Flight to Quality

Key Takeaways

- This week saw significant rallies in GBTC, ETHE, and BTC, fueled by the SEC's decision not to appeal the Grayscale case (and the fleeting rumor of ETF approval), with Bitcoin notably reclaiming its 200-day moving average.

- An increase in the aggregate market capitalization of the top 10 stablecoins and the third consecutive week of inflows into digital asset ETPs suggest that flows into the crypto economy might be improving.

- Solana, the best performer in our core strategy, has rallied 25% since late September, largely as a counter-reaction to overblown fears about FTX estate liquidations, despite lackluster on-chain activity.

- In contrast to the broader market uptrend, ETH has lagged, affected by subdued post-ETF approval flows, declining network fees, and a possible market preference for ETHE over ETH.

- Core Strategy – Given a likely local peak in interest rates, emerging signs of a global liquidity turnaround, the potential for near-term clarity on spot Bitcoin ETF approval, and strong seasonal trends, we believe it's prudent to remain constructive in the near term, as reflected in our Core Strategy.

The Bid We’ve Been Waiting For

Last week, we painted a picture of a market on the cusp of a potential rally. Our thesis hinged on a confluence of favorable factors: a local peak in rates, a possible global liquidity turnaround, and encouraging seasonality trends. However, the market remained largely inert, a phenomenon we attributed to the uncertainty surrounding the SEC’s potential stance on Grayscale. The market had been in a holding pattern, with high-volume BTC traders preferring GBTC over spot BTC to mitigate directional price risk, likely also hedging their bets by shorting the futures market.

GBTC and ETHE Rallies

This week marked a notable shift. Both GBTC and ETHE witnessed impressive rallies, with GBTC’s discount momentarily dipping to 8% before rebounding to the 12-14% range. The market seemed to finally respond to the catalysts we identified, breaking the inertia, and injecting fresh buying interest into the spot BTC market.

Bitcoin too played its part, rallying in the overnight hours of Sunday to crest above $28,000, a significant level that aligns with its 200-day moving average. This level also holds psychological importance, acting as a trading fulcrum around which market sentiment tends to pivot.

In a dramatic twist, a spurious tweet from Cointelegraph claimed that the SEC had approved BlackRock’s Bitcoin ETF application, sending shockwaves through the market. The rumor alone was enough to push BTC prices up by $2,000, peaking at $30,000, and causing $105 million in hourly liquidations in the derivatives market. Despite this volatility and the sizeable retrace, BTC remained above $28,500 after the dust had settled.

BlackRock CEO Larry Fink weighed in, interpreting the market’s reaction as symptomatic of “pent-up interest in crypto” and categorizing Bitcoin as a “flight to quality” asset amidst global unrest. We believe this episode revealed two important insights:

- The ETF approval is clearly not priced into the market, as demonstrated by the volatile response to false news.

- As we’ve recently highlighted, capital flows into the industry have been relatively subdued. Therefore, the 11% intraday surge suggests that the amount of liquidity needed to trigger significant price movements in Bitcoin is currently quite low.

Monday’s events led to the highest trading volumes for BTC on Coinbase since March, potentially rekindling interest among investors who have been frustrated with the lack of action in the crypto market.

