SOL Keeps Shining as Signs of Market Exhaustion Remain Absent

Key Takeaways

- The October CPI data, cooler than anticipated, triggered a surge in equity indices but received a subdued reaction from the crypto market, underscoring crypto's weakened short-term correlation with macro factors.

- Despite reduced correlations with daily macro variables, the improved global liquidity situation, driven by U.S. Treasury bill issuances, falling interest rates, and China's economic shifts, is fostering a supportive environment for liquidity-sensitive assets such as crypto.

- The lag in performance of crypto-linked equities like Coinbase, despite gains in the broader crypto market, in our view is linked to the uncertainties surrounding interest rates. The recent decline in rates is likely to restore their upside beta to the underlying cryptoassets.

- The SEC's decision to delay the review of Hashdex's Bitcoin ETF application, which uniquely combines futures contracts, spot Bitcoin, and cash, diminishes but does not rule out the possibility of imminent approvals for spot ETFs.

- Solana's continued exceptional performance, achieving new year-to-date highs, might prompt some investors to realize profits. However, we argue that growing DEX activity, increasing user base, and anticipated airdrops from Pyth and Jupiter present support for a continued rally.

- Core Strategy – Given the strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the development of a “Flight to Safety” narrative, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market.

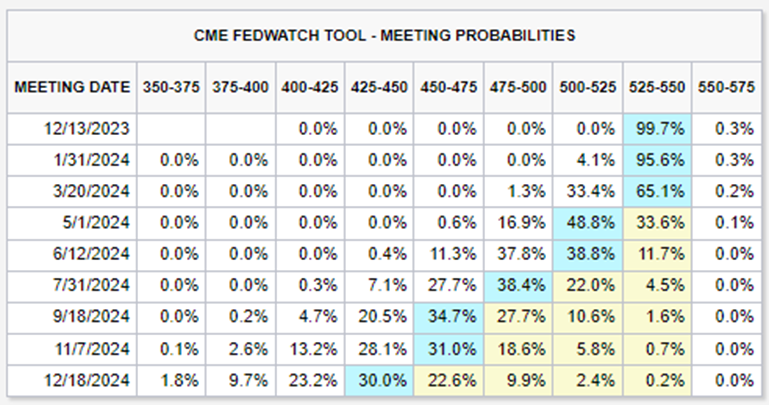

Market Prices in Rate Cuts

The key macro event this week was the release of the October CPI data, which came in notably cooler than anticipated. The year-over-year CPI was slightly lower at 3.2%, just below the predicted 3.3%, while the month-over-month figure remained steady at 0.0%, in contrast to the expected 0.1%.

This cooler inflation data spurred a surge in equity indices. It also bolstered investor confidence in the Federal Reserve’s policy direction, hinting at a possible end to the ongoing series of rate hikes. As a result, the market has begun to factor in potential rate cuts, possibly as early as May.

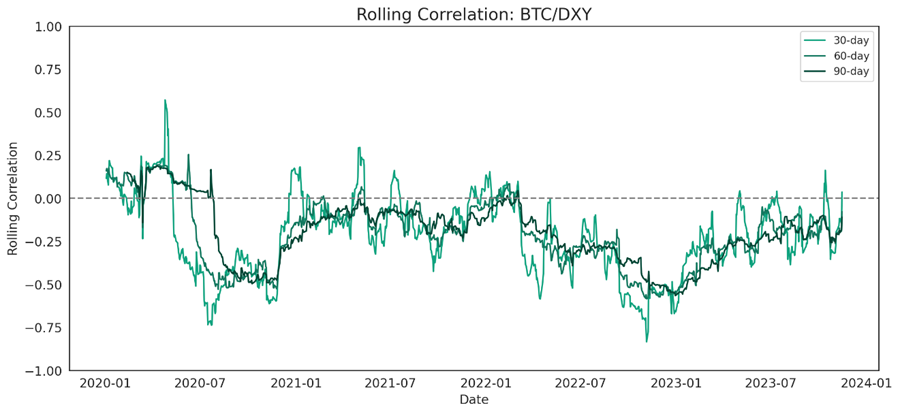

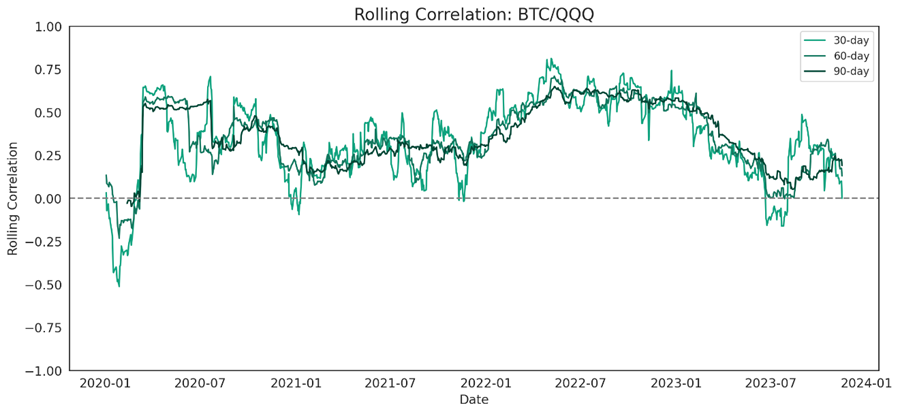

Crypto had a muted reaction to the shifting interest rate dynamics. Many were surprised to see this transpire, but as we noted in our FlashInsight on Tuesday, this phenomenon can largely be attributed to a breakdown in the short-term correlations that cryptoassets previously shared with broader macro factors.

Current correlation metrics with technology stocks and the U.S. dollar are minimal, hovering around or at zero. This detachment highlights a significant shift from the patterns observed in 2022, where daily linkages to macro trends were more pronounced.

Global Liquidity Improving

To be clear, while the direct, day-to-day correlations have clearly diminished, it remains important to monitor overarching macro trends for their potential impact on crypto markets, as we think larger macro shifts still have significant impacts on crypto.

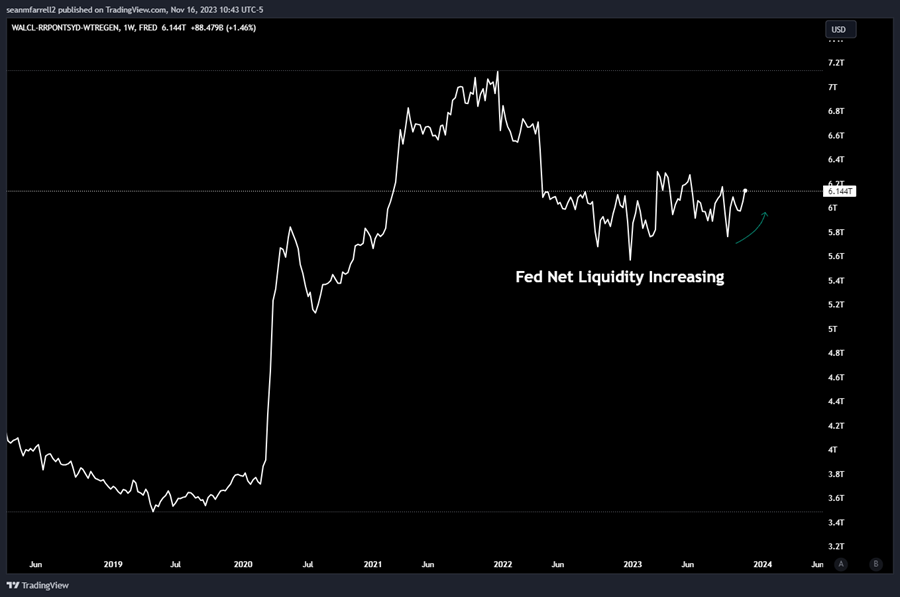

Recently, the U.S. Treasury’s sustained high bill issuance has been a key factor in moving dollars out of the Reverse Repurchase Agreement Facility (RRP) towards higher short-term yields in bills. This movement has positively influenced the Federal Reserve’s Net Liquidity metric, which we have been closely monitoring since the start of this year. Notably, there has been an upward trend in this metric since the end of September, a development that is generally favorable for the crypto market.

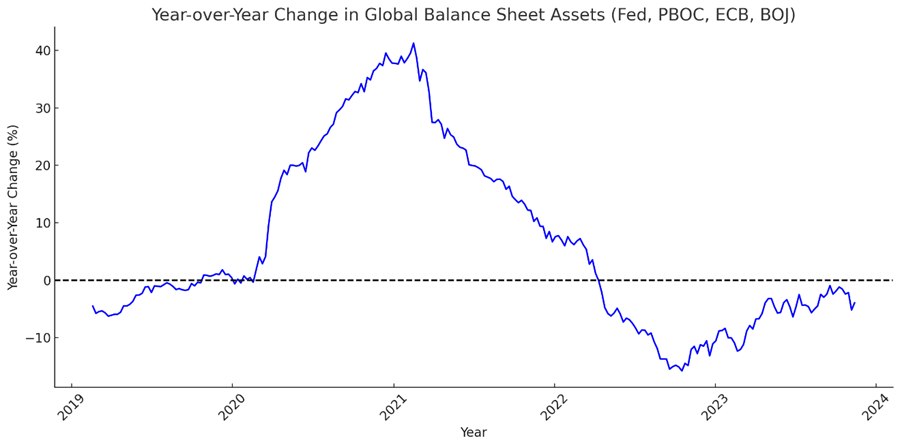

Moreover, the stabilization of the Chinese yuan, alongside a decline in the strength of the U.S. dollar and ongoing economic stimulus from China, has contributed to an increase in global liquidity. This trend is evident when observing the expansion in the balance sheets of major central banks. Such an environment is particularly beneficial for liquidity-sensitive assets like Bitcoin.

While the increase in global liquidity is not steep, we would like to note that the year-over-year trend is broadly ascending, moving toward positive territory for the first time in over a year, indicating a gradual but consistent improvement.

It’s crucial to remember that markets often respond more significantly to relative changes rather than absolute figures, a factor that should be considered in our ongoing market analyses.

In summary, while there has clearly been a dislocation between macro and crypto as of late, we should not start to ignore macro. Recent trends in domestic and global liquidity paint a relatively constructive picture for liquidity-sensitive assets in the near term.

Rates Could Boost Crypto-Linked Equities

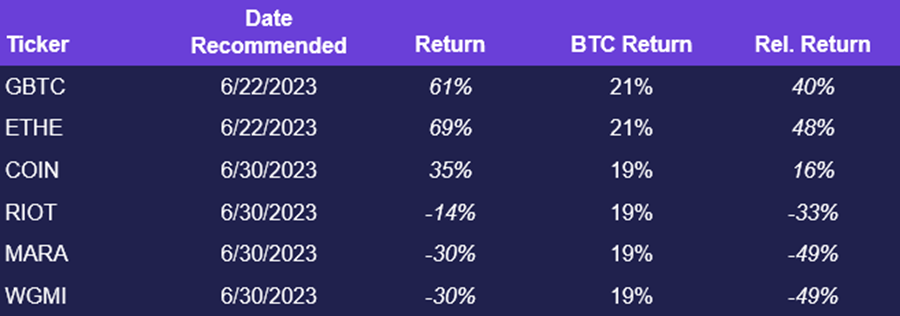

Despite the recent uptick in crypto markets, crypto-linked equities have underperformed, particularly when considering their historical high beta relationships with underlying cryptoassets. This divergence is likely attributable to the prevailing uncertainties surrounding interest rates. Equities, more so than the cryptoassets themselves, are sensitive to fluctuations in interest rates.

To illustrate this point, let’s consider the price movements of Coinbase (COIN) relative to Bitcoin. Throughout this year, COIN has often led Bitcoin’s rallies, exhibiting greater volatility in response to Bitcoin’s upward trends. This pattern was evident during the initial surge from the January lows and the rally following the BlackRock ETF application in June.

However, during the most recent surge in Bitcoin prices, this relationship did not hold.

For the rallies in January and June, the US 10Y was at or well below 4%, a key psychological level for many investors. In October, as the 10-Year Treasury yield neared 5%, the typically bidirectional relationship between Coinbase and Bitcoin was disrupted. Then, as interest rates began to decline in November, COIN started to regain its footing against Bitcoin.

This trend suggests that the elevated cost of capital was a significant factor weighing down crypto-adjacent equities. Should the current trend in long-term interest rates continue, it will likely foster a resurgence in the outperformance of these equities. We used Coinbase as the example here, but bitcoin miners and other crypto-linked equities could also stand to benefit from this dynamic.

On-Chain Sentiment Suggests Path of Least Resistance is Higher

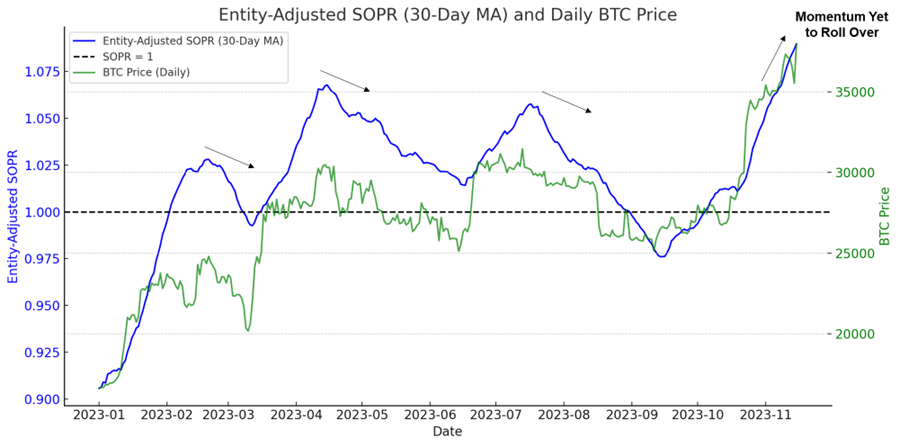

We often turn to Spent Output Profit Ratio (SOPR) to identify when BTC is gaining/losing steam in the short term. SOPR, in essence, measures the profit ratio of spent outputs by comparing the value at the time of creation of a UTXO (Unspent Transaction Output) to its value at the time of spending. A rising SOPR indicates that market participants are selling their holdings at increasingly profitable levels, suggesting growing confidence in the market’s upward trajectory. This is often interpreted as a sign of strengthening market conviction.

Conversely, when the SOPR’s moving average begins to decline, it signals that individuals are starting to sell at less profitable levels, reflecting a potential loss of confidence in Bitcoin’s near-term momentum. The 30-day moving average of SOPR has proven to be a reliable indicator of broad shifts in market momentum. Although it’s challenging to make daily trading decisions based solely on this data, SOPR offers a valuable snapshot of the market’s strength and sentiment at any given time.

As of now, despite some fluctuations in prices over the recent weeks, the 30-day moving average of SOPR has not shown signs of turning over. This steadiness suggests that the majority of current market participants believe that the path of least resistance for Bitcoin is upwards.

Latest Developments in BTC ETF Approval Process

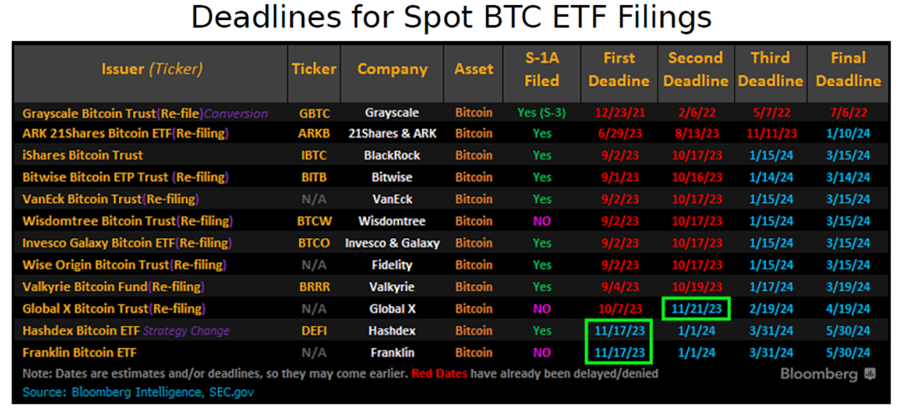

In our last update, we highlighted the valuable insights from Bloomberg’s ETF analysts, James Seyffart and Eric Balchunas, regarding the ongoing ETF approval process. They had identified a potential window for the approval of a spot ETF this week. This anticipation was based on several factors: (1) the SEC’s preference to approve ETFs simultaneously to avoid granting a first-mover advantage to any single issuer, (2) the regulatory constraint that prevents ETF approval during a comment period, (3) a coinciding period that began on 11/9 where none of the 12 ETF issuers are in a comment period, (4) fast-approaching application deadlines for two issuers on 11/17 and 11/21, and (5) the likelihood that, if approval is delayed for these ETFs, they would enter their own comment periods, extending until January.

However, a recent development has impacted these prospects. The SEC has postponed its decision on Hashdex’s application, which sought to convert its Bitcoin futures ETF into a spot ETF. Originally set for a decision by tomorrow, pushed the deadline to January 1st. This delay, initiating a comment period, significantly reduces the likelihood of an ETF approval in the immediate timeframe since Hashdex will not be able to be approved tomorrow.

However, it is worth noting that Hashdex’s application stands out as it proposes a blend of futures contracts, spot Bitcoin, and cash, aiming to minimize the risks of market manipulation. This unique composition might set it apart from other applications, potentially influencing its approval prospects differently. Meanwhile, other applications, like those from Franklin Templeton and Global X, face imminent decision deadlines. While the probability of a spot ETF approval tomorrow has diminished since Monday, it remains within the realm of possibility.

Positive Trends in Crypto Investment Flows

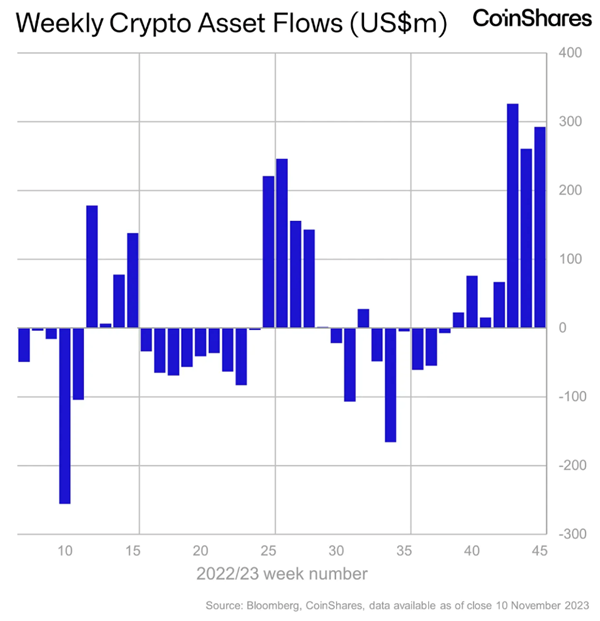

We continue to observe substantial and constructive flows into crypto. Digital asset investment products experienced significant inflows of $293 million last week. This influx extends the past seven weeks’ cumulative inflows to over $1 billion, elevating the YTD figure to $1.14 billion — the third highest on record. This activity, alongside recent price movements, has escalated the total assets under management for ETPs to $44.3 billion.

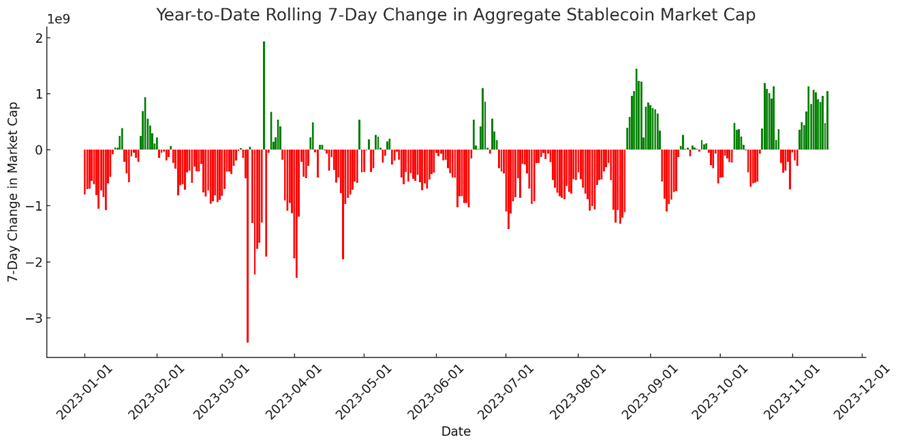

Moreover, the stablecoin sector continues to mirror this positive trend, with its market cap steadily increasing. Over the past two weeks, there has been a consistent rise in the rolling 7-day change in stablecoin market cap, culminating in an increase of over $1 billion compared to the previous week. Such growth in stablecoin market cap is a bullish signal, suggesting that capital is actively moving off the sidelines and into the broader crypto ecosystem.

SOL Keeps Shining

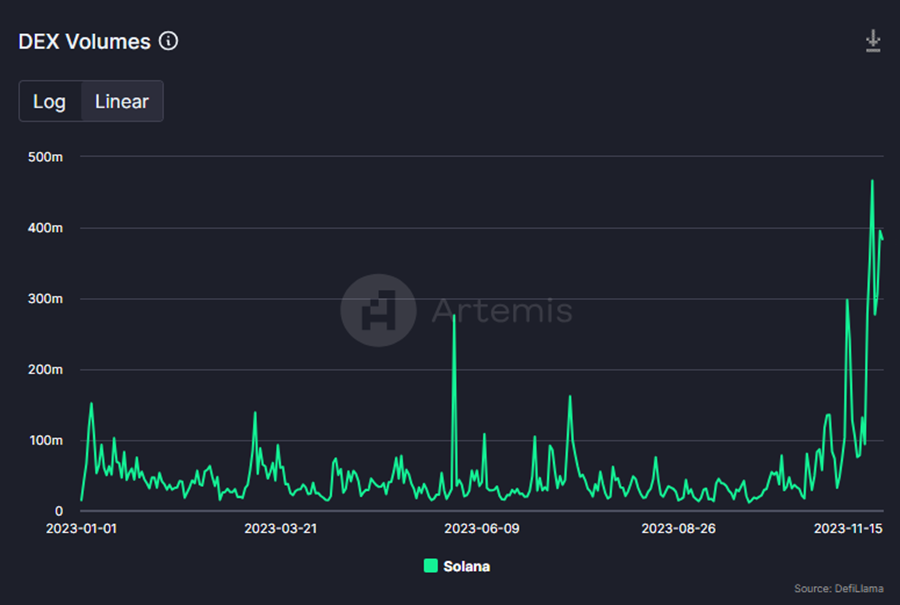

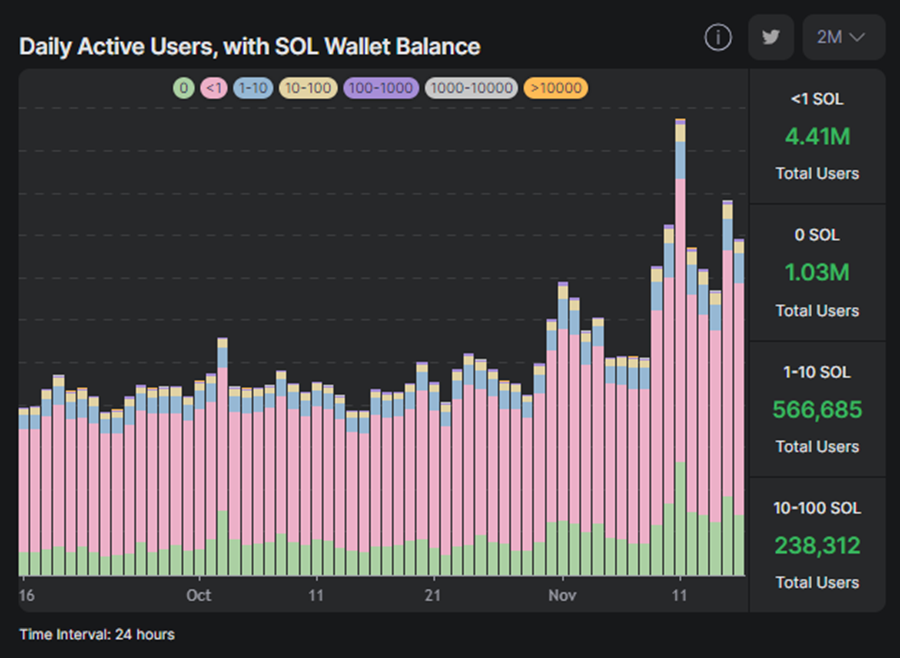

Solana has undeniably been the star performer in our core strategy portfolio this year, achieving another YTD high this past week and demonstrating remarkable momentum. Despite the temptation for investors to take profits after an almost 4x return in a month, several factors suggest that SOL may continue its upward trajectory. Key among these is the notable increase in DEX volumes on Solana, signaling a growing utilization of Solana’s DeFi ecosystem.

Additionally, we’re observing a promising trend where the count of active wallets is finally catching up with the increasing transactions, indicating an expanding user base – a bullish sign for the network.

But perhaps more importantly, looking ahead, two significant wealth creation events are on the horizon for the Solana ecosystem, involving airdrops from leading applications.

The first is from Pyth, the on-chain oracle, planning to airdrop 255 million PYTH tokens, which based on current illiquid futures markets, could have a potential total value exceeding $100 million. Although this airdrop targets users across multiple chains, the PYTH token will reside on Solana, likely concentrating the wealth effect there.

The second event involves Solana-based DEX aggregator Jupiter, which facilitated over $1 billion in swaps in October. Jupiter plans to distribute 10 billion tokens, with 40% allocated to its airdrop. This airdrop, potentially worth a directionally similar amount to the PYTH airdrop, is structured in multiple phases to reward both early and new users.

These airdrops are expected to create a wealth effect on Solana, possibly stimulating further on-chain activity and increasing demand for SOL as we move into the rest of Q4.

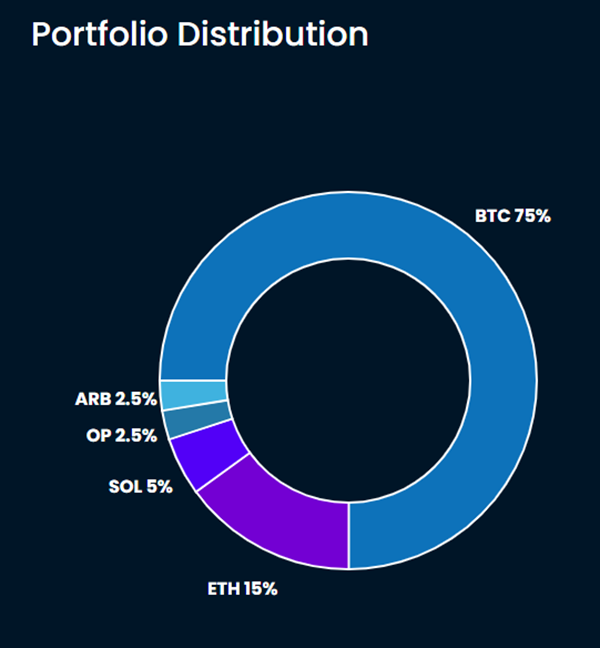

Core Strategy

Given the strong capital inflows, increased volumes in both spot and futures markets, significant institutional involvement, renewed excitement for an anticipated ETF, and the developing of a “Flight to Safety” narrative, we believe that now is an opportune time to be fully allocated in the market. Despite the recent broadening of market participation and the intensity of the rally in the past month, we are yet to see indications of an overbought market.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC 0.84% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH 0.98% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.39% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities