An Appealing Case for a Rally

Key Takeaways

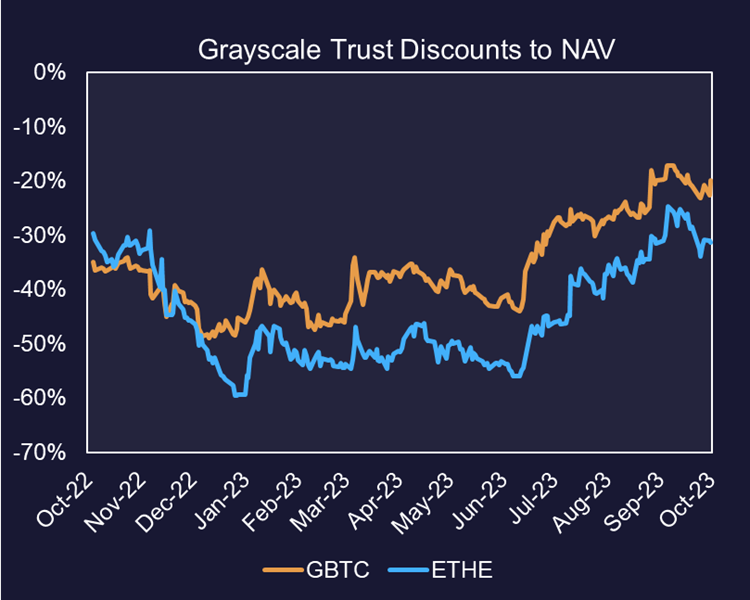

- The SEC faces a crucial deadline tomorrow to appeal a court ruling in favor of Grayscale regarding Bitcoin ETFs. If no appeal is made, this could set the stage for the approval of spot ETFs, positively impacting trusts like GBTC and ETHE.

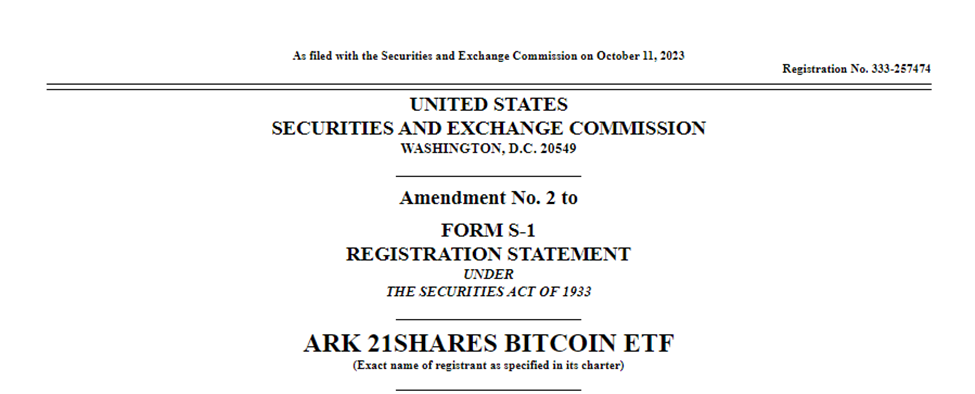

- In light of Grayscale's decisive legal victory and Ark's recent S-1 amendments, we anticipate the SEC is unlikely to appeal. Such an outcome could spark a favorable market reaction, particularly benefiting trusts and Coinbase, a partner in several Bitcoin spot ETF applications.

- Despite recent unsettling CPI data and turbulent bond auctions, the broader macroeconomic landscape appears to be softening for risk assets. This is evidenced by a stabilizing bond market and an interruption in the steady decline of global liquidity.

- While the market conditions for crypto assets seem favorable, they have not yielded corresponding price gains. This may be due to external factors such as geopolitical risk from the ongoing war in the Middle East and selling pressure in the futures market ahead of the SEC's pivotal decision.

- Core Strategy – Despite a mounting set of bullish indicators—including a likely local peak in interest rates, emerging signs of a global liquidity turnaround, the possibility of near-term clarity on spot Bitcoin ETF approval, and robust seasonal trends—the market has yet to respond. We believe the SEC's decision tomorrow could serve as a catalyst for positive momentum. Looking ahead, our outlook for Q4 remains optimistic, particularly for the majors and Grayscale's trust products.

