Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

Key Takeaways

- While monetary factors (rates, Fed balance sheet) should continue to be considered, Bitcoin’s performance in the face of a hot CPI suggests that the US fiscal situation may have more relative influence on monetary hedges like BTC going forward.

- Hong Kong is poised to launch spot ETH & BTC ETFs this month, which we think could attract significant investment interest from the mainland (despite it being technically illegal), as evidenced by the strong demand for gold and gold-linked equities as investors seek alternative assets in uncertain times.

- Despite some calls for “selling the news,” the upcoming halving is not expected to be a significant tradable event (in the immediate term) due to a relative lack of uncertainty, absence of structural sellers, and decreasing leverage, with flows and macro factors playing a more crucial role in the near term.

- ETH has performed well YTD, but it has failed to break out of its long-term downtrend against BTC. We think that the advent of restaking will help to boost fundamental demand for ETH, and that the upcoming ETF deadline could serve as a potential turning point for the ETHBTC ratio.

- Rumors of escalation in the Middle East put risk assets in the crosshairs on Friday, with investors flocking to bonds. Cascading liquidations moved crypto prices lower. Notably, the start of the last two major global conflicts resulted in higher near-term prices. We will use this as an opportunity to rebalance our Core Strategy.

- Core Strategy – War risk took prices lower on Friday. There may be some pre-Tax Day selling that is exacerbating this drawdown. We will use this weakness as an opportunity to rebalance our Core Strategy. As a reminder, changes to the Core Strategy are detailed at the end of every strategy note.

What BTC Shrugging Off CPI Says About Current Fiscal Situation

The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury yield climbing by 20 basis points—a situation further exacerbated by a poor 10Y auction on Wednesday.

The DXY ascended back above 105 as major equity indices experienced declines. Despite this, Bitcoin closed the day in the green, surprising many. This was a massively bullish sign, which, in our view, is a nod to fiscal dominance, the stimulative effect fiscal spending is having on the economy and financial assets, as well as the precarious position that the Fed and the Treasury have found themselves in.

In our outlook for the year, we presented the following chart and discussed how the divergence between gold and real rates suggests that the opportunity to curb inflation with rate adjustments may be over, whether achieved or not. The peak in real rates has occurred – and the market knows this.

A combination of a growing fiscal deficit, increased geopolitical risk, and an upcoming election places the treasury in a precarious position.

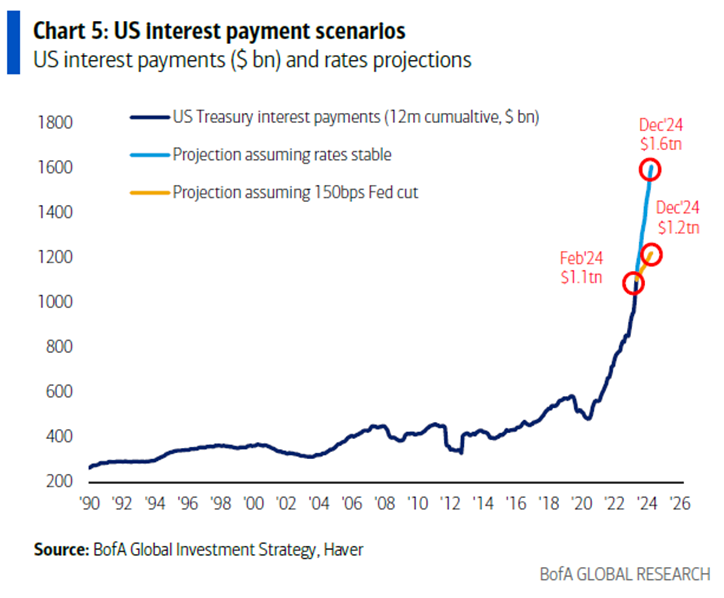

Below is a good view on the fiscal conundrum that we are talking about. If rates remain constant, the total interest paid this year will equal $1.6 trillion. Even with 150 bps of rate cuts, it will still be $1.2 trillion. This will (1) be stimulative to the economy and asset prices, and (2) will need to be paid either via inflation, outsized real growth, or through monetization (YCC). Thus far this year, our base case has been that real growth increases as inflation continues to move lower, but the important thing here is that, ultimately, it doesn’t matter how the bill gets paid. In any of the outlined scenarios, monetary hedges like bitcoin are designed to benefit.

