Inflows Suggest This Rally Has Legs (Core Strategy Rebalance)

Key Takeaways

- Bitcoin reached the lower bound of our annual forecast range, exhibiting a distinct divergence from traditional markets and suggesting renewed institutional interest, as evidenced by elevated open interest on the CME.

- Recent data points to a positive shift in the capital flows, highlighted by a reversal in the declining stablecoin market cap, sustained inflows into Exchange-Traded Products (ETPs), and a surge in Bitcoin's Realized Cap, all of which suggest renewed investor confidence and potential for a more sustainable rally.

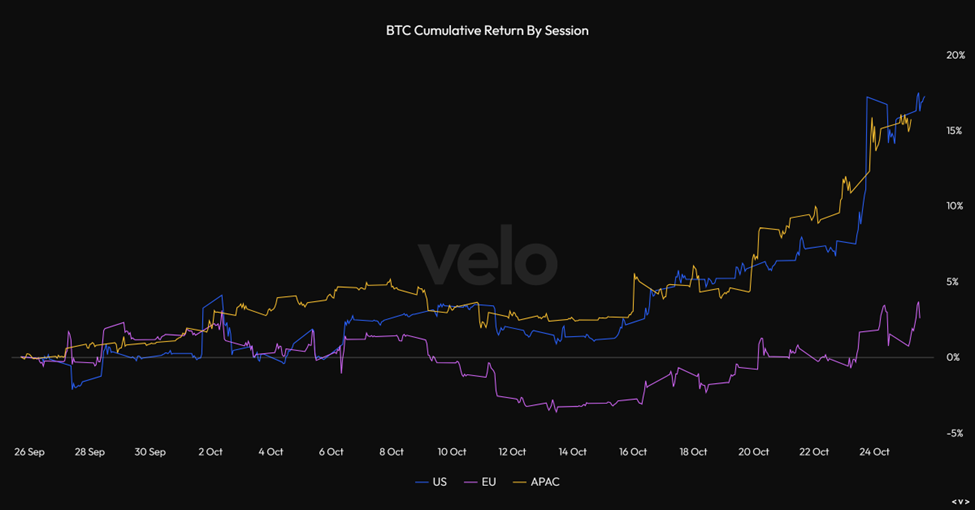

- We think that China's recent monetary stimulus and softening stance on crypto, coupled with a lack of attractive domestic investment options and increased crypto activity in Hong Kong, are converging to act as a positive catalyst for crypto prices, as evidenced by Bitcoin's performance during Asia market hours.

- Solana reached a new YTD high this past week. While tactically focused investors might contemplate de-risking ahead of the Solana Breakpoint conference, we believe it's an opportune time for medium-to-long-term investors to consider adding on dips.

- Core Strategy – Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it's an opportune time to deploy the remaining stablecoins in our core strategy. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC's dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

Institutional Capital Back in the Fold

It took 10 months, but BTC finally made it to the lower bound of our forecasted range for the year ($35k – $44k). The past week has been remarkable for crypto markets, marked by a notable divergence from traditional financial markets. This breakaway may portend a shift in investor sentiment, potentially signaling increased confidence in digital assets as an independent asset class.

In any market rally, it’s crucial to scrutinize various indicators to assess the rally’s sustainability. One common pitfall is overestimating the momentum of a rally that is merely driven by short squeezes or event-driven trades. To avoid this, we focus on multiple metrics, including trading volumes in both spot and futures markets, stablecoin flows, changes in realized cap, and flows into Exchange-Traded Products (ETPs).

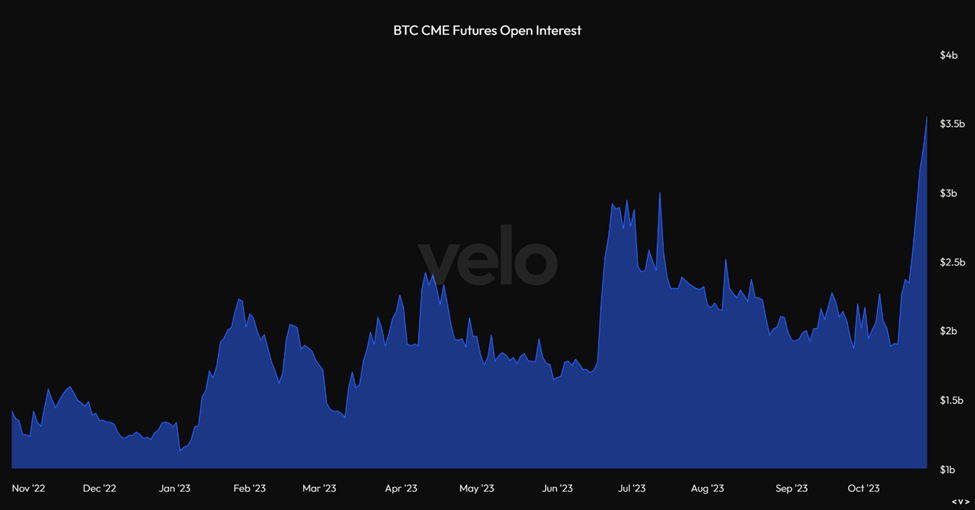

What stood out significantly this week was the flurry of trading activity on the CME. As the preferred trading venue for U.S. institutions, a surge in CME volumes usually signifies that institutional investors are actively speculating on Bitcoin.

Data reveals that futures open interest on the CME spiked to an all-time high when denominated in BTC. This surge in trading volume points to a more robust rally compared to previous ones this year.

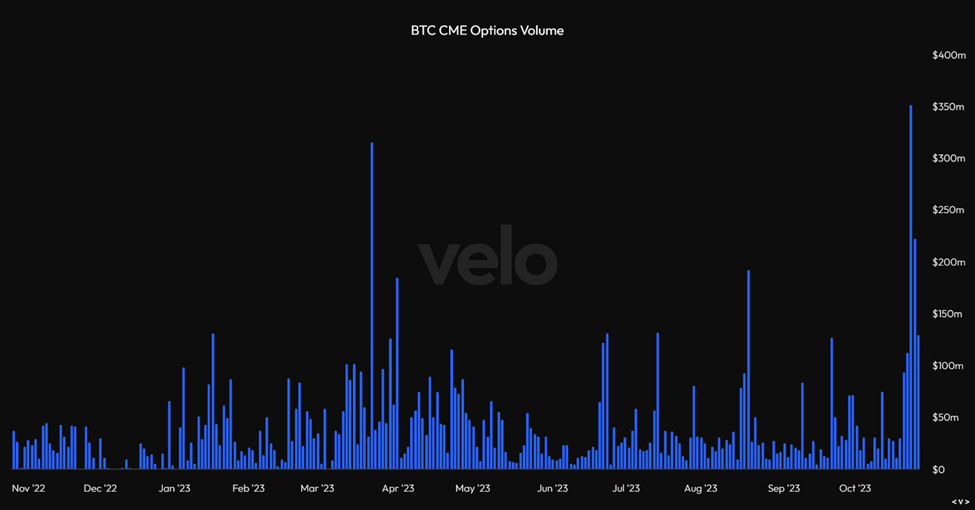

The options market has also seen notable activity, with volumes displaying an outsized increase.

