Dollar Reigns Supreme

Key Takeaways

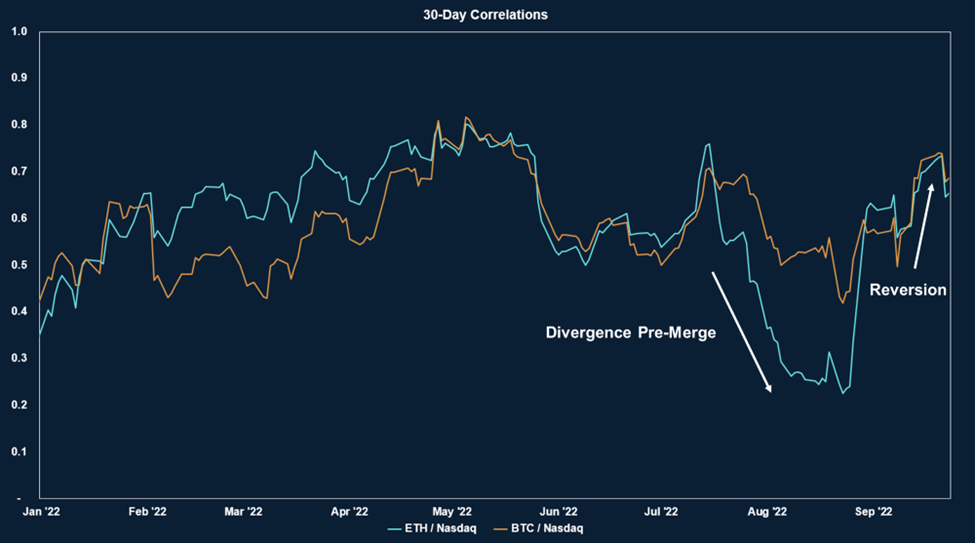

- The CPI print and subsequent Fed actions have led to an increase in correlations between crypto and equities.

- Both US 2Y yields and the DXY reached multi-decade highs this week.

- We note that October (next week) has been a historically bullish month for crypto.

- Relative strength in crypto compared to equities could be an early sign of a tactical bottom.

- Strategy – We are still constructive on select assets (core: BTC 5.22% , ETH 7.34% , SOL, merge-adjacent: LDO, RPL, OP, MATIC) through the balance of the year. However, we acknowledge that the most recent CPI report has put the market on an uneasy footing. Our clients/members will recall us viewing downside protection as appropriate in late Q1 and Q2 of this year. While we may rally from oversold conditions in the next couple of weeks, a similar level of risk management is wise in the near term.

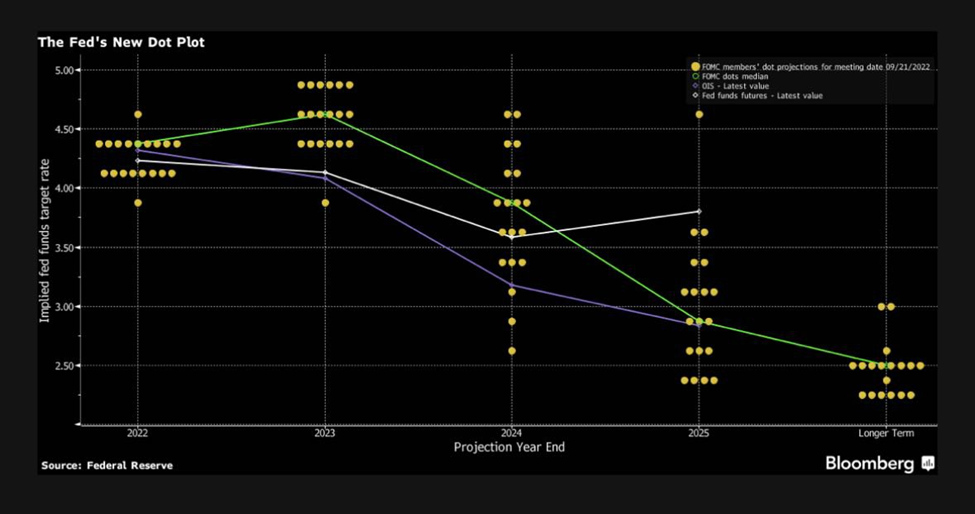

Fed Raised Rates Above Futures

This week, the Fed went ahead and raised interest rates another 75 bps in its attempt to stimy demand and bring down the prices of consumer goods. While the rate hike was already priced in by the market, the Fed’s revised dot plot was not. The Federal Reserve’s forecast for rates (green line below) was well above the futures market expectations. Thus, asset prices continued to dive, crypto included. The S&P 500 would go on to close at a new YTD low.