Signs of Improving Flows

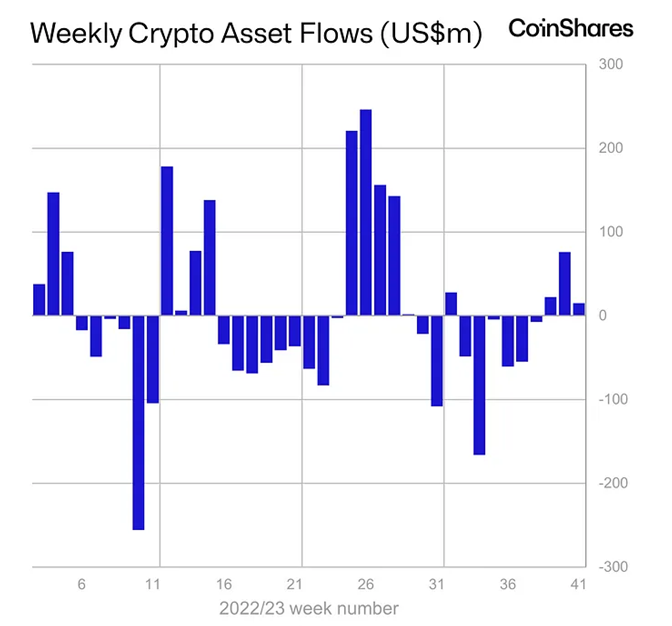

As we previously emphasized following the approval of the ETH ETF, good news alone isn’t sufficient to sustain a rally. It’s crucial to examine capital flows into and out of the crypto economy to gauge the durability of any upward momentum.

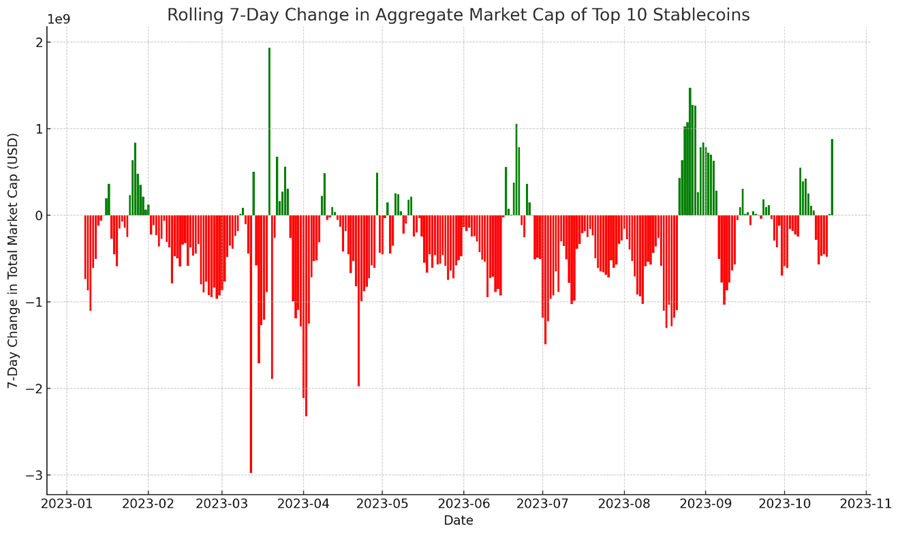

Recent data offers a glimmer of hope. After enduring a lengthy and painful drawdown this year, the rolling 7-day change in the aggregate market capitalization of the top 10 stablecoins has posted a significant gain. This could indicate that investors are reallocating capital back into the crypto economy, not just through Bitcoin purchases but also via the minting of stablecoins.

Before the trading week kicked off, we observed inflows into digital asset ETPs for the third consecutive week. This trend is noteworthy, especially when considering the broader financial landscape and the specific drivers within the crypto economy.

Given Bitcoin’s impressive performance this week, coupled with the encouraging news surrounding Grayscale and Larry Fink’s bullish comments on Bitcoin, we anticipate a fourth week of positive inflows into digital asset ETPs.

The consistency in ETP inflows, combined with various positive market signals, suggests that capital could be making its way back into the crypto economy.

ETH’s Relative Underperformance

While improved flow dynamics and positive news around Grayscale have buoyed certain assets, ETH has been a notable exception. Since August, ETH has largely moved sideways or lower on a nominal basis, even as Bitcoin has shown resilience amidst global turmoil and a deteriorating bond market.

The ETH to BTC ratio has reached its lowest point since last June.

There are multiple possible explanations for ETH’s subdued price action:

- Post-ETF Approval Flows: Despite the approval of the ETH ETF, inflows were muted, and were coupled with rising rates and a strengthening dollar—creating an unfavorable macro environment.