We think that these factors may be contributing to Bitcoin’s overall solid performance post-CPI.

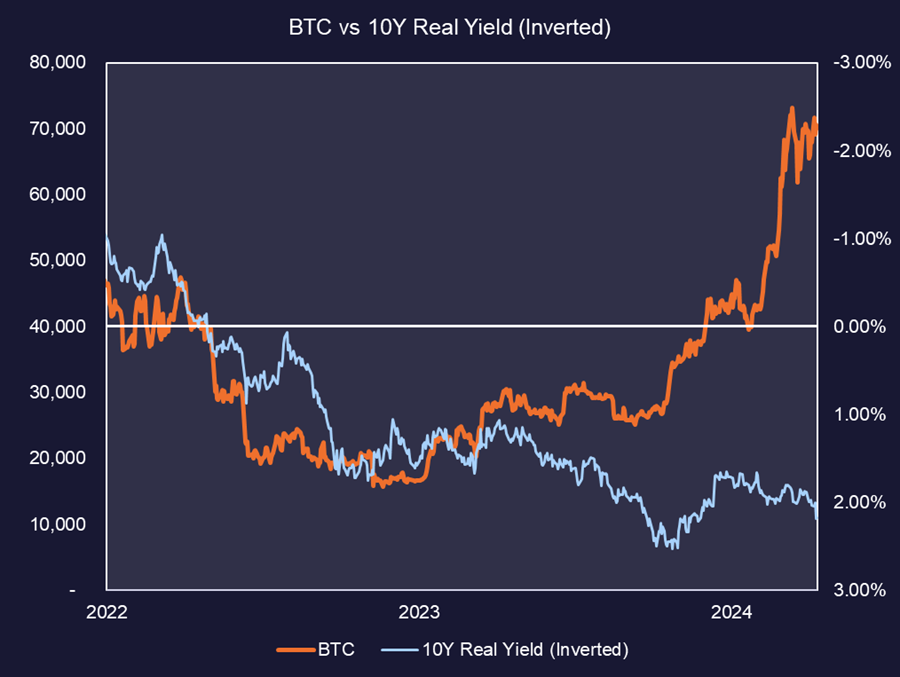

Here is a similar chart, now showing the 10-year real yield (inverted) plotted against Bitcoin’s performance. While there are obviously other fundamental and monetary-policy-related variables to consider when evaluating the drivers behind Bitcoin performance, it’s worth noting that Bitcoin has largely ignored the recent move of the real 10-year yield back above 2%.

Hong Kong to Launch Spot ETFs

It is no secret that the Chinese economy is on uneasy footing, a theme we’ve discussed over the past 12 months as reports of capital fleeing the mainland for crypto have emerged, despite it being technically illegal to trade. Much of this capital flight has occurred via Hong Kong.

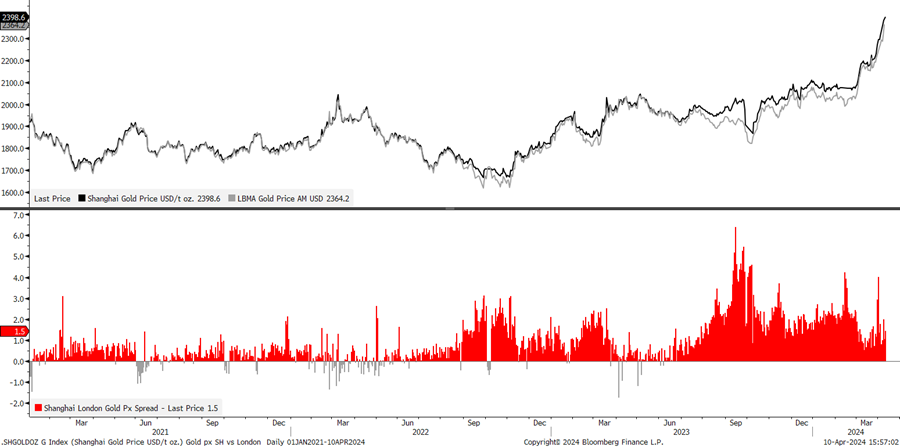

Recently, we’ve also observed incredibly strong demand from China for gold and gold-linked equities. This highlights the clear demand for hard assets among Chinese citizens, especially as global sanctions intensify and there’s a dearth of viable assets in China to store wealth.

The ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF, which invests in gold companies, recently experienced a dramatic increase in demand in China, leading to a temporary trading halt. This halt was implemented after the fund’s premium over its assets soared to an unprecedented 30%, reflecting the broader trend of Chinese investors seeking stability in gold amidst economic uncertainty.

This trend is not new. Below, we note the sustained premium for gold in Shanghai relative to London prices. Some of this demand is from the Chinese central bank, but a portion also comes from Chinese investors looking to protect their capital.

Looking ahead, a report released this week indicates that Hong Kong is on the verge of approving a series of spot BTC ETFs, amidst rising enthusiasm for Hong Kong to become a significant player in the crypto space. A follow up report on Friday indicated that ETH ETF approvals were also on the menu. According to reports, these approvals could come as soon as next week, with trading expected to begin this month.

It’s important to note that Hong Kong is not mainland China. While Hong Kong itself is a substantial market, capital flows from mainland China could be a gamechanger. We think there is a good likelihood that this will result in significant mainland flows. The lines between the two entities have blurred considerably over the past several years. We are inclined to believe that these ETFs have received tacit approval from the CCP. Furthermore, assets traded in Hong Kong are accessible to certain mainland constituents, provided they meet specific criteria. Notably, several of the asset managers applying for the ETFs, such as China Asset Management, Harvest Fund Management, and Bosera Asset Management, are Hong Kong units of mainland companies, which suggests that we might see substantial flows from mainland China. Indeed, such flows would be a gamechanger.

No News to Sell

We have received numerous inquiries from clients about the upcoming halving and whether it should be considered a “sell the news” event. We understand the concern, especially given the brief downturn in volatility following the ETF approval. However, we do not view the halving as an immediate-term tradable event in any direction.

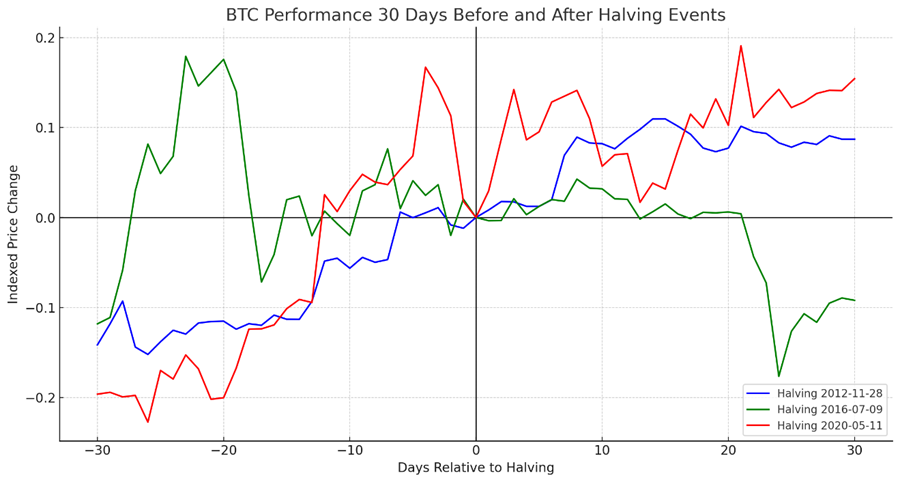

Firstly, for there to be “news to sell,” there must initially be a rumor. In the case of the ETFs, despite our confidence in their approval, there was still considerable uncertainty among market participants, which attracted speculative capital betting on their eventual approval. The halving, expected around April 20th, is nearly a certainty. This event should already be reflected in prices (in the immediate term). Additionally, there is no significant precedent for a dramatic rally immediately following a halving. While one could point to a major rally post-2020 halving, it was more a recovery from a pre-halving dip than a sudden surge. Generally, major gains have been gradual after past halvings.