The CPI print and subsequent Fed actions have led to an increase in correlations between crypto and equities. As demonstrated by the chart below, short-term correlations with the QQQ 0.13% have dramatically increased, particularly for ETH.

Naturally, the US treasury market witnessed extreme volatility, plummeting dramatically relative to the rest of the market.

Below we can see the dramatic effect the increased tightening expectations had on the 2-year yield. The US 2Y at one point reached 4.26%, the highest level in 15 years.

The dollar continued to exhibit strength, rising to multi-decade highs in a parabolic way.

Silver Linings

There was a semblance of good news at the end of the week, as crypto performed relatively well compared to equities. Since risk clears from farther out on the risk curve inward, crypto has often bottomed and peaked before equities. This relative strength could signify that we could see a relief rally of sorts starting in the next couple of weeks.

At the very least, it speaks to the lack of leverage in the market as compared to the first half of this year. It is not unreasonable to speculate that if we had experienced the price action we saw the past two weeks back in Q1 or Q2, there would be cascading liquidations throughout the crypto market, exacerbating any drawdowns.

To corroborate this robustness in the crypto market, we can see that ETH performed with similar relative strength against equities, albeit slightly less so.

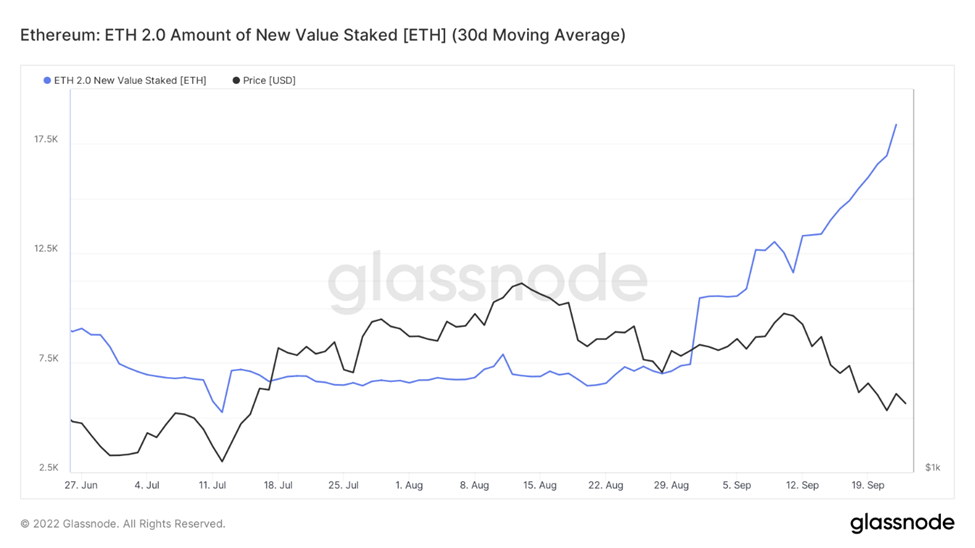

Strength in Liquid Staking

One of the benefits of Ethereum’s successful merge was the mitigation of technical risk and the potential to start earning fees for block validation. Thus, it is not surprising that since early September, the average ETH staked per day has increased substantially. While we are not seeing the earth-shattering figures that we witnessed at the height of the bull market or when the Beacon Chain launched, this is a bullish pattern that we think signifies an increased appetite for yield.

An interesting observation that coincides with the increase in ETH staked is the persistently negative basis for ETH futures. While it’s entirely possible that the market simply thinks that ETH is destined to fall further, it is also possible that traders are hedging their staked positions by shorting futures.

Since bitcoin’s basis is positive, and forward prices for BTC and ETH most often are directionally consistent, this provides further evidence that the staked ETH yield trade is popular. This makes a lot of sense in a bear market. It allows industry players with larger books to essentially gain “risk-free” (no, nothing is risk-free) long exposure to ETH.

Given the preceding data, the chart below comes as no surprise. Lido (LDO) has outperformed ETH since the Merge, as many realize the potential value of possessing governance over the DAO, controlling the largest liquid staking provider in the industry.