SEC Deadline Looms

Back in August, a court sided with Grayscale, accusing the SEC of acting in an “arbitrary and capricious manner” when it denied their spot Bitcoin ETF application. Since then, the SEC’s options have narrowed to the following:

- Appeal the court’s decision within a 45-day window.

- Develop a new rationale for rejecting spot Bitcoin ETFs.

- Consider revoking existing approvals for futures-based ETFs as justification for denying spot ETFs.

- Conform to the judicial ruling by approving the spot Bitcoin ETFs, thereby avoiding further legal issues.

As tomorrow marks the end of the SEC’s appeal window, the regulatory landscape is on the cusp of significant change. Should the SEC forgo an appeal, the court is expected to outline the subsequent steps, potentially instructing the SEC to greenlight Grayscale’s application.

Market Implications

The Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust (ETHE) have seen their discounts to Net Asset Value (NAV) narrow. Despite this trend, both trusts still trade at a significant discount to their respective NAVs, a situation we still view as offering an enticing risk/reward profile for investors.

We believe that the SEC will forgo an appeal. This perspective is informed by the decisive nature of Grayscale’s legal victory, a verdict rendered with clarity by a politically diverse panel of judges.

Furthermore, Ark’s recent S-1 refiling with minor amendments suggests they’ve been in active discussions with the SEC, potentially paving the way for eventual spot ETF approval.

The specifics of tomorrow’s developments remain uncertain, and market reactions might depend on how promptly and clearly the SEC or the court communicates the decision. But regardless of the delivery, if the SEC does not appeal, we should expect positive momentum for the trusts and for Coinbase, which has been selected as the surveillance-sharing partner in various Bitcoin spot ETF applications.

Looking beyond the SEC decision tomorrow, the first final deadline for the ETFs is in January, along with multiple soft deadlines.

Macro Picture Softening in the Near-term

Recent economic indicators and events have led to some volatility in financial markets. The Consumer Price Index (CPI) data released on Thursday came in hotter than expected, contributing to an uptick in rates. This was further exacerbated by a less-than-smooth 30-year bond auction, resulting in a strengthened Dollar Index (DXY) during Thursday’s trading session.

However, the bond market has shown signs of cooling off over the past two weeks. The short bond trade appears to have become overcrowded, and rates have started to roll over. The unfortunate ongoing war in Israel may have further catalyzed this, as bonds remained in demand this week.

Shifting the lens to global liquidity, there seems to be a pause in the downward trend that has characterized this metric, which combines the balance sheet sizes of key central banks—the Fed, PBOC, BOJ, and ECB. For the first time since August, this metric is on track to close higher for two consecutive weeks. This positive shift is partially supported by a stabilizing Chinese yuan and continued stimulus activities from the People’s Bank of China (PBOC).

