Market Breadth Widens as Inflows Continue, Eyeing Tomorrow's ETF Approval Window

Key Takeaways

- The crypto market's breadth is expanding. This expansion is occurring more rapidly against the USD than BTC. This data combined with continued positive flows, suggests that the current market is far from overheated.

- Flows into the crypto ecosystem remain strong, evidenced by a significant uptick in stablecoin issuance, sustained inflows into digital asset ETPs, and a record-setting open interest in BTC terms on CME.

- On-chain spot and derivatives volumes are showing a marked increase, with a particularly notable surge in Solana's DEX volumes.

- Bloomberg analysts suggest a possible ETF approval in the imminent window starting 11/9, due to a unique period where all issuers are clear of comment periods.

- The Arbitrum DAO's new token lockup incentive, likely aimed at reducing selling pressure before a significant token unlock, arguably reinforces a bullish outlook for ARB, supported by its conservative pricing relative to its fees, and elevated usage compared to peers.

- Core Strategy – Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it's an opportune time to be fully deployed in the market. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC's dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

Market Breadth Expanding

The crypto market is exhibiting signs of increased breadth, particularly noticeable as altcoins, typically further out on the risk curve, begin to attract more interest. As illustrated in the data below, the total market cap for altcoins (including stablecoins) is advancing towards its previous year-to-date high.

ETH has not yet seen a substantial rally, but it appears to have established a potential near-term bottom against BTC. This stabilization is crucial for encouraging capital flow into assets within the Ethereum ecosystem.

Liquidity dispersion across the crypto market into assets beyond BTC and ETH often signals a time to be vigilant of potential downside risks. This dispersion typically leads to thinner liquidity for larger-cap assets, unless accompanied by continued capital inflows.

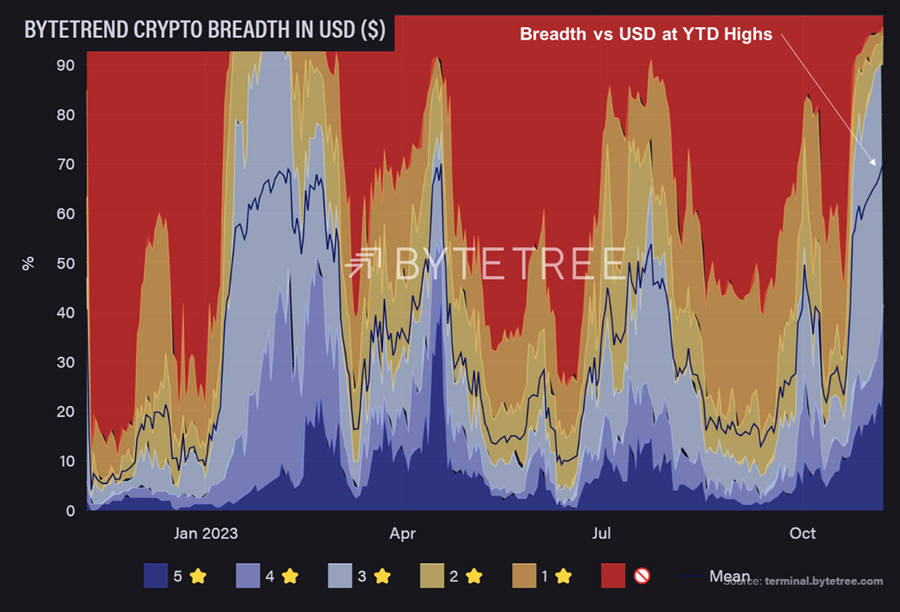

The following charts suggest that the market’s breadth is widening. However, this expansion is occurring more rapidly against USD than BTC. Further, when combined with the ongoing data showing continued positive flows, the current rally still seems fundamentally healthy and worth buying into.

ByteTree, a crypto data provider, offers a breadth score ranging from 0 to 5 — with 5 indicating the strongest momentum — across various metrics for the leading 170 coins. The scoring system allocates points based on several criteria:

- The price surpasses the 280-day moving average.

- The price is higher than the 42-day moving average.

- There is an upward trend in the 280-day moving average slope.

- The 42-day moving average slope is increasing.

- The most recent interaction with the 20-day maximum/minimum boundary was at the maximum.

Currently, the average breadth metric against the USD has reached its highest of the year.

