A Historically Momentous Week, Increasing ETH Exposure

Key Takeaways

- From what we gather, it appears that the SEC has done a complete 180 on their ETH ETF stance and is likely to greenlight 19b-4 approvals this week, possibly as early as Wednesday.

- We believe ETH will play some catch-up here, and thus we are increasing our Core Strategy allocation to ETH and ETH-adjacent assets. ETHBTC is still near 3-year lows.

- Keep in mind that, despite much less demand from institutional investors for ETH exposure in their brokerage accounts, it should take much less capital to move ETH higher.

- We are less certain about launch timing, as both 19b-4 (rule change applications) and S-1s need to be signed off on.

- The larger implications of this surprise, beyond the price of ETH, are that the regulatory attitudes of the current administration towards crypto may be shifting in a direction that is beneficial to the industry.

- MakerDAO is an integral part of the DeFi landscape, and with the anticipated Endgame upgrade, expanding product offerings, and increasing integration with traditional financial markets, MakerDAO is well-positioned to achieve outsized adoption and growth, making MKR a compelling ETH beta opportunity in the intermediate term.

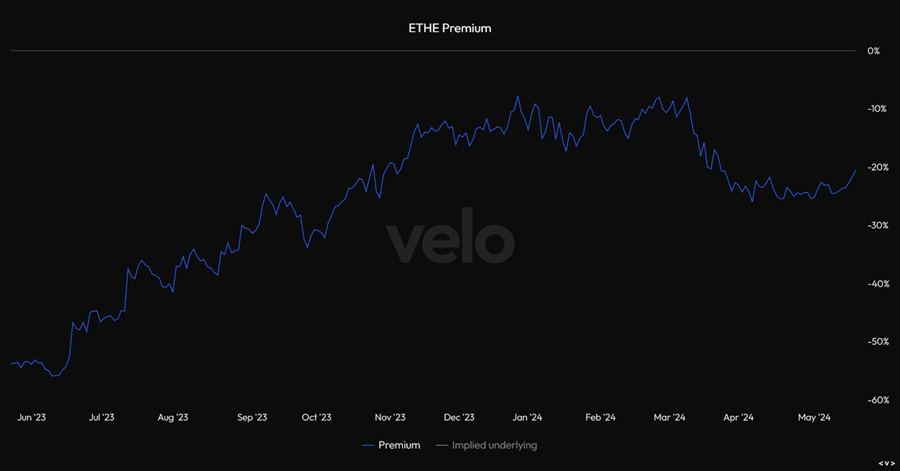

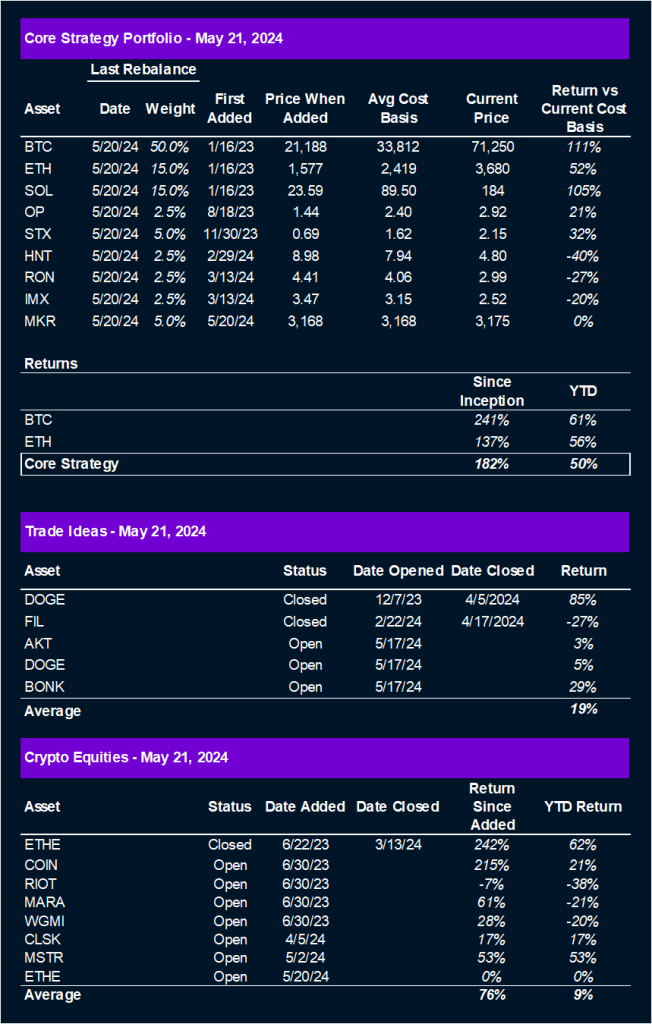

- We are also adding ETHE back to our recommended crypto equities in anticipation of the discount converging upon any approval.

- Core Strategy – Our view remains that early May’s QT taper and dovish commentary from the Fed marked a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. Recent resumption of flows following an encouraging CPI print reinforces our bullish view on crypto in the near term. SOL remains a preferred avenue for large cap beta, but the apparent rising probability of ETH ETF approval brings ETH back into the equation. We think increasing ETH and ETH beta basket is correct here. We are adding MKR to our ETH beta basket.

Imminent 19b-4 Approval Seems Likely

Up until yesterday, we were quite bearish about the prospects of a spot ETH ETF approval. Our off-the-record conversations with those close to the situation confirmed this sentiment. ETF experts James Seyffart and Eric Balchunas, who accurately predicted the Bitcoin ETF call, also assigned a very low probability of approval. The market agreed as well, with the ETHE discount widening from 8% to over 20% in the past couple of months, indicating a lack of conviction over ETH ETF approval.

Thus, we are inclined to think that this is indeed a late development from the SEC, potentially part of a wider shift in regulatory attitudes from the current administration. The Biden White House and the Warren-led Senate have been notably antagonistic towards crypto, with the latter even campaigning on an anti-crypto platform.

What changed? A couple of weeks ago, at an event at the Trump estate in Florida, Presidential Candidate Trump was asked about his attitudes toward crypto. He replied that he was open to it and wanted to see crypto businesses stay in the US.

We think that this, combined with tight polls across major swing states and the bipartisan overturning of the notably anti-consumer SAB 121 last week, has led to a forced change in tone from the Biden administration regarding crypto.

Is this administration suddenly pro-crypto? No, that is unlikely. But it is concerned about winning the presidential election in November. In an electoral college format where a few thousand votes can have a major impact in key states, a few thousand crypto supporters are worth capitulating to with regard to chokepoint 2.0.

We have yet to see whether President Biden will forego his veto on SAB 121 or if FIT21, the market structure bill scheduled to be voted on in the House this week, will be signed into law. However, based on current trends, both seem more likely than they were just a few weeks ago.

Thus, we view an ETH ETF as part of what is shaping up to be a momentous week for crypto in America.

Launch Date Less Certain

Below is the current outlook for applications and deadlines for the ETFs. The first in line is ARK on Thursday. Bloomberg is reporting that we could receive approval on the 19b-4 applications as soon as Wednesday.

Digging into our memory banks from the BTC approval process, remember that there are actually two things that the SEC needs to approve – the 19b-4, which is the big one. This is the approval for exchanges to list spot ETH ETFs.

However, these issuers will also need to have their S-1s approved to go to market. This could happen simultaneously or could take a little while (weeks) to happen, so the listing date is still TBD.

ETH Had a Major Rally But Is Still Near 3-Year Lows Relative to BTC

For those who feel as though they missed out on the “big move” following yesterday’s monster ETH candle, keep the chart below in mind. ETH is still pretty close to 3-year lows relative to BTC.

Thus, we would caution investors against exiting the trade too early or thinking that it has already run too far. ETH has favorable supply tailwinds with massive supply locked in EigenLayer and Blast. Additionally, there is no major bankrupt entity, to our knowledge, with large amounts of ETH waiting to unload this supply onto the market.

MakerDAO

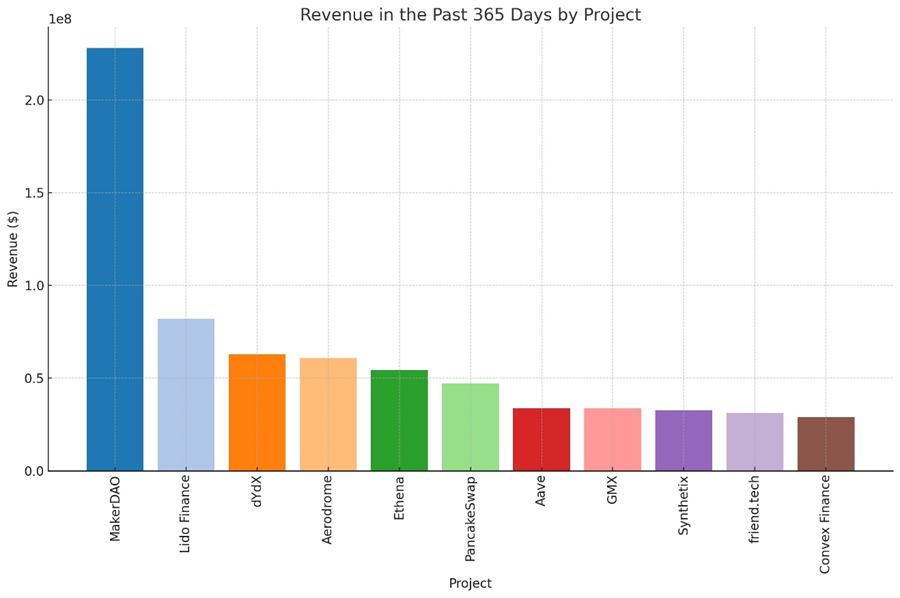

MakerDAO is a leading DeFi protocol on the Ethereum network. Launched in 2017, MakerDAO’s primary product is DAI, a decentralized stablecoin pegged to the US dollar. DAI is generated through a peer-to-contract lending mechanism where users lock collateral in smart contracts to mint DAI. This process allows for decentralized borrowing and lending, functioning similarly to a traditional bank but with the benefits of blockchain technology, such as transparency, reduced counterparty risk, and lower operational costs. As demonstrated by the chart below, Maker is one of the most used projects in crypto and has the highest revenue of any individual application featured on TokenTerminal over the past 365 days. Note that we are defining revenue as the share of fees that accrues to the protocol.

How Does MKR Work and How Does It Accrue Value?

MKR is the governance token for MakerDAO. MKR holders have the exclusive right to vote on various aspects of the Maker protocol, including risk parameters, collateral types, and fee structures. This governance role ensures that the community drives the evolution and stability of the protocol.

MKR accrues value in several ways:

- Fee Generation: MakerDAO earns revenue through stability fees (interest) and liquidation penalties charged on DAI loans. A portion of these fees is used to buy back and burn MKR tokens, reducing the total supply and increasing the value of remaining tokens.

- Risk Management: MKR tokens act as a backstop for the system. If the collateral backing DAI becomes undercollateralized, MKR is minted and sold to cover the shortfall, ensuring the stability of DAI.

- DAI Savings Rate (DSR): By offering competitive interest rates on DAI deposits, MakerDAO attracts more users, increasing the demand for DAI and consequently driving up MKR value through higher fee generation.

Catalysts on the Roadmap

Several upcoming developments and strategic shifts are expected to positively impact MKR’s token price:

- Endgame Upgrade: This ambitious overhaul aims to scale the DAI supply by transforming MakerDAO into a modular ecosystem of protocols. Central to this upgrade are SubDAOs, which will operate semi-independently under Maker’s governance, allowing for faster product development and increased decentralization.

- Increased DAI Demand: Fundamentally, increased demand for credit as ETH catches a bid will increase demand for DAI, which should increase revenue to the protocol and result in more MKR burned.

- Expansion into Real World Assets (RWAs): MakerDAO has made the leap into RWAs, utilizing partnerships to invest its treasury into high-yielding treasuries. It is actively exploring expanding into a wider breadth of RWAs to diversify collateral sources and tap into traditional finance markets. This expansion could significantly increase DAI issuance and associated fee generation.

- Rebrand and Token Redenomination: An upcoming rebrand and token redenomination (24,000:1) are expected to make MKR more accessible to retail investors and increase market interest (we think this could be a huge driver of demand as unit bias is a real thing).

- New Product Launches: SubDAOs like Spark, which will offer new lending and borrowing markets, and innovative products such as cross-chain bridges and AI-driven governance models, are set to enhance Maker’s ecosystem, drive user adoption, and increase the demand for MKR.

MakerDAO stands as an integral piece of the DeFi landscape, offering a decentralized alternative to traditional banking with its stablecoin, DAI. The MKR token plays a crucial role in governing and stabilizing this system while accruing value through various revenue streams and strategic mechanisms. With the anticipated Endgame upgrade, expanding product offerings, and increasing integration with traditional financial markets, MakerDAO is well-positioned to move beyond its reputation as a slow-moving blue-chip DeFi application and achieve outsized adoption and growth, making MKR a compelling ETH beta opportunity in the intermediate term.

Core Strategy

Our view remains that early May’s QT taper and dovish commentary from the Fed marked a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. Recent resumption of flows following an encouraging CPI print reinforces our bullish view on crypto in the near term. SOL remains a preferred avenue for large cap beta, but the apparent rising probability of ETH ETF approval brings ETH back into the equation. We think increasing ETH and ETH beta basket is correct here. We are adding MKR to our ETH beta basket.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -4.63% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe.

- Ethereum (ETH -5.72% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL -8.66% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP -7.92% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. OP Stack is the most popular development platform for other L2s. Outside of ARB, which is excluded due to the recent inflation of token supply, Optimism has garnered the most traction compared to other L2s with a liquid token. Offers beta exposure to ETH.

- Stacks (STX N/A% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q2 2024.

- Helium (HNT -10.54% ): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX -6.27% ) & Ronin (RON -5.72% ): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms.

- MakerDAO (MKR -2.90% ): MakerDAO stands as an integral piece of the DeFi landscape, offering a decentralized alternative to traditional banking with its stablecoin, DAI. With the anticipated Endgame upgrade, expanding product offerings, and increasing integration with traditional financial markets, MakerDAO is well-positioned to achieve outsized adoption and growth, making MKR a compelling ETH beta opportunity in the intermediate term.

Active Trades

- Dogecoin (DOGE -2.49% ) & Bonk (BONK -4.17% ): With the anticipation of animal spirits returning, we believe it is time to pay attention to memecoins again, as they serve as a clear barometer of speculative fervor. The rationale for a long position in BONK mirrors that of DOGE, but BONK likely offers better immediate upside due to the recent relative strength of SOL and the inherent link between the two.

- Akash Network (AKT -4.33% ): There is clearly rising demand for compute resources, particularly GPUs, to power large language models (LLMs) and other AI applications. Akash Network is a decentralized cloud computing marketplace that allows users to buy and sell cloud computing resources in a secure and efficient manner. Think “AirBNB for datacenters.” With NVDA’s earnings coming up next week, it is possible that we will see a run-up in AI-related crypto names ahead of the release. We have precedent that shows a strong pattern of AKT outperformance relative to BTC into NVDA earnings.