A Good Time to Consider Adding Miners

Key Takeaways

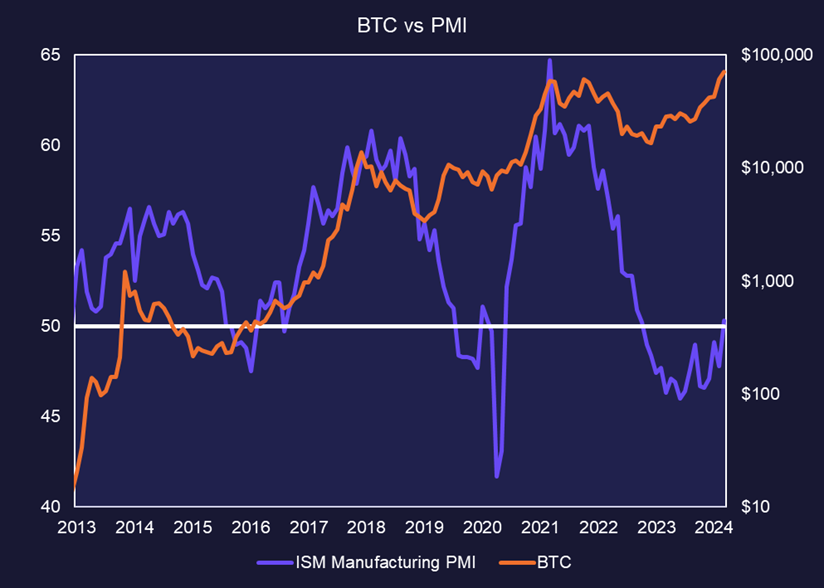

- Bitcoin tends to thrive in an expanding economy, showing a strong positive relationship with manufacturing PMIs, which suggests that growth and increased business confidence portends higher crypto prices.

