BTC ETF Issuers Get Ducks in a Row, Funding Rates Soar

Market Update

- The crypto market commenced 2024 on a high note. BTC spearheaded the rally, climbing from just above $42k to nearly $46k, setting a new peak in the ongoing bull market. Despite a slight retracement, Bitcoin's price remains over $45k. ETH, while not matching Bitcoin's pace, has still made considerable bullish strides, now trading around $2,350 after briefly nearing $2,400. ETH's Layer 2 solution, ARB -0.15% , is undergoing consolidation following its ascent towards record highs, reflecting the early stages of a Layer 2 rotation seen last week. Similarly, STX has rebounded, likely in response to Bitcoin's upward move, and has seen a 9% increase in the last 24 hours. In a parallel development, SEI, the debut parallelized EVM, has been performing beyond expectations, suggesting a strong market interest for upcoming parallelized EVMs. On the traditional markets front, the first trading day of the year is witnessing some consolidation as major US stock indices pull back amidst rising rates. With crypto prices also consolidating since the US market opened, it raises the question of whether macro correlations might reemerge soon. This week, significant macro data, including PMIs and jobs numbers, are due for release. These figures could alter the Federal Reserve's timeline for its first rate cut.

- Several BTC ETF applicants, including Fidelity, BlackRock, and Valkyrie, have updated their Bitcoin ETF applications with the SEC. These updates mainly highlight their selected broker-dealers and management fee structures. Notable firms like Jane Street Capital and JPMorgan Securities have been designated as authorized participants tasked with managing cash flows in the ETFs. The proposed fees vary, with Valkyrie and the Ark/21Shares joint venture suggesting a 0.80% fee, whereas Fidelity offers a more competitive rate of 0.39%. Invesco has set a fee of 0.59% but plans to waive this for the initial six months of trading. These revisions underscore the firm's preparedness for a possible SEC decision, anticipated as early as January 8th.

Source: James Seyffart at Bloomberg

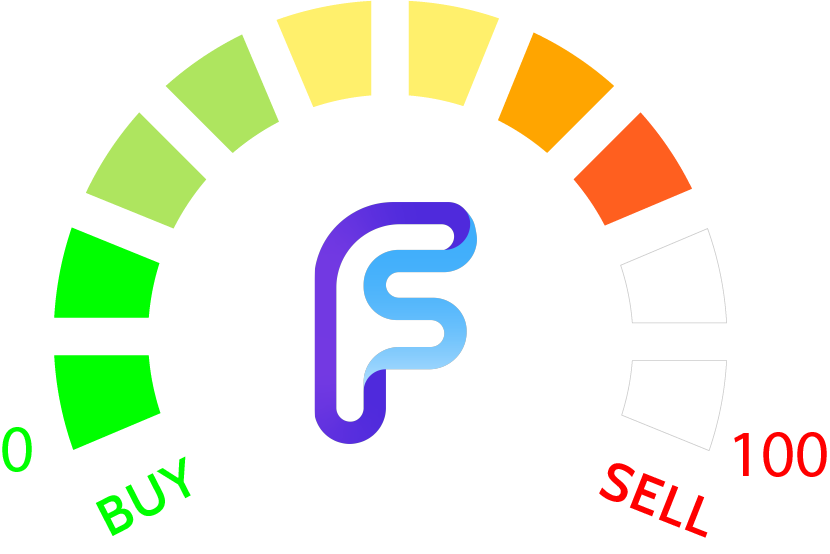

- The prospect of imminent ETF approval has triggered a bullish wave in the Bitcoin futures markets. This optimism is clearly reflected in the recent surge in leverage prices. Since the onset of the new year, funding rates in both standard and perpetual futures markets have risen sharply. Notably, the annualized 3-month basis on futures contracts has escalated to over 16%, a marked increase from 11% just a week prior and the highest since November 2021. In the perpetual futures market, the average annualized funding rate, essentially the cost leveraged longs pay to shorts, oscillates between 60% and 80%. This scenario offers a profitable opportunity for traders to capitalize on this funding in a delta-neutral approach. It's important to note that this represents the first indication of speculative excess that we have seen in the current bull market. Funding costs at these levels normally precede volatility, and the direction of that volatility will depend on near-term flows.

Source: Glassnode, Fundstrat

Source: Glassnode, Fundstrat

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Mark Newton is on vacation. He will return to providing Daily Technical Commentary tomorrow.

