Bitcoin Transaction Fee Record, Celo Chooses OP Stack for L2

Market Update

- After significantly outperforming equities leading up to its halving event on Friday, BTC 6.17% continued its upward trend over the weekend, now trading just below $66k. ETH has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL 1.25% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well today, with no particular themes overshadowing others, but some noteworthy outperformers include IMX and OP 13.91% , as well as AI-adjacent tokens like NEAR 2.28% and RNDR 9.29% . Equity indices have seen slight gains so far today, with the financials sector leading the charge. Earnings season begins in earnest this week, with Q1 numbers expected from Meta, Microsoft, and Google. Additionally, significant economic data to watch for this week includes Q1 GDP, with a current forecast of 2.5%, scheduled for release on Thursday and Core PCE arriving on Friday.

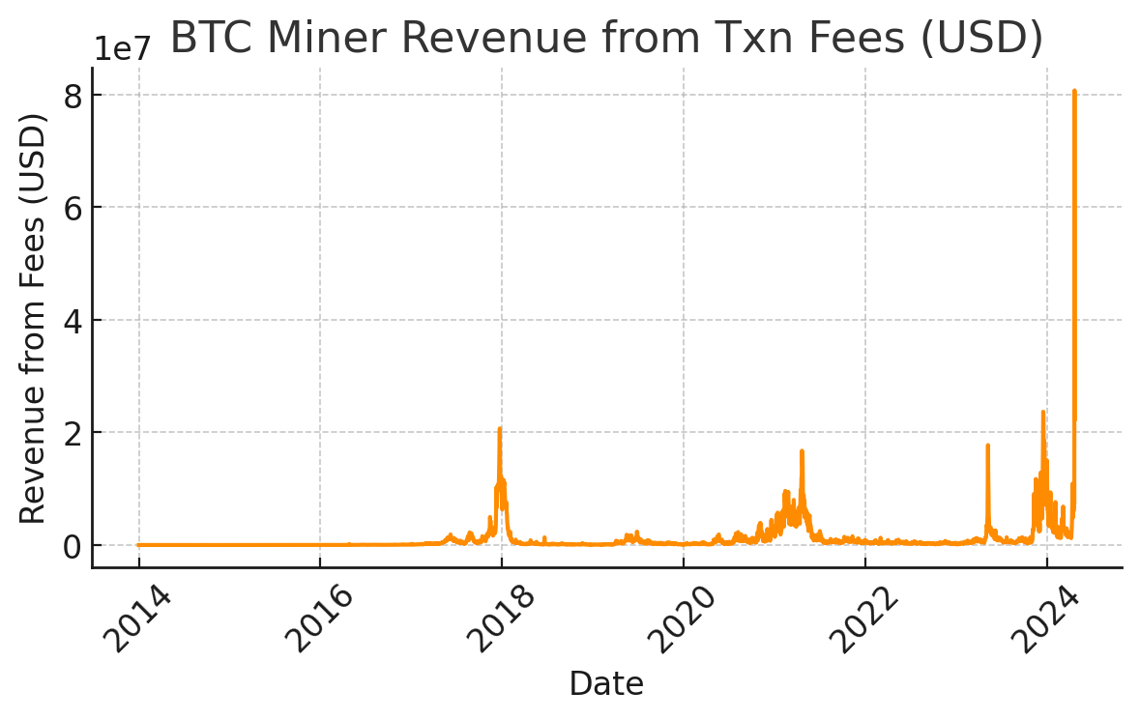

- Following the fourth Bitcoin halving on Friday evening, total bitcoin miner revenue saw a sharp increase, primarily due to a spike in network fees associated with the launch of the Runes protocol and the minting of new tokens. Daily transaction fees reached over $80 million the day after the halving, setting a new record. Transaction fees have since declined from these initial peaks to a more normalized, albeit still elevated, level. This resurgence in on-chain activity could be an important tailwind for miners. As the demand for block space driven by DeFi and speculative activities climbs, and transaction fees increase, the profitability of miners improves. A sustained rise in transaction fees may be underpriced by the market. Although it remains to be seen where fees will stabilize in the coming days, the initial surge in fees is likely a significant short-term relief for miners, who experienced an immediate 50% reduction in block reward margins due to the halving.

Source: Glassnode, Fundstrat

- After a thorough and competitive selection process involving various layer-2 solutions, Celo's primary developer, cLabs, has chosen Optimism's OP Stack for its transition to a layer-2 network atop Ethereum. This decision marks a strategic shift from Celo's current status as an independent L1 to becoming part of the larger Ethereum ecosystem. The proposal to adopt OP Stack, praised for its compatibility with features from other technologies like Polygon's Type 1 prover, will be deliberated in community calls before being put to a vote by CELO token holders. This move aligns with the increasing popularity of OP Stack among blockchain projects, as evidenced by Coinbase's use of the technology to build its layer-2 chain, Base, and Worldcoin's recent announcement of plans for a layer 2, World Chain, also built with OP Stack. The firm plans to deploy a testnet for the Celo Layer 2 sometime this summer, following another round of community voting.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Bitcoin looks to have stabilized at a key area of technical support and has begun to turn back higher following its first Halving since 2020. Gains have lifted BTC 6.17% back over early April lows at $64511, and it's thought that the ability to have held March lows of $60,760 on a closing basis last week makes this even more of an important support area going forward. Near-term, the rise in Cryptocurrencies has begun to happen ahead of the Equity market starting to bottom out, but I anticipate gains this week with key resistance for BTC initially found near $68,550 and any move over should help BTC accelerate back to test and exceed former all-time highs at $73,794 achieved back on 3/14. At present, this is a constructive move and should help BTC push higher. Ultimately, this one-month consolidation should be resolved by a push back to new high territory.

Daily Important Metrics

All metrics as of April 22, 2024 10:51 AM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $1.31T | $66,395 | ↑ 2.92% | ↑ 57% | |

ETH ETH | $384B | $3,197 | ↑ 1.92% | ↑ 41% | ↓ -17% |

SOL SOL | $69B | $155 | ↑ 4.03% | ↑ 52% | ↓ -5.22% |

DOGE DOGE | $23B | $0.1597 | ↑ 1.10% | ↑ 79% | ↑ 22% |

ADA ADA | $18B | $0.5173 | ↑ 4.37% | ↓ -13% | ↓ -70% |

DOT DOT | $11B | $7.45 | ↑ 5.46% | ↓ -8.09% | ↓ -65% |

LINK LINK | $9.0B | $15.35 | ↑ 3.88% | ↑ 2.56% | ↓ -55% |

NEAR NEAR | $7.5B | $7.07 | ↑ 15% | ↑ 96% | ↑ 39% |

MATIC MATIC | $7.3B | $0.7411 | ↑ 3.72% | ↓ -23% | ↓ -80% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| BITW | ↓ -32% | $33.65 | ↑ 2.65% | ↑ 44% | ↓ -13% |

| ETHE | ↓ -22% | $23.28 | ↑ 3.60% | ↑ 20% | ↓ -37% |

News

QUICK BITS

CoinDesk Grayscale Reveals 0.15% Fees For Its Bitcoin Mini Trust ETF Bitcoin ETF provider Grayscale has provided some illustrative details of its spin-off fund, the Bitcoin Mini Trust (BTC), including a more competitive 0.15% fee... |

The Block Mt. Gox creditors report bitcoin and bitcoin cash payment update on claims system Mt. Gox creditors have reported seeing bitcoin and bitcoin cash payment updates on the trustee's rehabilitation claims system. |

The Block Magic Eden launches platform for Bitcoin Runes Magic Eden's Runes Platform, in beta, lets users swap for BTC and buy Runes and Ordinals with their Magic Eden wallet. |

MARKET DATA

CoinDesk Bitcoin Miners Have Raked in Abnormal Transaction Fees Since Halving: Bernstein The spike in network fees was driven by speculative activity to mint new meme tokens following the launch of the Runes protocol, the report said. |

REGULATION

CoinDesk IRS Unveils Form Your Broker May Send Next Year to Report Your Crypto Moves The U.S. Internal Revenue Services (IRS) has previewed what crypto investors' future tax form might look like when it finishes its much-debated rule on how cryp... |

WEB 3.0

CoinDesk Celo Chooses Optimism, Concluding Bake-Off Among Layer 2s CLabs officially proposed using Optimism’s OP Stack for the transition. The proposal will be discussed on a couple of community calls and then go to a vote amon... |

The Block GatlingX comes out of stealth, claiming ‘most performant’ parallelized EVM GatlingX has developed GPU-EVM, described as the most performant Ethereum Virtual Machine currently available. |

The Block Ankr launches AI-focused Layer 1 blockchain Neura on public testnet Ankr Network’s ANKR token will act as Neura’s native cryptocurrency, with a mainnet launch anticipated later this year. |

Reports you may have missed

CRYPTO MARKET UPDATEDESPITE YIELDS MOVING HIGHER, RISK ASSETS ARE GENERALLY FARING WELL TODAY. BTC 6.17% BRIEFLY MOVED ABOVE $67,000 AGAIN IN THE MORNING HOURS AND IS NOW HOVERING JUST ABOVE THAT LEVEL. ETH 22.14% remains in a holding pattern, trading around $3,000 as it awaits a likely denial from the SEC this week on spot ETFs. The ETHE 0.00% discount did compress slightly last week, possibly driven by longshot bets that the SEC...

MARKET COMMENTARYU.S. EQUITIES ARE RELATIVELY FLAT AS THEY CONSOLIDATE ABOVE PRIOR ALL-TIME HIGHS. THE SPX IS TRADING AT 5,300, AND THE NDQ IS HOVERING NEAR $18,600, WHILE THE DXY 0.00% (-0.07%) IS SHOWING A SLIGHT DECLINE, TRADING AT $104.4. Crypto assets are showing strength, with BTC 6.17% rising 2.84% to $67.1k and ETH 22.14% surging 4.86% to $3,090. Liquid staking tokens are building on Ether's outperformance, as LDO 32.47% and PENDLE 17.99% have gained 10.11% and 13.43%, respectively. Similarly, layer-2...

CRYPTO MARKET UPDATETODAY, WE ARE SEEING SOME MINOR CONSOLIDATION IN THE CRYPTO MARKET COINCIDING WITH THE SLIGHT BOUNCE IN THE RATES AND DXY 0.00% . BTC 6.17% is trading just north of $65k, while ETHBTC continues to struggle, with ETH 22.14% moving lower for the 5th consecutive day and still trading below the $3k mark. Despite the market consolidation, SOLBTC is still green on the day as SOL 1.25% works to regain the $160 level....

MARKET COMMENTARYINVESTORS WELCOMED THIS MORNING’S SLIGHTLY SOFTER THAN EXPECTED CPI DATA AND A LARGE DOWNSIDE MISS ON U.S. RETAIL SALES, ALLEVIATING INFLATION CONCERNS AND HELPING TO PROPEL STOCK INDICES TO NEW INTRADAY ALL-TIME HIGHS. The SPY 0.12% and QQQ 0.60% have gained over 1% to surpass $528 and $451, respectively, while US treasury rates have turned significantly lower, with the US10Y dropping below 4.34%. Crypto is responding in similar fashion with BTC 6.17% ...