Shifting Election Odds Erases “Trump Premium,” but it Remains Difficult to Be Bearish Amid Falling Rates and Dollar

Key Takeaways

- Despite a conclusively bullish outcome for risk assets on Wednesday, BTC did not experience the same uptick seen in equities, bonds, and gold.

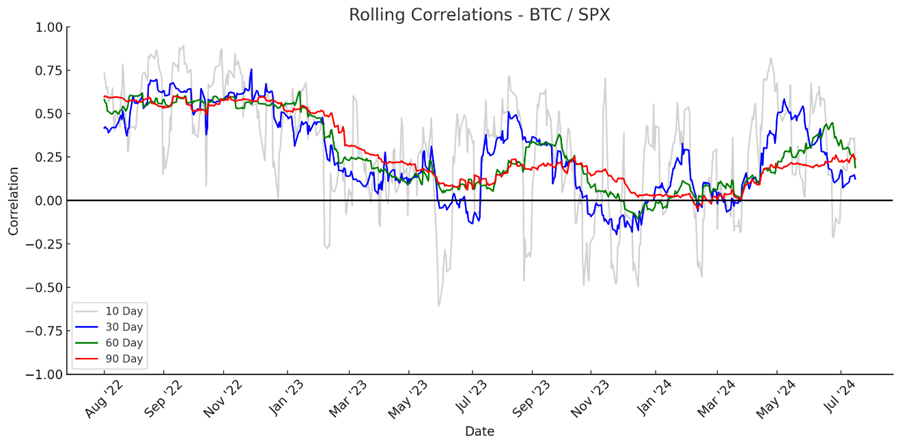

- The correlation breakdowns in July can be attributed to initial supply concerns at the start of the month and election-related price movements since mid-July.

- We believe the recent weakness can be linked to the surge of presidential candidate Harris in polls and prediction markets. An alternative theory points to sales of Silk Road coins, but flows data suggests that is not the driving factor.

- ETHE has reached outflow levels similar to those seen when GBTC bottomed, suggesting a potentially favorable risk/reward for ETHBTC at this point.

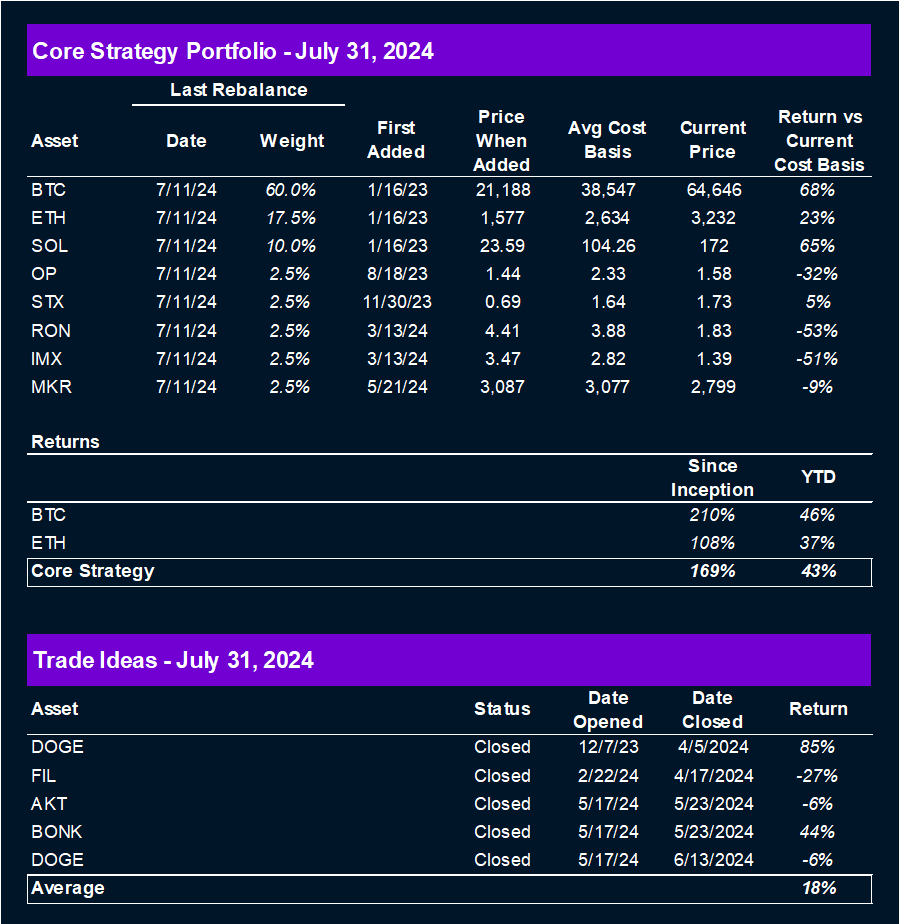

- Core Strategy – Despite the election-related divergence from other risk assets, we remain cautiously optimistic given the supportive macro backdrop, including falling interest rates, a declining DXY, and favorable fiscal flows.

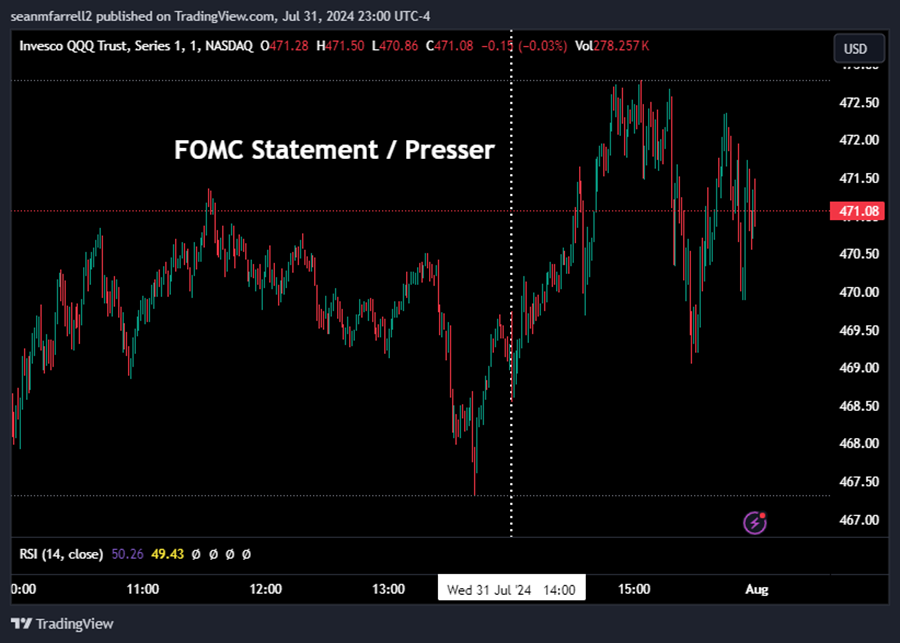

Ideal FOMC Outcome

This week’s events have been a reminder that while macro factors can align favorably, idiosyncratic elements can sometimes complicate the picture. On Wednesday, the Federal Reserve decided to hold interest rates steady until September. Notably, the FOMC statement emphasized the Fed’s dual mandate, a significant shift from previous communications. Fed Chair Jerome Powell expressed a dovish stance, indicating a potential openness to rate cuts in September, contingent on forthcoming data. Although he refrained from making any guarantees, his tone was notably accommodative.

The market’s reaction underscored the dovish interpretation: both the DXY and interest rates declined following the statement, continuing their downward trend throughout Powell’s press conference.

Risk assets rallied strongly into the market close, reflecting investor optimism.

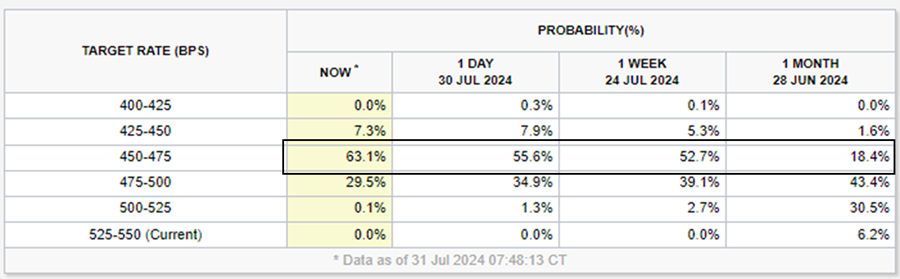

The Fed funds futures market for September remained relatively stable, but there was a significant increase in the perceived likelihood of three rate cuts by December.

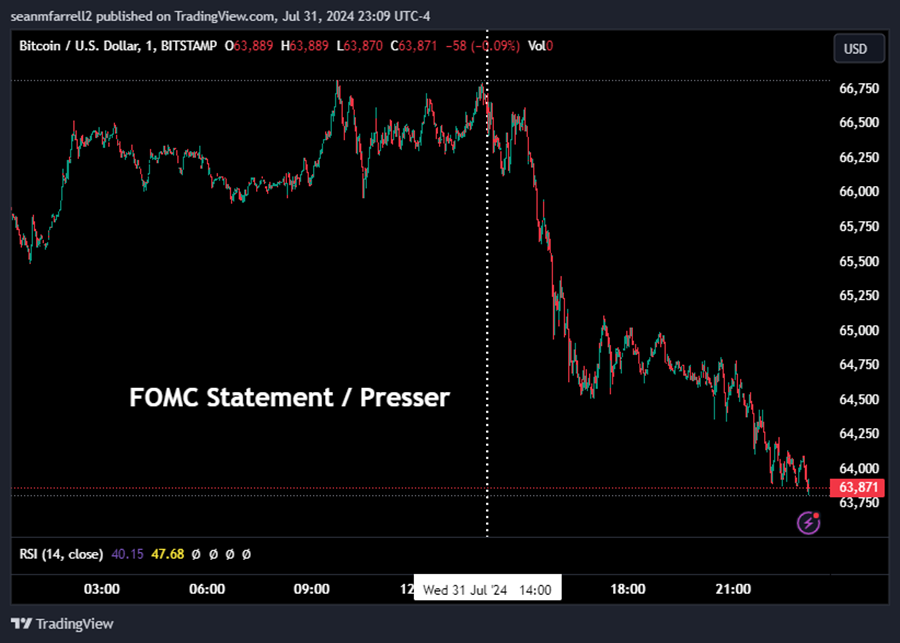

Despite this seemingly bullish macro backdrop, bitcoin and the broader crypto market moved sideways and eventually sold off after the market close.

This unexpected reaction may have been due to investors closing out long positions in the absence of a clear buying interest, even on a day with strong macro signals favorable to crypto.

This outcome prompts a critical question: why didn’t the anticipated buying pressure materialize?

Election Odds: The Most Likely Reason for Decoupling from Macro

Crypto markets have been diverging from equities for over a month now. As seen in the accompanying chart, Bitcoin’s correlation with the S&P 500 is nearly zero across most lookback periods.

The recent decoupling can be attributed to a couple of factors, including a recent panic over a supply overhang and shifting political dynamics. In early July, the market faced panic selling due to concerns over German government coins, causing sell pressure beyond what the broader macro environment would justify. By mid-July, the market sentiment shifted with the Trump campaign’s open embrace of crypto, coupled with a surge in his polling numbers, pushing Bitcoin towards $70,000. However, recent days have seen a significant shift in political betting markets, moving away from Trump.

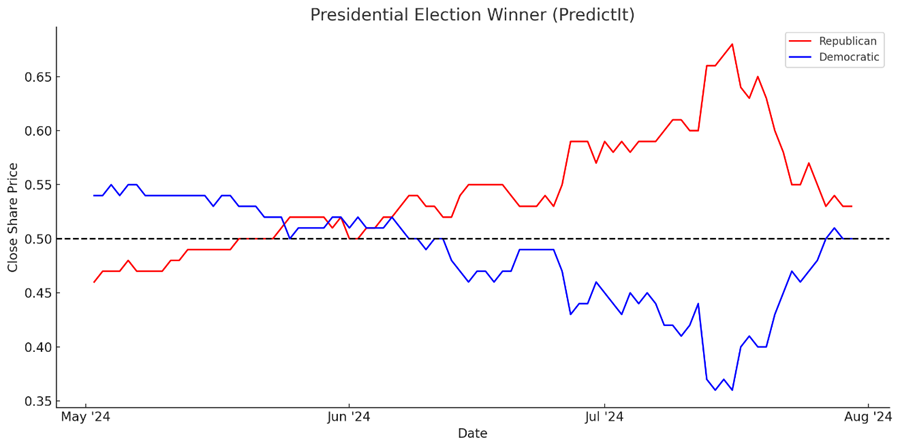

PredictIt shows a dead heat between Harris and Trump, while Polymarket’s odds for a GOP victory have declined from nearly 70% to 54%.

This political uncertainty likely contributed to the fading momentum of the July rally and the absence of the anticipated buying pressure post-FOMC.

The “Trump Premium” may continue to fluctuate as prediction markets change, but that does not mean that macro factors should not be considered going forward.

The Polymarket chart below indicates that Trump’s odds began to rally following the assassination attempt on 7/13 around 5 PM ET, when Bitcoin was priced around $60,000. The subsequent price action suggests that while the “Trump trade” has been largely reversed, macro factors have still supported a 7% gain above the $60,000 level. This is probably the correct way to think about this going forward – macro factors plus or minus a Trump premium, with you normal crypto-specific overlay.

Silk Road Coins Present Alternative Theory

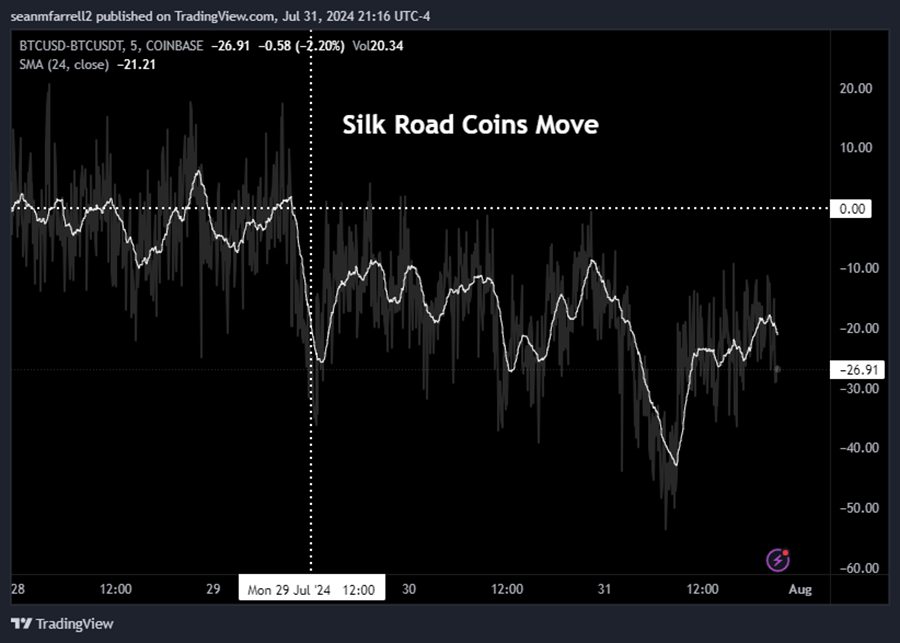

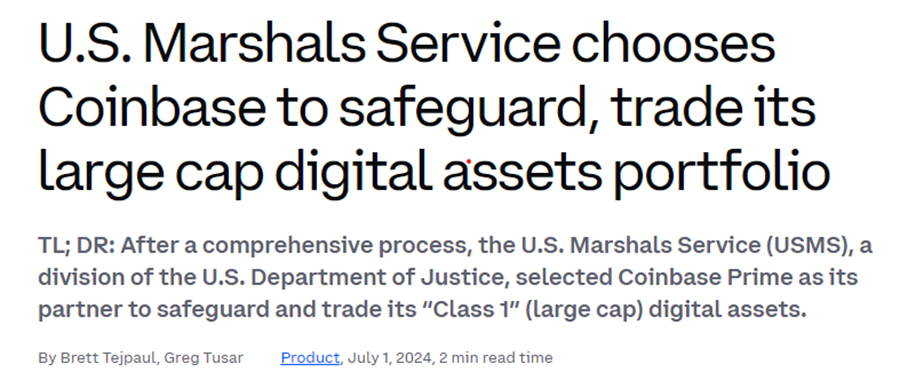

An alternative theory suggests that the ongoing price dampening in the crypto market could be due to a TWAP sell order from the U.S. government, offloading $2 billion worth of confiscated Silk Road coins. The movement of these coins from government wallets on Monday sparked bearish speculation among traders.

One notable consequence was the emergence of a discount for BTC on Coinbase compared to Binance, coinciding with the movement of these coins. This discount could be interpreted as evidence that a TWAP sell order may be pressuring prices.

However, further investigation suggests that this movement may be related to a recent agreement between the U.S. government and Coinbase, designating Coinbase as a custody and trading partner for these assets. There is no clarity on whether these coins are being sold or merely held in custody, as the terms of the agreement are not publicly available. It’s entirely possible that these Silk Road coins are simply being transferred to a different wallet address without being sold into the market.

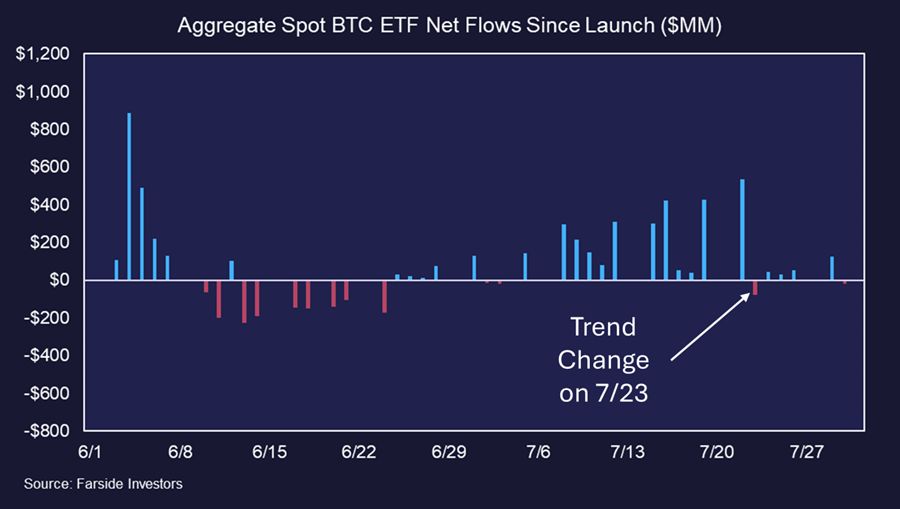

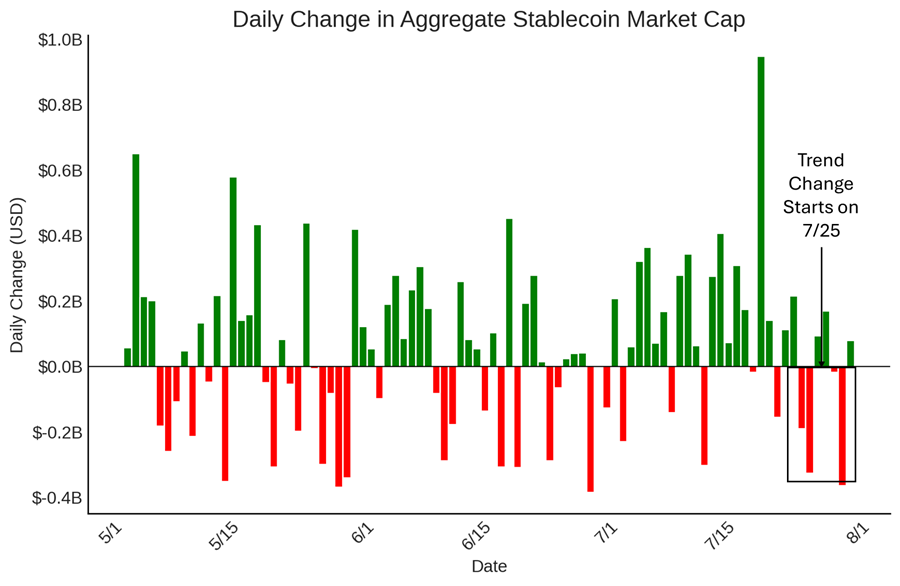

Additionally, capital flows indicate a pattern of slowing inflows into both ETFs and stablecoins before July 29th, the day the coins were moved. This observation leads us to believe that the recent price action is more likely attributed to the unwinding of the “Trump Premium” rather than the sale of Silk Road coins. The uncertainty surrounding these coins’ status adds a layer of complexity, but the broader market dynamics appear to be driven by political developments rather than specific asset movements.

Outflows Present Compelling Case for ETHBTC Bottom

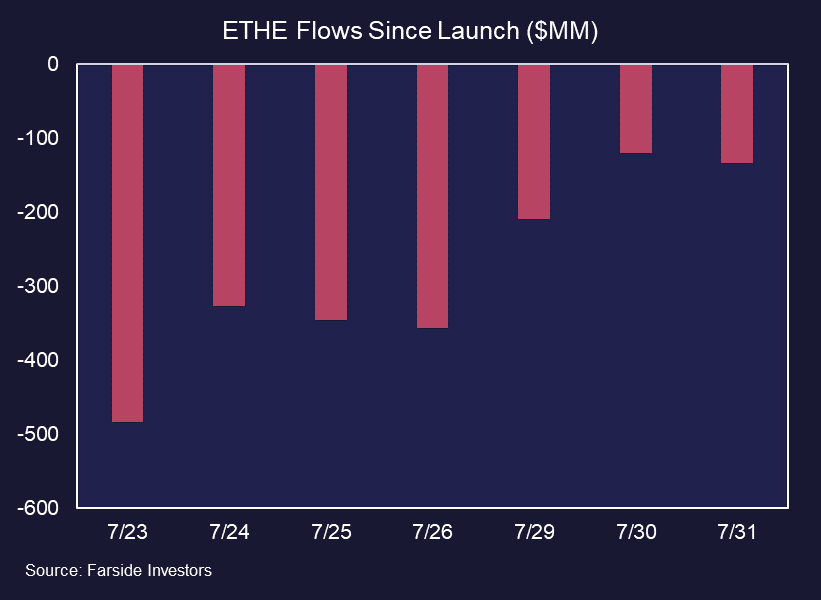

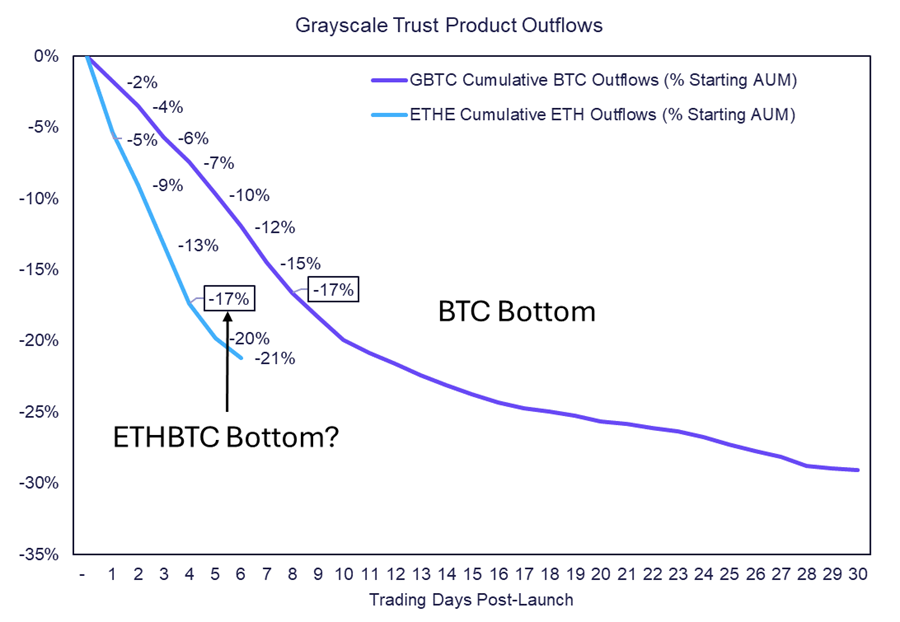

A promising development this week suggests that the ETHBTC pair may have established a sustainable bottom, presenting a favorable risk/reward scenario. This optimism is partly based on precedent observed from the Grayscale Bitcoin Trust (GBTC), now mirrored by the Grayscale Ethereum Trust (ETHE). While outflows from ETHE were anticipated, they occurred at nearly double the pace of those from GBTC, measured as a percentage of Assets Under Management (AUM).

Interestingly, recent trends indicate that the pace of outflows from ETHE might have peaked. Over the past two days, outflows have been under $150 million, a significant decrease from the over $300 million observed during the first four days of trading.

When charting the outflows as a percentage of starting AUM, it becomes evident how rapid the withdrawal from ETHE has been compared to GBTC. ETHE reached cumulative outflows equal to 17% of starting AUM in just four trading days, a level it took GBTC until the eighth trading day to reach. Notably, this 17% threshold coincided with the bottoming of BTC, which subsequently surged to a new all-time high.

Analyzing the ETHBTC ratio, which normalizes for macro factors, we see that this ratio found a short-term bottom the day after ETHE reached the 17% outflow level. Although the sample size is small, it appears that hitting this 17% outflow threshold might have been critical for stabilizing ETHE-related weakness.

We emphasize the relative value aspect of the ETHBTC ratio because absolute returns remain subject to broader macro and political conditions. Should crypto rebound due to favorable macro tailwinds in the coming weeks, we think ETH is poised to benefit both on an absolute scale and relative to BTC.

Core Strategy

Despite the election-related divergence from other risk assets, we remain cautiously optimistic given the supportive macro backdrop, including falling interest rates, a declining DXY, and favorable fiscal flows.

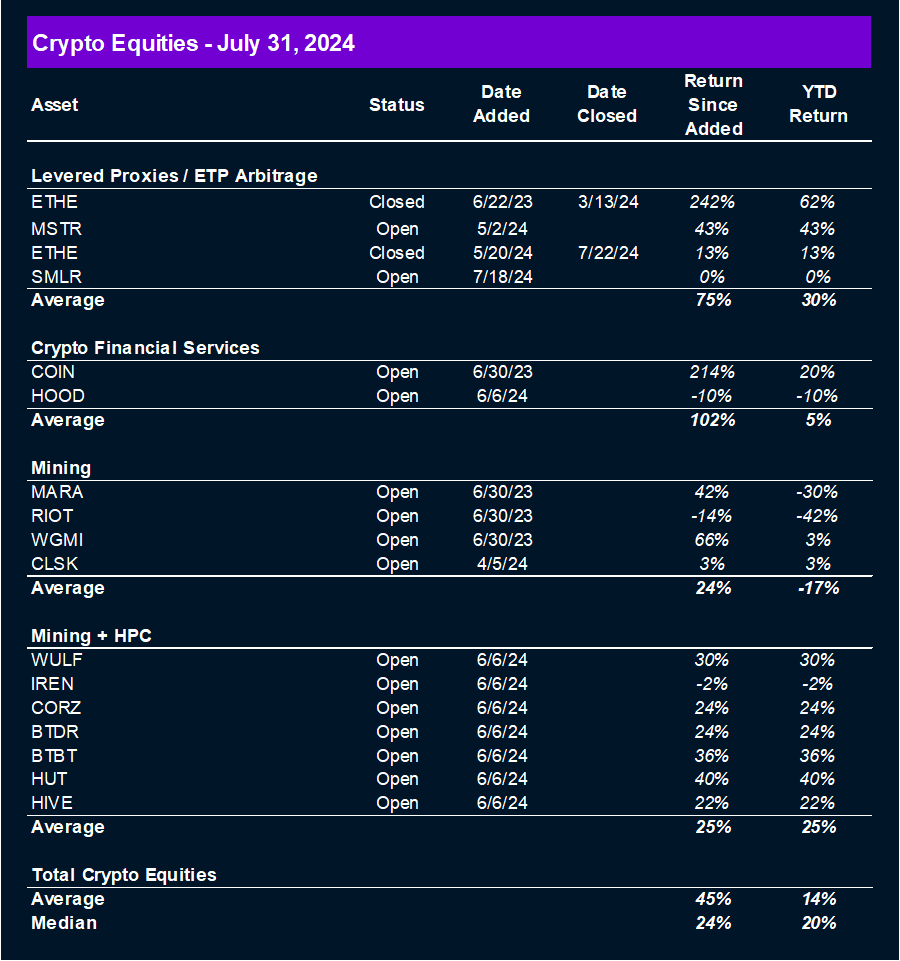

Tickers in this Report: BTC 2.97% , ETH 3.61% , SOL 6.42% , OP 2.47% , STX N/A% , RON 2.93% , IMX 7.97% , MKR 4.76% , MSTR 0.75% , COIN 1.44% , HOOD 2.12% , MARA 1.97% , RIOT 5.24% , WGMI 7.42% , CLSK 5.30% , WULF 11.16% , IREN 7.22% , CORZ 5.39% , BTDR 5.99% , BTBT 1.20% , HUT 9.68% , HIVE 5.15%