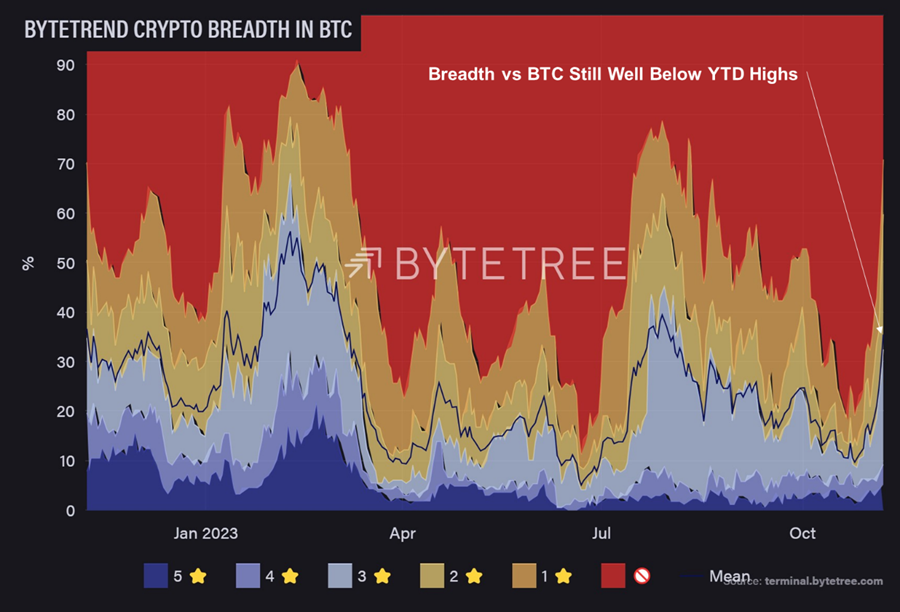

However, in comparison to market breadth with BTC as the trading pair, it’s evident that while market breadth is growing, it is doing so at a more moderate pace, with the average breadth metric remaining below the year-to-date highs. This suggests to us that there is potential for select altcoins to further appreciate against BTC, and it might be premature to consider the market as overheated at this juncture.

Flows Story Remains Compelling

As previously mentioned, market breadth expansion versus BTC can be a positive trend, provided that it is supported by capital inflows. The following charts are some that we have repeated in our strategy notes over the past few weeks, and will likely continue to turn to, as we view them as pivotal for tracking the recent shift in liquidity conditions.

