Buy In May Thesis Intact (Core Strategy Rebalance)

Key Takeaways

- In our view, yesterday marked the turning point that risk assets needed, as two of the three criteria outlined in our Crypto Comments video on Tuesday were met—QT tapering and a dovish stance from the Fed.

- The Fed's decision to taper QT to a greater degree than the market anticipated, along with their confirmation that their next move is likely to be a cut, provided the necessary relief for asset prices.

- Likely intervention by Japanese authorities in the JPY further supports the evidence of a local DXY peak.

- COIN reports after the market closes on Thursday. We anticipate that the company will beat top-line estimates. However, a particularly interesting aspect of this earnings report will be the examination of the assets on Coinbase’s balance sheet, as they will begin marking cryptoassets to market.

- Crypto Equities – Despite trading at a sustained premium over the value of the BTC on its balance sheet, we are adding MSTR to our crypto equities basket following its recent pullback.

- Core Strategy – Our view is that the QT taper and the Fed’s dovish commentary signal a local top in the DXY, suggesting improved liquidity conditions going forward, which bodes well for crypto. Although there's a risk of short-term consolidation as capital flows resume, we believe the current prices offer an attractive risk/reward. Consequently, we are shifting our Core Strategy's allocation from stablecoins toward BTC, and plan to increase our exposure to altcoins following confirmation of BTC's strength.

Short-term Outlook Recap

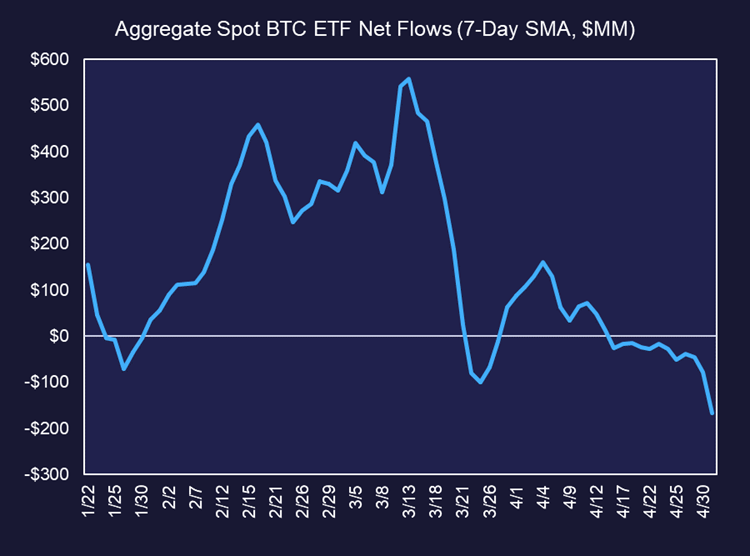

Our short-term market outlook over the past few weeks has been one of caution and patience, particularly in anticipation of yesterday’s events—the Treasury’s quarterly refunding announcement and the FOMC meeting. During this period, we observed a weakening market characterized by declining flows, surging rates, and a strengthening dollar, compounded by negative fiscal flows during tax season.

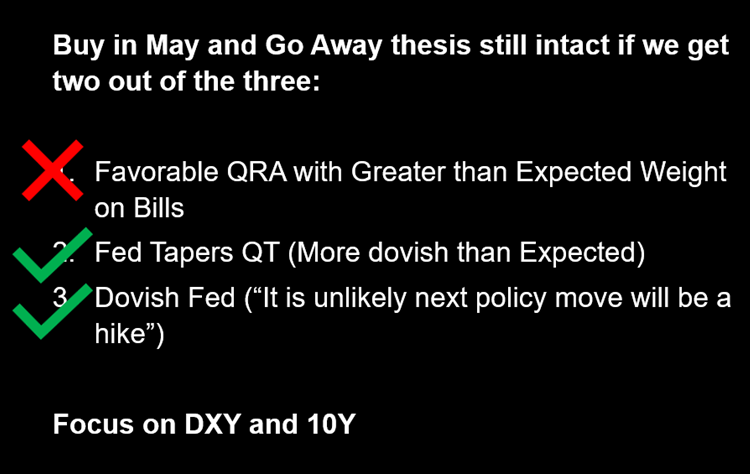

We viewed yesterday as a potential turning point for risk assets due to the Quarterly Refunding Announcement (QRA) from the Treasury and the FOMC meeting. Since we entered an era that many call “fiscal dominance,” QRAs have preceded shifts in the direction of interest rates, hence our adoption of the theme “Buy in May and Go Away”—a twist on the traditional “Sell in May and Go Away.”

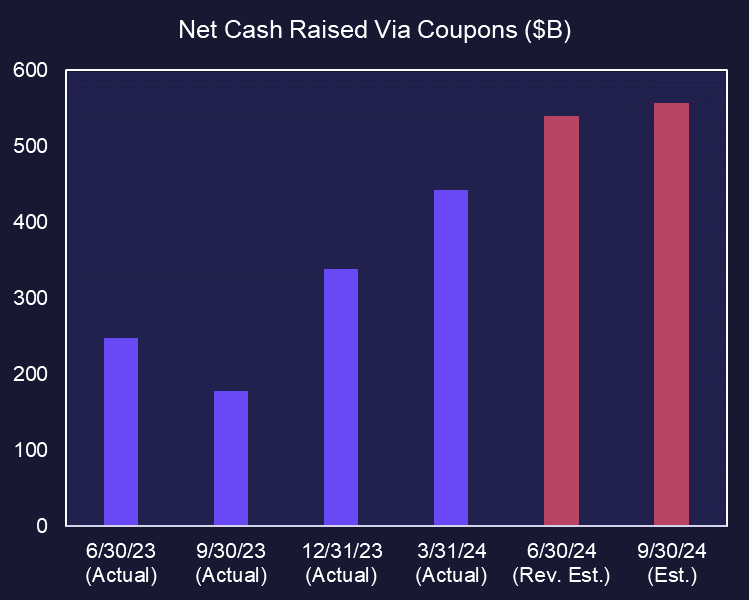

We anticipated a fiscal surplus this quarter from tax receipts, influencing the Treasury to prefer bills over coupons in this QRA. We believed that an increase in bill issuance would lead the Federal Reserve to perceive a reduction in the RRP as a risk to the banking system, prompting them to taper quantitative tightening (QT) soon. Our rationale was based on the Treasury’s desire to stabilize bond market volatility in an election year and, assuming favorable inflation data in the coming months, issue more coupons later at potentially lower rates.

Furthermore, the Fed had been discussing the possibility of tapering QT in the near term. The Fed’s benchmark for ample reserves in the banking system, the RRP, has been declining at a rapid clip over the past 12 months. The deeper they go into the tightening cycle, the higher the risk of another hiccup in the banking system, and tapering QT could help to circumvent or delay this.

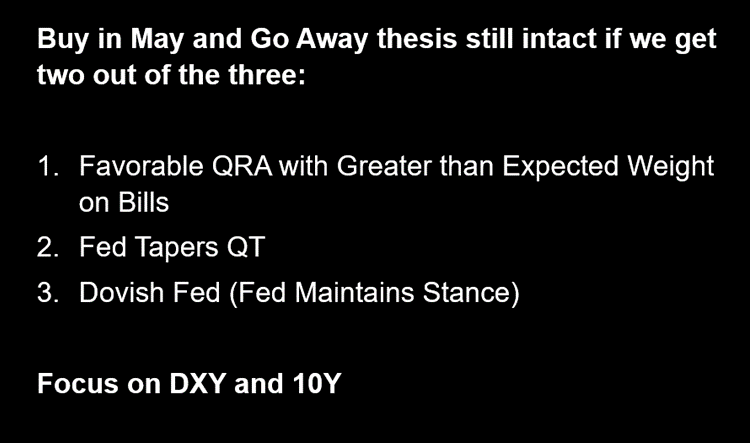

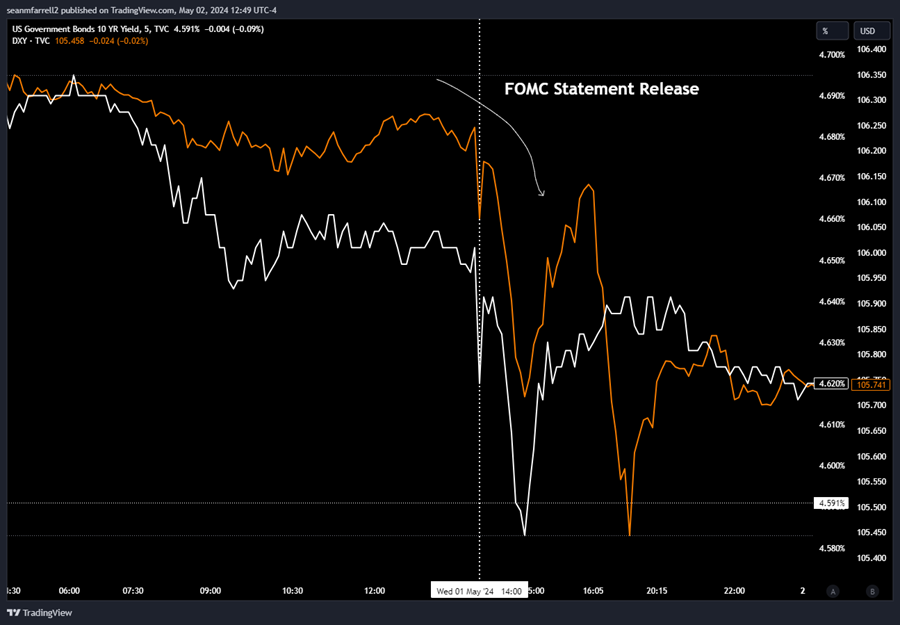

In our crypto comments video on Tuesday, we summarized our views with the following outlook: We wanted to see two of the three listed events—favorable QRA, Fed taper, and dovish commentary from the Fed—to confirm our bullish pivot thesis.

We would look to the 10Y and the DXY for a market response to confirm that the market interprets the treasury and Fed in a “dovish” manner.

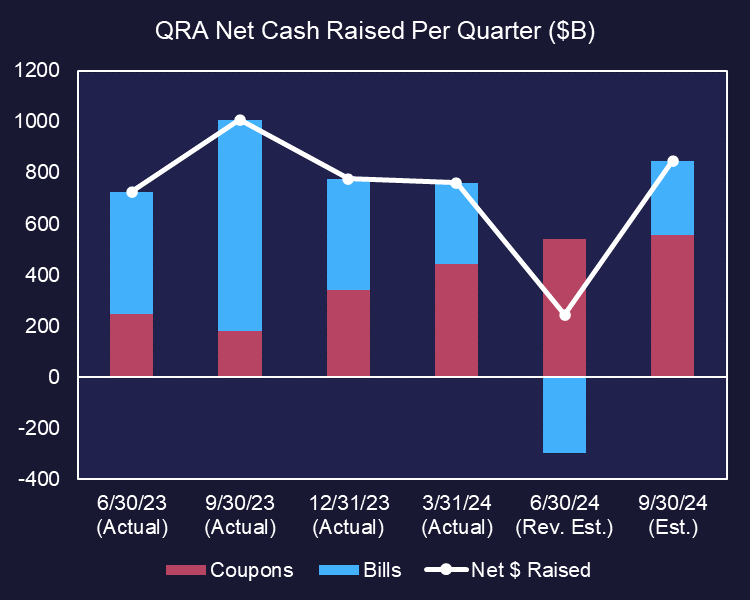

The QRA = Neutral

Regarding the QRA, it turned out to be what we would categorize as neutral. Although there was an overall increase in bills issued, the Treasury did not skew their issuance toward short-dated bills and actually showed an increase in net coupon issuance over the next few quarters.

However, given the recent run-up in rates, it seems this was already priced in, hence our view of it as neutral rather than hawkish.

Nevertheless, we are not comfortable marking this as confirmation of one of our criteria for a bullish pivot given the general orientation towards issuing coupons versus bills. The one caveat being that their commentary on the issuance schedule did mention a reversion toward favoring bills in subsequent quarters.

QT Taper = Favorable

The next variable was the Fed’s views on tapering the runoff of the Fed balance sheet. The Fed announced in their FOMC statement that they would be tapering QT starting in June, reducing the runoff from approximately $60B to $25B—surpassing many analysts’ expectations of a taper to $30B per month. This outcome is more favorable for risk assets than anticipated.

They also mentioned that the pace of MBS runoff would remain at $35B, and excess proceeds would be funneled into Treasuries. Paired with the Treasury’s announced buyback program, this suggests that both entities are concerned about UST liquidity at these levels.

The bond market reacted sharply to the FOMC statement, with the DXY and rates falling.

FOMC Press Conference = Favorable

Finally, during the FOMC press conference, Chair Powell hit all the dovish talking points:

- He reaffirmed that the next move is likely to be a cut, despite the need for patience, with a lot of his commentary centering around the job market as opposed to inflation, which surprised many.

- He also directly addressed a question on stagflation, striking down the suggestion that we are approaching a low growth/high inflation scenario. As a reminder, our view is that stagflation is the worst economic regime for liquidity sensitive assets.

The market responded positively to the press conference, with the bond market, equities, and crypto reversing post-conference, suggesting some bidirectional short squeezing throughout the afternoon.

But ultimately, the dollar and rates moved lower, confirming two out of the three requirements we outlined that would give us confidence in adding risk.

The Yen Providing More Confidence

To compound the dovish outcome on Wednesday, after the market close, we observed a rapid appreciation of the JPY, suggesting a second intervention by the MOF to prop up the yen.

While it is possible that this was detached from the day’s events, we find that unlikely. We would be surprised to see any Japanese intervention in an environment where they believed the DXY would continue to rise. We would not be surprised to learn that this defense of the Yen was done in collaboration with fiscal and monetary authorities in the US.

Thus, we view this data as confirmation of a near-term top in DXY and for rates.

All this taken together, given the >20% decline from the all-time high in BTC and many altcoins retracing their entire gains for April, we view this as a solid risk-reward scenario for entries in crypto, and should rates roll over as we anticipate, for crypto-linked equities.

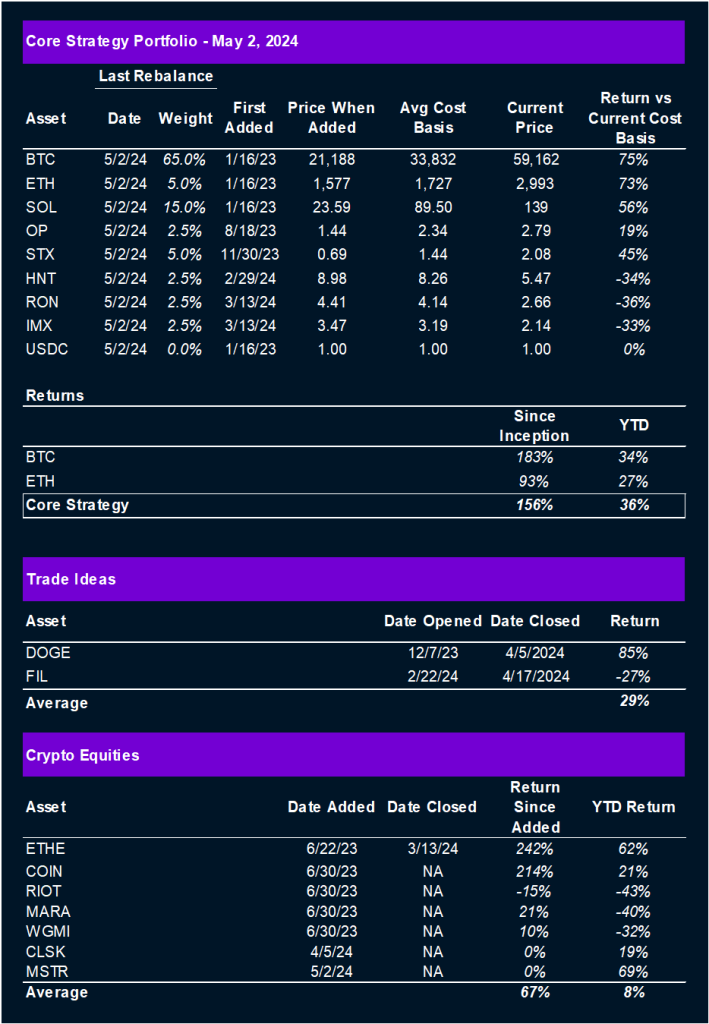

It may take a few days of consolidation to play out and for flows to reverse course, but we think this is a favorable risk/reward area. With that in mind, we are rebalancing the Core Strategy, bringing our stablecoin allocation to 0 and increasing our BTC allocation to 65%, maintaining the rest of the portfolio as is.

Adding MSTR

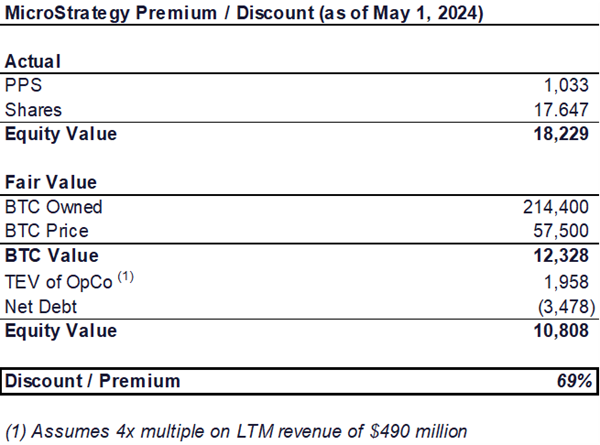

We are also adding MicroStrategy to our recommended crypto equities bucket. Thus far in this bull market, we have not included this name in our crypto equities basket due to the significant premium that MSTR -2.84% traded at relative to the BTC on its balance sheet, with the rationale that there were other ways to achieve beta to BTC without the risk of market efficiencies closing that gap.

However, the market has proven that over the course of the past year or so, that this premium is a nonfactor for investors, as this figure increased to over 100% at times.

Since the recent drawdown, we have seen this premium come back down to approximately 69%, which is still rather large, but we think that traders will continue to look to MSTR for beta to BTC.

Coinbase Earnings Preview

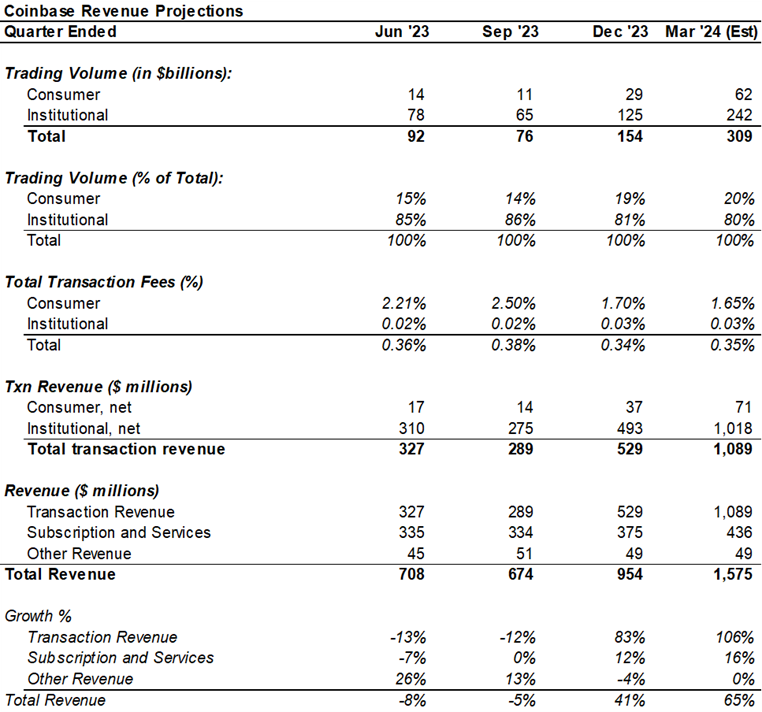

We anticipate that Coinbase (COIN) will exceed top-line expectations this afternoon when they report earnings after the market close, driven by increased trading volumes and growth in the USDC market cap. We expect revenues to come in at $1.57B for the quarter, compared to a consensus estimate of $1.36B.

The more intriguing aspect of this earnings report will be an examination of the assets on Coinbase’s balance sheet. According to the company’s previous 10-K, these assets, currently marked at approximately $450 million will begin to be marked at fair value in Q1, rather than at cost less impairment. Given that Coinbase has invested in many assets that have outperformed in this bull market, it is possible that we will see a significant expansion of the company’s balance sheet, and a positive impact on their EPS figures.

Core Strategy

Our view is that the QT taper and dovish commentary from the Fed marks a local top in the DXY and suggests better liquidity conditions going forward, which is favorable for crypto. We think that despite the risk of immediate-term consolidation as capital flows return, current prices present a favorable risk/reward. Thus, we are shifting the allocation toward stablecoins in our Core Strategy toward BTC and will look to increase alt exposure upon confirmation in BTC strength.

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC -2.26% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe.

- Ethereum (ETH -1.38% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL -2.47% ): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP 0.84% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. OP Stack is the most popular development platform for other L2s. Outside of ARB, which is excluded due to the recent inflation of token supply, Optimism has garnered the most traction compared to other L2s with a liquid token. Offers beta exposure to ETH.

- Stacks (STX N/A% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q2 2024.

- Helium (HNT 3.75% ): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX 5.71% ) & Ronin (RON 1.06% ): Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms.