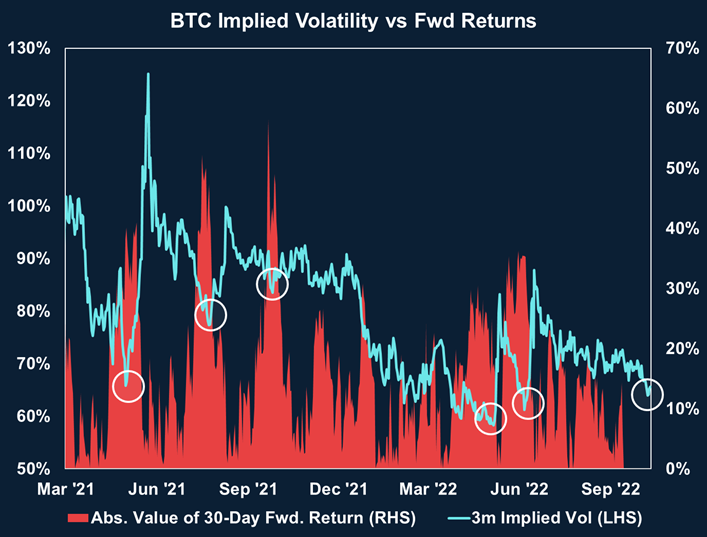

If we examine recent history for extended periods of sliding implied volatilities, we see that:

- This is one of the more impressive and sustained slides in volatility in recent history. This dynamic possibly stems from the excessive volatility “pulled forward” during the massive deleveraging events in Q2 this year.

- Each prior episode of declining volatility counterintuitively lines up with outsized bidirectional forward returns. Below we use the absolute value of 30-day forward returns to demonstrate the future realized volatility following these instances of low implied volatility.

We think this presents an interesting opportunity for investors to take advantage of. Options premiums in crypto are often very expensive due to the asset class’s consistent and outsized volatility.

Given the dramatic decline in implied volatilities, we think now might be a good opportunity to either capitalize long options strategies (i.e., call spread) or employ a risk-mitigated non-directional options strategy (i.e., a straddle) to take advantage of any overdue price action for bitcoin over the coming 1-3 months.

