Vibe Shift

Key Takeaways

- Crypto continues to hold up well relative to equities, perhaps indicating a tactical bottom.

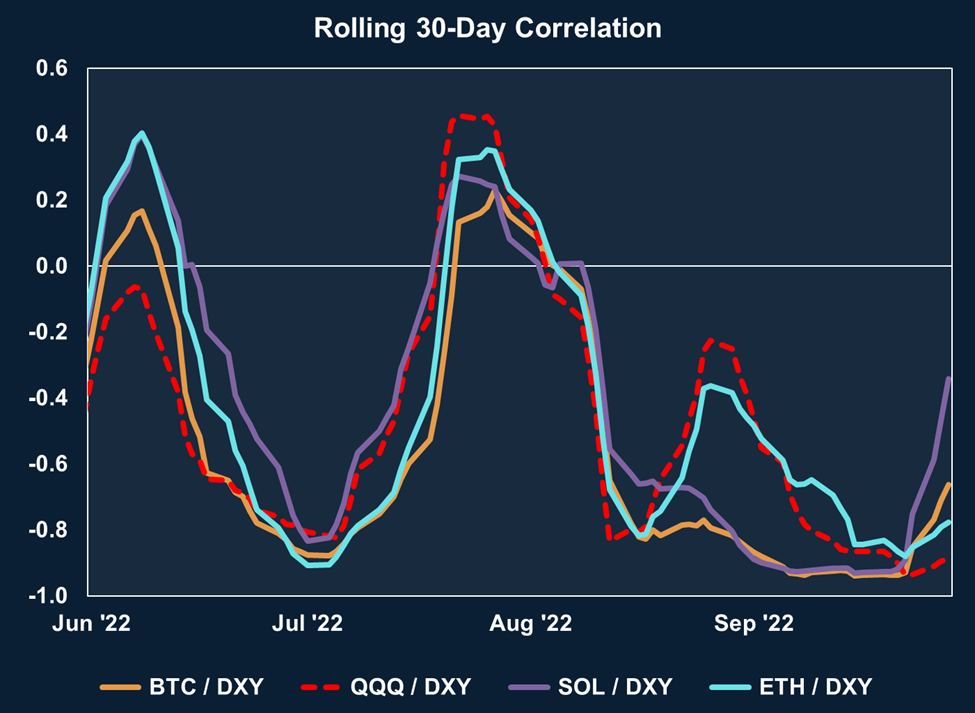

- The QQQ 0.13% remains negatively correlated to the US dollar while correlations between DXY and major cryptoassets are breaking down rapidly, a positive sign of crypto “decoupling” from other risk assets.

- Solana’s recent strength is likely driven by its surging NFT ecosystem. We examine recent activity on the network.

- We review recent on-chain activity on the Ethereum network that suggests increasing usage and bullish momentum.

- Strategy - Recent strength against the dollar and equities is encouraging for near-term price action. We are still constructive on select assets (core: BTC 5.22% , ETH 7.34% , SOL, merge-adjacent: LDO, RPL, OP, MATIC) through the balance of the year.

Crypto Continues to Show Relative Strength

It was an eventful week in global macro (this is now the default opening line of every note), as consequential headlines rolled across the tape at a rapid clip. Among them:

- Signs of slowing demand appeared in Apple’s revised agreement with suppliers, and early signs of potential deflation were on display in Nike’s surging inventories.

- Despite this, the Fed’s preferred inflation figure, PCE, came in extra hot for the month of August, consistent with the CPI print released earlier this month. Markets clearly already contemplated this number in asset prices following the CPI release, but it still left many market observers scratching their heads.

- We witnessed the second material intervention from a major central bank this week, as the Bank of England was forced to bid on long-duration UK treasuries such that large pensions did not go belly-up (more on this later).

- The Bank of Japan revealed that it spent nearly $20 billion in last week’s currency intervention. They stated that selling US treasuries was not yet an option on the table, but at the time of writing, the JPY -0.06% is trading about where it did before the central bank’s intervention.

- Nord Stream 2, a critical chess piece in the War in Ukraine, was destroyed, the proximate causes and implications of which are still being determined. Meanwhile, on the heels of this event, Russia announced it was annexing certain occupied territories in Ukraine.

Despite the barrage of market-moving headlines, major cryptoassets continued to show strength relative to major equity indices. When measured against the Nasdaq 100, BTC, ETH, and SOL materially outperformed. While the optimistic sliver left in our bodies would like to believe this is an early sign of permanent decoupling, it is more likely that crypto is discovering a local bottom for risk assets, as we suggested last week.

We titled last week’s note Dollar Reigns Supreme, which is empirically valid. No one wants to be holding the Japanese Yen, Euros, or the British Pound during a time of global monetary tightening. Everyone wants dollars. In fact, if we didn’t have two of the major global Central Banks intervene with their respective financial systems over the past two weeks, the DXY might be on an unimpeded path to 120.

However, it is interesting to note that the last seven days of data have highlighted a stark divergence in the formally strong correlations between the USD and major cryptoassets. Below, we see that recent trends point to BTC, ETH, and particularly SOL breaking free from the dollar’s firm grasp. Should this be viewed as a permanent trend? No, not yet, at least.

For example, we have witnessed a few similar divergences between risk assets and the DXY already this year during periodic relief rallies. However, one must note that the correlation between DXY and QQQ, our proxy for traditional risk assets, is lagging crypto, a dynamic not present in previous rallies. In this respect, crypto is certainly raising some eyebrows.

Sol Cycle

As the preceding charts demonstrate, Solana has shown the most relative strength of the three major cryptoassets examined. Its 30-day correlation with the DXY is fast approaching 0 and seems to have found solid underlying support at the $30 level. Over the past month, SOL outperformed SPX and QQQ by approximately 20%.

While it is possible that SOL is benefitting from oversold and low-leverage conditions, we think it’s important to peel back the curtain and find fundamental factors driving the token’s demand.

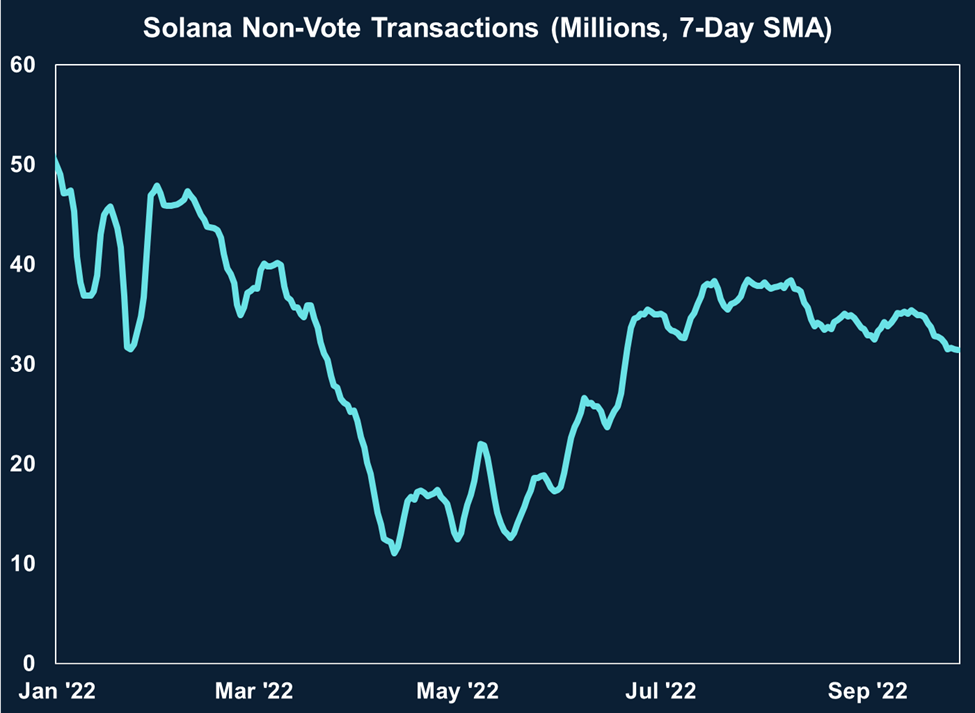

Below we see that transactions are still relatively high compared to the market’s trough. We highlighted this as a key reason we were constructive on the asset. Despite declining prices, there is still demand to use the underlying network. Not many networks can claim the same persistence of demand in the face of massive drawdowns and reductions in on-chain yields.