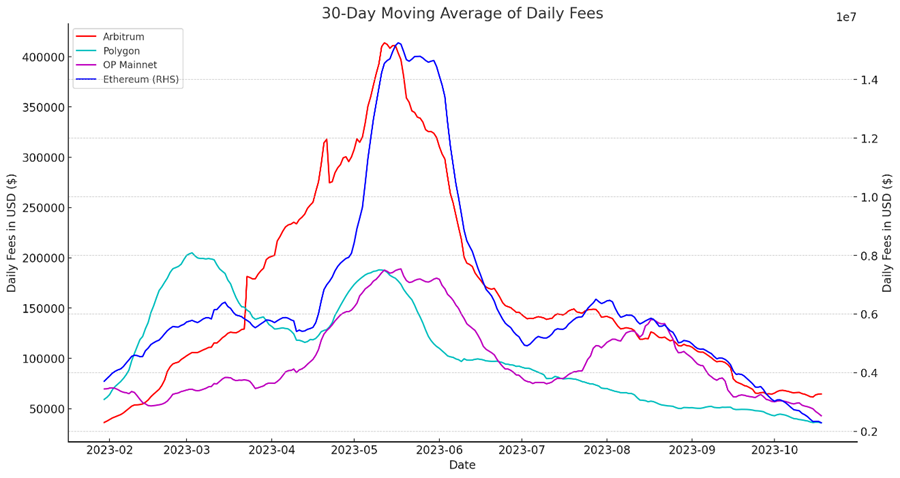

- Network Fee Dynamics: Another under-discussed factor is the reduced demand for ETH to pay network fees. Both ETH and its Layer 2 ecosystems have seen a consistent downward trend in fees, indicating decreased network utilization.

We also note the popularity of the ETHE trade. As the market awaits clarity on whether ETHE will convert to an ETF (we think it ultimately will), it’s possible that the spot market is favoring ETHE over ETH. This dynamic could lead to additional selling pressure in ETH’s futures market, particularly from traders looking to reduce their exposure to directional price movements in ETH.

While we remain cyclically bullish on ETH and related assets, they haven’t experienced the same uptick as BTC and SOL. This segment of our core strategy may require more patience as we await a potential rotation into ETH and its adjacent assets.

Solana’s Resilient Surge

Since reintroducing Solana (SOL) into our core strategy at the end of September, the asset has rallied by approximately 25%, outperfoming Bitcoin by ~16%.

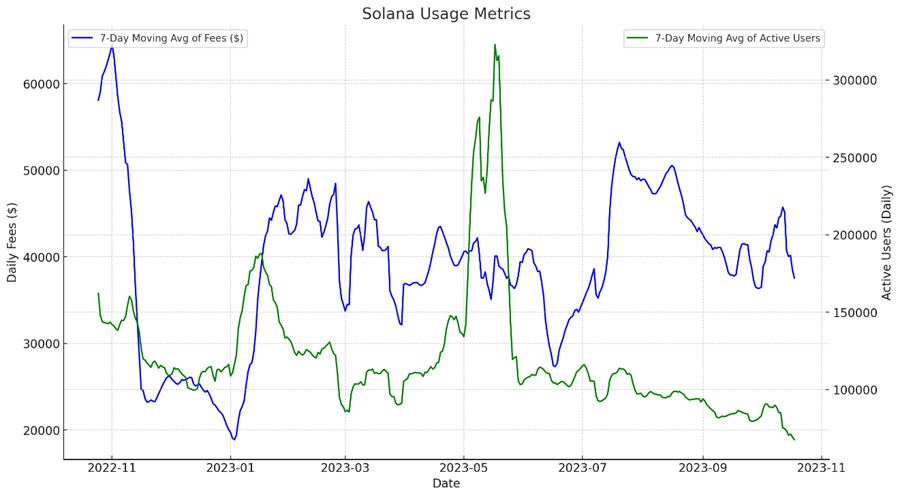

Contrary to what one might expect, the uptrend in SOL’s price is not correlated with increased on-chain activity. While fees have shown a mixed trend since late June, the number of active users has distinctly dwindled since May, reaching a YTD low.

