Rates Tell the Story

Key Takeaways

- Despite the QRA showing an uptick in relative coupon issuance, the market’s response to this QRA release was rather tame. This reflects a market that had effectively priced in this data ahead of time.

- Overall, the Fed's latest communication has tempered expectations for rate cuts in the first quarter, likely resulting in a short-term increase in rates. However, the overall shift in the burden of proof from the doves to the hawks is a positive signal for potential rate cuts in the first half of the year.

- Despite limited risks currently affecting only a couple of banks, if wider contagion arises from commercial real estate credit issues, bitcoin stands out as the best asset to be allocated to, in our view.

- Flows continue to be constructive, with spot BTC ETFs posting four consecutive days of net inflows.

- The aggregate stablecoin market cap also continues to expand, reflecting an environment conducive for altcoin, should BTC hold its current range.

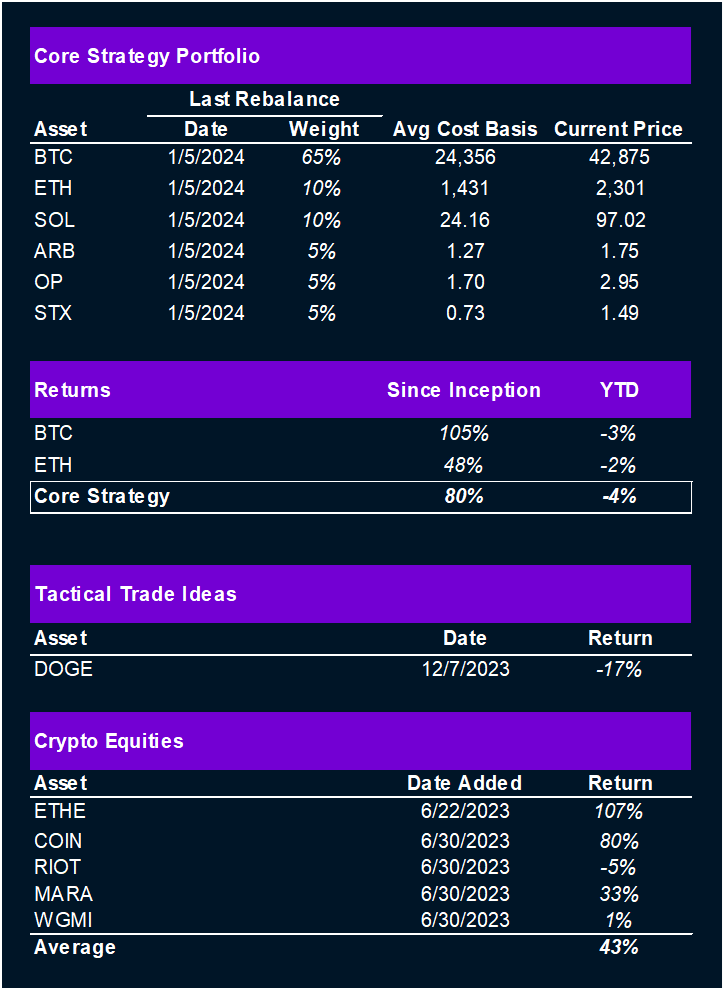

- Core Strategy – Our outlook on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining majority exposure to BTC in our Core Strategy will provide the opportunity to rotate into altcoins once the turbulence subsides. We continue to believe that ETH, L2s, and STX present compelling idiosyncratic upside due to their respective near-term catalysts, and SOL should benefit from continued momentum post-Jupiter airdrop.