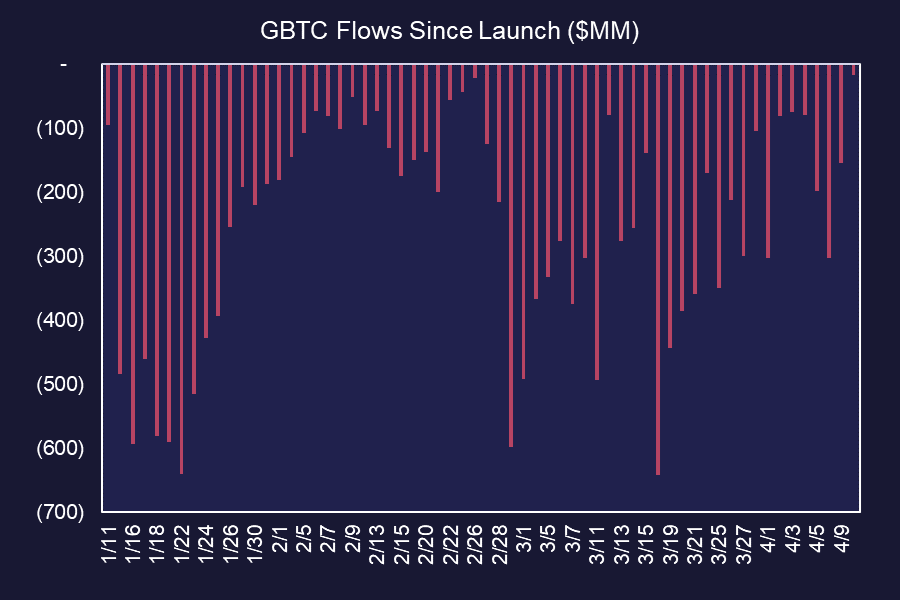

Second, there are no major structural sellers this time. A popular strategy before the ETF approval involved the GBTC arbitrage trade, where traders would go long on GBTC (which was trading at a discount) and short spot BTC to exploit the price differential, anticipating that upon ETF approval, GBTC would trade at its NAV and could be redeemed. These were structural sellers that contributed to substantial outflows post-approval. This, combined with unfavorable macro conditions at the time—such as re-priced rate cuts and a surging dollar—led to a selloff in the weeks following the ETF launch.

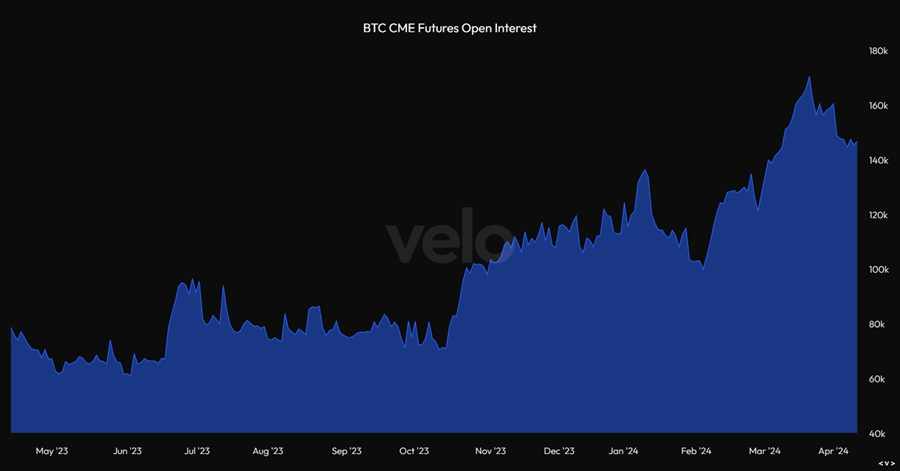

Moreover, event-driven traders who bet on a rally into the approval and unwound their positions afterward primarily operated in the futures market, where institutions could leverage up and capitalize on the momentum leading up to the ETF decision. Currently, we are not observing the same momentum in CME futures open interest (OI) that we saw before the ETF decision. In fact, CME OI has been trending lower over the past several weeks, indicating that traders have been reducing leverage.

The key takeaway here is not that the halving will influence prices in either direction immediately following the event, but rather that there is less uncertainty to leverage ahead of the halving, no structural arbitrage trade poised to unwind, and speculation is not ramping up into the event. Instead, macroeconomic factors are more crucial to consider in the near term than the halving itself.

Ethereum’s Time Will Come

Make no mistake, Ethereum (ETH) has performed well this year, up 55% YTD. We also capitalized on the ETHE trade, exiting when it became apparent that the likelihood of an ETH ETF approval was decreasing. But historically, ETH has been a beta to BTC in bull markets, justifying its inclusion in our core strategy. Yet, ETH has not sustained outperformance against BTC for some time now, with the ETH/BTC chart still failing to break out of its long-term downtrend. While BTC continues to dominate as a monetary asset and Solana emerges as the preferred platform for DeFi and high-performance applications this cycle, ETH finds itself in an ambiguous middle ground.