The FTX Liquidation Overhang

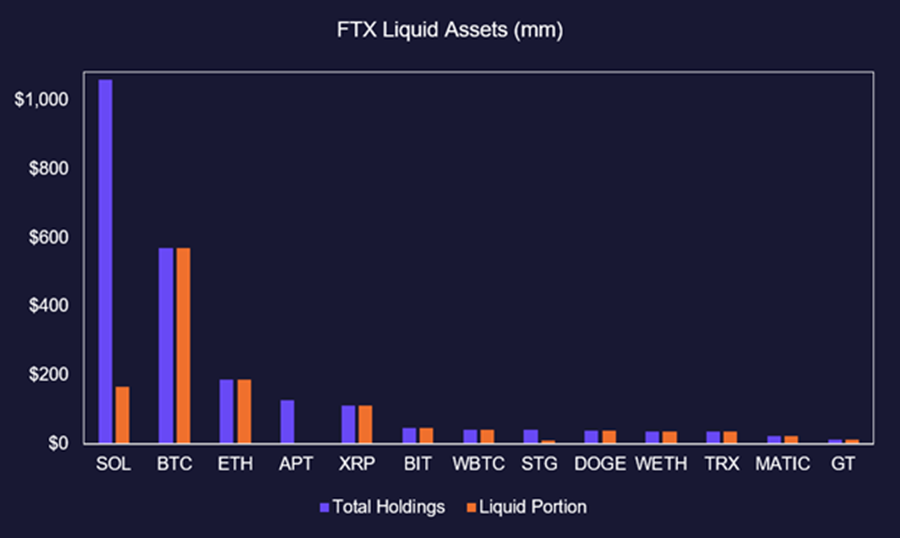

We believe the current rally is largely a reaction to the market’s exaggerated fears surrounding the FTX estate liquidations. In mid-September, the Bankruptcy Court approved FTX’s plan to liquidate billions in crypto assets, managed by Galaxy Digital. Investors were naturally concerned about the SOL holdings in the FTX estate and many likely front-ran these concerns.

Our analysis, however, revealed that the fears were largely unfounded. Only about 13% of the estate’s Solana holdings, valued at approximately $1.06 billion, were actually eligible for liquidation due to vesting restrictions. Consequently, even in a worst-case scenario, the impact on the market would have been minimal.

The rally in SOL is likely a counter-reaction to the overly bearish sentiment that was pervading the market in September. This sentiment was largely fueled by concerns about FTX’s large-scale liquidations, which turned out to be more bark than bite.

However, it is important to note, given the lack of supportive on-chain activity, investors might consider tactically de-risking in the coming weeks. However, we believe that the time for such a move has not yet arrived.

No More Hikes (For Now)

