Liquidity Rising

Key Takeaways

- The Federal Reserve raised its target Fed Funds rate by 25 basis points, hinting at an approaching end to rate hikes, while banking stress has overshadowed inflation as the primary concern in the financial industry.

- Amid an ongoing banking crisis, the Fed's language shift and easing monetary policies from major central banks have led to increased net liquidity in the U.S. and higher global USD liquidity.

- Recent increased tether mints and a strong uptick in realized cap suggest that more capital is flowing into the crypto market.

- The Arbitrum token airdrop led to a surge in activity and wealth creation, with daily active users and revenue skyrocketing, highlighting the potential rewards of exploring tokenless platforms in anticipation of future airdrops.

- Coinbase's receipt of a Wells notice from the SEC is concerning, but despite the crackdown, regulatory risks do not necessarily translate to lower token prices. Past examples of fines and shutdowns have not been closely correlated to drawdowns in digital asset prices, and the case may ultimately provide much-needed regulatory clarity for the crypto space, fostering stability and growth within the industry.

- Core Strategy – Despite ongoing banking concerns, we think the risk asymmetry in 1H remains to the upside, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Investors are increasingly turning to BTC and gold as alternative ways to store wealth during periods of inflation or increased risk, with BTC's rising dominance potentially leading to sustained altcoin rallies down the road.

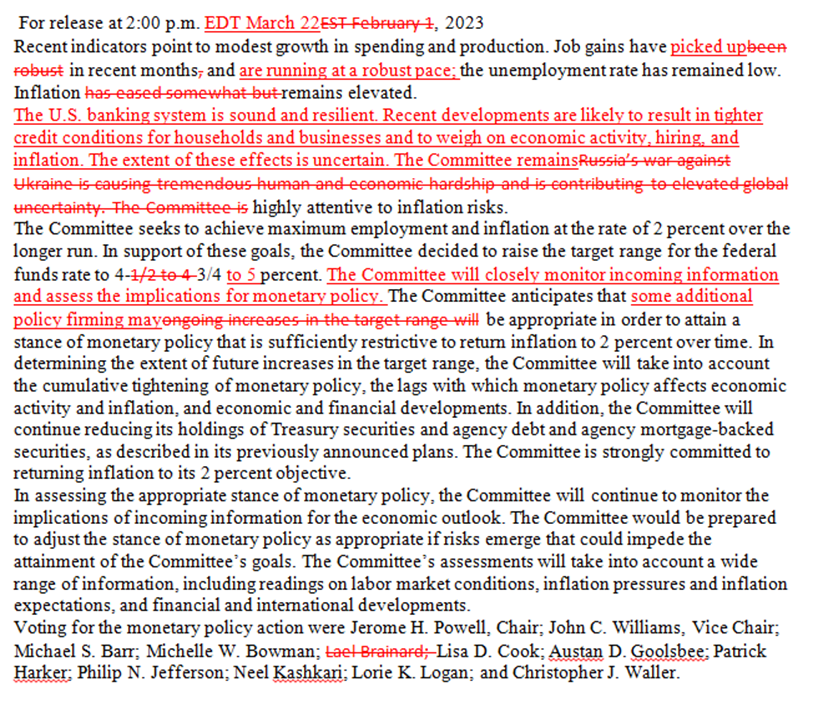

Dovish Fed Statement

On Wednesday, the Federal Reserve raised the target Fed Funds rate range by 25 basis points (BPS), marking the ninth increase in just over a year. The FOMC statement hinted at a nearing end to rate hikes by removing the reference to “ongoing increases.”

According to the FOMC’s updated forecast, there will be one more rate increase this year, and officials expect slower economic growth in 2023 compared to previous estimates. The market generally responded well to this information, with major equity indices and cryptoassets remaining mostly unchanged immediately after the report’s release and throughout most of the press conference.

However, Treasury Secretary Yellen, while testifying before Congress, refused to provide assurances regarding insuring a greater percentage of deposits across the troubled banking sector. This happened towards the end of Powell’s press conference and led to a significant sell-off in bank equities, which spilled over into broader risk assets.

Despite the volatility in asset prices following Yellen’s statements, the key takeaway from the FOMC meeting is that both the statement and press conference were more dovish than markets had anticipated a month ago.

This dovishness is justified, as banking stress has replaced inflation as the primary concern for investors. Inflation should continue to decline, as evidenced by publicly available consumer pricing data. The focus has now shifted to addressing the issues within the banking sector, which we maintain should remain constructive for the global liquidity outlook.

Liquidity Set-up Remains Constructive

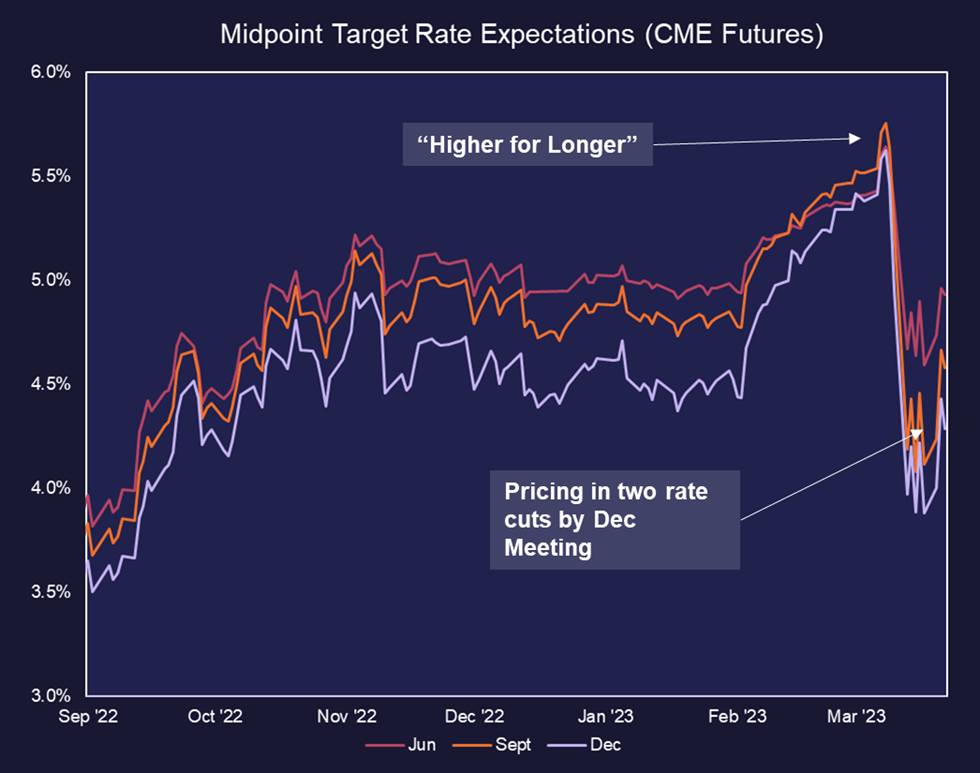

The shift in Fed language (from “ongoing increases” to “policy firming”), combined with the ongoing banking crisis, led the futures market to view the recent hike as the last in this cycle. Despite the Fed’s assurances of keeping rates higher for longer, markets appear to have priced in two rate cuts by the December FOMC meeting.

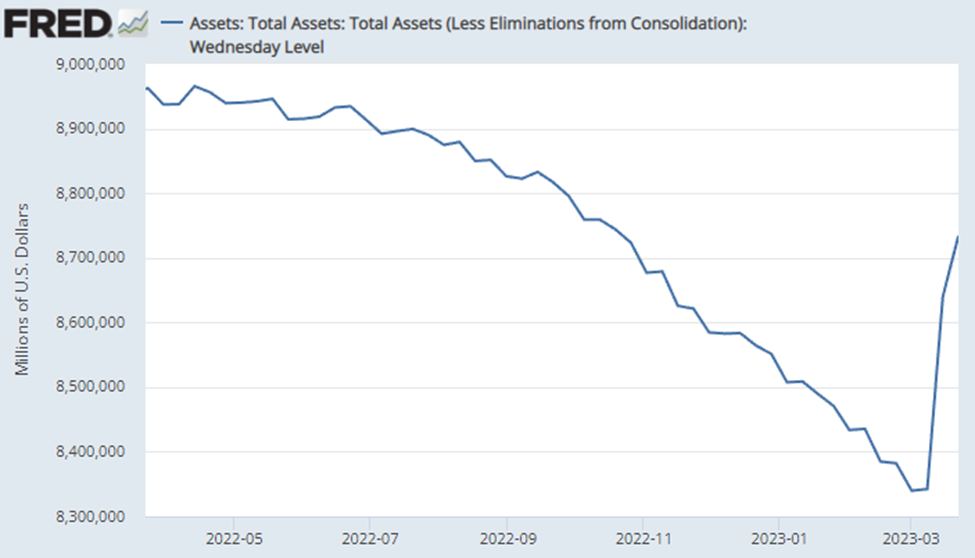

Coupled with easing rates and a falling dollar, we saw another week of increased net liquidity in the U.S. The Fed’s balance sheet expanded by $100 billion in the latest week, going from $8.7 trillion to $8.8 trillion. This expansion is due to the emergency lending to banks through the discount window and the Bank Term Funding Program (BTFP), as well as lending to foreign central banks and monetary authorities.

With capital tied up in the Reverse Repo facility and the Treasury General Account considered, total net liquidity remains well above levels seen a few weeks ago.

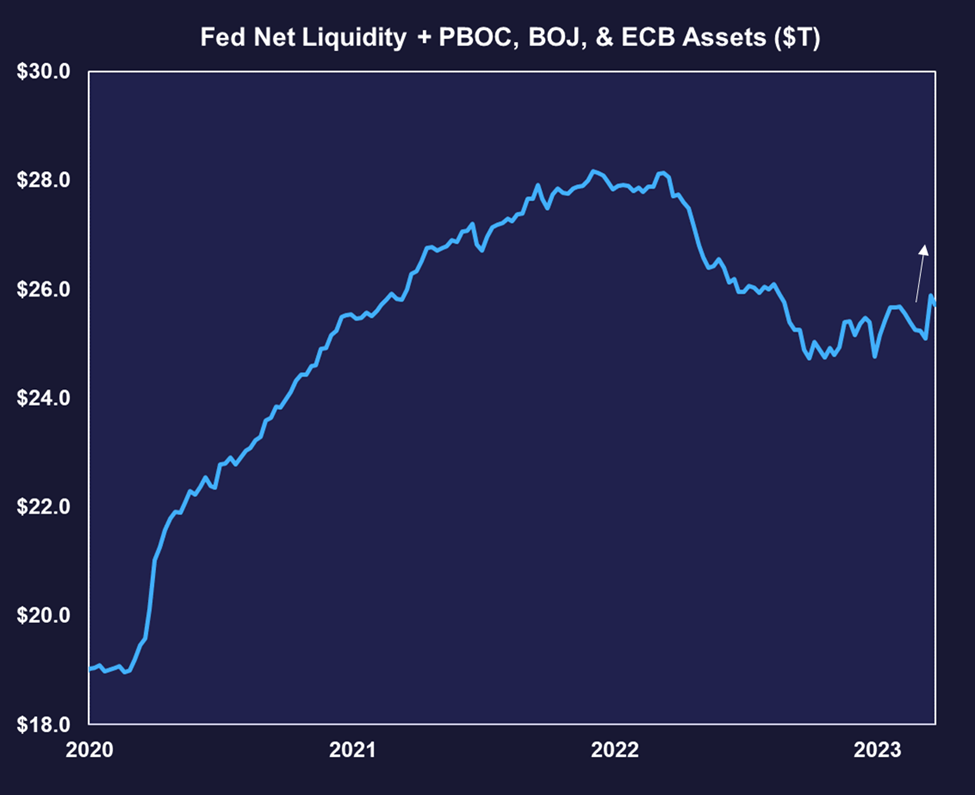

As discussed last week, we have also seen easing monetary policy resume out of the BOJ and the PBOC over the past couple of weeks.

When paired with the increase in domestic liquidity referenced above, we can see a sizeable tick higher in global USD liquidity among the four major central banks. Bitcoin is the most effective liquidity sink in the world, thus, we believe that so long as global private market liquidity is increasing, the conditions for crypto to thrive remain intact.