While noting the consistently elevated level of transactions, it would be unfair to claim the net trend is higher over the past month. If anything, transactions have probably decreased slightly.

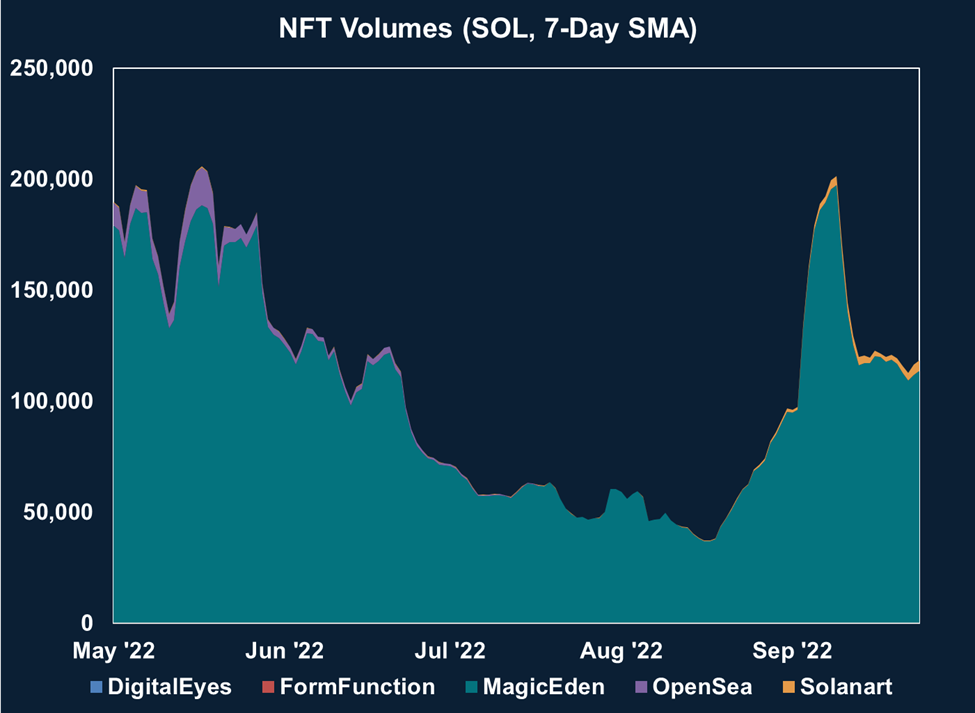

Examining activity in the NFT ecosystem tells us a more conclusive story. Below we see an enormous spike in SOL-denominated volumes since early September. We have noticed an approximate 2.5x increase in volume over the previous 30 days. This increased activity is likely the fundamental driving factor behind the relative strength of SOL against other cryptoassets.

This huge resurgence was indeed buttressed by a large project launching on the network. Earlier this month, Dust Labs, creators of DeGods, the most valuable NFT project on Solana, launched its y00ts NFT series driving a wave of traffic to the Solana NFT ecosystem. This dynamic is not dissimilar from how the launch of blue-chip NFTs on Ethereum would inspire periodic upticks in NFT activity on that network.

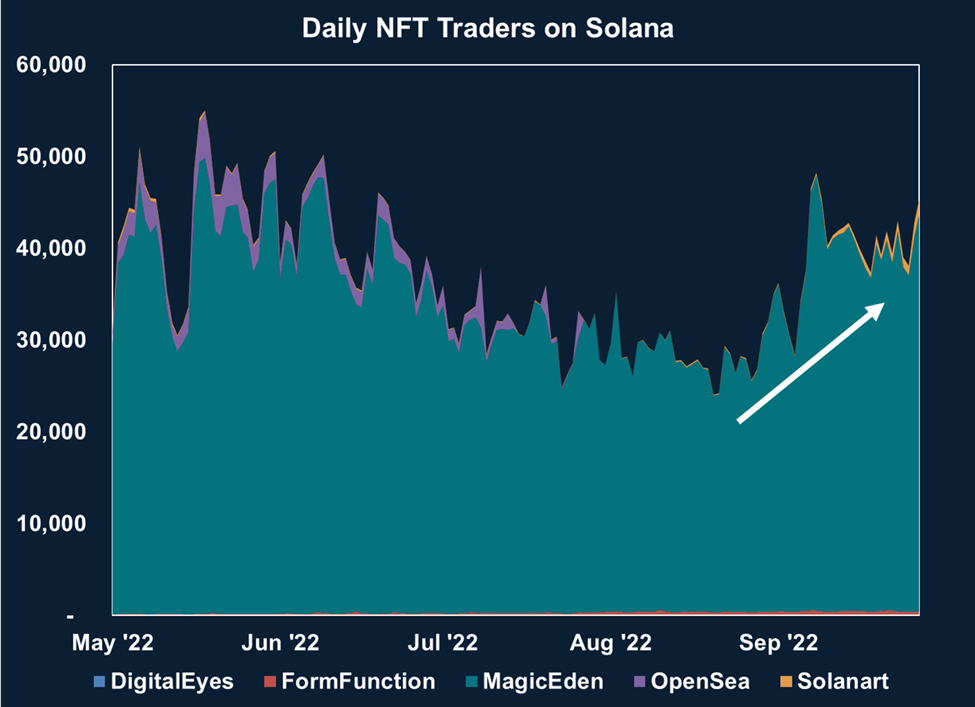

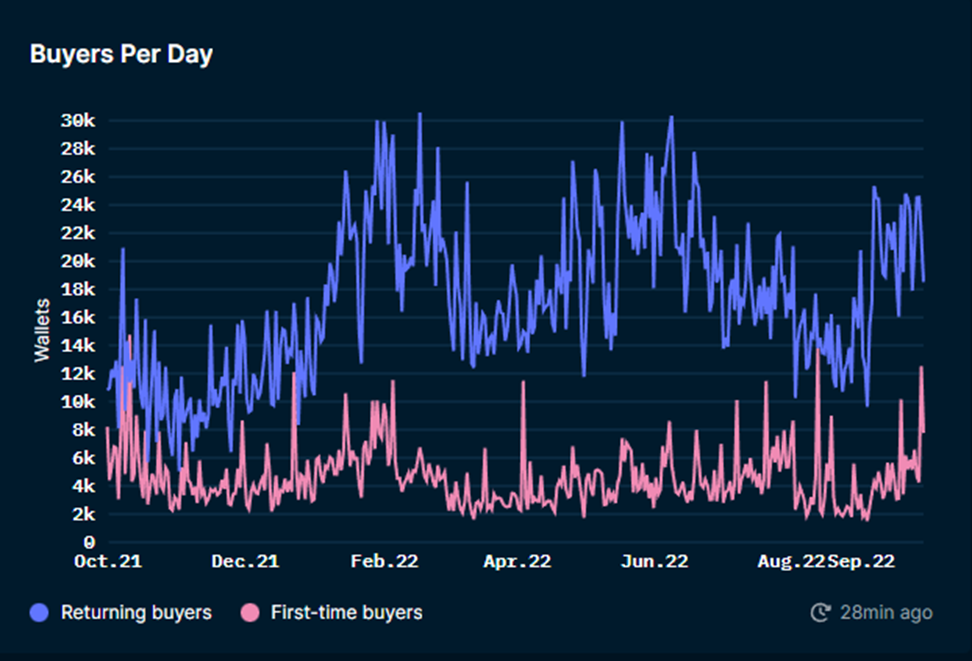

Encouragingly, we can see that it is not just volume but unique users that are increasing.

Importantly, data also points to these users being comprised of existing Solana users and new entrants into the market. This is a good sign that the network continues to attract new users into the ecosystem for either experimentation or sustained usage.

Ethereum Activity Showing Signs of Life

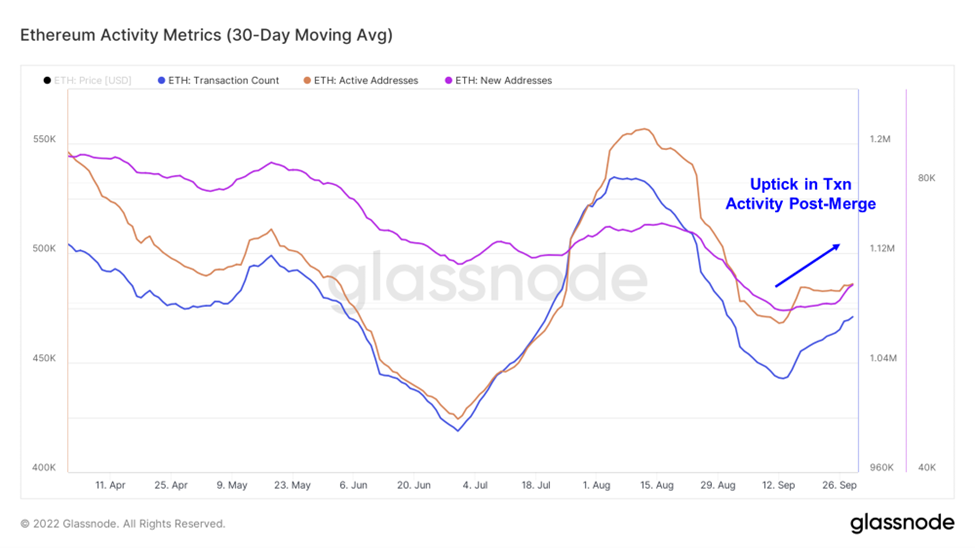

While not nearly as flourishing as the Solana NFT ecosystem, there are indications of improving demand for Ethereum blockspace. New and active addresses have both moved slightly higher while transactions have increased in a pronounced fashion.

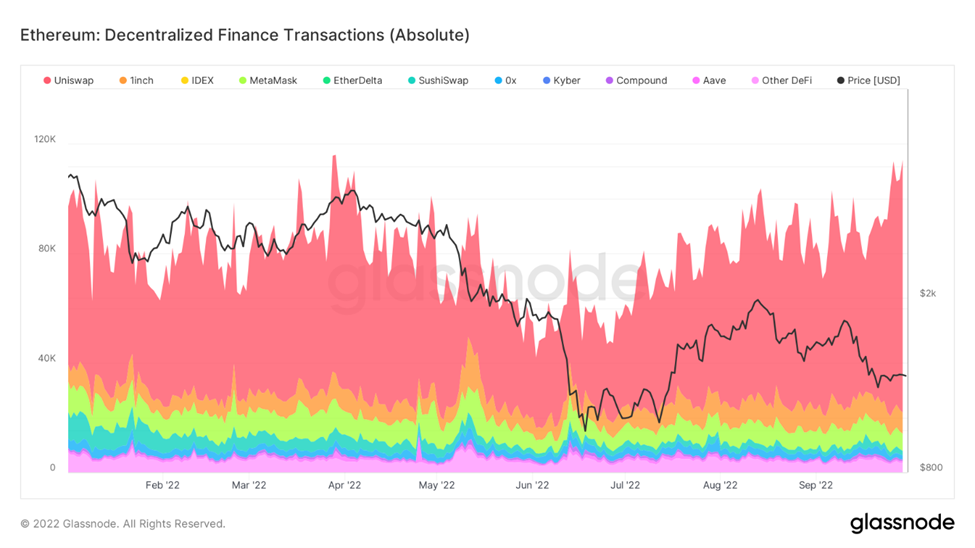

Double-clicking on this activity, we see that the lion’s share of this activity stems from an apparent uptick in DeFi transactions, rivaling levels not seen since April of this year.

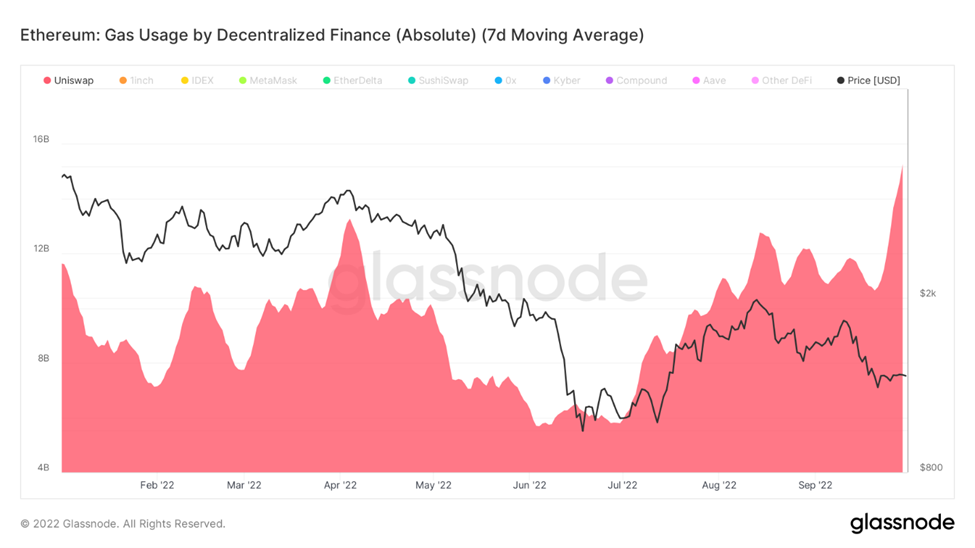

This activity is seemingly concentrated to Uniswap, where the 7-day moving average of gas usage has gone parabolic, reaching YTD highs.

The underlying factors driving this activity are largely a mystery. In many ways, this does seem anomalous without a particular catalyst. There is the cynical view that the Uniswap Labs team (the development team behind the DEX) might be “cooking the books,” hoping to land a fat round of financing. However, our more optimistic take is that this comprises mostly organic demand for ETH exposure. The shifting momentum among ETH holders below demonstrates this is a definite possibility.

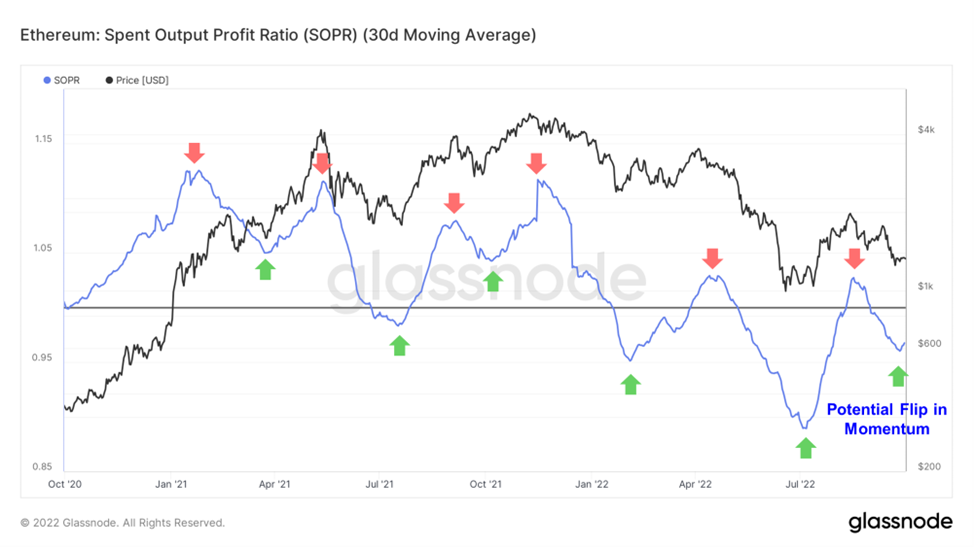

The Spent Output Profit Ratio is best thought of as a momentum indicator. As indicated by the directional arrows at specific inflection points, the 30-day SMA for this metric has been relatively reliable in identifying shifts in momentum among ETH holders. While it might be early to claim that SOPR is showing a definitive break to the upside, it has slowed its descent and has recently turned higher.

October Starts Tomorrow

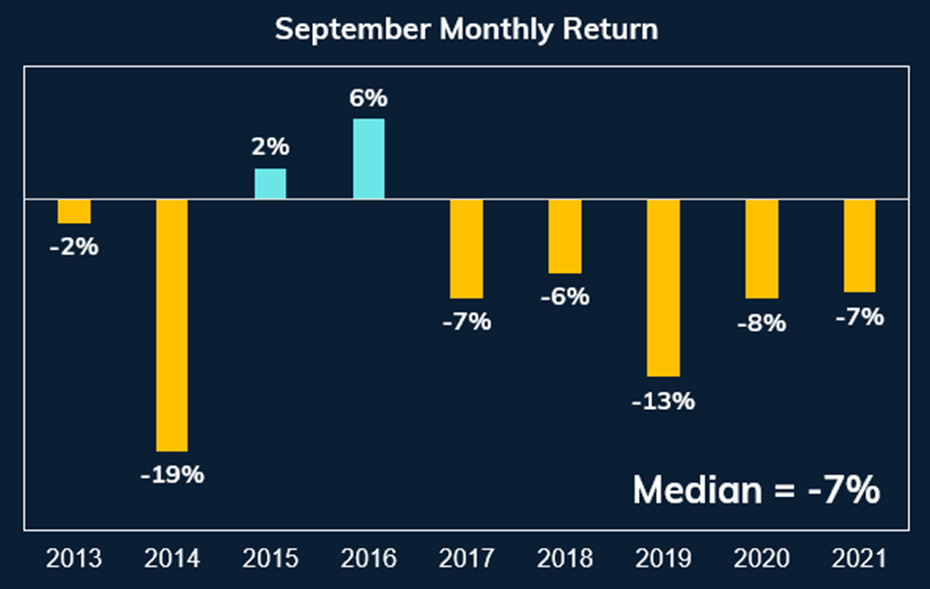

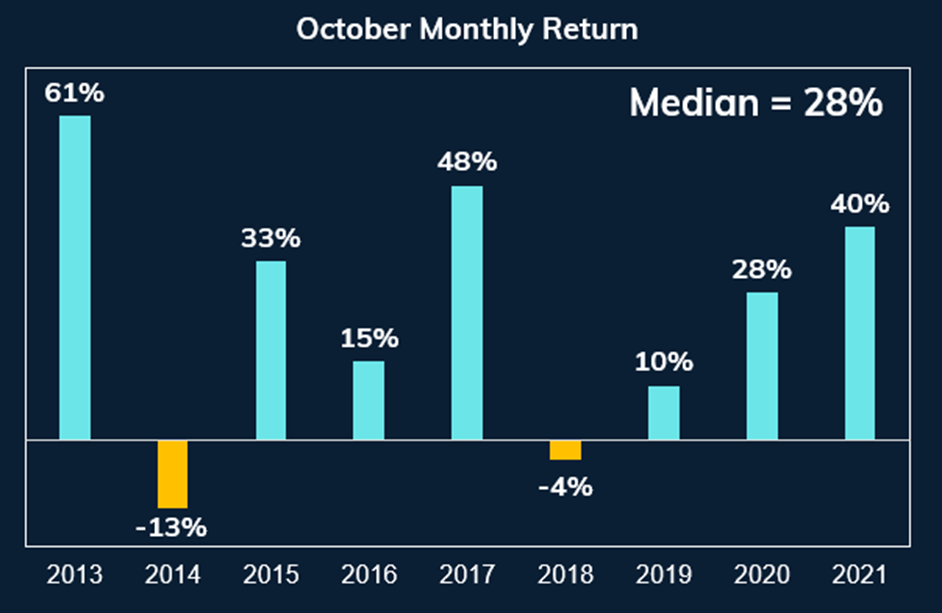

To rehash a point from last week, September and October have displayed remarkable consistency in directional bias for crypto. September has historically been a red month for bitcoin, while October has been a strikingly profitable month for bitcoin holders. This trend is seen throughout equities to a certain extent, but it is particularly pronounced in crypto.

The median return for bitcoin in October over the past nine years has been an impressive 28%.

A Vibe Shift

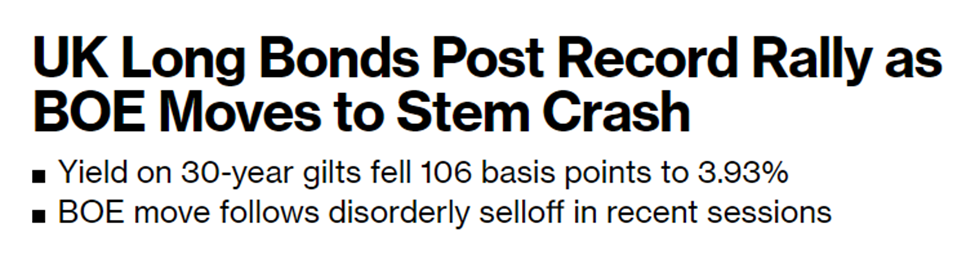

As mentioned at the beginning of this note, the debt-ridden global monetary system started to show its cracks in the past couple of weeks. First in the form of direct intervention from the Bank of Japan, as they bulk purchased $20 billion worth of Japanese Yen to prevent its continued spiral against the US dollar. Then this week, the Bank of England faced a potential “Lehman moment” as long-duration bonds held by enormous pensions went no-bid, rates started to spiral, and many retirement funds were close to becoming insolvent.

Of course, the BOE intervened, purchasing treasuries and stimulating the market, despite rampant inflation and a purported commitment to monetary tightening. This stabilized rates and set the market back into equilibrium. But the damage was done, and the dangers embedded in the sovereign debt bubble became apparent to anyone willing to pay attention.

The UK is ranked 30th in GDP per capita and is the third largest foreign holder of US treasuries. Thus, their government bonds are perceived to carry a similar risk profile to treasuries of other developed nations. With that in mind, investors do not expect to see charts like the one below.

This week’s events highlighted the danger of eroding trust in central banks and was a stark reminder of one of the significant use cases for crypto – software-governed monetary networks.

While it is impossible to quantify, we think some of the folks who wrote off crypto as a passing blip brought on by excessively loose monetary policy that lets people make unsound bets on weird monkey pictures have rethought the need to outsource more trust to decentralized networks. Indeed, we even had Stanley Druckenmiller speak out on the issue. While he notes that crypto still trades as a risk asset, there is the possibility of it decoupling from tech stocks if widespread distrust in global central banks rears its head.

Of course, being the exit ramp for an over-leveraged fiat system is not the only upside of bitcoin or crypto. Crypto is not a monolith. More efficient global liquidity networks, composability, immutability, and network ownership are just some of the other elements contributing to the entire industry’s potential upside.

However, recent deteriorations in correlations between major cryptoassets and the dollar combined with these central banking calamities are reminders that should the world desire a monetary network that is built to resist the same human errors that have put central banks in their current position, it already exists.

Strategy

Recent strength against the dollar and equities is encouraging for near-term price action. We are still constructive on select assets (core: BTC 5.22% , ETH 7.34% , SOL, merge-adjacent: LDO, RPL, OP, MATIC) through the balance of the year.