Daily Important Metrics

All metrics as of January 2, 2024 1:11 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $883B | $45,088 | ↑ 4.57% | ↑ 172% | |

ETH ETH | $284B | $2,361 | ↑ 1.35% | ↑ 97% | ↓ -75% |

SOL SOL | $46B | $108 | ↓ -0.17% | ↑ 990% | ↑ 818% |

ADA ADA | $22B | $0.6141 | ↑ 0.64% | ↑ 149% | ↓ -23% |

DOGE DOGE | $13B | $0.0917 | ↓ -0.05% | ↑ 31% | ↓ -141% |

DOT DOT | $11B | $8.44 | ↓ -0.67% | ↑ 94% | ↓ -78% |

MATIC MATIC | $9.4B | $0.9788 | ↓ -2.28% | ↑ 28% | ↓ -144% |

LINK LINK | $8.6B | $15.21 | ↓ -1.19% | ↑ 174% | ↑ 1.78% |

NEAR NEAR | $3.9B | $3.91 | ↑ 4.77% | ↑ 207% | ↑ 35% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -8.04% | $37.35 | ↑ 7.89% | ↑ 351% | ↑ 178% |

| BITW | ↓ -35% | $24.50 | ↑ 5.83% | ↑ 356% | ↑ 184% |

| ETHE | ↓ -11% | $20.13 | ↑ 3.52% | ↑ 323% | ↑ 151% |

| BTCC | ↑ 1.60% | $8.22 | ↑ 7.17% | ↑ 171% | ↓ -0.89% |

News

MARKET DATA

CoinDesk Bitcoin Bullish Bets Costlier Than Ever as Funding Rates Hit Record 66% Data tracked by Matrixport show global average perpetual funding rates rose to a record 66% annualized early Monday. |

CoinDesk Polymarket Traders See 89% Chance of SEC Approving Spot BTC ETF by Jan. 15 Some investors have bought the "No side shares" of the prediction contract to hedge against potential delays in the SEC's approval of spot ETFs. |

The Block Bitcoin price spike above $45,800 caused over $73 million in short liquidations Bitcoin has hit a year-to-date high, causing over $133 million in shorts liquidated across the crypto market in the past 24 hours. |

The Block Arbitrum and Optimism tokens trade near all-time high price levels The Arbitrum and Optimism tokens recorded significant price rallies over the past month — currently trading near their all-time highs. |

HACKS, EXPLOITS, AND SCAMS

The Block Orbit Chain’s hacked funds ‘remain unmoved’ following $81 million exploit Orbit Chain said on X that the stolen assets were frozen after its bridge was hacked for $81.5 million worth of crypto on Dec. 31. |

The Block Crypto wallet founder loses $125,000 to fake LFG token phishing attack The phishing attack was related to a fake airdrop guide for the new LFG token, which seeks to onboard Ethereum big fee spenders to Solana. |

Reports you may have missed

MARKET COMMENTARYU.S. EQUITIES ARE RELATIVELY FLAT AS THEY CONSOLIDATE ABOVE PRIOR ALL-TIME HIGHS. THE SPX IS TRADING AT 5,300, AND THE NDQ IS HOVERING NEAR $18,600, WHILE THE DXY 0.00% (-0.07%) IS SHOWING A SLIGHT DECLINE, TRADING AT $104.4. Crypto assets are showing strength, with BTC 0.15% rising 2.84% to $67.1k and ETH 0.87% surging 4.86% to $3,090. Liquid staking tokens are building on Ether's outperformance, as LDO -1.29% and PENDLE 4.20% have gained 10.11% and 13.43%, respectively. Similarly, layer-2...

CRYPTO MARKET UPDATETODAY, WE ARE SEEING SOME MINOR CONSOLIDATION IN THE CRYPTO MARKET COINCIDING WITH THE SLIGHT BOUNCE IN THE RATES AND DXY 0.00% . BTC 0.15% is trading just north of $65k, while ETHBTC continues to struggle, with ETH 0.87% moving lower for the 5th consecutive day and still trading below the $3k mark. Despite the market consolidation, SOLBTC is still green on the day as SOL 1.96% works to regain the $160 level....

MARKET COMMENTARYINVESTORS WELCOMED THIS MORNING’S SLIGHTLY SOFTER THAN EXPECTED CPI DATA AND A LARGE DOWNSIDE MISS ON U.S. RETAIL SALES, ALLEVIATING INFLATION CONCERNS AND HELPING TO PROPEL STOCK INDICES TO NEW INTRADAY ALL-TIME HIGHS. The SPY 0.14% and QQQ -0.07% have gained over 1% to surpass $528 and $451, respectively, while US treasury rates have turned significantly lower, with the US10Y dropping below 4.34%. Crypto is responding in similar fashion with BTC 0.15% ...

Tornado Cash Developer Sentenced to 5 Years in Prison, LayerZero Succeeding Against Sybils

CRYPTO MARKET COMMENTARYAPRIL PPI CAME IN MIXED THIS MORNING, WITH A LARGE UPSIDE SURPRISE IN MOM READINGS (0.5% VS. 0.3% EXP.) AND YOY METRICS LARGELY IN LINE WITH EXPECTATIONS. The upside in the MoM reading was offset by March figures being revised downwards. Yields initially spiked upon the data release but have turned negative across the curve. Equities are showing mild gains as attention shifts towards tomorrow’s CPI data release. The SPY 0.14% has gained 0.17% and the QQQ -0.07% has gained 0.31%. Crypto assets are...