Skate to Where the Puck is Going

Key Takeaways

- Fed Chair Powell took to the microphone in Jackson Hole on Friday. We assess the gravity (or lack thereof) of his statements.

- Despite an inflation nowcast that suggests easing CPI figures, forward inflation and tightening expectations have increased.

- We look at the changes in derivatives positioning and on-chain activity that were seemingly knock-on effects of the Tornado Cash sanctions.

- Negative funding rates suggest an overly reactionary bearish sentiment and indicate a good 2-3 month buying opportunity.

- Strategy – We continue to be long BTC, ETH, and SOL N/A% into year-end and think that Merge-adjacent names, including LDO, RPL, OP -2.59% , and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities. The recent rally, coupled with prevailing market narratives and miner dynamics, suggests it might be wise to be overweight large cap altcoins in the medium term.

Despite Market Pullback, Jackson Hole was Nothing of Substance

Fed Chair Jerome Powell took to the microphone on Friday afternoon for the first time since he announced the Fed’s prior 75 bps rate increase. Powell has mastered the art of tactful political speech, as he used 10 minutes of words to say nothing of substance. While there was a small corner of the market that thought Powell would cavalierly announce the end of this tightening regime, most expected him to do precisely as he did – stymie overzealous doves that were high off the recent summer rally by using his oft-repeated rhetoric about preserving price stability while remaining data dependent thus leaving the door open for lower rate increases through the balance of the year.

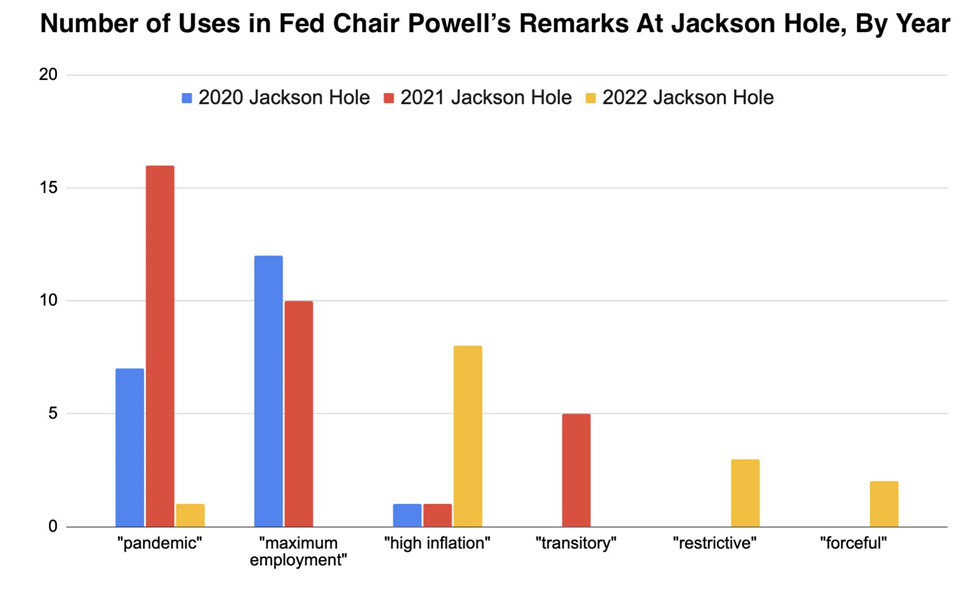

We found the analysis below, put together by Jack Farley (@jackfarley96) at Blockworks, quite interesting. While not exactly something we would trade off of, it is fascinating to see how over the past 24 months, the Fed’s interests have shifted from jobs and supply-side effects of inflation to instilling fear in the market through hawkish language.

If anything, this should serve as another reminder that Powell and the Fed have been, and likely will continue to be, backward-looking. While this can be frustrating, it makes sense that our Central Bank waits for hard data to make such consequential decisions about the cost of money. Fortunately for us, we can skate to where the puck is going and position accordingly.