However, it’s premature for many to declare ETH’s downfall. There are compelling reasons to believe that ETH will begin to outperform in the near term.

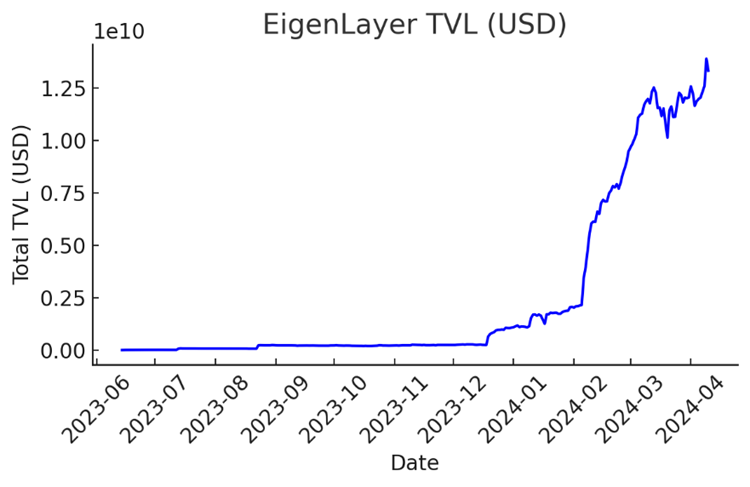

Firstly, there’s increased fundamental demand for ETH. This week, EigenLayer launched to great fanfare, introducing a re-staking protocol that has already amassed over $13 billion in TVL.

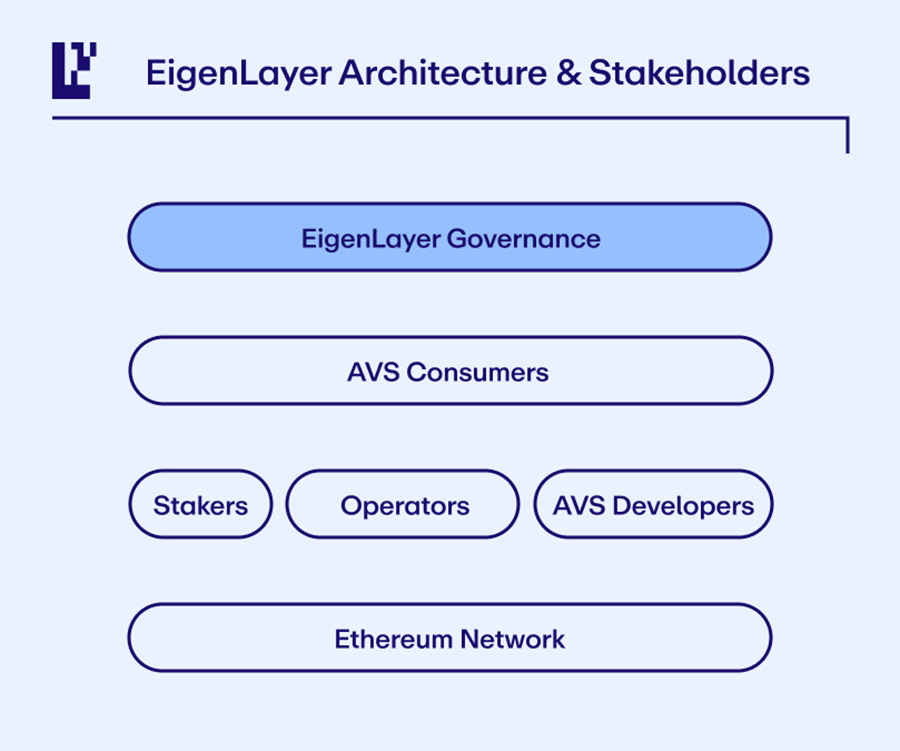

EigenLayer, a protocol on Ethereum, introduces a novel mechanism called re-staking. This allows ETH stakers to reuse their staked assets to bolster security for other applications on the network. By opting into EigenLayer smart contracts, users can re-stake their native ETH or Liquid Staking Tokens (LSTs) to support additional services, earning extra rewards. This reduces capital costs for stakers and enhances trust guarantees for individual services, helping to prevent security fragmentation across new decentralized services. EigenLayer allows these services to leverage the pooled security of Ethereum’s stakers, promoting permissionless innovation and free-market governance. The architecture involves operators running Actively Validated Services (AVSs) and stakers who delegate their staked ETH to these operators or validate directly for AVSs, maintaining control over their stake and choosing which services to support.

We anticipate that as AVSs launch, introducing new slashing conditions and increased yields, there will be a significant rise in demand for ETH to participate in this new validation form and to capitalize on these yields. We also expect EigenLayer competitors to emerge, spurred by its early success.

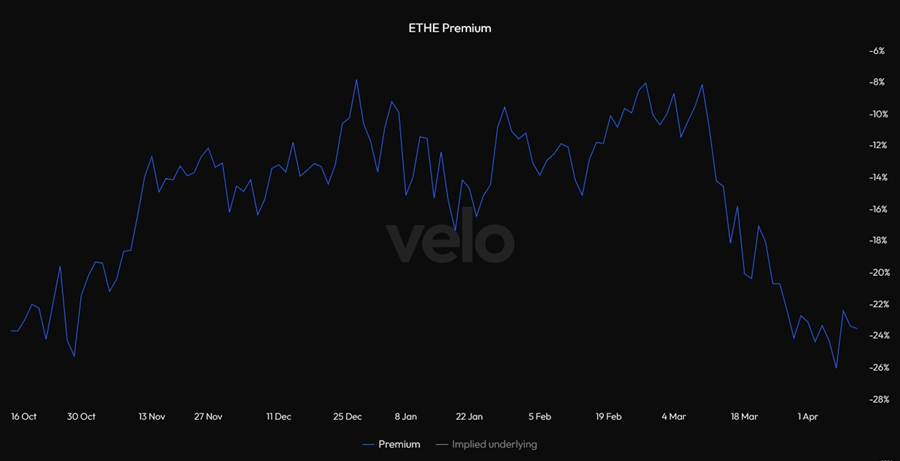

Additionally, there is a significant overhang with the ETF approval deadline looming at the end of May. Our view is that the SEC will not approve the ETH ETF, a sentiment reflected in the market as evidenced by the widened discount to NAV in ETHE.

Currently, there appears to be a buying hesitation for ETH, as many anticipate that an ETF denial could further depress its price. While it’s conceivable that the SEC might label ETH a security in the process of denying the ETF, we believe such a move would be overly aggressive and likely lead to a regulatory dispute with the CFTC—a scenario the SEC is likely keen to avoid.

Therefore, we view the May 23rd deadline as a potential turning point for ETH/BTC. Upon approval, one would naturally rush to buy ETHE, wait for the arbitrage opportunity to resolve, and then transition into spot holdings. Even if ETH inflows are a fraction of those seen in BTC products, ETH stands to benefit significantly. However, given the low likelihood of approval, if the ETF is denied, we expect only a minor dip—since this outcome is largely priced in—which should present a buying opportunity. Investors will then likely turn their attention to ETH’s fundamental progress and its scaling roadmap.

War Risk

On Friday afternoon, rumors of escalation in the Middle East surfaced, putting downward pressure on both traditional and crypto markets, with only treasuries seeming to benefit from the uncertainty. While we are not foreign intelligence experts and cannot comment on the validity of any risks of escalation, there are a couple of things from a market perspective to consider:

On Friday afternoon, rumors of escalation in the Middle East surfaced, putting downward pressure on both traditional and crypto markets, with only treasuries seeming to benefit from the uncertainty. While we are not foreign intelligence experts and cannot comment on the validity of any risks of escalation, there are a couple of things from a market perspective to consider:

- Any escalation in the ongoing war in the Middle East only strengthens the fiscal dominance thesis. The more global conflict there is, the higher our defense budget will go. At the same time, the more multipolar the world becomes, the less liquid the market for US debt will be.

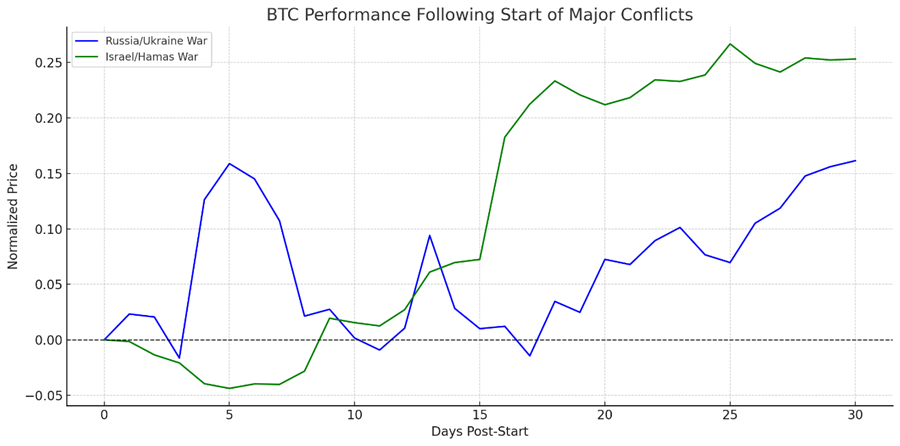

- The two recent precedents for major global conflicts have presented good short-term buying opportunities.

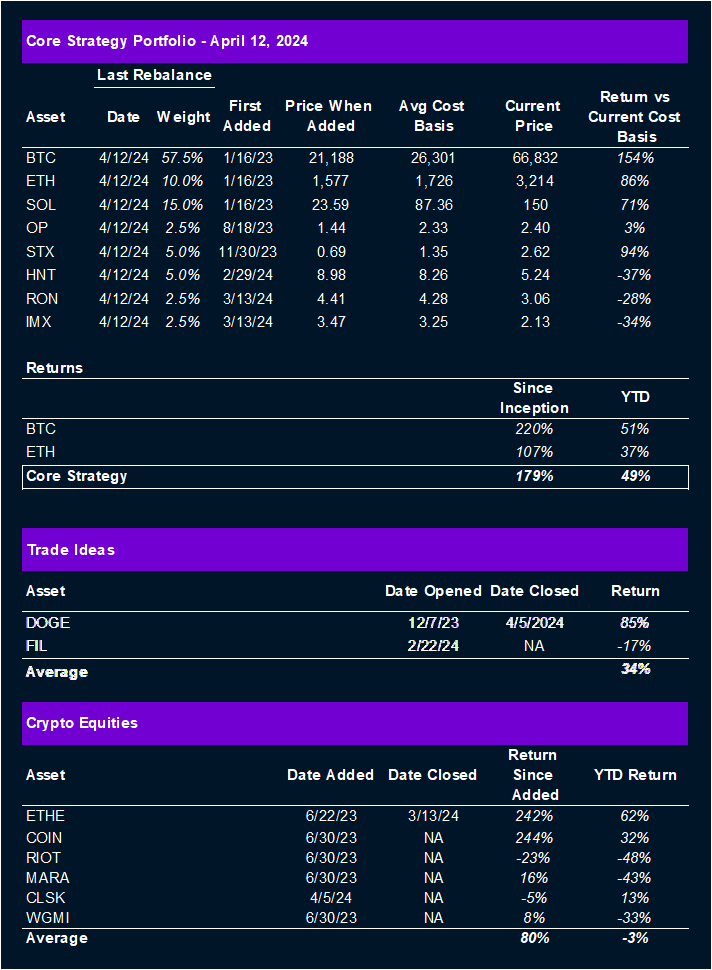

Core Strategy

The market continues to be led by BTC, a generally positive indicator for the overall market. War risk took prices lower on Friday. There may be some pre-Tax Day selling that is exacerbating this drawdown. We will use this weakness as an opportunity to rebalance our Core Strategy. As a reminder, changes to the Core Strategy are detailed at the end of every strategy note.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. Offers beta exposure to ETH.

- Stacks (STX): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- Helium (HNT): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX) & Ronin (RON): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms. As appendages of the ETH ecosystem, they also offer a different flavor of ETH beta.

- Filecoin (FIL): Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling short-medium-term trade at these levels. Narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.

Reports you may have missed

BUYERS ON STRIKE Last week, we discussed our immediate-term cautious approach to the crypto market, highlighting recent geopolitical tensions, tax-related selling, negative fiscal flows, and the persistent rise in real yields as reasons for a more risk-averse positioning (albeit relative, as holding 7.5% in cash and the rest in crypto is hardly considered risk-averse in most circles). This uncertainty has persisted into this week, evidenced by what we consider an...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....