QRA In Line With Market Expectations

The Results

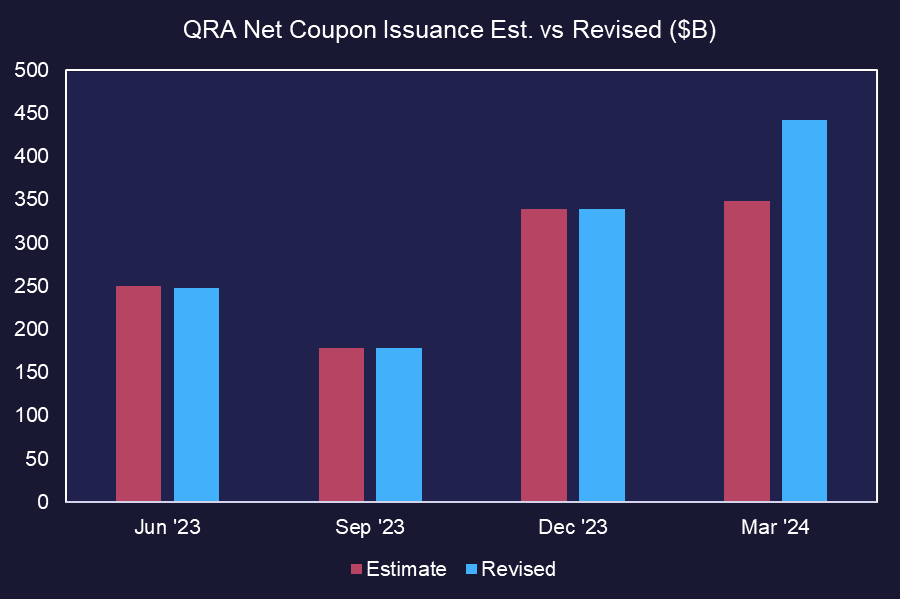

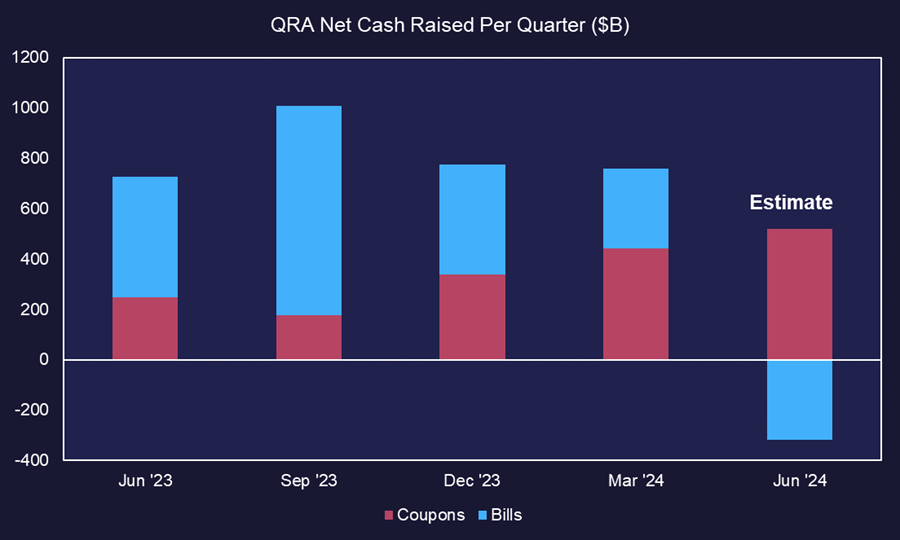

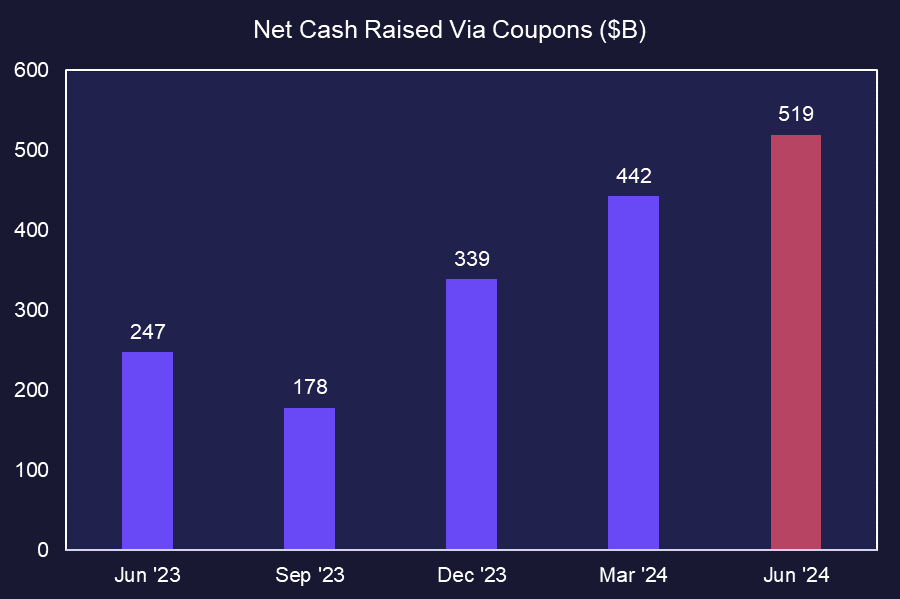

The Treasury’s quarterly refunding announcement (QRA) was the first of two major macro events to transpire on Wednesday. Leading up to this, on Monday, there was an indication that the net borrowing for the current quarter would be $760 billion, which is $55 billion lower than the initial $815 billion estimate, and the total funding needs for Q2 would be just over $200 billion, well below the past several quarters. On Wednesday, the composition of the refunding was revealed. Overall, for this quarter, net bill issuance is significantly less than expected, decreasing from $468 billion to $318 billion. Furthermore, Q2 is projected to be mostly financed through duration, with over $500 billion in net new cash from coupons and a net negative issuance of bills.