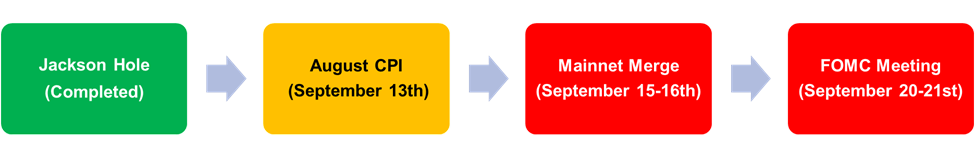

And this concludes the first major event in our hybrid macro/crypto timeline for the months of August and September. The next major event that our team has our eyes set on is the CPI print in a couple of weeks. We think that the current weakness we are experiencing is a net positive for anyone positioning around the merge since it mitigates the macro risk that is paired with the perceived technical risk of the network upgrade.

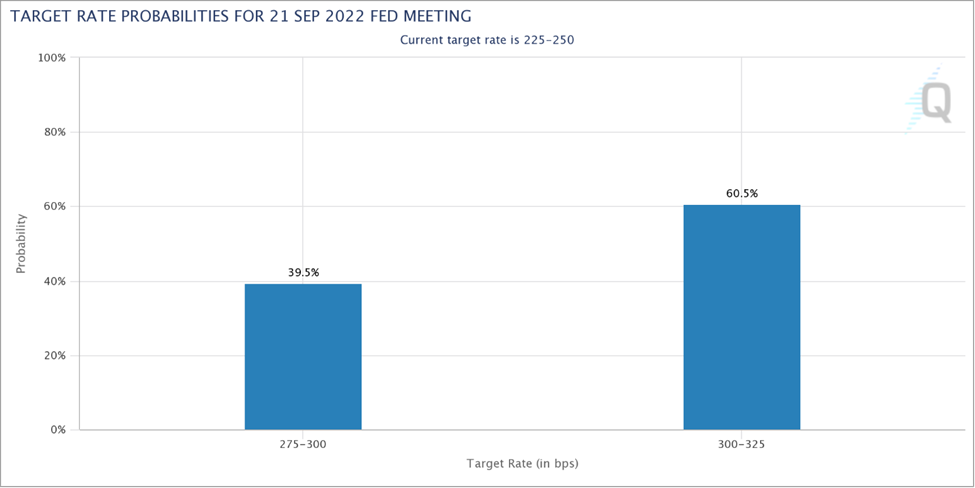

Below we see that after a quick dip down to 50 bps last week, the market is conclusively pricing in a 75 bps increase next month. This is also a positive sign, as this leaves room for softer inflation figures to have constructive effects on asset prices.

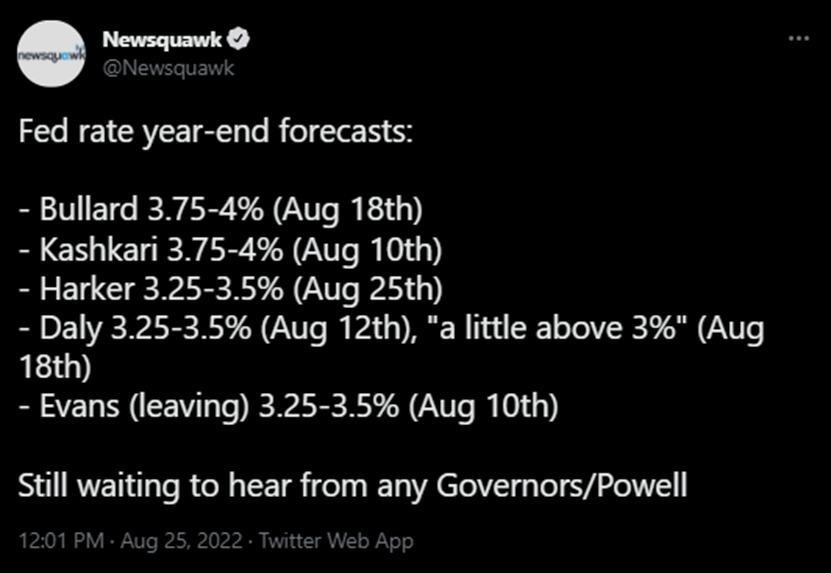

Not to mention, a 75-bps rate increase will get us quite close to the current year-end projections made by Federal Reserve Officials. Bullard and Kashkari’s estimates, the highest of the bunch, project a mere 75 bps of additional rate increases on top of the 75 bps that the market is pricing in for September.

