Setup Still Looks Promising, Investors Just Need a Little More Convincing

Key Takeaways

- Improved conditions for liquidity-sensitive assets like BTC remain our base case in the near term.

- Despite the drawdown in rates, investors likely want to see confirmation that this was not a false signal, hence the subpar flow data over the past few days.

- On-chain momentum metrics demonstrate the weak sentiment among short-term traders relative to longer-term investors. However, there is evidence that the bottom for trader sentiment has been reached.

- SOL has shown relative strength versus BTC and ETH since rates started to decline, suggesting SOL remains the preferred large-cap alt for BTC beta exposure.

- The upcoming ETH ETF decision in late May could present a buying opportunity for ETH. Our base case remains that it will be denied by the SEC. The level of opportunity will largely depend on the SEC's rationale for denying the product.

- Core Strategy – Our view remains that last week’s QT taper and dovish commentary from the Fed marks a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. We think that despite the risk of immediate-term consolidation as capital flows return, current prices present a favorable risk/reward.

Macro Setup Still Looks Good for Crypto

As discussed last week, we achieved the favorable setup we were anticipating. A combination of (1) a dovish Federal Reserve, (2) an accelerated tapering of quantitative tightening (QT), and (3) a Quarterly Refunding Announcement (QRA) that met investors’ expectations contributed to a decline in rates during the first week of May, alongside a rebound in crypto assets.

However, crypto investors remain cautious, and capital remains sidelined. Recent dovishness from foreign central banks and a partial retracement of the Japanese yen rally have led investors to adopt a wait-and-see approach before fully recommitting to the market.

Despite the macro setup paving the way, we have yet to see flows return to the market.

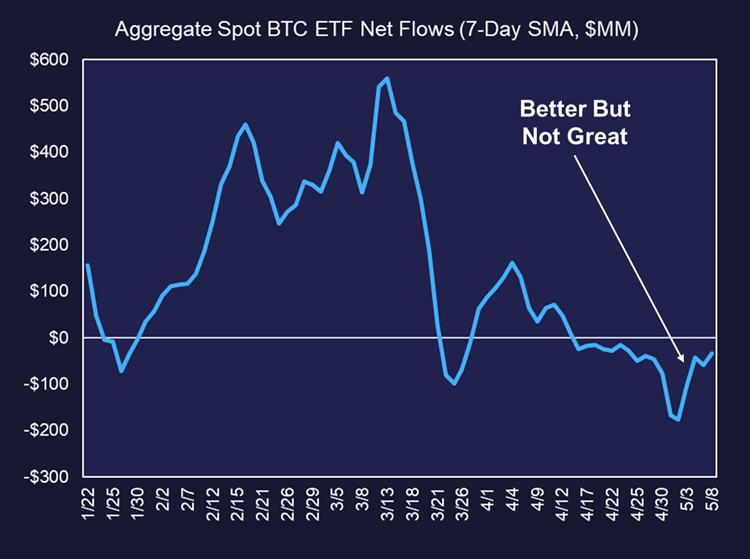

ETF flows were strong in the early days of May but have since decreased, showing a slight net negative bias thus far this week.

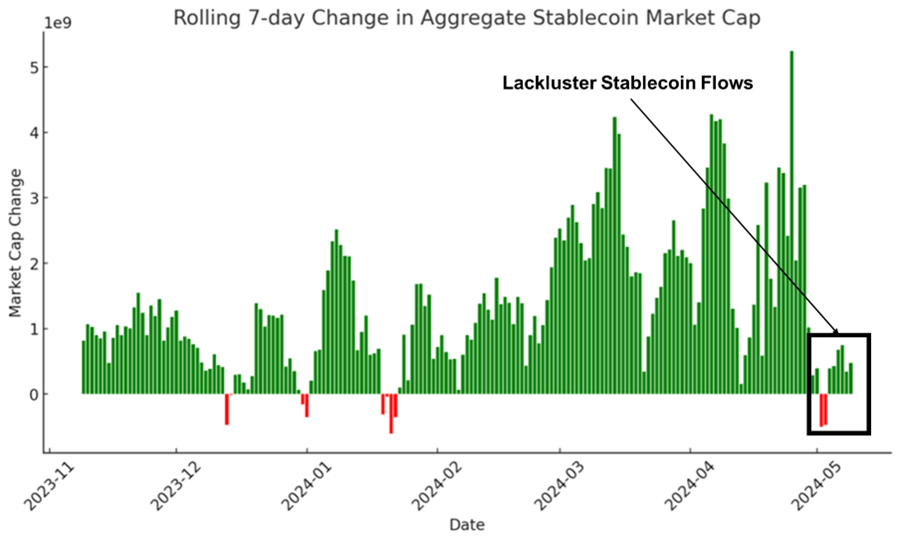

Stablecoin flows have also been unimpressive at best.

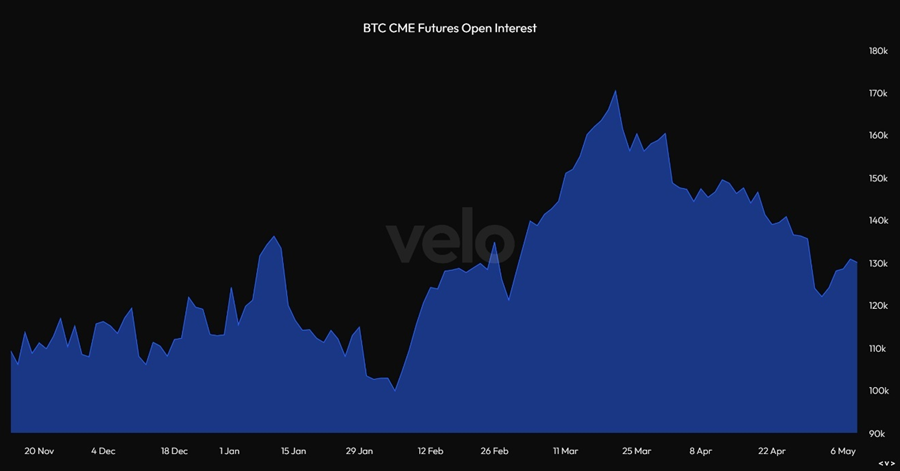

CME futures open interest also remains in a downtrend, indicating that U.S. institutional investors are still hesitant to re-enter the market – either on the long side or for the carry trade.

Investors’ hesitancy to get back into the mix in full force makes sense given the general market weakness over the past month or so.

Plus, despite the Fed’s assurances, recent weak jobs data does suggest that, should inflation not cool next week, the market could be faced with a strengthening stagflation narrative, which is generally not a good thing for crypto prices (to be clear, this is not our base case).

Right now, we view growth as steady, inflation still rolling over, and the current monetary and fiscal picture to be more constructive in May and June than in March and April. Thus, we still view this as a good time to be adding risk.

