Technical Strength Into Year-End

Key Takeaways

- Bitcoin has surpassed the 50% retracement area of its entire 2021 decline, strongly signaling that “crypto-winter” has run its course.

- Near-term Bitcoin targets lie between $46k-$48k, which will likely be followed by a consolidation period in Q1 2024.

- Ethereum is slowly building momentum, prepping for a bullish 2024. Momentum indicators have turned positive on multiple timeframes, with intermediate-term price targets materializing near $2,900, and then $3,300.

- ETH/BTC continues to trade in a clear downtrend, but as it approaches significant support near $0.0437-$0.0463 it will increasingly look like an attractive counter-trend trade. At present, it still remains premature, but it could be on the verge of a bullish 2024.

- Within crypto-equities, MSTR and COIN are the correct choices to be overweight. Although still constructive, MARA and RIOT remain the laggards of the group.

Bitcoin (BTC)

“Crypto-winter” looks to be over. A bullish 2024 looks likely technically following a 1Q consolidation.

Bitcoin looks to be giving off strong signals that the crypto-winter that has kept most coins in bear markets over the last couple years has finally run its course. The act of having taken the lead ahead of many cryptocurrencies in finally surpassing the 50% retracement area of its entire decline from 2021 is promising heading into 2024.

Near-term targets lie between $46-$48k, initially lining up near the 61.8% Fibonacci retracement of the decline from 2021 along with several Fibonacci projections of the initial rally off the 2023 lows. This area would represent the likely first real area of resistance to this rally.

However, momentum is quite strong at present, and Counter-trend exhaustion is premature on weekly timeframes per DeMark indicators by around 6-7 weeks. Thus, the ideal scenario would call for a rally to $46-$48k, some consolidation, followed by some acceleration up to challenge $69k into mid-January.

Importantly, the timeframe of the weekly DeMark count could align nicely with the cycle composite chart (shown later in this report) which argues for a January peak in Bitcoin utilizing the 41-week cycle that has been prevalent and reliable in identifying peaks and troughs in Bitcoin since 2009. Bottom line, while overbought at present based on traditional technical methods like RSI, it looks premature to make adjustments to BTC longs at current levels and further gains look likely in December which would allow for acceleration to aforementioned targets. Support likely can materialize near $35-$37k which likely creates a favorable risk/reward opportunity to buy dips in the days/weeks ahead.

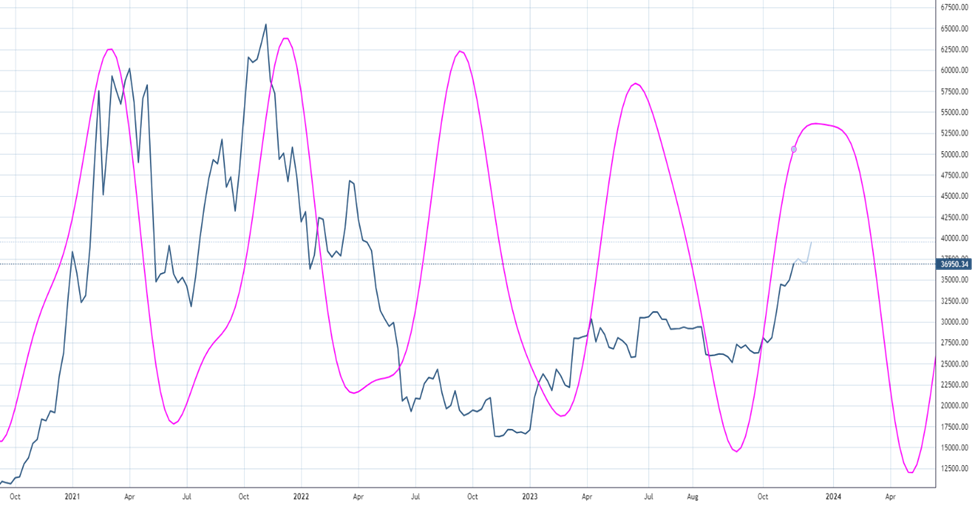

Bitcoin Cycle

Upcoming cyclical peak possible in January along with a bottom in April 2024.

Bitcoin’s cycle looks to be nearing a potential peak as 2024 approaches, and I suspect that Q1 2024 brings about consolidation before BTC can begin a more meaningful trek higher to test 2021 highs. Looking back, the cycle composite containing the 41-week cycle has been pivotal in identifying prior peaks made in early and late 2021 along with peaks in late 2022, Spring 2023. This has been successful in resulting in slowdowns and reversals of prior rallies, and only the rally into Fall 2022 failed to materialize.

Conversely, the cycle composite’s low projections successfully identified a Bitcoin trading bottom in Summer 2021, Spring of 2022, Spring 2023 and now shows a potential future low forecast for Spring of 2024. This might coincide with the coming Bitcoin halving in April of next year, and any weakness into this period would be thought to likely find support and begin to turn back higher for the remainder of 2024.

Ideally, a possible technical peak aligning with a January spot Bitcoin ETF might be a plausible scenario, resulting in consolidation into April before prices bottom out and turn higher. Interestingly enough, two prominent dates of focus for the months ahead both line up with important cyclical turning points.

Ethereum (ETH)

Bullish for 2024 – Slowly building momentum.

Ethereum’s recent rally has effectively broken out above peaks which have been present as resistance since mid-2022. This is a very constructive technical development and has led to prices pushing higher to test resistance near $2400, which lines up with the 38.2% Fibonacci retracement area of the entire decline from 2021 into June 2022.

Momentum has begun to turn higher on multiple timeframes, with the weekly MACD crossover of its signal line now having been joined by a similar but potentially more powerful monthly MACD bullish crossover. Intermediate-term targets should materialize initially near $2900, then $3300 which approximate the 50% and 61.8% Fibonacci retracement level of the prior decline.

While Ethereum has lagged Bitcoin over the past couple years, this recent acceleration in momentum coinciding with structural improvement should be helpful in providing a coming mean reversion to this recent underperformance. Moreover, favoring Ethereum as it’s just starting to emerge while expecting less robust returns out of Bitcoin from overbought conditions might make sense into early 2024.

At present, it’s hard to make lengthy technical projections of an immediate retest of all-time highs until the early year 2024 consolidation plays out. However, it’s logical to expect that a bullish rally in cryptocurrencies from April into November/December 2024 should involve a test and breakout above the prior peaks from 2021. This prior high for ETHUSD at $4867 will represent the most important level to concentrate on an intermediate-term basis for 2024.

Solana (SOL 3.18% )

Breakout should help its recent relative strength continue.

Solana’s push to new 19-month highs should jump-start its acceleration up to initial Fibonacci projection targets near $83 into late December 2023 with eventual January targets found near $104 into January of 2024. Such a level would represent a 38.2% Fibonacci target of the entire decline from late 2021 into June of 2022.

Overall, the recent technical improvement has been helpful towards momentum starting to slope more strongly to the upside, and volume has been supportive of gains, as price has begun to scale higher more parabolically in recent weeks.

Further intermediate-term targets are found at $134, then $165 which can’t be ruled out on a more parabolic advance. Bottom line, SOL has lagged movement in both BTC and ETH, but its breakout has enabled its rally to progress at a bit quicker pace lately and has been growing in relative strength vs. other coins, which is certainly a technical positive.

Overall, SOL remains positive technically, and dips should find support near $$63-$65 which would represent an attractive risk/reward opportunity for dip buyers ahead of acceleration into January 2024.

Optimism (OP -4.59% )

Optimism’s rise to the highest levels since 11/17 paves the way for a coming breakout to new 2023 highs in the weeks to come. Thursday’s rally is a bullish technical development, having exceeded peaks of the past two weeks, and any close above $1.859 constitutes an official technical breakout of the consolidation triangle from early November.

Given that OP -4.59% held its 38.2% Fibonacci retracement area on the prior decline from February-June 2023, this breakout should help OP push higher to at least $2.09 but more likely $2.37 before this finds meaningful resistance. Thursday’s gains have added importance given that $1.82 also held back in August. Overall, this looks to be the start of a good period of gains for OP and I suspect this pushes higher into mid-to-late December.

Stacks (STX -0.48% )

Parabolic rise as part of large rounding bottom pattern makes this attractive on an intermediate term basis.

The consolidation in recent days likely spells opportunity for Stacks which has begun to stabilize following a 38.2% Fibonacci retracement of its former run-up from late November. Daily charts show the reversal which happened on 12/5 at marginally lower levels than March 2023 peaks. However, price gave an ample warning of potential consolidation to come following its “Doji” pattern following the steep run-up from late November.

Technically, price lies at an attractive risk/reward at $1.01-$1.02, and gains are likely in the weeks to come to test and break out above former December highs to reach new highs for 2023. The area at $1.3193 could represent temporary resistance, but it’s expected that the recent gains in momentum might allow for a breakout above this level given the prior peak at $1.257 this past week. Consolidation has helped to alleviate some of the overbought levels in momentum, and the degree of the runup in the last month is quite similar to the rally earlier this year.

Overall, the larger pattern from 2023 represents a large bullish rounding bottom pattern, which will have very bullish intermediate-term path projections for STX -0.48% once $1.257 can be exceeded on a weekly close. Longer-term targets lie near $1.78 followed by $2.33 which should both have importance as resistance in 2024. Bottom line, the rapid rise over the past few weeks makes this attractive for 2024, and it looks right to own at current levels, seeking to add on any potential further consolidation at $0.92 prior to a larger runup.

Ethereum/Bitcoin (ETHBTC)

Increasingly setting up as an attractive risk/reward for 2024.

ETHBTC continues to trade within a very well-defined downtrend, having sliced below October 2023 lows on a closing basis (as of mid-day), Wednesday to the lowest levels since June 2022. Fundamentally, many might argue that Ethereum should be ready to start making relative strides vs. Bitcoin. However, until ETHBTC can start trending higher in a way that would achieve some significance in breaking out above its ongoing downtrend, this scenario remains premature.

Elliott-wave patterns of weekly charts of ETHBTC help to put this recent activity into perspective. As can be seen, the ratio managed to bottom at a near exact 50% retracement back in June 2022 of the prior rally from 2019 into late 2021. The subsequent decline since late 2021 has taken the shape of a large ABC-type corrective retracement which could be complete into year-end. Pullbacks to a strong zone of support $0.0437-$0.04630 look possible in the weeks to come, which represents Fibonacci relationships to the prior run-up, as well as alternative extension wave projections of the recent selloff.

Overall, while near-term trends remains lower for ETHBTC, this is increasingly looking like an attractive counter-trend trade and would be ideal to consider technically on any break of June 2022 lows. Such a decline would likely serve to stop-out existing longs at potentially the exact wrong time ahead of a meaningful intermediate-term rally. Bottom line, ETHBTC bulls could be on the verge of a very good 2024, but at present, this looks to take a bit more time.

Crypto Stocks

Coinbase (COIN) – Coinbase’s recent breakout of an 18-month reverse Head and Shoulders pattern is quite constructive technically and should result in acceleration up to targets near $161, then $200 into 2024. Momentum has turned positive based on weekly MACD, and dips should find strong support at $120-$125 which would create an excellent risk/reward opportunity. Overall, this base breakout makes COIN one of the better crypto-currency related stocks, and this deserves to be overweighted into 2024.

Marathon Digital Holdings, Inc. (MARA) – MARA’s recent strength has helped momentum turn positive on weekly charts and structurally an upcoming test of July 2023 peaks at $19.88 looks likely into January of 2024. While MARA is weaker structurally speaking than stocks like MSTR, or COIN which have already broken out of intermediate-term bases, its recent uptick in relative strength augurs well for a period of catchup in the weeks to come. The area just below $20 at $19.88 has held two separate times since mid-2022, which makes it an important area of resistance on a test in the weeks/months to come. The ability to exceed $19.88 on a weekly close would allow for a period of acceleration that have been seen in other stocks which have broken out of similar bases. Intermediate-term targets lie at $34, then $43 which look likely sometime in 2024.

Riot Blockchain (RIOT) – RIOT is short-term bullish but remains a definite laggard vs. other crypto stocks and should be underweighted compared to others like COIN or MSTR. In the short run, momentum has begun to improve and its rally to multi-week highs should aid RIOT in pushing higher to test $20.65 which lies near the key 23.6% Fibonacci retracement of the 2021-2022 decline and is an initial area of technical importance. The act of making a weekly close above that level would be quite constructive to RIOT’s future prospects and should allow for an intermediate term rally up to $33, or above near $41 sometime in 2024. At present, pullbacks to $12.50-$13 should constitute good technical support to buy dips for a push back higher in the weeks to come. Overall, RIOT looks like an Up-and-comer, but until this can successfully break out over July highs, this lacks the strength to be a leader within the space.

Microstrategy (MSTR) – Microstrategy is the preferred stock to overweight within the cryptocurrency space at the present time. Its strength in exceeding the 38.2% Fibonacci retracement zone of the prior decline from 2021 makes this quite positive technically and should allow for further gains up to $720-30 before any meaningful consolidation gets underway. Moreover, MSTR has seen its momentum accelerate to overbought levels on multiple timeframes over the last week. However, this shouldn’t be seen as problematic, but merely the sign of superior strength within a group leader. Given the recent signs of parabolic price strength, dips likely should prove minor and find strong resistance near $500-$520 before pushing higher as this trend higher towards its 50% retracement level of the 2021 decline. In the short run, weekly DeMark TD Sell Setups might materialize in the next 1-2 weeks, which could allow for some near-term stalling out in this recent acceleration near $600. However, consolidation should prove minor, and intermediate-term gains should allow for strength up to $720-$730 and eventual targets near 2021 peaks at $890.50. Overall, MSTR remains quite positive in the short run, and would become more appealing from a risk/reward standpoint on any signs of minor consolidation in the weeks ahead.

Reports you may have missed

Bitcoin looks to strengthen relatively speaking after nearly a month of lagging

Bitcoin (BTC) broke out of its triangle pattern today, Monday 11/8, and could set a new all-time high close above 65,990.31.Relatively speaking, BTCUSD should begin to gain in relative strength based on a minor breakout in its Dominance chart which should help its market capitalization start to pick up speedLTCUSD, ALGOUSD, and LINKUSD all should be favored for gains in the weeks ahead as these are making favorable technical breakouts...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In b6ae78-39a3e2-82df74-ad5535-cfa1f9

Already have an account? Sign In b6ae78-39a3e2-82df74-ad5535-cfa1f9