Rates and Dollar Strength

Those who follow our work adequately understand the interplay between rates, the dollar, and BTC. Thus, it checks out that this rate rally has been met with weakness in crypto. Interestingly, a pattern has emerged that seems to demonstrate excessive downward pressure on risk assets when the US 10Y rises above 3%.

We saw similar pressure in mid and late July. This was during a time when ETH was diverging due to increased confidence in the merge, offering an idiosyncratic catalyst to push ETH and the ETH/BTC chart higher.

In a similar but slightly nuanced light, the DXY has shown pronounced strength, reaching new YTD highs. In addition to rates, the US dollar has been buoyed by increased downward pressure on the EUR in the face of a waning European economy and a potential energy crisis.

As we have mentioned many times, over the past 7-8 years, the DXY has shown a strong inverse correlation to crypto and has one of the strongest relationships to crypto out of all the macro factors out there.

Inflation Expectations Increasing

As “price stability” is the new focus of the Fed, it is essential to understand where the market’s inflation expectations are anchored and in which direction they are trending. We are sure that the chart below gave the Fed chest pains around the late-July timeframe since a market that expects inflation to start to ease will be more inclined to spend, thus increasing the prices of both assets and goods. Fed Officials’ increased hawkish rhetoric has caused the market’s expectations for inflation to climb again.

Despite inflation breakeven climbing, the dollar strengthening, and the US 10Y ripping higher, we still have ample evidence to support softer inflation.

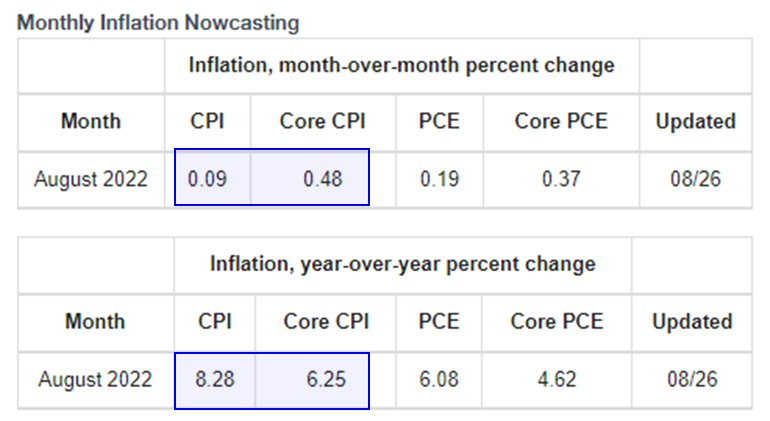

The latest figures on the Fed’s inflation NowCast forecast a monthly CPI increase of 0.09%, or an annual increase of 8.28%, well below many current analyst forecasts, which hover around 8.5%.

This is another encouraging sign that the Fed is behind the curve, but unlike at the beginning of the year, the curve is sloping downwards. This gives us confidence that despite the residual macro risks hanging in the air, the asymmetry for crypto through the rest of the year is to the upside.

Additional Commentary on Recent Pullback

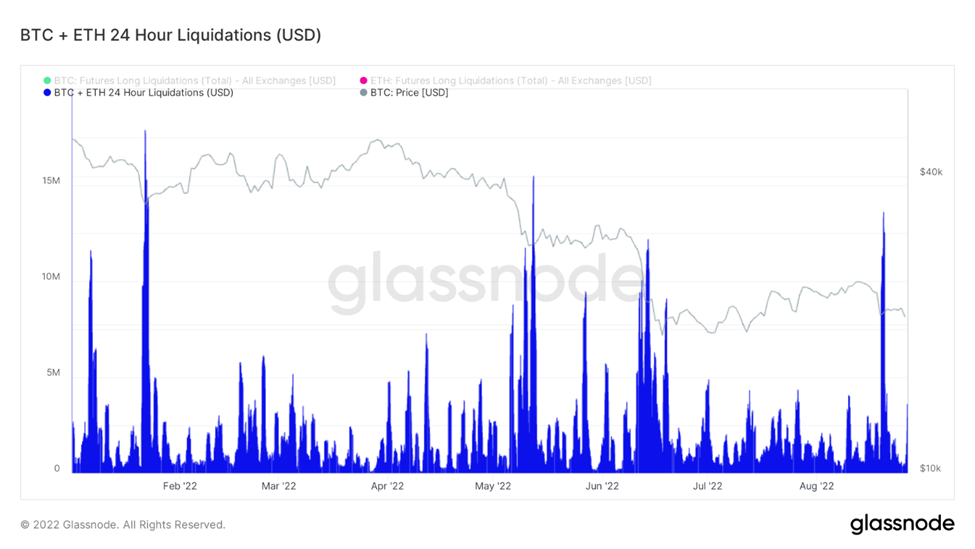

We alluded to this last week, but most of the selling of late has been from forced market participants subject to liquidations of leveraged positions.

We can see below that the rolling 24-hour long liquidations for ETH and BTC reached levels rivaling that of mid-June when the industry was reeling from the 3AC unwind.

In addition to technical exhaustion, increased hawkish sentiment, and rising dollar strength, we have noticed signs that the recent sanctioning of Tornado Cash may have added to the bearish price action of late, particularly for ETH.

On August 8th, the US Treasury sanctioned crypto mixer Tornado Cash after accusing the protocol of laundering more than $455 million. Tornado Cash is a mixing service that allows users to anonymize their transactions. While many innocent users use the protocol to maintain their privacy on-chain (for instance, Vitalik used it to pay USDC to Ukraine in their war fundraising efforts while avoiding the eyes of the Russian government), it’s also regularly used by hackers trying to hide their tracks.

The US Treasury added Tornado Cash and 44 related wallets to its Specially Designated Nationals list. These wallets include the smart contract that runs Tornado Cash, its Gitcoin grants address, and the Tornado Cash donation wallet.

While there is certainly a conversation to be had with regards to OFAC censorship and the censorship resistance of Ethereum, we think that many folks mistakenly conflated a potential compromise of the decentralization of Ethereum with the prospects of a successful Merge. We can see below that once the Treasury announced its sanctions, the relative volume of puts started to tick higher.

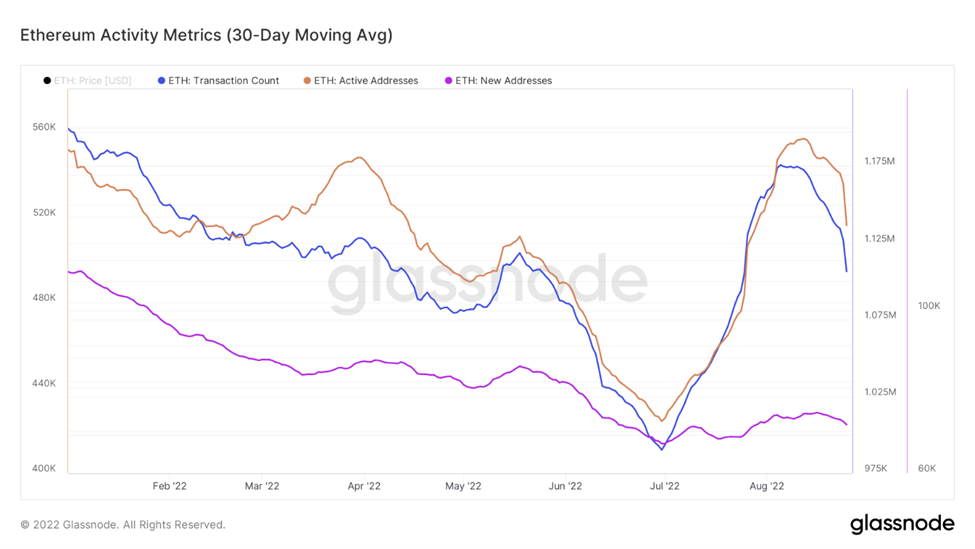

Further, we can see that the activity metrics showing fundamental on-chain demand started to roll over on the news – a sign that the government was effective in causing trepidation surrounding investors in the network.

While we plan to address our thoughts on Ethereum and censorship resistance in our comprehensive overview of the Merge due for release next week, we see this seemingly bearish response to the sanctions as an overreaction.

The potential accretive effects of the Merge and the censorship resistance of ETH are variables that an investor should assess on different timeframes.

In the near term, we think it is proper to continue discussing censorship resistance and understand its importance in the industry. However, we also must remember that this network upgrade is scheduled to occur and remains a potentially key catalyst. In the immediate term, the Tornado Cash sanctions are a non-event. The Merge is happening, and we should position as such.

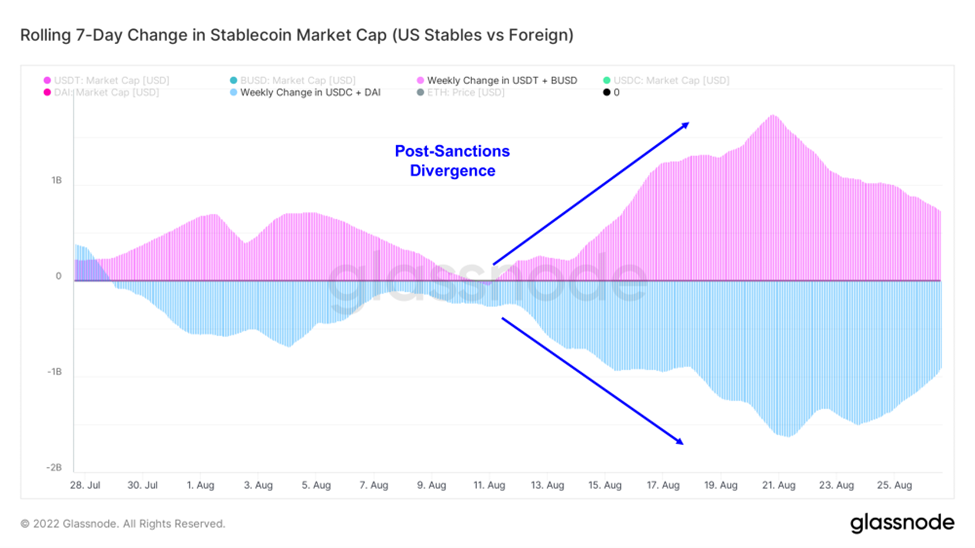

As a quick aside, we thought the chart below was fascinating. It maps out the change in total stablecoin market cap for stablecoins largely subject to US sanctioning in USDC and DAI (a significant portion of DAI is backed by USDC) and the change in market cap for those outside the umbrella of US sanctions in USDT and BUSD.

Despite the US Treasury’s most arduous efforts, it would seem that a 24-hour global, liquid market created via open-source software is impossible to contain as the liquidity parked in US stables has simply moved to the non-US cohort.

