Stablecoin Data Suggests Risk Appetite is Rising, Adding SMLR to Equities Basket

Key Takeaways

- Catalyst Watch – The political tailwinds for crypto have intensified following the attempted assassination of former President Trump. He is scheduled to speak next week at the Bitcoin Conference. While he will likely reiterate the GOP’s stated platform, there are rumors circulating about a potential announcement regarding a strategic BTC reserve—something to keep an eye on.

- A strong push to devalue the dollar for onshoring purposes, whether realized or not, could bolster the investment case for a monetary hedge like Bitcoin.

- There is compelling evidence that the broader market is shifting its risk-taking appetite, indicated by a large uptick in USDT market cap this week.

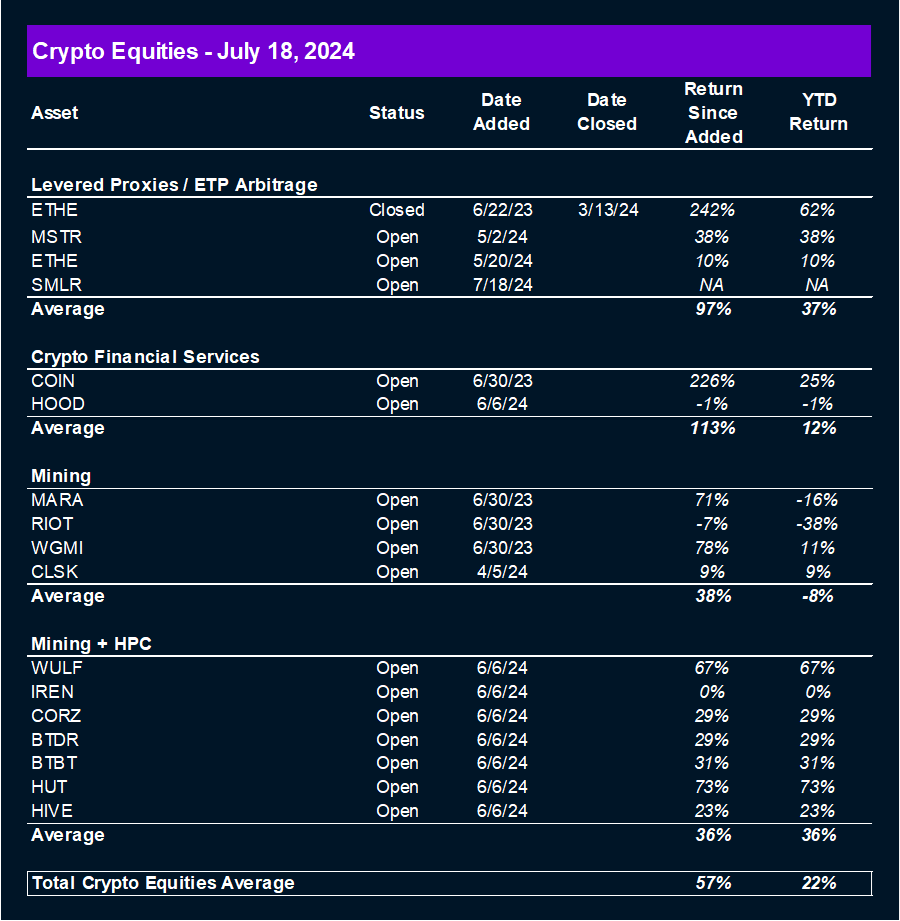

- Crypto Equities – This week we are adding Semler Scientific (SMLR) to our crypto equities basket. Despite the industry and company-specific risks, we believe it is on a path to becoming a small-cap MSTR.

- Core Strategy – We acknowledge the near-term risk to the market from the ongoing transfer of BTC out of the Mt. Gox estate, which could result in short-lived downside volatility. However, with inflation continuing to fall, economic data remaining non-recessionary, and political tailwinds intensifying, we remain fully allocated.

BTC As a Possible Strategic Reserve

Last week, we discussed the rising political tailwinds affecting crypto. Despite events earlier in the year that might have suggested a changed stance from the Democratic Party, the political divide over the issue has grown stronger. The GOP has become the party that is undoubtedly more favorable to the industry.

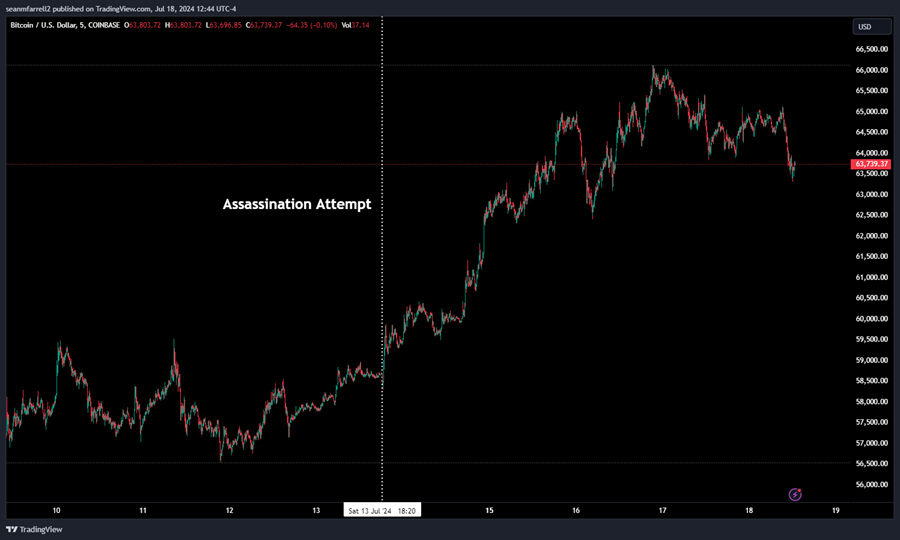

The attempted assassination of former President Trump, juxtaposed against a Democratic Party seemingly in disarray, boosted the prospective GOP leader in the polls and on prediction markets.

There is good reason to think that this strength over the weekend was largely due to the shifting political winds, likely adding BTC to many Trump trade baskets, even in investing circles that normally do not wade into crypto due to a lack of interest.

Of course, we are still four months out from the general election, and a lot could change between now and then. Biden stepping aside for a more competent candidate could certainly move pieces on the chessboard against crypto, which is something to be cognizant of. But as it stands, the political tailwinds over the next few months should be an added boost to what have been fairly conducive macro conditions for the asset class.

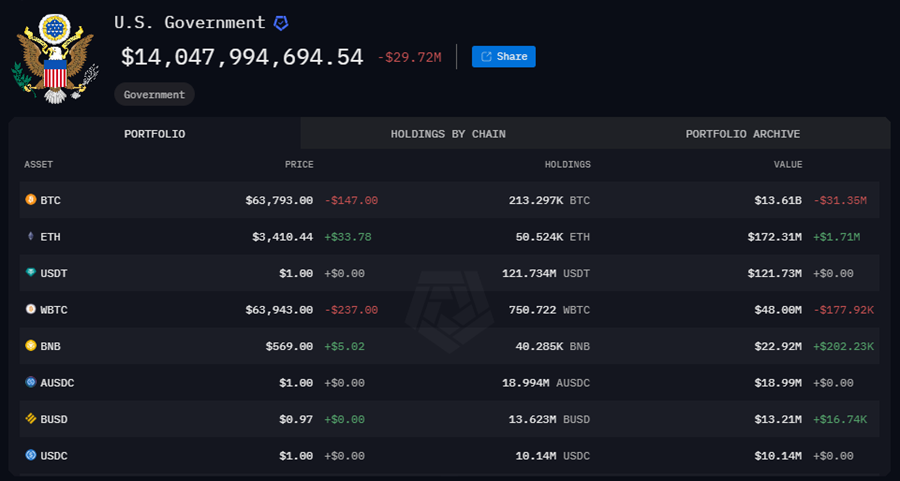

Catalyst Watch: Trump is expected to be the headline speaker at the Bitcoin Conference next weekend. While it is more likely that he will simply reiterate the crypto-focused initiatives featured in the GOP platform released last week, there are rumors that he might discuss the possibility of a strategic bitcoin reserve. While this seems like a pipe dream to many — from a practical perspective, it is uncertain whether BTC is of the size or has the liquidity (yet) to suit the Treasury’s needs — it is important to remember that the government is currently in possession of nearly 1% of the total BTC supply, as we have been discussing lately. Thus, it is possible that he intimates that the government should simply not sell their holdings, which, in our view, could have a material effect on the price.

Why Would a BTC Strategic Reserve Even Make Sense for the US?

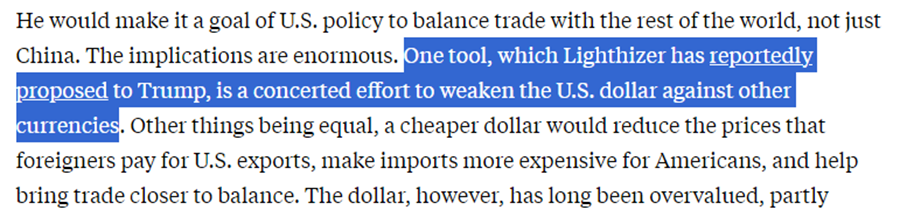

Some might wonder what would make the US even contemplate adding BTC to its balance sheet. The answer is simpler than you think. Over the past 15-20 years, we have seen the emergence of scaled and reliable manufacturing in emerging markets. Due to the global reserve currency status of the USD and its consequent strength relative to these emerging markets, the US economy has largely hollowed out its industrial base, relocating it to Asia and parts of Latin America. This shift has negatively impacted many areas in the rust belt, a significant concern for Trump and his recently announced running mate, Vance. They advocate for reshoring manufacturing, which would naturally involve the devaluation of the USD as companies would need to boost exports to make this venture profitable.

Both political parties support this reshoring for reasons beyond populist fervor, including geopolitical and national security considerations, but Trump has certainly been more outspoken about it, and seems more determined to approach the problem from a dollar devaluation perspective. How can the dollar be significantly weakened? There are several approaches, but mainly through debasement. This entails running a deficit and either monetizing the debt (Japan Strategy) or inflating it away.

As noted in the screenshot above, there are different nuances around this debasement effort, one nuance possibly involving tariffs. However, tariffs would likely be inflationary, which is just a different way to crack the same egg.

None of these strategies necessitate the end of the dollar as the global reserve currency. However, they would lead to dollar devaluation, making monetary hedges highly valuable in dollar terms. To preserve the wealth of the national balance sheet amidst a falling currency, it makes sense to add a monetary hedge.

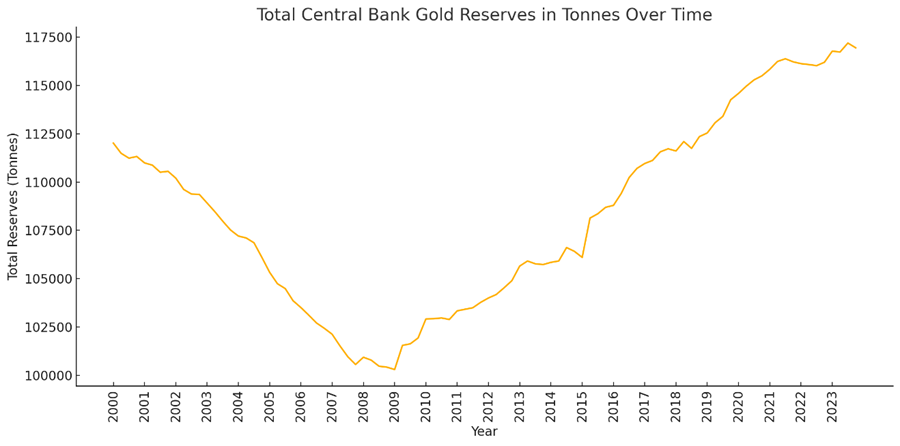

Historically, the USD has crowded out other foreign currencies over the past 15 years, prompting other countries to adopt similar strategies, with gold being the most popular monetary hedge. The US might want to add more gold to its balance sheet. To outcompete other countries, it might also consider adding digital gold—Bitcoin.

Flows Show Considerable Improvement, USDT Stands Out

One factor that exacerbated the drawdown following the sales from the German government was the generally illiquid environment plaguing crypto markets toward the end of June and into July. Although ETFs have been consistently acquiring BTC over the past nine days, other areas of the market had not demonstrated a reignition of animal spirits.

However, over the past week, we have seen compelling evidence that the broader market is shifting its risk-taking appetite, and that capital is returning.

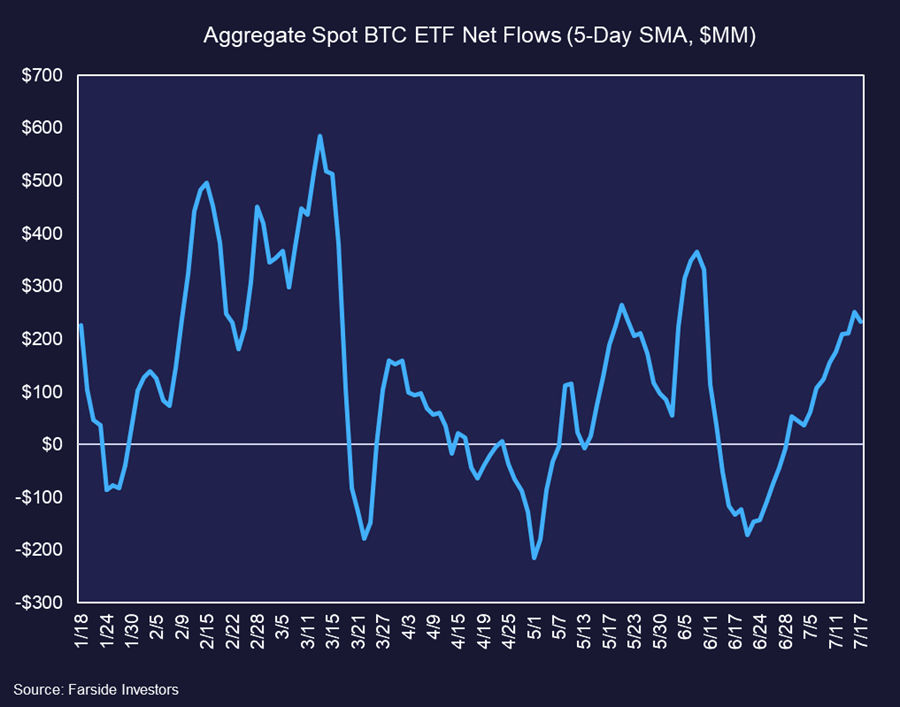

Below, we see the rolling 5-day moving average for net BTC ETF flows. This metric has moved up convincingly since early last week.

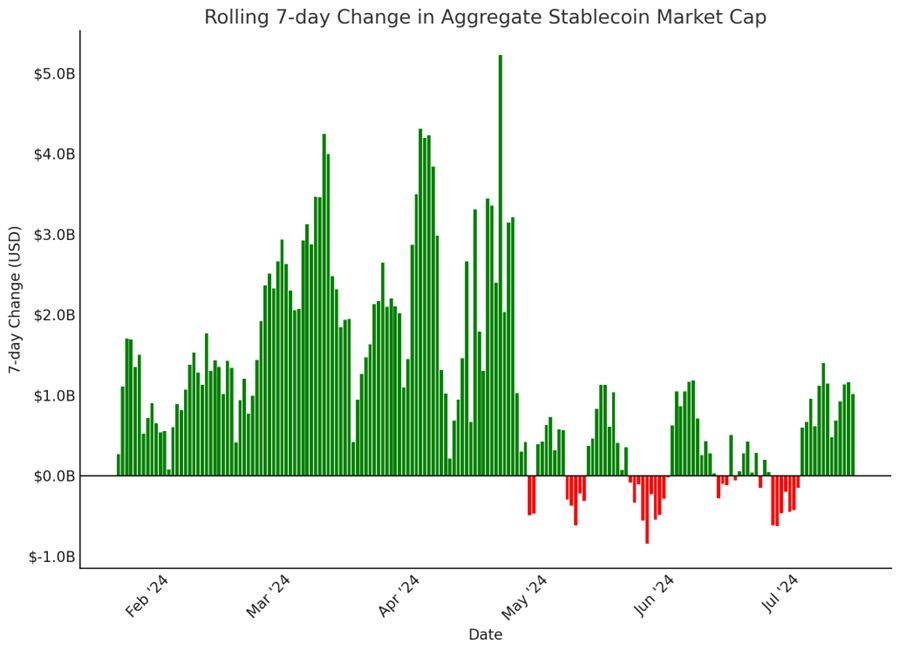

Similarly, the rolling change in stablecoin market cap is another good indicator of capital crossing from traditional financial markets to crypto markets. This metric has also shown a bullish pattern, with the aggregate market cap inflecting higher at the beginning of the month. Last week, we were hesitant to call this a conclusive bullish impulse, as we saw a similar increase in stablecoins at the beginning of June, only to be erased later in the month. However, this pattern has sustained itself for several weeks now.

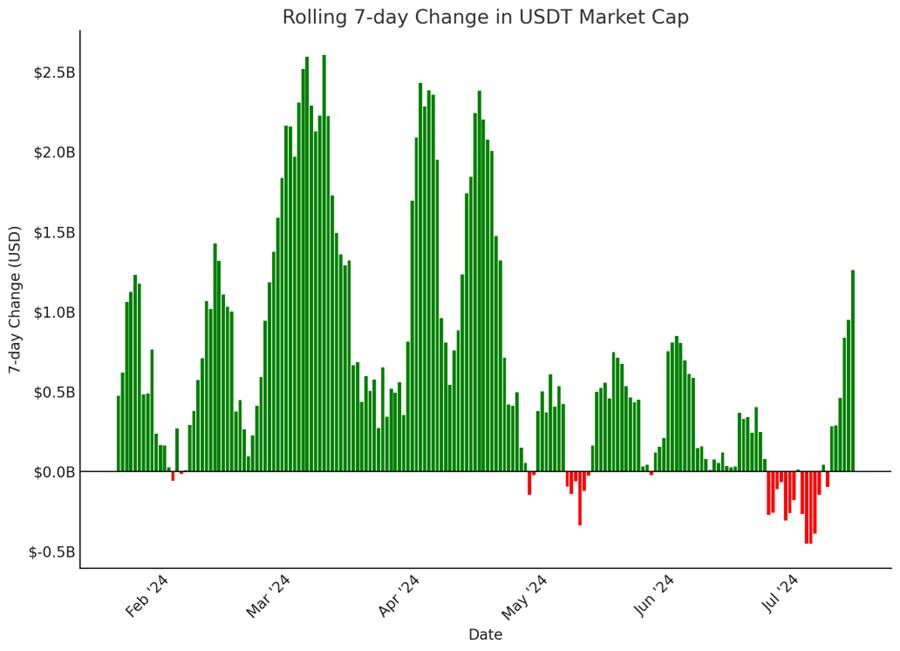

Perhaps the most constructive piece of evidence that this pattern has reversed is the sharp increase in USDT, which rose by $1.2 billion over the past seven days—the most significant rise since April.

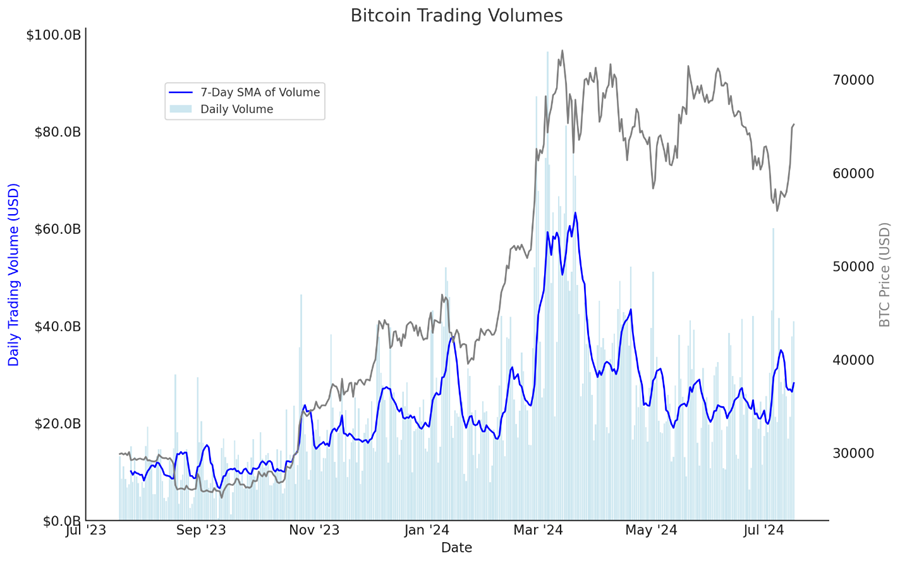

Finally, it is worth looking at overall Bitcoin volumes, which serve as a good barometer for market participation. As shown below, there has been a sharp move higher in recent days, following the German-induced drawdown to $53k. This is a positive sign and could indicate that liquidity conditions and market participation have troughed for the year.

A Good Time to Add SMLR – A Small Cap MSTR

Semler Scientific (SMLR) experienced a significant rally upon announcing its bitcoin treasury strategy in late May. Given the recent drawdown, we believe it is an opportune time to add SMLR to our crypto equities basket.

Company Overview

Semler Scientific is a medical technology company specializing in products that help physicians detect and diagnose peripheral arterial disease (PAD). For the trailing 12 months, the company reported approximately $66 million in revenue and $22 million in net income, reflecting a 33% net margin. Despite 20% topline growth in 2023, revenue declined in Q3 and Q4 after being front-loaded in the first half of the year.

Risks

In 2023, the Centers for Medicare and Medicaid Services (CMS) removed the HCC code for PAD without complications from the Medicare Advantage risk adjustment model for 2024. This regulatory change led to a nearly 50% drop in SMLR’s stock price and a 12.6% revenue decline in Q1 2024 compared to the previous year. The company also faces high revenue concentration, with 80% of last quarter’s revenue coming from just three customers.

Path Forward

Despite these challenges, Semler Scientific remains confident in the clinical value of their primary product, QuantaFlo, a non-invasive PAD screening tool. They are expanding their customer base beyond Medicare Advantage patients, targeting hospital systems, retail pharmaceutical markets, and delegated medical groups. They are also seeking additional FDA 510(k) clearance for other heart dysfunctions. A three-year phase-in of the CMS changes is expected to support continued PAD screening during the transition.

Investment Thesis

Unlike MicroStrategy (MSTR), a significant portion of SMLR’s equity value is derived from its medtech business, making it subject to industry-specific and company-specific risks. However, we believe that over time, their bitcoin treasury strategy will outpace the impact of their operational company (OpCo) on the company’s equity value, warranting its inclusion in our crypto equities basket.

Illustrative Analysis

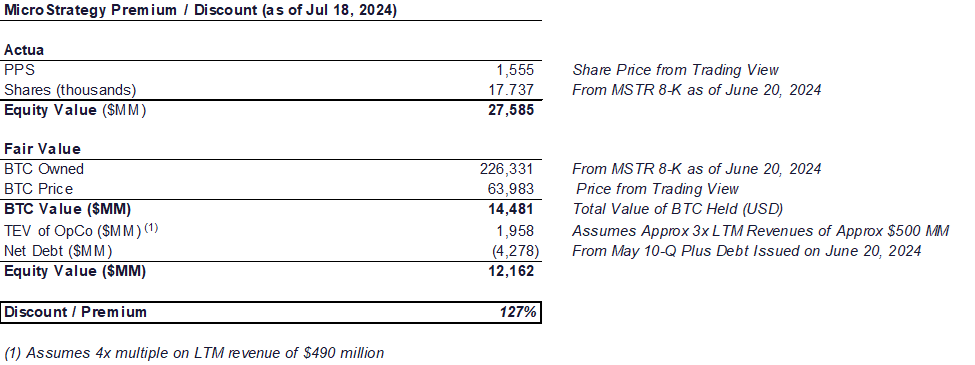

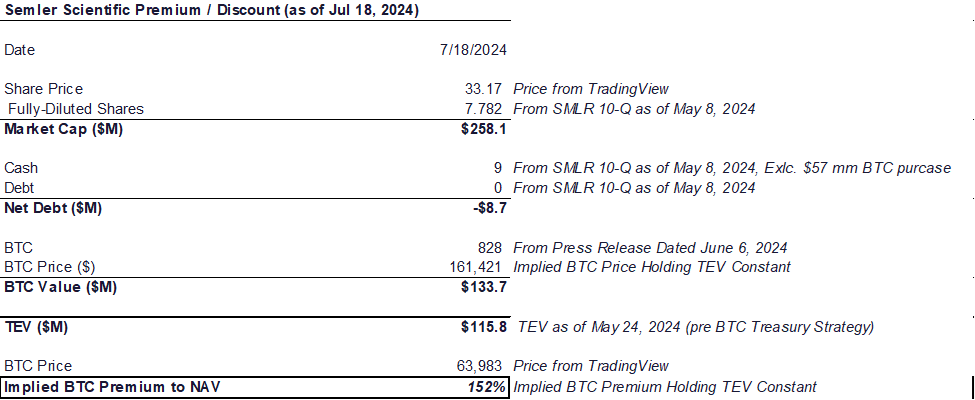

We do not offer an opinion on the medical technology part of the business. Instead, we quantify the upside to the current stock price by holding their market valuation pre-BTC-treasury-strategy announcement constant and assuming the company exhausts its projected financing resources to acquire more bitcoin. Using MSTR as a comp, we calculate the current MSTR premium to the bitcoin on its balance sheet. Applying a conservative 3x multiple to its LTM revenues, we estimate a Premium to NAV of 127%, which we use as a market comp for SMLR.

For SMLR, we estimate the current premium to NAV at 152%, significantly higher than that of MSTR. While this may be off-putting to some, it is important to note that some of this premium might be pricing in the company’s recent prospectus to issue a $150 million convertible note and complete a $50 million ATM equity offering, assumed to go towards purchasing more bitcoin.

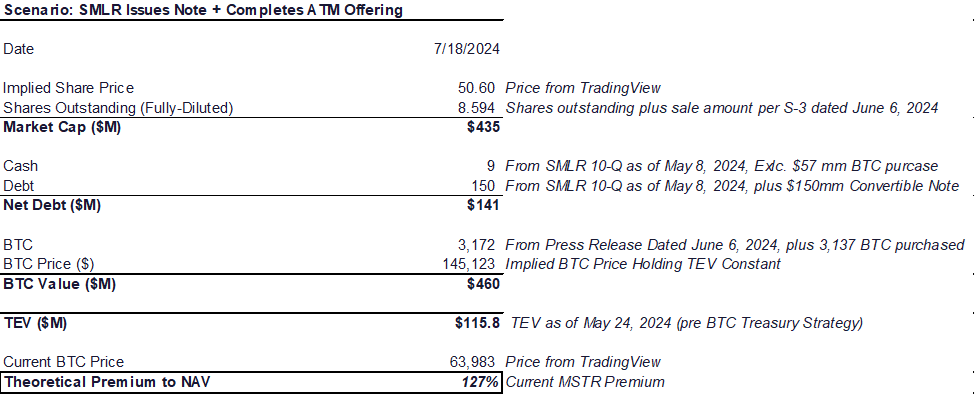

Below, we assume that the notes and ATM offering are closed and BTC is purchased at the prevailing market price, holding the enterprise value constant. It is worth noting that, despite the outlined risks above, the reduced cost of capital due to their BTC strategy could actually result in multiple expansion. Applying the current MSTR premium to NAV to this revised cap structure and bitcoin treasury, we estimate an implied share price north of $50, representing a 53% increase from Thursday’s closing price.

Finally, it is worth noting that this analysis does not contemplate any appreciation in BTC price. If BTC rises, SMLR’s price is likely to follow. Given the current market conditions and strategic moves by Semler Scientific, now is an opportune time to add SMLR to our crypto equities basket.

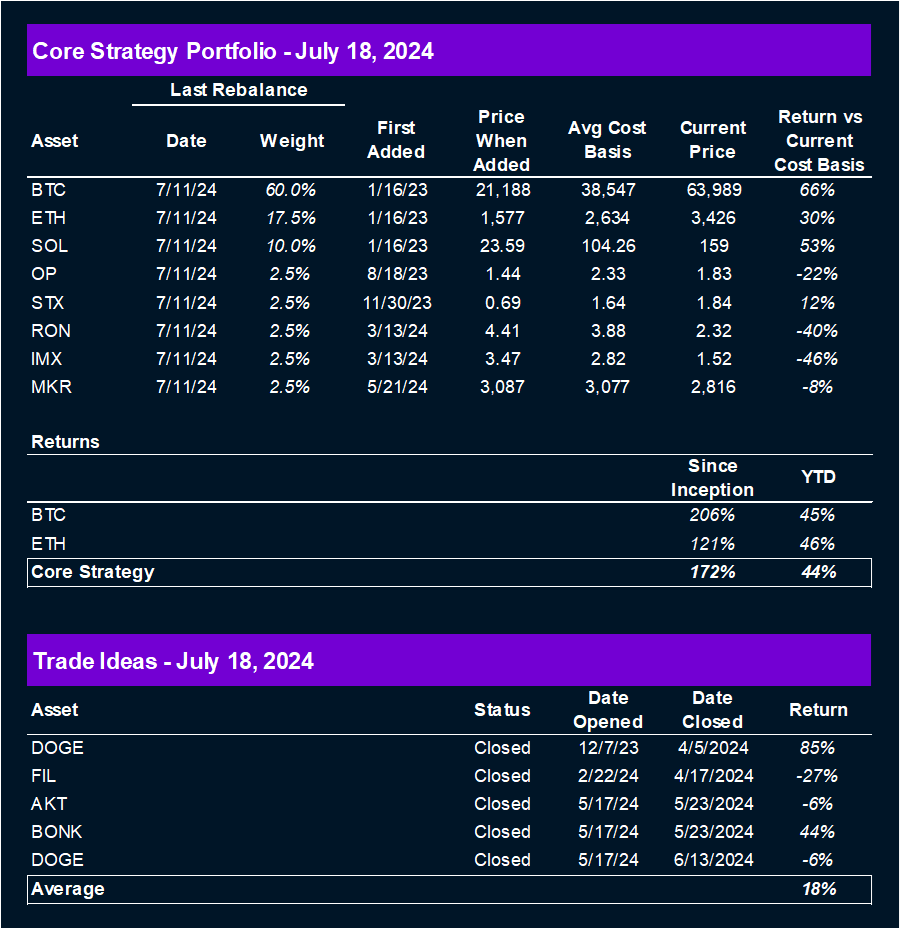

Core Strategy

We acknowledge the near-term risk to the market from the ongoing transfer of BTC out of the Mt. Gox estate, which could result in short-lived downside volatility. However, with inflation continuing to fall, economic data remaining non-recessionary, and political tailwinds intensifying, we remain fully allocated.

Tickers in this Report: BTC -1.53% , ETH -1.70% , SOL -2.15% , OP -1.74% , STX N/A% , HNT 7.96% , RON -7.34% , IMX 2.65% , MKR 0.65% , MSTR -2.84% , ETHE N/A% , COIN -8.40% , HOOD, MARA -3.97% , RIOT -3.72% , WGMI N/A% , CLSK, WULF, IREN, CORZ, BTDR, BTBT, HUT, HIVE -4.04%