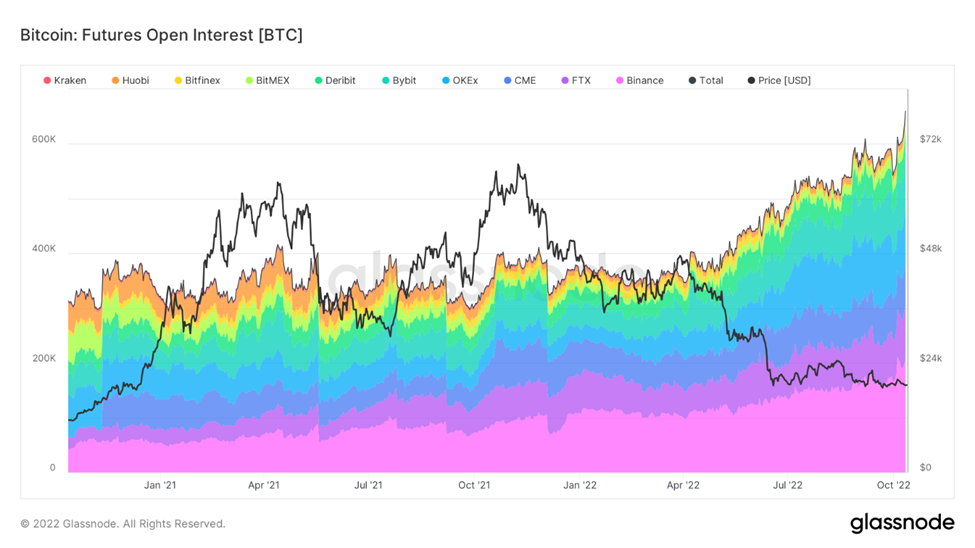

Leverage is Increasing, but the Risk of Cascading Liquidations is Overstated

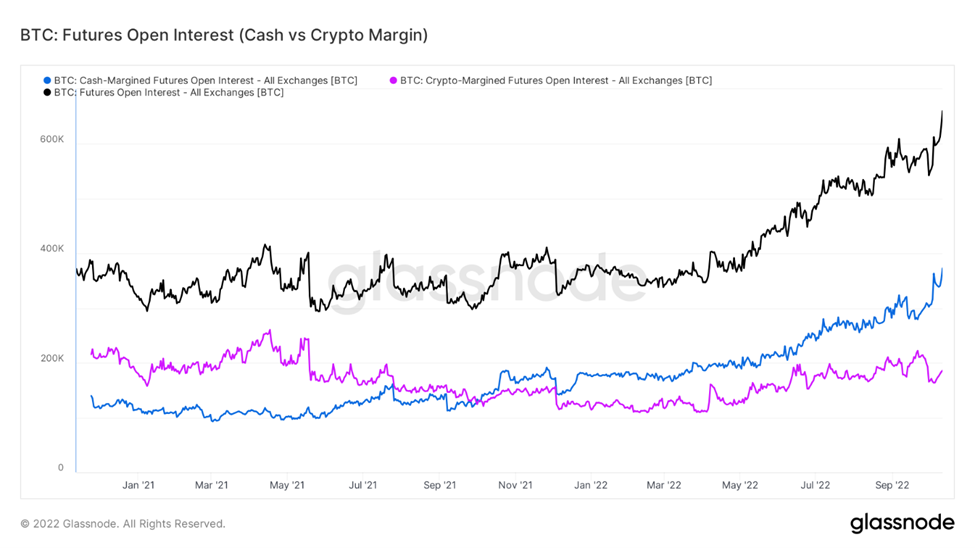

One of the reasons that some find this lack of volatility somewhat baffling is attributed to the active bitcoin futures market. Since the massive market decline in April, open interest denominated in BTC has been climbing higher at a breakneck pace, setting new all-time highs on a near-daily basis.

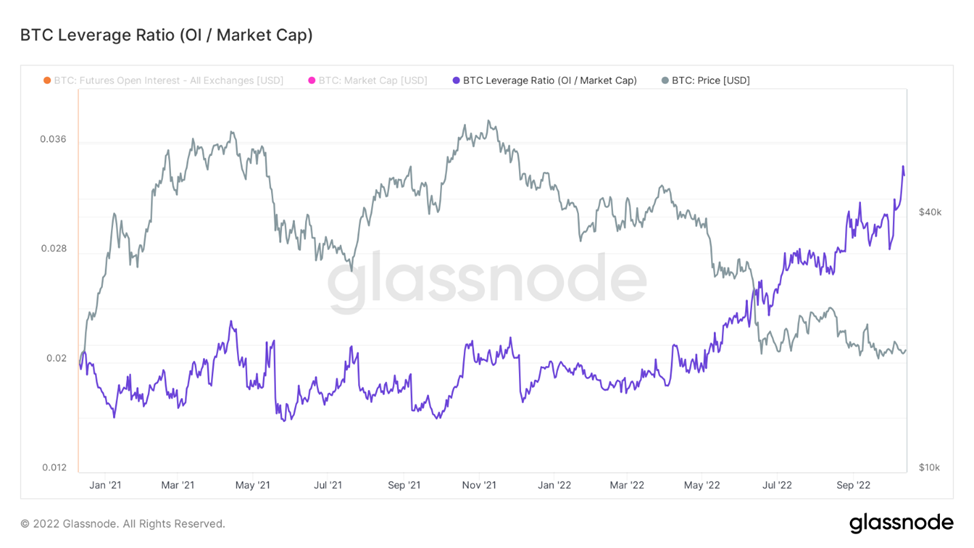

Since merely looking at this metric through the lens of BTC-denominated contracts is limiting, we can look to bitcoin’s ratio of open interest relative to market cap to get a better feel for how this current level of futures market activity stacks up historically. Bitcoin’s current open interest level is quite elevated, even compared to the frothier parts of the prior bull market.

Due to this rapid increase in OI, coupled with unrelenting macro and geopolitical risk in traditional markets, many have started raising concerns over potential liquidation risk. To be clear, we stand by our thoughts above and think we are overdue for a strong move soon, but we also believe that any concerns regarding cascading liquidations require more context.

There are a couple of nuances to consider, the first of which is the health of the underlying collateral behind these futures contracts. In prior years, investors would repeatedly “long their longs” by margining their futures contracts with crypto. This would result in pronounced returns to the upside but would leave the market vulnerable to the aforementioned liquidation cascades.

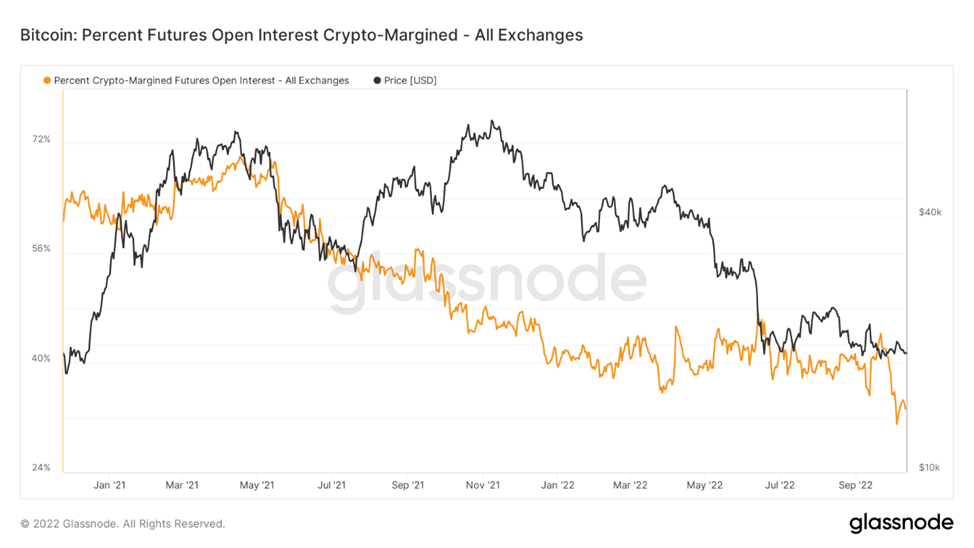

This historical precedent, coupled with the credit crunch in Q2 of this year, might skew an investor’s view of the current setup. While OI is undoubtedly elevated, only 34% is margined with cryptoassets compared to nearly 50% a year ago and upwards of 70% 18 months ago. It certainly does not preclude the market from experiencing liquidations, but it is an essential factor when contemplating the degree of risk embedded in the market.

Below is another interesting view of the different margin components. Approximately one year ago, cash-margined futures (cash in this context includes both USD and USD-pegged stablecoins) surpassed crypto-margined contracts, and the market has only improved on this ratio since.

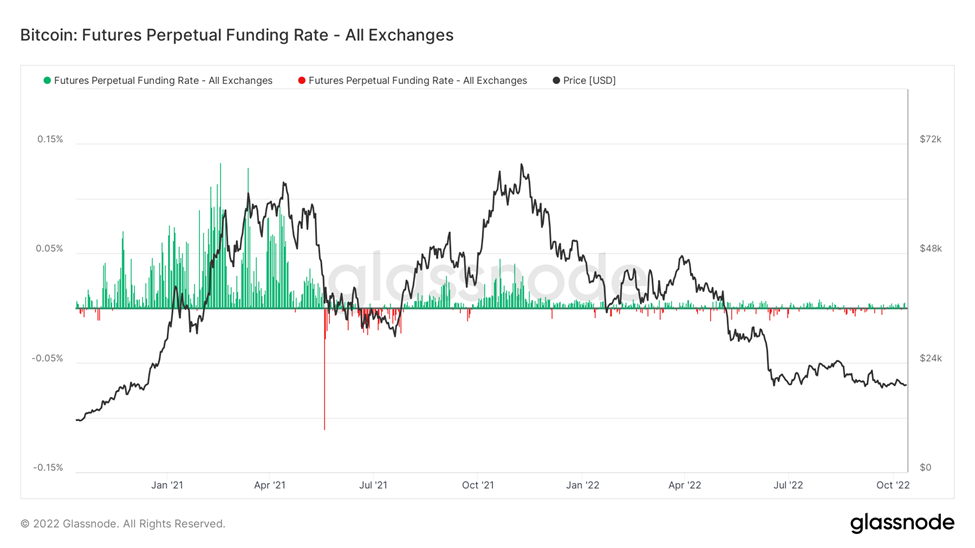

The second aspect to consider is the lack of directional bias in the perpetual futures market, which can indirectly inform our view on how aggressively the overall market is positioned. Throughout the prior bull market, we saw very conclusive periods of perps traders piling into one side of the trade, paying massive premiums to market makers to ride the market’s prevailing momentum (the pronounced red and green areas below). However, since the market started to drop, we can see that funding rates have been comparatively tame and have oscillated between short periods of both positive and negative funding, indicating a more balanced market positioning.

While perps are merely a subset of the overall crypto trading universe, the lack of conclusiveness around directional demand provides us with some confidence that the overall market is not aggressively positioned in either direction, thus strengthening our view that futures OI is neither excessively short nor long.

Strategy

Given the extent of the range-bound price action in recent months, we think now is a good opportunity to capitalize on a reasonably priced non-directional options strategy (i.e., a straddle) to take advantage of any overdue volatility over the coming 1-3 months.

The dramatic bullish reversal on Thursday, coupled with recent strength against the dollar and equities, is encouraging for near-term price action. We are still constructive on select assets (core: BTC, ETH, SOL -1.07% , merge-adjacent: LDO, RPL, OP -9.70% , MATIC) through the balance of the year.