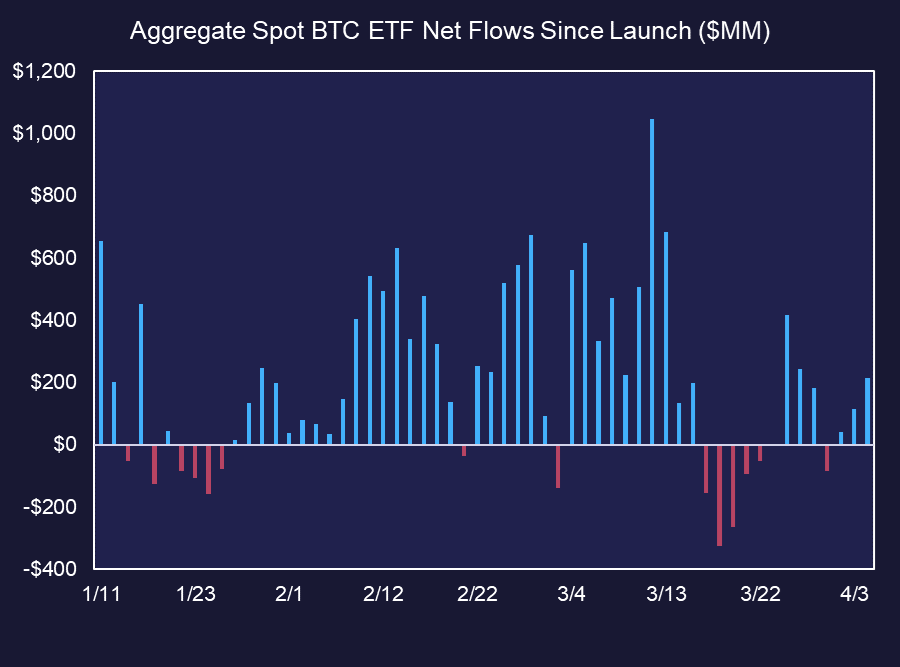

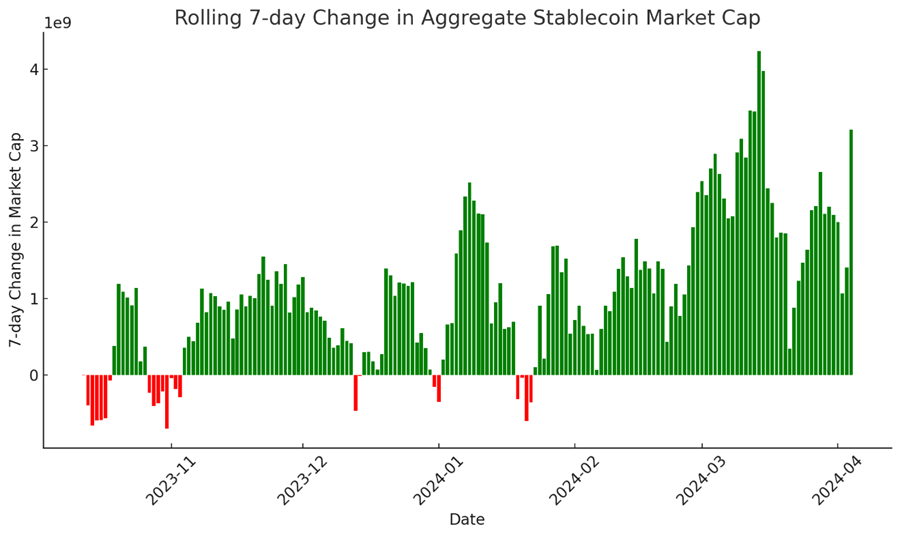

- Capital flows have reversed a brief negative trend, with inflows into spot BTC ETFs increasing once again, alongside a rapid expansion in the aggregate stablecoin market cap, which has grown by $3 billion this week.

- Similar to the PYTH, JTO, and JUP airdrops, we believe the Wormhole airdrop on Wednesday will generate another significant wealth effect on Solana, potentially boosting speculation and providing additional reason for a positive outlook on SOL.

- We still view increased tax receipts and concurrent asset selling during tax season as the biggest near-term risk to crypto. But rates rolling over, and a subsequent increase in capital flows would mitigate this risk.

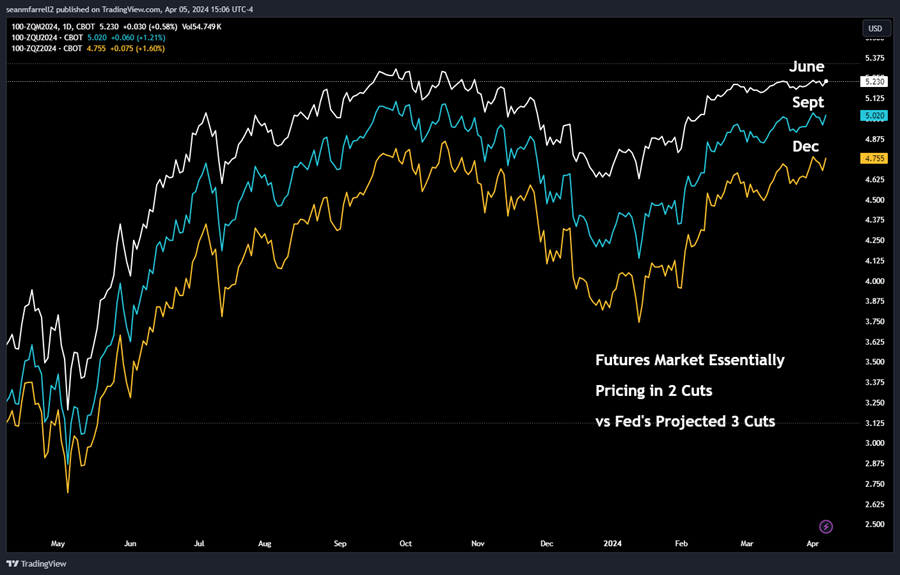

- Crypto Equities - In our view, the most significant factor negatively affecting miner share prices is the current interest rate environment. Given the recent surge in rates and the DXY, along with the adjustment of rate cut expectations (the futures market now prices in two cuts this year, as opposed to the Federal Reserve's projected three), we believe it's an opportune time to begin increasing exposure to miners. Accordingly, we are adding CleanSpark (CLSK) to our list of recommended crypto equities. We still like MARA, RIOT, and WGMI as well.

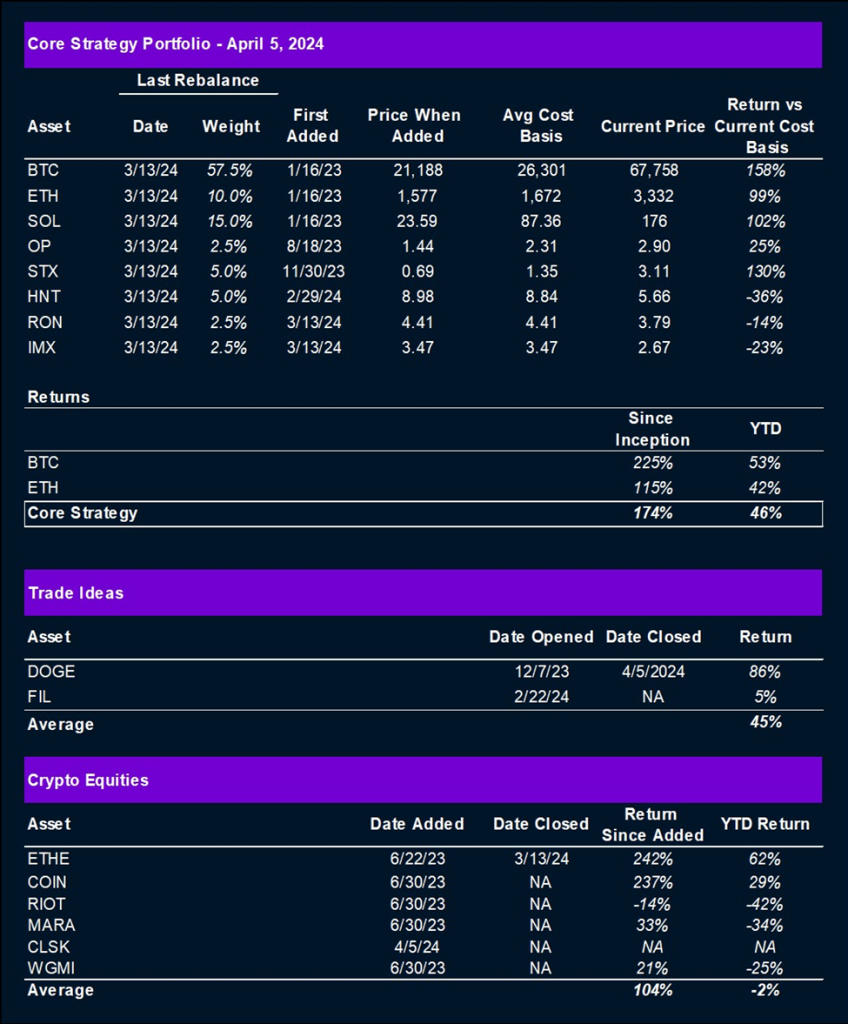

- Tactical Trade Update - While we lean bullish on the overall market in the near term, there is more uncertainty over the next couple of weeks as compared to late Q1. Given that the memecoin space has been running quite hot as of late, coupled with the impressive gains (+86%) made from this trade, we think it is right to close our tactical DOGE recommendation. It is unlikely that this will be our last dance with meme coins this year.

- Core Strategy - The market continues to be led by BTC, a generally positive indicator for the crypto market. The next near-term risk we foresee is a potential pullback due to increased tax receipts and concurrent asset sales as tax season approaches. However, with recent weeks factoring in higher rates and a stronger dollar, we anticipate that near-term financial conditions should ease, leading to a continuation of capital inflows and the mitigation of any decrease in market liquidity. As a reminder, changes to the Core Strategy are detailed at the end of every strategy note.

Inflows Resume

On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy.

However, in our crypto comments video on Tuesday, we outlined a couple of reasons why we were not overly concerned about the implications of a robust PMI figure.

First, an expanding economy is generally beneficial for Bitcoin. Throughout its relatively short history, Bitcoin has demonstrated a strong positive correlation with manufacturing PMIs. As the economy expands and business confidence grows, there is an increase in investment in the real economy. This confidence eventually translates into financial assets, with investors becoming more inclined to engage in speculation.

Therefore, an expansionary PMI figure is, on the whole, a positive indicator for crypto prices. It’s worth noting that a scenario featuring both a contractionary PMI and rising inflation (stagflation) is, in our analysis, the only economic regime that poses a sustained threat to crypto prices.

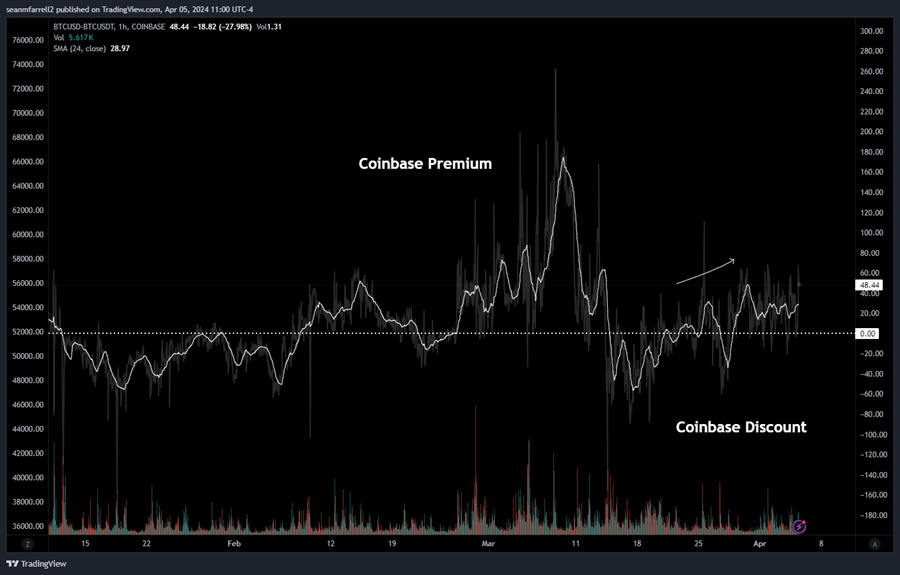

The second reason we maintained a less concerned stance regarding the strong PMI figure relates to the observable shift in the direction of capital flows into the crypto economy.

The Coinbase premium—a metric comparing the price of BTC on Coinbase versus Binance—serves as an effective barometer for gauging the demand for BTC among U.S. investors, including Bitcoin ETF products. Despite witnessing outflows on Monday, we observed an overarching trend of this premium increasing, contrasting with the more pronounced discount seen in mid-March.

Advancing to the present, there has indeed been a noticeable shift towards net inflows, marked by three consecutive days of positive and escalating inflows. This trend underscores a growing investor interest and confidence in the crypto market.

Additionally, we have observed a continuation in the creation of stablecoins, another prevalent method for transferring capital from the traditional economy into the crypto economy. The past week, in particular, was notable for stablecoin creations, with over $3 billion minted. This surge in activity has propelled the total market cap of stablecoins to exceed $150 billion. Such robust growth in stablecoin issuance is a clear indicator of increasing liquidity and investment readiness within the crypto market, further supporting our optimistic outlook, particularly for altcoins.

The Wormhole Airdrop Offers Potential for a Continued Wealth Effect

On Wednesday, the Wormhole (W) airdrop claims were initiated. Wormhole, a prominent cross-chain messaging protocol, has enabled over $40 billion in transfers across more than 30 chains. Approximately 400,000 wallets were eligible to claim around 680 million tokens. While Wormhole operates across platforms, its token is an SPL token on Solana.

W was initially trading at around $1.30 at its launch but has since decreased to approximately $1.00. Based on the current market price, the airdrop’s value still exceeds $600 million.

Recently, there have been several significant and widely distributed airdrops, including PYTH, JTO, and JUP. Among these, Jupiter’s airdrop in January was the most substantial, valued at approximately $700 million in total.

Airdrops, akin to stimulus packages, often result in increased spending and speculation within the chain. Recipients of airdrops might convert the airdropped tokens into the native token of the underlying chain, or they may simply engage in increased speculation, feeling wealthier than before the airdrop.

We are optimistic that the Wormhole airdrop will further stimulate speculation on Solana and offer another reason to maintain a positive outlook on SOL, given its potential to enhance the wealth effect.

A Good Time to Start Scaling into Miners

Miners have certainly been underperforming year-to-date (YTD), and there’s no denying this fact. Ahead of the upcoming halving, a cloud of uncertainty looms over shareholders as block rewards for miners will be reduced by 50%, potentially affecting margins negatively. However, the current price levels should be sufficient for profitable miners to remain operational.

In our view, the most significant factor negatively affecting miner share prices is the current interest rate environment. Unlike Bitcoin, which benefits from its status as a commodity driven by straightforward supply and demand dynamics, miners are subject to a cost of capital. Their cost of capital increases with higher interest rates, as the risk premium on these stocks remains unchanged.

This explains why, when expectations for rate cuts are delayed and interest rates rise, miners typically underperform compared to Bitcoin.

A similar dynamic can be observed between small caps and the S&P 500, highlighting a high-beta relationship analogous to that between Bitcoin and Bitcoin miners.

Given the recent surge in rates and the DXY, along with the adjustment of rate cut expectations (the futures market now prices in two cuts this year, as opposed to the Federal Reserve’s projected three), we believe it’s an opportune time to begin increasing investments in miners.

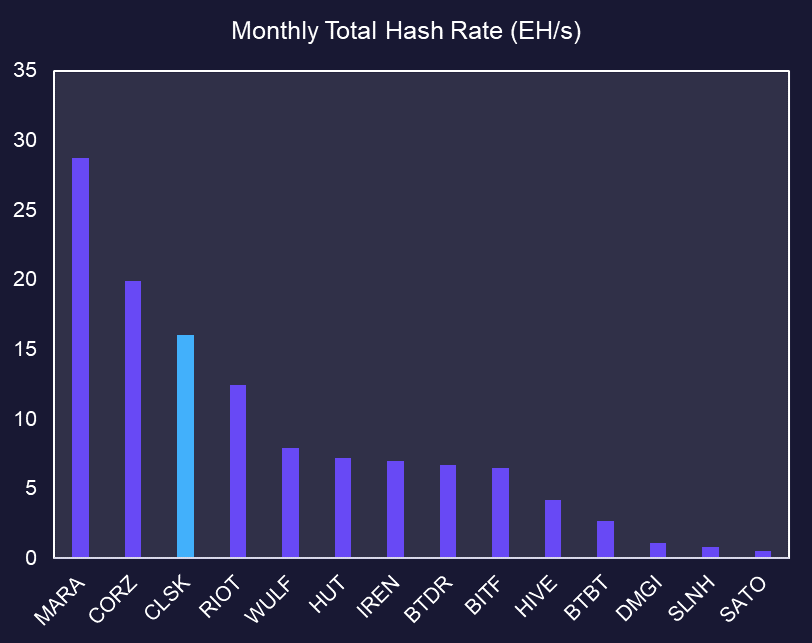

Accordingly, we are adding CleanSpark (CLSK) to our list of recommended crypto equities. This decision is motivated by several factors:

- Earnings Beats: CleanSpark has recently outperformed market expectations, beating Q3 2023 earnings by nearly 300% and Q4 earnings estimates by 154% (source: TradingView).

- Hash Rate Growth: In February, CleanSpark increased their hash rate by 60%, positioning them as the third largest miner by total hash rate. CLSK is now third in hash rate among publicly traded miners.

- ATM Offering: The company recently announced an $800 million at-the-market (ATM) offering, which led to a significant selloff in late March, reflecting almost a 20% dilution from the offering. Although the stock has yet to be issued, we believe most of the dilution is already reflected in the current market price. Furthermore, the ATM offering significantly enhances their capitalization, preparing them for any market conditions.

We still like RIOT, MARA, and WGMI, which is a BTC mining index that captures both the large caps and the long tail of bitcoin miners.

Big Risk is Still Tax Season

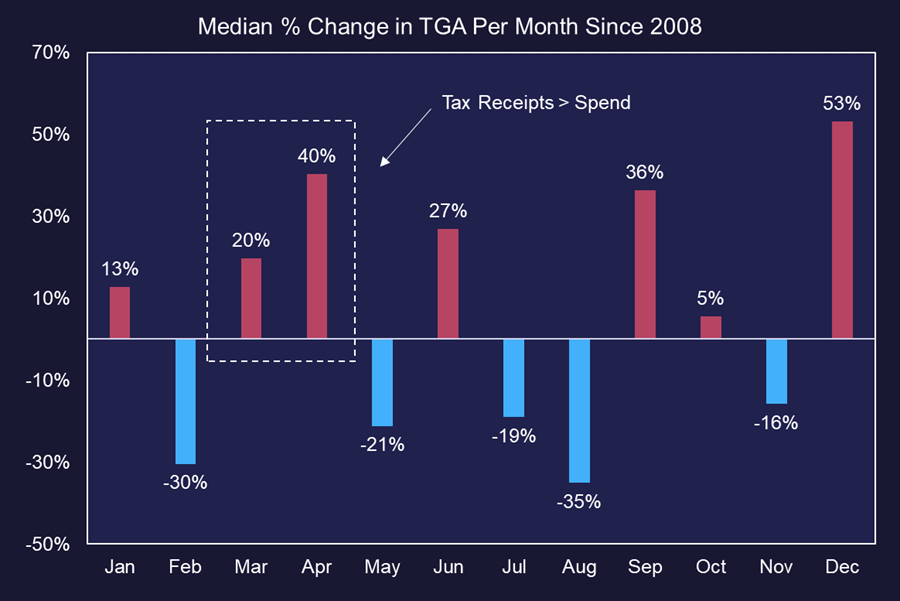

A few weeks ago, we pinpointed tax season as the primary near-term risk to liquidity-sensitive assets. It’s important to stress that this is a short-term concern, and any downturns occurring in the next few weeks should be seen as an opportunity to buy the dip. Nonetheless, it’s crucial to stay aware of this factor.

As we progress through tax season, following a year of robust economic and market performances, we’re bracing for a notable surge in deposits into the Treasury General Account (TGA). This anticipation is reinforced by the expectation that many investors will need to liquidate assets to cover unexpected tax bills.

Our analysis reveals a distinct seasonal trend in the TGA, with March and April typically witnessing increased activity due to higher tax receipts compared to government spending. It seems unlikely that the current pace of Reverse Repurchase Agreement (RRP) withdrawals will sufficiently offset this upward movement.

However, it’s important to remember that any increase in inflows into the crypto economy should cushion the impact of a tax season-driven drawdown in market liquidity.

Given the immediate trajectory likely points to a lower direction for the Dollar Index (DXY) and interest rates following the release of any favorable inflation data next week, we believe that the risks associated with tax season could be somewhat alleviated.

Core Strategy

A brief summary of the theses behind each component of the Core Strategy/Active Trades:

- Bitcoin (BTC 5.22% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include the halving (April 2024).

- Ethereum (ETH 7.34% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights.

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light.

- Optimism (OP): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks.

- Stacks (STX -0.97% ): A bet on the development of a bitcoin economy. Key catalysts include the bitcoin halving and the Nakamoto upgrade in Q1 2024.

- Helium (HNT): DePIN is an emerging theme in crypto that we think is bound to make waves in traditional markets. Helium is a leader in this category and has shown signs of early traction in its 5G product. Helium also adds Solana beta to the portfolio.

- Immutable X (IMX) & Ronin (RON) : Both networks have displayed impressive traction and are poised to be the category leaders among crypto gaming platforms. As appendages of the ETH ecosystem, they also offer a different flavor of ETH beta.

- Filecoin (FIL): Despite its recent rally from $5 to $8, FIL remains 96% below its ATH. With several narrative-based and fundamental tailwinds at its back, we think that FIL presents a compelling short-medium-term trade at these levels. Narrative-driven tailwinds stemming from the integration with Solana, alongside the potential fundamental boosts from liquid staking, instill a degree of confidence in the risk/reward proposition of FIL over the next 1-3 months.