CPI Opens the Liquidity Floodgates

Key Takeaways

- Wednesday's favorable CPI brought flows back into the market, evident through a conclusive Coinbase Premium, substantial ETF inflows, a large uptick in CME open interest, and a strong move higher in stablecoin creations.

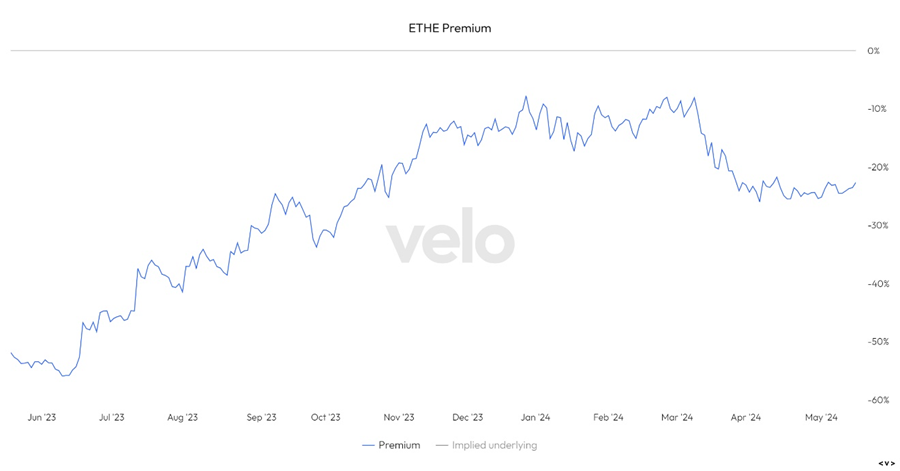

- We maintain our base case that the ETH ETF will be denied. Regardless of the outcome, we think that this could serve as a bottom for ETHBTC and a good buying opportunity for ETH/ETHE on any post-denial weakness.

- The bipartisan vote to overturn SAB 121 is overall a constructive shift on Capitol Hill. There are two fairly good options from here: (1) President Biden follows through on his veto, the politicization of crypto becomes more blatant, and this likely results in a galvanizing effect, or (2) Biden relents, does not issue his veto and this opens the door for banks to become more engaged in crypto and for bipartisan stablecoin and market structure legislation to move through Congress.

- Should the hostile wing of the democratic party not soften their views on crypto, look for crypto to potentially become a quasi-prediction market for the upcoming Presidential election.

- Trade Idea – with overall market conditions improving and NVDA earnings approaching it is a good time to put on a tactical trade to take advantage of potential continued momentum among AI-related coins. We think AKT presents a good risk/reward here, given its observed adoption and its strong correlation with AI-related equities.

- Trade Idea – in anticipation of animal spirits returning, we think it is right to consider readding exposure to memecoins. Our choices are DOGE and BONK.