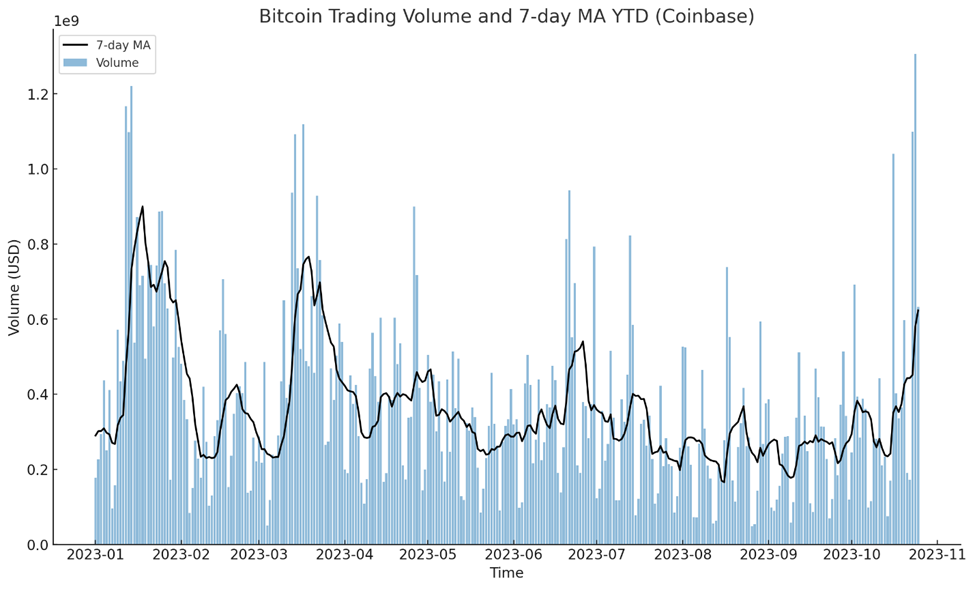

We also observed significant activity in the spot market, with Bitcoin volumes on Coinbase reaching a year-to-date high for daily trading volume earlier this week.

Positive Inflows Data

As a reminder, there are primarily three avenues through which traditional financial capital enters the crypto ecosystem: purchasing Bitcoin, buying Ether, and minting stablecoins.

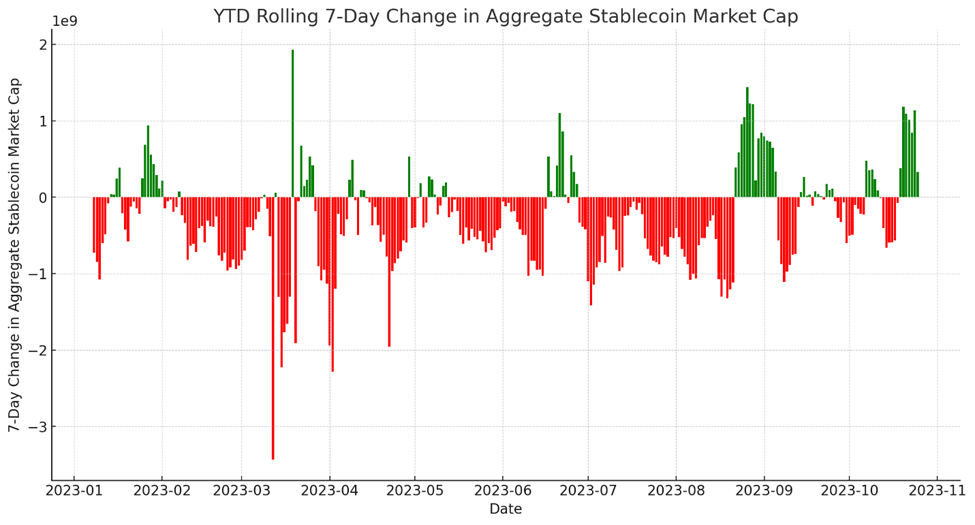

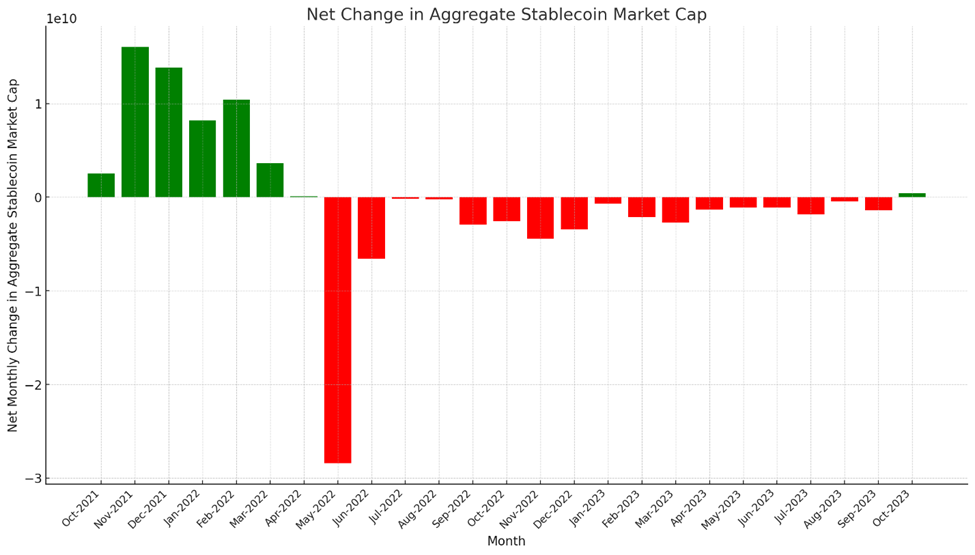

When stablecoins like USDT or USDC are minted and enter the crypto space, they often go towards purchasing other assets. Most of this year witnessed continuous redemptions, as stablecoins were exchanged for fiat currencies. However, recent data shows a positive 7-day change in the stablecoin market cap, suggesting that the capital outflow from the crypto ecosystem may have halted or even reversed. This remains one of our most bullish indicators.

Significantly, the current month has shown a possible extreme divergence from recent trends. The aggregate stablecoin market cap, which has been on a decline for the past 17 calendar months, is now showing a positive change with just five days left in the month. This reversal could signal a significant shift in market dynamics and is a trend we will continue to closely monitor.

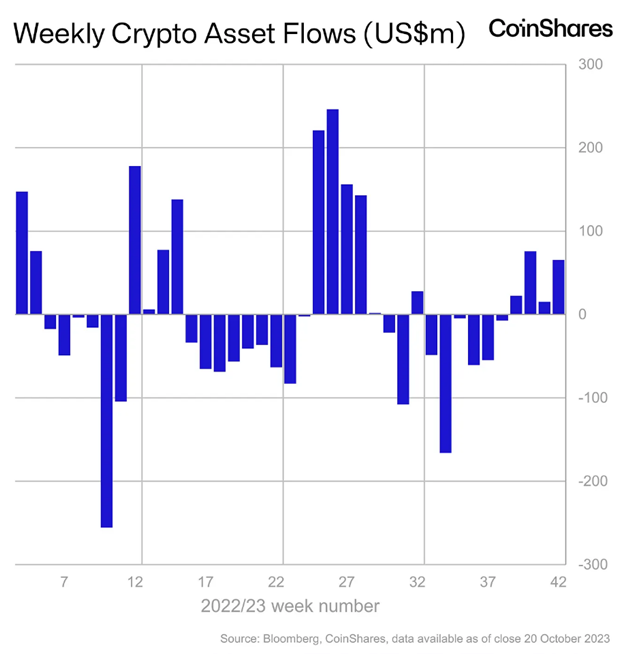

Although less definitive, the capital inflow into ETPs also deserves attention. Many of these ETPs are futures-based products, making them less impactful on the spot market. However, they still serve as a reliable gauge of retail sentiment. We are currently in our fourth consecutive week of ETP inflows, and we would be surprised if the trend doesn’t continue into the fifth week.