Sentiment Check

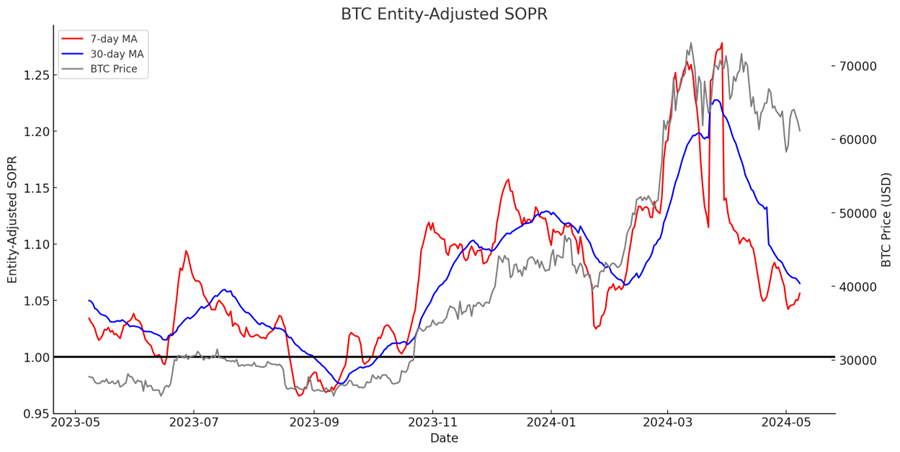

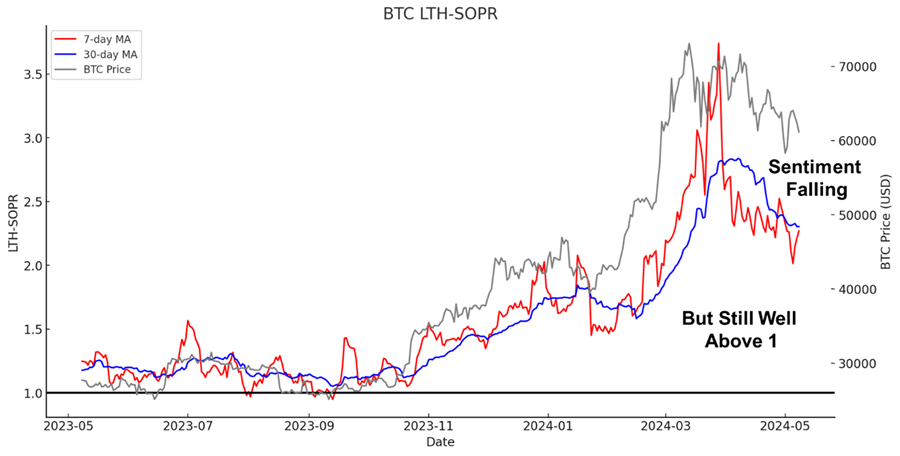

To illustrate the current market sentiment, we can examine bitcoin’s Spent Output Profit Ratio (SOPR). SOPR is a metric that evaluates the overall profit or loss of coins transacted on a given day relative to when they were last moved. This ratio is calculated by dividing the selling price of a coin by its purchase price. A SOPR above one suggests that, on average, coins are being sold at a profit, indicative of bullish investor sentiment. Conversely, a SOPR below one indicates sales at a loss, reflecting bearish sentiment or panic selling. While not perfect, this metric provides valuable insights into market mood, particularly during volatile periods, by tracking whether investors are securing gains or minimizing losses.

The data below illustrates a dynamic where longer-term BTC holders have stopped distributing old supply into the market, after doing so for most of Q1. Meanwhile, short-term traders have demonstrated a clear lack of confidence in the potential for a rally.

The overall SOPR has been on a downward trend since early April, a period marked by negative fiscal flows, tax-related selling, and rising interest rates, which adversely affected BTC price.

However, a closer examination of the behavior among different investor types reveals a divergence.

Long-term holders (LTH), as evidenced by both the 30-day and 7-day moving averages, maintain a SOPR well above one, indicating that despite a decrease in momentum/sentiment, they continue to bolster the network’s average SOPR.

On the other hand, short-term holders—traders who typically maintain positions for about five months or less—have seen a rapid decline in sentiment, boasting a current 30-day average SOPR below zero.

Fortunately, the 7-day moving average has recently moved into positive territory and is showing signs of improvement, suggesting that sentiment and momentum may have reached a low point.

SOL Still Preferred Beta vs ETH

Among the majors (here we are considering BTC, ETH, and SOL majors), SOL has shown outsized strength relative to BTC and ETH since rates started to turn on May 1st.

Admittedly, this relative strength has come with some volatility attached to it, but regardless, this seems to be signaling to the market that, of the large cap names out there, SOL is still the preferred outlet for beta to BTC and we should trust that strength until proven otherwise.

Below, we see that ETH/BTC has still not found stable footing, falling back towards 0.046. As a reminder though, we are approaching the first final deadline for an ETH ETF application on May 23rd.

Our current base case is denial, further enforced by Grayscale withdrawing their application to convert ETHE to a spot ETF this week. We think investors are likely sitting on their hands to receive confirmation of denial and to see what the SEC’s rationale for denial is. There might be some reasons that the SEC thinks of to deny the ETF that have further ramifications.

However, we think that on denial or approval, it is possible that this serves as a good buying opportunity for ETH and ETH-related assets. Denial is, in our opinion, already priced in, so chances are we wouldn’t see that much further weakness. If the ETF were to shock the world and get approved, then one would have to buy ETH and ETH-related assets as fast as possible.

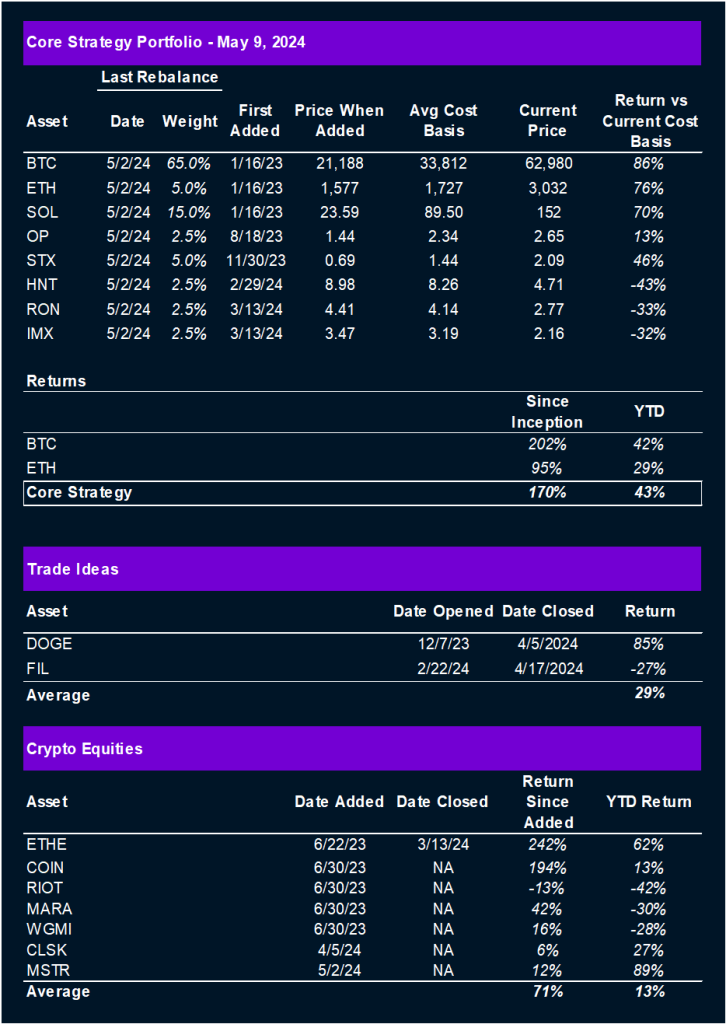

Core Strategy

Our view remains that last week’s QT taper and dovish commentary from the Fed marks a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. We think that despite the risk of immediate-term consolidation as capital flows return, current prices present a favorable risk/reward.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -1.66% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe.

- Ethereum (ETH -2.33% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL -4.21% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP -10.40% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. OP Stack is the most popular development platform for other L2s. Outside of ARB, which is excluded due to the recent inflation of token supply, Optimism has garnered the most traction compared to other L2s with a liquid token. Offers beta exposure to ETH.

- Stacks (STX N/A% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q2 2024.

- Helium (HNT 15.68% ): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX -3.36% ) & Ronin (RON -3.84% ): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms.