ETF Prospects Improving (And Not Just for Bitcoin)

Key Takeaways

- Longer-term interest rates surged this week, with the US 30-year rate reaching its highest level since November of last year.

- Both BTC and ETH showed relative steadiness amid the bond selloff, defying the usual heuristic of a strong dollar leading to weak coins.

- Bitcoin has effectively decoupled from macro variables in recent months, as correlations with both the DXY and QQQ are at or near zero.

- Bloomberg analysts raised their odds of a spot Bitcoin ETF approval to 65% (up from 50%), reinforcing our positive outlook on ETF approval.

- This week we saw several issuers file applications for futures-based ETH ETFs as well as hybrid BTC & ETH ETFs. Based on the early dialogue around these products, approval seems likely.

- Core Strategy – Last week we wrote about near-term risks such as (1) seasonal headwinds, (2) the potential impact of headlines related to Binance, or (3) headlines related to an ETF deferral. Nonetheless, we maintain our view that the risk asymmetry this year remains to the upside, and it would be irrational to take risk off the table with so many potential positive catalysts on the horizon.

Yield Curve Steepens

Over the past week, a flurry of news has led to a significant steepening in the yield curve. The key events:

- Last Friday, the Bank of Japan (BOJ) signaled a more lenient approach to their Yield Curve Control (YCC) policy. While their target 10-year rate remains at 50 basis points (bps), they are now willing to let it drift as high as 1%. This announcement sparked fears that it could trigger a wholesale 50 bps increase in global 10-year rates. Additionally, the BOJ’s decision means there will be more supply of Japanese Government Bonds (JGBs) in the market, as they are reducing the amount of debt they will purchase. This might have second-order effects on the demand for US Treasuries (USTs).

- On Tuesday, Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating from AAA to AA+ due to concerns about anticipated fiscal deterioration, erosion of governance, and a growing general debt burden over the next three years.

- Finally, on Wednesday, the US Treasury announced plans to ramp up the issuance of longer-dated securities in response to the soaring deficit and high interest rates. This move was clearly a signal to the market that rates were expected to rise higher. We think this was the most important contributor to the selloff in bonds.

As a result of these developments, we witnessed a substantial increase in longer-term interest rates. Below is the US 30Y, which reached its highest level since November of last year.

Dollar Strength Fails to Translate to Weakness in the Coins

We naturally observed a concurrent rise in the DXY, as the surge in yields contributed to a rally in the USD.

As our clients know, a (generally) good heuristic when trading crypto is that strong dollar = weak coins.

However, despite the challenges posed by the bond selloff, both Bitcoin and the broader crypto market showed relative steadiness and have not been significantly affected this week, contrary to what we have seen in the equity market.

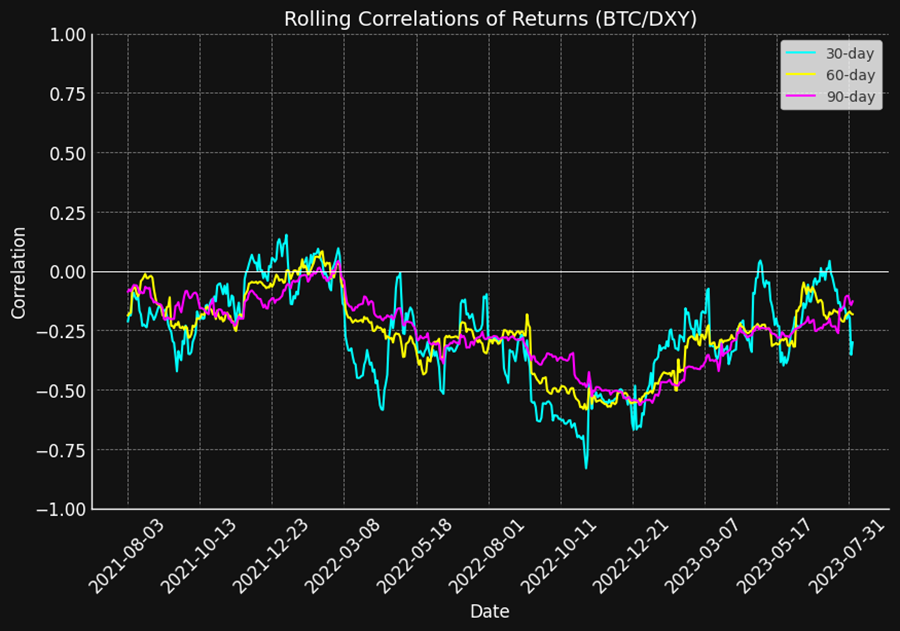

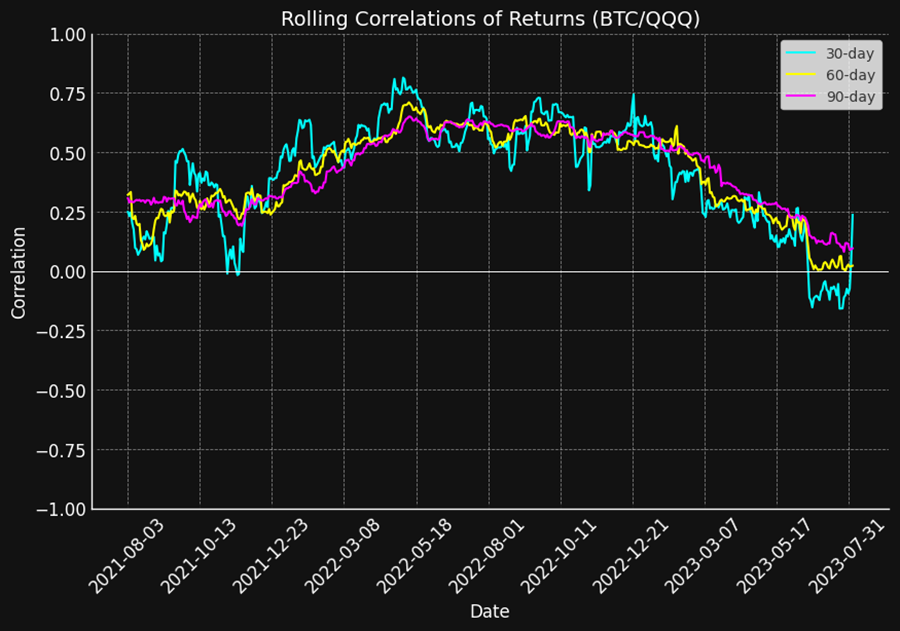

As shown below, correlations between BTC and the DXY across multiple timeframes are approaching zero. This indicates that the movements in Bitcoin’s price are becoming less dependent on fluctuations in the US Dollar, making it more independent of traditional macroeconomic trends.

Similarly, the connection between daily returns in technology stocks and Bitcoin is also at or near zero.

In light of this breakdown in correlations, we have seen BTC and ETH continue to trade in extremely tight ranges. We do not expect these low correlations to last indefinitely, but they are important to note as we navigate the current market setup.

ETF Optimism

Despite a lack of price movement in the crypto market, it was a rather bullish week for news related to crypto investment products.

Bloomberg ETF analysts Eric Balchunas and James Seyffart revised their odds of approval for a spot Bitcoin ETF to 65%, a significant increase from 50% a couple of weeks ago and a remarkable rise from just 1% a few months back.

Both Eric and James were great resources when we were tracking the likelihood of approval of the BTC futures ETF back in 2021. Thus, we view them as a trustworthy resource on the matter.

This updated probability aligns with our positive outlook on the ETF’s approval likelihood. The optimism stems from recent developments in the crypto market, including BlackRock’s filing of an ETF application and the ongoing Grayscale case against the SEC in Federal court. A favorable outcome for Grayscale could pave the way for simultaneous approvals of all spot Bitcoin ETF filings as early as the end of Q3.

ETH-TF Optimism

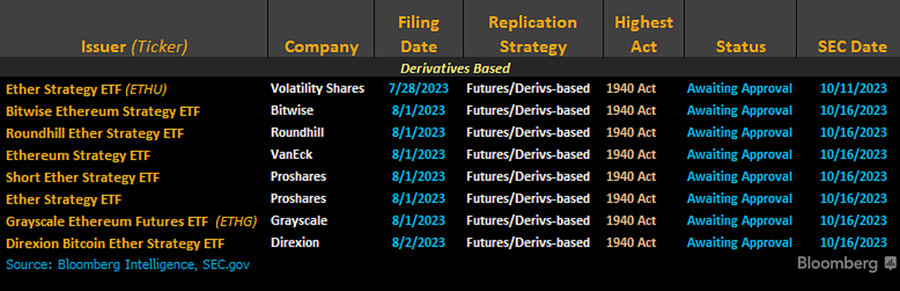

Alongside this favorable forecast for a BTC spot ETF, a total of 6 issuers, including Volatility Shares and Bitwise, submitted applications for ETH futures ETFs, with the potential for the first ETH futures ETF to launch in early October if approved by the SEC. We also saw several applications hit the tape for futures-based ETFs that featured both ETH and BTC futures in the same fund.

Although at this point we would place marginally less probability of approval for ETH futures ETF approval than the BTC spot approval, (1) the warming climate for crypto ETFs and (2) the recent Ripple ruling make us optimistic about an ETH futures ETF hitting the market by October.

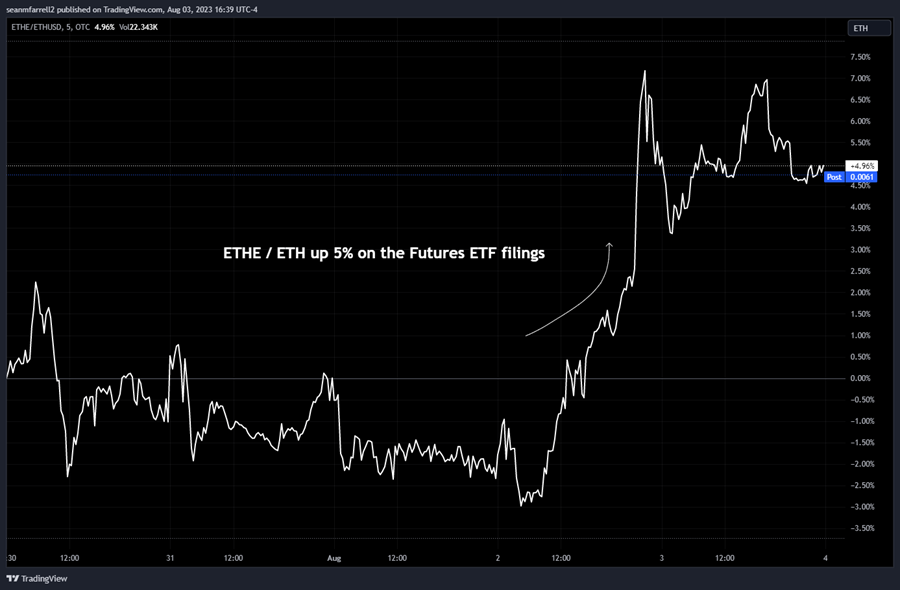

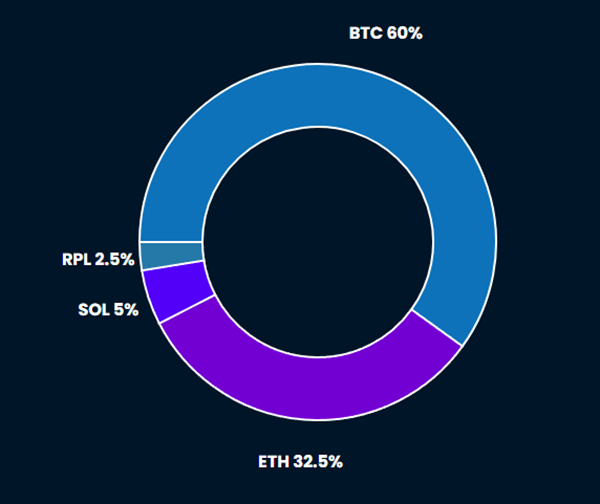

Overall, the increasing likelihood of a BTC spot ETF and the emergence of ETH futures ETF applications supports our rationale for being long both GBTC 2.46% and ETHE 4.57% .

Below is the 5% spike observed following the news that issuers were moving on bringing an ETH-based ETF to market. We think the risk/reward in the near term continues to be compelling for both Grayscale trusts.

As a reminder, we are due a decision from the SEC on ARK’s bitcoin ETF application next week. We maintain that it is likely that this decision will be deferred to the November deadline seen below. Again, this does not mean that the ETF will ultimately be denied.

We believe that this deferral will be followed by a decision in the Grayscale vs SEC case that is skewed in Grayscale’s favor. Then, we think that either towards the end of Q3 or beginning of Q4, we could see all BTC ETF applications approved at once.

Somethings Gotta Give

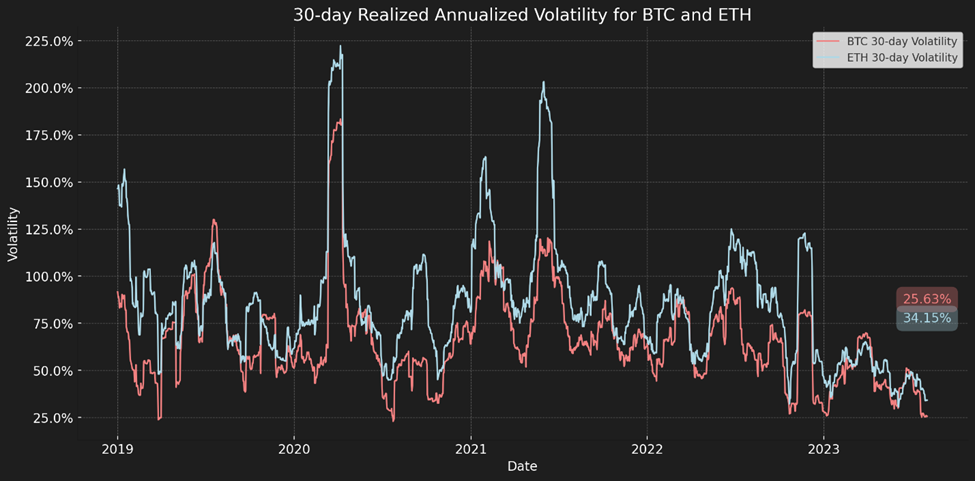

Last week, we discussed the drawdown in realized volatility for both BTC and ETH and how this traditionally led to favorable returns. As indicated by the chart below, volatility has yet to find its way back into the market.

We believe that the bevy of upcoming catalysts should jostle us out of this doldrum.

Last week we wrote about near-term risks such as (1) seasonal headwinds, (2) the potential impact of headlines related to Binance, or (3) headlines related to an ETF deferral. Nonetheless, we maintain our view that the near-term asymmetry remains to the upside, and it would be irrational to take risk off the table with so many potential positive catalysts on the horizon.

To summarize the reasons, we think it’s right to stay allocated in the near-term:

- Volatility compression historically leads to favorable returns (as mentioned in last week’s Strategy note).

- The imminent Grayscale verdict, which should lead to a further decrease in the discount to NAV for both GBTC and ETHE.

- Increasing optimism surrounding the approval of a spot bitcoin ETF.

- Recent applications for Ethereum futures ETFs, suggesting a positive view on the potential for approval.

Core Strategy

Active Trade Update

Tickers in this report: GBTC 2.46% , ETHE 4.57% , COIN 4.40% , RIOT -1.68% , MARA -0.50% , WGMI -2.58% , ETH, BTC , RPL, SOL N/A%