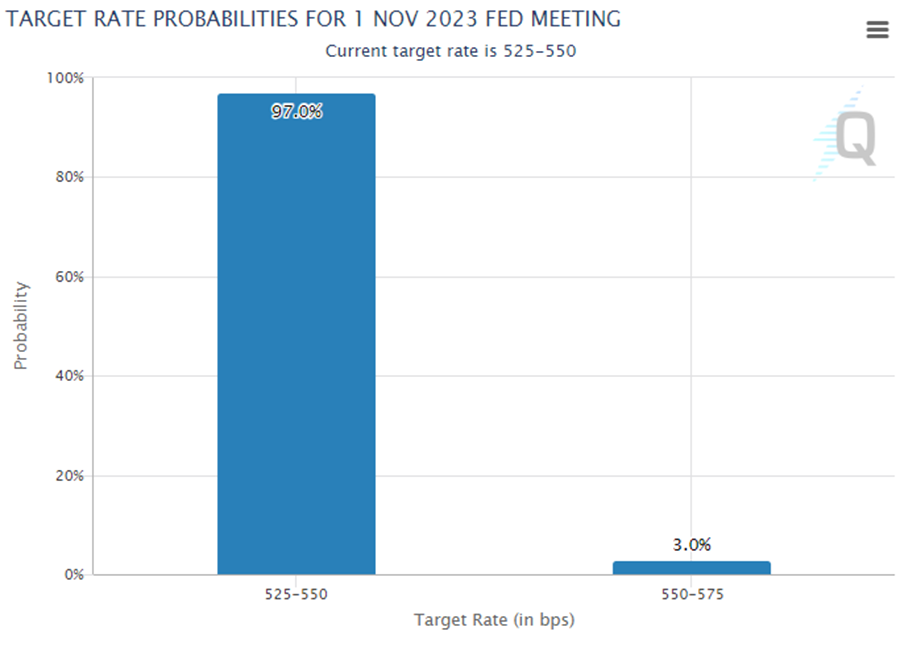

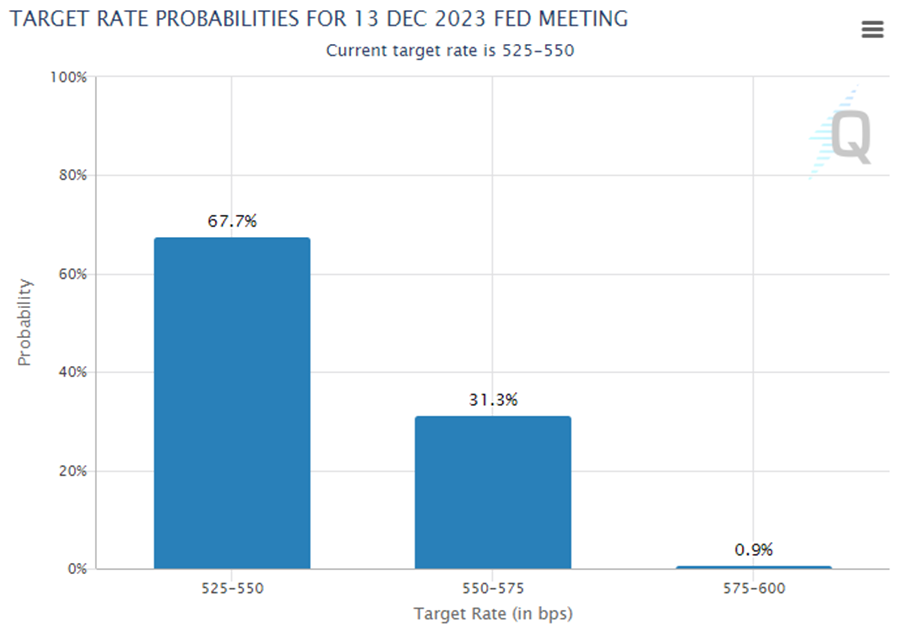

This afternoon, Federal Reserve Chair Jay Powell provided insights into the economy and monetary policy. From our perspective, his acknowledgment of the dampening effect of long rates on the economy suggests a net-dovish stance.

Although Powell didn’t rule out more rate hikes if inflation accelerates, he indicated that rate hikes are likely to remain on pause for the rest of this year. This view aligns with the Fed funds futures markets, which also anticipate no rate hikes in November and December.

Flight to Quality

Chair Powell also (surprisingly) commented on the deteriorating fiscal situation in the United States, pointing to an expanding deficit as a primary factor behind the ongoing pain in the bond market.

While we concur with this assessment, what’s more interesting is the market’s reaction: a surge in long yields but a drop in the dollar. This is far from an ideal situation for an issuer of sovereign debt.

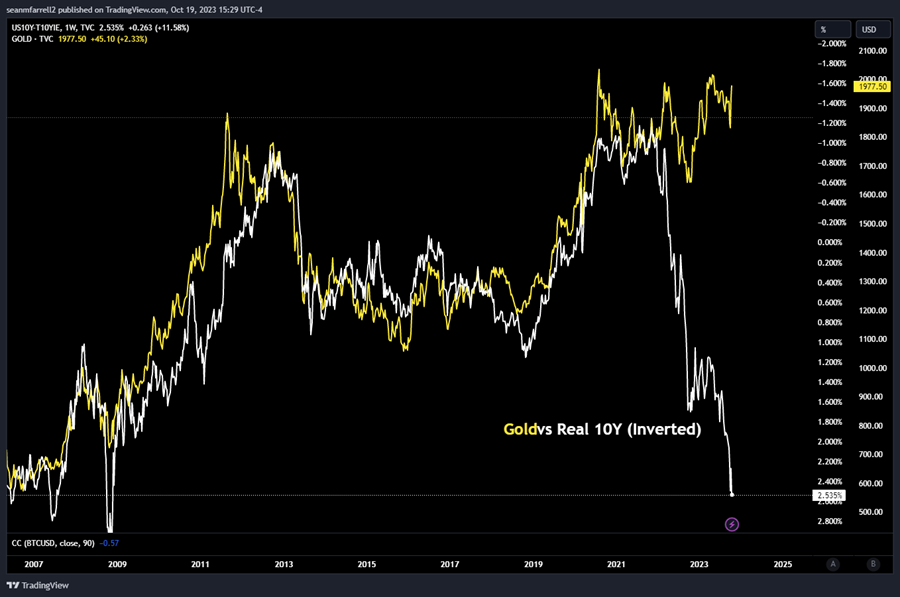

A couple of months ago, we highlighted the divergence between real yields and gold on our market call, and recent events have brought this back into focus. Typically, rising real yields diminish the appeal of gold as investors find better returns in yield-bearing assets and see less need to hedge against future inflation.

The current market behavior suggests an anomaly. Despite rising real rates, gold is outperforming, hinting that the market finds current real yields unattractive compared to potential returns in gold. This could be driven by a mix of factors including geopolitical tensions and fiscal deficits, but ultimately it signals a preference for non-sovereign commodity money over traditional state-sponsored assets.

Interestingly, Bitcoin, whose correlation with gold had recently weakened, is now showing strong performance alongside the precious metal. This dovetails with Larry Fink’s comments suggesting a possible “flight to quality,” with both physical and digital versions of gold standing to benefit.

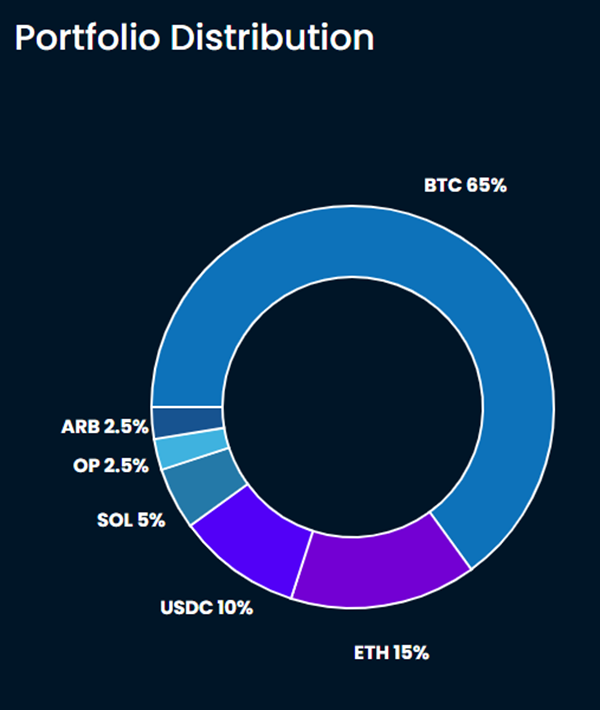

Core Strategy

Given a likely local peak in interest rates, emerging signs of a global liquidity turnaround, the potential for near-term clarity on spot Bitcoin ETF approval, and strong seasonal trends, we believe it’s prudent to remain constructive in the near term, as reflected in our Core Strategy.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC -2.72% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH -5.16% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.49% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

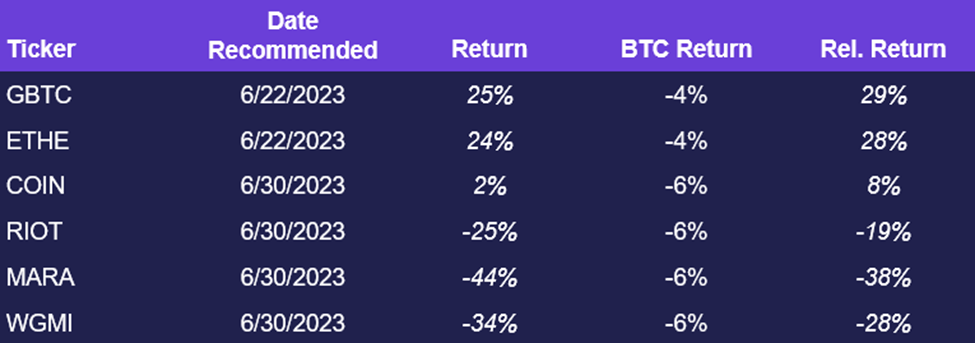

Crypto Equities