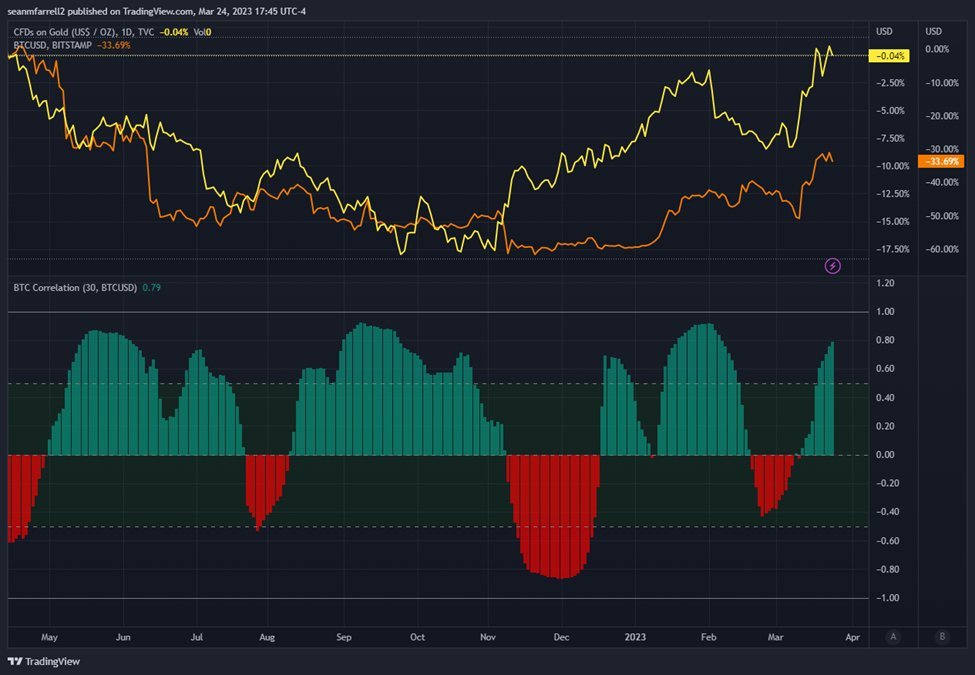

Gold Correlation Strengthening

As we have discussed in prior notes, there are two types of inflation – asset and goods inflation. As we witnessed over the past year, BTC was not very suitable as a hedge against consumer goods inflation. However, it worked phenomenally well as a hedge against asset inflation and monetary debasement.

With that in mind, we continue to see a strengthening relationship between gold and bitcoin, suggesting that the leading cryptoasset is sniffing out the ongoing monetary expansion.

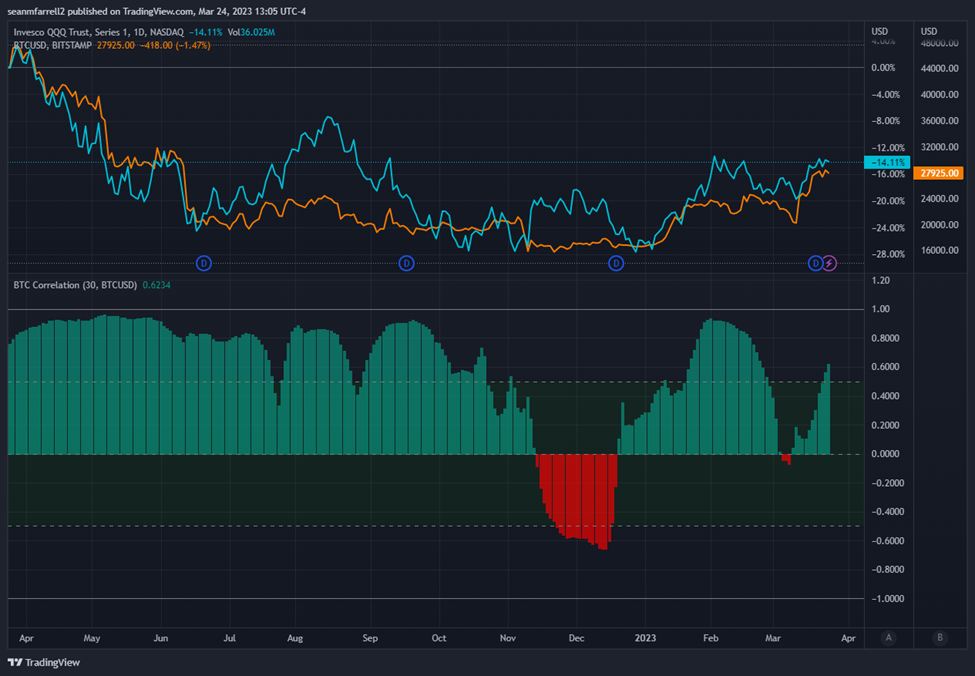

For comparison, below is the correlation between bitcoin and the Nasdaq 100, which has also been a decent indicator of expansionary monetary policy, and therefore has been closely correlated with BTC. However, as credit risk persists, and the possibility of a recession remains present, we are not seeing as strong of a short-term correlation between the major tech index and BTC.

Tether Growth & Realized Cap Increases Suggest Inflows

Moving beyond the current macro setup, we can look to on-chain indicators that suggest some of the liquidity in the private market flowing into crypto.

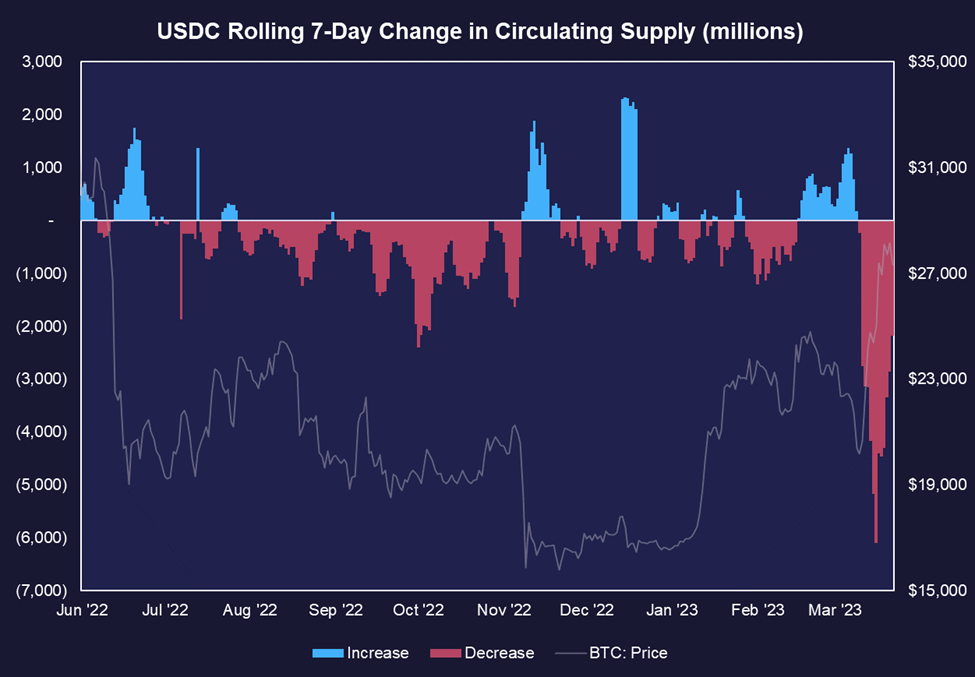

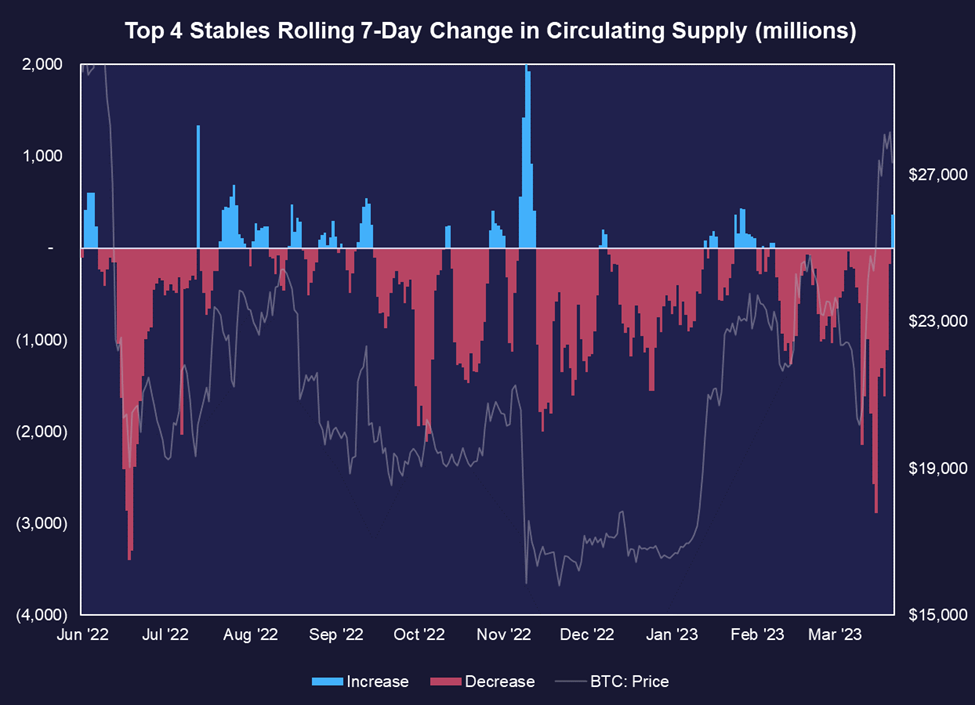

Major stablecoin circulating supply changes are important signals of capital flows into and out of the crypto ecosystem. Stablecoins being minted often signifies market participants bridging capital from the “real” economy to invest in, use, or trade cryptoassets. Thus, we believe any significant increase in minting activity is a positive sign that investors are again getting involved in trading activity.

With the ongoing banking crisis, we had witnessed a severe rise in redemptions for USDC, over concerns about run risk at the banks that service Circle, the issuer of USDC. Many have also simply moved from USDC to other stablecoins out of an abundance of caution that the US government would further encroach on the crypto industry.

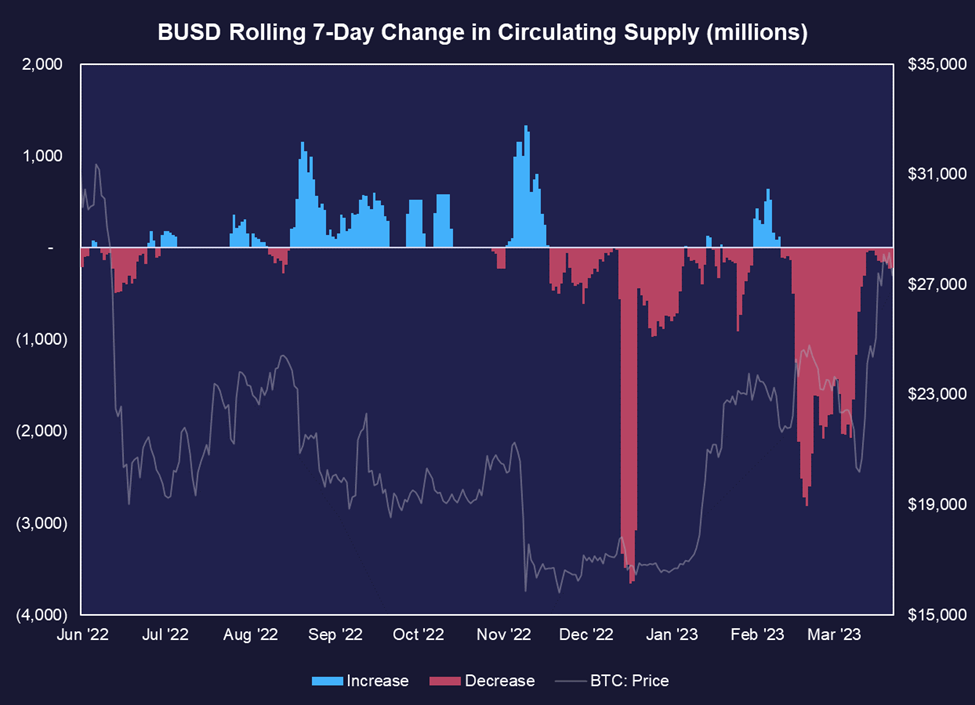

The net outflows of USDC exacerbated the issue of net BUSD redemptions which were largely spurred on by regulatory actions against Binance.

As a result, we have seen a net outflow of capital from major stablecoins (top 4 include USDT, USDC, BUSD, and DAI).

This is certainly an oddity, since price action has been relatively favorable for the better part of Q1, and normally this coincides with net mints of stablecoins.

Encouragingly for asset prices, tether mints have accelerated in recent weeks to lead to a net increase in the overall stablecoin market cap over the past 7 days.

This is a constructive sign and suggests that (1) some former USDC and BUSD holders have found refuge in USDT, and (2) there is more dry powder entering the crypto arena.

Realized cap is one of our favorite metrics. It values each unspent transaction output (UTXO) in a blockchain network based on the price at which it was last moved rather than its current market value.

A coin that was last moved at a lower price and is now spent at a higher price will increase the realized cap, while a coin spent at a lower price will decrease the realized cap. Realized cap can be considered a proxy for the value stored or saved in the asset and thus can be viewed through a framework of inflows and outflows into/out of the network.

As observed in the chart below, we have seen a strong uptick in realized cap over the past couple of weeks. This is a very encouraging sign that more capital is flowing into the space on the back of the recent rally.

Arbitrum Airdrop Was Indeed a Wealth Creation Event

Ethereum Layer 2 network Arbitrum (ARB 0.08% ) finally held their long-anticipated token airdrop on Thursday. Arbitrum is a Layer 2 scaling solution for Ethereum that uses Optimistic Rollups to increase throughput, reduce transaction costs, and improve user experience. Developed by Offchain Labs, it bundles multiple transactions off-chain and submits a single proof to the Ethereum mainnet, relieving network congestion and lowering gas fees. It’s compatible with existing Ethereum tools, making it easy for developers to deploy and migrate their dApps to the platform.

The airdrop unleashed a whirlwind of activity, catapulting daily active users from a modest 190k to an astounding 611k, and daily revenue skyrocketed from $53k to an eye-popping $1.5 million.

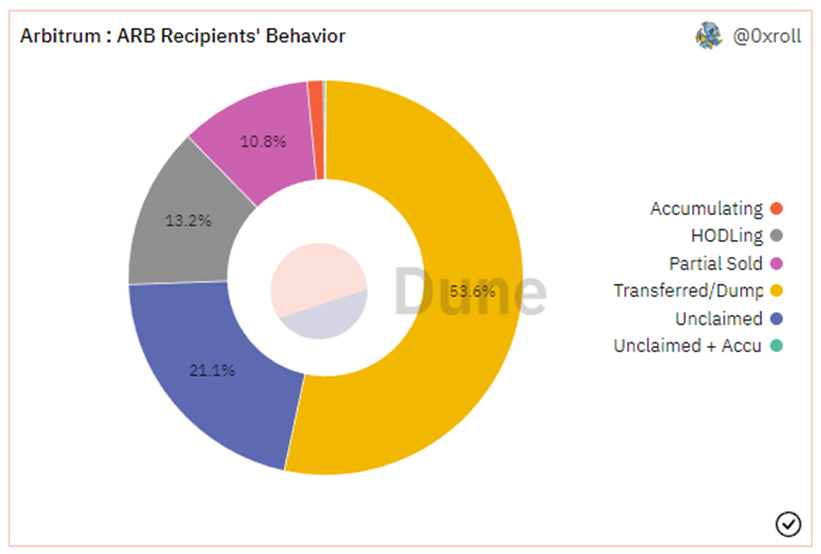

Overall, 492,650 addresses claimed nearly 80% of the airdrop, with 926 million ARB tokens being traded between $1.35 and $1.50. This activity led to a significant wealth creation event, valuing the total ARB holdings between $1.2 and $1.4 billion based on Thursday’s market prices. The ETHBTC ratio experienced a (very) brief spike as some recipients exchanged their ARB tokens for ETH.

Examining the chart below, it seems that most ARB recipients chose to sell at least part of their airdrop holdings, which is a common occurrence after such events, however, we acknowledge that the “transferred” category leaves much to be desired in terms of clarity. It is possible that many of those in the transferred category have sent their ARB to a different wallet and are simply farming yield with that wallet.

With that in mind, we think it is right to be generally constructive on L2 networks over the long term, especially given the impending EIP-4844 coming to Ethereum in the near future, however, those looking for short-term opportunities in ARB might not be rewarded for the risk.

Further, a major takeaway from this event should be that airdrops are a phenomenal way to be rewarded for using application during a bear market. We encourage all of our clients who have the free time to explore some of the tokenless platforms that are likely to engage in an airdrop over the coming 12 months. Our resident DeFi expert, Walter put together this excellent overview on airdrops a while back (he even mentioned Arbitrum as a good opportunity). If we were to update our current list of airdrop farming opportunities, it might include zkSync, Starknet, Celestia, Scroll, and Aztec. This is another very helpful resource for those looking to capitalize on airdrop opportunities.

Alls Wells that Ends Wells

In a surprise to no one, Coinbase received its Wells notice from the Securities and Exchange Commission (SEC). This notice indicates that the SEC staff is considering recommending enforcement action against the company for potential violations of securities laws. The allegations involve select digital assets listed on Coinbase, as well as its staking service (Coinbase Earn), Coinbase Prime, and Coinbase Wallet.

This is disconcerting for a number of reasons – Coinbase is a prominent player in the digital assets space and has seemed to operate compliantly since their inception. Further, the SEC had approved their process embedded in their S-1 prior to their direct listing less than two years ago. Moreover, if we are to believe what Brian Armstrong is telling us, there seems to have been a legitimate effort on the part of Coinbase to work with the SEC to come into compliance, but to no avail.

As we have discussed repeatedly, this type of crackdown was expected and should continue to be expected. However, as discussed following the Kraken settlement, the systemic deleveraging risk we saw last year is not the same as the regulatory risks we are witnessing now.

The actions being taken by the regulatory bodies in charge aim to reel in the on/off-ramps of crypto. While this is discouraging for business owners developing infrastructure to serve the crypto economy, this should not necessarily translate to lower token prices.

We already have ample precedent of substantial fines and shutdowns of crypto-related companies. None of which were closely correlated to a drawdown in digital asset prices.

Further, despite the seemingly negative implications of the SEC’s actions, the case could ultimately provide much-needed regulatory clarity for the cryptocurrency sector. If the matter proceeds to court, the resulting ruling could establish legal precedents, defining how securities laws apply to digital assets and associated services. Consequently, a clearer and more consistent regulatory landscape may emerge, fostering stability and growth within the industry.

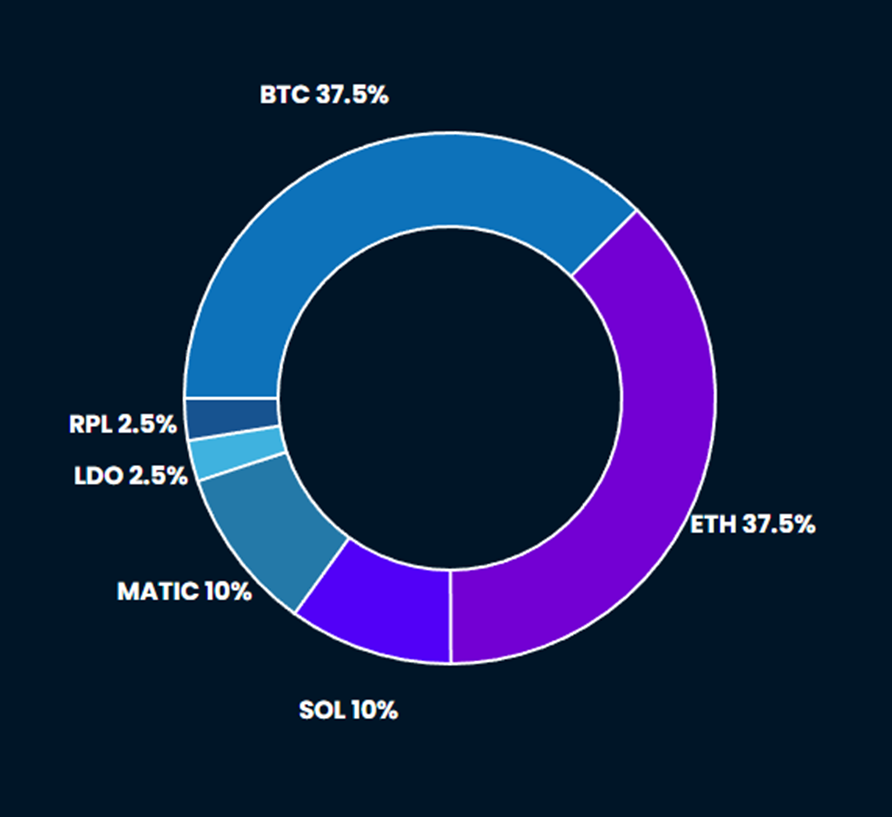

Strategy

Despite ongoing banking concerns, the risk asymmetry in 1H remains to the upside, in our view, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Investors are increasingly turning to BTC and gold as alternative ways to store wealth during periods of inflation or increased risk, with BTC’s rising dominance potentially leading to sustained altcoin rallies down the road.

Tickers in this report: BTC 5.22% , RPL, LDO, MATIC, SOL, ETH 7.34% , ARB 0.08% , USDT, BUSD, USDC, DAI