Missing: The Bid for Crypto

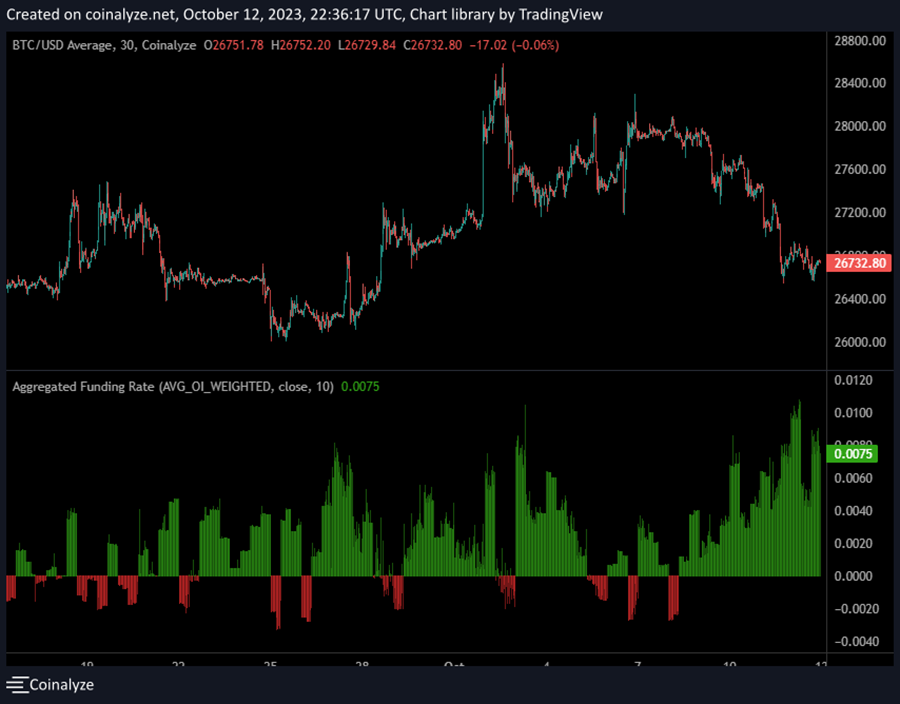

In light of the recent disconnection between Bitcoin and other macro assets, current conditions—such as peaking interest rates, a possible bottom in global liquidity, and a probable spot Bitcoin ETF approval—appear to align favorably for a long position in crypto assets. These factors, combined with seasonally positive trends, should be driving prices upward. However, the market has yet to reflect this optimism. Both Bitcoin and altcoins have relinquished early-month gains, leading to a cautious market environment.

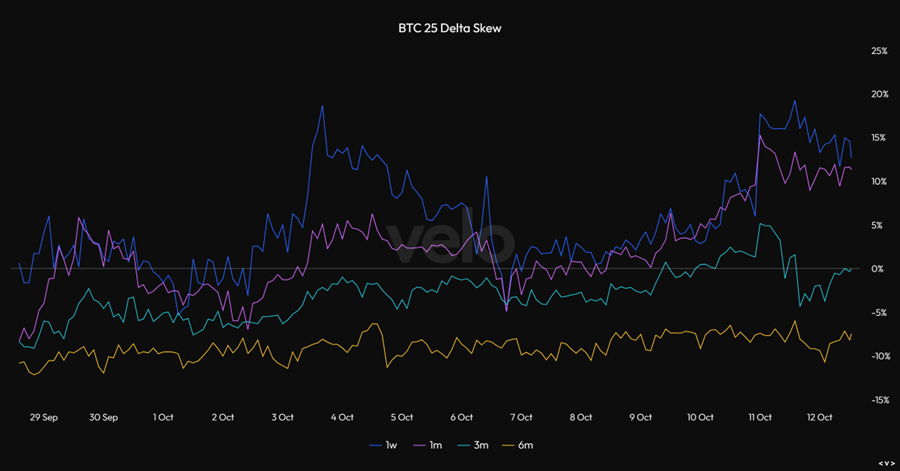

This caution may be influenced by the ongoing war in the Middle East, as investors take a guarded stance, awaiting further developments. The options market reflects this sentiment, with short-term positions like 1-week and 1-month delta skews indicating a defensive posture. Additionally, the uptrend in 3-month implied volatilities—although still lower than 1-week and 1-month figures—suggests that traders are becoming increasingly bearish for the rest of the calendar year.

Adding to this, we’ve observed a decline in the 3-month annualized basis of futures contracts this week, signaling further risk aversion in the futures market.

However, ironically, we think that another dynamic negatively affecting the market is the impending SEC decision on Grayscale’s Bitcoin ETF. The existence of the Grayscale trust trade creates a nuanced landscape. On one hand, potential Bitcoin buyers appear to be pivoting towards GBTC, anticipating a rally if the SEC opts not to appeal. This shift diverts buying pressure from the spot market. On the other hand, some investors might be hedging their GBTC exposure by selling futures contracts or buying puts on the spot price. This strategy aims to mitigate exposure to spot price volatility while capitalizing on a potential narrowing of GBTC’s discount to NAV. These contrasting strategies could be combining to exert selling pressure on Bitcoin, with altcoins suffering as a downstream consequence.

Interestingly, the one segment of the market that hasn’t turned bearish is the perpetual futures market. Given their 24-hour funding dynamics, perpetuals are likely being used primarily for speculation (and not hedging). This explains the divergence in sentiment between the futures and perpetual futures markets.

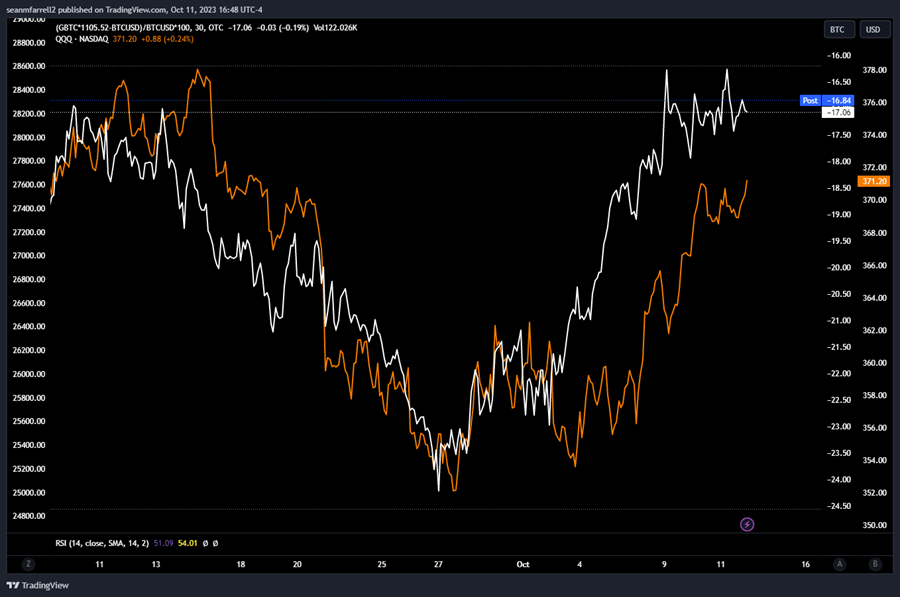

In addition to these dynamics, it’s worth highlighting that while the correlation between equities and Bitcoin remains, it is manifesting in a unique way: through the GBTC discount to NAV rather than spot prices. The chart below compares the GBTC discount to NAV, not the GBTC market price, against the Nasdaq 100. Over the past month, these two metrics have tracked closely. This suggests that the equity market’s influence on Bitcoin remains significant but is now primarily channeled through GBTC.

This observed correlation between the GBTC discount to NAV and the Nasdaq 100 lends credence to the theory that GBTC is diverting liquidity from the Bitcoin spot market. If investors find that GBTC offers a similar exposure to market trends as Bitcoin but with the added benefit of a narrowing discount to NAV, they might opt to allocate capital to GBTC. This would effectively divert buying pressure from the Bitcoin spot market to GBTC, especially if this correlation is not similarly reflected in Bitcoin’s spot prices.

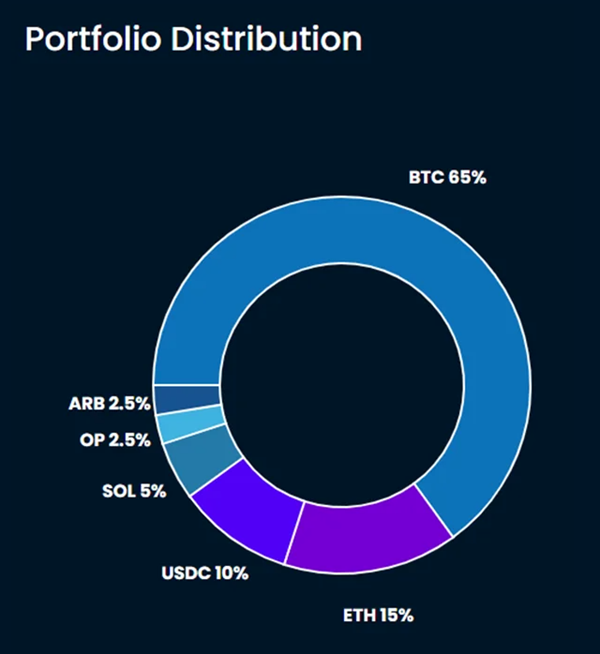

Core Strategy

Despite a mounting set of bullish indicators—including a likely local peak in interest rates, emerging signs of a global liquidity turnaround, the possibility of near-term clarity on spot Bitcoin ETF approval, and robust seasonal trends—the market has yet to respond. We believe the SEC’s decision tomorrow could serve as a catalyst for positive momentum. Looking ahead, our outlook for Q4 remains optimistic, particularly for the majors and Grayscale’s trust products.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin (BTC -2.72% ): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption.

- Ethereum (ETH -5.16% ): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana (SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Optimism (OP) & Arbitrum (ARB -0.49% ): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

Crypto Equities