Source: Treasury, Fundstrat

To summarize, the QRA indicated lower overall debt issuance (good), a slowdown in bill issuance (mixed), and a step-up in coupon issuance relative to prior estimates (not good).

The bullish perspective on the QRA is that the net cash raised by the Treasury is set to decrease for two consecutive quarters. This trend is particularly interesting given the size of the current fiscal deficit.

Source: Treasury, Fundstrat

Additionally, the reduction in the amount of bills being issued is likely to slow the drain of the RRP, which has served as a buffer for banking liquidity and staves off a potential liquidity lock-up in the event that the RRP runs dry while the Fed continues to engage in QT.

Source: Treasury, Fundstrat

However, there are concerns as well. The changes could potentially extend QT and add some upward pressure on long-term rates as coupon issuances come to market.

Market Reaction

The last two QRAs have led to decisive changes in the direction of risk assets. Our expectation heading into this QRA was that it would show a coupon issuance schedule for the remainder of the current quarter and for Q2 that was either equal to or closely aligned with Q4, and that it would be net positive for risk assets. The more critical factor was to observe the market’s reaction, particularly in rates and the dollar (DXY), following the QRA to gauge how its details were being absorbed.

From the initial reaction, it seems the market was comfortable with these figures, suggesting that any increase in rates from increased issuance might already be factored in. The upward pressure in rates occurred only after the Fed press conference shot down the idea of a March rate cut.

One could argue that the minor turmoil witnessed in a couple of regional banks on Wednesday morning due to CRE credit risk fears might have influenced the drawdown in rates around the QRA release. But, if this were true, we would likely not have seen the same uptick in rates following this Fed press conference.

The bottom line here is that despite the QRA showing higher relative coupon issuance, the market’s response to this QRA release was rather tame, likely due to the reduced overall debt issuance or perhaps the market had priced the QRA in ahead of time. We should trust that reaction.

Fed Shifts the Burden of Proof on Hawks

Wednesday’s FOMC interest rate decision and subsequent press conference marked the second massive macro event of the day, with the Federal Reserve making a notable shift in its monetary policy stance.

In line with expectations, there were no changes to the overnight rate. However, the key development was the Fed’s official shift in risk assessment. With its latest statement, the Fed has effectively shifted the burden of proof from the doves to the hawks. It will be up to hawks to demonstrate that recent inflation numbers are temporary as opposed to the doves needing to prove that inflation is rolling over. This change in approach suggests that, should the data remain conducive for rate cuts, then the market should expect them.

That being said, the market’s reaction was notably bearish on some of Chairman Powell’s comments, particularly regarding the low probability of a rate cut in March.

This sentiment is likely to lead to a further upward swing in rate expectations as the market recalibrates to match Powell’s more patient tone.

An additional point of interest from the FOMC press conference was Chairman Powell’s mention that discussing the path for QT is on the Fed’s agenda for the March meeting. While concrete details on the Fed’s approach to QT were not provided, it’s clear that more information and guidance will be forthcoming in a couple of months.

Overall, the Fed’s latest communication has tempered expectations for rate cuts in the first quarter, likely resulting in a short-term increase in rates. However, the overall shift in the burden of proof from the doves to the hawks is a positive signal for potential rate cuts in the first half of the year.

Impact of Potential Banking Crisis 2.0

As mentioned earlier, there are renewed concerns about banking stability. This time, the issues are less about unrealized losses on available-for-sale (AFS) securities and more about the potential deterioration of commercial real estate (CRE) credit on bank balance sheets. Currently, only two banks are affected, and the contagion appears limited. However, if this contagion – whether driven by actual events or merely narrative – begins to spread, we believe that bitcoin represents the best asset to be allocated to.

We have a compelling example of BTC’s resilience during banking crises, demonstrated when it outperformed following the collapse of Silicon Valley Bank (SVB). Furthermore, we are confident that any signs of instability within the banking system are likely to prompt a liquidity response from the Federal Reserve to alleviate concerns, creating a favorable environment for BTC.