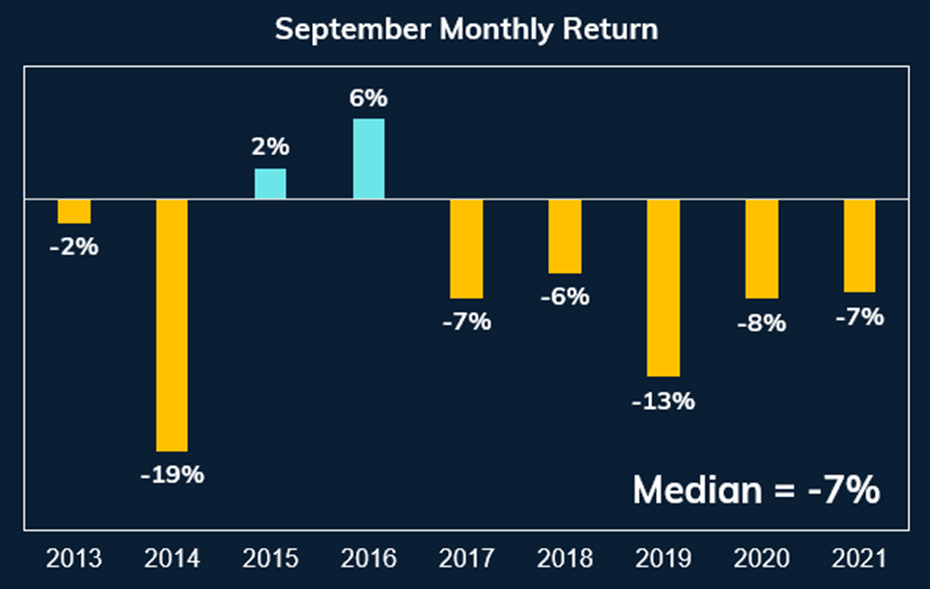

The Hunt for Green October

Given the ongoing monetary tightening, rampant inflation, and existing geopolitical risks, one could certainly understand ignoring variables like seasonality when putting on a trade. However, the performance of bitcoin in the months of September and October over the past decade is strikingly consistent.

September is historically a terrible month for BTC. In both raging bull and dire bear markets, September has mostly served up losses for investors. The median September return for BTC since 2013 is a paltry -7%.

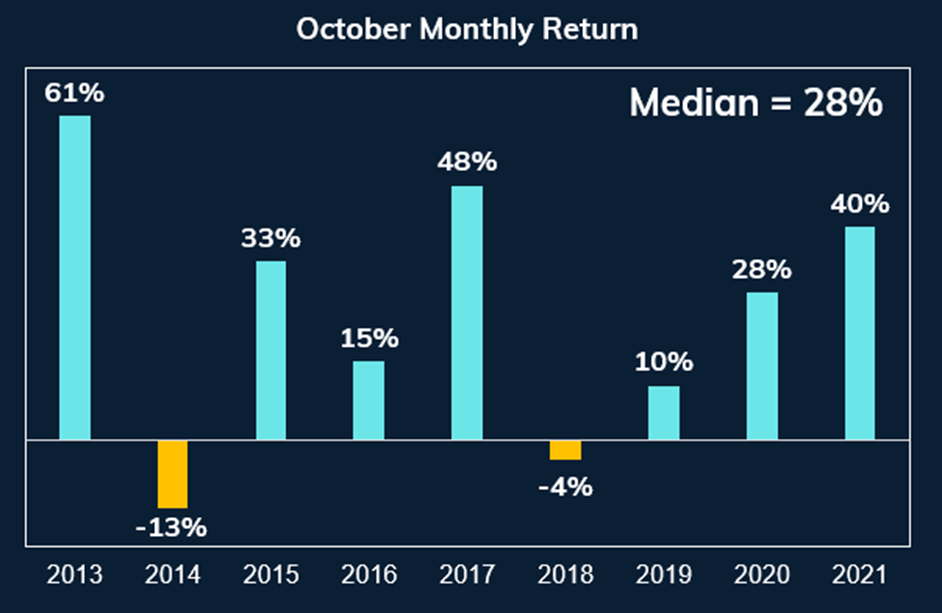

Conversely, October is an indisputably bullish month for bitcoin, posting a median return since 2013 of 28%. In a mirror image of September, bitcoin has only witnessed two instances of negative returns in October, granted the last took place during the 2018 bear market.

We think this is a valuable data point for those looking to capitalize on a tactical rally.

Strategy

We are still constructive on select assets (core: BTC 5.22% , ETH 7.34% , SOL, merge-adjacent: LDO, RPL, OP, MATIC) through the balance of the year. However, we acknowledge that the most recent CPI report has put the market on an uneasy footing. Our clients/members will recall us viewing downside protection as appropriate in late Q1 and Q2 of this year. While we may rally from oversold conditions in the next couple of weeks, a similar level of risk management is wise in the near term.