Increasing Negative Sentiment Into a Positive Catalyst

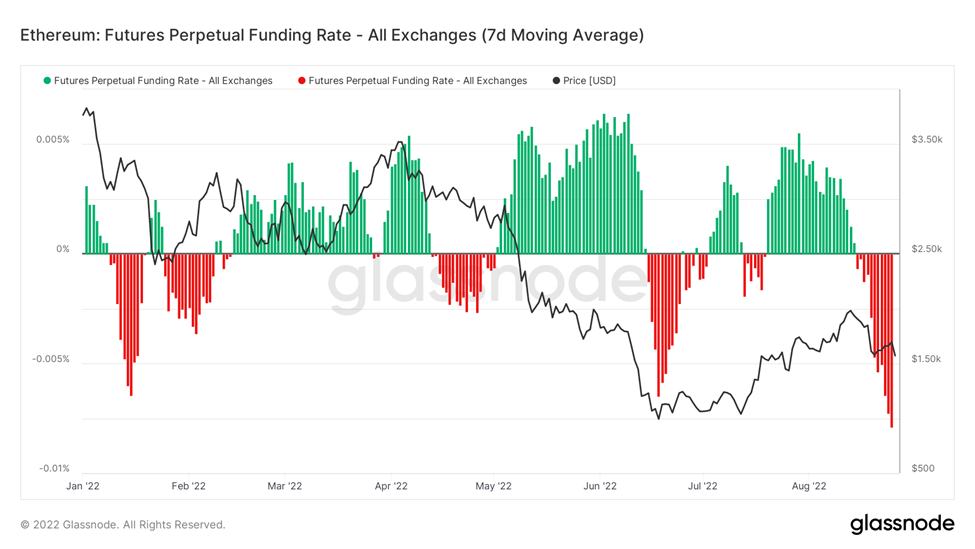

Looking at the funding rates for perps, we see an increasing appetite for traders to be net short ETH. The 7-day moving average for funding rates is conclusively negative, meaning there is more demand for the short side of the trade. Should this trend persist into two potentially bullish catalysts in the August CPI report and the ETH Merge, we could see a reflexive move higher as bears will be forced to cover their overly cautious short positions.

Ignoring both aforementioned potential catalysts, we can see that a sustained pattern of negative rates has served as a good buying opportunity.

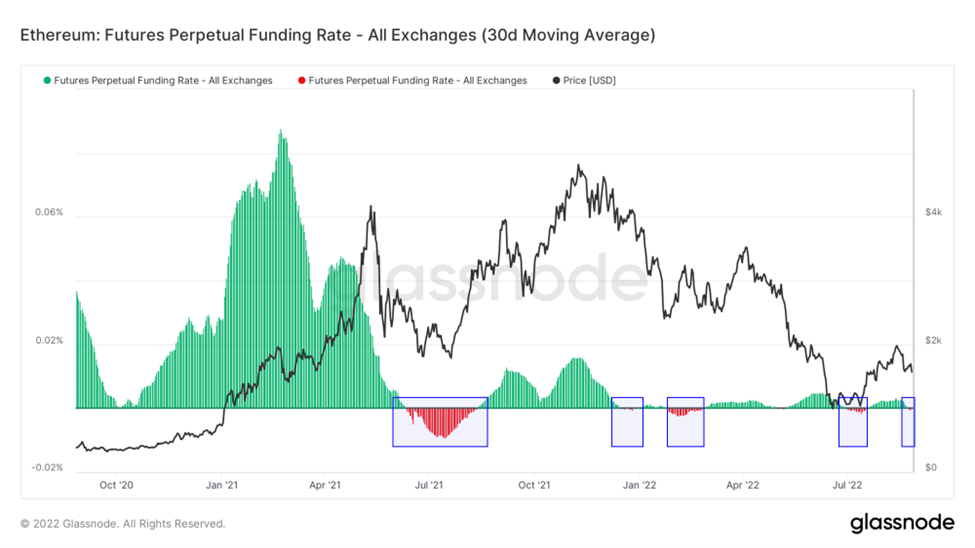

Over the past two years, whenever the 30-day moving average for perps funding rates has moved into negative territory, ETH has moved higher over the subsequent 2-3 months.

Strategy – We continue to be long BTC, ETH, and SOL N/A% into year-end and think that Merge-adjacent names, including LDO, RPL, OP -2.59% , and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities. The recent rally, coupled with prevailing market narratives and miner dynamics, suggests it might be wise to be overweight large cap altcoins in the medium term.