Some Quick Thoughts on ETH ETF, Regulation, and Updates on Recent Tactical Trade Ideas

On ETH Approval and Volatility

We expect a decision on the ETH ETFs today and are bullish on the prospect of approval. ETH open interest is well above all-time highs. Whichever way this breaks, expect some potentially whipsawing volatility. Our base case right now is that we are likely to see a bit of a rally and drawdown post-19b-4 approval, then a slow march higher into S-1 approval and listing.

What will be interesting post-approval is which assets are identified as next in line for an ETF. Our money is on SOL.

FIT21 was passed by the House yesterday on a bipartisan basis. This bill provides clarity around market structure and regulatory jurisdiction for the SEC and CFTC. This was yet another regulatory victory for crypto this week. We think that regardless of what happens, this 180-degree pivot from the Democratic party has created a bullish environment for crypto asset prices and is encouraging for the broader outlook for the industry in the US.

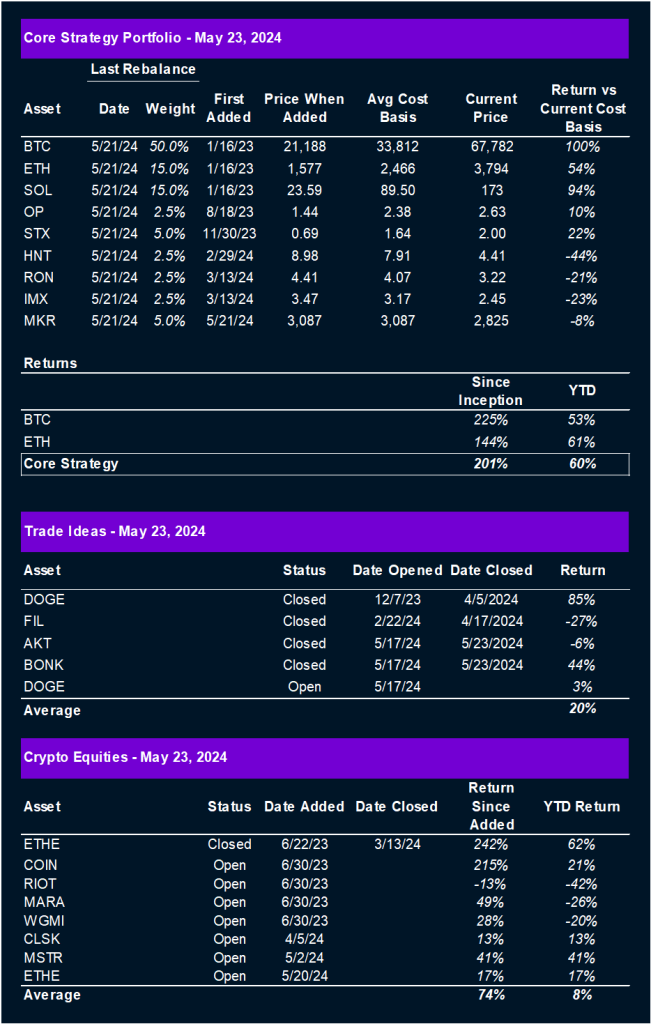

Tactical Trade Updates

Closing AKT – We did not get the follow-through out of AKT that we were looking for post-NVDA earnings, despite smashing new all-time highs. Thus, we think it’s right to cut this trade loose and perhaps revisit it next earnings season.

Closing BONK – We think it’s right to take profits here on the BONK trade, currently up about 50% in a week. Although we skew towards this being destined for all-time highs, SOL has stalled in the face of ETH taking the spotlight. We do not think this will last forever, but if SOL continues to move sideways, it’s probably right to de-risk here.

Staying Long Doge – We are keeping DOGE on as an active trade since we think that broadly animal spirits are still working their way back into the market. DOGE is only slightly above its 200-day SMA relative to BTC.

Core Strategy

A brief summary of the theses behind each component of the Core Strategy:

- Bitcoin (BTC -4.66% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe.

- Ethereum (ETH -4.69% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL -4.46% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP -5.69% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. OP Stack is the most popular development platform for other L2s. Outside of ARB, which is excluded due to the recent inflation of token supply, Optimism has garnered the most traction compared to other L2s with a liquid token. Offers beta exposure to ETH.

- Stacks (STX N/A% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q2 2024.

- Helium (HNT -2.34% ): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX -5.05% ) & Ronin (RON -2.90% ): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms.

- MakerDAO (MKR -0.18% ): MakerDAO stands as an integral piece of the DeFi landscape, offering a decentralized alternative to traditional banking with its stablecoin, DAI. With the anticipated Endgame upgrade, expanding product offerings, and increasing integration with traditional financial markets, MakerDAO is well-positioned to achieve outsized adoption and growth, making MKR a compelling ETH beta opportunity in the intermediate term.