Market Lacks Convincing Signs of Market Froth, Major Demand Side Catalyst for CORE (Core Strategy Rebalance)

Key Takeaways

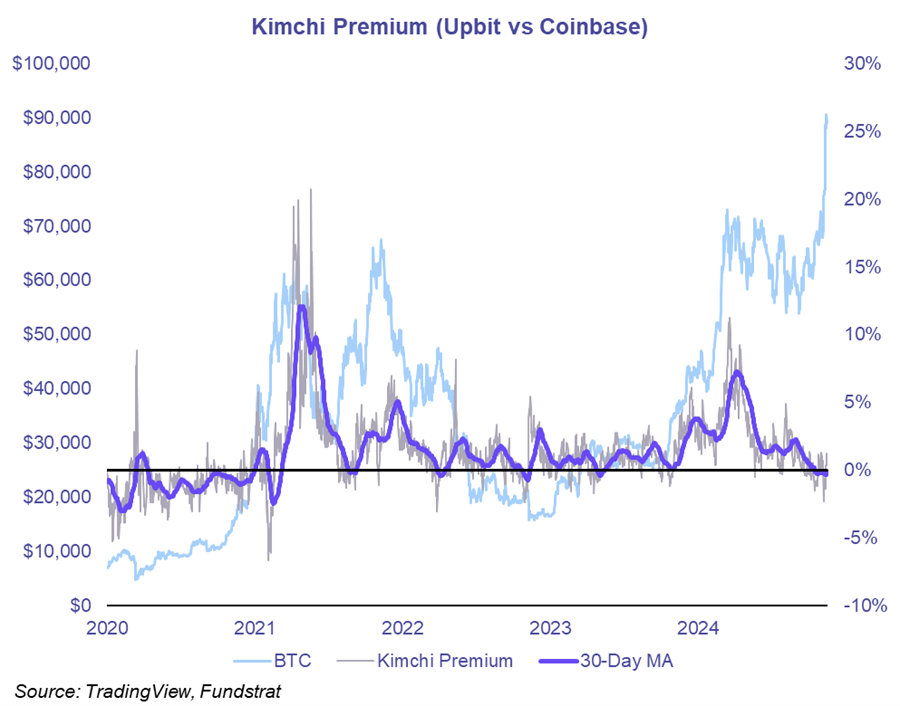

- While temporary consolidation is possible, many signs of froth (sustained elevated funding rates, Kimchi Premium >5%, massive breadth) are simply not present.

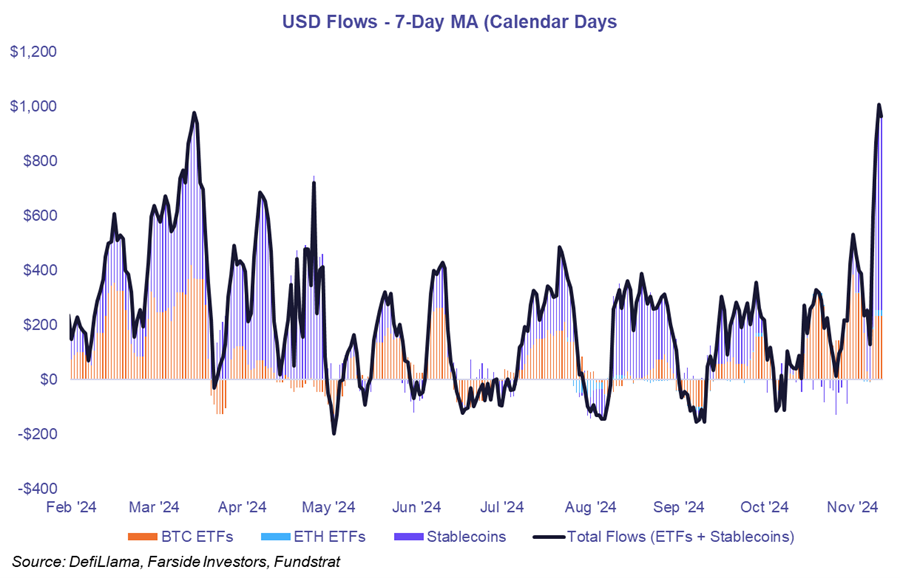

- The ongoing rerating of regulatory risk in crypto has led to a massive influx of capital into ETFs and stablecoin creations.

- Despite CORE's modest performance relative to BTC in the recent rally, the emergence of a MicroStrategy-like buyer and growing adoption as a BTC scaling solution support maintaining a small position of CORE within one’s portfolio.

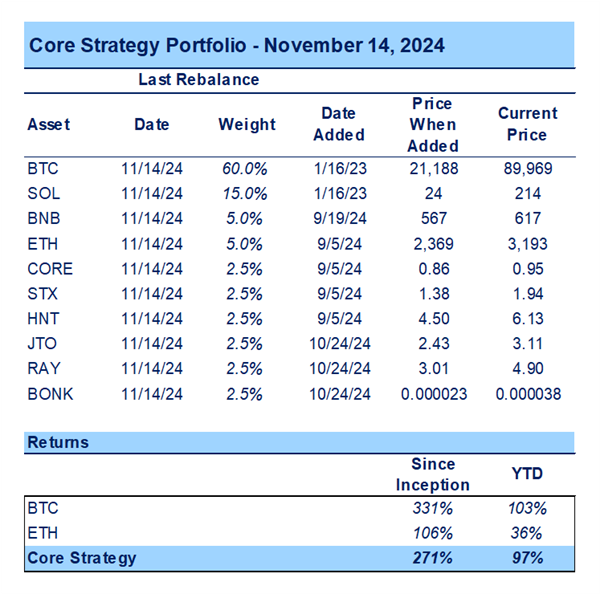

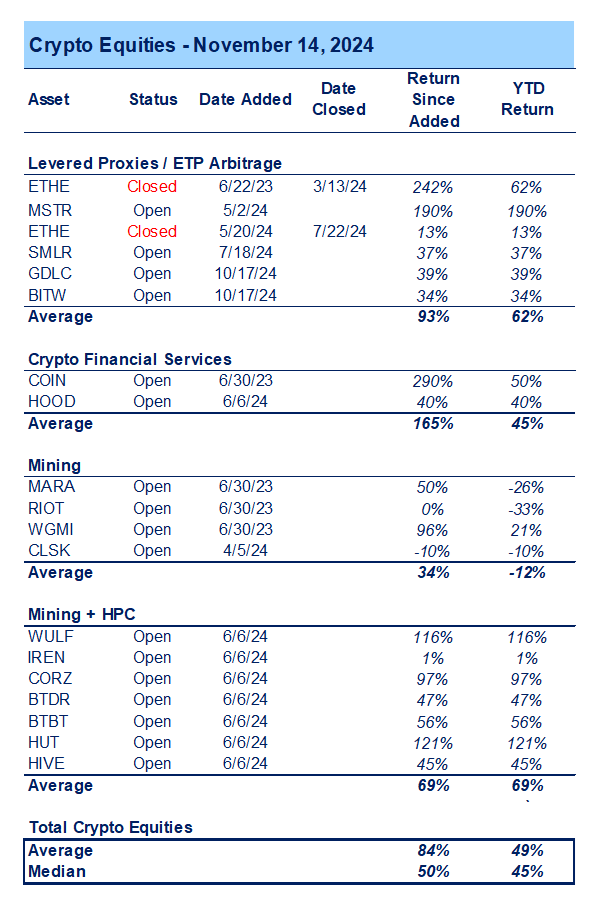

- Core Strategy – In addition to a favorable macro environment, crypto is poised to benefit from strong regulatory and political tailwinds, likely extending through inauguration day. We remain overweight on SOL with and still like altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE, emphasizing assets with high SOL and (potential) BTC beta. Minor adjustments have been made to certain weights this week, detailed at the end of this note. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, are included at the conclusion of each note.

Froth or Repricing?

A heated debate is unfolding among crypto investors: have we just hit a local top, or will the breakout after eight months of consolidation continue higher through year-end? The crypto market has surged rapidly, as we anticipated, but the key question remains—can this rally sustain itself, or is it nearing exhaustion?

Anecdotally, we are seeing renewed interest in crypto from casual observers. Friends and family are once again asking about crypto, and Coinbase’s climb to the top of app store charts adds to the chatter about this being a local peak. Surely, these investors are destined to buy the top, right?

Well, in our view, while such social signals can be useful, Goodhart’s Law serves as a cautionary reminder: “When a measure becomes a target, it ceases to be a good measure.” In today’s market, everyone is looking at this metric as a top signal, thus potentially dampening its effectiveness as a metric. Further, think of memecoins. In prior cycles, memecoins rallying would be a red flag that the cycle was almost over, or at least that a near-term top was close. However, memes have been a mainstay throughout this cycle, rallying and falling multiple times over.

Looking beyond social cues to more quantifiable market indicators, the current landscape does not exhibit the frothiness of the March rally or the late 2021 cyclical peak. The data suggests a market that is far from overheated, leaving room for further potential upside, provided macro conditions do not throw us an unanticipated curveball.

Key Indicators

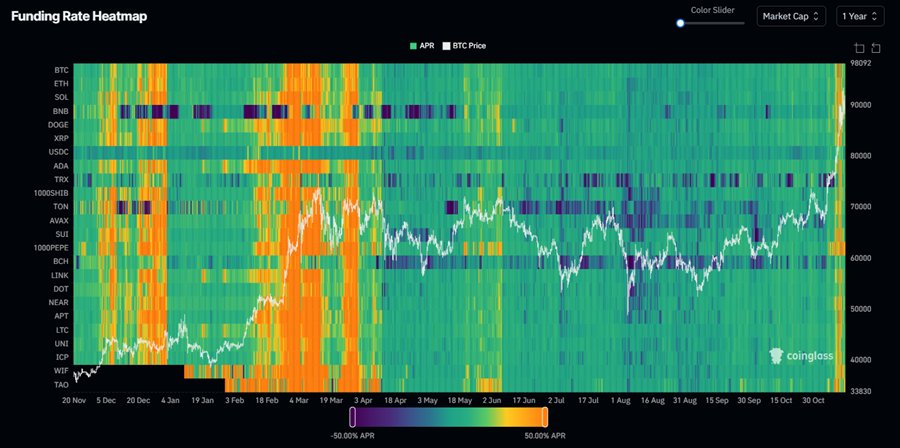

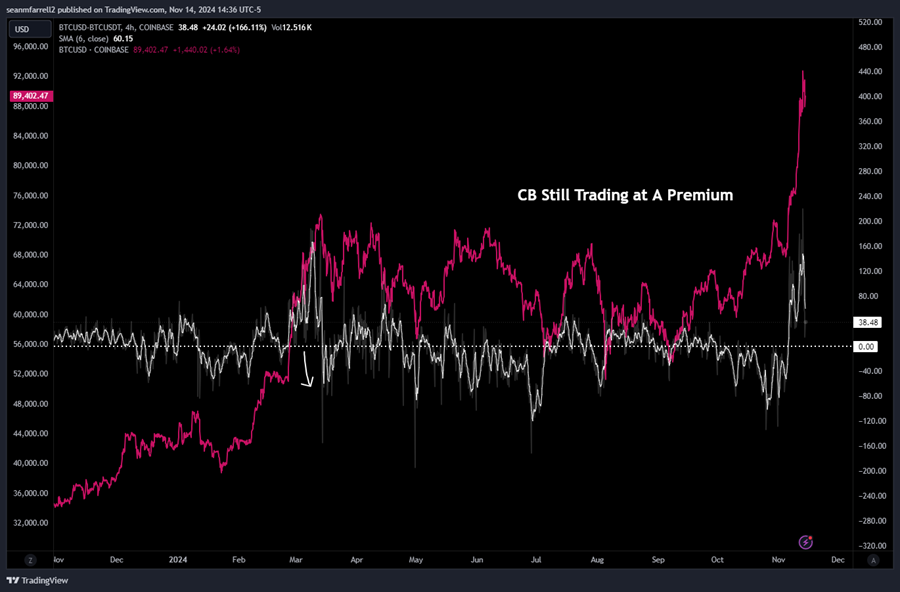

Funding Rates: Funding rates, or simply the cost of leverage in the perps market, spiked to elevated levels briefly last week. However, the funding rate heatmap below demonstrates that the market can normally sustain levels of 20- 50% annualized for weeks before the market runs out of steam. This level of leverage can persist as long as it is paired with capital inflows and strong spot demand. Recent ETF and stablecoin inflows, along with a significant Coinbase premium, suggest healthy underlying demand. If we were to see the direction of flows reverse and the CB premium flip to a discount, it would warrant greater concern.

Kimchi Premium: When thinking about retail speculation in crypto, one needs to think globally. Korea is a massive market for crypto, and due to certain capital control laws, major price discrepancies on Korean exchanges and other global exchanges can’t be arbitraged away. Thus, when speculative fervor commences, we end up seeing a premium on the price of BTC on Korean exchanges relative to other crypto exchanges. This is colloquially referred to as the “Kimchi Premium.” Historically, this premium has surged to over 10% before the market peaks. But currently, the premium is around 0, signaling a lack of overexuberance among Korean traders.

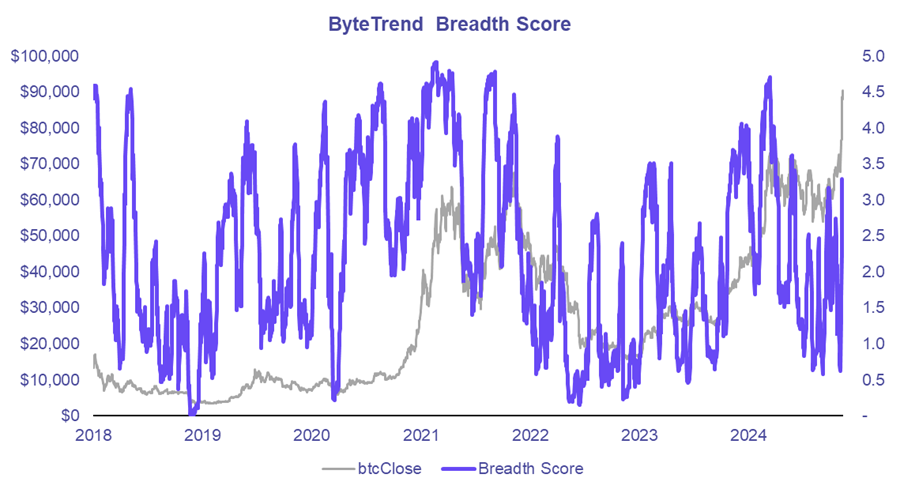

Market Breadth: Broad market participation is typically a positive indicator of strength during a rally. However, in crypto, excessive breadth can signal the start of a problem. Liquidity often thins quickly as investors shift toward more speculative assets, and this expansion in breadth has historically preceded market tops. ByteTrend’s breadth score is a reliable benchmark for assessing market participation. While breadth has expanded during this rally, it currently sits just above 3—below the 4.5–5 range, which has historically aligned with market peaks.

Rationale for the Rally

This rally is underpinned by meaningful fundamental developments. The regulatory landscape has shifted dramatically, transitioning from objectively hostile to overtly favorable toward crypto.

This transformation has fueled speculation about the industry’s potential. The market is now also pricing in the non-zero probability of the U.S. adopting a strategic BTC reserve. While we remain skeptical of this outcome, it presents a notable upside risk that investors must at least consider.

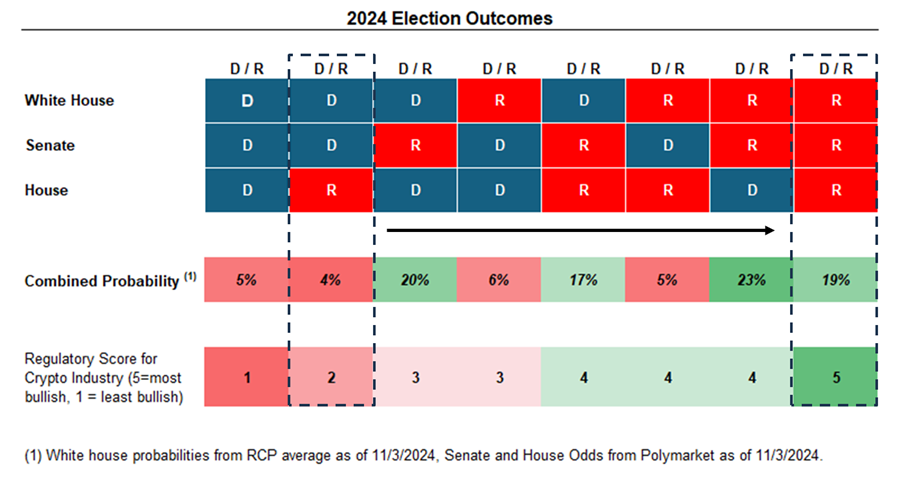

The past week’s rally should not be dismissed as mere speculative exuberance. Instead, it reflects a step-function improvement in the regulatory environment for crypto. As illustrated below, we’ve moved from what we would rate as a 2/5 regulatory backdrop to a 5/5 (based on our unofficial qualitative score). This structural shift has created a solid foundation for the current market dynamics.

Some Macro Thoughts

Over the past few weeks, we’ve stepped back from discussing macro factors, as political developments have been the primary drivers of price action (although one could consider political factors to also be macro factors). However, with the election behind us, it’s worth briefly revisiting the rates and liquidity environment.

Since the election, we’ve observed an uptick in real yields, a strengthening DXY, and the continued pricing out of rate cuts. While some of the rising rates can be attributed to expectations of stronger growth, there are also concerns about increasing deficits, potential tariffs, and resulting inflationary pressures.

Typically, these are conditions in which crypto struggles. However, regulatory tailwinds have allowed the market to navigate this challenging environment. That said, the recent rise in rates has begun to weigh on broader risk assets.

Our view is that the path of least resistance for rates is lower as the post-election enthusiasm for the reflationary trade fades. Oil remains below $70, goods are still deflating, and jobs data falling short of the Fed’s expectations. This means that the Fed is unlikely to pivot anytime soon.

From a macro perspective, this creates asymmetric upside risk for crypto. The combination of a cooling rate environment and strong regulatory momentum positions the market for continued strength.

CORE Shows Promising Fundamentals, With Impending Demand-Side Pressures From “CoreFi Strategy”

DeFi Technologies announced on Thursday the upcoming launch of CoreFi Strategy, a public company designed to provide investors access to Core—the bitcoin scaling solution that we added to our Core Strategy (no association between the strategy and the chain) back in late September. If you need a refresher on CORE, we highly recommend revisiting our previous analysis.

In short, our thesis centered on the large and growing bitcoin DeFi TAM, the likelihood of the BTC DeFi narrative garnering a rotational bid in the near term, its potential to serve as reliable BTC beta, and early signs of traction on Core. The element of this thesis that has clearly not played out is the reliable beta component (which applies to STX as well). However, the other three parts of this thesis are still in play.

Similar to MicroStrategy, CoreFi Strategy is an operating company (not an ETF) that intends to acquire, hold, and stake BTC and CORE. Thus, the company’s shares should track a mix of BTC, CORE, and any CORE-denominated yield that the company’s staking operation yields. It seems that the goal is for this to become a “MicroStrategy+,” and it makes some intuitive sense. It is unclear how the company will be initially financed. The company may be seeded by DeFi Technologies but will likely look to raise convertible notes at some point. If the company can benefit from the same premium to NAV achieved by MSTR and SMLR, there should be reasonable demand for cheap dept (MSTR’s most recent converts were priced at 0.625). If they can raise debt at a cheap price, then they will be able to service any interest using a portion of the yield earned.

According to reports, this company plans to go public in Q1, which is just a couple of months away. It is possible that the market front-runs this announcement.

From a fundamental point of view, CORE is still experiencing solid early adoption. TVL has climbed rapidly, doubling over the past month to reach over $800 million.

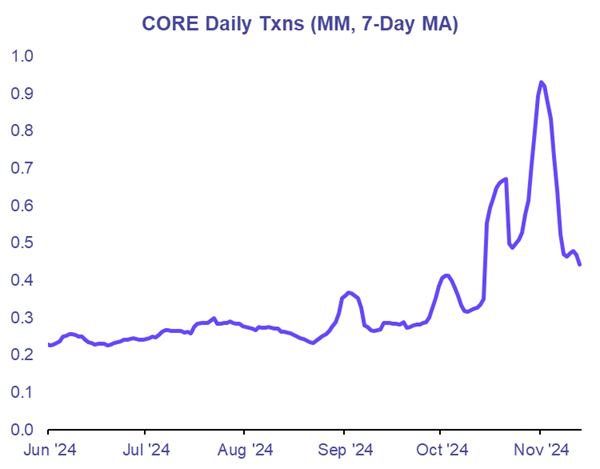

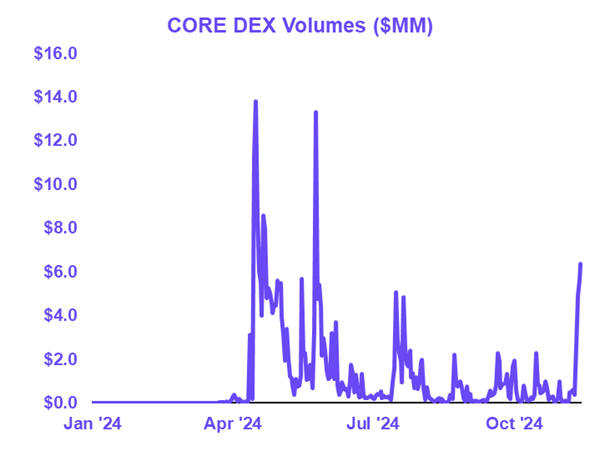

Transaction activity also appears to be ticking higher along with DEX volumes, which are still rather low compared to DEX volumes on other chains.

The CORE DAO also has a major upgrade planned for November 19th, which is supposed to introduce significant performance improvements for the chain. It is possible that post-upgrade we see an uptick in activity.

In summary, despite CORE not providing outsized returns relative to BTC during the latest rally, the emergence of a MicroStrategy-esque company intending to purchase CORE on the open market should result in substantial demand-side pressures. Furthermore, adoption seems to be trending in the right direction for this BTC scaling solution. Thus, we think that reserving a small spot for CORE in one’s portfolio is still warranted.

Changes to Core Strategy

- Reducing relative weight on STX and CORE – while this might seem counterintuitive based on our bullish rhetoric above, the lack of beta to BTC exhibited during the most recent rally does partially increase the risk in both CORE and STX. Having both of these names comprise 5% of the strategy will still provide ample upside in the event that we see a rotation to BTC DeFi names but limits downside in the near-term.

- Bringing RAY and BONK back into balance – both of these names have done really well. We think they continue to exhibit strength over the medium-term but shouldn’t comprise more than 5% of the strategy combined.

Tickers in this report: BTC 1.83% , XRP 2.74% , SOL 3.80% , ETH 4.42% , HNT 0.74% , STX N/A% , MKR 3.97% , BNB 1.30% , CORE, JTO -0.26% , BONK 2.03% , RAY 8.86% , MSTR 1.98% , SMLR -0.26% , COIN 4.40% , HOOD 3.09% , MARA -0.50% , RIOT -1.68% , WGMI -2.58% , CLSK 1.49% , WULF -2.24% , IREN -6.57% , CORZ -3.89% , BTDR 4.62% , BTBT 3.30% , HUT 2.28% , HIVE -1.68% , AVAX 3.92% , XRP 2.74% , GDLC, BITW