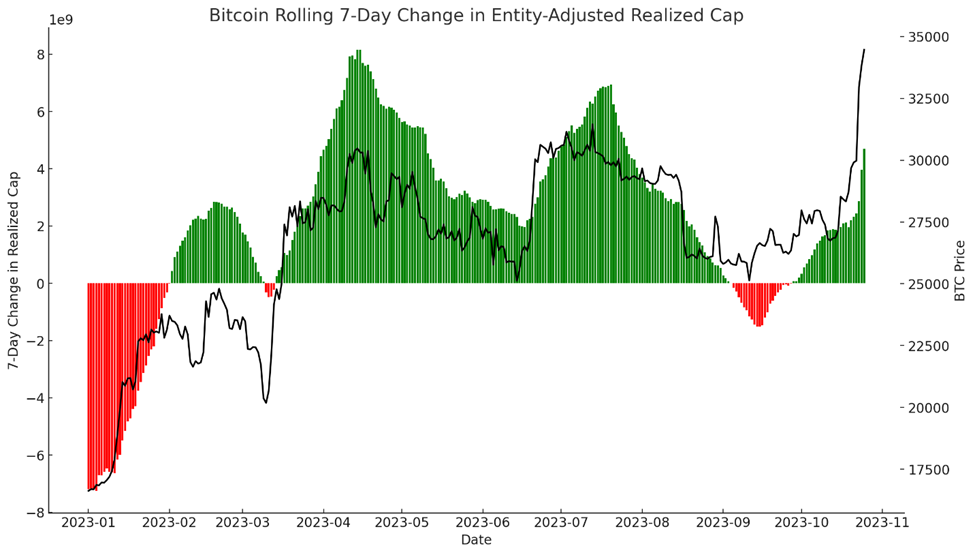

An increase in Bitcoin’s Realized Cap serves as a reliable metric for assessing the flow of capital into the network, as it indicates a larger volume of coins changing hands at higher prices. Additionally, a rapidly accelerating rate of change in the Realized Cap can act as a bullish indicator, signaling strong momentum in capital inflows and increased investor confidence in the asset. As illustrated below, the Realized Cap has surged, reflecting a swift increase in the network’s overall cost basis and a significant influx of capital.

China Stimmy

From a global macro perspective, one emerging theme worth discussing is the re-engagement of Hong Kong and, by extension, mainland China in the crypto industry. Recent softening of Hong Kong’s stance toward crypto can be interpreted as implicit approval from China for crypto initiatives. This is significant because it offers a channel for wealth to move out of China, bypassing the traditional financial regime.

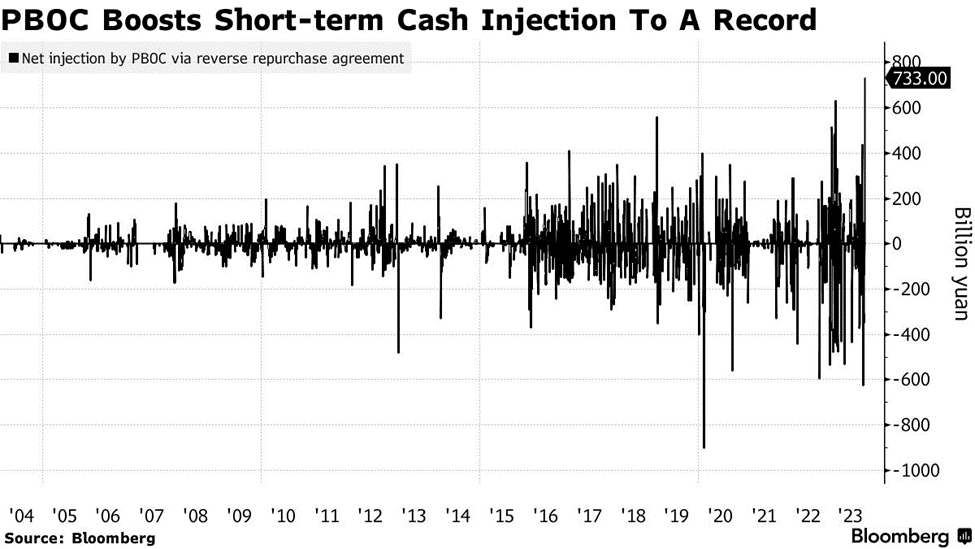

Even more noteworthy is China’s recent wave of monetary stimulus. The People’s Bank of China (PBOC) has engaged in cash injections that have reached record highs, and there are indications that in addition to monetary boosts, more fiscal stimulus could be on the horizon.

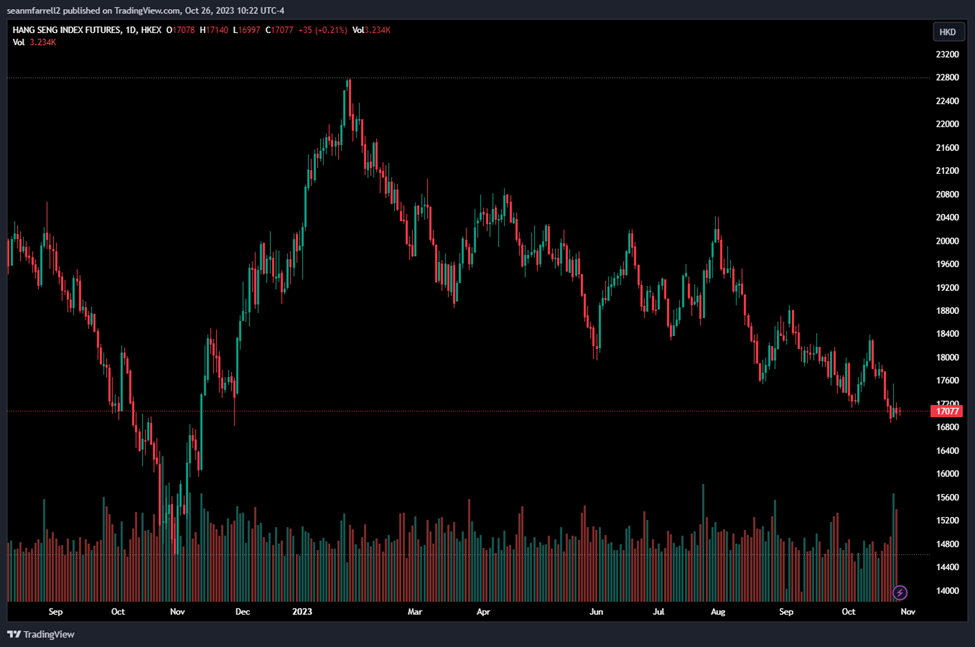

Interestingly, this massive stimulus has yet to manifest in traditional asset prices – the struggling real estate sector and the yet-to-bottom-out Chinese equities market bare testament to this.

We propose that (1) the extreme stimulus, (2) a scarcity of attractive domestic assets for investment, and (3) a burgeoning crypto ecosystem in Hong Kong, forms a confluence of factors acting as a positive catalyst for crypto prices.

These factors seem to be reflected in Bitcoin’s price action during Asia market hours, indicating a potentially significant shift in market dynamics.

Solana Outperforms

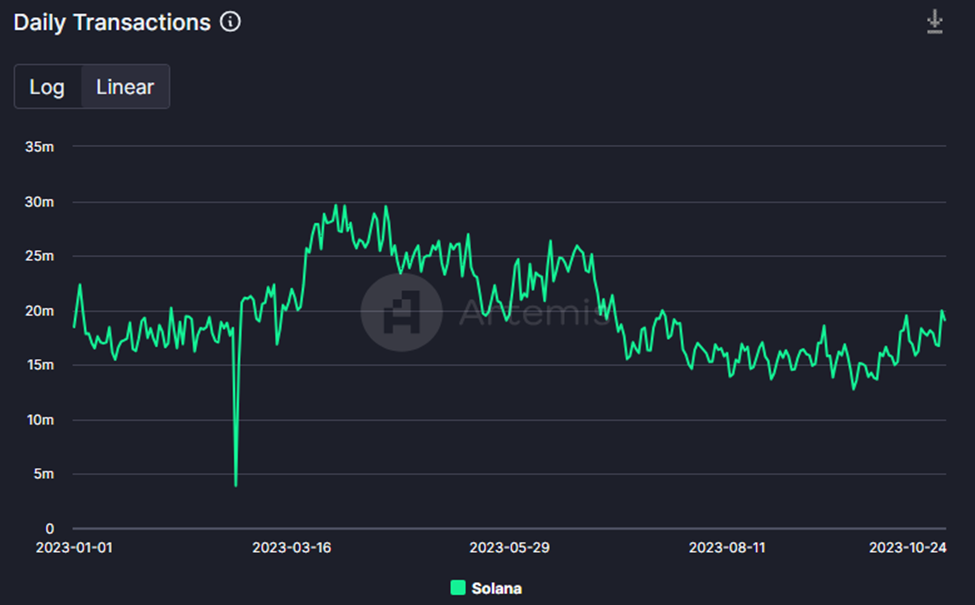

Solana, a Layer 1 blockchain that has navigated through various challenges, continues to be a focal point of our optimistic outlook for this year. The asset has maintained its impressive rally, reaching nearly $34 this past week. As outlined in our recent Flash Insights, tactical traders should consider the current price levels as a potential point for reducing risk, for two primary reasons.

First, on-chain activity for Solana is showing signs of recovery but remains below its year-to-date highs. This is a key metric to monitor, as on-chain activity serves as a comprehensive indicator of underlying demand, going beyond the trading volumes on centralized exchanges. A robust on-chain activity often signals strong user engagement and utility, which can exert upward pressure on the asset’s price.

Second, from a narrative standpoint, the upcoming Solana Breakpoint conference introduces an interesting dynamic. The native asset of a given ecosystem’s conference often exhibits volatility around the time of such events.

For investors with a medium-to-long-term horizon, we recommend maintaining positions in SOL and considering adding on any short-term dips. We anticipate that Solana will sustain its strong leadership among alts in the crypto landscape over the longer term.

Core Strategy

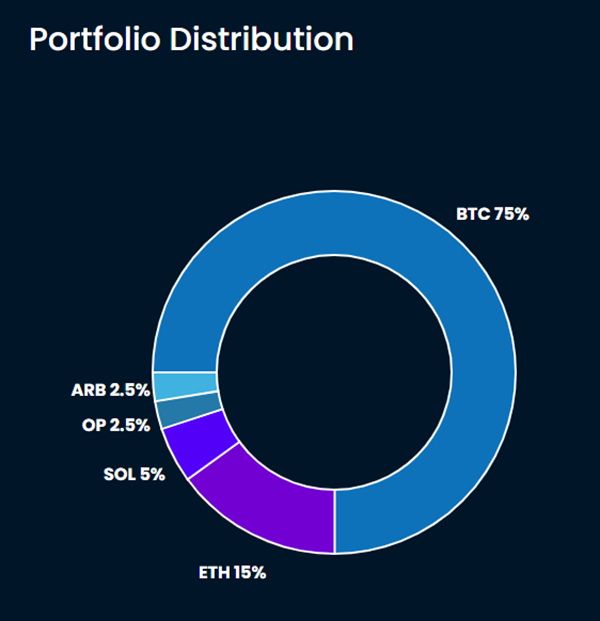

Based on robust capital inflows, heightened spot market volumes, significant institutional participation, renewed enthusiasm for an upcoming ETF, and an emerging Flight to Safety narrative, we believe it’s an opportune time to deploy the remaining stablecoins in our core strategy. While we expect Ethereum (ETH) to gain some tactical ground on Bitcoin (BTC) in the next month, BTC’s dominance is likely to persist, interspersed with occasional outperformance from select altcoins.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC 7.33% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH 11.55% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB 0.23% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities