How the US Could Adopt BTC as a Strategic Reserve Asset, Look for ETH to Bottom Within Next Few Trading Days

Key Takeaways

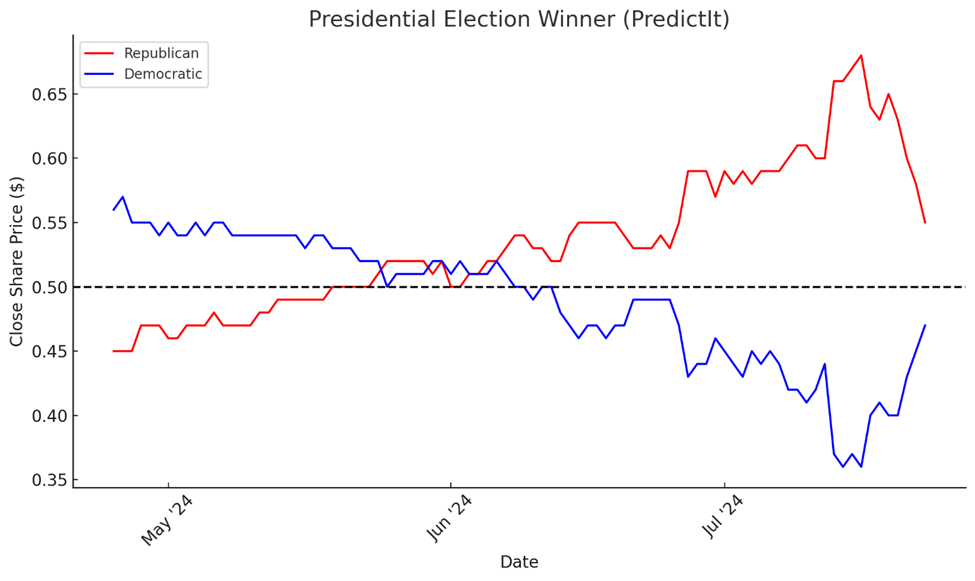

- A combination of broad degrossing and a resurgence in prediction markets from the Democratic Party has led to a stalling of the July rally.

- Catalyst Watch: The most likely path for the US to adopt BTC as a strategic reserve asset is to siphon the BTC obtained by the DOJ into the Exchange Stabilization Fund. We discuss the details and the likelihood of this being endorsed by Trump at the BTC Conference this weekend.

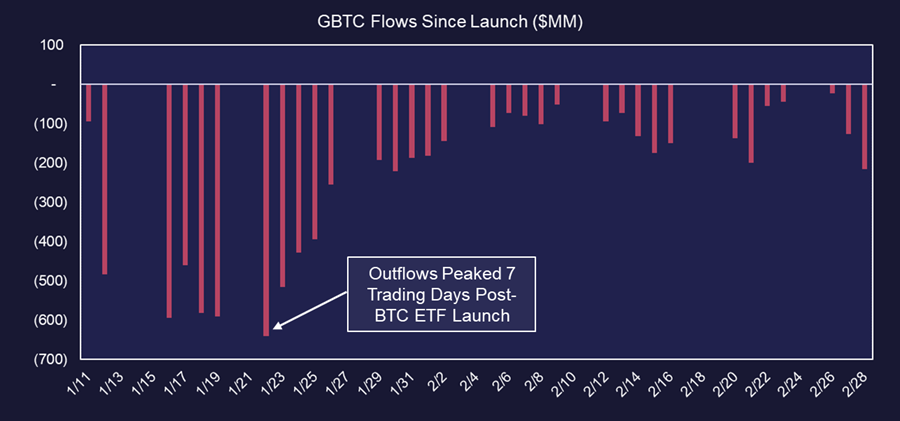

- GBTC bottomed eight trading days post-launch, following a slowdown in outflows. Given the pace of the current ETHE exodus, it is possible that a bottom will be in place within the next few days.

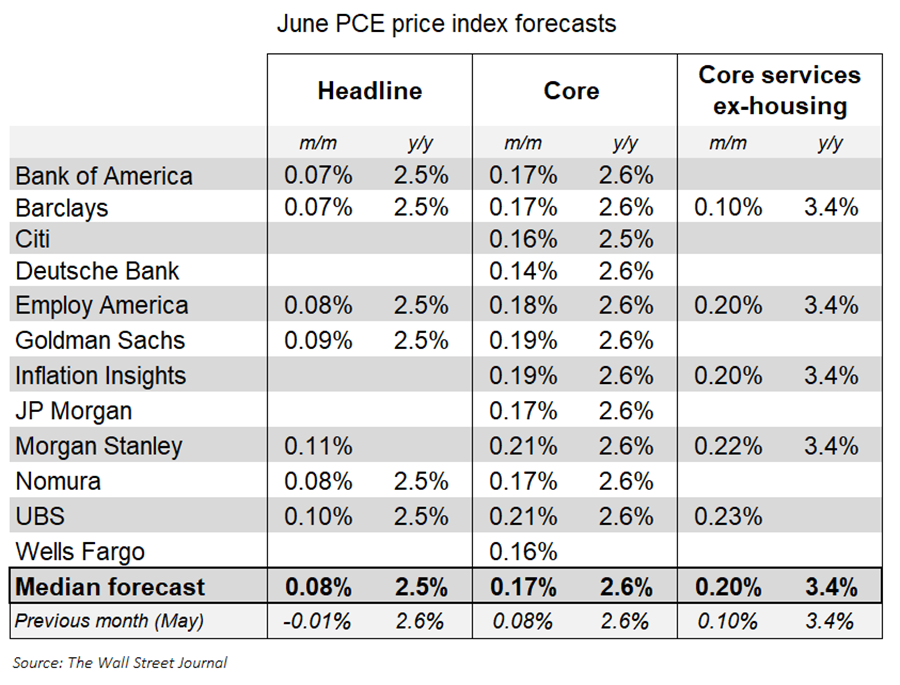

- A cool PCE tomorrow will likely cement a dovish Fed at next week’s FOMC meeting. This should lead to further weakness in the dollar and rates and help boost risk assets into next week.

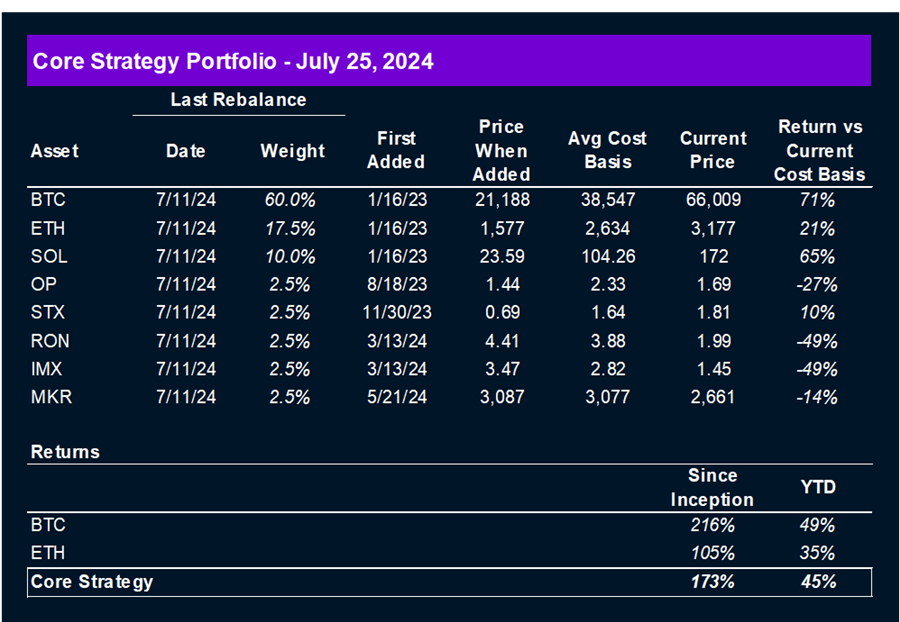

- Core Strategy: With inflation continuing to fall, economic data remaining non-recessionary, and political tailwinds intensifying, we remain fully allocated.

Political Prediction Markets Provide Partial Rationale for Pause in Rally

We see the recent pause in the July rally driven by two factors:

- General Degrossing Across All Asset Markets: The past couple of days have seen degrossing across all asset markets, including the crypto markets. This is less crypto-specific and more of a function of the market rotating out of strategies (like the long MAG 7) that worked in the first half of the year but might not continue to be favored going forward. The IWM/QQQ chart below illustrates the shock that equity markets have experienced over the past few days. Once broader asset markets regain their footing, which could come as early as Friday’s PCE report, this should be less of a concern for crypto markets.

- Political Developments: Since President Biden has withdrawn from the race and Kamala Harris has become the presumptive Democratic nominee, betting markets have repriced the Democratic odds of victory higher. While the current outlook remains net positive for the GOP, this mitigates some of the Trump trade tailwinds for price that we have been discussing recently. It is likely that we will continue to see some volatility on this front through November.

Additional Comment on Political Tailwinds/Headwinds

Many are focused on the presidential race, and for good reason. However, it seems to me that the industry is perhaps too focused on the presidency and not enough on Congress. Should the GOP lose the White House but gain control of the Senate, this would mitigate many of the oppressive regulatory options for the executive branch. Any agency or cabinet appointees would need to obtain sign-off from the Senate, making it unlikely that radical opponents of crypto would have much luck obtaining seats at the Treasury, SEC, or FDIC.

BTC Conference Still a Possible Catalyst

Lately, we have been discussing a potentially seismic catalyst that many believe will occur this weekend at the BTC conference. This massive event typically attracts a large number of attendees, and this year, there is outsized energy due to the high-profile speakers, none more headline-grabbing than former President Trump. He will be speaking on Saturday at 2 pm.

There is growing confidence in the possibility of him announcing an intent for the US to adopt BTC as a strategic reserve asset.

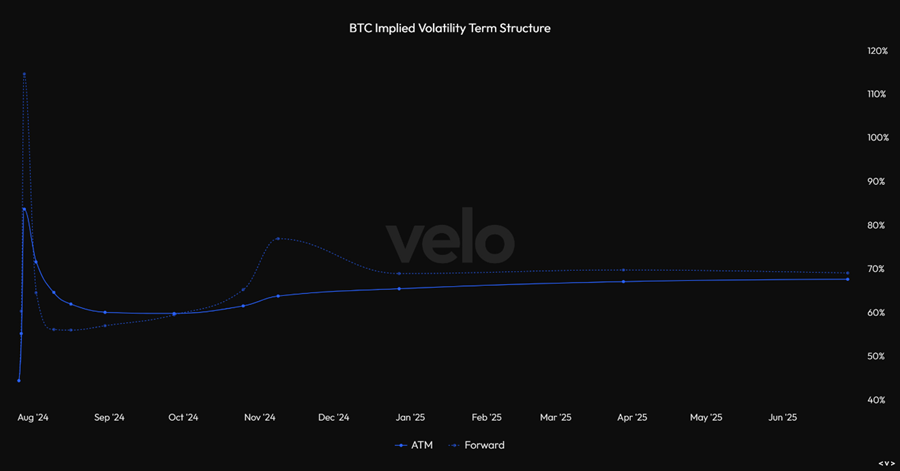

The volatility curve reflects the excitement that has built up over the past several days, with the inflection at the front of the curve indicating a large expected move over the weekend. It is worth noting that there is not a significant volume for 7/28 expiry options, so some of the uptick in implied volatility could be due to illiquidity. However, implied volatility is also elevated for the 8/2 expiry.

The natural question for many is: how would the U.S. mechanically go about adopting BTC as a strategic reserve asset? There are several ways. The Federal Reserve could purchase it, the US could create a new strategic reserve similar to the Strategic Petroleum Reserve (SPR), or they could integrate it with the Exchange Stabilization Fund (ESF) at the treasury. Recent reports suggest that the latter, which would require congressional approval, is the most probable route.

Reports indicate that Senator Cynthia Lummis, who is set to speak on Friday afternoon, will discuss proposed legislation to add BTC as a holding in the ESF. Many expect former President Trump to endorse this legislation when he takes the stage the following day.

What is the ESF?

The Exchange Stabilization Fund (ESF) is an emergency reserve fund managed by the U.S. Department of the Treasury, separate and distinct from the Treasury’s account with the Federal Reserve. Established by the Gold Reserve Act of 1934, the ESF allows the Treasury to buy and sell foreign currencies, hold foreign exchange and Special Drawing Rights (SDRs), and provide financing to foreign governments, serving as a flexible financial tool for managing currency stability and providing emergency support during economic crises.

The primary objectives of the ESF are:

- Stabilizing the Value of the U.S. Dollar: The ESF stabilizes the exchange value of the U.S. dollar through foreign exchange market interventions. This involves buying and selling foreign currencies to influence exchange rates and maintain dollar stability.

- Providing Financial Support: The ESF can extend credit and provide loans to foreign governments and institutions to support their currencies and stabilize international financial markets. This includes entering into swap agreements and other credit arrangements.

- Managing Financial Crises: The ESF has been used to address financial crises by providing emergency financial support. For instance, it was used during the Mexican Peso Crisis in 1994, the 2008 financial crisis to guarantee money market mutual funds, and the COVID-19 pandemic to support various sectors through the CARES Act.

As of May 2024, the ESF contained $206 billion in assets and $167 billion in liabilities, for a total net position of $39 billion. Its assets are comprised of dollars, foreign currencies, and SDRs. SDRs are an international reserve asset created by the IMF to supplement member countries’ official reserves, valued based on a basket of major currencies, including the USD, EUR, CNY, JPY, and GBP. Its liabilities are mostly SDR allocations.

Why add BTC to the ESF?

As we discussed last week, there are good reasons for the Treasury to add an asset that hedges against monetary debasement to this account. Both political parties have a desire, driven in large part by the need to onshore manufacturing, to weaken the dollar on a relative basis over the next several years. This would intuitively make the liabilities within the ESF more expensive. Adding gold or BTC, or both, to the ESF would be a proper hedge for the U.S. Treasury and would presumably help maintain national wealth levels in the presence of a weakening dollar.

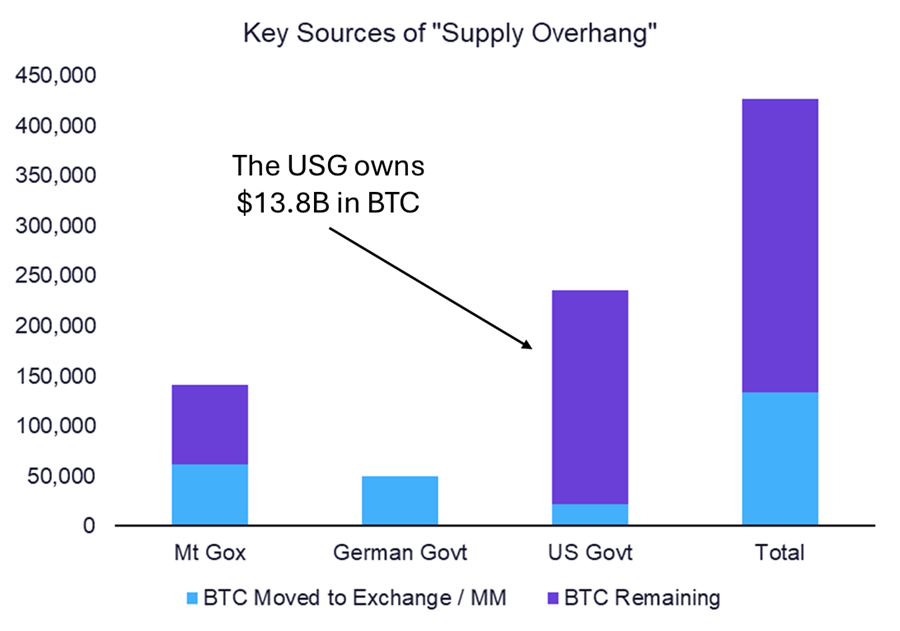

Many are curious about why the government would announce this intention since it likely makes their execution price worse as people front-run them. First, since this requires legislation, it is doubtful that this could ever be done covertly. Second, they don’t actually have to buy BTC from the open market. As we have covered in our recent “supply overhang” analyses, they already own nearly 1% of the entire BTC network via DOJ asset seizures.

They would simply have to announce that they would not be selling the nearly $14 billion (almost 7% of the current ESF asset value) in BTC that they already have and make a plan for gradually adjusting their ESF allocation to BTC over time.

Assuming that Lummis and Trump are in sync with the strategy outlined above, this could certainly become a bullish tailwind for BTC after Saturday. The magnitude of this tailwind will need to be adjusted based on the varying probability of victory for the GOP.

Regardless, the fact that senators and presidential candidates are now on stage speaking in support of BTC and the wider crypto industry is quite a leap from where the space was a couple of years ago.

GBTC Bottomed in 8 Trading Days – ETHE Could Happen More Quickly

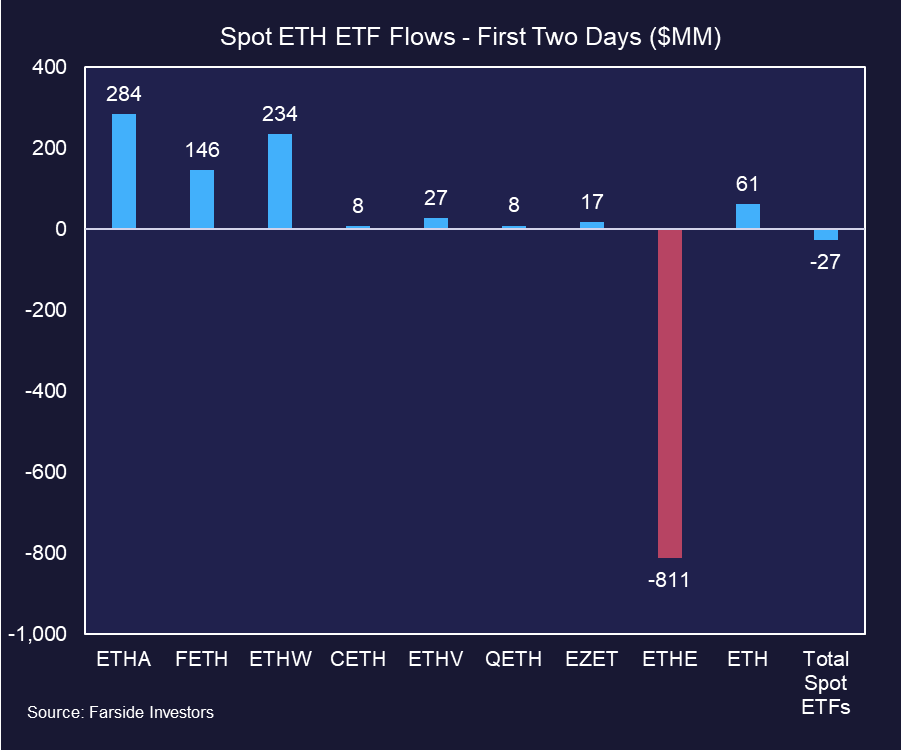

There is no question that we have seen sizeable outflows from ETHE beyond what many, including myself, expected in the first two days of trading. For comparison purposes, GBTC saw about 2% of AUM exit the fund in its first two days of trading, whereas ETHE saw about 10% of AUM leave.

To be clear, it is still possible that these outflows are front-loaded, and overall outflows may be less than the market expects. If following the same pattern as GBTC, investors likely anticipate upwards of $2.2 billion in outflows over the first month of trading (currently at approximately $800 million). However, we will need to see this outflow trend slow over the next several trading days for this to come to fruition.

Looking to GBTC as a reference, in January, we saw outflows peak 7 trading days post-launch. The price then bottomed in the following trading session and went on to achieve a new all-time high shortly thereafter. We think it is prudent to be alert for slowing outflows, as this should be a sign that a bottom for ETH is near.

If we see outflows slow before the 7-trading-day precedent set by GBTC, it would be a bullish surprise for investors.

Regardless of Conference Outcome, Macro Still Warrants Long Bias

In addition to the potential for a near-term catalyst at the BTC Conference, we believe it is prudent to stay allocated here for macro reasons. The July FOMC meeting is next week, and the market seems to agree (looking at Fed Funds futures) that a rate cut in September is warranted.

Even hawkish former Fed presidents are coming out in support of a near-term cut.

A signal from the Fed at next week’s meeting should lead to further weakness in the dollar and rates and help boost risk assets into August.

The last hurdle, of course, is the Core PCE reading on Friday. The consensus estimate is currently 0.17%, which, if met, would result in the second consecutive month of an annual core PCE of 2.6%, possibly providing the Fed with enough cover to perform a maintenance cut in September.

Core Strategy

With inflation continuing to fall, economic data remaining non-recessionary, and political tailwinds intensifying, we remain fully allocated.

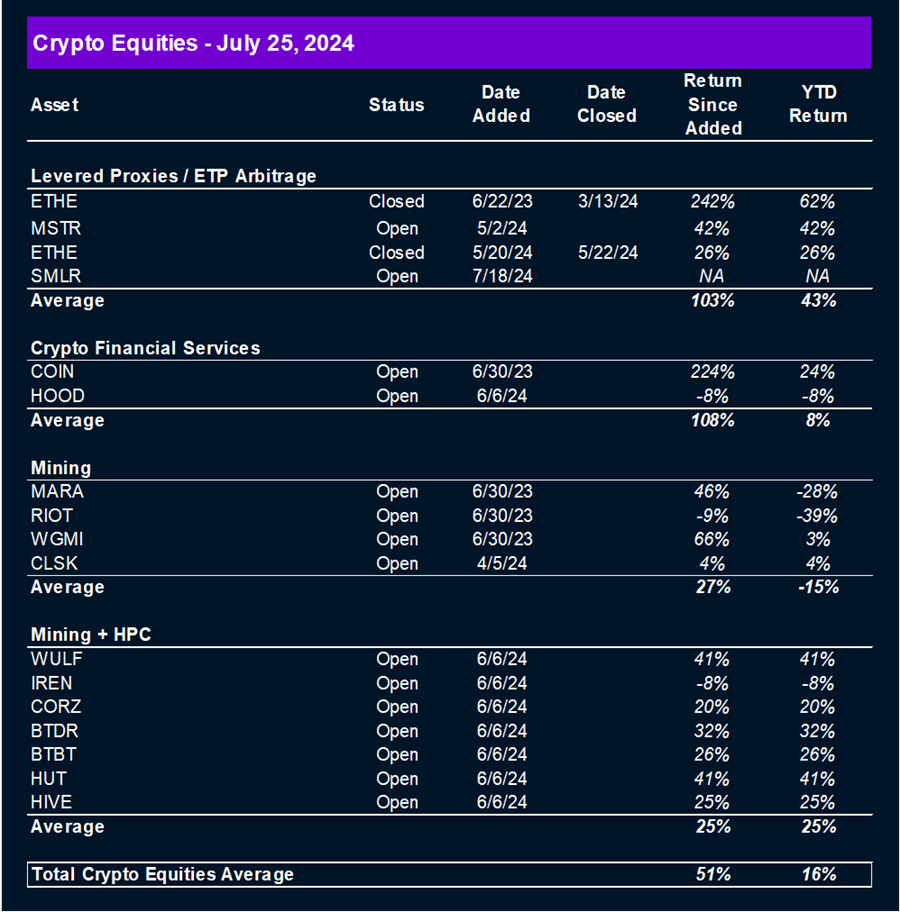

Tickers in this Report: BTC 3.61% , ETH 5.87% , SOL 7.58% , OP 10.45% , STX N/A% , RON 6.81% , IMX 4.85% , MKR 4.67% , MSTR -2.92% , ETHE -4.72% , SMLR, COIN -2.76% , HOOD -4.53% , MARA 6.51% , RIOT -4.81% , WGMI -5.43% , CLSK -4.69% , WULF -9.62% , IREN -7.44% , CORZ -5.45% , BTDR -3.27% , BTBT -6.18% , HUT -2.90% , HIVE -5.70%