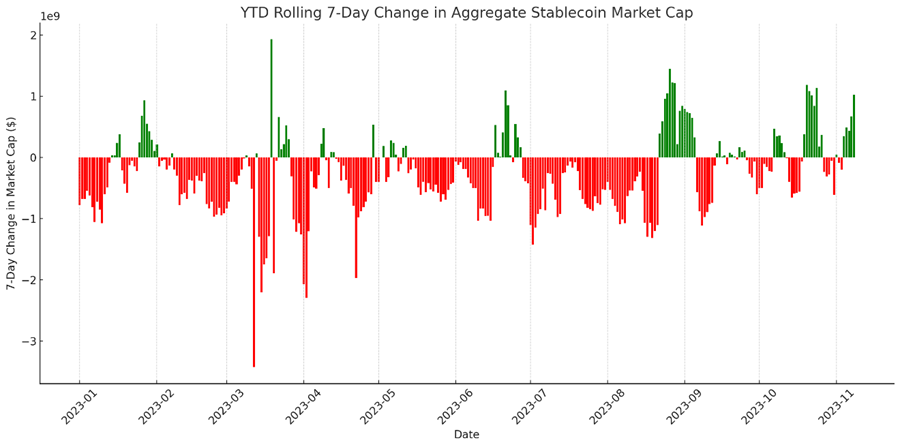

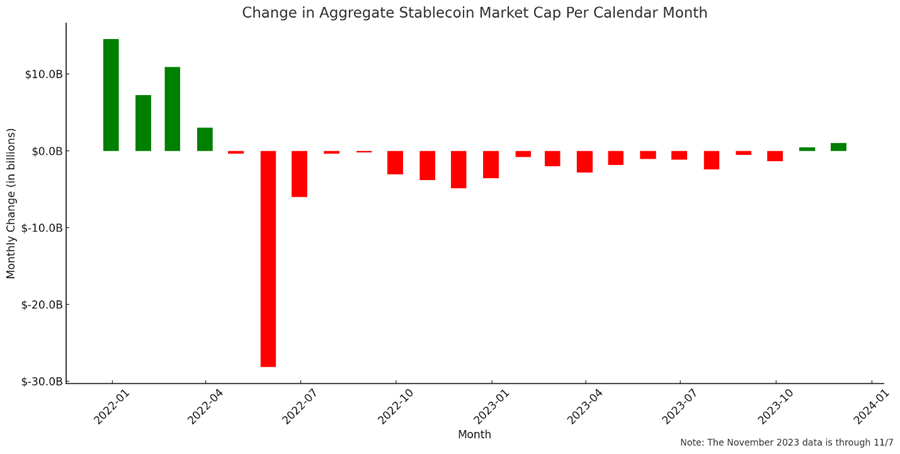

Below we see an uptick in stablecoin issuance, after a short period of redemptions. This reflects a healthy amount of continued capital formation within the crypto ecosystem.

The monthly data on stablecoin market cap changes is revealing. October marked the first month to register a net increase in stablecoin issuance after more than a year of contraction. Furthermore, just a week into November, the pace of creation is already surpassing that of the previous month.

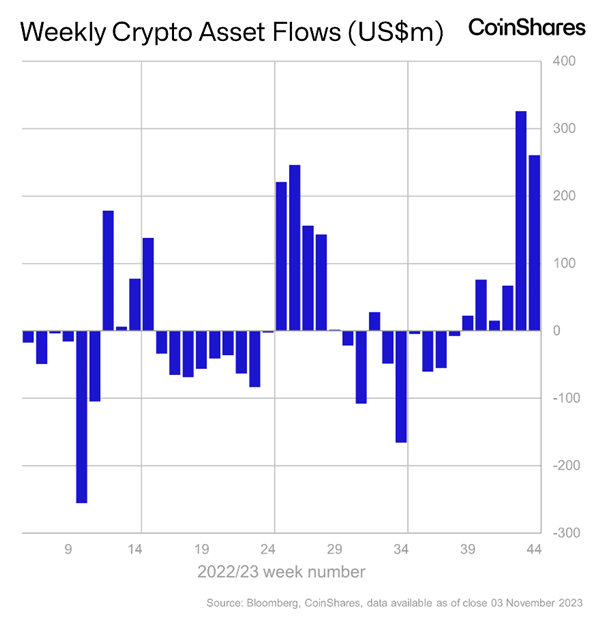

Digital asset ETPs have seen $261 million in inflows for the sixth consecutive positive week, cumulatively amassing $767 million over this period. This figure notably exceeds the total inflows of the previous year. A significant portion of this capital has been channeled into Bitcoin-focused products, which attracted $229 million. Ethereum products also benefited, drawing in $17.5 million, aligning with the recent ETH to BTC price recovery. Furthermore, Solana ETPs experienced an increase of $10.8 million in inflows.

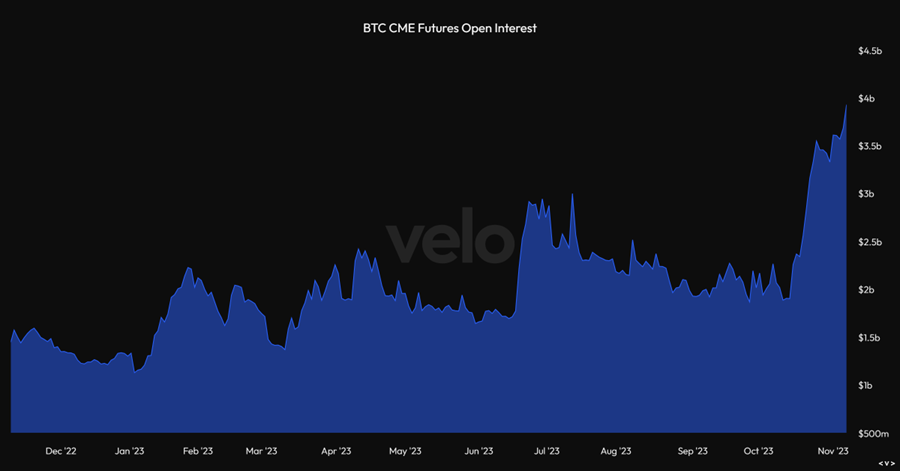

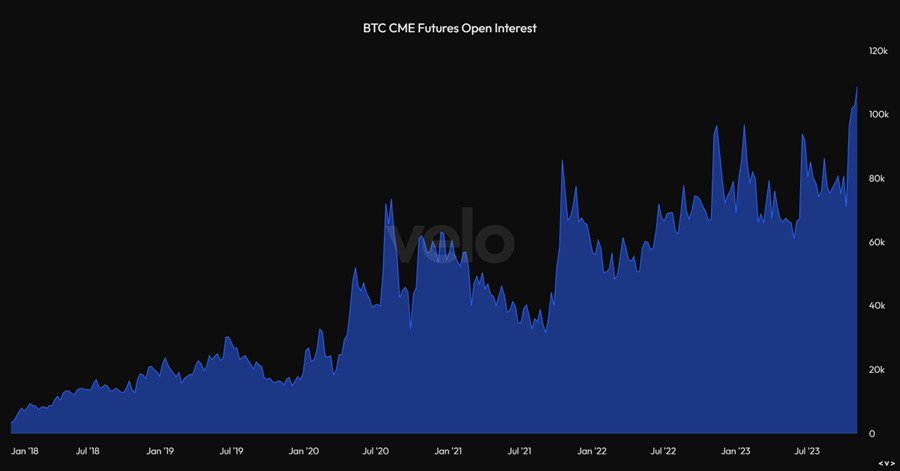

CME, a favored platform among U.S. institutional investors, continues to witness a steady increase in open interest measured in USD. This trend reflects the sustained engagement of institutional participants in the market.

Moreover, when viewed in BTC terms, open interest on the CME just set new all-time high.

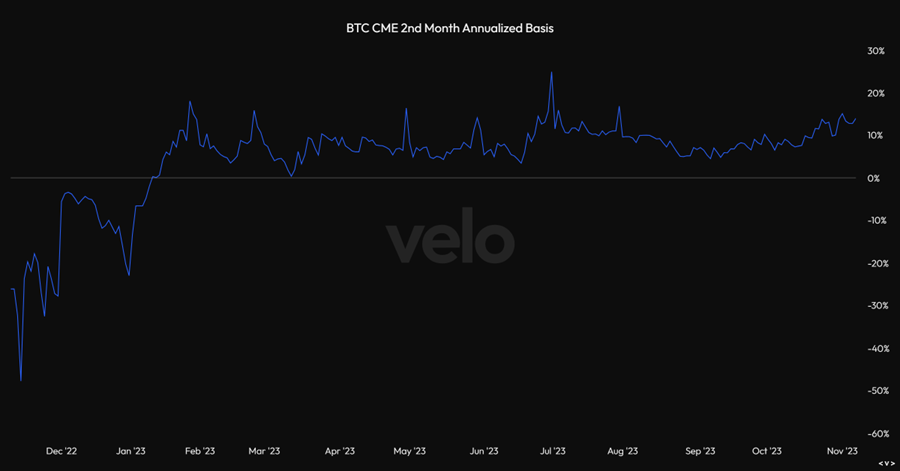

Beyond the appetite for direct long positions, there is significant institutional demand for engaging in the popular bitcoin basis trade. This strategy involves selling a futures contract trading at a premium to the spot price, coupled with buying spot bitcoin. While this mirrors the cash and carry trade typical in other markets, the annualized basis on BTC futures contracts can vary widely from spot price, influenced by the cyclical demand for bitcoin during bull markets. The data below illustrates a steady rise in the 2nd month annualized basis since September, now notably exceeding 10%.

On-Chain Activity Picking Up

We have been monitoring on-chain activity closely, seeking confirmation that demand for transacting on chain is picking up. Recent trends indicate a resurgence of activity.