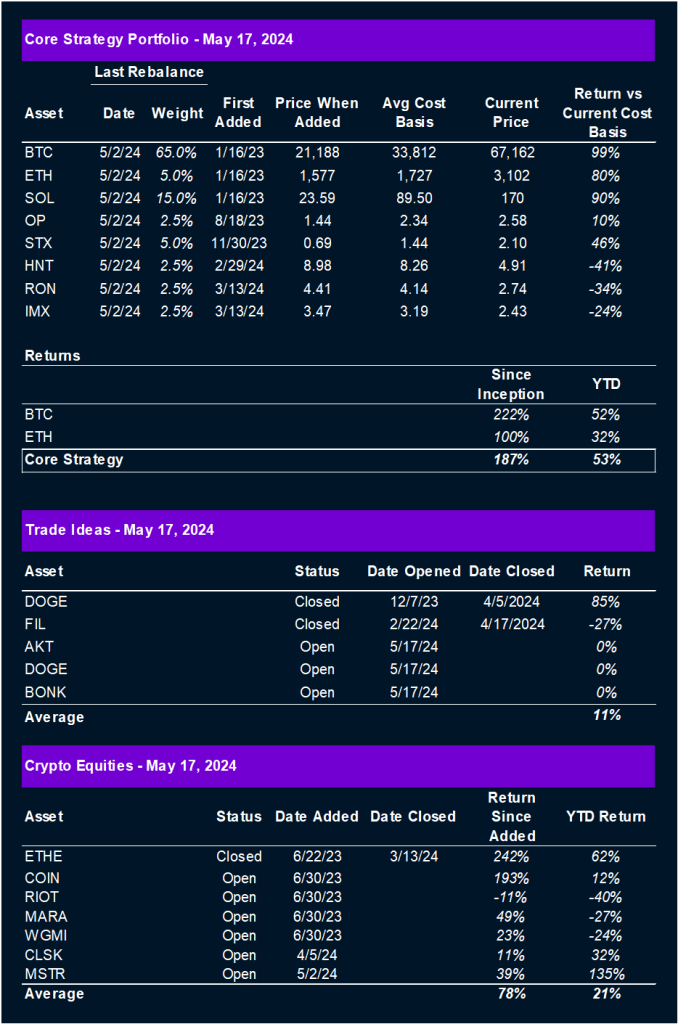

- Core Strategy – Our view remains that early May’s QT taper and dovish commentary from the Fed marked a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. Recent resumption of flows following an encouraging CPI print reinforces our bullish view on crypto in the near term. SOL remains our preferred avenue for large cap beta. We will likely see opportunities to capitalize on ETH weakness next week following probable SEC denial of the spot ETH ETF.

Flows Returning to the Market

Last week, we discussed how our base case remained that conditions for liquidity-sensitive assets like crypto would improve in the near term, and we continued to lean on our “Buy in May” thesis, given the constructive setup.

A combination of (1) a dovish Federal Reserve, (2) an accelerated tapering of quantitative tightening (QT), and (3) a Quarterly Refunding Announcement (QRA) that met investors’ expectations contributed to a decline in rates during the first couple weeks of May, alongside a rebound in crypto assets.

However, despite the drawdown in rates, investors wanted to see confirmation of better inflation figures given recent weak job numbers—a weak economy and hot inflation is a mix that investors do not want to see. Thus, the on-target CPI number released on Wednesday, showing progress on shelter and auto inflation as well as outright monthly deflation in goods, was important to bring investors back into the fold. Based on the initial market reaction, it appears that market confidence has been restored.

Importantly, this was not just short covering and speculative day trading. There were identifiable improvements in the flows situation.

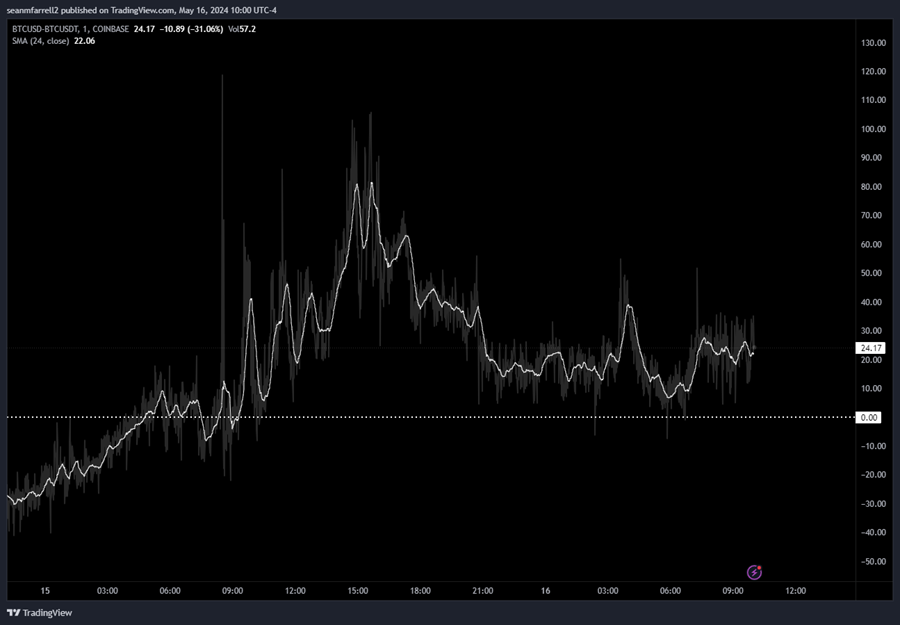

We saw a massive uplift in the BTC Coinbase Premium, which, as a reminder, suggests that US institutional investors are buying.

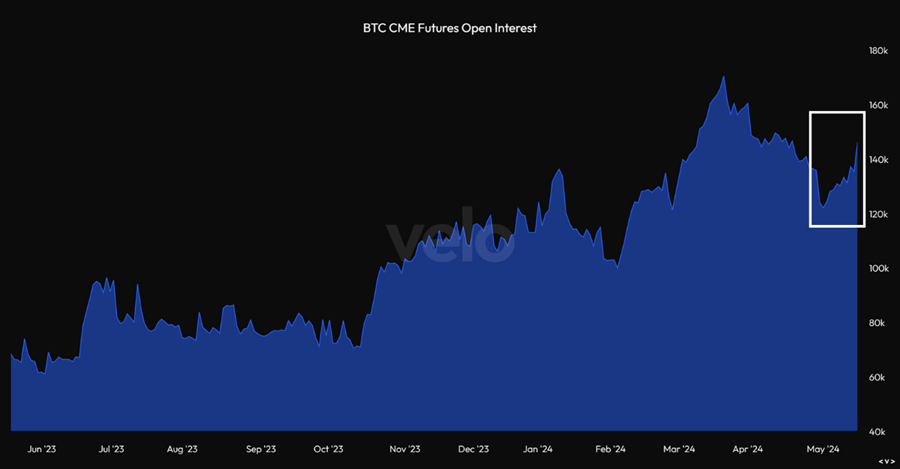

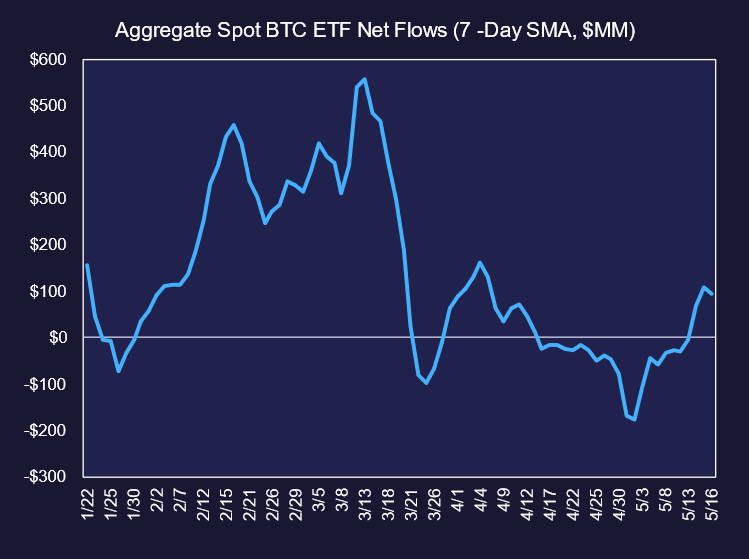

Additionally, nearly $1.4 billion in Open Interest was added on the CME, and over $300 million flowed into Bitcoin spot ETFs, marking the highest level in over two weeks and pushing the 7-day moving average well into positive territory.

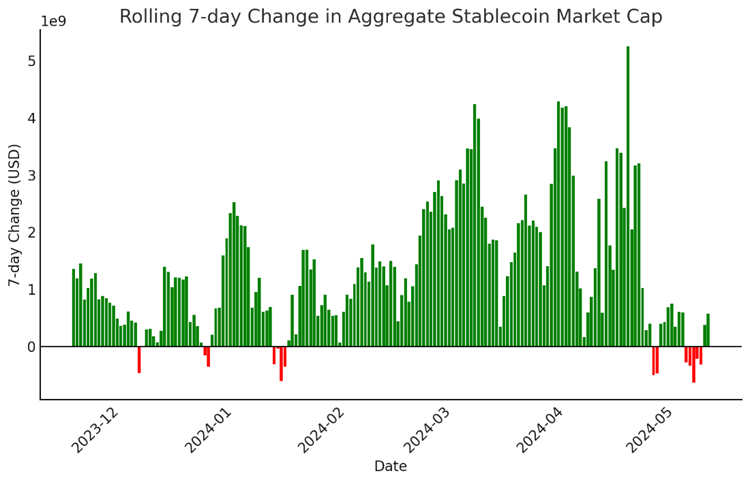

Furthermore, more than $600 million was added to the total stablecoin market cap since the CPI print.

This is an enormously positive development.

SEC Likely to Deny Spot ETH ETF

We continue to view the likelihood of the SEC greenlighting the ETH ETF to be very low. Our last firm probability that we put on approval was 40%, but frankly, it is likely south of 10% at this point.

The major question that remains is – what rationale will they use to deny the product?

It is possible that they rely on the same correlation analysis as they did for the BTC product, or they could resort to something completely new. There have been rumors floating around that Gensler will look to label ETH as a security. This, on its surface seems like a death blow to crypto. However, it is important to understand that Consensys, Coinbase, and Robinhood are all engaged in active legal proceedings against the SEC, and therefore, it is unlikely that a security designation would result in the removal of ETH from major crypto exchanges. Also, keep in mind that this would start an interagency battle between the CFTC and SEC, and therefore, might be viewed as more of a galvanizing event than anything else.

Thus, we think that next Thursday, May 23rd, the day on which the SEC is due to make a final decision on the ETH ETF will serve as a buyable low in ETHBTC.

On approval, we will want to load up on ETHE for its immediate convergence to NAV.

On denial, we likely see some immediate weakness, but once the dust settles, one will want to allocate to both ETHE and ETH. We would also look to add some ETH beta exposure at that time.

SAB 121 Nullified & Crypto as a Prediction Market

Personal Note: We understand that our clients have a broad array of political views. As analysts, we strive to remain objective and apolitical. As the election approaches and crypto regulation becomes increasingly pertinent to our analyses, political commentary may become more frequent than usual. Please do not interpret any such commentary as endorsements of any wider political ideology.

To the surprise of many, particularly those in the White House, the U.S. Senate voted 60 to 38 on Thursday to overturn the SEC’s SAB 121, implemented just over two years ago. The measure, previously passed by the House, now goes to President Biden, who has already stated that he will veto it, with both chambers lacking the two-thirds majority needed to override the veto. This represents a notable shift from House and Senate Democrats, who went against President Biden’s veto promise.

Many aspects of Chokepoint 2.0 require a deep understanding of crypto and regulation to grasp their detrimental impact on consumers and innovation, but the issues with SAB 121 are straightforward.

This bulletin mandates that digital asset custodians record custodied assets on their balance sheets, diverging from the off-balance-sheet accounting traditionally used by banks for other custodied assets. As a result, the capital requirements needed to maintain proper capital ratios are increased, making it prohibitively expensive for regulated depository institutions to custody crypto assets.

This leads to federally regulated banks being unable to offer crypto custody solutions, creating an unhealthy concentration of custody services among a few non-bank custodians.

Furthermore, this also places customers at greater risk in the event of bankruptcy, as they become unsecured creditors instead of having their assets housed in a bankruptcy-remote structure.

There is no scenario in which this arrangement protects consumers, promotes capital formation, or ensures fair, orderly, and efficient markets (the purported mission of the SEC).

Because the SEC issued SAB 121 as guidance, it circumvented the rulemaking process governed by the Administrative Procedures Act. Thus, the House introduced a resolution to repeal SAB 121 under the Congressional Review Act.

It passed the House on a surprisingly bipartisan basis, with 21 Democrats voting in favor of nullifying the rule. Initially, there was little optimism about it passing the Senate due to Senate Banking Committee leadership being overtly hostile to crypto and friendly towards the SEC and prudential banking regulators.

However, the vote was held without going through the Banking Committee and passed with a dozen Democrats voting against Biden’s veto threat.

The least bullish takeaway from this is that it took the banks being disadvantaged to get support from Congress. SAB 121 certainly hurt consumers, but it also hurt banks since they were excluded from offering custody solutions.

However, we choose to view this through a more favorable lens. We think this is a great turn of events. This was a huge victory for crypto advocacy groups and might be a sign that SEC Chair Gensler overstepped with SAB 121.

If it wasn’t apparent already, this mini-rebellion certainly paints the Biden/Warren/Gensler wing of the democratic party as overtly hostile to crypto. We think this either opens the door for Democrats to become softer on crypto and start moving bipartisan market structure and stablecoin legislation through Congress or will simply serve to increase the politicization of crypto. This, on the margin, likely helps pro-crypto candidates, as there aren’t many people who visit the polls to vote on a purely anti-crypto stance, and dispels the notion that regulatory efforts to stymie crypto have been anything but purely political in nature.

If we get the former, then that is great for the regulatory landscape for crypto. If we still get a veto, then it further entrenches crypto as a partisan issue and as we approach November, BTC will likely continue to trade on macro trends, but the wider crypto ecosystem may serve as a quasi-prediction market for the election.

Trade Idea: Akash Network (AKT)

Akash Network is a decentralized cloud computing marketplace that allows users to buy and sell cloud computing resources in a secure and efficient manner. Think “AirBNB for datacenters.” It is built on the Cosmos blockchain ecosystem and utilizes the Tendermint consensus algorithm. Its native token is AKT.

It is an open-source, decentralized peer-to-peer marketplace for cloud computing resources. Providers on the network can offer their unused capacity, while consumers can rent resources on-demand at a lower cost compared to centralized cloud providers. Akash Network aims to democratize cloud computing by enabling anyone to become a cloud provider or consumer without centralized control. It leverages containerization technology like Kubernetes to ensure secure and efficient deployment of applications across the decentralized network.

AKT is the native utility token of Akash Network, used for governance, staking, and as a means of exchange for cloud services on the platform. It is used to secure the network through Proof-of-Stake (PoS) consensus, where AKT holders can stake their tokens and earn rewards for validating transactions. AKT holders can participate in the governance of the network by voting on proposals related to network upgrades, inflation rates, and other parameters. The token is used as a payment method for renting computing resources from providers on the Akash Network.

Thesis

There is clearly rising demand for compute resources, particularly GPUs, to power large language models (LLMs) and other AI applications. There are also natural trends toward centralization in AI computing, with GPUs becoming more expensive and big tech AI models becoming larger as those with large balance sheets have better access to high end chips. Akash is among the several decentralized compute projects aiming to lower costs and increase access to chips.

Akash Network underwent a mainnet upgrade in late 2023 to enable the distributed training of AI models, thus enhancing the network’s applicability to AI.

In the Q4 2023 recap, Akash developers mention hosting open-source AI applications like “Stable Diffusion XL (SDXL) for image generation and Akash Chat for interacting with open-source language models” on their decentralized GPU infrastructure. They also state they are “paving the way for a new wave of open-source and permissionless AI applications.”

Further, there are open-source LLM models that are verifiably using Akash GPUs to train their models, the most notable being the recently launched Venice.ai.

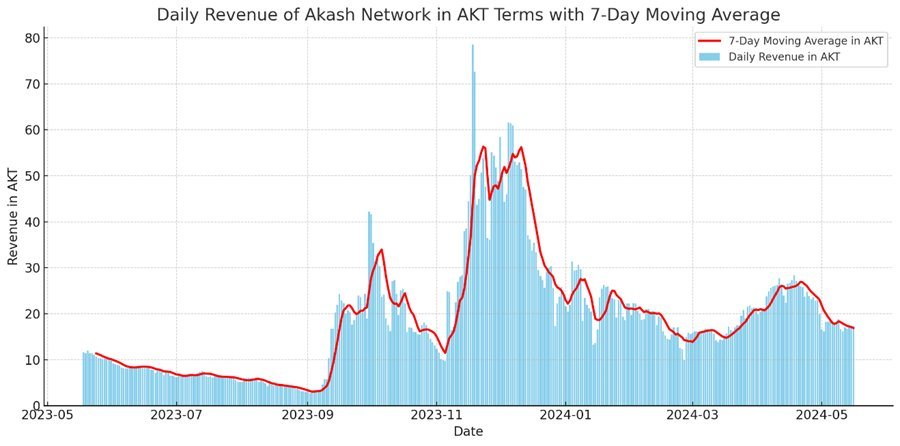

The chart below displays the network revenue in AKT terms. While activity has receded since the Q4 peak, there was clearly an inflection point in September of last year, when it first introduced GPUs to the network.

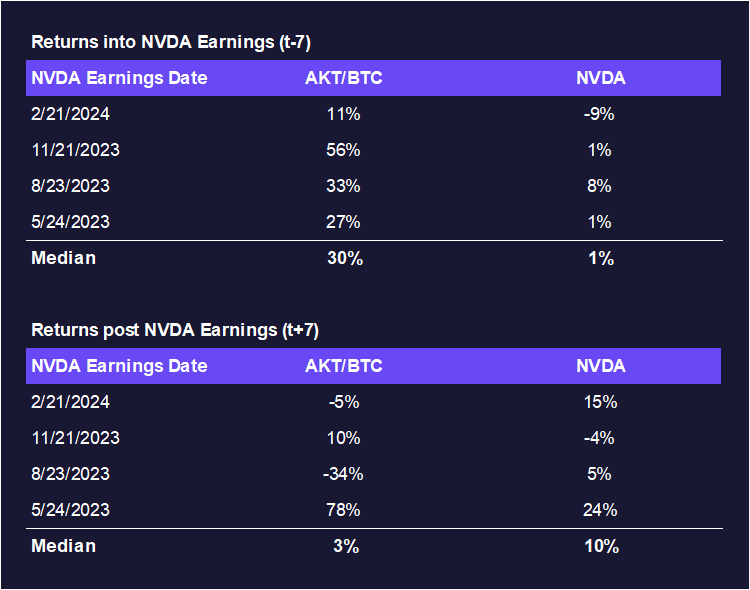

The fundamental traction that the network has seen is a long-term tailwind. As it pertains to the trade opportunity, its correlation with AI is what is important. With NVDA’s earnings coming up next week, it is possible that we will see a run-up in AI-related crypto names ahead of the release.

We have precedent that shows a strong pattern of outperformance relative to BTC into NVDA earnings. Performance post-earnings is highly dependent on the prevailing market environment. We think the environment will remain conducive for AI coins for a little while, but we will actively reassess along the way.

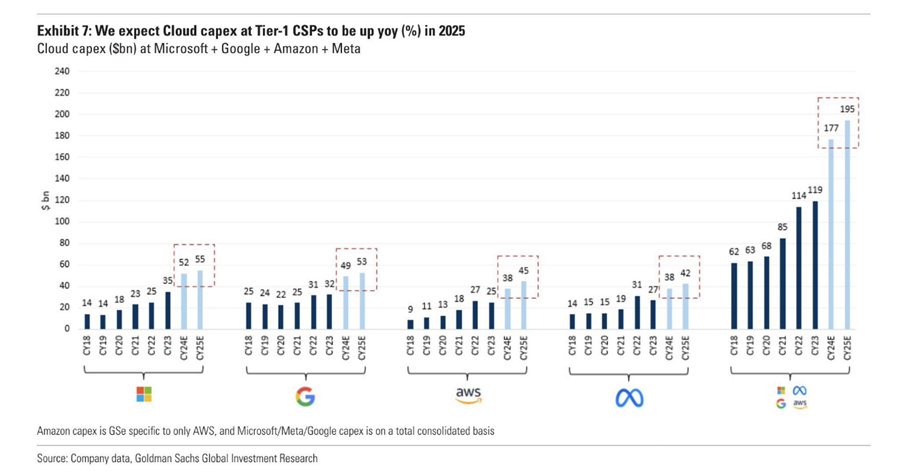

Given the relentless announcements around AI from the likes of Meta, Apple, and Google, it is unlikely that Nvidia’s topline projections have slowed. Goldman Sachs projects that Nvidia’s major customers will spend a total of $177 billion in capex this year. Thus, there is good reason to be optimistic heading into the May 23rd earnings date.

Yes, AKT has rallied ahead of the wider market as AI coins caught a bid before we really started to see flows return to the crypto market. However, the chart is clearly on the cusp of breaking out, and should NVDA break out to ATH, so should AKT.

Trade Idea: Adding Memecoins Back with Animal Spirits Returning (DOGE & BONK)

This trade idea is straightforward and is one we implemented in Q1 of this year. With the anticipation of animal spirits returning, we believe it is time to pay attention to memecoins again, as they serve as a clear barometer of speculative fervor.

The key difference now is our addition of exposure to BONK, a preferred memecoin of the Solana network. The rationale for a long position in BONK mirrors that of DOGE, but BONK likely offers better immediate upside due to the recent relative strength of SOL and the inherent link between the two.

Core Strategy

Our view remains that early May’s QT taper and dovish commentary from the Fed marked a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. Recent resumption of flows following an encouraging CPI print reinforces our bullish view on crypto in the near term. SOL remains our preferred avenue for large cap beta. We will likely see opportunities to capitalize on ETH weakness next week following probable SEC denial of the spot ETH ETF.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC 2.24% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe.

- Ethereum (ETH 2.36% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL 4.26% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP 3.14% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. OP Stack is the most popular development platform for other L2s. Outside of ARB, which is excluded due to the recent inflation of token supply, Optimism has garnered the most traction compared to other L2s with a liquid token. Offers beta exposure to ETH.

- Stacks (STX N/A% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q2 2024.

- Helium (HNT 11.05% ): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX 8.56% ) & Ronin (RON 7.76% ): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms.

Active Trades

- Dogecoin (DOGE -1.39% ) & Bonk (BONK 5.22% ): With the anticipation of animal spirits returning, we believe it is time to pay attention to memecoins again, as they serve as a clear barometer of speculative fervor. The rationale for a long position in BONK mirrors that of DOGE, but BONK likely offers better immediate upside due to the recent relative strength of SOL and the inherent link between the two.

- Akash Network (AKT 2.54% ): There is clearly rising demand for compute resources, particularly GPUs, to power large language models (LLMs) and other AI applications. Akash Network is a decentralized cloud computing marketplace that allows users to buy and sell cloud computing resources in a secure and efficient manner. Think “AirBNB for datacenters.” With NVDA’s earnings coming up next week, it is possible that we will see a run-up in AI-related crypto names ahead of the release. We have precedent that shows a strong pattern of AKT outperformance relative to BTC into NVDA earnings.