Flows Moving Higher

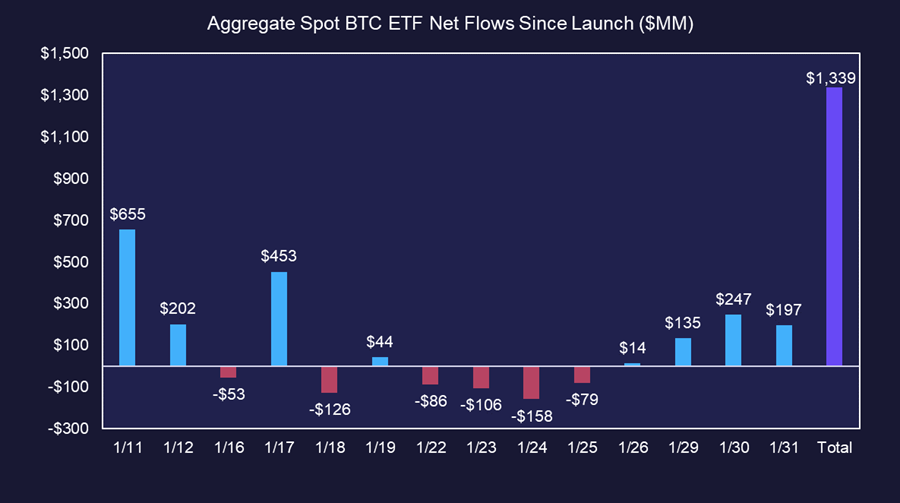

We continue to monitor the daily flows into and out of the spot BTC ETFs. Now that the exodus out of GBTC has slowed considerably, we are witnessing sustained daily inflows into these products. On Wednesday, aggregate net inflows were just under $200 million, bringing the total aggregate inflows since launch to over $1.3 billion.

Source: Farside Investors, Fundstrat

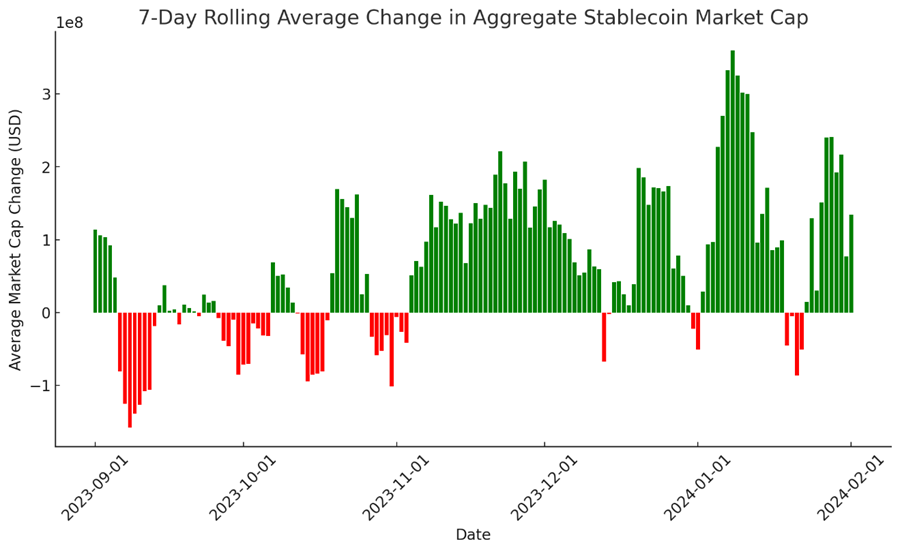

On the altcoin side of the market, we are also seeing constructive flows data in the form of stablecoin mints. The aggregate stablecoin market cap experienced a brief pullback in mid-January following the launch of the spot BTC ETFs but has since reaccelerated.

This is a great sign for altcoins. Should bitcoin be able to hold its current range in the near-term, or continue to move higher, these flows should be supportive of altcoin prices.

Source: DefiLlama, Fundstrat

Core Strategy

Our outlook on Q1 headwinds materialized somewhat faster than anticipated, but in our view, it is a passing storm. Maintaining majority exposure to BTC in our Core Strategy will provide the opportunity to rotate into altcoins once the turbulence subsides. We continue to believe that ETH, L2s, and STX present compelling idiosyncratic upside due to their respective near-term catalysts, and SOL should benefit from continued momentum post-Jupiter airdrop.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalyst is the possibility of a spot ETF coming to market in Q2.

- Solana (SOL 0.52% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP -60.98% ) & Arbitrum (ARB): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

- Stacks (STX 0.81% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- DOGE (DOGE): Given (1) the return of animal spirits in the crypto market, and (2) two impending space missions with connections to DOGE, we think it is an opportune time to think about developing a position for a near-term (1-3 month) trade.