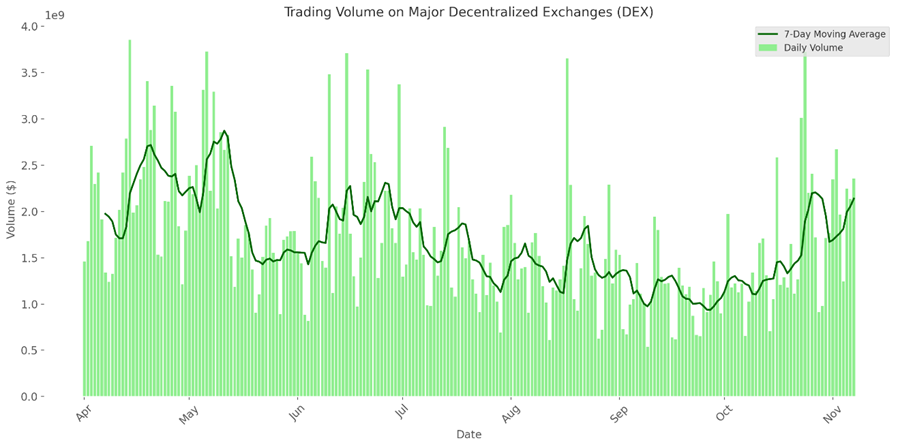

The chart below shows the volume across major decentralized exchanges within various ecosystems. This measure is clearly on an upward trajectory, with the current 7-day moving average reaching its highest value since July.

Exchanges included: Uniswap, Curve, PancakeSwap, DODO, 0x, Balancer, SushiSwap, Trader Joe, ParaSwap, KyberSwap, CoW Protocol, QuickSwap, Hashflow, MetaMask, Velodrome, Tokenlon, Zyberswap, Osmosis, Wombat Exchange, Biswap.

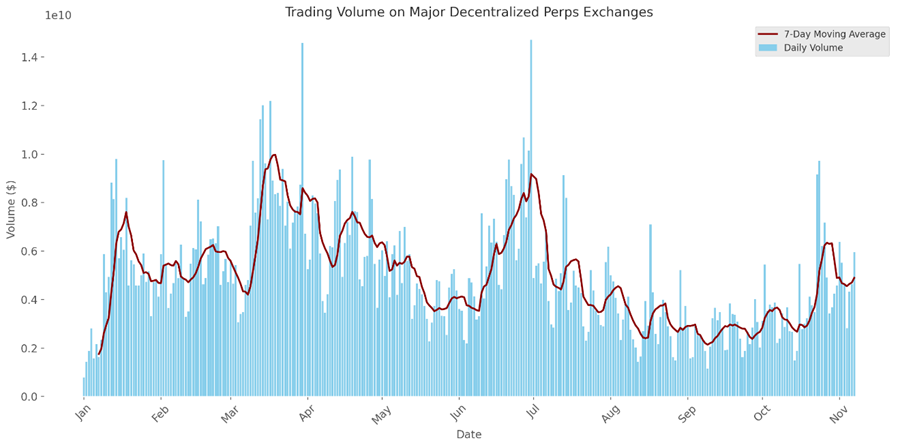

On chain derivatives are also experiencing a surge in volume. As outlined in our recent analyses, the resurgence of volatility in the majors logically correlates with heightened on-chain speculative activity.

Exchanges included: dYdX, GMX, Synthetix, Kwenta, Voltz, Gains Network, Level Finance, MUX, Futureswap, Vega Protocol, Atlantis Exchange, CoW Protocol, ApolloX, SynFutures, Polynomial Protocol, Cap, IPOR Protocol, Mummy Finance, Lyra, Deri Protocol, Metavault.Trade, UniDex.

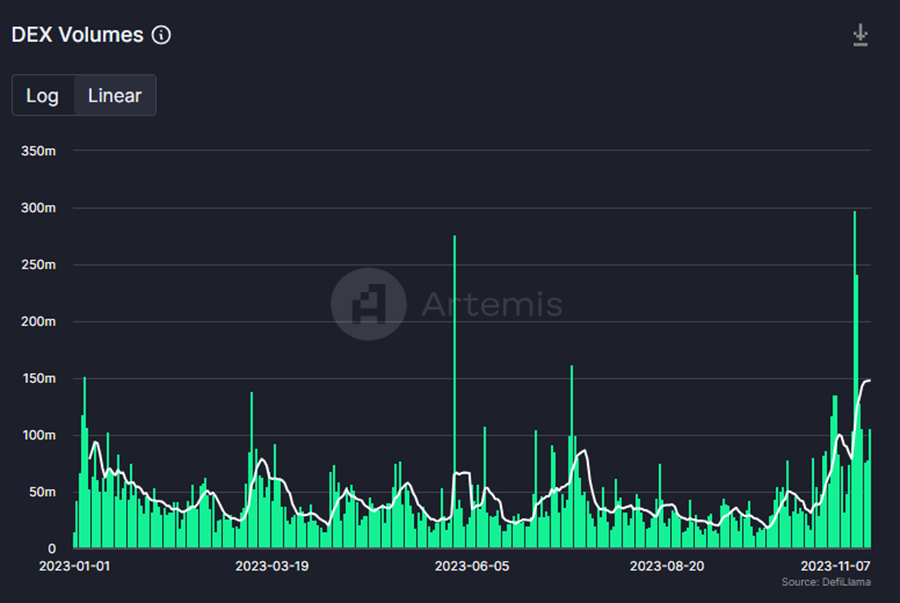

The charts above do not contemplate any of the exchanges in the Solana ecosystem. We should note that DEX volumes on Solana have risen parabolically over the past few weeks.

Window for ETF Approval

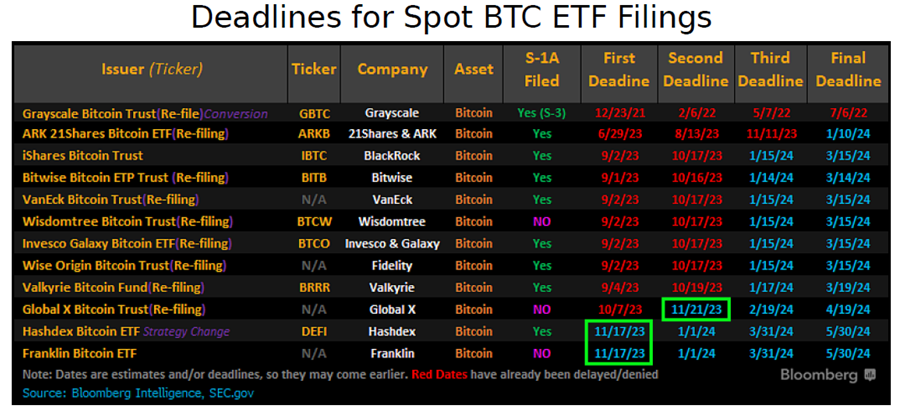

The esteemed ETF analysts at Bloomberg, James Seyffart and Eric Balchunas have highlighted key insights regarding the current ETF approval process.

In their most recent analysis, they pointed out an imminent window, opening tomorrow, 11/9, during which a spot ETF might gain approval. They base this on several factors: (1) the SEC’s preference to approve ETFs simultaneously to avoid granting a first-mover advantage to any single issuer, (2) the regulatory constraint that prevents ETF approval during a comment period, (3) a coinciding period beginning tomorrow where none of the 12 ETF issuers are in a comment period, (4) fast-approaching application deadlines for two issuers on 11/17 and 11/21, and (5) the likelihood that, if approval is delayed for these ETFs, they would enter their own comment periods, extending until January.

Therefore, the probability of seeing an ETF approval either this week or the next is likely on the rise. Failing that, January seems to be the next plausible window for approval.

Arbitrary Lockups

The Arbitrum DAO has approved a governance proposal enabling ARB token holders to lock their tokens in exchange for a yield funded by the treasury, distributed over 12 months via a smart contract.

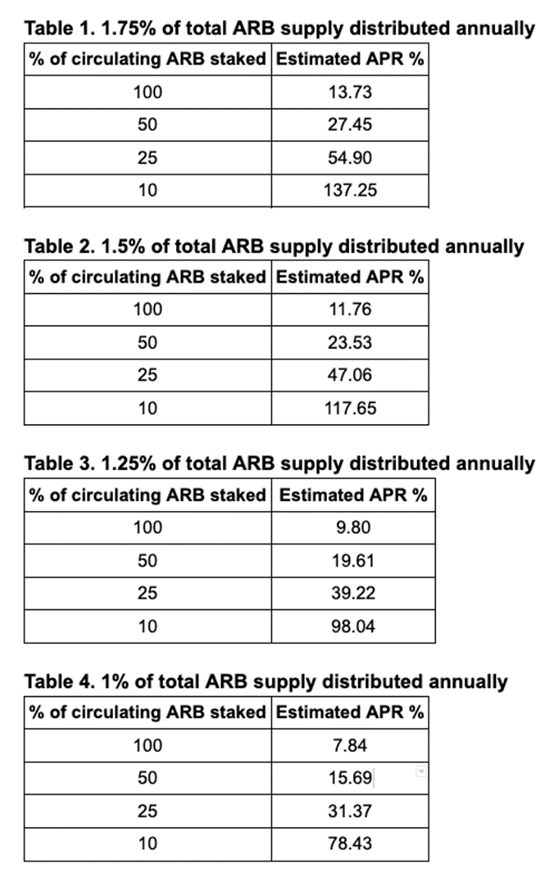

The proposal, which received majority support for the lowest 1% allocation of the ARB supply for staking, presents an estimated annualized yield ranging from 7.84% to 78.43% based on staked percentages. A subsequent proposal will address implementation details, including selecting a technology service provider, specifying contracts, and choosing an auditor, with a two-week community review period before implementation.

To be clear, those locking their ARB will not contribute to the security of the platform nor will their yield come from sequencer fees. Hence, we hesitate to use the staking nomenclature. This is literally just an agreement to not sell their holdings for a predetermined period of time, enforced by smart contract. In exchange for not selling for 12 months, they receive tokens from the DAO treasury.

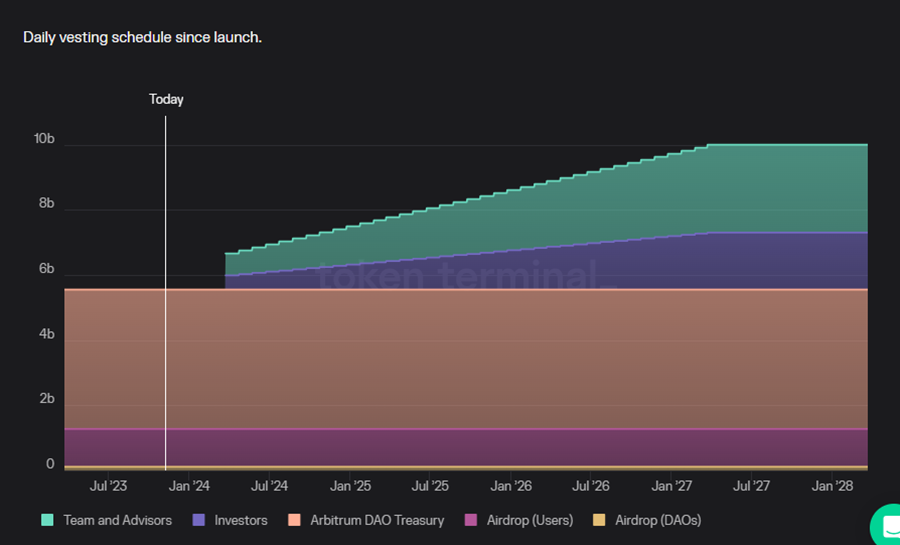

For us, given its early-stage nature, the use of treasury funds for locking incentives raises legitimate questions. This is being touted as a way to share realized growth with token holders, but it seems like it might just be a way to mitigate sell pressure ahead of a large token unlock in Q1.

Despite our skepticism around the necessity of this proposal, if it passes, may act as a token sink for a pretty significant percentage of circulating ARB. Below are the different token yields to be passed onto locked ARB, depending upon the total amount of ARB ultimately locked.

If we even see 10% of circulating ARB locked, it will certainly benefit the supply-side of the Arbitrum token equation.

Regardless of the outcome of this proposal, we maintain a positive stance on ARB, mostly driven by advances on the demand side of things.

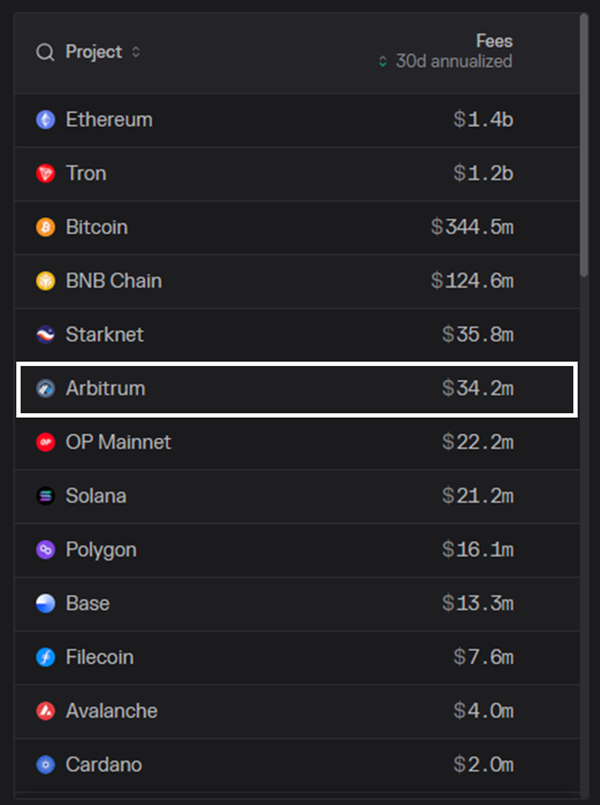

Among the universe of L1s and L2s with a token, Arbitrum ranks 6th in 30-day annualized fees, right above both Optimism and Solana.

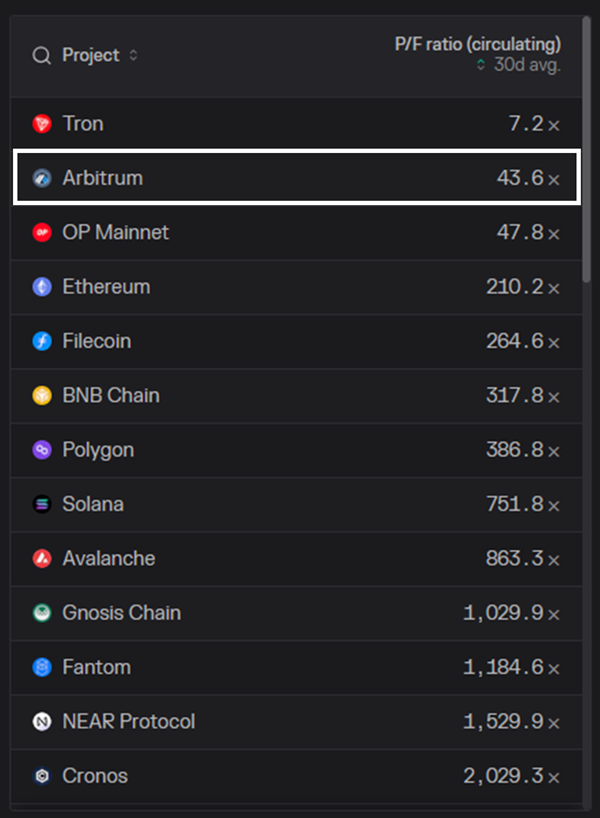

It is also the case that relative to its annualized 30-day fees, Arbitrum is priced conservatively when compared to its peers, ranking 2nd among the same cohort.

Thus, although the actions of the Arbitrum DAO are unnecessary for the growth and development of the ecosystem, there are plenty of reasons to remain constructive on this token.

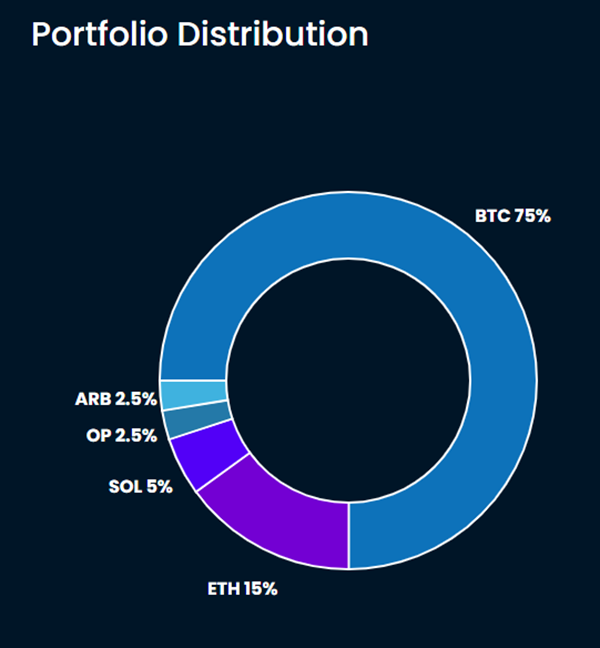

Core Strategy

Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it’s an opportune time to be fully deployed in the market. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC’s dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC -2.65% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH -2.24% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.02% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities